Day-776

Quiz-summary

0 of 20 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 20 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- Answered

- Review

-

Question 1 of 20

1. Question

Consider the following statements about fertilizer subsidy:

1. The Union Government provides subsidy only for urea fertilizers in India.

2. The prices of phosphatic and potassic fertilizers are decontrolled and the manufacturers are free to fix their maximum retail price.

Which of the statements given above is/are correct?Correct

Answer: B

Explanation:

Statement 1 is incorrect:

Subsidy for urea fertilizer is provided by the Government under the Urea Subsidy Scheme. In June, 2023, the scheme has been extended for another three years till March 2025, which aims to ensure constant availability of urea to farmers at the same price of ₹242/45 kg bag. The actual cost of a bag comes around ₹2,200, while subsidy is provided for other fertilizers under Nutrient Based Subsidy (NBS) regime.

Statement 2 is correct:

Under the NBS regime, MRP of Potassium and Phosphorus fertilizers has been left open and fertilizer manufacturers/marketers are allowed to fix the MRP at reasonable rates.

Additional Information

Nutrient Based Subsidy regime:

● Under this, a fixed rate of subsidy (in Rs. per Kg basis) is announced on nutrients namely Nitrogen (N), Phosphate (P), Potash (K) and Sulphur (S) by the government on annual basis.

● It is applicable to 22 fertilizers (other than Urea) for which MRP will be decided taking into account the international and domestic prices of P&K fertilizers, exchange rate, and inventory level in the country.

Objective:

● Ensuring Nation’s food security, improving agricultural productivity and ensuring the balanced application of fertilizers.Incorrect

Answer: B

Explanation:

Statement 1 is incorrect:

Subsidy for urea fertilizer is provided by the Government under the Urea Subsidy Scheme. In June, 2023, the scheme has been extended for another three years till March 2025, which aims to ensure constant availability of urea to farmers at the same price of ₹242/45 kg bag. The actual cost of a bag comes around ₹2,200, while subsidy is provided for other fertilizers under Nutrient Based Subsidy (NBS) regime.

Statement 2 is correct:

Under the NBS regime, MRP of Potassium and Phosphorus fertilizers has been left open and fertilizer manufacturers/marketers are allowed to fix the MRP at reasonable rates.

Additional Information

Nutrient Based Subsidy regime:

● Under this, a fixed rate of subsidy (in Rs. per Kg basis) is announced on nutrients namely Nitrogen (N), Phosphate (P), Potash (K) and Sulphur (S) by the government on annual basis.

● It is applicable to 22 fertilizers (other than Urea) for which MRP will be decided taking into account the international and domestic prices of P&K fertilizers, exchange rate, and inventory level in the country.

Objective:

● Ensuring Nation’s food security, improving agricultural productivity and ensuring the balanced application of fertilizers. -

Question 2 of 20

2. Question

Consider the following statements about the Special Purpose Acquisition Companies (SPACs)?

1. These companies raise capital through the IPOs without having any revenue or operations.

2. These companies are also referred as to as “Blank Cheque” companies.

3. These companies usually acquire a profit-making unlisted company.

4. The current regulatory framework in India supports creation of SPACs.

How many of the above statements are correct?Correct

Answer: C

Explanation:

Statements 1, 2 and 3 are correct:

Special Purpose Acquisition Companies (SPACs)-

● Usually, if a company wants to raise capital through the issuance of Initial Public Offer (IPO), it needs to have its own revenue as well as operations.

● However, in the case of SPACs, it raises capital through the issuance of IPO without having its own revenue or operations.

● It raises 80% of the money through the IPO from the investors and the remaining 20% is raised internally from the sponsors of the SPACs.

● When the investors buy the shares issued by the SPAC, they are usually unaware as to where their money would be invested and hence, the SPACs are also referred to as “Blank Cheque Companies”.

● Once the money is raised, SPAC would then use that money to acquire a profit- making unlisted company.

● If it fails to acquire a company within a stipulated time period (2 years), then the money would have to be returned back to the investors along with the interest and the SPAC would be delisted.

Statement 4 is incorrect:

● The current regulatory framework of India is not supportive of the SPAC structure. The Companies Act 2013 authorizes the Registrar of Companies to strike-off the name of companies that do not commence operation within one year of incorporation. SPACs typically take 2 years to identify a target and perform due-diligence. Further, SPACs do not find acceptance even under the Securities and Exchange Board of India Act. The eligibility criteria for public listing, requires a company to have net tangible assets of at least ₹3 crore in the preceding three years, minimum average consolidated pre-tax operating profits of ₹15 crore during any three of last five years and net worth of at least ₹1 crore in each of the last three years.

● The absence of operational profits, net tangible assets would prevent SPACs from making an IPO in India.

● Hence, in order to take advantage associated with SPACs in India, the SEBI has set up an expert committee to explore the viability of formulating rules and regulations for SPACs.Incorrect

Answer: C

Explanation:

Statements 1, 2 and 3 are correct:

Special Purpose Acquisition Companies (SPACs)-

● Usually, if a company wants to raise capital through the issuance of Initial Public Offer (IPO), it needs to have its own revenue as well as operations.

● However, in the case of SPACs, it raises capital through the issuance of IPO without having its own revenue or operations.

● It raises 80% of the money through the IPO from the investors and the remaining 20% is raised internally from the sponsors of the SPACs.

● When the investors buy the shares issued by the SPAC, they are usually unaware as to where their money would be invested and hence, the SPACs are also referred to as “Blank Cheque Companies”.

● Once the money is raised, SPAC would then use that money to acquire a profit- making unlisted company.

● If it fails to acquire a company within a stipulated time period (2 years), then the money would have to be returned back to the investors along with the interest and the SPAC would be delisted.

Statement 4 is incorrect:

● The current regulatory framework of India is not supportive of the SPAC structure. The Companies Act 2013 authorizes the Registrar of Companies to strike-off the name of companies that do not commence operation within one year of incorporation. SPACs typically take 2 years to identify a target and perform due-diligence. Further, SPACs do not find acceptance even under the Securities and Exchange Board of India Act. The eligibility criteria for public listing, requires a company to have net tangible assets of at least ₹3 crore in the preceding three years, minimum average consolidated pre-tax operating profits of ₹15 crore during any three of last five years and net worth of at least ₹1 crore in each of the last three years.

● The absence of operational profits, net tangible assets would prevent SPACs from making an IPO in India.

