THE INDIAN POLITY AND GOVERNANCE

IPC SECTION 295A

THE CONTEXT: Amid controversy surrounding the comments by Political Spokespersons Nupur Sharma and Naveen Jindal have put the spotlight on the law that deals with criticism of or insult to religion. Provisions in the Indian Penal Code (IPC), primarily Section 295A, define the contours of free speech and its limitations with respect to offences relating to religion.

What is IPC Section 295A?

- Section 295A defines and prescribes punishment for deliberate and malicious acts, intended to outrage religious feelings of any class by insulting its religion or religious beliefs.

- “Whoever, with the deliberate and malicious intention of outraging the religious feelings of any class of citizens of India by words, either spoken or written, or by signs or by visible representations or otherwise, insults or attempts to insult the religion or the religious beliefs of that class, shall be punished with imprisonment of either description for a term which may extend to [three years], or with fine, or with both.”

- Simply put, Section 295A is one of the key provisions in the IPC chapter to penalise religious offences.

- The chapter also includes offences to penalise damage or defilement of a place of worship with intent to insult the religion (Section 295); trespassing in a place of sepulture (Section 297); uttering, words, etc, with deliberate intent to wound the religious feelings of any person (Section 298); and disturbing a religious assembly (Section 296).

- Section 295A has been invoked on a wide range of issues from penalising political satire and seeking bans on or withdrawal of books to even political critique on social media.

- Note: India does not have a formal legal framework for dealing with hate speech. However, a cluster of provisions, loosely termed hate speech laws, are invoked. These are primary laws to deal with offences against religions.

What are the other similar Sections or Provisions?

- Section 153A IPC penalises ‘the promotion of enmity between different groups on grounds of religion, race, place of birth, residence, language, etc., and doing acts prejudicial to the maintenance of harmony.

- Section 153B IPC penalises ‘imputations, and assertions prejudicial to national integration.

- Section 505 of the IPC punishes statements conducing to public mischief.

- Part VII of the Representation of People Act, 1951 classifies hate speech as an offence committed during elections into two categories: corrupt practices and electoral offences. The relevant provisions regarding hate speech in the RPA are Sections 8, 8A, 123(3), 123(3A) and 125.

- Model Code of Conduct (MCC) Item 1 (General Conduct)- prohibits parties and candidates from making any appeals to caste or communal feelings for securing votes.

- Section 66A of the Information Technology Act – In cases of hate speeches online, the section punishes sending offensive messages through communication services is added. In a landmark verdict in 2015, the Supreme Court struck down Section 66A as unconstitutional on the ground that the provision was “vague” and a “violation of free speech”. However, the provision continues to be invoked.

Why is Rangila Rasool case important ?

- Section 295A was brought in 1927. The case which becomes important as it is linked to the origin of Section 295A is Rangila Rasool case.

THE SOCIAL JUSTICE AND SOCIAL ISSUES

EXPLAINED: GOVT’S NEW GUIDELINES BANNING SURROGATE ADS

THE CONTEXT: Sellers of alcoholic beverages have asked the government to provide clarity on ‘surrogate advertisements’, which have been banned under the new guidelines to tackle misleading advertisements.

THE EXPLANATION:

According to the Consumer Affairs Ministry guidelines were issued on June 10 2022, by the Central Consumer Protection Authority (CCPA), and include a Rs 10 lakh penalty for first violation and a Rs 50 lakh penalty for subsequent violations.

What do the new advertising guidelines say?

The Guidelines for Prevention of Misleading Advertisements and Endorsements for Misleading Advertisements, 2022, have been released to “protect the consumers” and “to ensure that consumers are not being fooled with unsubstantiated claims, exaggerated promises, misinformation and false claims”.

- These guidelines focus on misleading ads and ads shown during programming for children.

- Surrogate ads, meanwhile, have been banned completely.

- Misleading ads have not been defined, instead characteristics of non-misleading ads have been mentioned such as those which “contain truthful and honest representation” and do not exaggerate benefits.

On advertisements aimed at children, detailed criteria has been spelt out to disqualify certain ads, such as: ads that encourage practices detrimental to children’s physical health or mental well-being, imply children are “likely to be ridiculed or become less popular” if they do not purchase the goods, and ads that use qualifiers such as ‘just’ or ‘only’ to make the price of goods seem less expensive even when additional charges are present.

What is surrogate advertising?

- Surrogate advertising is the strategy of advertising a product that cannot be advertised openly. Advertisers instead create ads that help in building a brand, and often involve popular celebrities – all without naming the actual product that is being indirectly advertised.

