THE INDIAN POLITY AND GOVERNANCE

1. THE FARM LAWS REPEAL BILL, 2021

THE CONTEXT: The Lok Sabha and Rajya Sabha passed the “Farm Laws Repeal Bill 2021” to repeal the three contentious farms laws enacted in 2020, against which various farm organizations have been carrying out widespread protests for the past one year.

THE EXPLANATION:

The Farm Laws Repeal Bill, 2021 is aimed at repealing the three farm laws

- Farmers (Empowerment and Protection) Agreement on Price Assurance and Farm Services Act, 2020,

- The Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act, 2020,

- The Essential Commodities (Amendment) Act, 2020 – and amending the Essential Commodities Act, 1955.

These laws were enacted to: (i) provide a framework for contract farming, (ii) facilitate barrier-free trade of farmers’ produce outside the markets notified under the various state Agricultural Produce Marketing Committee (APMC) laws, and (iii) regulate the supply of certain food items (such as cereals, pulses, and onions) only under extraordinary circumstances such as war, famine, and extraordinary price rise. Note that, in January 2021, the Supreme Court had stayed the implementation of the three farm laws.

Problem with the laws?

- The main grievance raised by the farmers is that the laws will result in the dismantling of the state-run Agricultural Produce Marketing Committees,

and will disrupt the Minimum Support Price mechanism. - The protesting farmers fear that the laws will pave the way for corporate exploitation. A batch of petitions have been filed in the supreme court challenging the validity of these farm laws and questioning the competence of the Parliament in enacting the same.

What is meant by Repeal?

“Repeal means to revoke, abrogate, or cancel particularly a statute,” according to a ‘Reference Note’ prepared by the Lok Sabha Secretariat in 2016, and “any statute may repeal any Act in whole or in part, either expressly or implicitly, by enacting matter contrary to and inconsistent with the prior legislation.”

Generally, laws are repealed to either remove inconsistencies or after they have served their purpose. When new laws are enacted, old laws on the subject are repealed by inserting a repeal clause in the new law.

What is the procedure?

- Laws can be repealed in two ways – either through an ordinance, or through legislation.

- In case an ordinance is used, it would need to be replaced by a law passed by Parliament within six months. If the ordinance lapses because it is not approved by Parliament, the repealed law can be revived.

- The government can also bring legislation to repeal the farm laws. It will have to be passed by both Houses of Parliament and receive the President’s assent before it comes into effect.

- All three farm laws can be repealed through a single legislation.

Article 245

- Article 245 of the Constitution which gives Parliament the power to make laws also gives the legislative body the power to repeal them through the Repealing and Amending Act. The Act was first passed in 1950 when 72 Acts were repealed.

- The last time the Repealing and Amending provision was invoked was in 2019 when the Union government sought to repeal 58 obsolete laws and make minor amendments to the Income Tax Act, 1961 and The Indian Institutes of Management Act, 2017.

- The Repealing and Amending (Amendment) Bill will pass through the same procedure as any other Bills. It will have to cleared by both Houses of Parliament and the President would give his assent to make it a law.

2. THE SUSPENSION OF MP’S

THE CONTEXT: Twelve Opposition members of the Rajya Sabha were suspended for the entire winter session for “unprecedented acts of misconduct”, “unruly and violent behaviour” and “intentional attacks on security personnel” on August 11, 2021, the last day of the previous monsoon session.

POWERS AND FUNCTIONS AS CHAIRMAN:

As Presiding Officer of the House

- As the Chairman of the Rajya Sabha, the Vice-President presides over the meetings of the House.

- As the Presiding Officer, the Chairman of the Rajya Sabha is the unchallenged guardian of the prestige and dignity of the House. He is also the principal spokesman of the House and represents the collective voice to the outside world.

- He ensures that the proceedings of the House are conducted in accordance with the relevant constitutional provisions, rules, practices and conventions and that decorum is maintained in the House.

- He is the custodian and guardian of the rights and privileges of the House and its members. Due to several pressing and urgent engagements and preoccupations as Vice-President he may not be able to devote full time as Presiding Officer of the Rajya Sabha, but in practice he presides during the first hour of the sitting of the House which is the Question Hour.

Maintenance of Order in the House

- Maintenance of order in the House is a fundamental duty of the Chairman and he has been invested with all the necessary disciplinary powers under the rules for the purpose, such as checking irrelevance or repetition in the speech of a member, intervening when a member makes an unwarranted or defamatory remark by asking him to withdraw the same.

- The Chairman may also order expunction of any unparliamentary, or undignified words used in the debate, or order that anything said by a member without his permission would not go on record.

