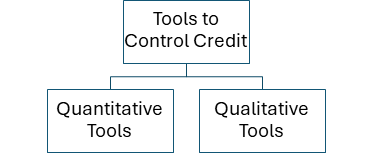

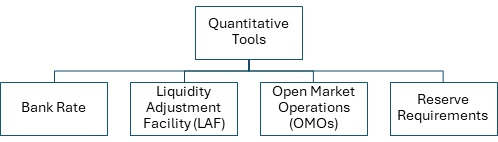

Quantitative Tools

1. Bank Rates

-

- The rates at which RBI provides long term loans to Scheduled Commercial Banks without asking for any security as collateral from the banks.

- It is a re-discounting rate that RBI extends to banks.

- Bank Rate: 6.75% (Jan 2024)

- As a policy rate, bank rate is not in consideration anymore because the RBI now focuses only on the repo rate as the policy rate.

2. Liquidity Adjustment Facility (LAF)

-

- LAF is used to aid banks in resolving any short-term cash shortages.

- Through repurchase agreements (repos) or reverse repo agreements

- Use of collateral for loan.

- Liquidity corridor is equal to the difference between the reverse repo rate and the repo rate.

Three instruments under Liquidity Adjustment Facility:

a) Repo Rate

-

- It is the rate at which RBI provides loan to Commercial Banks.

- It is a tool to inject short term liquidity in the banking system.

- Repo Rate is the official Policy Rate which is decided by the Monetary Policy Committee.

- A higher repo rate signals a higher borrowing rate in the market which leads to lesser credit flow in the system.

b) Reverse Repo Rate

-

- The rate at which RBI borrows funds from Commercial Banks.

- Basically, banks park their excess liquidity for a short period of time.

- A higher reverse repo rate will incentivise banks to park their money with RBI than to offer the same money for loan. Thus, the supply of credit in the market will go down.

Though there is no restriction on the maximum period for which repos can be undertaken. Generally, repos are for an average period of one week.

c) Marginal Standing Facility (MSF)

-

- It is a relatively new instrument which has been introduced by RBI.

- It was announced in 2011.

- It aims to contain the volatility in the overnight inter-bank call money rates.

- For SCBs (Scheduled Commercial Banks)

- Overnight short-term loan upto 2% of Net Demand and Time Liabilities (NDTL)

- MSF rate is generally higher than policy rate

- MSF rate: 6.75% (May 2024)

Note: With MSF, RBI has created a 50-basis point (1 basis point equals 0.01%) corridor in policy rates with repo rates in the middle and MSF at the 25 bps above the repo rate and reverse repo rate at 25 bps lower than the repo rate.

3. Open Market Operations (OMOs)

-

- It is conducted by RBI by way of sale or purchase of government securities to or from the market with an objective to adjust the rupee liquidity conditions in the market.

Terms associated with Open Market Operations (OMOs)

a) Operation Twist

-

- Its aim is to bring down the interest rates of the long-term government bonds and securities.

- When the interest rate of bonds and debts comes down, borrowing becomes cheaper which fuels private investments and overall increase in aggregate demand.

- It is a type of open market operations by which long-term securities are bought and short-term government securities are sold simultaneously by the Government of India under the guidance of the Reserve Bank of India.

b) Sterilisation

-

- It refers to the action taken by the Central Bank such as RBI, to counterbalance the effects of foreign exchange inflows or outflows on domestic money supply and inflation.

- It involves the simultaneous sale or purchase of government securities to offset the impact of foreign currency inflows or outflows.

How is sterilisation done by RBI?

When there is a foreign inflow, the same amount must be exchanged into local currency by RBI. This increases the liquidity of Indian Rupees in the market which may turn inflationary. To arrest this issue, RBI simultaneously sells G-Secs in the market to absorb the extra liquidity created by the introduction of those rupees which were earlier injected in the market.

The reverse happens in case of foreign investors pulling out of Indian economy.

Note: It is at the discretion of RBI whether they will opt for sterilisation or not, which is dependent on the data coming from the market on growth and inflation fronts.

c) Market Stabilisation Scheme (MSS)

-

- The MSS scheme was launched in April 2004 to strengthen the RBI’s ability to conduct exchange rate and monetary management.

- It is an arrangement between the Government of India and RBI to absorb excess liquidity from the market which are generated due to foreign capital inflows.

- The bills/bonds issued under MSS have all the attributes of the existing treasury bills and dated securities which are issued by RBI through auction process.

- The securities issued under the MSS scheme are matched by an equivalent cash balance held by the government with the RBI. As a result, their issuance will have a negligible impact on the fiscal deficit of the government.

4. Reserve Requirements: There are 2 types of reserve requirements:

a) Cash Reserve Ratio (CRR)

-

- The percentage of a banks’ Net Demand and Time Liabilities (NDTL) that it needs to maintain as liquid cash with RBI.

