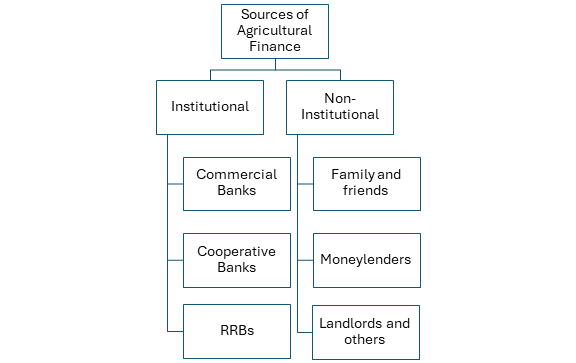

Most Indian farmers are small or marginal with inadequate savings, requiring sufficient and timely credit for inputs like fertilizers, pesticides, and seeds. It is also essential for the entire crop yield period, including sowing, harvesting, and sale of produce. Moreover, farmers also need these credits for non-agricultural purposes

Types of Agricultural Loans

Based on Time

-

- Short-term Loan: Up to 15 months for inputs like seeds, fertilizers.

- Medium-term Loan: 15 months to 5 years for repairs, procurement of implements.

- Long-term Loan: Beyond 5 years for structural changes in cultivation.

Based on Purpose

-

- Productive: For improving agricultural production like seeds, fertilizers, pesticides, labour payments.

- Consumption: For subsistence and basic needs of the family.

- Unproductive: For social obligations like marriages, rituals.

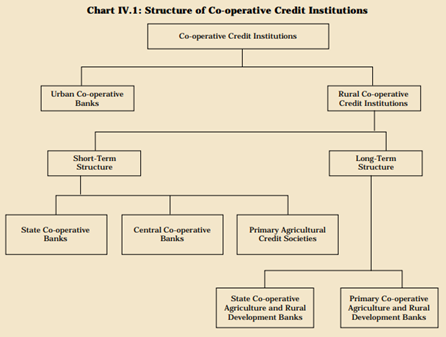

Co-operative Credit Institutions

Organisation of Cooperatives

-

- Three-tier Structure

1. Primary Level: Primary Agriculture Credit Societies (PACS) at the village level.

2. Intermediate Level: District Central Cooperative Banks (DCCBs) at the district level.

3. State Level: State Cooperative Banks (SCBs).

-

- Membership: Open to individuals, with PACS memberships comprising farmers.

- Function: Provide short-term credit for inputs and long-term credit for land improvements, purchasing implements, and repaying debts.

Cooperatives accounted for 12 percent of institutional credit to agriculture (total credit to agriculture sector was Rs 20 lakh crore in 2023-24)

Challenges of cooperative credit institutions

1. Resource Mobilization: Many PACS and DCCBs fail to mobilize rural savings, relying heavily on external funds.

2. High Overdue: PACS face a high level of overdue loans, weakening their financial position.

3. High NPAs: Rural cooperatives have high non-performing assets (NPAs), impacting their health and viability.

4. Losses: Many cooperatives incur substantial losses; as of 2021, 85% of PACS reported losses.

5. Inefficiency: PACS are often too small and plagued by inefficiencies and management issues.

6. Access to Credit: Credit is often accessible only to members, with less than 50% of members actually availing themselves of credit.

7. Socio-economic Disparities: Large landowners benefit more, while small farmers and tenants have limited access.

8. Government Interference: Excessive control by the government hinders cooperative autonomy, leading to inefficiencies and politicisation.

Role of NABARD

Apex Finance Agency: Provides refinance to lending institutions with special focus on micro finance institutions.

Promotion: Institutional development and rural financing.

Supervision: Supervises RRBs (not regulation).

Assistance: Extends support to government and RBI for rural development.

Training and Research: Offers facilities for banks, cooperatives.

|

Kisan Credit Card (KCC) Purpose: Facilitates short-term formal credit. Offered by: Public sector banks, private banks, cooperative banks, RRBs. Eligibility: Individual farmers, tenants, sharecroppers, SHGs. Validity: 5 years, collateral waived up to ₹1.60 lakh. Insurance: Crop insurance for notified areas, personal accident insurance. |