● Hence, in order to take advantage associated with SPACs in India, the SEBI has set up an expert committee to explore the viability of formulating rules and regulations for SPACs. -

Question 3 of 20

3. Question

Consider the following statements about the Public Enterprises Selection Board (P.E.S.B):

1. It is a high-powered statutory body constituted under the Companies Act 2013.

2. It has been set up with the objective of evolving a sound managerial policy for the central public sector enterprises.

3. It builds a data bank containing data relating to the performance of PSEs and its officers.

How many of the above statements are correct?Correct

Answer: B

Explanation:

Statement 1 is incorrect:

The Public Enterprises Selection Board [P.E.S.B] is a high powered body constituted by Government of India Resolution dated 3.3.1987. So, it is not a statutory body.Statement 2 is correct:

The P.E.S.B has been set up with the objective of evolving a sound managerial policy for the Central Public Sector Enterprises and, in particular, to advise Government on appointments to their top management posts.Statement 3 is correct:

Functions of P.E.S.B-

● To be responsible for the selection and placement of personnel in the posts of Chairman, Managing Director or Chairman-cum-Managing Director (Level-I), and Functional Director (Level-II) in PSEs as well as in posts at any other level as may be specified by the Government;

● To advise the Government on matters relating to appointments, confirmation or extension of tenure and termination of services of the personnel of the above mentioned levels;

● To advise the Government on the desired structure at the Board level, and, for senior management personnel, for each PSE or group of PSEs;

● To advise the Government on a suitable performance appraisal system for both the PSEs and the managerial personnel in such enterprises;

● To build a data bank containing data relating to the performance of PSEs and its officers;

● To advise the Government on formulation and enforcement of a code of conduct and ethics for managerial personnel in PSEs;

● To advise the Government on evolving suitable training and development programs for management personnel in PSEs.Incorrect

Answer: B

Explanation:

Statement 1 is incorrect:

The Public Enterprises Selection Board [P.E.S.B] is a high powered body constituted by Government of India Resolution dated 3.3.1987. So, it is not a statutory body.Statement 2 is correct:

The P.E.S.B has been set up with the objective of evolving a sound managerial policy for the Central Public Sector Enterprises and, in particular, to advise Government on appointments to their top management posts.Statement 3 is correct:

Functions of P.E.S.B-

● To be responsible for the selection and placement of personnel in the posts of Chairman, Managing Director or Chairman-cum-Managing Director (Level-I), and Functional Director (Level-II) in PSEs as well as in posts at any other level as may be specified by the Government;

● To advise the Government on matters relating to appointments, confirmation or extension of tenure and termination of services of the personnel of the above mentioned levels;

● To advise the Government on the desired structure at the Board level, and, for senior management personnel, for each PSE or group of PSEs;

● To advise the Government on a suitable performance appraisal system for both the PSEs and the managerial personnel in such enterprises;

● To build a data bank containing data relating to the performance of PSEs and its officers;

● To advise the Government on formulation and enforcement of a code of conduct and ethics for managerial personnel in PSEs;

● To advise the Government on evolving suitable training and development programs for management personnel in PSEs. -

Question 4 of 20

4. Question

Consider the following statements about the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme:

1. The RoDTEP scheme has replaced the Merchandise Exports from India Scheme.

2. Under the scheme, the embedded central, state and local duties or taxes will get refunded and credited in an exporter ledger account with customs.

3. The benefits of the RoDTEP scheme are extended to all export goods.

How many of the statements given above are correct?Correct

Answer: C

Explanation:

Statement 1 is correct:

● The RoDTEP scheme has replaced the popular Merchandise Exports from India Scheme as the latter has been found to violate global trade norms following a complaint from the United States at the World Trade Organization. RoDTEP is based on the globally accepted principle that taxes and duties should not be exported, and taxes and levies borne on the exported products should be either exempted or remitted to exporters.

Statement 2 is correct:

● Under the scheme, the embedded central, state and local duties or taxes will get refunded and credited in an exporter‘s ledger account with customs. This can be used to pay basic customs duty on imported goods. The credits can also be transferred to other importers.

Statement 3 is correct:

● Benefits of Remission of Duties and Taxes on Exported Products (RoDTEP) scheme are extended to all export goods from January 1, 2021.

Note: The Scheme for Remission of Duties and Taxes on Exported Products (RoDTEP), initially notified until 30th September 2023, has been extended until 30th June 2024, with the same rates applicable to existing export items.Incorrect

Answer: C

Explanation:

Statement 1 is correct:

● The RoDTEP scheme has replaced the popular Merchandise Exports from India Scheme as the latter has been found to violate global trade norms following a complaint from the United States at the World Trade Organization. RoDTEP is based on the globally accepted principle that taxes and duties should not be exported, and taxes and levies borne on the exported products should be either exempted or remitted to exporters.

Statement 2 is correct:

● Under the scheme, the embedded central, state and local duties or taxes will get refunded and credited in an exporter‘s ledger account with customs. This can be used to pay basic customs duty on imported goods. The credits can also be transferred to other importers.

Statement 3 is correct:

● Benefits of Remission of Duties and Taxes on Exported Products (RoDTEP) scheme are extended to all export goods from January 1, 2021.

Note: The Scheme for Remission of Duties and Taxes on Exported Products (RoDTEP), initially notified until 30th September 2023, has been extended until 30th June 2024, with the same rates applicable to existing export items. -

Question 5 of 20

5. Question

With respect to the Harmonised List of Infrastructure sector, consider the following statements:

1. The List contains both physical infrastructure as well as social infrastructure.

2. The List is notified by the Ministry of Finance.

Which of the statements given above is/are correct?Correct

Answer: C

Explanation: Statements 1 and 2 are correct.

Harmonised List of Infrastructure Sector-

● The Ministry of Finance notifies the list of sectors which can be considered to be part of the Harmonized List of Infrastructure sector.

● Presently, it includes 5 main sectors and several sub-sectors:

✔ Transport and Logistics: Roads, Railways, Waterways, Airports, Pipelines, Multi- modal Logistics Parks etc.

✔ Energy: Generation, Transmission, Distribution, Storage of Oil / Gas / LNG.

✔ Water and Sanitation: Solid Waste Management, Irrigation, Water Treatment Plants etc.

✔ Communication: Telecommunication Towers and Services.

✔ Social and Commercial: Educational Institutions, Sports, Hospitals, Tourism Infrastructure, Cold Chain Infrastructure, Affordable Housing, Affordable Rental Housing Complex, Exhibition-cum- Convention Centres etc.

Purpose of list:

● The ‘Harmonized Master List of Infrastructure sub-sectors’ (‘Harmonized Master List’) was introduced with the intent to guide financial institutions/ agencies that are responsible for supporting infrastructure in various ways.

