THE CONTEXT: Vertical Fiscal Imbalance (VFI) in India arises due to the mismatch between states’ expenditure responsibilities, such as health and education, and their limited revenue-raising powers, compounded by the Union’s control over buoyant taxes like income tax and GST. Despite a 41% tax devolution under the Fifteenth Finance Commission, VFI has widened post-2018–19, with estimates suggesting a required devolution of 47.5% to equalize fiscal gaps, highlighting the need for reforms to strengthen cooperative fiscal federalism.

CAUSES OF VFI IN FEDERAL SYSTEMS:

-

- Revenue Centralization vs. Expenditure Decentralization: In most federations, central governments control buoyant taxes like income tax, corporate tax, and customs duties, while sub-national governments rely on less elastic taxes like property tax or sales tax.

- Macroeconomic Stabilization Role: The central government is tasked with stabilization functions such as monetary policy, external trade, and national security, which require significant revenue but are less frequent than state-level welfare spending.

- Redistributive Taxation: Taxes with redistributive effects (e.g., personal income tax, corporate tax) are often centralized to avoid inter-state tax competition and ensure equitable distribution.

- Subsidiarity Principle: Local governments are better positioned to address allocation functions (e.g., education, health), but these responsibilities are resource-intensive.

- Centrally Sponsored Schemes (CSS): In India, schemes like MGNREGA or PMAY require states to co-finance programs initiated by the Union government, further straining state finances.

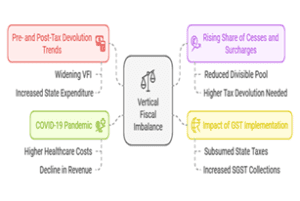

- Rising Share of Cesses and Surcharges: These non-shareable components of central taxes have increased in India, reducing the pool of divisible resources for states.

CONSTITUTIONAL FRAMEWORK FOR FISCAL RELATIONS IN INDIA:

-

- Division of Revenue-Raising Powers and Expenditure Obligations: This arrangement creates a Vertical Fiscal Imbalance (VFI) due to the mismatch between revenue powers (centralized) and expenditure responsibilities (decentralized).

Union List:

-

- The Union government has exclusive powers to levy taxes on income (except agricultural income), corporate profits, customs duties, and excise on non-alcoholic goods. These taxes are buoyant and broad-based, ensuring a stable revenue stream.

- Expenditure Responsibilities: Defense, external affairs, atomic energy (macro-stabilization functions).

State List:

-

- States levy taxes on land, agriculture, entertainment, and stamp duties. These revenue sources are less elastic and insufficient to meet growing developmental needs.

- Expenditure Responsibilities: Health, education, agriculture, and social welfare (allocation functions).

Concurrent List:

-

- Both levels can legislate on education, forests, and labor welfare. However, the Union has overriding authority in case of conflict.

Article 280: It mandates the establishment of a Finance Commission every five years to address fiscal imbalances between the Union and the States. The Finance Commission’s advisory recommendations have been largely implemented by successive governments.

Tax devolution:

-

- It recommends the share of net proceeds of central taxes to be devolved to states. For 2021–26, the Fifteenth Finance Commission recommended a 41% share for states, slightly reduced from 42% under the Fourteenth Commission due to the creation of new Union Territories (Jammu & Kashmir and Ladakh).

Grants-in-Aid:

-

- Recommends revenue deficit grants for states unable to meet their expenditure needs post-devolution.

- Additional sector-specific grants for health, education, or disaster management.

Horizontal Equity:

-

- Ensures equitable distribution among states based on criteria like population (15%), area (15%), forest cover (10%), income distance (45%), and tax effort (2.5%).

Article 275: Article 275 provides statutory grants-in-aid from the Consolidated Fund of India to states needing assistance. These grants help bridge post-devolution revenue gaps. For example, under the Fifteenth Finance Commission’s recommendations, ₹2.94 lakh crore was allocated as revenue deficit grants for FY2021–26.

Article 282 and Discretionary Grants: Article 282 allows the Union and States to make discretionary grants for any “public purpose,” even if it falls outside their legislative competence.

Centrally Sponsored Schemes (CSS): Implemented under Article 282, CSSs dominate state subjects like health (e.g., Ayushman Bharat) or education (e.g., Samagra Shiksha Abhiyan). Funding patterns vary. Core CSSs are shared at a ratio of 60:40 between the Union and States; for special category states, it is 90:10. The Supreme Court upheld that discretionary grants under Article 282 are constitutional but emphasized that their use should align with federal principles.

ESTIMATION OF VERTICAL FISCAL IMBALANCE (VFI) IN INDIA:

-

- Methodology for Calculating VFI: Vertical Fiscal Imbalance (VFI) is quantitatively assessed by comparing the revenue-raising capacity of states with their expenditure responsibilities. The standard formula used is:

-

-

- Own Revenue Receipts (ORR): Includes states’ tax and non-tax revenues.

- Own Revenue Expenditure (ORE): Excludes expenditure on Centrally Sponsored Schemes (CSS), as these are mandated by the Union government and not discretionary for states.

