Day-782

Quiz-summary

0 of 20 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 20 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- Answered

- Review

-

Question 1 of 20

1. Question

If a foreign investor will invest in government securities of India, then it will not:

Correct

Answer: D

Explanation:

Government borrows money from abroad or from foreign institutions like the World Bank, IMF. Foreign Portfolio Investors Purchase Government of India bonds from the Indian market as these Government bonds are listed in Indian markets (G-Secs) or Capital markets.

The following will be the effect, when foreign investor will invest in government securities of India:

-

- Statement 1 is correct: As there will be more investors willing to purchase Government of India bonds, so interest rate on these bonds will come down i.e. Government’s cost of borrowing will come down.

- If India has a Current Account Deficit (CAD), then it needs to be financed. So, money raised through Government bonds from abroad (capital account in Balance of Payment) will fund CAD.

- Statement 2 is correct: Banks and financial institutions purchase Government bonds (and kept under SLR or otherwise). If the government will raise money from abroad then Indian banks and financial institutions can lend to the private sector (better/more productive allocation of financial resources).

- Statement 3 is correct: Raising money from abroad through Government bonds will lead to currency appreciation and may negatively impact our trade competitiveness. And can also lead to currency volatility but overall positives are more.

- Statement 4 is incorrect: If a foreign investor will invest in government securities of India then it will lead to increase in inflation. Because they will inject money in the Indian market by purchasing government security.

Incorrect

Answer: D

Explanation:

Government borrows money from abroad or from foreign institutions like the World Bank, IMF. Foreign Portfolio Investors Purchase Government of India bonds from the Indian market as these Government bonds are listed in Indian markets (G-Secs) or Capital markets.

The following will be the effect, when foreign investor will invest in government securities of India:

-

- Statement 1 is correct: As there will be more investors willing to purchase Government of India bonds, so interest rate on these bonds will come down i.e. Government’s cost of borrowing will come down.

- If India has a Current Account Deficit (CAD), then it needs to be financed. So, money raised through Government bonds from abroad (capital account in Balance of Payment) will fund CAD.

- Statement 2 is correct: Banks and financial institutions purchase Government bonds (and kept under SLR or otherwise). If the government will raise money from abroad then Indian banks and financial institutions can lend to the private sector (better/more productive allocation of financial resources).

- Statement 3 is correct: Raising money from abroad through Government bonds will lead to currency appreciation and may negatively impact our trade competitiveness. And can also lead to currency volatility but overall positives are more.

- Statement 4 is incorrect: If a foreign investor will invest in government securities of India then it will lead to increase in inflation. Because they will inject money in the Indian market by purchasing government security.

-

Question 2 of 20

2. Question

What are the limitations of using GDP as the indicator of well-being of the people of a country?

1. It does not take into account the distribution of income.

2. It only accounts for those economic activities that are evaluated in monetary terms.

3. It ignores negative externalities on human health and the environment.

4. It does not measure the contribution of the informal sector in an economy.

Select the correct answer using the code given below:

Correct

Answer: C

Explanation:

-

- Gross Domestic Product (GDP) is the total market value of all the finished goods and services produced within a country’s borders in a specific time period. It does not claim to measure welfare or wellbeing or inequality or happiness. An economy can have rising levels of inequality, falling levels of democratic norms, falling levels of civil liberties, increasing air and water pollution, worsening gender equality etc. and still have rising levels of GDP.

- Some criticisms of GDP as a measure are:

- Statement 1 is correct: If there is a high degree of income inequality, the majority of people do not really benefit from an increased economic output because they cannot afford to buy most of the goods and services. It does not account for income distribution.

- Statement 2 is correct: It does not account for several unofficial income sources – GDP relies on official data, so it does not take into account the extent of informal economic activity. GDP fails to quantify the value of under-the-table employment, black market activity, volunteer work, and household production, which can be significant in some nations.

- It is geographically limited in a globally open economy : GDP does not take into account profits earned in a nation by overseas companies that are remitted back to foreign investors. This can overstate a country’s actual economic output.

- Statement 3 is correct: It emphasizes material output without considering overall well-being – GDP growth alone cannot measure a nation’s development or its citizens’ well-being. An externality, in economics, is the cost or benefit that affects a party who did not choose to incur that cost or benefit. For example, a nation may be experiencing rapid GDP growth, but this may impose a significant cost to society in terms of environmental impact and an increase in income disparity.

- Statement 4 is incorrect: GDP calculation takes into account the contribution of the informal sector. However, it fails to provide a complete picture of the contribution from this sector since it is challenging to define what informal sector entails and there is a lack of data capturing of the informal sector as a whole. Thus, the issue of undervaluation of the informal sector in GDP is a major limitation.

Incorrect

Answer: C

Explanation:

-

- Gross Domestic Product (GDP) is the total market value of all the finished goods and services produced within a country’s borders in a specific time period. It does not claim to measure welfare or wellbeing or inequality or happiness. An economy can have rising levels of inequality, falling levels of democratic norms, falling levels of civil liberties, increasing air and water pollution, worsening gender equality etc. and still have rising levels of GDP.

- Some criticisms of GDP as a measure are:

- Statement 1 is correct: If there is a high degree of income inequality, the majority of people do not really benefit from an increased economic output because they cannot afford to buy most of the goods and services. It does not account for income distribution.

- Statement 2 is correct: It does not account for several unofficial income sources – GDP relies on official data, so it does not take into account the extent of informal economic activity. GDP fails to quantify the value of under-the-table employment, black market activity, volunteer work, and household production, which can be significant in some nations.

- It is geographically limited in a globally open economy : GDP does not take into account profits earned in a nation by overseas companies that are remitted back to foreign investors. This can overstate a country’s actual economic output.

- Statement 3 is correct: It emphasizes material output without considering overall well-being – GDP growth alone cannot measure a nation’s development or its citizens’ well-being. An externality, in economics, is the cost or benefit that affects a party who did not choose to incur that cost or benefit. For example, a nation may be experiencing rapid GDP growth, but this may impose a significant cost to society in terms of environmental impact and an increase in income disparity.

- Statement 4 is incorrect: GDP calculation takes into account the contribution of the informal sector. However, it fails to provide a complete picture of the contribution from this sector since it is challenging to define what informal sector entails and there is a lack of data capturing of the informal sector as a whole. Thus, the issue of undervaluation of the informal sector in GDP is a major limitation.

-

Question 3 of 20

3. Question

With reference to the Real Effective Exchange Rate (REER), consider the following statements:

1. It is calculated as the weighted average of the real exchange rates of all its trade partners.

2. It is interpreted as the quantity of domestic goods required to purchase one unit of a given basket of foreign goods.

3. An increase in REER implies that exports become more expensive.

How many of the above statements are correct?

Correct

Answer: C

Explanation:

-

- Statement 1 is correct: The Real Effective Exchange Rate (REER) is calculated as the weighted average of the real exchange rates of all its trade partners, the weights being the shares of the respective countries in its foreign trade.

- Statement 2 is correct: It is interpreted as the quantity of domestic goods required to purchase one unit of a given basket of foreign goods.

- REER is the real effective exchange rate (a measure of the value of a currency against a weighted average of several foreign currencies) divided by a price deflator or index of costs.

- Statement 3 is correct: An increase in REER implies that exports become more expensive and imports become cheaper; therefore, an increase indicates a loss in trade competitiveness.

- Nominal Effective Exchange Rate (NEER) which is a multilateral rate representing the price of a representative basket of foreign currencies, each weighted by its importance to the domestic country in international trade (the average of export and import shares is taken as an indicator of this).

