About:

-

- Constitutional body under Article 279A by 101st Constitutional Amendment Act, 2016.

- Composition (Article 279A(2)):

- Chairperson- Union Finance Minister

- Members- Union Minister of State in charge of Revenue or Finance and Minister in charge of Finance or Taxation or any other Minister nominated by each state government

- It has its own secretariat.

Role:

-

- To promote coordination at federal level.

- It oversees the implementation of GST.

- It is empowered to take decisions related to GST rates and rules.

Working:

| Achievements | Weakness |

|---|---|

| State as equal partners rather than fiscal neighbours. (Vijay Kelkar) Increased consensus building. GST reviewed multiple times to ensure effective implementation. Rationalization of GST by minimizing slabs and maximum rate at 28%. | Alleged biasness of centre towards the states ruled by same party. Imposition of decisions on states rather than proper discussions and deliberations. Vague provisions in law about role, functions and powers of GST Council. Criticized by state as decisions taken by bureaucracy are imposed on states. |

Relevance in promoting fiscal federalism:

-

- Fosters consensus-based decision-making

- Balancing state and central fiscal needs

- Uniformity in taxation

- Equal power to centre and states

Mohit Minerals vs Union of India, 2022

About:

Ø Supreme Court ruled that GST Council recommendations are not binding.

Ø Both the Union and State have equal powers to legislate on GST.

Ø SC reinforces that States’ concerns must be heard, promoting a more cooperative federal structure.

Concerns:

Ø Politicization at state level for not implementing GST Council’s decisions.

Ø Possibility of State’s withdrawing from GST regime.

Ø A legal challenge for implementation of GST.

Conflictual and combative federalism

-

- It is characterized by increasing disagreements and confrontations between the central and state governments, often leading to tensions.

- Some examples include:

- The conflict between the West Bengal government and the central government regarding the deployment of central forces in state.

- Tamil Nadu and some other states expressed reservations about National Education Policy 2020.

- The friction between the state government of Maharashtra and the office of Governor, during formation of government in 2019.

- States accuse the Centre of misusing agencies like the CBI, ED, and IT Department for political vendetta like CBI denied entry into West Bengal.

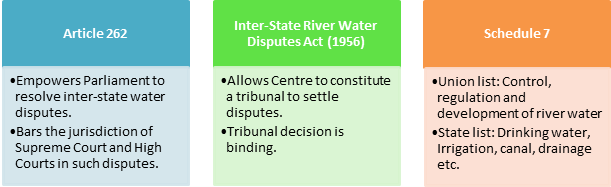

Inter-state river water dispute

Basics:

Causes for failure of dispute resolution:

-

- Legal and Constitutional powers:

- Centre has powers but has not intervened proactively.

- Legal ambiguity related to water like groundwater and institutions dealing with it, relationship between ground water and surface water.

- Ambiguity with respect to rights of state in terms of downstream or upstream state.

- Institutional problems

- Interventional of SC through Special leave petition results in States not constituting tribunals and directly going to SC.

- It defeats the rationale of Article 262 and introduces legal technicality.

- Political problems (Hydro-politics)

- Disputes being politically motivated

- When the party in state different from ruling party, matter becomes more political rather than technical.

- Legal and Constitutional powers:

Way forward:

-

- A permanent tribunal with multi-member body and expertise, as recommended by Punchhi Commission.

- Clear definition of terms to overcome structural and institutional problems.

- Greater emphasis on dialogue, negotiation and consultation.

- Bring Inter-state water disputes under interstate council (Article 263).