-

If the ratio of ORR to ORE is less than 1, it indicates a fiscal gap, highlighting the extent of dependency on Union transfers. It also considers tax devolution, grants from the union, and borrowing by states, though it is constrained under the Fiscal Responsibility and Budget Management (FRBM) Acts.

-

- Pre-Tax Devolution VFI: Pre-tax devolution VFI measures the fiscal gap before considering Union transfers. It has widened due to increased state-level expenditure responsibilities in welfare sectors like health and education.

- Post-Tax Devolution VFI: Post-tax devolution VFI accounts for the share of Union taxes devolved into states as recommended by Finance Commissions. Despite a higher tax devolution rate of 42% under the Fourteenth Finance Commission and 41% under the Fifteenth Finance Commission, post-tax devolution VFI remains significant. Estimates suggest that to eliminate VFI, tax devolution should have been around 48.4% of net proceeds between 2015–16 and 2022–23.

FACTORS CONTRIBUTING TO VERTICAL FISCAL IMBALANCES (VFI) IN INDIA:

-

- Decentralization of Expenditures vs. Revenue Mobilization: States in India bear 61% of the total public expenditure. States collect only 38% of total revenue, relying on less buoyant taxes like property tax or state excise. This structural imbalance is exacerbated by the rising share of non-shareable cesses and surcharges collected by the Union, which accounted for nearly 19% of gross tax revenue in FY2022–23.

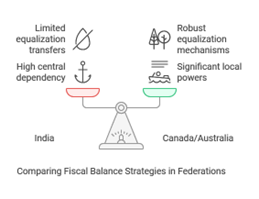

- Union Government’s Exclusive Domains: Stabilization functions require significant resources but are less frequent than state-level welfare spending. The centralization of progressive taxes facilitates income redistribution but limits states’ fiscal autonomy. According to the Fifteenth Finance Commission, India’s VFI is larger than most federations globally.

- States’ Responsibilities in Social Sectors: States are constitutionally mandated to provide public goods and services such as education, healthcare, sanitation, and rural development. While the Finance Commission provides grants under Article 275 to bridge revenue gaps, these are often insufficient to meet growing expenditure needs.

- Buoyancy of Taxes at Different Levels of Government: Direct taxes like income tax and corporate tax are highly buoyant. For instance, the direct tax-to-GDP ratio reached a 24-year high of 6.64% in FY2023–24, with buoyancy at 2.12. State taxes such as property tax or stamp duty are less elastic and grow slower than GDP. The Union’s increasing reliance on cesses and surcharges (non-divisible pool) reduces the resources available for devolution to states.

THE WAY FORWARD:

-

- Increasing Tax Devolution Share: The tax devolution share should be increased to 48.4%, as estimated necessary to equalize VFI between the Union and states. Ceases and surcharges should be included in the divisible pool to expand states’ share of central revenues. These components accounted for nearly 19% of gross tax revenue in FY2022–23, reducing states’ fiscal space.

- Balancing Conditional and Unconditional Transfers: Increase the proportion of unconditional grants, particularly revenue deficit grants, to reduce dependency on tied transfers. Rationalize CSS funding patterns by reducing states’ financial burden (e.g., revising the 60:40 ratio for core CSS to a more equitable ratio).

- Strengthening States’ Fiscal Autonomy: Empower states to mobilize more own revenue by reforming property taxation, improving GST compliance, and leveraging natural resources. Provide technical and financial support for modernizing tax administration systems at the state level.

- Addressing Inter-State Disparities: Strengthen equalization mechanisms through targeted grants for backward regions or sectors (e.g., health, education). Enhance transparency in fund allocation criteria to ensure fairness in resource distribution.

- Reforming Borrowing Framework: Relax FRBM borrowing limits during economic downturns or emergencies while maintaining long-term debt sustainability. Encourage innovative financing mechanisms such as municipal bonds or public-private partnerships (PPPs) for infrastructure projects.

- Strengthening Cooperative Fiscal Federalism: Institutionalize regular dialogue between the Union and state governments through platforms like the Inter-State Council or NITI Aayog to address fiscal concerns collaboratively. Ensure timely release of funds from the Union to avoid delays in state-level implementation of welfare programs.

THE CONCLUSION:

To address India’s widening Vertical Fiscal Imbalance (VFI), increasing tax devolution to at least 48.4% of net proceeds, including cesses and surcharges in the divisible pool, and enhancing untied grants will empower states with greater fiscal autonomy. These measures, supported by state demands and empirical evidence, will strengthen cooperative fiscal federalism, ensuring equitable development and efficient resource allocation aligned with regional priorities.

UPSC PAST YEAR QUESTIONS:

Q.1 How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? 2021

Q.2 How is the Finance Commission of India constituted? What do you think about the terms of reference of the recently constituted Finance Commission? Discuss. 2018

MAINS PRACTICE QUESTION:

Q.1 Vertical Fiscal Imbalance (VFI) in India reflects a structural mismatch between revenue-raising powers and expenditure responsibilities of the Union and States. Critically analyze.

SOURCE:

Spread the Word