Incorrect

Answer: C

Explanation:

-

- Statement 1 is correct: The Real Effective Exchange Rate (REER) is calculated as the weighted average of the real exchange rates of all its trade partners, the weights being the shares of the respective countries in its foreign trade.

- Statement 2 is correct: It is interpreted as the quantity of domestic goods required to purchase one unit of a given basket of foreign goods.

- REER is the real effective exchange rate (a measure of the value of a currency against a weighted average of several foreign currencies) divided by a price deflator or index of costs.

- Statement 3 is correct: An increase in REER implies that exports become more expensive and imports become cheaper; therefore, an increase indicates a loss in trade competitiveness.

- Nominal Effective Exchange Rate (NEER) which is a multilateral rate representing the price of a representative basket of foreign currencies, each weighted by its importance to the domestic country in international trade (the average of export and import shares is taken as an indicator of this).

-

Question 4 of 20

4. Question

Which one of the following statements is incorrect regarding Revenue and Capital Receipt of Government of India?

Correct

Answer: D

Explanation:

-

- Revenue Receipts: These are those receipts that do not lead to a claim on the government. They are therefore termed non-redeemable. They are divided into tax and non-tax revenues. Tax revenues, an important component of revenue receipts, have for long been divided into direct taxes (personal income tax) and firms (corporation tax), and indirect taxes like excise taxes (duties levied on goods produced within the country), customs duties (taxes imposed on goods imported into and exported out of India) and service tax. Other direct taxes like wealth tax, gift tax and estate duty (now abolished) have never brought in large amounts of revenue and thus have been referred to as paper taxes.

- Firms are taxed on a proportional basis, where the tax rate is a particular proportion of profits. With respect to excise taxes, necessities of life are exempted or taxed at low rates, comforts and semi- luxuries are moderately taxed, and luxuries, tobacco, and petroleum products are taxed heavily.

- Non-tax revenue of the central government mainly consists of interest receipts on account of loans by the central government dividends, and profits on investments made by the government, fees and other receipts for services rendered by the government from grants-in-aid Cash foreign international countries and organizations are also included.

- Statement D is incorrect: Cash grants-in- aid from international organizations and foreign countries are included in revenue receipts.

- Capital Receipts: The government also receives money by way of loans or from the sale of its assets. Loans will have to be returned to the agencies from which they have been borrowed. Thus they create liability: Sale of government assets, like sale of shares in Public Sector Undertakings (PSUs) which is referred to as PSU disinvestment, reduces the total amount of financial assets of the government. All those receipts of the government liability or reduction creates which financial assets are termed as capital receipts.

- When the government takes fresh loans it will mean that in future these loans will have to be returned and interest will have to be paid on these loans. Similarly, when the government sells an asset, then it means that in future its earnings from that asset will disappear. Thus, these receipts can be debt creating or non-debt creating.

Incorrect

Answer: D

Explanation:

-

- Revenue Receipts: These are those receipts that do not lead to a claim on the government. They are therefore termed non-redeemable. They are divided into tax and non-tax revenues. Tax revenues, an important component of revenue receipts, have for long been divided into direct taxes (personal income tax) and firms (corporation tax), and indirect taxes like excise taxes (duties levied on goods produced within the country), customs duties (taxes imposed on goods imported into and exported out of India) and service tax. Other direct taxes like wealth tax, gift tax and estate duty (now abolished) have never brought in large amounts of revenue and thus have been referred to as paper taxes.

- Firms are taxed on a proportional basis, where the tax rate is a particular proportion of profits. With respect to excise taxes, necessities of life are exempted or taxed at low rates, comforts and semi- luxuries are moderately taxed, and luxuries, tobacco, and petroleum products are taxed heavily.

- Non-tax revenue of the central government mainly consists of interest receipts on account of loans by the central government dividends, and profits on investments made by the government, fees and other receipts for services rendered by the government from grants-in-aid Cash foreign international countries and organizations are also included.

- Statement D is incorrect: Cash grants-in- aid from international organizations and foreign countries are included in revenue receipts.

- Capital Receipts: The government also receives money by way of loans or from the sale of its assets. Loans will have to be returned to the agencies from which they have been borrowed. Thus they create liability: Sale of government assets, like sale of shares in Public Sector Undertakings (PSUs) which is referred to as PSU disinvestment, reduces the total amount of financial assets of the government. All those receipts of the government liability or reduction creates which financial assets are termed as capital receipts.

- When the government takes fresh loans it will mean that in future these loans will have to be returned and interest will have to be paid on these loans. Similarly, when the government sells an asset, then it means that in future its earnings from that asset will disappear. Thus, these receipts can be debt creating or non-debt creating.

-

Question 5 of 20

5. Question

Consider the following:

1. Growth

2. Privatization

3. Modernization

4. Equity

5. Self-Reliance

How many of the above goals were included in almost every Five-Year Plan in India?

Correct

Answer: C

Explanation:

A plan spells out how the resources of a nation should be put to use. It should have some general goals as well as specific objectives which are to be achieved within a specified period of time; in India plans are of five years duration and are called five-year plans (we borrowed this from the former Soviet Union, the pioneer in national planning). Every Five-Year Plan has specified goals which are the ultimate targets, and their achievement ensures the success of the plans. Without specific goals, a plan would be directionless, and resources would not be utilized in a proper manner without wastage.

Following goals are focused in every Five-Year Plan:

Growth: It refers to increase in the country’s capacity to produce the output of goods and services within the country. It implies either a larger stock of productive capital, or a larger size of supporting services like transport and banking, or an increase in the efficiency of productive capital and services.

Modernisation: To increase the production of goods and services the producers have to adopt new technology. For example, a farmer can increase the output on the farm by using new seed varieties instead of using the old ones.

Self-reliance: To make India sufficient, which means avoiding imports of those goods which could be produced in India itself. This goal aims to reduce India’s dependence on foreign countries especially for food and to retain India’s sovereignty that was vulnerable to foreign interference in our policies.

Equity: To ensure the benefits of economic prosperity reach the poor sections as well instead of being employed only by the rich. This goal aims to provide every Indian his or her basic needs such as food, a decent house, education, and health care and inequality in the distribution of wealth should be reduced.

Incorrect

Answer: C

Explanation:

A plan spells out how the resources of a nation should be put to use. It should have some general goals as well as specific objectives which are to be achieved within a specified period of time; in India plans are of five years duration and are called five-year plans (we borrowed this from the former Soviet Union, the pioneer in national planning). Every Five-Year Plan has specified goals which are the ultimate targets, and their achievement ensures the success of the plans. Without specific goals, a plan would be directionless, and resources would not be utilized in a proper manner without wastage.

Following goals are focused in every Five-Year Plan:

Growth: It refers to increase in the country’s capacity to produce the output of goods and services within the country. It implies either a larger stock of productive capital, or a larger size of supporting services like transport and banking, or an increase in the efficiency of productive capital and services.

Modernisation: To increase the production of goods and services the producers have to adopt new technology. For example, a farmer can increase the output on the farm by using new seed varieties instead of using the old ones.

Self-reliance: To make India sufficient, which means avoiding imports of those goods which could be produced in India itself. This goal aims to reduce India’s dependence on foreign countries especially for food and to retain India’s sovereignty that was vulnerable to foreign interference in our policies.

Equity: To ensure the benefits of economic prosperity reach the poor sections as well instead of being employed only by the rich. This goal aims to provide every Indian his or her basic needs such as food, a decent house, education, and health care and inequality in the distribution of wealth should be reduced.

