Day-606

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

1. Consider the following statements:

Statement-I: ‘Crowding in’ occurs when higher government spending leads to higher private investment.

Statement-II: Higher government spending can stimulate aggregate demand.

Which one of the following is correct in respect of the above statements?Correct

Answer: A

Explanation:

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

Crowding-in refers to the situation where an increase in government spending leads to an increase in private sector investment.

The mechanism behind it works like this:

● A rise in government spending can boost aggregate demand (C+I+G+X-M) which can lead to increased real economic growth, higher employment and higher real incomes.

● This, in turn, can increase consumer and business confidence (an improvement in animal spirits) leading to increased private investment in new projects and businesses.

● The phenomenon is more likely to occur when the government expenditure is in the form of capital expenditure, targeted at infrastructure projects, etc, that increases the productivity of the economy.

● An opposite of this phenomenon is ‘crowding-out’. It occurs when higher government spending results in driving out the private sector from borrowing, thus effectively reducing private investment.

● This occurs because higher spending by the government requires the government to borrow from the market. This leaves less funds available for the private sector to borrow. A high demand for funds increases the interest rate in the market. An interest rate can be defined as the cost of the funds. Thus, crowding out of private investment happens.Incorrect

Answer: A

Explanation:

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

Crowding-in refers to the situation where an increase in government spending leads to an increase in private sector investment.

The mechanism behind it works like this:

● A rise in government spending can boost aggregate demand (C+I+G+X-M) which can lead to increased real economic growth, higher employment and higher real incomes.

● This, in turn, can increase consumer and business confidence (an improvement in animal spirits) leading to increased private investment in new projects and businesses.

● The phenomenon is more likely to occur when the government expenditure is in the form of capital expenditure, targeted at infrastructure projects, etc, that increases the productivity of the economy.

● An opposite of this phenomenon is ‘crowding-out’. It occurs when higher government spending results in driving out the private sector from borrowing, thus effectively reducing private investment.

● This occurs because higher spending by the government requires the government to borrow from the market. This leaves less funds available for the private sector to borrow. A high demand for funds increases the interest rate in the market. An interest rate can be defined as the cost of the funds. Thus, crowding out of private investment happens. -

Question 2 of 5

2. Question

2. With reference to ‘Debentures’, consider the following statements:

1. An individual’s investment in debentures represents the proportional stake in the company’s ownership.

2. They are entitled to periodic interest payments at a predetermined rate.

Which of the statements given above is/are correct?Correct

Answer: B

Explanation:

Statement 1 is incorrect: A debenture is a type of a long-term debt instrument, and not equity representing a stake in the company, issued by a company or organisation to raise funds from the public or institutional investors. It is a loan that investors provide to the issuer, typically a corporation or a government entity.

Statement 2 is correct: A debenture holder is entitled to interest at the fixed rate.

There exist different types of debentures:

● Convertible debentures: They are bonds that can convert into equity shares of the issuing corporation after a specific period. Convertible debentures are hybrid financial products with the benefits of both debt and equity.

● Non-convertible debentures: They are traditional debentures that cannot be converted into equity of the issuing corporation. To compensate for the lack of convertibility investors are rewarded with a higher interest rate when compared to convertible debentures.

● Redeemable debentures: They are debentures that come with a specific maturity date. The issuer is obligated to repurchase them from debenture holders at face value upon maturity.

● Irredeemable debentures: These do not have a fixed maturity rate. They continue indefinitely and the issuer has no obligation to repurchase them.

● Registered debenture: It is a debenture for which the issuer maintains a register of debenture holders. These debentures are linked to specific investors.

● Unregistered debenture: These debentures do not have a specific record of individual debenture holders.Incorrect

Answer: B

Explanation:

Statement 1 is incorrect: A debenture is a type of a long-term debt instrument, and not equity representing a stake in the company, issued by a company or organisation to raise funds from the public or institutional investors. It is a loan that investors provide to the issuer, typically a corporation or a government entity.

Statement 2 is correct: A debenture holder is entitled to interest at the fixed rate.

There exist different types of debentures:

● Convertible debentures: They are bonds that can convert into equity shares of the issuing corporation after a specific period. Convertible debentures are hybrid financial products with the benefits of both debt and equity.

● Non-convertible debentures: They are traditional debentures that cannot be converted into equity of the issuing corporation. To compensate for the lack of convertibility investors are rewarded with a higher interest rate when compared to convertible debentures.