● The Harmonized Master List lays down the sectors/ activities that qualify as ‘infrastructure’.

● Bank and NBFC finance to these sectors laid down in the Harmonized Master List would qualify as ‘infrastructure loans’, which are loans that are subject to different regulatory requirements given the nature of these loans.

● For instance, infrastructure loans are subject to different asset classification norms, concentration norms, etc.

Note: The Finance Ministry has proposed to review the list in Union Budget 2023-24. The institutional mechanism to update the Master List and for revisiting the sub-sectors outside the Master List, will be a Committee chaired by Secretary, Department of Economic Affairs with Member-Secretary, Planning Commission, Secretary, Department of Revenue, Chief Economic Adviser, and one representative each of RBI, SEBI, IRDA, PFRDA and the Secretary of the concerned Administrative Ministry/Department, as members. The Committee will be serviced by DEA and will make recommendations to the Finance Minister for decision.Incorrect

Answer: C

Explanation: Statements 1 and 2 are correct.

Harmonised List of Infrastructure Sector-

● The Ministry of Finance notifies the list of sectors which can be considered to be part of the Harmonized List of Infrastructure sector.

● Presently, it includes 5 main sectors and several sub-sectors:

✔ Transport and Logistics: Roads, Railways, Waterways, Airports, Pipelines, Multi- modal Logistics Parks etc.

✔ Energy: Generation, Transmission, Distribution, Storage of Oil / Gas / LNG.

✔ Water and Sanitation: Solid Waste Management, Irrigation, Water Treatment Plants etc.

✔ Communication: Telecommunication Towers and Services.

✔ Social and Commercial: Educational Institutions, Sports, Hospitals, Tourism Infrastructure, Cold Chain Infrastructure, Affordable Housing, Affordable Rental Housing Complex, Exhibition-cum- Convention Centres etc.

Purpose of list:

● The ‘Harmonized Master List of Infrastructure sub-sectors’ (‘Harmonized Master List’) was introduced with the intent to guide financial institutions/ agencies that are responsible for supporting infrastructure in various ways.

● The Harmonized Master List lays down the sectors/ activities that qualify as ‘infrastructure’.

● Bank and NBFC finance to these sectors laid down in the Harmonized Master List would qualify as ‘infrastructure loans’, which are loans that are subject to different regulatory requirements given the nature of these loans.

● For instance, infrastructure loans are subject to different asset classification norms, concentration norms, etc.

Note: The Finance Ministry has proposed to review the list in Union Budget 2023-24. The institutional mechanism to update the Master List and for revisiting the sub-sectors outside the Master List, will be a Committee chaired by Secretary, Department of Economic Affairs with Member-Secretary, Planning Commission, Secretary, Department of Revenue, Chief Economic Adviser, and one representative each of RBI, SEBI, IRDA, PFRDA and the Secretary of the concerned Administrative Ministry/Department, as members. The Committee will be serviced by DEA and will make recommendations to the Finance Minister for decision. -

Question 6 of 20

6. Question

Greedflation was recently in the news, which of the following statements is correct regarding Greedflation?

Correct

Answer: D

Explanation:

● Statement D is correct: Greedflation refers to price inflation caused by corporate greed for high profits. Greedflation is not caused by an economic upturn but rather by corporate greed. It might be seen as a circumstance when corporations want excessive profit.

● The only way corporations can influence the overall price level is by reducing the supply of goods and services. Thus, greedflation is often compared to other cost-push inflation factors.Incorrect

Answer: D

Explanation:

● Statement D is correct: Greedflation refers to price inflation caused by corporate greed for high profits. Greedflation is not caused by an economic upturn but rather by corporate greed. It might be seen as a circumstance when corporations want excessive profit.

● The only way corporations can influence the overall price level is by reducing the supply of goods and services. Thus, greedflation is often compared to other cost-push inflation factors. -

Question 7 of 20

7. Question

Consider the following statements regarding dated government securities:

1. They are short term debt instruments.

2. They are issued by both the Central and the State governments.

Which of the statements given above is/are correct?Correct

Answer: C

Explanation:

A Government Security (G-Sec) is a tradable instrument issued by the Central Government or the State Governments. G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

Statement 1 is correct: Dated Securities are basically long-term securities issued by the Central Government and generally have a tenor of 5 years to 40 years.

Statement 2 is correct: The Central Government issues both, treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

The Public Debt Office (PDO) of the Reserve Bank of India acts as the registry/depository of G-Secs and deals with the issue, interest payment and repayment of principal at maturity. Most of the dated securities are fixed coupon securities.Incorrect

Answer: C

Explanation:

A Government Security (G-Sec) is a tradable instrument issued by the Central Government or the State Governments. G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

Statement 1 is correct: Dated Securities are basically long-term securities issued by the Central Government and generally have a tenor of 5 years to 40 years.

Statement 2 is correct: The Central Government issues both, treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

The Public Debt Office (PDO) of the Reserve Bank of India acts as the registry/depository of G-Secs and deals with the issue, interest payment and repayment of principal at maturity. Most of the dated securities are fixed coupon securities. -

Question 8 of 20

8. Question

Consider the following statements:

Statement I: High tax to GDP ratio is an indicator of a growing economy.

Statement II: The share of direct tax is more than the indirect tax in the tax to GDP ratio of India.

Which one of the following is correct in respect of the above statements?Correct

Answer: B

Explanation:

● Statement 1 is correct: Tax-to-GDP ratio represents the size of a country’s tax kitty relative to its GDP. It is a representation of the size of the government’s tax revenue expressed as a percentage of the GDP. Higher the tax to GDP ratio the better financial position the country will be in. The ratio represents that the government is able to finance its expenditure. A higher tax to GDP ratio means that the government is able to cast its fiscal net wide. It reduces a government’s dependence on borrowings.

● Although India has improved its tax-to-GDP ratio in the last six years, it is still far lower than the average OECD ratio which is 34 per cent.● Statement 2 is correct: Tax to GDP ratio: 11.1% in FY23. Direct Taxes: 6%, Indirect taxes: 5.1%.

Incorrect

Answer: B

Explanation:

● Statement 1 is correct: Tax-to-GDP ratio represents the size of a country’s tax kitty relative to its GDP. It is a representation of the size of the government’s tax revenue expressed as a percentage of the GDP. Higher the tax to GDP ratio the better financial position the country will be in. The ratio represents that the government is able to finance its expenditure. A higher tax to GDP ratio means that the government is able to cast its fiscal net wide. It reduces a government’s dependence on borrowings.