- He may direct any member guilty of disorderly conduct to withdraw from the House and name a member for suspension if he disregards the authority of the Chair and persists in obstructing the proceedings of the House. He may also adjourn or suspend the sitting of the House in case of grave disorder.

THE INDIAN ECONOMY

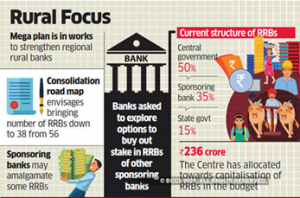

3. RRB’S SURPASS PRESCRIBED LENDING TARGET

THE CONTEXT: As per the data from Ministry of Finance, the Regional Rural Banks surpass prescribed lending target to Small & Marginal Farmers & SCs/STs during 2018 to 2021. Regional Rural Banks (RRBs) have been playing an important role in purveying agricultural credit, particularly to Small and Marginal Farmers (SF/MF) and weaker sections of the society.

THE EXPLANATION:

RBI guidelines for priority sector lending by Regional Rural Banks

RRBs will have a target of 75 per cent of their outstanding advances for priority sector lending and sub-sector targets.

| Categories | Targets |

| Total Priority Sector | 75 per cent of ANBC or CEOBE whichever is higher; However, lending to Medium Enterprises, Social Infrastructure and Renewable Energy shall be reckoned for priority sector achievement only up to 15 per cent of ANBC. |

| Agriculture | 18 per cent ANBC or CEOBE, whichever is higher; out of which a target of 10 percent is prescribed for SMFs |

| Micro Enterprises | 7.5 per cent of ANBC or CEOBE, whichever is higher |

| Advances to Weaker Sections | 15 per cent of ANBC or CEOBE, whichever is higher |

| Adjusted Net Bank Credit (ANBC) is: It is the net bank credit plus investments made by banks in non-SLR bonds held in the held-to-maturity category or credit equivalent amount of off-balance-sheet exposure, whichever is higher. |

Regional Rural Banks:

Regional Rural Banks were established under the provisions of an Ordinance passed on 26 September 1975 and the RRB Act 1987 to provide sufficient banking and credit facility for agriculture and other rural sectors. Regional Rural Banks (RRB) are Indian Scheduled Commercial Banks (Government Banks) operating at regional level in different states of India. They have been created with a view of serving primarily the rural areas of India with basic banking and financial services. However, RRBs may have branches set up for urban operations and their area of operation may include urban area too.

The area of operation of RRBs is limited to the area as notified by Government of India covering one or more districts in the State. RRBs perform various functions in following heads:

- Providing banking facilities to rural and semi –urban areas.

- Carrying out government operations like disbursement of wages of MGNREGA workers, distribution of pension etc.

- Providing Para-Banking facilities like locker facilities, debit and credit cards, mobile banking, internet banking, UPI etc.

What is Priority Sector Lending?

Priority Sector means those sectors which the Government of India and Reserve Bank of India consider as important for the development of the basic needs of the country and are to be given priority over other sectors. The banks are mandated to encourage the growth of such sectors with adequate and timely credit.

The categories of priority sector are as follows

- Agriculture

- Micro, Small and Medium Enterprises

- Export Credit

- Education

- Housing

- Social Infrastructure

- Renewable Energy

- Others

4. RBI SUPERSEDES RELIANCE CAPITAL BOARD

THE CONTEXT: The RBI superseded the board of Reliance Capital Ltd (RCL), promoted by Anil Ambani’s Reliance Group, in view of the defaults in meeting payment obligations.

THE EXPLANATION:

- The RBI said the board has been superseded “in view of the defaults by RCL in meeting the various payment obligations to its creditors and serious governance concerns which the Board has not been able to address effectively”. It also said the company would go for insolvency proceedings shortly.

- As per the data, Reliance Capital had defaulted on Rs 8,3138.8 crore. The company had said in its December-quarter earnings last year that it had listed non-convertible debentures (NCD) of Rs 14,827 crore.

- The RBI has appointed Nageswar Rao Y, former executive director of Bank of Maharashtra, administrator of Reliance Capital.

- The non-banking finance companies that are facing a crisis of confidence saw a slew of measures from the budget to restore investors’ confidence in the sector.

What is a Non-Banking Financial Company (NBFC)?

- A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of the immovable property.

- A non-banking institution which is a company and has the principal business of receiving deposits under any scheme or arrangement in one lump sum or in instalments by way of contributions or in any other manner is also a non-banking financial company (Residuary non-banking company).

What is the difference between banks & NBFCs?