- A bank does not earn interest on this cash deposit.

- Banks cannot use this cash for investing and lending purposes.

- Current CRR: 4.5% of Banks’ Net Demand and Time Liabilities (NDTL) (May 2024).

- If banks fail to maintain it, RBI charges a penalty at rates above bank rates.

- It acts a tool to control the money multiplier in the market. A high CRR reduces the money multiplier of initial deposits in the banking system.

Note: All Scheduled Commercial Banks (SCBs), Urban Cooperative Banks (UCBs) and State Cooperative Banks (top tier of rural cooperative financing), Regional Rural Banks (RRBs), Small Finance Banks as well as Payments Banks are required to maintain CRR as per Section 42(1) of RBI Act, 1934.

b) Statutory Liquidity Ratio (SLR)

-

- The minimum percentage of banks’ Net Demand and Time Liabilities (NDTL) that a commercial bank has to maintain.

- In the form of liquid cash, gold or other government approved securities (either one or combination of three)

- Those G-Sec used for SLR should not be treated as the one used in Repo operations.

- SLR is maintained by SCBs themselves and not with RBI.

- Interest is earned on maintaining SLR in terms of Government securities.

- Current SLR: 18% of Banks’ NDTL (May 2024).

Note: Similarly, all those financial institutions which are required to maintain CRR are also required to maintain SLR.

Primary Agriculture Credit Society (PACS) are not required to maintain CRR and SLR

Monetary Policy Transmission

It is the process through which changes in a central bank’s monetary policy affect the economy, particularly influencing variables such as inflation, output, and employment.

It determines the effectiveness of passage of current monetary policy rates and the consequent adjustments in deposit as well as lending rates by banks for retail customers.

Various Lending Rates

MCLR (Marginal Cost of Funds Based Lending Rate) and EBLR (External Benchmark Lending Rate) are two different methods used by banks to set interest rates for loans.

1. Marginal Cost of Funds Based Lending Rate (MCLR)

-

- It was implemented by the Reserve Bank of India (RBI) in April 2016.

- It replaced the Base Rate system to improve the transmission of monetary policy.

- It is based on the marginal cost of funds (primarily the cost of new deposits), operating costs, cost of maintaining cash reserve ratio (CRR), and tenor premium.

- The marginal cost of funds is influenced by the cost of deposits and borrowing.

- It is more transparent than the Base Rate system, as it reflects the actual costs of funds more closely.

- Still, it has some lag in reflecting RBI’s policy rate changes.

2. External Benchmark Lending Rate (EBLR)

-

- It was introduced by the RBI in October 2019 to further enhance transparency and improve monetary policy transmission.

- It is linked to an external benchmark, which can be: repo rate, T-Bills or any other benchmark market interest rate published by FBIL.

- Banks add a spread over the external benchmark, which includes factors like operating costs and credit risk premium.

- It is more responsive to changes in the external benchmark rates compared to MCLR and provides greater transparency and quicker transmission of changes in policy rates to borrowers.

Use of Quantitative Tools

| Instruments | Reducing Money Supply (to control inflation) | Increasing Money Supply (to increase economic growth) |

|---|---|---|

| Bank Rate (BR) | Increase BR | Decrease BR |

| Repo Rate (RR) | Increase RR | Decrease RR |

| Reverse Repo Rate (RRR) | Increase RRR | Decrease RRR |

| Open Market Operations (OMO) | Sell G-Secs | Buy G-Secs |

| CRR | Increase CRR | Decrease CRR |

| SLR | Increase SLR | Decrease SLR |

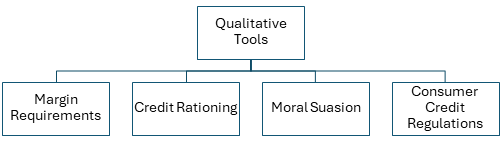

Qualitative Tools

1. Margin Requirements

-

- Also known as Loan-to-Value Ratio

- It determines the extent up to which a bank can finance a borrower.

- A higher LTV ratio means a higher loan will be granted as a proportion of securities offered for loan.

- To decrease money supply, LTV ratio is decreased, or margin requirements are increased.

Margin Requirement is opposite of LTV ratio.

Margin Requirement is the difference between the value of collateralised securities and the value of loan granted. So, higher is the margin requirement, lower is the LTV ratio.

2. Credit Rationing

-

- RBI fixes a ceiling (maximum limit) on loans and advances of various categories, which the commercial banks cannot exceed.

- This controls the amount of credit for certain sectors and ensures that all sectors get adequate credit.

- This ensures inclusive growth of all sectors of the economy.

3. Moral Suasion

-

- RBI nudges banks to adhere to certain policies through persuasion and pressure tactics to maintain adequate level of liquidity in the market.

4. Consumer Credit Regulations

-

- RBI gives directives to the banks with regards to down payments, maturities, EMIs etc.