- In India, tobacco products and alcohol cannot be advertised openly under laws like the Cigarette and Other Tobacco Products Act, 2003, which bans all kinds of direct and indirect advertisements of tobacco products.

- To circumvent them, surrogate advertising is done.

Why are advertisers seeking clarity?

As per the new guidelines, a surrogate ad will refer to an ad which indicates directly or indirectly to consumers that it is an advertisement for the goods whose advertising is prohibited. Using any brand name, logo, colour, etc. associated with goods whose advertisement is banned is also not allowed.

EXPLAINED: WHY ARE JOB ASPIRANTS PROTESTING AGAINST THE ‘AGNIPATH’ SCHEME?

THE CONTEXT: Days after the government unveiled its Agnipath scheme for recruiting soldiers across the three services, protests raged in several cities against the new defence recruitment path with aspirants raising job security and post-service benefits as their major concerns.

THE EXPLANATION:

Why are job aspirants up in arms?

Job security and pension are two major issues being cited by protesters. Under the previous system, troops joined for a 17-year period, which could be extended for some personnel, and it resulted in a lifelong pension.

The new scheme, however, envisages just a four-year tenure for most, and the Agniveers will not be eligible for pension benefits.

What is the Agnipath scheme?

- The Agnipath scheme is the government’s defence recruitment reform under which around 45,000 to 50,000 soldiers will be recruited annually, and most will leave service in just four years.

- Of the total annual recruits, only 25 per cent will be allowed to continue for another 15 years under permanent commission.

- The new system is only for personnel below officer ranks (those who do not join the forces as commissioned officers). The scheme is not optional as all personnel below officer rank will be hired only through this route from now on. Under the Agnipath scheme, aspirants between the ages of 17.5 years and 21 years will be eligible to apply.

EXTENSION OF ENTRY AGE : AGNIPATH SCHEME

· Amid tensions in Bihar and other states for the consequent to the commencement of the AGNIPATH scheme, the entry age for all new recruits in the Armed Forces has been fixed as 17 ½ – 21 years of age.

· Cognizant of the fact that it has not been possible to undertake the recruitment during the last two years, the Government has decided that a one-time waiver shall be granted for the proposed recruitment cycle for 2022.

· Accordingly, the upper age limit for the recruitment process for the Agnipath scheme for 2022 is increased to 23 years.

THE INTERNATIONAL RELATIONS

I2U2 GROUPING OF INDIA, ISRAEL, UAE AND U.S. TO RE-ENERGISE AMERICAN ALLIANCES GLOBALLY

THE CONTEXT: According to the White House, the new I2U2 grouping of India, Israel, the UAE, and the U.S. will hold its first virtual summit next month (July 2022) as part of the Biden administration’s efforts to re-energise and revitalise American alliances across the world.

THE EXPLANATION:

What is I2U2?

I2U2 is the new grouping formed by four nations- India, Israel, UAE, and the US. The countries share various common global issues including food security crisis and defence, which will also be a highlight of the meeting of the four nations.

India-Israel-UAE-US grouping

- The grouping of the four nations- India, Israel, United Arab Emirates, and the United States met for the first time under a new framework in October 2021. The grouping dealt with the issues concerning maritime security, infrastructure, digital infrastructure, and transport.

- At that time, the Ambassador of UAE to India Ahmed Albanna had referred to the new grouping as the ‘West Asian Quad’.

I2U2 Grouping: Background

In October 2021, a meeting of the foreign ministers of the four countries took place when the External Affairs Minister of India was visiting Israel. At that time, the grouping of the four-nation was called ‘International Forum for Economic Cooperation’. This time, the meeting between the grouping of four nations will take place at the level of the heads of government/state- an upgrade.

THE ECONOMIC DEVELOPMENTS

THE MOVE TO LINK CREDIT CARDS WITH UPI

THE CONTEXT: The Reserve Bank of India (RBI) has proposed to allow the linking of credit cards with the Unified Payments Interface (UPI) platform. The move is part of the central bank’s efforts to enhance the scope of UPI.

THE EXPLANATION:

RBI Governor stated that RuPay credit cards issued by the RBI-promoted National Payments Corporation of India (NPCI) will be enabled first and will become available after system developments. The UPI, also managed by the NPCI, was first introduced in 2016.

What explains the effort to link credit cards with UPI?

The UPI has, over time, become a popular mode of payment in India with more than 26 crore unique users and five crore merchants on the platform. In May 2022, about 594 crore transactions amounting to ₹10.4 lakh crore were processed through the interface.

