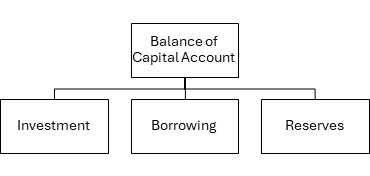

The capital account keeps track of the net change in a nation’s assets and liabilities during a year. In real sense, it gives the idea about whether the nation is a net importer or exporter of capital.

Non-Debt Flows (Investments)

Non-debt capital flows mean that assets are sold-off by way of equity investments by foreign investors or through direct operations. Foreign capital is raised by giving away ownership of assets (partial or full). It includes FDI and FPI.

1. Foreign Direct Investment (FDI)

-

- Investment made by foreign individuals or organizations into businesses located in other countries.

- Gives control over assets of the company to the foreign investor.

- Part of decision making for the company.

Forms of FDI

a. Financial Investment: 10% or more stake in a listed company or any investment in an unlisted company.

b. Direct operations: Fresh capital brought in for direct operations like setting up factories or service firms.

Types of FDI (Direct Operations)

a. Brownfield investment: Buying an existing factory or company.

b. Greenfield investment: Starting a new operation by setting up new factories or service units.

Routes of FDI

a. Automatic Route: No prior permission of Government is needed.

b. Government Route: Requires approval by respective Administrative Ministry/Department. FIPB was abolished in 2017.

FDI Statistics

-

- Total FDI inflows in FY 22-23: $70.97 Bn | Equity inflows: $46.03 Bn

- Total FDI (April 2000 – September 2023): $953.143 Bn

- FDI in last 9 years (April 2014 – September 2023): $615.73 Bn (~65% of total FDI)

- Top 5 Countries: Mauritius (24%), Singapore (23%), USA (9%), Netherlands (7%), Japan (6%)

- Top 5 Sectors: Services (16%), Computer Software & Hardware (15%), Trading (6%), Telecom (6%), Automobile (5%)

2. Foreign Portfolio Investment (FPI)

-

- Securities and financial assets held by foreign investors.

- No ownership/control over companies.

- Less than 10% stake in listed firms.

- Highly volatile and also known as “hot money”.

Types of Institutional Investors

1. Foreign Institutional Investment (FII): Only institutions like investment companies, insurance funds, etc. can invest directly.

2. Qualified Foreign Investors (QFIs): Foreign individuals/groups from FATF member countries.

Depository Receipts

These are financial instruments which are issued by Banks. It allows foreign company’s shares to be traded on the stock market of the domestic market.

a. American Depository Receipts (ADR)

American Depository Receipts (ADR) is a type of negotiable security instrument that is issued by a US bank on behalf of a non-US company, which is trading on the US stock exchange. It helps US investors to invest in non-US companies. It is issued in US Dollars

How does this work?

A company located in India, looking to get stock listed on the New York Stock Exchange, will get into an agreement with a depository bank of the USA, which in turn will issue Depository Receipts (DRs) which reflect the shares of the Indian Company. DRs can, in turn, be bought by US residents.

b. Global Depository Receipts (ADR)

-

- Same as ADR but on a global scale.

- Issued in USD or Euro

- Trades on Non-US Stock Exchange (Like French Stock Exchange etc)

c. Indian Depository Receipt (IDR)

It is opposite of ADR and GDR. It is used when a foreign company wants to mobilise investment from Indian Capital Market, they get IDR of their companies listed on NSE or BSE IDRs They are issued in Indian currency (INR) and are bought by Indian investors.

Debt flows (Borrowings):

It includes External assistance, External Commercial Borrowings (ECBs), Non-resident deposits, etc. When this route is used for foreign capital, then liability for the nation increases and the economy bears the obligation of interest payment.

a. External Commercial Borrowings (ECBs)

-

- These are commercial loans which are raised from international market.

- They can be raised by banks, corporates and other entities.

- The External Commercial Borrowing (ECB) policy is regularly reviewed by the Government in consultation with Reserve Bank of India (RBI) to keep it in tune with the evolving macroeconomic situation, changing market conditions, sectoral requirements, etc.

- Trade credits which include suppliers’ credit and buyers’ credit for 3 years and above come under the category of ECB.

- ECBs cannot be used for investment in stock market or speculation in real estate.

Note: A government entity like State Owned Enterprises (SOEs) are also allowed to raise ECBs if they are commercial in nature. For example, Indian Railways through its financing corporation (Indian Railways Financing Corporation or IRFC) can raise ECBs to fund capital projects.

b. External Assistance

-

- These are loans extended by multilateral and bilateral loans under the agreements between Government of India and other Governments/International institutions like IMF, World Bank, Japan International Cooperation Agency (JICA) etc.

- It has long term repayment options and lower interest rates.

c. Non-Resident Deposits

Deposits made by non-resident who keep their surplus funds with Indian Banks.

There are three types of accounts for non-resident deposits. They are:

1. Non-Resident External Rupee Account (NRE Account): They are maintained in Indian Rupees. It can be opened by Non-Resident Indians (NRIs). These accounts are prone to exchange rate risk because at the time of repatriation of amount, the prevailing exchange rates are factored-in while converting the amount from Indian currency to a foreign currency.

2. Non-Resident Ordinary Rupee Account (NRO Account): They can be opened by any non-resident (whether Indian or not). They are also maintained in Indian Currency (INR). They are not prone to exchange rate risk in terms of difference in exchange rate at the time of deposit and at the time of redemption.

3. Foreign Currency Non-Resident Account (FCNR Account): They are maintained in foreign currency which are generally widely accepted like USD, Japanese Yen, Sterling Pound etc. The account can be opened by Non-Resident Indians (NRI) and Overseas Corporate Bodies (OCB).

External Debt

-

- It is the total Debt that India owes to foreign creditors

- It includes External Commercial Borrowings, External Assistance, NRI deposits, Trade Credits along with the borrowing of the Government (sovereign external debt)

- It is an important parameter which are gauged by international credit rating agencies to rate the macro-economic framework of any country.

Some of the important parameters to gauge the levels of external debt are: External Debt-to-GDP ratio, External Debt-to-FER ratio (FER means Foreign Exchange Reserves).

Spread the Word