-

- The Budget is the Annual Financial Statement of the Government which contains estimates of receipts and expenditures of the Government for the upcoming financial year.

- The Union Budget is presented on 1st February of every year.

- Earlier, a separate Railway Budget was used to be presented. But it has been merged with the General Budget from 2017-18 onwards.

Constitutional Provisions

Article 266: No money can be spent from the Consolidated Fund of India without authorisation through an Annual Budget presented before the Parliament.

Article 112: The President shall in respect of every financial year cause to be laid before both the Houses of Parliament a statement of the estimated receipts and expenditure of the Government of India for that year referred to as the “Annual Financial Statement”.

Various Funds of India

1. Consolidated Fund of India: All the revenues, borrowings, receipts against loans. Money from this account can be withdrawn only after approval of the Parliament.

2. Contingency Fund of India: To meet any emergency or any unforeseen emergency expenditure. It is at the disposal of the President of India and is held by the Finance Secretary on behalf of the President.

3. Public Account of India: Small savings Scheme, money from Disinvestment, Postal insurance, National Calamity and Contingency Fund for disaster management. Any withdrawal from the Public Account of India does not require Parliament’s approval.

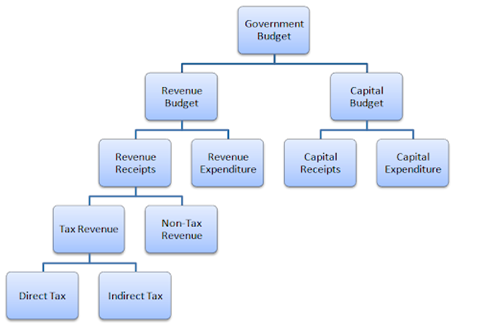

Components of Budget

1. Revenue Receipts

-

- Revenue receipts are those receipts for the government that do not result in an increase in liability for the government or a reduction in its assets.

- They are of a regular and recurring nature.

There are 2 types of Revenue Receipts

a) Tax Revenue: These are the receipts from various sources of direct as well as indirect taxes from the public.

b) Non- Tax Revenue: Revenue received from sources other than tax receipts. E.g. – Interest receipts on loans extended by the Government; Dividend and Profit receipts including surplus transfer by RBI; Fees; License and permit; grant-in aids or external assistance received by the government; Fines and penalties; Profits from sale of government books etc.

2. Revenue Expenditure

-

- These are consumption-based expenditure which are regular and recurring in nature.

- It does not have any impact on assets and liability account of the Government.

- High Revenue expenditure is a sign of poor public finance management if it creates revenue deficits.

- g. – Salaries and pension payment to Government employees; Interest payment on previous loans; Defence expense; Grants to states; subsidies payment

3. Capital Receipts

-

- Those receipts which either create liabilities or reduce the asset value of the government.

- There are 2 types of capital receipts.

a) Debt Creating: External Borrowing by Government, Borrowing through sale of Government securities (G-Secs), Small Savings Funds

b) Non-Debt Creating: Recovery of Principal amount of loans, Disinvestment proceeds

Disinvestment

-

- Sale or dilution of shares held by Government in State Owned Enterprises (or Public Sector Undertakings or PSUs).

- Government retains the management and control of the company.

- The proceeds of disinvestment are credited to the National Investment Fund (NIF) and can be used for any purposes as decided by the Government through Budget.

- E.g. – Disinvestment of shares of Life Insurance Corporation (LIC).

Strategic Disinvestment

-

- Sale of substantial portions of Government shares in a government company.

- Leads to transfer of management control.

- Government’s ownership falls below 50% (and sometimes to even 0).

- Also known as Privatisation of the Government Company

- E.g. – Sale of Air India to Tata Group

4. Capital Expenditure

-

- Increase in assets like building infrastructure, acquiring a company, or giving loans to another company.

- It mainly helps in creating a multiplier effect in the economy.

- Unlike revenue expenditure which are recurring and consumption-based, capital expenditure is one-time expense and leads to capital formation.

Multiplier Effect

-

- It refers to the change in the final income generated by a change in initial spending.

- Simply put, it measures the change in national income that occurs when additional money is invested in the economy.

- In India, earlier research has estimated that the capital expenditure multiplier is 2.45 and the revenue expenditure multiplier is 0.99.