THE CONTEXT: The recent El Niño event of 2023-2024 demonstrated how climate anomalies can cascade through agricultural systems to impact food security, inflation, and broader economic conditions in India. This event, characterized by abnormal warming of central and eastern equatorial Pacific Ocean waters, had profound implications for India’s agricultural productivity, food prices, and consumer spending patterns, highlighting the critical interdependence between climate phenomena and economic stability.

UNDERSTANDING THE EL NIÑO-LA NIÑA CYCLE:

-

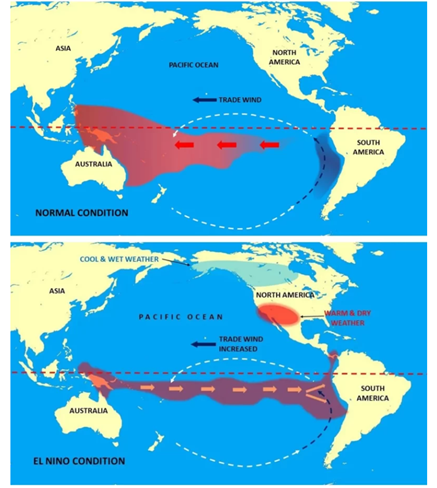

- El Niño and La Niña represent opposite phases of the El Niño-Southern Oscillation (ENSO) cycle, a natural climate phenomenon characterized by fluctuations in sea surface temperatures in the central and eastern tropical Pacific Ocean.

- During El Niño events, warmer-than-average sea surface temperatures develop in these regions, disrupting normal atmospheric circulation patterns and leading to changes in global weather patterns, including altered rainfall patterns.

- Conversely, La Niña events feature cooler-than-average sea surface temperatures in the same Pacific regions.

- The classification threshold for an El Niño event is a positive sea surface temperature (SST) departure of 0.5 degrees Celsius or more above the 30-year average for the region. Similarly, La Niña events are characterized by SST departures of negative 0.5 degrees Celsius or below.

- While seemingly small, these temperature anomalies trigger significant atmospheric responses that influence weather patterns globally, with particular relevance for monsoon-dependent regions like India.

NATURE OF THE 2023‑24 EL NIÑO

| Parameter | Threshold for El Niño | 2023 24 Episode |

|---|---|---|

| SST anomaly | ≥ +0.5 °C for ≥ 5 overlapping 3-month periods | Peaked at +2 °C (Apr–Sep ‘23) |

| Duration | Typically, 9 12 months | ~14 months (Apr ‘23 – May ‘24) |

| Intensity category (NOAA) | Weak / Moderate / Strong | Strong |

IMPACT ON INDIAN AGRICULTURE AND FOOD PRODUCTION:

-

- Disruption of Seasonal Rainfall Patterns: The 2023-2024 El Niño significantly impacted India’s precipitation patterns across multiple seasons. Large parts of the country experienced inadequate rainfall during the 2023-24 southwest monsoon (June-September), post-monsoon (October-December), and winter (January-February) seasons.

- This precipitation deficit was further complicated by the winter’s delayed onset and warmer-than-usual temperatures, culminating in heat waves from mid-March through mid-June 2024.

- Agricultural Production Challenges: The disrupted precipitation patterns resulted in 2023-24 becoming a suboptimal agricultural year for India, with underperformance in both major cropping seasons:

- Disruption of Seasonal Rainfall Patterns: The 2023-2024 El Niño significantly impacted India’s precipitation patterns across multiple seasons. Large parts of the country experienced inadequate rainfall during the 2023-24 southwest monsoon (June-September), post-monsoon (October-December), and winter (January-February) seasons.

-

-

- Kharif Season (June-August sowing, October-December harvest): Inadequate monsoon rainfall affected the establishment and growth of key crops like rice, pulses, and oilseeds.

- Rabi Season (October-December sowing, March-May harvest): The delayed winter onset followed by foggy conditions and insufficient sunshine in January particularly affected central India’s wheat production. While yields in north and northwest India were above average, poor harvests in Madhya Pradesh, Gujarat, and Maharashtra reduced overall national production.

-

-

- These agricultural production challenges were reflected in declining government food stocks, particularly wheat, which reached their lowest April 1st levels since 2008, with only 7.5 million tonnes in government godowns by April 2024.

ECONOMIC CONSEQUENCES: FOOD INFLATION AND CONSUMER SPENDING

-

- Food Inflation Trends: The agricultural production shortfalls directly translated into persistent food inflation. Between July 2023 and December 2024, the annual rise in the official consumer food price index averaged over 8.5%, marking one of India’s longest episodes of food inflation in recent times. Wheat prices remained particularly elevated throughout this period and into early 2025, reflecting the production challenges in central India.

