THE INDIAN POLITY AND GOVERNANCE

1.EXPLAINED: THE PROCESS OF ELECTING INDIA’S PRESIDENT

THE CONTEXT: The tenure of the current President of India is set to end in July this year(2022), which is also when the 16th Indian Presidential election will be held to elect his successor. The Voting for the presidential election in which NDA candidate Droupadi Murmu is pitted against joint Opposition pick Yashwant Sinha began on July 18.

THE EXPLANATION:

How is the President elected?

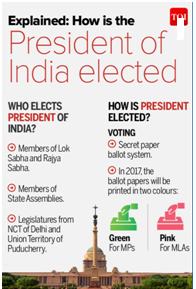

• The Indian President is elected through an electoral college system, wherein the votes are cast by national and State-level lawmakers. The elections are conducted and overseen by the Election Commission (EC) of India.

• The electoral college is made up of all the elected members of the Upper and Lower Houses of Parliament (Rajya Sabha and Lok Sabha MPs), and the elected members of the Legislative Assemblies of States and Union Territories (MLAs).

Parliament (Rajya Sabha and Lok Sabha MPs), and the elected members of the Legislative Assemblies of States and Union Territories (MLAs).

• This means, in the upcoming polls, the number of electors will be 4,896 — 543 Lok Sabha MPs, 233 MPs of the Rajya Sabha, and 4,120 MLAs of all States, including the National Capital Territory (NCT) of Delhi and Union Territory of Puducherry.

• Before the voting, comes the nomination stage, where the candidate intends to stand in the election, and files the nomination along with a signed list of 50 proposers and 50 seconders. These proposers and seconders can be anyone from a total of 4,896 members of the electoral college from the State and national levels.

What is required to secure a victory?

• A nominated candidate does not secure victory based on a simple majority but through a system of bagging a specific quota of votes. While counting, the EC totals up all the valid votes cast by the electoral college through paper ballots and to win, the candidate must secure 50% of the total votes cast + 1.

• Unlike general elections, where electors vote for a single party’s candidate, the voters of the electoral college write the names of candidates on the ballot paper in the order of preference.

What is the value of each vote and how is it calculated?

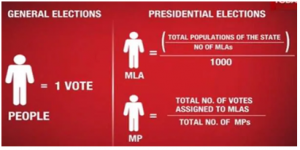

A vote cast by each MP or MLA is not calculated as one vote. There is a larger vote value attached to it.

The fixed value of each vote by an MP of the Rajya Sabha and the Lok Sabha is 708. Meanwhile, the vote value of each MLA differs from State to State based on a calculation that factors in its population vis-a-vis the number of members in its Legislative Assembly. As per the Constitution (Eighty-fourth Amendment) Act 2001, currently, the population of States is taken from the figures of the 1971 Census. This will change when the figures of the Census taken after the year 2026 are published.

THE ECONOMIC DEVELOPMENTS

2.WILL RBI MOVE HELP GREATER TRADE IN RUPEE?

THE CONTEXT:The Reserve Bank of India (RBI) issued a circular that detailed ‘additional arrangement’ for invoicing, payment, and settlement of exports and imports in Indian rupees.

THE EXPLANATION:

Under this mechanism, Indian importers could make payment in rupees to the Special Vostro account of the correspondent bank of the partner country, against invoices for the supply of goods or services from the overseas seller. Indian exporters shall be paid proceeds in rupees from the balances in the designated vostro account of the correspondent bank of the partner country.

How does this change the status quo?

• Vostro accounts have been around for a while. They were likely not widely used because exporters in any country typically prefer settlements in a strong and stable currency.

• Also, there are at least three new aspects to the newly-issued circular. First, the RBI has explicitly said that exchange of messages in a safe, secure and efficient way may be agreed upon mutually between the banks of partner countries. SWIFT system was seen as an acceptable standard for international transactions.”

• It may be recalled that soon after Russia invaded Ukraine, the Belgium-based SWIFT, or Society for Worldwide Interbank Financial Telecommunication, a system that allows instant messaging among banks, began excluding Russian banks from transacting through this channel.