-

Question 6 of 20

6. Question

Consider the following statements:

1. The contribution of Industrial Sector to the GDP of India increased significantly from 1950 to 1990.

2. Indian Industries were restricted largely to cotton textiles and jute till 1990.

3. The proportion of GDP contributed by agriculture declined significantly from 1950 to 1990.

How many of the above statements are correct?

Correct

Answer: B

Explanation:

-

- The achievements of India’s industrial sector during the first seven five plans are impressive. Industry provides employment which is more stable than the employment in agriculture; it promotes modernisation and overall prosperity. It is for this reason that the five year plans place a lot of emphasis on industrial development.

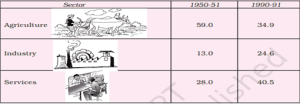

- Statement 1 is correct: The proportion of GDP contributed by the industrial sector increased in the period from 13 per cent in 1950-51 to 24.6 per cent in 1990-91. The rise in the industry’s share of GDP is an important indicator of development. The six per cent annual growth rate of the industrial sector during the period is commendable.

- Statement 2 is incorrect: No longer was Indian industry restricted largely to cotton textiles and jute; in fact, the industrial sector became well diversified by 1990, largely due to the public sector. The promotion of small-scale industries gave opportunities to those people who did not have the capital to start large firms to get into business. Protection from foreign competition enabled the development of indigenous industries in the areas of electronics and automobile sectors which otherwise could not have developed.

- In the late 1960s, Indian agricultural productivity had increased sufficiently to enable the country to be self-sufficient in food grains. Approximately 65 percent of the country’s population continued to be employed in agriculture even as late as 1990.

- Statement 3 is correct: The proportion of GDP contributed by agriculture as well as the proportion of population working in the sector declines considerably. In India, between 1950 and 1990, the proportion of GDP contributed by agriculture declined significantly but not the population depending on it (67.5 per cent in 1950 to 64.9 percent by 1990).

- The Contribution of different sectors in GDP between 1950-51 to 1990-91(in percentage):

Incorrect

Incorrect

Answer: B

Explanation:

-

- The achievements of India’s industrial sector during the first seven five plans are impressive. Industry provides employment which is more stable than the employment in agriculture; it promotes modernisation and overall prosperity. It is for this reason that the five year plans place a lot of emphasis on industrial development.

- Statement 1 is correct: The proportion of GDP contributed by the industrial sector increased in the period from 13 per cent in 1950-51 to 24.6 per cent in 1990-91. The rise in the industry’s share of GDP is an important indicator of development. The six per cent annual growth rate of the industrial sector during the period is commendable.

- Statement 2 is incorrect: No longer was Indian industry restricted largely to cotton textiles and jute; in fact, the industrial sector became well diversified by 1990, largely due to the public sector. The promotion of small-scale industries gave opportunities to those people who did not have the capital to start large firms to get into business. Protection from foreign competition enabled the development of indigenous industries in the areas of electronics and automobile sectors which otherwise could not have developed.

- In the late 1960s, Indian agricultural productivity had increased sufficiently to enable the country to be self-sufficient in food grains. Approximately 65 percent of the country’s population continued to be employed in agriculture even as late as 1990.

- Statement 3 is correct: The proportion of GDP contributed by agriculture as well as the proportion of population working in the sector declines considerably. In India, between 1950 and 1990, the proportion of GDP contributed by agriculture declined significantly but not the population depending on it (67.5 per cent in 1950 to 64.9 percent by 1990).

- The Contribution of different sectors in GDP between 1950-51 to 1990-91(in percentage):

-

Question 7 of 20

7. Question

With reference to Personal Disposable Income (PDI), consider the following statements:

1. It includes all the tax payments made by the consumer.

2. It shows the maximum amount of goods and services the household is able to access.

3. The government affects the PDI of households by making transfers and collecting taxes.

How many of the above statements are correct?

Correct

Answer: B

Explanation:

-

- Statement 1 is incorrect: Personal disposable income refers to personal income minus taxes at a personal level. It measures the amount of net income that remains after households have paid all their tax levies. It also represents the amount households will spend on goods and services or will save to invest. Therefore, household savings equals personal disposable income (PDI) minus consumption expenditures, interest paid to businesses, and personal transfer payments.

- Personal Income (PI) ≡ National Income – Undistributed profits – Net interest payments made by households – Corporate tax + Transfer payments to the households from the government and firms.

- PDI = PI – Personal tax payments – Non-tax payments

- Statement 2 is correct: Personal Disposable Income is the part of the aggregate income which belongs to the households. They may decide to consume a part of it, and save the rest. It shows the maximum amount of goods and services that the household is able to access.

- Statement 3 is correct: The government sector affects the personal disposable income of households by making transfers and collecting taxes. It is through this that the government can change the distribution of income and bring about a distribution that is considered ‘fair’ by society.

Incorrect

Answer: B

Explanation:

-

- Statement 1 is incorrect: Personal disposable income refers to personal income minus taxes at a personal level. It measures the amount of net income that remains after households have paid all their tax levies. It also represents the amount households will spend on goods and services or will save to invest. Therefore, household savings equals personal disposable income (PDI) minus consumption expenditures, interest paid to businesses, and personal transfer payments.

- Personal Income (PI) ≡ National Income – Undistributed profits – Net interest payments made by households – Corporate tax + Transfer payments to the households from the government and firms.

- PDI = PI – Personal tax payments – Non-tax payments

- Statement 2 is correct: Personal Disposable Income is the part of the aggregate income which belongs to the households. They may decide to consume a part of it, and save the rest. It shows the maximum amount of goods and services that the household is able to access.

- Statement 3 is correct: The government sector affects the personal disposable income of households by making transfers and collecting taxes. It is through this that the government can change the distribution of income and bring about a distribution that is considered ‘fair’ by society.

-

Question 8 of 20

8. Question

Consider the following statements regarding Cash Reserve Ratio (CRR):

1. The Reserve Bank of India pays interest on the CRR amounts.

2. Decrease in CRR can lead to inflation.

3. Increase in CRR can increase the lending rates of commercial banks.

How many of the above statements are correct?

Correct

Answer: B

Explanation:

-

- Under cash reserve ratio (CRR), the commercial banks have to hold a certain minimum amount of deposit as reserves with the central bank. The percentage of cash required to be kept in reserves as against the bank’s total deposits, is called the Cash Reserve Ratio. The cash reserve is either stored in the bank’s vault or is sent to the RBI. Banks can’t lend the CRR money to corporates or individual borrowers, banks can’t use that money for investment purposes. And Banks don’t earn any interest on that money.

- Statement 1 is incorrect: The amendment carried out to RBI Act 1934, omitting sub-section (1B) of section 42, the Reserve Bank of India does not pay any interest on the CRR balances maintained by Scheduled Commercial Banks with effect from the fortnight beginning March 31, 2007.

- Effect of Cash Reserve Ratio:

- Statement 2 is correct: When the cash reserve ratio is minimized, commercial banks will have more funds and hence, the money supply of the banking system will increase. When there is a rise in the money supply, excessive funds will result in high inflation.

- Statement 3 is correct: When the cash reserve ratio is increased by the RBI, banks will have less money to invest in other businesses since the amount of funds that needs to be kept with the RBI is high. This shows that banks will have less funds and hence, there will be an increase in the interest rates that are charged on loans.