NBFCs lend and make investments and hence their activities are akin to that of banks; however, there are a few differences as given below:

- NBFC cannot accept demand deposits;

- NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself;

- deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks.

Wider Regulatory Powers:

The Union budget 2019-20 has proposed to amend the RBI Act 1934, in order to strengthen the central bank’s autonomy and regulatory powers in following domains:

- It can supersede the board of NBFCs (other than those owned by the government) in the public interest or to prevent the affairs of NBFC being conducted in a manner detrimental to the interests of the depositor or creditor.

- It can remove and can further appoint the director of a board of NBFC.

- The proposed amendment to the RBI act will allow it to frame schemes for amalgamating, splitting and reconstructing an NBFC that will enable resolution of financially troubled NBFCs through a merger or by splitting them into viable and non-viable units called bridge institutions.

- RBI can also remove auditors, call for audit of any group company of an NBFC, and have control over the compensation of senior management.

About the Insolvency Bankruptcy Code:

The IBC was enacted in 2016, replacing a host of laws, with the aim to streamline and speed up the resolution process of failed businesses.

The Code also consolidates provisions of the current legislative framework to form a common forum for debtors and creditors of all classes to resolve insolvency.

The Code creates various institutions to facilitate resolution of insolvency. These are as follows:

- Insolvency Professionals.

- Insolvency Professional Agencies.

- Information Utilities.

- Adjudicating authorities: The National Companies Law Tribunal (NCLT); and the Debt Recovery Tribunal (DRT).

- Insolvency and Bankruptcy Board.

THE ENVIRONMENT AND ECOLOGY

5. KOLKATA’S ALIPORE ZOO INTRODUCES SHORT-TERM ADOPTION OF ANIMALS

THE CONTEXT: Alipore Zoological Garden in Kolkata has introduced month-long adoption of animals to create public awareness about them, besides the earlier year-long duration.

THE EXPLANATION:

Adoption of Zoo Animals Scheme

- Under the scheme anyone willing to adopt an animal will have to pay specific amount for a year, which will be spent for the upkeep of chosen animal including its seeding and healthcare needs.

- Zoo Director said adoption fees have been lowered, and authorities are encouraging people to adopt lesser-popular birds and animals, besides popular ones such as deer, tigers and chimpanzees

- After adoption, though the animals continue remaining in the zoo, the sponsor gets a complimentary entry pass to the premises for up to four people, can celebrate his/her birthday on the campus, and gets an adoption card.

- The annual adoption rate for a lion, tiger or elephant is ₹2 lakh, while that for a giraffe is ₹1.5 lakh. One needs to shell out ₹15,000-20,000 for adopting smaller animals, and ₹2,000-3,000 for birds.

- “The monthly rates will be one-twelfth of the annual ones. We will upload the photo of the animal and the sponsor on the website and also put it up near the respective enclosure,”.

- The Alipore Zoological Gardens (also called Kolkata Zoo) is India’s oldest formally stated zoological park and a big tourist attraction in Kolkata, West Bengal. It has been open as a zoo since 1875 and covers 18.81 hectars.

6. GREEN HYDROGEN

THE CONTEXT: According to the International Renewable Energy Agency (IRENA), hydrogen will make up 12% of the energy mix by 2050. The agency also suggested that about 66% of this hydrogen used must come from water instead of natural gas. Recently, IRENA has released the ‘World Energy Transitions Outlook’ Report.

THE EXPLANATION:

Hydrogen as a fuel:

- Hydrogen is considered an alternative fuel. It is due to its ability to power fuel cells in zero-emission electric vehicles, its potential for domestic production, and the fuel cell’s potential for high efficiency.

- In fact, a fuel cell coupled with an electric motor is two to three times more efficient than an internal combustion engine running on gasoline. Hydrogen can also serve as fuel for internal combustion engines.

- Hydrogen is seen as a sunrise technology for achieving net-zero emission targets as it does not emit GHG upon combustion.

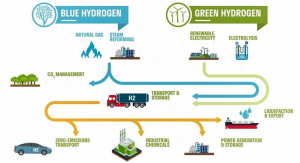

Types of Hydrogen:

- Green Hydrogen: It is produced from renewable resources of energy and not fossil fuels. The by-products are water and water vapour.

- Blue Hydrogen: It is sourced from fossil fuels, and the emission or the by-products such as CO2 and CO are stored. It is better than grey hydrogen.

- Grey Hydrogen: India’s bulk comes from fossil fuels at present. This type of hydrogen is called grey hydrogen.

How can green hydrogen be used?

Hydrogen can be used in broadly two ways. It can be burnt to produce heat or fed into a fuel cell to make electricity.

