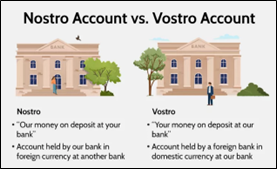

Nostro and Vostro accounts are terms commonly used in international finance to describe accounts that financial institutions (mostly banks) hold with each other to facilitate smoother cross-border transactions. A nostro account and a vostro account refer to the same entity but from a different perspective.

Nostro Account

The word “Nostro Account” is derived from the Latin word which means “Our account with You”. Nostro account is a bank account, that a bank holds in a foreign country’s currency at another bank in that country. This type of account is used by banks to facilitate foreign exchange transactions and to hold funds that belong to their customers who have accounts in foreign currencies.

For example, XYZ Bank in USA wants to conduct business in India and needs to hold Indian Rupee for this. It can open a Nostro account with Bank ABC in India. Bank XYZ can then use the Nostro account to facilitate transactions in Indian Rupee without having to convert the US dollar into Indian Rupee every time it needs to make a transaction.

Vostro Account

The word “Vostro” is derived from the Latin word which means “Your account with Us”. VOSTRO account is a type of bank account that is held by a foreign bank at a domestic bank in the domestic bank’s currency. In other words, a Vostro account is a foreign bank’s account at a domestic bank. Thus, in the last example, Bank ABC (India) holds of Bank XYZ (USA) in Indian Currency. Thus, Bank ABC will refer that account as Vostro account which is held by them on behalf of bank XYZ.

Loro Account

A Loro account is an account that is held by a third party on behalf of two parties engaged in a transaction. The term “Loro account” is derived from the Italian word which means “their account.” Loro accounts are used when two parties who want to conduct transactions through a third party for various reasons, such as confidentiality or convenience. The third party holds the funds or assets on behalf of the two parties involved. Loro accounts are less common compared to Nostro and Vostro accounts.

Spread the Word