BACKGROUND: Young companies that are just in the development phase are called startups. These companies are founded by one or more people who generally want to develop a product or service and bring it to market. Raising money is one of the first things that a startup needs to do. This financing is what most people refer to as startup capital.

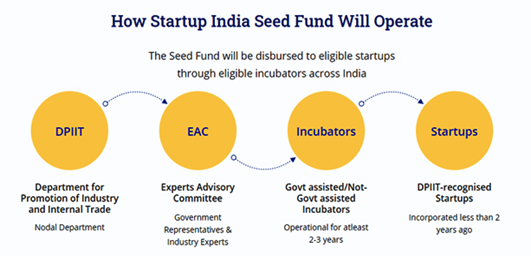

Funding from angel investors and venture capital firms becomes available to startups only after the proof of concept has been provided. Startup India Seed Fund Scheme (SISFS) aims to provide financial assistance to startups for proof of concept, prototype development, product trials, market entry and commercialization. This would enable these startups to graduate to a level where they will be able to raise investments from angel investors or venture capitalists, or seek loans from commercial banks or financial institutions.

NEED FOR THE SCHEME: The Indian startup ecosystem suffers from capital inadequacy in the seed and ‘Proof of Concept’ development stage. The capital required at this stage often presents a make or break situation for startups with good business ideas. Many innovative business ideas fail to take off due to the absence of this critical capital required at an early stage for proof of concept, prototype development, product trials, market entry and commercialization. Seed Fund offered to such promising cases can have a multiplier effect in validation of business ideas of many startups, leading to employment generation.

ELIGIBILITY CRITERIA:

| Eligibility Criteria for Startups | Eligibility Criteria for Incubators |

|

|

SALIENT FEATURES:

-

- The scheme is sector agnostic and will support start-ups across all sectors.

- No mandatory physical incubation

- Startups can apply to 3 incubators simultaneously.

- Experts Advisory Committee (EAC): An Experts Advisory Committee (EAC) will be constituted by DPIIT, which will be responsible for the overall execution and monitoring of the Startup India Seed Fund Scheme.

- Incubators would get up to Rs. 5 crore as grant which should be utilized fully within a period of three years from the date of receipt of the first installment of funds. If the Incubator does not utilize at least 50% of the total commitment within the first 2 years, then the Incubator will not be eligible for any further drawdowns and will have to return all unutilized funds along with interest.

- Each of the incubators applying for the Startup India Seed Fund Scheme will constitute a committee called the Incubator Seed Management Committee (ISMC), consisting of experts who can evaluate and select startups for seed support.

- Start-ups can avail up to ₹70 lakh of which up to Rs. 20 Lakhs as grant for validation of Proof of Concept, or prototype development, or product trials and up to Rs. 50 Lakhs of investment for market entry, commercialization, or scaling up through convertible debentures or debt or debt-linked instruments.