• The aim was to make it difficult and tedious for Russian entities to transact with the rest of the world. The RBI’s circular could be taken to mean that partnering banks may use any messaging system they deem fit and not confine themselves to the SWIFT platform.

How does the new mechanism help India?

• For India, doing business with Russia using rupees would mean there is no hard currency outflow in such transactions. The impact on the rupee market is that foreign currency outflow would be lesser by $3 billion every month. Technically, it would ease the downward pressure on the rupee, which has been sliding to fresh record lows frequently in the recent past.

• However, the arrest in the rupee’s fall would be seen only in the medium to long term because in the current scenario, payments to Russia have anyway not been going through and a credit system has helped continuity of trade.

• If other countries too begin showing interest in using the facility, then a strengthening impact may be seen more quickly for the rupee. According to experts, “Amid ongoing rupee weakness, the RBI’s steps appear to be aimed at reducing demand for foreign exchange… While incremental for now, we see these measures as useful long-term steps, which can enable greater use of the rupee in foreign trade.”

NABARD PLANS FARMER DISTRESS INDEX

THE CONTEXT: With small and marginal farmers getting a raw deal in farm loan waivers, National Bank for Agriculture and Rural Development (NABARD) is planning to formulate a farmer distress index (FDI) to track, identify and support the real needy and distressed farmers.

THE EXPLANATION:

• According to a study jointly conducted by NABARD and Bharat Krishak Samaj (BKS), a farmers producers’ organization, in Punjab, more than 60 per cent of the ‘very high’ and ‘high’ distress small and marginal farmers (SMFs) did not receive farm loan waiver (FLW) benefits. The exclusion rate was also 60 per cent for the medium distress category SMFs.

• In Maharashtra, SMFs that were relatively better off as they were categorized as ‘low’ distress received the maximum FLW benefits. Close to 42 per cent of the SMF whose distress category was ‘very high’ did not receive FLW benefits.

• In UP, 47 per cent of the ‘very high distress’ category, and 45 per cent of the ‘high distress’ category SMF did not receive FLW benefits. In the three states together, more than 40 per cent of the ‘very high distress’ farmers did not receive any FLW benefits.

• NABARD study says this farmer distress index can integrate the available high-frequency data on key agricultural variables like deviation of monsoon rains, excessive rainfall, drought and dry spells, variations in temperature and soil moisture, the yield of major crops in the district, the proportion of area under irrigation, depth of underground water, unusual frost, marketing opportunities available to the farmer that may include the proportion of wheat, paddy, chana, tur, groundnut, soybean etc. produced and procured at MSP.

• NABARD also noted that the “Use of weather data derived from remote sensing technology, automatic weather stations, mobile telephony and artificial intelligence can help in identifying the distressed villages”.

• “Use of data of claims received for crop insurance is also likely to help in identification of distressed regions. These can be tracked on a real-time basis and be used to monitor and predict the level of farmer distress,” the study said.

• Technology breakthroughs like the use of space technology, AI and blockchain in agriculture can be harnessed to bring dynamism and credibility to the system.

• Further, depending on the kind and severity of distress, the support can be given as a combination of unconditional grants, loan restructuring and/or a complete debt waiver. The assistance to individual farmers can be based on a combination of district index and individual farmers’ distress captured via irrigation status of his land, income from crops grown by him, the average productivity of the district and the average price in APMC markets of this district as compared to the average price of the state.

VALUE ADDITION:

National Bank for Agriculture and Rural Development (NABARD)

• NABARD is a development bank focusing primarily on the rural sector of the country. It is the apex banking institution to provides finance for Agriculture and rural development. Its headquarter is located in Mumbai, the country’s financial capital.

• It is responsible for the development of small industries, cottage industries, and any other such village or rural projects.

• It is a statutory body established in 1982 under Parliamentary act-National Bank for Agriculture and Rural Development Act, 1981.