- Demand Liabilities: Demand Liabilities include all liabilities which are payable on demand that include current deposits, demand liabilities portion of savings bank deposits, margins held against letters of credit/guarantees, balances in overdue fixed deposits, cash certificates and cumulative/recurring deposits, outstanding Telegraphic Transfers (TTs), Mail Transfer (MTs), Demand Drafts (DDs), unclaimed deposits, credit balances in the Cash Credit account and deposits held as security for advances which are payable on demand. Money at Call and Short Notice from outside the Banking System should be shown against liability to others.

- Time Liabilities: Time Liabilities are those which are payable otherwise than on demand that include fixed deposits, cash certificates, cumulative and recurring deposits, time liabilities portion of savings bank deposits, staff security deposits, margin held against letters of credit, if not payable on demand, deposits held as securities for advances which are not payable on demand and gold deposits.

Incorrect

Answer: B

Explanation:

-

- Under cash reserve ratio (CRR), the commercial banks have to hold a certain minimum amount of deposit as reserves with the central bank. The percentage of cash required to be kept in reserves as against the bank’s total deposits, is called the Cash Reserve Ratio. The cash reserve is either stored in the bank’s vault or is sent to the RBI. Banks can’t lend the CRR money to corporates or individual borrowers, banks can’t use that money for investment purposes. And Banks don’t earn any interest on that money.

- Statement 1 is incorrect: The amendment carried out to RBI Act 1934, omitting sub-section (1B) of section 42, the Reserve Bank of India does not pay any interest on the CRR balances maintained by Scheduled Commercial Banks with effect from the fortnight beginning March 31, 2007.

- Effect of Cash Reserve Ratio:

- Statement 2 is correct: When the cash reserve ratio is minimized, commercial banks will have more funds and hence, the money supply of the banking system will increase. When there is a rise in the money supply, excessive funds will result in high inflation.

- Statement 3 is correct: When the cash reserve ratio is increased by the RBI, banks will have less money to invest in other businesses since the amount of funds that needs to be kept with the RBI is high. This shows that banks will have less funds and hence, there will be an increase in the interest rates that are charged on loans.

- Demand Liabilities: Demand Liabilities include all liabilities which are payable on demand that include current deposits, demand liabilities portion of savings bank deposits, margins held against letters of credit/guarantees, balances in overdue fixed deposits, cash certificates and cumulative/recurring deposits, outstanding Telegraphic Transfers (TTs), Mail Transfer (MTs), Demand Drafts (DDs), unclaimed deposits, credit balances in the Cash Credit account and deposits held as security for advances which are payable on demand. Money at Call and Short Notice from outside the Banking System should be shown against liability to others.

- Time Liabilities: Time Liabilities are those which are payable otherwise than on demand that include fixed deposits, cash certificates, cumulative and recurring deposits, time liabilities portion of savings bank deposits, staff security deposits, margin held against letters of credit, if not payable on demand, deposits held as securities for advances which are not payable on demand and gold deposits.

-

Question 9 of 20

9. Question

Consider the following statements:

1. NEER is a measure of the value of a currency against a weighted average of several foreign currencies.

2. An increase in NEER indicates depreciation of the local currency against the weighted basket of currencies of its trading partners.

3. The basket of foreign currencies is selected based on an international standard set by the IMF.

How many of the above statements are correct?

Correct

Answer: A

Explanation:

-

- The Nominal Effective Exchange Rate (NEER) is a multilateral rate representing the price of a representative basket of foreign currencies, each weighted by its importance to the domestic country in international trade (the average of export and import shares is taken as an indicator of this).

- Statement 1 is correct: NEER is a measure of the value of a currency against a weighted average of several foreign currencies.

- Statement 2 is incorrect: An increase in NEER indicates an appreciation of the local currency against the weighted basket of currencies of its trading partners.

- In economics, the NEER is an indicator of a country’s international competitiveness in terms of the foreign exchange (forex) market. Forex traders sometimes refer to the NEER as the trade-weighted currency index.

- The NEER may be adjusted to compensate for the inflation rate of the domestic country relative to the inflation rate of its trading partners.

- The basket of foreign currencies is chosen based on the domestic country’s most important trading partners as well as other major currencies. The values of foreign currencies in a basket are weighted according to the value of trade with the domestic country (like export or import value).

- Statement 3 is incorrect: There is no international standard for selecting a basket of currencies. However, many different institutions rely on International Financial Statistics (IFS) published by the IMF.

Incorrect

Answer: A

Explanation:

-

- The Nominal Effective Exchange Rate (NEER) is a multilateral rate representing the price of a representative basket of foreign currencies, each weighted by its importance to the domestic country in international trade (the average of export and import shares is taken as an indicator of this).

- Statement 1 is correct: NEER is a measure of the value of a currency against a weighted average of several foreign currencies.

- Statement 2 is incorrect: An increase in NEER indicates an appreciation of the local currency against the weighted basket of currencies of its trading partners.

- In economics, the NEER is an indicator of a country’s international competitiveness in terms of the foreign exchange (forex) market. Forex traders sometimes refer to the NEER as the trade-weighted currency index.

- The NEER may be adjusted to compensate for the inflation rate of the domestic country relative to the inflation rate of its trading partners.

- The basket of foreign currencies is chosen based on the domestic country’s most important trading partners as well as other major currencies. The values of foreign currencies in a basket are weighted according to the value of trade with the domestic country (like export or import value).

- Statement 3 is incorrect: There is no international standard for selecting a basket of currencies. However, many different institutions rely on International Financial Statistics (IFS) published by the IMF.

-

Question 10 of 20

10. Question

Consider the following statements about the Scheduled Banks in India:

1. Any bank listed in the 2nd schedule of the Reserve Bank of India Act 1934 is considered a scheduled bank.

2. To qualify as a scheduled bank, the paid- up capital and collected funds of the bank must not be less than Rs 5 lakh.

3. Scheduled Banks are eligible for loans from the Reserve Bank of India at bank rate and are given membership to clearing houses.

How many of the above statements are correct?

Correct

Answer: C

Explanation:

-

- Banks are classified into commercial and cooperative. Commercial banks operate on the commercial (profit) principles while the basis of operation for cooperative banks is on cooperative lines i.e., service to its members and the society. Cooperative banks provide a higher rate of interest on deposits as compared to commercial banks.

- Commercial banks are of two categories viz. scheduled commercial banks and non- scheduled commercial banks.

- Statement 1 is correct: A scheduled bank is so called because it has been included in the second schedule of the RBI Act 1934. The other conditions for a scheduled bank are it must be a corporation and the Paid-up share capital should be at least Rs. 500 crores.

- Statement 2 is correct: The bank’s paid-up capital and raised funds must be at least Rs. 5 lakh to qualify as a scheduled bank. These banks are liable for low interest loans from the RBI. Or Commercial Banks which conduct the business of banking in India and which (a) have paid up capital and reserves of an aggregate real and exchangeable value of not less than Rs.5 lakhs and (b) satisfy the Reserve Bank of India that their affairs are not being conducted in a manner detrimental to the interest of their depositors.

- Statement 3 is correct: Scheduled Banks are eligible for loans from the Reserve Bank of India at bank rate. They also have membership in clearing houses.

- They also have numerous obligations to fulfill such as maintaining an average daily Cash Reserve Ratio with the central bank.

- The difference between scheduled and non-scheduled banks is the type of banking activity that they are allowed to carry out in India. A Non-Scheduled bank can carry out limited operations, for example, non-scheduled banks are not allowed to deal in Foreign Exchange. Non-Scheduled banks need to maintain reserve requirements (as per the Banking Regulation Act 1949) but may not be with RBI. Banks with a reserve capital of less than 5 lakh rupees qualify as non-scheduled banks. Scheduled Banks are required to maintain reserve requirements with RBI as per the RBI Act 1934.