- Impact on Consumer Spending: The elevated food prices significantly impacted household consumption patterns and broader economic activity. As families allocated a larger portion of their incomes to food purchases, discretionary spending declined.

- This shift was evident in the performance of India’s largest fast-moving consumer goods company, Hindustan Unilever, which reported diminishing annual sales volume growth: 2% each in the July-September 2023, October-December 2023, and January-March 2024 quarters, followed by 4% in April-June 2024, 3% in July-September 2024, and ultimately 0% in October-December 2024.

RECOVERY PHASE: LA NIÑA AND AGRICULTURAL RESURGENCE:

-

- Transition to Mild La Niña Conditions: By early 2025, climate conditions had transitioned to a mild La Niña phase, characterized by cooling sea surface temperatures in the central and eastern tropical Pacific.

- While the negative SST departures during November-February 2024-25 (minus 0.5-0.6 degrees) barely qualified as a full-fledged La Niña event, they were sufficient to normalize precipitation patterns across India.

- La Niña typically produces effects opposite to El Niño: The trade winds blowing west along the equator carry warm water from South America toward northern Australia and Indonesia, increasing cloudiness and rainfall over this region with beneficial effects often extending to the Indian subcontinent.

- Agricultural Recovery and Inflation Moderation: This climatic transition facilitated significant agricultural recovery in 2024-25, supported by improved monsoon conditions and a more normal winter season.

- The combined effect of successful kharif and rabi harvests began to alleviate food inflation pressures, with retail food inflation dropping to 2.7% year-on-year by March 2025 – the lowest level since November 2021.

- Transition to Mild La Niña Conditions: By early 2025, climate conditions had transitioned to a mild La Niña phase, characterized by cooling sea surface temperatures in the central and eastern tropical Pacific.

EVIDENCE OF RECOVERY (2024‑25 AGRICULTURAL YEAR):

RABI WHEAT TURNAROUND: FROM VULNERABILITY TO RESILIENCE:

-

- India’s wheat sector, adversely impacted by the El Niño-induced climatic volatility in 2023–24, has shown promising signs of recovery in the 2024–25 agricultural year.

-

- Central India Bumper Harvest: Yield gains of 12–15% in Madhya Pradesh, Gujarat, and Maharashtra—driven by favourable temperature regimes and absence of January fog—signal strong recovery in dryland agro-ecosystems.

- Agro-Technological Diffusion: Progressive farmers in Punjab and Haryana recorded 24–25 quintals/acre, aided by next-gen cultivars like HD‑3386 and PBW‑872. While marginally lower than 2023’s record of 27–28 q/acre, these yields remain 5–7% above the five-year moving average, underscoring varietal resilience under moderate climatic conditions.

- Market Indicators: Wheat mandi prices in Dewas and Ujjain corrected to ₹ 2,400–2,500/quintal—indicating ample supply and softening inflationary expectations, with prices dipping marginally below the MSP of ₹2,425.

- Public Procurement and Buffer Rebuilding: With procurement likely to exceed 30 million tonnes, wheat buffer stocks are set for replenishment after falling to a 16-year low of 7.5 MT (April 2024). This is critical for food price stabilization and NFSA commitments.

FOOD INFLATION COOLING: A TRANSITORY RELIEF

-

- CFPI Trends: The Consumer Food Price Index (CFPI) dropped to 2.7% y-o-y in March 2025, its lowest level in 40 months, owing to synchronised kharif and rabi crop arrivals in Q1 FY2025.

- Supply-Driven Disinflation: The food inflation cooling is supply-led, not demand-constrained. It highlights the interlinkage between agri-supply shocks and inflation transmission, particularly in cereals and pulses where India is structurally sensitive.

- Urban-Rural Consumption Parity: Easing food inflation is expected to revive rural real wages, enabling positive consumption elasticity across fast-moving consumer goods and informal sector outputs.

MACRO TAILWINDS: ENABLERS OF CONSUMPTION REVIVAL

-

- Terms-of-Trade Shock:

- Brent crude correction below $68/bbl from a high of $80 (Dec 2024) reduced logistics and input costs, including fertilisers.

- INR appreciation to ₹85.4/$ in March 2025 bolstered import affordability and eased the oil import bill, which constitutes ~20% of India’s total imports.