- fuel-cell hydrogen electric cars and trucks

- container ships powered by liquid ammonia made from hydrogen

- “green steel” refineries burning hydrogen as a heat source rather than coal

- hydrogen-powered electricity turbines that can generate electricity at times of peak demand to help firm the electricity grid

- as a substitute for natural gas for cooking and heating in homes.

Current Status Worldwide:

- Less than 1% of hydrogen produced is green hydrogen.

- Manufacturing and deployment of electrolysers will have to increaseat an unprecedented rate by 2050 from the current capacity of 0.3 gigawatts to almost 5,000 gigawatts.

Indian Scenario:

- Consumption of Hydrogen: India consumes about six million tonnesof hydrogen every year for the production of ammonia and methanol in industrial sectors, including fertilisers and refineries.

- This couldincrease to 28 million tonnes by 2050, principally due to the rising demand from the industry, but also due to the expansion of transport and power sectors.

- Cost of Green Hydrogen:By 2030, the cost of green hydrogen is expected to compete with that of hydrocarbon fuels (coal, Crude Oil, natural gas).

- The price will decrease further as production and sales increase. It is also projected that India’s hydrogen demand will increase five-fold by 2050, with 80% of it being green.

- Exporter of Green Hydrogen:India will become a net exporter of green hydrogen by 2030 due to its cheap renewable energy tariffs.

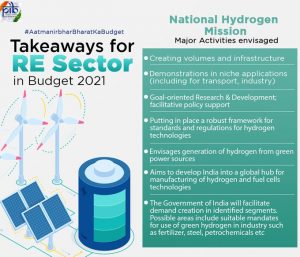

National Hydrogen Energy Mission:

- The Union Budget for 2021-22 has announced a National Hydrogen Energy Mission (NHM) that will draw up a road map for using hydrogen as an energy source.

- Focus on the generation of hydrogen from green power resources.

- To link India’s growing renewable capacity with the hydrogen economy.

- India’s ambitious goal of 175 GW by 2022 got an impetus in the 2021-22 budget, which allocated Rs. 1500 crore for renewable energy development and NHM.

- The usage of hydrogen will not only help India in achieving its emission goals under the Paris Agreement but will also reduce import dependency on fossil fuels.

The Way Forward

- Set a national target for green hydrogen and electrolyser capacity: A phased manufacturing programme should be used to build a vibrant hydrogen products export industry in India such as green steel (commercial hydrogen steel plant).

- Implement complementary solutions that create virtuous cycles: For example hydrogen infrastructure can be set up for refueling, heating and generating electricity at airports.

- Decentralised Production: Decentralised hydrogen production must be promoted through open access of renewable power to an electrolyser (which splits water to form H2 and O2 using electricity).

- Providing Finance: Policymakers must facilitate investments in early-stage piloting and the research and development needed to advance the technology for use in India.

7. ARUNACHAL PRADESH: INDIA’S 1ST CERTIFIED ORGANIC FRUIT KIWI LAUNCHED

THE CONTEXT: India’s only certified organic kiwi from Ziro Valley Farms of Arunachal Pradesh was launched at a mega National Tribal Festival called Aadi Mahotsav.

THE EXPLANATION:

- Arunachal Pradesh is the first Indian state, that obtained “organic certification of kiwifruit” under the organic certification was provided by the Mission Organic Value Chain Development for North East Region (MOVCD-NER), a scheme for the northeastern states by the Ministry of Agriculture & Farmers’ Welfare under the Central government.

- An agricultural practice/product is considered organic when there are no chemical fertilisers or pesticides involved in its cultivation process. Such certifications in India can be obtained after strict scientific assessment done by the regulatory body, Agricultural and Processed Food Products Export Development Authority (APEDA).

Ziro Valley

- Ziro Valley is a town and district headquarters of Lower Subansiri district in Arunachal Pradesh. This town has been included in Tentative List for UNESCO’s World Heritage Site for its Apatani cultural landscape.

- The land of Arunachal Pradesh ideal for the production of Kiwi is its altitude which is about 1500-2000 metre high in some parts of the state including the Ziro valley along with the cool climate of the state which experiences winters for more 8-9 months of the year.

|

About APEDA The Agricultural and Processed Food Products Export Development Authority (APEDA) was established by the Government of India under the Agricultural and Processed Food Products Export Development Authority Act 1985. The Authority replaced the Processed Food Export Promotion Council (PFEPC). APEDA, under the Ministry of Commerce and Industries, promotes export of agricultural and processed food products from India. APEDA is mandated with the responsibility of export promotion and development of the following scheduled products:

|

8. AFRICA’S GREAT GREEN WALL

THE CONTEXT: According to the Food and Agriculture Organization of the United Nations (FAO) study showed that for every dollar invested into land restoration yields across the African continent from Senegal in the west to Djibouti in the east, investors can expect an average return of $1.20, with outcomes ranging between $1.10 and $4.40.