Incorrect

Answer: C

Explanation:

-

- Banks are classified into commercial and cooperative. Commercial banks operate on the commercial (profit) principles while the basis of operation for cooperative banks is on cooperative lines i.e., service to its members and the society. Cooperative banks provide a higher rate of interest on deposits as compared to commercial banks.

- Commercial banks are of two categories viz. scheduled commercial banks and non- scheduled commercial banks.

- Statement 1 is correct: A scheduled bank is so called because it has been included in the second schedule of the RBI Act 1934. The other conditions for a scheduled bank are it must be a corporation and the Paid-up share capital should be at least Rs. 500 crores.

- Statement 2 is correct: The bank’s paid-up capital and raised funds must be at least Rs. 5 lakh to qualify as a scheduled bank. These banks are liable for low interest loans from the RBI. Or Commercial Banks which conduct the business of banking in India and which (a) have paid up capital and reserves of an aggregate real and exchangeable value of not less than Rs.5 lakhs and (b) satisfy the Reserve Bank of India that their affairs are not being conducted in a manner detrimental to the interest of their depositors.

- Statement 3 is correct: Scheduled Banks are eligible for loans from the Reserve Bank of India at bank rate. They also have membership in clearing houses.

- They also have numerous obligations to fulfill such as maintaining an average daily Cash Reserve Ratio with the central bank.

- The difference between scheduled and non-scheduled banks is the type of banking activity that they are allowed to carry out in India. A Non-Scheduled bank can carry out limited operations, for example, non-scheduled banks are not allowed to deal in Foreign Exchange. Non-Scheduled banks need to maintain reserve requirements (as per the Banking Regulation Act 1949) but may not be with RBI. Banks with a reserve capital of less than 5 lakh rupees qualify as non-scheduled banks. Scheduled Banks are required to maintain reserve requirements with RBI as per the RBI Act 1934.

-

Question 11 of 20

11. Question

With respect to the recent changes in the equalisation levy, consider the following statements:

1. The equalisation levy has been made applicable to all the foreign companies which have permanent establishment in India.

2. The equalisation levy has been expanded to include the goods and services purchased through the online platforms.

Which of the statements given above is/are correct?

Correct

Answer: B

Explanation:

Statement 1 is incorrect:

Equalisation Levy is not applicable-

-

- When the non-resident service provider including E Commerce operator has a permanent establishment in India, and the digital services are effectively connected with the permanent establishment.

- When the Annual turnover of the e-commerce operator from the e-commerce supply or services is less than rupees 2 crores during the previous year.

- When the digital service is not covered under the provision given under equalisation levy section 165 of the Finance Act 2016.

Statement 2 is correct:

Applicability of Equalisation Levy-

Equalisation Levy is a direct tax imposed by the Indian government on digital transactions involving non-residens. The applicability of Equalisation Levy depends on the following factors:

-

- Equalisation levy applies only to specified services such as online advertising, digital platforms, and e-commerce.

- The amount of consideration received by the non-resident exceeds ₹ 1 lakh in a financial year in case of online advertisement.

Additional Information Equalisation Levy:

● Equalisation Levy is a direct tax levied on online transactions made to non-resident or consideration received by a non-resident for specific services.

● Aim: It is aimed at taxing foreign companies which have a significant local client base in India but are billing them through their offshore units, effectively escaping the country’s tax system.

● Equalisation levy at 6% has been in force since 2016 on payment exceeding Rs 1 lakh a year to a non-resident service provider for online advertisements.

● It is now applicable for e-commerce companies that are sourcing revenue from Indian customers without having tangible presence here in the country.

● The amendments to the Finance Act, 2020 had expanded the ambit of the equalisation levy for non-resident e-commerce operators involved in supply of services, including online sale of goods and provision of services, with the levy at the rate of 2% effective April 1, 2020.

● The tax applies on e-commerce transactions on websites such as Amazon.com. Google in particular as the tax applies on advertising revenue earned overseas if those ads target customers in India.

Penalties Involved:

● The non-payment could result in a penalty equal to the amount of equalisation levy, along with interest.

● The late-payment would attract interest at the rate of 1% per month or part of the month.

Incorrect

Answer: B

Explanation:

Statement 1 is incorrect:

Equalisation Levy is not applicable-

-

- When the non-resident service provider including E Commerce operator has a permanent establishment in India, and the digital services are effectively connected with the permanent establishment.

- When the Annual turnover of the e-commerce operator from the e-commerce supply or services is less than rupees 2 crores during the previous year.

- When the digital service is not covered under the provision given under equalisation levy section 165 of the Finance Act 2016.

Statement 2 is correct:

Applicability of Equalisation Levy-

Equalisation Levy is a direct tax imposed by the Indian government on digital transactions involving non-residens. The applicability of Equalisation Levy depends on the following factors:

-

- Equalisation levy applies only to specified services such as online advertising, digital platforms, and e-commerce.

- The amount of consideration received by the non-resident exceeds ₹ 1 lakh in a financial year in case of online advertisement.

Additional Information Equalisation Levy:

● Equalisation Levy is a direct tax levied on online transactions made to non-resident or consideration received by a non-resident for specific services.

● Aim: It is aimed at taxing foreign companies which have a significant local client base in India but are billing them through their offshore units, effectively escaping the country’s tax system.

● Equalisation levy at 6% has been in force since 2016 on payment exceeding Rs 1 lakh a year to a non-resident service provider for online advertisements.

● It is now applicable for e-commerce companies that are sourcing revenue from Indian customers without having tangible presence here in the country.

● The amendments to the Finance Act, 2020 had expanded the ambit of the equalisation levy for non-resident e-commerce operators involved in supply of services, including online sale of goods and provision of services, with the levy at the rate of 2% effective April 1, 2020.

● The tax applies on e-commerce transactions on websites such as Amazon.com. Google in particular as the tax applies on advertising revenue earned overseas if those ads target customers in India.

Penalties Involved:

● The non-payment could result in a penalty equal to the amount of equalisation levy, along with interest.

● The late-payment would attract interest at the rate of 1% per month or part of the month.

-

Question 12 of 20

12. Question

Which one of the following policies is not a part of the impossible trinity?

Correct

Answer: D

Explanation: Options 1, 2 and 3 are related to impossible trinity.

Impossible Trinity

-

- The impossible trinity, or the trilemma, refers to the idea that an economy cannot pursue independent monetary policy, maintain a fixed exchange rate, and allow the free flow of capital across its borders all at the same time.

- In a fixed exchange rate regime, the domestic currency is tied to another foreign currency such as the U.S. dollar, Euro, the Pound Sterling or a basket of currencies.

- An able policymaker can, at best, achieve two of these three objectives at any given time.

- The idea was proposed independently by Canadian economist Robert Mundell and British economist Marcus Fleming in the early 1960s.

- The Impossible Trinity is a fundamental concept in international economics and monetary policy.

- It describes the inherent challenges countries face when trying to simultaneously achieve three specific policy objectives related to their exchange rate and capital flows.

Incorrect

Answer: D

Explanation: Options 1, 2 and 3 are related to impossible trinity.

Impossible Trinity

-

- The impossible trinity, or the trilemma, refers to the idea that an economy cannot pursue independent monetary policy, maintain a fixed exchange rate, and allow the free flow of capital across its borders all at the same time.

- In a fixed exchange rate regime, the domestic currency is tied to another foreign currency such as the U.S. dollar, Euro, the Pound Sterling or a basket of currencies.