● Redeemable debentures: They are debentures that come with a specific maturity date. The issuer is obligated to repurchase them from debenture holders at face value upon maturity.

● Irredeemable debentures: These do not have a fixed maturity rate. They continue indefinitely and the issuer has no obligation to repurchase them.

● Registered debenture: It is a debenture for which the issuer maintains a register of debenture holders. These debentures are linked to specific investors.

● Unregistered debenture: These debentures do not have a specific record of individual debenture holders. -

Question 3 of 5

3. Question

3. Consider the following statements:

Statement-I: Direct monetisation of fiscal deficit leads to inflationary pressure in the economy.

Statement-II: The central bank purchases government securities in the secondary market.

Which one of the following is correct in respect of the above statements?Correct

Answer: C

Explanation:

Statement-I is correct but Statement-II is incorrect

Direct monetization of deficit refers to a scenario where a central bank prints currency to the tune of accommodating massive deficit spending by the government. The central bank, the RBI in India, does so by purchasing government securities directly in the primary market and not secondary market. Hence, statement 2 is incorrect.

Direct monetisation of the deficit leads to inflationary pressure in the economy as there is increase in money supply in the economy. Hence, statement 1 is correct.

Direct monetisation process used to be automatic in India only until 1997, when it was later decided to end this practice by entrusting RBI to conduct such OMOs (Open Market Operations) only in the secondary market.Incorrect

Answer: C

Explanation:

Statement-I is correct but Statement-II is incorrect

Direct monetization of deficit refers to a scenario where a central bank prints currency to the tune of accommodating massive deficit spending by the government. The central bank, the RBI in India, does so by purchasing government securities directly in the primary market and not secondary market. Hence, statement 2 is incorrect.

Direct monetisation of the deficit leads to inflationary pressure in the economy as there is increase in money supply in the economy. Hence, statement 1 is correct.

Direct monetisation process used to be automatic in India only until 1997, when it was later decided to end this practice by entrusting RBI to conduct such OMOs (Open Market Operations) only in the secondary market. -

Question 4 of 5

4. Question

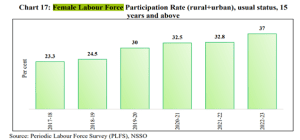

4. With reference to the Female Labour Force Participation Rate (FLFPR) in India in the last five years, consider the following statements:

1. It has been falling in the urban areas, while it has been rising in the rural areas.

2. Rise in rural FLFPR is marked by a rise in the share of self-employment and agriculture among working women.

3. Overall, it has risen to more than 35%.

How many of the above statements are correct?Correct

Answer: B

Explanation:

Statement 1 is incorrect: The government has taken various steps to improve women’s participation in the labour force and quality of their employment. Female Labour Force Participation Rate (FLFPR) has been rising for at least six years now. While urban FLFPR has also been rising, the rural FLFPR has seen a sharp growth. Hence, both the urban as well as rural areas have registered an increase in participation.

Statement 2 is correct: The rise in rural female LFPR has been accompanied by a rise in the share of self-employment and agriculture among working women. The rise in rural female employment has been contributed by both own account worker/employer category (share rising from 19 per cent in 2017-18 to 27.9 percent in 2022-23) and the unpaid helper category (share rising from 38.7 percent to 43.1 per cent, which is a relatively smaller rise), indicating a rising contribution of females to rural production.

Statement 3 is correct: Overall, FLFPR rose from 23.3 per cent in 2017-18 to 37 per cent in 2022-23.

Incorrect

Incorrect

Answer: B

Explanation:

Statement 1 is incorrect: The government has taken various steps to improve women’s participation in the labour force and quality of their employment. Female Labour Force Participation Rate (FLFPR) has been rising for at least six years now. While urban FLFPR has also been rising, the rural FLFPR has seen a sharp growth. Hence, both the urban as well as rural areas have registered an increase in participation.

Statement 2 is correct: The rise in rural female LFPR has been accompanied by a rise in the share of self-employment and agriculture among working women. The rise in rural female employment has been contributed by both own account worker/employer category (share rising from 19 per cent in 2017-18 to 27.9 percent in 2022-23) and the unpaid helper category (share rising from 38.7 percent to 43.1 per cent, which is a relatively smaller rise), indicating a rising contribution of females to rural production.