● Although India has improved its tax-to-GDP ratio in the last six years, it is still far lower than the average OECD ratio which is 34 per cent.● Statement 2 is correct: Tax to GDP ratio: 11.1% in FY23. Direct Taxes: 6%, Indirect taxes: 5.1%.

-

Question 9 of 20

9. Question

Consider the following:

1. NRI deposits

2. Employee compensation

3. Remittances

4. Banking services

5. External commercial borrowing

How many of the above are part of the Current Account?Correct

Answer: A

Explanation: Options 2 and 3 are correct. Employee compensation and Remittances are part of the invisibles in the current account.

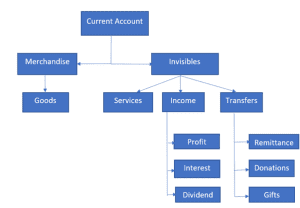

● Current account is one of the two component accounts of the balance of payments of a nation. It records the trade of goods and services of an economy with other countries of the world.

● Current account deals in those transactions which do not alter Indian residents’ assets or liabilities, including contingent liabilities, outside India and foreign resident’s assets or liabilities inside India.

● Current account includes three components – net exchange i.e. exports minus imports of goods, net exchange of services and net transfers to and from the country. The balance in this account before accounting for the transfer component is generally referred to as the balance of trade. In India, current accounts are reported by the Reserve Bank of India.

Component of Current account:

● Component of Capital account:

o FDI/FPI

o External commercial borrowing (ECB)

o NRI deposits (Banking services)

Therefore, options 1, 4 and 5 are incorrect.Incorrect

Answer: A

Explanation: Options 2 and 3 are correct. Employee compensation and Remittances are part of the invisibles in the current account.

● Current account is one of the two component accounts of the balance of payments of a nation. It records the trade of goods and services of an economy with other countries of the world.

● Current account deals in those transactions which do not alter Indian residents’ assets or liabilities, including contingent liabilities, outside India and foreign resident’s assets or liabilities inside India.

● Current account includes three components – net exchange i.e. exports minus imports of goods, net exchange of services and net transfers to and from the country. The balance in this account before accounting for the transfer component is generally referred to as the balance of trade. In India, current accounts are reported by the Reserve Bank of India.

Component of Current account:

● Component of Capital account:

o FDI/FPI

o External commercial borrowing (ECB)

o NRI deposits (Banking services)

Therefore, options 1, 4 and 5 are incorrect. -

Question 10 of 20

10. Question

Consider the following statements:

1. Global debt refers to only governments borrowings of all the countries.

2. Global debt as a share of GDP has been rising steadily over the decades.

Which of the statements given above is/are incorrect?Correct

Answer: A

Explanation:

● Statement 1 is incorrect: Global debt refers to the borrowings of governments as well as private businesses and individuals. Governments borrow to meet various expenditures that they are unable to meet through tax and other revenues. Governments may also borrow to pay interest on the money that they have already borrowed to fund past expenditures. The private sector borrows predominantly to make investments.

● Statement 2 is correct: Both global debt in nominal terms and global debt as a share of GDP have been rising steadily over the decades. Quite notably, global debt has risen by about $100 trillion over the last decade. Further, global debt as a share of gross domestic product (GDP) has started to increase once again to hit 336% after dropping quite steeply for seven consecutive quarters.

● Most (more than 80%) of the rise in global debt has come from advanced economies such as the U.S., the U.K., Japan, and France. Among emerging market economies, China, India and Brazil have seen the most growth in debt.Incorrect

Answer: A

Explanation:

● Statement 1 is incorrect: Global debt refers to the borrowings of governments as well as private businesses and individuals. Governments borrow to meet various expenditures that they are unable to meet through tax and other revenues. Governments may also borrow to pay interest on the money that they have already borrowed to fund past expenditures. The private sector borrows predominantly to make investments.

● Statement 2 is correct: Both global debt in nominal terms and global debt as a share of GDP have been rising steadily over the decades. Quite notably, global debt has risen by about $100 trillion over the last decade. Further, global debt as a share of gross domestic product (GDP) has started to increase once again to hit 336% after dropping quite steeply for seven consecutive quarters.

● Most (more than 80%) of the rise in global debt has come from advanced economies such as the U.S., the U.K., Japan, and France. Among emerging market economies, China, India and Brazil have seen the most growth in debt. -

Question 11 of 20

11. Question

Consider the following indicators:

1. Cooking Fuel

2. Sanitation

3. Drinking Water

4. Housing

5. Electricity

6. Assets

7. Bank Account

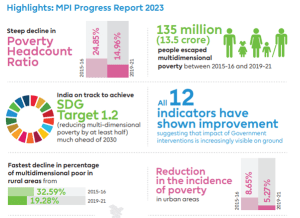

How many of the above are the indicators of the Multidimensional Poverty Index of India?Correct

Answer: D

Explanation:

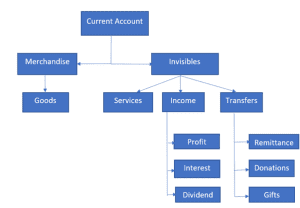

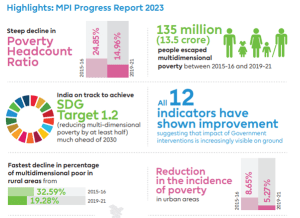

● The Government of India has acknowledged the significance of the global MPI under the mandate of the Global Indices for Reform and Action (GIRG) initiative. In this context, NITI Aayog, as the nodal agency for MPI, has been responsible for constructing an indigenized index for monitoring the performance of States and Union Territories in addressing multidimensional poverty.

● The National MPI Project is aimed at deconstructing the Global MPI and creating a globally aligned and yet customised India MPI for drawing up comprehensive Reform Action Plans with the larger goal of improving India’s position in the Global MPI rankings.

● The national MPI model retains the ten indicators of the global MPI model, staying closely aligned to the global methodology. It also adds two indicators, viz., Maternal Health and Bank Accounts in line with national priorities.

Incorrect

Incorrect

Answer: D

Explanation:

● The Government of India has acknowledged the significance of the global MPI under the mandate of the Global Indices for Reform and Action (GIRG) initiative. In this context, NITI Aayog, as the nodal agency for MPI, has been responsible for constructing an indigenized index for monitoring the performance of States and Union Territories in addressing multidimensional poverty.

● The National MPI Project is aimed at deconstructing the Global MPI and creating a globally aligned and yet customised India MPI for drawing up comprehensive Reform Action Plans with the larger goal of improving India’s position in the Global MPI rankings.