At present, the UPI facilitates transactions by linking savings/current accounts through users’ debit cards. It is now proposed to allow linking of credit cards on the UPI platform. This is intended to provide additional convenience to users and enhance the scope of digital payments.

When will the facility be made available?

This facility would be available after the required system development is complete. The RBI will issue necessary instructions to NPCI separately to facilitate the change. To begin with, the indigenous RuPay credit cards would be linked to the UPI platform. It is likely to be followed by other card networks such as Visa and MasterCard which would bring in more users.

What is the benefit of this provision?

The arrangement is expected to provide an additional avenue for payment to customers and hence enhance convenience. the linking of credit cards to UPI has been proposed to further deepen the reach and usage of credit cards.

Why do authorities expect this move to spur the use of credit cards?

- It is expected to bolster transactions and acceptance at more merchant sites. people who generally prefer to pay by credit card so as to avail of a longer pay-back period or loans on credit-card outstanding, or who do not wish to touch their savings at the moment of purchase, can pay using credit cards via UPI.

- Currently, many merchants do not have credit card point-of-sale (POS) terminals especially in semi-urban and rural areas but a significant number do have the QR code-based UPI acceptance facility. now, they too will be able to accept credit payments via UPI without needing a POS device.

- Linking of credit cards with UPI is likely to increase the use of such cards in small-ticket-size payments, as it would provide users with more options to pay from. the move will provide a significant boost to overall spending via credit cards — currently, spending through the use of credit cards is more than double the average spend via debit cards. more spending is generally a force multiplier for the economy.

- Besides accelerating digital transactions this measure is also expected to affect the average ticket size of financial transactions. currently the average ticket size per transaction is ₹1,600 while it is ₹4,000 in credit cards. so, with the new development the UPI transaction ticket size is likely to go up to somewhere around ₹3,000 to ₹4,000, analysts claim. many people use credit cards for rewards and benefits and UPI for its convenience & security. the new provision of linking credit cards to UPI brings both these advantages together.

Will a merchant discount rate be applicable for these payments?

- There is no word yet on the merchant discount rate (MDR) applicable on transactions using credit card numbers via UPI, other than for RuPay, which attracts no such charge. Today, since foreign card issuers such as Visa and MasterCard have a lion’s share of the credit card network business, part of the fees goes to them.

- However, the Indian government has shown its intent to promote the indigenous RuPay card system. It remains to be seen if it indeed does turn out more economical for merchants to accept payments from users with credit cards from foreign issuers.

THE ENVIRONMENT, ECOLOGY AND CLIMATE CHANGE

URBAN HEAT ISLANDS GROW IN CAPITAL

THE CONTEXT: According to experts, Delhiites await some respite from the intense heatwave, when the mercury surpassed 35 degrees Celsius even at night, discussions on the growing number of urban heat islands in the Capital have once again come to the fore.

“The combination of high day and night-time temperatures is dangerous as it seriously impacts the blood circulation and other bodily functions of people, especially the elderly,”

THE EXPLANATION:

- “The combination of high day and night-time temperatures is dangerous as it seriously impacts the blood circulation and other bodily functions of people, especially the elderly”.

- “As the house becomes hot and is unable to cool down by midnight, it starts acting as a heat trap. In such a situation, the body gets heated and the heart starts pumping more blood to fight dehydration if adequate water intake is not maintained. If one’s heart is already weak, it may fail and the person may die due to cardiac failure induced due to heatwaves.

Growing heat islands

An image captured by NASA on May 5, 2022, showed how night-time temperatures in Delhi and adjoining villages were above 35 degrees Celsius, peaking at about 39 degrees Celsius, while the rural fields nearby had cooled to around 15 degrees Celsius.

- According to Climate Activists Experts, “One way of looking at the cause of urban heat islands is global warming but the other is that these heat islands are linked to micro-climatic changes, which occur when we start disrupting our landscapes”.

- “Over 60% of Delhi’s landscapes are disrupted, signalling alteration or encroachment of tree cover, forest cover, wetlands and natural ecosystems”.

- One way to counter the growing impact of urban heat islands is ‘green infrastructure’ that includes cool roofs or painting house roofs in a light colour to reflect heat and using sustainable cooling mechanisms. Promoting urban forestry and green transport can also help curb heat emissions. Industries, which also act as heat traps, need to minimize heat emission through thermal innovations

Heat-related deaths

- Data on ‘Accidental Deaths & Suicides in India’ released by the National Crime Records Bureau show that over the years, heatstrokes have become the second leading cause of death from a natural force in India, with 11,555 people being killed from 2011 to 2020 due to the condition.