Statement 3 is correct: Overall, FLFPR rose from 23.3 per cent in 2017-18 to 37 per cent in 2022-23.

-

Question 5 of 5

5. Question

5. Consider the following statements:

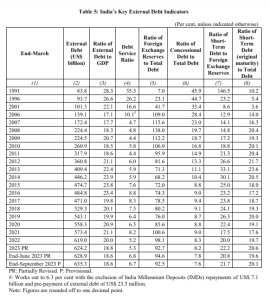

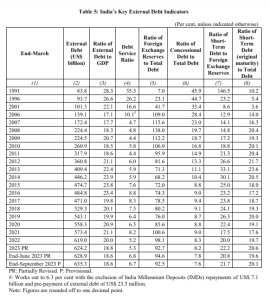

Statement-I: India is less vulnerable to the sovereign debt crisis.

Statement-II: US dollar-denominated debt remained the largest component of India’s external debt.

Which one of the following is correct in respect of the above statements?Correct

Answer: B

Explanation:

Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

Statement 1 is correct: India is less vulnerable to the sovereign debt crisis.

● Sovereign default or debt crisis occurs when a country fails to repay its debt, or its debt-to-GDP ratio becomes unsustainably high.

● As stated by the Finance Ministry, India’s public debt-to-GDP ratio has barely increased from 81% in 2005-06 to 84% in 2021-22, and is back to 81% in 2022-23.

● According to a recent IMF report (International Monetary Fund), India’s general government debt, including the Centre and States, could be 100% of GDP under adverse circumstances by fiscal 2028. This created a controversy, with the government refuting the IMF projections as “a worst-case scenario and is not fait accompli”.

● According to the Reserve Bank of India’s (RBI) monthly bulletin, India’s debt-to-GDP ratio could decline to 73.4% by 2030-31 from an estimated 81.6% in 2023-24.

● On the external debt front, at end-September 2023, India’s external debt was placed at $635.3 billion, recording an increase of $ 6.4 billion over its level at end-June 2023.

● The external debt to GDP ratio stood at 18.61% as at end-September 2023, as against 18.58% as at end-June 2023. It was 20% in 2022.

● In a 2020 research paper, Reserve Bank of India (RBI) economists noted that India’s external vulnerability remained minimal. In a 2022 note, RBI economists said the threshold level of external debt is 23-24% of GDP, implying India could raise growth maximizing external debt.

Statement 2 is correct: The US dollar denominated debt remained the largest component of India’s external debt with a share of 54.7% at end-September 2023, followed by Indian Rupee (30.5%), SDR (5.7%), Japanese Yen (5.6%), and Euro (2.9%).Incorrect

Answer: B

Explanation:

Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

Statement 1 is correct: India is less vulnerable to the sovereign debt crisis.

● Sovereign default or debt crisis occurs when a country fails to repay its debt, or its debt-to-GDP ratio becomes unsustainably high.

● As stated by the Finance Ministry, India’s public debt-to-GDP ratio has barely increased from 81% in 2005-06 to 84% in 2021-22, and is back to 81% in 2022-23.

● According to a recent IMF report (International Monetary Fund), India’s general government debt, including the Centre and States, could be 100% of GDP under adverse circumstances by fiscal 2028. This created a controversy, with the government refuting the IMF projections as “a worst-case scenario and is not fait accompli”.

● According to the Reserve Bank of India’s (RBI) monthly bulletin, India’s debt-to-GDP ratio could decline to 73.4% by 2030-31 from an estimated 81.6% in 2023-24.

● On the external debt front, at end-September 2023, India’s external debt was placed at $635.3 billion, recording an increase of $ 6.4 billion over its level at end-June 2023.

● The external debt to GDP ratio stood at 18.61% as at end-September 2023, as against 18.58% as at end-June 2023. It was 20% in 2022.

● In a 2020 research paper, Reserve Bank of India (RBI) economists noted that India’s external vulnerability remained minimal. In a 2022 note, RBI economists said the threshold level of external debt is 23-24% of GDP, implying India could raise growth maximizing external debt.

Statement 2 is correct: The US dollar denominated debt remained the largest component of India’s external debt with a share of 54.7% at end-September 2023, followed by Indian Rupee (30.5%), SDR (5.7%), Japanese Yen (5.6%), and Euro (2.9%).