● The national MPI model retains the ten indicators of the global MPI model, staying closely aligned to the global methodology. It also adds two indicators, viz., Maternal Health and Bank Accounts in line with national priorities.

-

Question 12 of 20

12. Question

Consider the following statements:

1. It is the global reference rate for unsecured short-term borrowing in the interbank market.

2. It is an indicator of the health of the financial system and provides an idea of the trajectory of impending policy rates of central banks.

3. Indian currency is one of the five currencies for which LIBOR is computed.

4. India has currently shifted to the Mumbai Interbank Forward Outright Rate (MIFOR).

How many of the above statements are correct regarding LIBOR?Correct

Answer: B

Explanation:

● Statement 1 is correct: LIBOR, the acronym for London Interbank Offer Rate, is the global reference rate for unsecured short-term borrowing in the interbank market. It acts as a benchmark for short-term interest rates. It is used for pricing of interest rate swaps, currency rate swaps as well as mortgages.● Statement 2 is correct: It is an indicator of the health of the financial system and provides an idea of the trajectory of impending policy rates of central banks.

● LIBOR is administered by the Intercontinental Exchange or ICE. It is computed for five currencies with seven different maturities ranging from overnight to a year.● Statement 3 is incorrect: The five currencies for which LIBOR is computed are Swiss franc, euro, pound sterling, Japanese yen and US dollar.

● Statement 4 is incorrect: LIBOR and the Mumbai Interbank Forward Outright Rate (MIFOR) were phased out by June 2023 and replaced by the Secured Overnight Financing Rate (SOFR). MIFOR, a domestic interest rate benchmark, is presently published by Financial Benchmarks India Pvt Ltd (FBIL).

● The term Mumbai Interbank Forward Offer Rate (MIFOR) refers to a benchmark rate used by commercial banks for certain financial contracts in India. MIFOR is used for setting prices on forward-rate agreements and derivatives. It is a mix of the London Interbank Offered Rate (LIBOR) and a forward premium derived from Indian foreign exchange markets.Incorrect

Answer: B

Explanation:

● Statement 1 is correct: LIBOR, the acronym for London Interbank Offer Rate, is the global reference rate for unsecured short-term borrowing in the interbank market. It acts as a benchmark for short-term interest rates. It is used for pricing of interest rate swaps, currency rate swaps as well as mortgages.● Statement 2 is correct: It is an indicator of the health of the financial system and provides an idea of the trajectory of impending policy rates of central banks.

● LIBOR is administered by the Intercontinental Exchange or ICE. It is computed for five currencies with seven different maturities ranging from overnight to a year.● Statement 3 is incorrect: The five currencies for which LIBOR is computed are Swiss franc, euro, pound sterling, Japanese yen and US dollar.

● Statement 4 is incorrect: LIBOR and the Mumbai Interbank Forward Outright Rate (MIFOR) were phased out by June 2023 and replaced by the Secured Overnight Financing Rate (SOFR). MIFOR, a domestic interest rate benchmark, is presently published by Financial Benchmarks India Pvt Ltd (FBIL).

● The term Mumbai Interbank Forward Offer Rate (MIFOR) refers to a benchmark rate used by commercial banks for certain financial contracts in India. MIFOR is used for setting prices on forward-rate agreements and derivatives. It is a mix of the London Interbank Offered Rate (LIBOR) and a forward premium derived from Indian foreign exchange markets. -

Question 13 of 20

13. Question

Consider the following statements:

1.Capital Lease is a lease agreement in which the lessor agrees to transfer the ownership rights to the lessee after the completion of the lease period.

2. In Operating Lease, the ownership is retained by the lessor during and after the lease term.

Which of the statements given above is/are incorrect?Correct

Answer: D

Explanation:

● Statement 1 is correct: Capital Lease or finance lease is a lease agreement in which the lessor agrees to transfer the ownership rights to the lessee after the completion of the lease period. Capital or finance leases are long term and non cancellable in nature.

● Finance lease characteristics include:

o Ownership: Transfers to the lessee at the end of the lease term.

o Bargain purchase options: Enables the lessee to buy an asset at less than fair market value.

o Terms: Equals or exceeds 75% of the asset’s estimated useful life.

o Present value: PV of lease payments equals or exceeds 90% of the asset’s original cost.

o Risks/benefits: All risk is transferred to the lessee.

● An Operating Lease is a contract that allows for an asset’s use but does not convey ownership rights of the asset. These leases allow businesses to use the asset without incurring the high expenses involved in purchasing it.

● Operating Lease characteristics include:

o Statement 2 is correct: Ownership: Retained by the lessor during and after the lease term.

o Bargain purchase options: Operating leases cannot contain a bargain purchase option.

o Terms: Less than 75% of the asset’s estimated economic life.

o Present value: The PV of lease payments is less than 90% of the asset’s fair market value.

o Risks/benefits: Right to use only. Risks/benefits remain with the lessor.Incorrect

Answer: D

Explanation:

● Statement 1 is correct: Capital Lease or finance lease is a lease agreement in which the lessor agrees to transfer the ownership rights to the lessee after the completion of the lease period. Capital or finance leases are long term and non cancellable in nature.

● Finance lease characteristics include:

o Ownership: Transfers to the lessee at the end of the lease term.

o Bargain purchase options: Enables the lessee to buy an asset at less than fair market value.

o Terms: Equals or exceeds 75% of the asset’s estimated useful life.

o Present value: PV of lease payments equals or exceeds 90% of the asset’s original cost.

o Risks/benefits: All risk is transferred to the lessee.

● An Operating Lease is a contract that allows for an asset’s use but does not convey ownership rights of the asset. These leases allow businesses to use the asset without incurring the high expenses involved in purchasing it.

● Operating Lease characteristics include:

o Statement 2 is correct: Ownership: Retained by the lessor during and after the lease term.

o Bargain purchase options: Operating leases cannot contain a bargain purchase option.

o Terms: Less than 75% of the asset’s estimated economic life.

o Present value: The PV of lease payments is less than 90% of the asset’s fair market value.

o Risks/benefits: Right to use only. Risks/benefits remain with the lessor. -

Question 14 of 20

14. Question

Consider the following statements:

1. The PM-CARES fund is created as a Public Charitable Trust in which individuals and organisations can donate.

2. The PM-CARES Fund is beyond the purview of the Right to Information Act, 2005.

3. Foreign Donations are allowed under the PM- CARES Fund and are exempted under Foreign Contribution Regulation Act.

4.The PM-CARES Fund is audited by the Comptroller and Auditor General of India.

