Meaning

-

- It is a general price rise of all goods and services in the basket over a period of time.

- It is measured through various price indices.

- It leads to reduction in purchasing power of the currency.

Effects of inflation on debtors and creditors

Debtors (or borrowers) gain and creditors (or lenders) lose due to inflation.

Why?

-

- Debtors return the same amount of money, but they pay less in terms of goods and services. This is because the value of money is less than when they borrowed the money. Thus, the burden of the debt is reduced and debtors gain.

- On the other hand, creditors lose.

- Thus, inflation brings about a redistribution of real wealth in favour of debtors at the cost of creditors.

Types of Inflation

1. Demand-pull Inflation

-

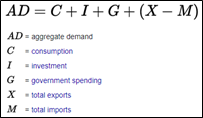

- It is caused by an increase in Aggregate Demand (AD)

- It can also be fuelled by factors like increased disposable income leading to increase in quantity demanded.

- An increase in money supply

- High Government or private expenditure

- Depreciation of rupees may also lead to demand-pull inflation since cost of imports increase leading to imported inflation.

How to tackle demand-pull inflation?

-

- Increasing supply of goods and services

- Using monetary policy and fiscal policy tools to control inflation.

2. Cost-push Inflation

-

- It is caused mainly due to supply constraints.

- The supply constraint may be caused due to rising input costs (costs of various factors of production).

- Increased rate of taxes also leads to cost-push inflation.

- Higher cost of capital and poor gross capital formation can lower supply of goods and services thus, pushing up inflation.

- Higher crude oil prices lead to increased energy cost and thus higher cost of production.

3. Structural Inflation

-

- It is also known as ‘Built-in Inflation’.

- It persists for a longer period.

- It is an indicator of inefficient utilisation of factors of production.

- Obsolete technology, poor human capital cause structural inflation.

- Structural reforms are needed to tackle built-in inflation.