NABARD and RBI

• Reserve Bank of India is the central bank of the country with the sole right to regulate the banking industry and supervise the various institutions/banks

• This also includes NABARD defined under the Banking Regulation Act of 1949.

• RBI provides 3 directors to NABARD’s Board of Directors.

• NABARD provides recommendations to the Reserve Bank of India on the issue of licenses to Cooperative Banks, and the opening of new branches by State Cooperative Banks and Regional Rural Banks (RRBs).

THE AGRICULTURE

3.EXPLAINED: IS THERE A CRISIS IN RICE?

THE CONTEXT:The southwest monsoon’s revival this month has resulted in the total area sown under kharif crops not only recovering, but even surpassing last year’s coverage for the same period from June to mid-July. However, paddy (rice) acreage, at 128.50 lakh hectares (lh) as of July 15, was 17.4% down from last year’s 155.53 lh.

THE EXPLANATION:

Should that be cause for worry?

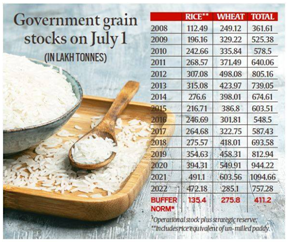

• On the face of it, not much, as government godowns had over 47.2 million tonnes (mt) of rice on July 1. These were nearly three-and-a-half times the minimum level of stocks, to meet both “operational” (public distribution system) and “strategic reserve” (exigency) requirements for the quarter. Rice stocks are still close to their peaks scaled last year.

• That comfort doesn’t extend, though, to wheat – where public stocks have plunged from all-time highs to 14-year lows within the space of a year (see table). Inflation-haunted policymakers would dread the wheat story getting repeated in rice. In wheat, it was a single bad crop — the one singed by the March-April 2022 heat wave — that did all the damage and brought down stocks to just above the minimum buffer.

lows within the space of a year (see table). Inflation-haunted policymakers would dread the wheat story getting repeated in rice. In wheat, it was a single bad crop — the one singed by the March-April 2022 heat wave — that did all the damage and brought down stocks to just above the minimum buffer.

• In rice, the stakes are higher: It is India’s largest agricultural crop (accounting for over 40% of the total foodgrain output), with the country also being the world’s biggest exporter (a record 21.21 mt valued at $9.66 billion got shipped out during the fiscal ended March 2022). Unlike with wheat, the options for import in rice — due to any production shortfall — are limited, when India’s own share in the global trade of the cereal is more than 40%.

Why has acreage fallen?

• Farmers first sow paddy seeds in nurseries, where they are raised into young plants. These seedlings are then uprooted and replanted 25-35 days later in the main field that is usually 10 times the size of the nursery seed bed.

• Nursery sowing generally happens before the monsoon rains. Farmers wait for their arrival to undertake transplantation, which requires the field to be “puddled” or tilled in standing water. For the first three weeks or so after transplanting, the water depth has to be maintained at 4-5 cm, in order to control weed growth in the early stage of the crop.

All this isn’t possible without the monsoon, which has overall been good this time. The country has received 353.7 mm of rainfall during June 1 to July 17, 12.7% more than the “normal” historical average for this period.

How serious is the situation?

• In UP — where the western and eastern subdivisions have so far recorded a mere 90 mm and 79.6 mm of rainfall, respectively — it certainly seems so.

• According to a farmer from Emiliya village in Chandauli district of eastern UP bordering Bihar, said paddy nursery sowing in his area is normally done from June 1 to June 10 and transplanting from July 1 to July 10. This time, there was some rain towards June-end, but hardly any thereafter. “The seedlings should leave the nurseries in 25-35 days, beyond which they will age and not have enough time to grow in the main field.

So, is there a crisis ahead in rice?

• To start with, the India Meteorological Department has forecast that the current monsoon trough, which is active and south of its normal position, is “very likely to shift gradually northwards from tonight (Sunday)”. That should, hopefully, provide much-needed relief to farmers in the Gangetic plains within the next few days.