How many of the above statements are correct?Correct

Answer: C

Explanation:

About PM CARES Fund:

● Statement 1 is correct: PM CARES Fund is a public charitable trust. It has been set up keeping in mind the need for having a dedicated fund with the primary objective of dealing with any kind of emergency or distress situation, like posed by the COVID-19 pandemic, and to provide relief to the affected.

● The fund consists entirely of voluntary contributions from individuals/organizations and does not get any budgetary support. Donations to this fund will be 100% exempted from income tax.

● Prime Minister is the ex-officio Chairman of the PM CARES Fund and Minister of Defence, Minister of Home Affairs and Minister of Finance, Government of India are ex-officio Trustees of the Fund.

● Statement 2 is correct: PM CARES is not a “public authority” within the meaning of Section 2(h)(d) of the RTI Act and as such provisions of the Act cannot be made applicable on the trust.

● Statement 3 is correct: PM CARES Fund has also got exemption under the FCRA and a separate account for receiving foreign donations has been opened. This enables PM CARES Fund to accept donations and contributions from individuals and organizations based in foreign countries.

● Statement 4 is incorrect: PM CARES Fund is audited by an independent auditor not by the CAG. Trustees of the Fund decided to appoint Chartered Accountants, as the auditors of PM CARES Fund for 3 years.

● Contributions can be made by following modes:

o Net Banking (SBI and other commercial Banks)

o Card Payments – SBI ATM-cum-Debit Card, Other Bank Debit Cards, Credit Card, Prepaid Card, Foreign Card

o Other Payment mode: SBI Branch, NEFT/RTGSIncorrect

Answer: C

Explanation:

About PM CARES Fund:

● Statement 1 is correct: PM CARES Fund is a public charitable trust. It has been set up keeping in mind the need for having a dedicated fund with the primary objective of dealing with any kind of emergency or distress situation, like posed by the COVID-19 pandemic, and to provide relief to the affected.

● The fund consists entirely of voluntary contributions from individuals/organizations and does not get any budgetary support. Donations to this fund will be 100% exempted from income tax.

● Prime Minister is the ex-officio Chairman of the PM CARES Fund and Minister of Defence, Minister of Home Affairs and Minister of Finance, Government of India are ex-officio Trustees of the Fund.

● Statement 2 is correct: PM CARES is not a “public authority” within the meaning of Section 2(h)(d) of the RTI Act and as such provisions of the Act cannot be made applicable on the trust.

● Statement 3 is correct: PM CARES Fund has also got exemption under the FCRA and a separate account for receiving foreign donations has been opened. This enables PM CARES Fund to accept donations and contributions from individuals and organizations based in foreign countries.

● Statement 4 is incorrect: PM CARES Fund is audited by an independent auditor not by the CAG. Trustees of the Fund decided to appoint Chartered Accountants, as the auditors of PM CARES Fund for 3 years.

● Contributions can be made by following modes:

o Net Banking (SBI and other commercial Banks)

o Card Payments – SBI ATM-cum-Debit Card, Other Bank Debit Cards, Credit Card, Prepaid Card, Foreign Card

o Other Payment mode: SBI Branch, NEFT/RTGS -

Question 15 of 20

15. Question

Consider the following statements:

1. Retail investors can purchase Government securities(G-secs) only through secondary markets by opening a Gilt Securities Account with RBI.

2. The proposed Retail Direct Scheme allows the retail investors to purchase G-secs directly from the RBI.

Which of the statements given above is/are correct?Correct

Answer: B

Explanation:

Statement 1 is incorrect: Retail Direct scheme is a one-stop solution to facilitate investment in Government Securities by Individual Investors. Under this scheme Individual Retail investors can open Gilt Securities Account – “Retail Direct Gilt (RDG)” Account with the RBI.Individuals can directly purchase treasury bills, dated securities, sovereign gold bonds (SGB) and state development loans (SDLs) from primary as well as secondary markets with the help of Retail Direct Scheme.

The RBI Retail Direct Online Portal will facilitate the following:

● On-boarding of Retail Direct Investors,

● Opening and management of RDG Accounts,

● Facilitate participation in Non Competitive Bidding in Primary G-sec Auctions through the Clearing Corporation of India (CCIL)

● Facilitate Investing in Sovereign Gold Bonds (SGBs) through CCIL

● Facilitate Negotiated Dealing System – Order Matching system (NDS OM) access to Retail Direct Investors for secondary market trading and settlement of such trades through CCIL.

The investor can place non competitive bids in Primary issuance of all Central Government securities (including Treasury Bills and Sovereign Gold bonds) as well as securities issued by various State Governments.

Under this scheme, the individual can also access Secondary market through “NDS OM” – RBI’s trading system.

The investor will automatically receive any interest paid/maturity proceeds into his linked bank account on due dates.Statement 2 is correct: Retail Direct Scheme facilitates retail investors to purchase government securities through the online portal directly from RBI( issuer of the G-secs) through the Retail Direct Gilt account.

● This allows individuals to buy Government securities directly in the primary market (auctions) as well as buy/sell in the secondary market. For the retail investor, Government securities offer an option for long term investment.Additional Information-

A Government Security (G-Sec) is a tradable instrument issued by the Central Government or the State Governments. It acknowledges the Government’s debt obligation. Such securities are short term (usually called treasury bills, with original maturities of less than one year) or long term (usually called Government bonds or dated securities with original maturity of one year or more).

In India, the Central Government issues both, treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.Incorrect

Answer: B

Explanation:

Statement 1 is incorrect: Retail Direct scheme is a one-stop solution to facilitate investment in Government Securities by Individual Investors. Under this scheme Individual Retail investors can open Gilt Securities Account – “Retail Direct Gilt (RDG)” Account with the RBI.Individuals can directly purchase treasury bills, dated securities, sovereign gold bonds (SGB) and state development loans (SDLs) from primary as well as secondary markets with the help of Retail Direct Scheme.

The RBI Retail Direct Online Portal will facilitate the following:

● On-boarding of Retail Direct Investors,

● Opening and management of RDG Accounts,

● Facilitate participation in Non Competitive Bidding in Primary G-sec Auctions through the Clearing Corporation of India (CCIL)

● Facilitate Investing in Sovereign Gold Bonds (SGBs) through CCIL

● Facilitate Negotiated Dealing System – Order Matching system (NDS OM) access to Retail Direct Investors for secondary market trading and settlement of such trades through CCIL.

The investor can place non competitive bids in Primary issuance of all Central Government securities (including Treasury Bills and Sovereign Gold bonds) as well as securities issued by various State Governments.

Under this scheme, the individual can also access Secondary market through “NDS OM” – RBI’s trading system.