- An able policymaker can, at best, achieve two of these three objectives at any given time.

- The idea was proposed independently by Canadian economist Robert Mundell and British economist Marcus Fleming in the early 1960s.

- The Impossible Trinity is a fundamental concept in international economics and monetary policy.

- It describes the inherent challenges countries face when trying to simultaneously achieve three specific policy objectives related to their exchange rate and capital flows.

-

Question 13 of 20

13. Question

Consider the following loans:

1. Loans to the agriculture and allied sector

2. Loans to the FCI for procurement of food grains

3. Loans to food processing industries

How many of the above are included in the category of food credit by the RBI?

Correct

Answer: A

Explanation: Option 2 is correct

Loans to the FCI for procurement of food grains are included in the category of food credit by the RBI.

Food Credit-

-

- According to the RBI’s classification, the loans provided by the banks are categorized into Food and Non-Food Credit.

- Non-Food Credit includes the loans provided for various purposes, such as agriculture and allied sector, industries, services and personal loans.

- Food Credit includes the loans provided by the banks to the Food Corporation of India (FCI) and other agencies involved in the procurement of food grains.

- Usually, these loans get repaid as and when the Central Government releases the subsidy amount to these procurement agencies.

Incorrect

Answer: A

Explanation: Option 2 is correct

Loans to the FCI for procurement of food grains are included in the category of food credit by the RBI.

Food Credit-

-

- According to the RBI’s classification, the loans provided by the banks are categorized into Food and Non-Food Credit.

- Non-Food Credit includes the loans provided for various purposes, such as agriculture and allied sector, industries, services and personal loans.

- Food Credit includes the loans provided by the banks to the Food Corporation of India (FCI) and other agencies involved in the procurement of food grains.

- Usually, these loans get repaid as and when the Central Government releases the subsidy amount to these procurement agencies.

-

Question 14 of 20

14. Question

Consider the following statements regarding Financial Services Institutions Bureau (FSIB):

1. It has a mandate of making recommendations for the appointment of full-time directors and non-executive chairman of state-run financial services institutions.

2. It came into being after replacing the Bank Board’s Bureau (BBB).

Which of the above statements is/are correct?

Correct

Answer: C

Explanation:

Statement 1 is correct:

The Primary role of FSIB:

-

- To identify manpower capabilities and ensure proper selection of talent for senior positions at financial institutions owned by the government.

- It is entrusted with making recommendations for the appointment of full-time directors and non-executive chairman of state-run financial services institutions.

- The final decision on the FSIB recommendation would be taken by the Appointments Committee of the Cabinet headed by the Prime Minister.

Statement 2 is correct:

It replaced the Bank Board’s Bureau (BBB).

Additional Information Financial Services Institutions Bureau–

● Set up under Department of Financial Services (DFS), Ministry of Finance.

● It has been constituted effective from July 01, 2022, by Central Government for the purpose of recommending persons for appointment as whole-time directors and non-executive chairpersons on the Boards of financial services institutions and for advising on certain other matters relating to personnel management in these institutions.

● The Secretariat of the Bureau currently comprises of Secretary and five officers.

● It replaced Bank Board’s Bureau (BBB).

Bank Board’s Bureau (BBB)-

● It has its genesis in the recommendations of ‘The Committee to Review Governance of Boards of Banks in India, May 2014 (Chairman – P. J. Nayak)’.

Formation:

● The government, in 2016, approved the constitution of the BBB to make recommendations for appointment of whole-time directors as well as non-executive chairpersons of Public Sector Banks (PSBs) and state-owned financial institutions.

● It was an autonomous recommendation body.

Incorrect

Answer: C

Explanation:

Statement 1 is correct:

The Primary role of FSIB:

-

- To identify manpower capabilities and ensure proper selection of talent for senior positions at financial institutions owned by the government.

- It is entrusted with making recommendations for the appointment of full-time directors and non-executive chairman of state-run financial services institutions.

- The final decision on the FSIB recommendation would be taken by the Appointments Committee of the Cabinet headed by the Prime Minister.

Statement 2 is correct:

It replaced the Bank Board’s Bureau (BBB).

Additional Information Financial Services Institutions Bureau–

● Set up under Department of Financial Services (DFS), Ministry of Finance.

● It has been constituted effective from July 01, 2022, by Central Government for the purpose of recommending persons for appointment as whole-time directors and non-executive chairpersons on the Boards of financial services institutions and for advising on certain other matters relating to personnel management in these institutions.

● The Secretariat of the Bureau currently comprises of Secretary and five officers.

● It replaced Bank Board’s Bureau (BBB).

Bank Board’s Bureau (BBB)-

● It has its genesis in the recommendations of ‘The Committee to Review Governance of Boards of Banks in India, May 2014 (Chairman – P. J. Nayak)’.

Formation:

● The government, in 2016, approved the constitution of the BBB to make recommendations for appointment of whole-time directors as well as non-executive chairpersons of Public Sector Banks (PSBs) and state-owned financial institutions.

● It was an autonomous recommendation body.

-

Question 15 of 20

15. Question

Consider the following statements regarding Liberalised Remittance Scheme (LRS):

1. The benefits of the scheme can be availed by corporates, partnership firms, HUF and Trusts.

2. Person’s resident in India are free to buy or sell foreign exchange for any current account transaction including remittance out of lottery winnings or from racing/riding.

3. Individuals are allowed to freely remit up to $2,50,000 per financial year under current account only.

How many of the above statements are correct?

Correct

Answer: D

Explanation:

Statement 1 is incorrect:

The Scheme is not available to corporates, partnership firms, HUF, Trusts etc.

Statement 2 is incorrect:

Prohibited items under the Scheme-

-

- Remittance for any purpose specifically prohibited under Schedule-I (like purchase of lottery tickets/sweep stakes, proscribed magazines, etc.) or any item restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

- Remittance from India for margins or margin calls to overseas exchanges / overseas counterparty.

- Remittances for purchase of FCCBs issued by Indian companies in the overseas secondary market.

- Remittance for trading in foreign exchange abroad.

- Capital account remittances, directly or indirectly, to countries identified by the Financial Action Task Force (FATF) as “non- cooperative countries and territories”, from time to time.

- Remittances directly or indirectly to those individuals and entities identified as posing significant risk of committing acts of terrorism as advised separately by the Reserve Bank to the banks.

- Gifting by a resident to another resident, in foreign currency, for the credit of the latter’s foreign currency account held abroad under LRS.

Statement 3 is incorrect:

Under the Liberalised Remittance Scheme, all resident individuals, including minors, are allowed to freely remit up to $2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both.

Additional Information Liberalised Remittance Scheme (LRS)-

● Liberalised Remittance Scheme (LRS) was brought out by the RBI in 2004.

● It allows resident individuals to remit a certain amount of money during a financial year to another country for investment and expenditure.

● According to the prevailing regulations, resident individuals may remit up to $250,000 per financial year.

In case of remitter being a minor, the LRS declaration form must be countersigned by the minor’s natural guardian. The Scheme is not available to corporates, partnership firms, HUF, Trusts etc.

Transactions are allowed under the LRS:

Restrictions under LRS:

● LRS restricts buying and selling of foreign exchange abroad, or purchase of lottery tickets or sweep stakes, proscribed magazines.

● Any items which are restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

● One cannot make remittances directly or indirectly to countries identified by the Financial Action Task Force as non-co-operative countries and territories.

Incorrect

Answer: D

Explanation:

Statement 1 is incorrect:

The Scheme is not available to corporates, partnership firms, HUF, Trusts etc.

