-

- Foreign exchange reserves are various types of assets held as reserves by a country’s central bank (like RBI) in foreign currencies.

- Net surplus in Balance of Payment is transferred to FER account and that leads to increase in foreign exchange reserves (or forex reserves).

- A deficit in BoP leads to outflow of assets from Forex accounts.

- It is maintained by RBI.

Components of Foreign Exchange Reserves (FER)

The main elements of forex reserves in India include

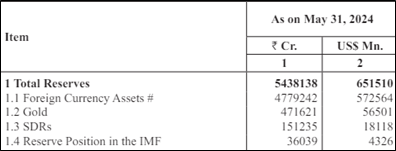

1. Foreign Currency Assets (FCAs): Bonds of foreign countries which are held by RBI. It is the largest component of FER. These are generally held in terms of government securities of foreign countries. Thus, central banks, like RBI, earn interest income in terms of coupon receipts, which form a bulk of profit for them. A portion of these profits are transferred as surpluses to the government. In 2023-24, RBI has transferred a record surplus of more than 2 lakh crore rupees to the central government.

2. Gold reserves: Gold reserves are another essential component of Indian forex reserves. Gold is a hedge against inflation and provides a safety net during economic uncertainties. Inclusion of gold in the reserves adds an extra layer of protection and value, reflecting the traditional importance of gold in the Indian economy. However, not all countries keep gold as reserves to avoid physical storage costs & the risks associated with it.

3. Special Drawing Rights (SDR): The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves. The SDR is not a currency, but its value is based on a basket of five currencies—the US dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling. However, the SDR value in terms of the US dollar is determined daily based on the spot exchange rates. Adding SDRs to a country’s international reserves makes it more resilient financially. In times of crisis, a country can dip into its savings for urgent needs.

SDR Allocation

A general allocation of SDRs requires broad support from the IMF’s members. The IMF distributes a general allocation to member countries in proportion to their quota shares at the IMF.

An SDR allocation is cost free. Allocating SDRs does not require contributions from donor countries’ budgets. SDRs are a reserve asset, not foreign aid. Most importantly, an SDR allocation does not add to any country’s public debt burden.

There have been four general allocations, most recently in 2021, when the IMF’s Board of Governors approved a general allocation of about SDR 456 billion, equivalent to US$650 billion, to boost global liquidity. Of this allocation, India was allocated roughly 12.5 billion SDR. The distribution – the largest SDR allocation in the history of the IMF – helped countries respond to the COVID-19 pandemic. The general allocation of about SDR 161 billion in 2009, equivalent to US$250 billion, boosted liquidity amid a global financial crisis.

4. Reserve Tranche Position (RTP) in IMF: A reserve tranche is a segment of an International Monetary Fund member country’s quota that is accessible without fees or economic reform conditions. It is the difference between the International Monetary Fund’s (IMF) holdings of that country’s currency and the country’s IMF-designated quota in SDR. RTP can be withdrawn any time by the member without any condition or paying any interest on it. The reserve tranches that countries hold with the IMF are considered as point of first resort, meaning they will tap into the reserve tranche before seeking a formal credit tranche from the IMF.

Note: Both SDR and RTP are held with IMF and are denoted in SDR only. Theoretically, a member nation can withdraw 100% of its SDR quota. But, firstly RTP will be withdrawn as it is received without paying any interest. Any SDR withdrawal over and above the RTP is considered as credit tranche and interest is charged by IMF.

Factors that that influence the levels of forex reserves

1. Economic Factors

-

- Growth and Stability: A growing economy may increase Indian forex reserves as foreign investors invest in the country. Conversely, economic instability may lead to a decrease as investors pull out. That is why, some portion of forex reserves are considered as ‘hot money’ as it keeps on fluctuating depending upon the investment climate and economic stability.

- Trade Balance: A positive trade balance can lead to an accumulation of forex reserves. A negative trade balance may require using funds to pay for imports. However, an importing country like India generally faces negative trade balance and that is why to keep stable levels of imports, it is important to accumulate decent forex reserves.

- Inflation Control: The central bank may buy or sell foreign currency to control inflation, impacting the level of reserves. Imported inflation are a major component of demand-pull inflation and that is considered while maintaining the adequate levels of forex reserves.

2. Political Factors

-

- Government Policies: Policies related to foreign trade, investment, and fiscal management can either attract or deter foreign capital, affecting reserves. A consistent long-term policy is seen as favourable by foreign as well as domestic investors which augurs well for foreign exchange rate management system.

- Political Stability: A stable political environment attracts foreign investment, leading to an increase in reserves. Political uncertainty can have the opposite effect.

- International Relations: Diplomatic relations with trading partners and international organisations can influence the flow of foreign capital. A good diplomatic channel helps in using local currency as medium of exchange which can relieve the burden on forex reserves and associated costs. For example, India keeps pushing for use of rupee for oil trade with its trading partners to have a reduced dependence on dollars for international trade.

3. Global Factors

-

- Global Economic Conditions: The state of the world economy affects foreign investment, trade, and, consequently, forex reserves. If the global economy is seen expanding, then it is a reflection of higher global trade and relevant positive changes in exchange rates as well as stable commodity prices. An unprecedented boom or dip in global economy has a negative bearing on the global commodity prices.

- Exchange Rate Fluctuations: Changes in currency exchange rates can lead to gains or losses in the forex reserves of India.

- International Crises: Financial crises, pandemics, or geopolitical tensions can lead to sudden reserve changes because international financial institutions and countries’ central banks take extreme steps to arrest the exchange rate volatilities.

Is holding very high forex reserve bad for the economy?

Holding large forex reserves means funds are not invested elsewhere, leading to potential opportunity costs. This can be understood from the perspective of investment. Foreign Currency Assets (FCAs) are nothing but investments in sovereign bonds of largely developed economies which give a very low yield on those investments. Thus, central banks of emerging markets like RBI in case of India, is earning a lower return on their investments. At the same time RBI is funding the debt of the government of advanced economies whereas Government of India needs capital at lower interest rates.

Moreover, since India is a growing economy and there is a huge capital inflow which balances the current account deficits. So, very high levels of forex reserves may not be economically prudent decision.

Spread the Word