The investor will automatically receive any interest paid/maturity proceeds into his linked bank account on due dates.Statement 2 is correct: Retail Direct Scheme facilitates retail investors to purchase government securities through the online portal directly from RBI( issuer of the G-secs) through the Retail Direct Gilt account.

● This allows individuals to buy Government securities directly in the primary market (auctions) as well as buy/sell in the secondary market. For the retail investor, Government securities offer an option for long term investment.Additional Information-

A Government Security (G-Sec) is a tradable instrument issued by the Central Government or the State Governments. It acknowledges the Government’s debt obligation. Such securities are short term (usually called treasury bills, with original maturities of less than one year) or long term (usually called Government bonds or dated securities with original maturity of one year or more).

In India, the Central Government issues both, treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments. -

Question 16 of 20

16. Question

Consider the following pairs:

Deficits – Descriptions

1. Effective Revenue Deficit – Fiscal deficit – interest payments.

2. Primary Deficit – Revenue deficit – grants for the creation of capital assets.

3. Monetised Deficit – Government deficit financed by borrowing from the RBI.

How many of the above pairs are correctly matched?Correct

Answer: A

Explanation:

Effective Revenue Deficit:

● Effective Revenue Deficit is the difference between revenue deficit and grants for creation of capital assets. The concept of effective revenue deficit has been suggested by the Rangarajan Committee on Public Expenditure. It is aimed to deduct the money used out of borrowing to finance capital expenditure.

● Pair 1 is incorrect: Effective Revenue Deficit = Revenue Deficit – Grants given to states for creation of capital assets.

● Effective Capital Expenditure = Capital Expenditure + Grants given to states for creation of capital assets.Primary Deficit:

● Pair 2 is incorrect: Primary Deficit = Fiscal Deficit – Net interest liabilities

● Primary deficit tells about the deficit in the government’s budget excluding the interest liabilities on the government’s accumulated debt.Monetised deficit:

Pair 3 is correct: Monetised deficit is the monetary support the Reserve Bank of India (RBI) extends to the Centre as part of the government’s borrowing programme. In other words, the term refers to the purchase of government bonds by the central bank to finance the spending needs of the government.

Incorrect

Answer: A

Explanation:

Effective Revenue Deficit:

● Effective Revenue Deficit is the difference between revenue deficit and grants for creation of capital assets. The concept of effective revenue deficit has been suggested by the Rangarajan Committee on Public Expenditure. It is aimed to deduct the money used out of borrowing to finance capital expenditure.

● Pair 1 is incorrect: Effective Revenue Deficit = Revenue Deficit – Grants given to states for creation of capital assets.

● Effective Capital Expenditure = Capital Expenditure + Grants given to states for creation of capital assets.Primary Deficit:

● Pair 2 is incorrect: Primary Deficit = Fiscal Deficit – Net interest liabilities

● Primary deficit tells about the deficit in the government’s budget excluding the interest liabilities on the government’s accumulated debt.Monetised deficit:

Pair 3 is correct: Monetised deficit is the monetary support the Reserve Bank of India (RBI) extends to the Centre as part of the government’s borrowing programme. In other words, the term refers to the purchase of government bonds by the central bank to finance the spending needs of the government.

-

Question 17 of 20

17. Question

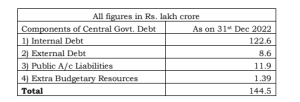

Consider the following statements regarding public debt:

Statement I: It consists of internal debt, external debt, and public account liabilities.

Statement II: In India, the share of internal debt forms a higher proportion of public debt than external debt.

Which one of the following is correct in respect of the above statements?Correct

Answer: D

Explanation:

● Public debt is the total amount, including total liabilities, borrowed by the government to meet its development budget. It has to be paid from the Consolidated Fund of India.

● Statement 1 is incorrect: Public debt includes internal debt and external debt. It does not include public account liabilities. It is also called the debt of the Government of India.

● According to the Reserve Bank of India Act, 1934, the RBI is both the banker and public debt manager for the government. The RBI handles all the money, remittances, foreign exchange and banking transactions. The Union government also deposits its cash balance with the RBI.

● Internal Debt: it is basically what the Government of India borrows by issuing Debt Securities like Treasury Bills and Dated Securities in the domestic market. It is also called Domestic Market Borrowings.

● External Debt: It is basically borrowing from other Governments (bilateral debt) and Multilateral Agencies like World Bank, ADB etc. and FPI purchasing G-Secs.

● Public Account Liability: It includes National Small Savings Schemes like Public Provident Fund, Kisan Vikas Patra etc.

● Off budget liabilities: Such financial liabilities of any corporate or other entity owned/controlled by the Central Government, which the Govt. has to repay or service from the Annual Financial Statement.

● Statement 2 is correct: Internal debt constitutes over 93 per cent of the overall public debt.

Incorrect

Incorrect

Answer: D

Explanation:

● Public debt is the total amount, including total liabilities, borrowed by the government to meet its development budget. It has to be paid from the Consolidated Fund of India.

● Statement 1 is incorrect: Public debt includes internal debt and external debt. It does not include public account liabilities. It is also called the debt of the Government of India.

● According to the Reserve Bank of India Act, 1934, the RBI is both the banker and public debt manager for the government. The RBI handles all the money, remittances, foreign exchange and banking transactions. The Union government also deposits its cash balance with the RBI.

● Internal Debt: it is basically what the Government of India borrows by issuing Debt Securities like Treasury Bills and Dated Securities in the domestic market. It is also called Domestic Market Borrowings.

● External Debt: It is basically borrowing from other Governments (bilateral debt) and Multilateral Agencies like World Bank, ADB etc. and FPI purchasing G-Secs.

● Public Account Liability: It includes National Small Savings Schemes like Public Provident Fund, Kisan Vikas Patra etc.

● Off budget liabilities: Such financial liabilities of any corporate or other entity owned/controlled by the Central Government, which the Govt. has to repay or service from the Annual Financial Statement.

● Statement 2 is correct: Internal debt constitutes over 93 per cent of the overall public debt.

-

Question 18 of 20

18. Question

Which one of the following statements is correct regarding the term ‘Sterilisation’?