• Secondly, paddy cultivation takes place across a wider geography, unlike wheat that is grown only in a few states north of the Vindhyas. Also, rice is both a kharif (monsoon) and rabi (winter-spring) season crop. So, the losses in one area or season can potentially be recouped from the other. In wheat, everyone — from farmers and traders to policymakers — was caught off-guard by the sudden surge in temperatures after mid-March that cut grain yields by a fifth or more. Rice is less likely to throw up huge negative surprises. And with the present stocks, it should be manageable.

THE GOVERNMENT SCHEMES IN NEWS

4.A NOD TO EXTEND GRAM SWARAJ SCHEME

THE CONTEXT: The Cabinet Committee on Economic Affairs (CCEA) approved a proposal to continue the Rashtriya Gram Swaraj Abhiyan (RGSA), a scheme for improving the governance capabilities of Panchayati raj institutions, till 2025-2026.

THE EXPLANATION:

• The CCEA, at a meeting chaired by Prime Minister, approved the extension of the scheme that ended on March 31, 2022, at a total financial outlay of ₹5,911 crores, of which ₹3,700 crores would be the Centre’s share and ₹2,211 crore the States’ share.

• “The approved scheme of RGSA will help more than 2.78 lakh rural local bodies…to develop governance capabilities to deliver on SDGs [Sustainable Development Goals] through inclusive local governance with a focus on optimum utilisation of available resources”.

• The scheme would work towards “poverty-free and enhanced livelihood in villages; healthy village, child-friendly village; water sufficient village; clean and green village; self-sufficient infrastructure in the village; socially secured village; village with good governance; engendered development in the village”.

Strengthening the panchayats

• The government said panchayats would be strengthened and a spirit of healthy competition inculcated. No permanent posts would be created under the scheme but “need-based contractual human resources may be provisioned for overseeing the implementation of the scheme and providing technical support to States/UTs”.

VALUE ADDITION:

About Gram Swaraj Abhiyan

• In continuation of “Gram Swaraj Abhiyan”, which started on the occasion of Ambedkar Jayanti, Govt. of India has extended it to 117 Aspirational Districts identified by the NITI Aayog.

• This campaign which, was undertaken under “Sabka Sath, Sabka Gaon, Sabka Vikas”, is to promote social harmony, spread awareness about pro-poor initiatives of the government, reach out to poor households to enrol them and also obtain their feedback on various welfare programmes.

• During this Abhiyan, the saturation of eligible households/persons would be made under seven flagship pro-poor programmes namely, Pradhan Mantri Ujjwala Yojana, Saubhagya, Ujala scheme, Pradhan Mantri Jan Dhan Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Suraksha Bima Yojana and Mission Indradhanush. In addition, 5 priority are related activities under Education, Health, Nutrition, Skills and Agriculture have also been identified as per the district plan.

THE PRELIMS PRACTICE QUESTIONS

QUESTION OF THE DAY

Q.Consider the following statements with respect to election to the office of the President

1. all the elected members of the Upper and Lower Houses of Parliament participate in the election

2. a vote cast by each MP or MLA calculated as one vote.

Which of the above statements is/are incorrect?

a) 1 only

b) 2 only

c) Both 1 and 2

d) Neither 1 nor 2

ANSWER FOR 16TH JULY 2022

ANSWER: A

EXPLANATION:

Statement 1 is incorrect. The United Nations Credentials Committee is a committee of the United Nations General Assembly.

Statement 2 is incorrect. A Credentials Committee is appointed at the beginning of each regular session of the General Assembly. It consists of nine members, who are appointed by the General Assembly on the proposal of the President.

Statement 3 is correct. The Committee reports to the Assembly on the credentials of representatives. The Committee is mandated to examine the credentials of representatives of Member States and to report to the General Assembly thereon (Rule 28 of the Rules of Procedure of the General Assembly).

The credentials of representatives and the names of members of the delegation of each Member State are submitted to the Secretary-General and are issued either by the Head of the State or Government or by the Minister for Foreign Affairs (Rule 27 of the Rules of Procedure of the General Assembly).