Meaning

-

- It is a financial market where short-term financial instruments are traded.

- The maturity period of these securities is upto 1 year.

- This market is highly liquid as the maturity period is very less, so it is very easy to convert the investments into cash.

- It is a form of debt market which is of short duration.

- The aim of raising money through money market is adjusting cash flows and working capital mismatch. This mismatch in cash flows generally happens due to intermittent nature of receipt or long credit cycle.

- Money market also provides an avenue for the central bank intervention for influencing liquidity and the general level of interest rates in the economy.

- Participants – RBI, Banks, NBFCs, mutual funds, corporates, insurance companies etc.

- It is mainly regulated by the Reserve Bank of India (RBI), which also performs the function of data collection, compilation and regular dissemination of information relating to the money market.

Terms related to Debt Market (also applicable to money market)

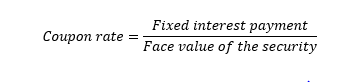

1. Coupon Rate: It is the pre-defined interest rate which is given on a fixed income security at the end of a specified period. No compounding is done on the coupon rate payment.

2. Market Price: Current price of the money market instrument in the market.

3. Issue Price: The price at which the money market instrument is issued.

4. Face Value: The amount which the investor will get at the time of maturity of the instrument.

5. Par Value: When the current market price (CMP) of the instrument is equal to the issue price.

6. Premium Value: When the current market price of the instrument is more than the issue price.

7. Discounted Value: When the current market price of the instrument is less than the issue price.

8. Yield: Rate of return generated on an instrument over a particular period of time. It is calculated over the investment value. It may be less or equal or more than the coupon rate. The yield rate of a bond is inversely proportional to the price of the bond.

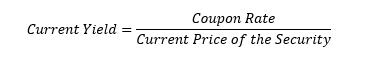

9. Current Yield: The rate of return generated over the current price of the instrument.

10. Yield to maturity (YTM): Total return expected if the debt instrument is held till maturity.

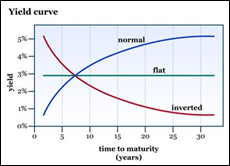

11. Yield Curve: It is a graphical representation that shows the relationship between the yield (interest rate) of bonds of the same credit quality but different maturities. It is an essential tool in finance, which is used to gauge the future interest rate changes, economic activity, and investor sentiment.

How interest rates affect bond yields

-

- When interest rates rise, the prices of existing bonds typically fall. This is because new bonds are issued at the higher current rates, making the older bonds with lower rates less attractive unless they are sold at a discount.

- Conversely, when interest rates fall, existing bonds with higher rates become more valuable, and their prices rise.

- Suppose the central bank raises the interest rate from 2% to 3%. New bonds are now issued at 3% interest. An existing bond with a 2% coupon rate becomes less attractive.

- Investors sell the old bonds to buy new ones with higher rates, driving down the price of the old bonds. If the price of the old bond drops to make its yield competitive with new issues, its yield rises.

- As bond prices adjust to changing interest rates, yields change as well. For example, if a bond’s price decreases due to rising interest rates, its yield (both current yield and YTM) increases to reflect the higher return required by investors.

Money market related terms:

1. Call Money: Money borrowed or lent for 1 day.

2. Notice Money: Money borrowed or lent for 2-14 days (including both limits).

3. Term Money: Money borrowed or lent for 15 days to 364 days.

Note: These borrowings or lending of money is on unsecured basis. That means that in case of default by the borrower, there is no collateral which can be sold-off to recover the debt.

Spread the Word