Correct

Answer: C

Explanation:

● Statement C is correct: Sterilization is a form of monetary action in which a central bank seeks to limit the effect of inflows and outflows of capital on the money supply. Sterilization most frequently involves the purchase or sale of financial assets by a central bank and is designed to offset the effect of foreign exchange intervention. The sterilization process is used to manipulate the value of one domestic currency relative to another and is initiated in the foreign exchange market.Incorrect

Answer: C

Explanation:

● Statement C is correct: Sterilization is a form of monetary action in which a central bank seeks to limit the effect of inflows and outflows of capital on the money supply. Sterilization most frequently involves the purchase or sale of financial assets by a central bank and is designed to offset the effect of foreign exchange intervention. The sterilization process is used to manipulate the value of one domestic currency relative to another and is initiated in the foreign exchange market. -

Question 19 of 20

19. Question

Consider the following statements regarding Peer to peer (P2P) lending:

1. P2P lending is a form of crowdfunding used to raise loans without any security.

2. The interest rate is fixed by way of a mutual agreement between the borrower and lender.

3. In P2P lending, there is no investor protection by way of a compensation scheme to cover defaults in this market as there is with deposit guarantee schemes for bank deposits.

How many of the above statements are correct?Correct

Answer: C

Explanation:

● Statement 1 is correct: Peer-to-peer lending is a form of crowdfunding used to raise loans for people who need to borrow, from people who want to invest. There is no security required for them to borrow money.

● It enables individuals to borrow and lend money without any financial institution as an intermediary and extends credit to borrowers who are unable to get it through traditional financial institutions.

● Statement 2 is correct: The interest rate of the loan is fixed by the mutual consent of the lender and borrower.

● The main idea is lenders getting higher interest by lending out their money instead of saving it, and borrowers getting funds at comparatively low interest rates. It typically uses an online platform where the borrowers and lenders register themselves. Due diligence is carried out before allowing the parties to participate in any lending or borrowing activity.

● The few examples of Peer to peer in India are LenDenClub, Faircent, Lendbox and Lendingkart.

● Statement 3 is correct: In peer-to-peer lending, there is no investor protection by way of a compensation scheme to cover defaults in this market as there is with deposit guarantee schemes for bank deposits. Retail investors, who do not have the capacity to absorb defaults, may lose significant proportions of their investments, if there are any defaults.Incorrect

Answer: C

Explanation:

● Statement 1 is correct: Peer-to-peer lending is a form of crowdfunding used to raise loans for people who need to borrow, from people who want to invest. There is no security required for them to borrow money.

● It enables individuals to borrow and lend money without any financial institution as an intermediary and extends credit to borrowers who are unable to get it through traditional financial institutions.

● Statement 2 is correct: The interest rate of the loan is fixed by the mutual consent of the lender and borrower.

● The main idea is lenders getting higher interest by lending out their money instead of saving it, and borrowers getting funds at comparatively low interest rates. It typically uses an online platform where the borrowers and lenders register themselves. Due diligence is carried out before allowing the parties to participate in any lending or borrowing activity.

● The few examples of Peer to peer in India are LenDenClub, Faircent, Lendbox and Lendingkart.

● Statement 3 is correct: In peer-to-peer lending, there is no investor protection by way of a compensation scheme to cover defaults in this market as there is with deposit guarantee schemes for bank deposits. Retail investors, who do not have the capacity to absorb defaults, may lose significant proportions of their investments, if there are any defaults. -

Question 20 of 20

20. Question

Consider the following statements:

1. Gross Value Added (GVA) at basic prices includes the payment of factors of production but does not include any tax.

2. The GVA at basic prices will always be less than Gross Value Added at market prices.

3. India has been calculating its GDP at market price since 1991.

How many of the above statements are correct?Correct

Answer: A

Explanation:

● Statement 1 is incorrect: For any commodity the basic price is the amount receivable by the producer from the purchaser for a unit of a product minus any tax on the product plus any subsidy on the product. However, GVA at basic prices will include production taxes and exclude production subsidies available on the commodity. On the other hand, GVA at factor cost includes no taxes and excludes no subsidies.

● Statement 2 is correct: Gross Value Added (GVA) at basic prices will always be less than Gross Value added at market prices. Because Gross Value added at market prices includes all the taxes imposed by the government and also varies with inflation in the economy. For example, GDP at Current Prices in the year Q1 2020-21 is estimated at ₹ 38.08 lakh crore. GVA at Basic Price at Current Prices in Q1 2020-21, is estimated at `35.66 lakh crore.

● There is a slight difference between GVA basic prices and GVA factor cost.

● GVA at basic prices = GVA factor cost + Production Taxes – Production subsidies

● GDP at MP = GVA basic prices + product taxes – Product subsidies

● Land revenue is a kind of production tax and railway subsidies are a kind of production subsidies. Production taxes and production subsidies are independent of the volume of actual production.

● Production taxes – Production subsidies are negligible as compared to other parameters, so we can ignore it and hence for all practical purposes, we can say that GVA basic prices = GVA factor cost.

● Statement 3 is incorrect: Before 2015, NSO was not using market prices to calculate GDP, rather it was using Factor Cost i.e., Market Price excluding indirect taxes and subsidies. Now, as per the global best practices and the IMF’s World Economic Outlook projections based on GDP at market prices, India has changed its methodology of GDP calculation at market prices.Incorrect

Answer: A

Explanation:

● Statement 1 is incorrect: For any commodity the basic price is the amount receivable by the producer from the purchaser for a unit of a product minus any tax on the product plus any subsidy on the product. However, GVA at basic prices will include production taxes and exclude production subsidies available on the commodity. On the other hand, GVA at factor cost includes no taxes and excludes no subsidies.

● Statement 2 is correct: Gross Value Added (GVA) at basic prices will always be less than Gross Value added at market prices. Because Gross Value added at market prices includes all the taxes imposed by the government and also varies with inflation in the economy. For example, GDP at Current Prices in the year Q1 2020-21 is estimated at ₹ 38.08 lakh crore. GVA at Basic Price at Current Prices in Q1 2020-21, is estimated at `35.66 lakh crore.

● There is a slight difference between GVA basic prices and GVA factor cost.

● GVA at basic prices = GVA factor cost + Production Taxes – Production subsidies

● GDP at MP = GVA basic prices + product taxes – Product subsidies

● Land revenue is a kind of production tax and railway subsidies are a kind of production subsidies. Production taxes and production subsidies are independent of the volume of actual production.

● Production taxes – Production subsidies are negligible as compared to other parameters, so we can ignore it and hence for all practical purposes, we can say that GVA basic prices = GVA factor cost.

● Statement 3 is incorrect: Before 2015, NSO was not using market prices to calculate GDP, rather it was using Factor Cost i.e., Market Price excluding indirect taxes and subsidies. Now, as per the global best practices and the IMF’s World Economic Outlook projections based on GDP at market prices, India has changed its methodology of GDP calculation at market prices.