Statement 2 is incorrect:

Prohibited items under the Scheme-

-

- Remittance for any purpose specifically prohibited under Schedule-I (like purchase of lottery tickets/sweep stakes, proscribed magazines, etc.) or any item restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

- Remittance from India for margins or margin calls to overseas exchanges / overseas counterparty.

- Remittances for purchase of FCCBs issued by Indian companies in the overseas secondary market.

- Remittance for trading in foreign exchange abroad.

- Capital account remittances, directly or indirectly, to countries identified by the Financial Action Task Force (FATF) as “non- cooperative countries and territories”, from time to time.

- Remittances directly or indirectly to those individuals and entities identified as posing significant risk of committing acts of terrorism as advised separately by the Reserve Bank to the banks.

- Gifting by a resident to another resident, in foreign currency, for the credit of the latter’s foreign currency account held abroad under LRS.

Statement 3 is incorrect:

Under the Liberalised Remittance Scheme, all resident individuals, including minors, are allowed to freely remit up to $2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both.

Additional Information Liberalised Remittance Scheme (LRS)-

● Liberalised Remittance Scheme (LRS) was brought out by the RBI in 2004.

● It allows resident individuals to remit a certain amount of money during a financial year to another country for investment and expenditure.

● According to the prevailing regulations, resident individuals may remit up to $250,000 per financial year.

In case of remitter being a minor, the LRS declaration form must be countersigned by the minor’s natural guardian. The Scheme is not available to corporates, partnership firms, HUF, Trusts etc.

Transactions are allowed under the LRS:

Restrictions under LRS:

● LRS restricts buying and selling of foreign exchange abroad, or purchase of lottery tickets or sweep stakes, proscribed magazines.

● Any items which are restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

● One cannot make remittances directly or indirectly to countries identified by the Financial Action Task Force as non-co-operative countries and territories.

-

Question 16 of 20

16. Question

Consider the following statements regarding surety bonds:

1. A surety bond is a mechanism to transfer risk for businesses.

2. The guidelines for surety bonds are issued by Reserve Bank of India (RBI).

3. Surety bond provides assurance that the obligee will be protected if the principal or contractor fails to perform the bonded contract.

How many of the above statements are correct?

Correct

Answer: B

Explanation:

Statement 1 is correct: A surety bond is a mechanism to transfer risk for businesses. It assures the project owner that the assigned contractor will perform the task as per the contract clause.

Statement 2 is incorrect:

The guidelines for surety bonds are issued by Insurance Regulatory and Development Authority of India (IRDAI).

Statement 3 is correct:

-

- Surety bonds guarantees that the obligee will be protected if the principal or contractor fails to perform the bonded contract.

- If the obligee declares the principal or contractor as being in default and terminates the contract,it can call on the Surety to meet the Surety’s obligations under the bond.

Additional Information

Surety Bond-

A surety bond is a legally binding agreement between three parties:

● the obligee (the entity requiring the bond)

● the principal (the party required to fulfil a certain task or duty)

● the surety (the party ensuring that the principal can perform the assignment).

Purpose:

The surety bond, which is most typically used in construction and infrastructure projects, guarantees that the principal will meet the commitments indicated in a contract. If the principal fails to meet these obligations, the surety compensates the obligee, reducing their financial risk.

IRDAI Guidelines:

The IRDAI has issued guidelines for surety bonds, which are designed to ensure that they are issued in a fair and transparent manner. The guidelines are designed to protect the interests of all parties involved in a surety bond transaction, including the surety, the principal, and the obligee.

According to the regulator, here are the types and definitions of Surety Contracts:

● Advance Payment Bond: It is a promise by the Surety provider to pay the outstanding balance of the advance payment in case the contractor fails to complete the contract as per specifications or fails to adhere to the scope of the contract.

● Bid Bond: It is an obligation undertaken by a bidder promising that the bidder will, if awarded the contract, furnish the prescribed performance guarantee and enter into contract agreement within a specified period of time.

It provides financial protection to an obligee if a bidder is awarded a contract pursuant to the bid documents, but fails to sign the contract and provide any required performance and payment bonds.

● Contract Bond: It provides assurance to the public entity, developers, subcontractors and suppliers that the contractor will fulfil its contractual obligation when undertaking the project.

Contract bonds may include: Bid Bonds, Performance Bonds, Advance Payment Bonds and Retention Money.

● Customs and Court Bond: This is a type of guarantee where the obligee is a public office such as tax office, customs administration or the court, and it guarantees the payment of a public receivable incurred from opening a court case,clearing goods from customs or losses due to incorrect customs procedures.

● Performance Bond: It provides assurance that the obligee will be protected if the principal or contractor fails to perform the bonded contract. If the obligee declares the principal or contractor as being in default and terminates the contract, it can call on the Surety to meet the Surety’s obligations under the bond.

Retention Money: It is a part of the amount payable to the contractor, which is retained and payable at the end after successful completion of the contract.

Incorrect

Answer: B

Explanation:

Statement 1 is correct: A surety bond is a mechanism to transfer risk for businesses. It assures the project owner that the assigned contractor will perform the task as per the contract clause.

Statement 2 is incorrect:

The guidelines for surety bonds are issued by Insurance Regulatory and Development Authority of India (IRDAI).

Statement 3 is correct:

-

- Surety bonds guarantees that the obligee will be protected if the principal or contractor fails to perform the bonded contract.

- If the obligee declares the principal or contractor as being in default and terminates the contract,it can call on the Surety to meet the Surety’s obligations under the bond.

Additional Information

Surety Bond-

A surety bond is a legally binding agreement between three parties:

● the obligee (the entity requiring the bond)

● the principal (the party required to fulfil a certain task or duty)

● the surety (the party ensuring that the principal can perform the assignment).

Purpose:

The surety bond, which is most typically used in construction and infrastructure projects, guarantees that the principal will meet the commitments indicated in a contract. If the principal fails to meet these obligations, the surety compensates the obligee, reducing their financial risk.

IRDAI Guidelines:

The IRDAI has issued guidelines for surety bonds, which are designed to ensure that they are issued in a fair and transparent manner. The guidelines are designed to protect the interests of all parties involved in a surety bond transaction, including the surety, the principal, and the obligee.

According to the regulator, here are the types and definitions of Surety Contracts:

● Advance Payment Bond: It is a promise by the Surety provider to pay the outstanding balance of the advance payment in case the contractor fails to complete the contract as per specifications or fails to adhere to the scope of the contract.

● Bid Bond: It is an obligation undertaken by a bidder promising that the bidder will, if awarded the contract, furnish the prescribed performance guarantee and enter into contract agreement within a specified period of time.

It provides financial protection to an obligee if a bidder is awarded a contract pursuant to the bid documents, but fails to sign the contract and provide any required performance and payment bonds.

● Contract Bond: It provides assurance to the public entity, developers, subcontractors and suppliers that the contractor will fulfil its contractual obligation when undertaking the project.

Contract bonds may include: Bid Bonds, Performance Bonds, Advance Payment Bonds and Retention Money.

● Customs and Court Bond: This is a type of guarantee where the obligee is a public office such as tax office, customs administration or the court, and it guarantees the payment of a public receivable incurred from opening a court case,clearing goods from customs or losses due to incorrect customs procedures.

● Performance Bond: It provides assurance that the obligee will be protected if the principal or contractor fails to perform the bonded contract. If the obligee declares the principal or contractor as being in default and terminates the contract, it can call on the Surety to meet the Surety’s obligations under the bond.

Retention Money: It is a part of the amount payable to the contractor, which is retained and payable at the end after successful completion of the contract.