THE EXPLANATION:

What is the Great Green Wall?

- The Great Green Wall is a symbol of hope in the face of one of the biggest challenges of our time – desertification. Launched in 2007 by the African Union, this game-changing African-led initiative aims to restore Africa’s degraded landscapes and transform millions of lives in one of the world’s poorest regions, the Sahel. Once complete, the Wall will be the largest living structure on the planet – an 8,000 km natural wonder of the world stretching across the entire width of the continent.

- The Great Green Wall is now being implemented in more than 20 countries across Africa and more than eight billion dollars have been mobilized and pledged for its support. The initiative brings together African countries and international partners, under the leadership of the African Union Commission and Pan-African Agency of the Great Green Wall.

Objectives

By 2030, the ambition of the initiative is to restore 100 million ha of currently degraded land; sequester 250 million tons of carbon and create 10 million green jobs. This will support communities living along the Wall to:

- Grow fertile land, one of humanity’s most precious natural assets

- Grow economic opportunities for the world’s youngest population

- Grow food security for the millions that go hungry every day

- Grow climate resilience in a region where temperatures are rising faster than anywhere else on Earth

- Grow a new world wonder spanning 8000 km across Africa

The GGW offers multiple (environmental, social and economic) benefits on an epic scale, touching on 15 of the 17 United Nations-mandated Sustainable Development Goals.

The Sahel extends south of the Sahara from Senegal in the west to Ethiopia in the east of Africa. Vast areas of the formerly fertile region are now virtually uncultivated due to droughts, poor agricultural cultivation methods as well as land overuse due to the growing demand for food and firewood.

The 11 countries selected as intervention zones for the Great Green Wall are Burkina Faso, Chad, Djibouti, Eritrea, Ethiopia, Mali, Mauritania, Niger, Nigeria, Senegal and Sudan.

THE GOVERNMENT SCHEMES/ INITIATIVES IN NEWS

9. THE ZERO-DEFECT ZERO EFFECT SCHEME

THE CONTEXT: As per the recent data by the Ministry of Micro, Small & Medium Enterprises, as many as 23,948 MSMEs had registered with intent to adopt the principle of the Zero Defect Zero Effect Scheme (ZED).

THE EXPLANATION:

In India’s pursuit of becoming globally competitive, the prime minister has pitched for ‘Make in India’ with ‘Zero Defect, Zero Effect (ZED)’ culture with twin focus – on customers and on society.

The objective of the Scheme:

- Develop an Ecosystem for Zero Defect Manufacturing in MSMEs.

- Promote adaptation of Quality tools/systems and Energy Efficient manufacturing.

- Enable MSMEs for manufacturing quality products.

- Encourage MSMEs to constantly upgrade their quality standards in products and processes.

- Drive manufacturing with the adoption of Zero Defect production processes and without impacting the environment.

- Support ‘Make in India’ campaign.

- Develop professionals in the area of ZED manufacturing and certification.

There are 50 parameters for ZED rating and additional 25 parameters for ZED Defence rating under ZED Maturity Assessment Model. The MSMEs are provided financial assistance for the activities to be carried out for ZED certification i.e., Assessment / Rating, Additional rating for Defence angle, Gap Analysis, Handholding, Consultancy for improving the rating of MSMEs by Consultants and Re-Assessment / Re-Rating.

Quality Council of India (QCI) has been appointed as the National Monitoring & Implementing Unit (NMIU) for the implementation of ZED.

|

Quality Council of India

§ Associated Chambers of Commerce and Industry of India (ASSOCHAM), § Confederation of Indian Industry (CII) and § Federation of Indian Chambers of Commerce and Industry (FICCI)

|

PRELIMS PRACTICE QUESTIONS

Q 1. What is blue carbon?

a) Carbon captured by oceans and coastal ecosystems

b) Carbon sequestered in forest biomass and agricultural soils

c) Carbon contained in petroleum and natural gas.

d) Carbon present in the atmosphere.

ANSWER FOR NOVEMBER 29th, 2021 PRELIMS PRACTICE QUESTIONS

ANSWER: C

EXPLANATION:

- Mahatma Gandhi was associated with “Songs from Prison”, a translation of ancient Indian religious lyrics in English in 1934.