- In 2020, Ahmedabad and Hyderabad, which have heatwave action plans that track every heat-related death, reported heatstroke to be the reason for the maximum – 50% – deaths due to natural forces. Delhi reported no such death, according to the data. The Delhi government did not provide a comment on whether it tracks heat-related deaths.

- Taking insights from India’s first heat action plan that came up in Ahmedabad in 2013, the Centre is currently working with 23 heatwave-prone States and over 130 cities, including Delhi, to implement a similar action plan.

Value Addition:

What is a heatwave?

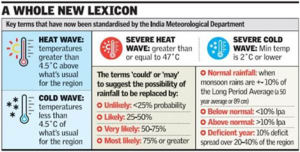

A region is considered to be under the grip of a heatwave if the maximum temperature reaches at least 40 degrees Celsius or more in the plains and at least 30 degrees Celsius or more in hilly regions. When the maximum temperature departure ranges between 4.5 and 6 degrees, the India Meteorological Department (IMD) declares a heatwave. A severe heatwave is declared when the recorded maximum temperature of a locality departure from normal is over 6.4 degrees Celsius. Also, if an area records over 45 degrees and 47 degrees Celsius on any given day, then the IMD declares heatwave and severe heatwave conditions, respectively.

Lack of pre-monsoon showers

Except for the southern peninsula and northeast regions, the weather has remained dry across the rest of the country. Once, in the last week, parts of Jammu and Kashmir and Delhi reported light to moderate rainfall. The lack of pre-monsoon showers has also led to an increase in the overall maximum temperature. Maharashtra recorded 63 per cent deficient rainfall from March 1 to April 26, 2022.

THE PRELIMS PRACTICE QUESTIONS

QUESTION FOR 17TH JUNE 2022

Q1. Consider the following statements:

- Spending through use of debit card is more than credit card in India.

- RuPay credit cards are issued by RBI.

- Unified Payments Interface (UPI) platform is managed by National Payments

Corporation of India (NPCI).

Which of the statements given above is/are correct?

- a) 1 and 2 only

- b) 2 and 3 only

- c) 3 only

- d) 1 and 3 only

ANSWER FOR 16TH JUNE 2022

Answer: C

Explanation:

Agnipath Scheme

- The government on 14th June 2022, unveiled its new Agnipath scheme for recruiting soldiers in three services.

- Soldiers recruited under the scheme will be called

What is the Agnipath scheme?

- Under the new scheme, around 45,000 to 50,000 soldiers will be recruited annually, and most will leave the service in just four years.

- Of the total annual recruits, only 25 per cent will be allowed to continue for another 15 years under permanent commission.

- The move will make the permanent force levels much leaner for the over 13-lakh strong armed forces in the country. This will, in turn, considerably reduce the defence pension bill, which has been a major concern for governments for many years.

What is the eligibility criteria?

- New system is only for personnel below officer ranks (those who do not join forces as commissioned officers).

- Under the Agnipath scheme, aspirants between the ages of 17.5 years and 21 years will be eligible to apply. The recruitment standards will remain the same, and recruitment will be done twice a year through rallies.

What happens after selection?

- Once selected, the aspirants will go through training for six months and then will be deployed for three and a half years.

- During this period, they will get a starting salary of Rs 30,000, along with additional benefits which will go up to Rs 40,000 by the end of the four-year service.

- Importantly, during this period, 30 per cent of their salary will be set aside under a Seva Nidhi programme, and the government will contribute an equal amount every month, and it will also accrue interest.

- At the end of the four-year period, each soldier will get Rs 11.71 lakh as a lump sum amount, which will be tax-free.

- They will also get a Rs 48 lakh life insurance cover for the four years.

- In case of death, the payout will be over Rs 1 crore, including pay for the unserved tenure.

- However, after four years, only 25 per cent of the batch will be recruited back into their respective services, for a period of 15 years. For those who are re-selected, the initial four-year period will not be considered for retirement benefits.

How will the scheme benefit the armed forces and the recruits?

- The average age in the forces is 32 years today, which will go down to 26 in six to seven years, the scheme envisions.

- Announcing the scheme, Defence Minister said that “efforts are being made that the profile of the Armed Forces should be as youthful as the wider Indian population.” Youthful armed forces will allow them to be easily trained for new technologies.

- The minister added that it will increase employment opportunities and because of the skills and experience acquired during the four-year service such soldiers will get employment in various fields.

- The government will help rehabilitate soldiers who leave the services after four years. They will be provided with skill certificates and bridge courses. The impetus will be to create entrepreneurs.