-

Question 17 of 20

17. Question

Consider the following statements:

Statement I: The world’s largest grain storage plan in the cooperative sector has been approved by Government of India.

Statement II: India has a huge responsibility of providing food security to its people along with reducing the food wastage.

Which one of the following is correct in respect of the above statements?

Correct

Answer: A

Explanation:

Statement I is correct:

-

- The Union Cabinet approved the constitution and empowerment of an Inter-Ministerial Committee (IMC) for the facilitation of the “World’s Largest Grain Storage Plan in the Cooperative Sector”.

- Implementation: An Inter-Ministerial Committee (IMC) will be constituted under the Chairmanship of the Minister of Cooperation.

- To ensure timely and uniform implementation of the plan in a professional manner, the Ministry of Cooperation would implement a pilot project in at least 10 selected districts of different States.

Statement II is correct and also explains Statement I correctly:

-

- Aim: The plan focuses on strengthening food security, reducing wastage, and empowering farmers by creating godowns and agricultural infrastructure at the Primary Agricultural Credit Societies (PACS) level.

Incorrect

Answer: A

Explanation:

Statement I is correct:

-

- The Union Cabinet approved the constitution and empowerment of an Inter-Ministerial Committee (IMC) for the facilitation of the “World’s Largest Grain Storage Plan in the Cooperative Sector”.

- Implementation: An Inter-Ministerial Committee (IMC) will be constituted under the Chairmanship of the Minister of Cooperation.

- To ensure timely and uniform implementation of the plan in a professional manner, the Ministry of Cooperation would implement a pilot project in at least 10 selected districts of different States.

Statement II is correct and also explains Statement I correctly:

-

- Aim: The plan focuses on strengthening food security, reducing wastage, and empowering farmers by creating godowns and agricultural infrastructure at the Primary Agricultural Credit Societies (PACS) level.

-

Question 18 of 20

18. Question

Consider the following statements regarding angel tax:

1. It is levied when an unlisted company issues shares to an investor at a price lower than its fair market value.

2. It is applicable to only local resident investors while foreign investment is exempted.

Which of the above statements is/are correct?

Correct

Answer: D

Explanation:

Statement 1 is incorrect:

Angel tax is an income tax levied at a 30.6% rate when an unlisted company, such as a startup, issues shares to an investor at a higher price than its FMV (Fair Market Value).

Statement 2 is incorrect:

This tax was imposed only on investments made by a resident investor.

However, the Finance Act 2023 proposed extending angel tax to non-resident investors, which now applies for the start-ups not registered with DPIIT since April, 2023.

Additional Information

Changes introduced in angel tax in Budget 2023-24:

● The Union Budget 2023-24 proposed extending the angel tax provisions to transactions involving foreign investors.

● It was applicable to just local resident investors.

● However, its ambit was expanded as part of the government’s anti-tax avoidance move.

● Thus, with the latest amendment, when a startup raises funding from a foreign investor, it will be counted as income and taxable.

● However, the DPIIT-recognised startups were excluded from the angel tax levy.

● An initial estimation suggested that over 80,000 DPIIT-registered startups will not come within the tax purview.

Incorrect

Answer: D

Explanation:

Statement 1 is incorrect:

Angel tax is an income tax levied at a 30.6% rate when an unlisted company, such as a startup, issues shares to an investor at a higher price than its FMV (Fair Market Value).

Statement 2 is incorrect:

This tax was imposed only on investments made by a resident investor.

However, the Finance Act 2023 proposed extending angel tax to non-resident investors, which now applies for the start-ups not registered with DPIIT since April, 2023.

Additional Information

Changes introduced in angel tax in Budget 2023-24:

● The Union Budget 2023-24 proposed extending the angel tax provisions to transactions involving foreign investors.

● It was applicable to just local resident investors.

● However, its ambit was expanded as part of the government’s anti-tax avoidance move.

● Thus, with the latest amendment, when a startup raises funding from a foreign investor, it will be counted as income and taxable.

● However, the DPIIT-recognised startups were excluded from the angel tax levy.

● An initial estimation suggested that over 80,000 DPIIT-registered startups will not come within the tax purview.

-

Question 19 of 20

19. Question

Consider the following statements about Indian economy:

1. Vivad se vishwas I scheme is implemented by Ministry of Micro, Small and Medium Enterprises.

2. The scheme is aimed at providing relief to Micro, Small and Medium Enterprises (MSMEs) for COVID-19.

Which of the above statements is/are correct?

Correct

Answer: B

Explanation:

Statement 1 is incorrect:

-

- Scheme was announced in Union Budget 2023-24.

- It was launched by Department of Expenditure, Ministry of Finance.

Statement 2 is correct:

Aim of scheme: Vivad se vishwas scheme provides relief to Micro, Small and Medium Enterprises (MSMEs) for COVID-19 period. Under it, Ministries will refund performance security, bid security and liquidated damages forfeited/ deducted during COVID-19 pandemic.

Incorrect

Answer: B

Explanation:

Statement 1 is incorrect:

-

- Scheme was announced in Union Budget 2023-24.

- It was launched by Department of Expenditure, Ministry of Finance.

Statement 2 is correct:

Aim of scheme: Vivad se vishwas scheme provides relief to Micro, Small and Medium Enterprises (MSMEs) for COVID-19 period. Under it, Ministries will refund performance security, bid security and liquidated damages forfeited/ deducted during COVID-19 pandemic.

-

Question 20 of 20

20. Question

Consider the following statements:

1. Harit Sagar Guidelines 2023 will be applied to both major and minor ports.

2. The Sagar Shreshtha Samman award for the best absolute performance for the year 2022-23 is conferred to the Jawaharlal Nehru Port.

3. India is selected as the first country under the International Maritime Organization’s Green Voyage 2050 project to conduct a pilot project related to green shipping.

How many of the above statements are correct?

Correct

Answer: A

Explanation:

Statement 1 is incorrect:

-

- The “Harit Sagar” Guidelines -2023 provide a comprehensive framework for our major ports, empowering them to create a comprehensive action plan aimed at achieving quantifiable reductions in carbon emissions over defined timelines.

Statement 2 is incorrect:

-

- The Sagar Shreshtha Samman award for the best Absolute Performance for the year 2022-23 conferred to the Deendayal Port, Kandla for handling highest cargo of 137.56 MMT.

- The Jawaharlal Nehru Port received award for achieving major milestone in Turn Around Time.

Statement 3 is correct:

-

- India has been selected as pioneer lead country for International Maritime Organization Green Voyage 2050 Project which is funded by the Government of Norway.

- It assists developing countries in their efforts to reduce GHG emissions from ships.

- India has been selected by IMO Green Voyage to be the first country for piloting green shipping projects.

Additional Information

“The ‘Harit Sagar’ Guidelines -2023

Launched by: Ministry of Ports, Shipping and Waterways

Aim: Achieving zero carbon emissions by promoting eco-friendly practices in port development, operation, and maintenance.

Objective of the guidelines is to minimize waste through reduce, reuse, repurpose, and recycle to attain zero waste discharge from port operations while promoting monitoring based on Environmental Performance Indicators.

● The guidelines emphasize the use of clean and green energy, such as green hydrogen, green ammonia, green methanol/ethanol, to reduce carbon emissions over defined timelines.

● The guidelines provide a framework for major ports to draw out a comprehensive action plan for achieving quantified reduction in carbon emissions over defined timelines and to achieve Sustainable Developmental Goals (SDG).

Sagar Shreshtha Samman Award 2022-23: