Contribution to GDP

-

- The industrial sector contributed 30.9% of India’s GDP in 2023-24.

- This is a significant increase from around 15% in 1950-51, showcasing the sector’s growth over the decades.

- The annual growth of GVA for 2023-24, at constant (2011-12) prices, is estimated to be 9.5%, which is highest among the three sectors – agriculture and allied services, industries and services

The share of the industrial sector in GVA over recent years:

-

- 2019-20: 29.6%

- 2020-21: 30.8%

- 2021-22: 31.6%

- 2022-23:30.2%

- 2023-24: 30.9%

Major Sectoral Classification

The industrial sector is divided into several major categories:

1. Mining and quarrying

2. Manufacturing

3. Electricity, gas, water supply, and other utility services

4. Construction

Note: Among these, the manufacturing sector is the largest contributor to GDP.

Performance of Key Sectors

-

-

Cement: Building the future

-

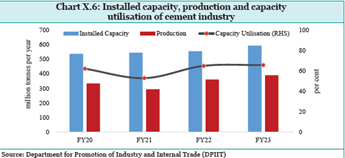

The Indian cement industry, contributing about 11% to the construction sector’s input costs, has grown significantly since de-licensing in 1991, making India the world’s second-largest cement producer after China. With 159 integrated plants, 120 grinding units, and 62 mini plants, the industry has an annual capacity of 622 million tonnes and produced 427 million tonnes in FY24. Concentrated in states like Rajasthan, Andhra Pradesh, and Gujarat, the industry imports just 0.2% of its cement needs. Despite a decline in clinker exports since FY19, India maintains strong domestic capacity to meet demand.

-

-

Steel sector on the growth path

-

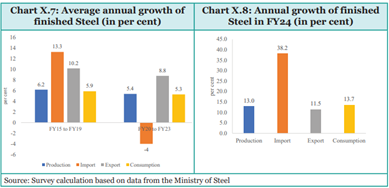

Iron and steel contribute 47% of inputs in building and construction and are crucial for machinery and consumer goods. In FY24, the sector saw its highest production and consumption. India, a net exporter of finished steel over the past decade, became a net importer in Q2 and Q3 of FY24 due to price differentials. Import dependence on coking coal rose from 56.1 MT in FY23 to 58.1 MT in FY24. With a 12% share in India’s greenhouse gas emissions and an emission intensity of 2.5 tonnes of CO2 per tonne of crude steel, green steel is essential as the world transitions to a low-carbon economy.

-

-

Coal: Reducing external dependence

-

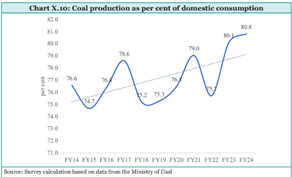

Coal accounts for over 55% of India’s primary commercial energy, with coal-fired power generation making up about 70% of total power generation. In FY24, India produced 997.2 million tonnes of coal, imported 261 million tonnes, and consumed 1233.86 million tonnes. Over the past decade, domestic production growth outpaced consumption growth, reducing import dependence.

The government has set a target to gasify 100 MT of coal by 2030 to reduce imports.

Challenges, opportunities and options in the Coal Sector

-

- Technological difficulties due to the limited availability of modern mining equipment from Indigenous manufacturers

- Procedural complexities in acquiring forestry and environmental clearances, land acquisition, and possession needed for timely development of mining projects.

- Need for sustainable solutions amid global environmental action.

- Need to blend coking coal with imported coal to reduce import costs

- Need to convert coal into other less damaging sources such as coal mine methane (CMM), coal bed methane (CBM), coal to liquid, and coal to methanol.

Major Consumer-oriented Industries

1. Pharmaceuticals: Growing and Global Presence

-

- India’s pharmaceutical market, valued at USD 50 billion, is the third largest globally, offering a diverse range of products and accounting for 20% of global generic exports.

- Pharma industry is expected to reach US$ 130 billion by 2030. The next leg of growth in pharma necessitates skill advancement, the use of innovation and technology, and the establishment of a strong supply chain.

- India’s pharmaceutical industry boasts high-quality compliance with numerous US FDA, European GMP, and WHO-GMP-approved facilities, with recent rule revisions aligning with global standards.

- PLI schemes have enhanced bulk drug production, reducing reliance on imports and making India a net exporter of bulk drugs, with higher export growth than import growth.

- The PLI scheme positively impacts domestic medical device production, narrowing the export-import gap, with local manufacturing of devices like CT-Scans and MRI machines.

- The Scheme for the Promotion of Bulk Drug Parks provides support to establish three bulk drug parks for the creation of world-class Common Infrastructure Facilities.

- Pradhan Mantri Bhartiya Janaushadhi Kendras (PMBJKs) are open to provide generic medicines.

2. Textile industry: Navigating challenges

-

- In FY23, the textile sector contributed ₹3.77 lakh Crore to GVA, accounting for 10.6% of manufacturing GVA and 29.3% of non-corporate manufacturing GVA.

- India, the second-largest clothing manufacturer, saw a 1% rise in textile and apparel exports to ₹2.97 lakh Crore in FY24, with readymade garments leading.

Challenges in the Sector

-

- The majority of India’s textile and apparel production capacity is on account of MSMEs, which account for over 80 per cent of the sector, and the average scale of operations is relatively small.

- India’s heavy dependence on imported machinery, inadequate availability of skilled manpower, technological obsolescence, etc, also act as significant constraints.

- The fragmented nature of India’s apparel sector, with raw materials sourced predominantly from Maharashtra, Gujarat, and Tamil Nadu, while spinning capacities are concentrated in southern states, contributes to higher transportation costs and delays.

3. Electronics industry: Powering the future

-

- India’s electronics sector grew significantly, contributing 4% to GDP in FY22, with domestic production reaching ₹8.22 lakh Crore and exports at ₹1.9 lakh Crore in FY23.

- The domestic value addition in mobile manufacturing rose from 8.7% to 22% between FY17-FY22, reflecting increased local participation and substantial growth in employment and wages.

- Direct employment in mobile phone production tripled from FY17 to FY22, with wages rising 317%, highlighting the sector’s impact on job creation and female workers.

- In order to attract and encourage significant investments in the electronics value chain and boost exports, the government has introduced several schemes: (i) Production Linked Incentive Scheme (PLI) for Large Scale Electronics Manufacturing, (ii) PLI IT Hardware, (iii) Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS), and (iv) Modified Electronics Manufacturing Clusters (EMC 2.0).

- As a result, the CAGR in the production of electronics goods from FY18 to FY23 was 16.19 per cent, while the exports increased by 35.7 percent in the same period.

4. Automotive industry

-

- The Indian automobile industry, including major global manufacturers and a vibrant auto component sector, saw moderated growth in FY20-FY23 due to pandemic impacts.

- The pandemic significantly affected all automotive segments, with passenger vehicles recovering quickly while two-wheelers, three-wheelers, and commercial vehicles faced longer recovery periods.

- In FY24, India produced around 49 lakh passenger vehicles, 9.9 lakh three-wheelers, 214.7 lakh two-wheelers, and 10.7 lakh commercial vehicles, showing expansion.

- Some of the initiatives for the promotion of the sector includes – PLI Scheme for automobile and auto components, National Programme on Advanced Chemistry Cell (ACC) Battery Storage, Phase II of the FAME Scheme and the Electric Mobility Promotion Scheme 2024 (EMPS 2024).