Derivatives are financial contracts, set between two or more parties, that derive their value from an underlying asset, group of assets, or benchmark.

-

- The underlying assets can be Shares, Bonds, Currencies, Commodities etc.

- They are used to hedge (or protect) risks arising from future price fluctuations.

- They can be exchange traded or can be outside exchange (known as Over the Counter or OTC).

- They are regulated by SEBI.

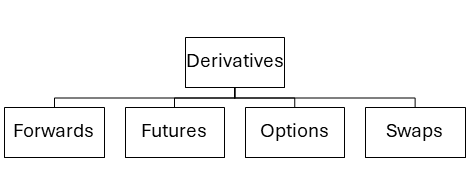

Types of Derivatives:

I. Forwards: A forward contract is a customized contract between two parties to buy or sell an asset at a specified price on a future date. These happen outside the stock exchange and are known as Over the Counter Contracts.

II. Futures: A futures contract is a standard agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. Futures contracts are standardized for quality and quantity and are traded on future exchange platforms.

III. Options: An options contract gives the holder the right to buy or sell an underlying security at a predetermined price, known as the strike price. It is not the obligation of the option buyer to perform the contract.

2 Types:

a) Call Option: They give the option buyer the right but not the obligation to buy the underlying asset at a specified price within a specific period. It is generally purchased when the prices are expected to rise.

b) Put Option: They give the option buyer the right but not the obligation to sell the underlying asset at a specified price within a specific period. It is generally purchased when the prices are expected to fall.

IV. Swaps: They are purchased to hedge risks when two parties enter into contract to mitigate interest rate risks or currency risks.

Spread the Word