- Household Budget Rebalancing: With food inflation easing and fuel prices stabilising, Indian households have experienced a real income effect, facilitating non-food discretionary spending.

- Corporate Earnings Impact: Consumer-facing firms (e.g., HUL, Dabur) reported uptick in volume growth from Q1 FY2025, signalling a turnaround in demand sentiment—critical for India’s consumption-led growth model.

- Terms-of-Trade Shock:

THE WAY FORWARD:

CLIMATE-SMART AGRICULTURE (CSA): INSTITUTIONALISE AGROECOLOGICAL ADAPTATION

-

- Scale-up Integrated Agromet Advisory Services (IAAS) under IMD and ICAR to deliver district-specific, crop-stage aligned advisories.

- Mainstream heat/drought-resilient cultivars through NICRA and Krishi Vigyan Kendras (KVKs).

- Incentivise Millets 2.0 strategy—nutri-cereals as climate buffers under PM-Poshan and PDS.

DYNAMIC FOOD MARKET MANAGEMENT & STRATEGIC BUFFER DIVERSIFICATION

-

- Expand the ambit of the Price Stabilisation Fund (PSF) for non-cereal essentials (tur, urad, onions, edible oils).

- Institute dynamic buffer stocking norms based on commodity-wise volatility indices and demand elasticity.

- Use Open Market Sales Scheme (OMSS) proactively to smoothen seasonal volatility—digital dashboards for transparency.

- Economic Survey 2022–23 advocated “adaptive granularity” in public procurement and buffer stock operations.

WATER STEWARDSHIP: RESILIENCE AGAINST RAINFALL SHOCKS

-

- Scale-up Atal Bhujal Yojana with community water budgeting and aquifer recharge protocols.

- Integrate micro-irrigation (PMKSY-Per Drop More Crop) with precision agronomy for cereals and pulses.

- Promote water stewardship index in crop insurance ratings and procurement incentives.

- Only 18% of net sown area is under micro-irrigation as of 2024; potential exists to expand to 60 million hectares, per NITI Aayog.

RISK TRANSFER MECHANISMS: FROM RELIEF TO RESILIENCE

-

- Integrate PMFBY with KCC interest subvention and real-time weather stations for indexed, fast-tracked payouts.

- Enable ‘parametric insurance’ models using remote sensing + AI for drought, heatwave, flood risks.

- Institutionalise block-level contingency funds linked to crop advisories for early response.

- The Dalwai Committee on Doubling Farmers’ Income stressed weather-indexed risk transfer as a critical pillar of farmer income security.

- Kenya’s ACRE Africa uses satellite data to trigger pay-outs—98% claims settled within 2 weeks post-event.

FISCAL-MONETARY COORDINATION: ANCHORING INFLATION EXPECTATIONS

-

- RBI must differentiate between supply-shock and demand-pull inflation in its CPI targeting framework; adopt a flexible inflation targeting (FIT) 2.0 lens.

- The Union Government should publish transparent tariff matrices and forward guidance on export bans/import duty changes, particularly on wheat, pulses and onions.

- Create a joint fiscal-monetary policy dashboard to improve policy synchronisation during agri-shocks.

RESEARCH, FORECASTING & DECENTRALISED EARLY WARNING SYSTEMS

-

- Accelerate Monsoon Mission–III with high-resolution, coupled ocean-atmosphere models tailored for Indian subcontinent.

- Develop regional ENSO impact dashboards for real-time agri-decision support at the block level.

- Forge PPP models for climate data commercialisation, incentivising agri-tech startups to build adaptive crop advisory solutions.

- IMD + INCOIS + IITM Pune collaboration under Ministry of Earth Sciences can be leveraged to scale predictive accuracy.

THE CONCLUSION:

The 2023‑24 El Niño underscored India’s agro‑climatic vulnerability: a 2 °C Pacific warming translated into crop shortfalls, an 18‑month food‑inflation streak and subdued rural demand. Swift transition to neutral‑mild La Niña, a robust rabi rebound and prudent buffer‑stock policy have since doused price pressures. Sustaining this respite, however, requires climate‑proofed agriculture, agile trade‑cum‑buffer management and science‑led early‑warning systems.

UPSC PAST YEAR QUESTION:

Q. Most of the unusual climatic happenings are explained as an outcome of the El-Nino effect. Do you agree? 2014

MAINS PRACTICE QUESTION:

Q. Discuss the role of climate-resilient agriculture, dynamic food market management, and macro-policy synchronisation in building a shock-proof agricultural economy.

SOURCE:

Spread the Word