Day-724

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

1. Consider the following statements:

Statement-I: The inclusion of Indian government bonds in the JP Morgan’s GBI-EM Global index can boost liquidity in the bond market.

Statement-II: Widening of investor base for Indian bonds can make it more attractive.

Which one of the following is correct in respect of the above statements?Correct

Answer: A

Explanation:

Both Statement I and Statement II are correct, and Statement II is the correct explanation for Statement I.

India has been included in JP Morgan’s global bond index-suite for emerging markets (GBI-EM). The AUMs benchmarked to the suite are worth US$ 236bn.

Statement 1 is correct: The inclusion of securities is a game changer, leading to widening of investor base and more inflows into the Indian market, boosting the liquidity in the bond market.

Statement 2 is correct: There will be more investor participation in the bond market leading to more trading volumes and that too global investors’ participation will mean that there will be enough liquidity in the secondary market and relieving pressure on the yield spreads.

Thus, statement 2 is also correct and is the correct explanation for statement 1.

It must be noted that India had made remarkable progress in promoting foreign participation in the domestic market due to which India was put on the index positive watch. Some of these measures included the introduction of a fully accessible route (FAR) for investment in G-sec markets. A total of 23 Indian government bonds (IGBs) under the FAR are eligible with a notional value of Rs 27 lakh crore or $330 billion. Furthermore, the inclusion will take place over 10 months starting from June ’24, at the rate of 1% per month over this period.Incorrect

Answer: A

Explanation:

Both Statement I and Statement II are correct, and Statement II is the correct explanation for Statement I.

India has been included in JP Morgan’s global bond index-suite for emerging markets (GBI-EM). The AUMs benchmarked to the suite are worth US$ 236bn.

Statement 1 is correct: The inclusion of securities is a game changer, leading to widening of investor base and more inflows into the Indian market, boosting the liquidity in the bond market.

Statement 2 is correct: There will be more investor participation in the bond market leading to more trading volumes and that too global investors’ participation will mean that there will be enough liquidity in the secondary market and relieving pressure on the yield spreads.

Thus, statement 2 is also correct and is the correct explanation for statement 1.

It must be noted that India had made remarkable progress in promoting foreign participation in the domestic market due to which India was put on the index positive watch. Some of these measures included the introduction of a fully accessible route (FAR) for investment in G-sec markets. A total of 23 Indian government bonds (IGBs) under the FAR are eligible with a notional value of Rs 27 lakh crore or $330 billion. Furthermore, the inclusion will take place over 10 months starting from June ’24, at the rate of 1% per month over this period. -

Question 2 of 5

2. Question

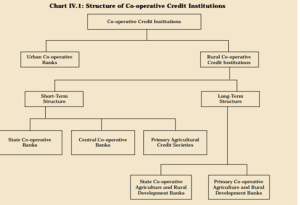

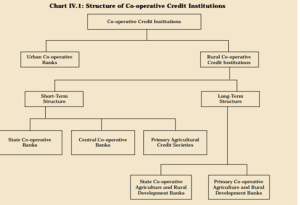

2. Consider the following statements about Primary Agriculture Credit Societies (PACS):

1. They accept deposits and provide loans to the needy members at the district level.

2. They are a source of long-term rural financing.

Which of the statements given above is/are correct?Correct

Answer: D

Explanation:

Statement 1 is incorrect: Primary Agriculture Credit Societies are grassroots-level institutions in villages with individual farmers, artisans, and other weaker sections as member shareholders.

They mobilise deposits and provide lending facilities to the needy members at the village level. Thus, they form the lowest tier of the federated short-term cooperative credit structure with District Cooperative Banks (DCCBs) and/or State Cooperative Banks (StCBs) in their upper tiers.

Statement 2 is incorrect: They provide short-term credit to the members and not long-term finance.

To strengthen Primary Agricultural Credit Societies (PACS), the project for Computerization of 63,000 functional PACS with a total financial outlay of ₹2,516 crore has been approved by the Government of India.Incorrect

Answer: D

Explanation:

Statement 1 is incorrect: Primary Agriculture Credit Societies are grassroots-level institutions in villages with individual farmers, artisans, and other weaker sections as member shareholders.

They mobilise deposits and provide lending facilities to the needy members at the village level. Thus, they form the lowest tier of the federated short-term cooperative credit structure with District Cooperative Banks (DCCBs) and/or State Cooperative Banks (StCBs) in their upper tiers.

Statement 2 is incorrect: They provide short-term credit to the members and not long-term finance.

To strengthen Primary Agricultural Credit Societies (PACS), the project for Computerization of 63,000 functional PACS with a total financial outlay of ₹2,516 crore has been approved by the Government of India. -

Question 3 of 5

3. Question

3. Consider the following statements with respect to WTO negotiations:

1. The temporary Peace Clause on public stock holding was adopted in the Bali Conference.

2. The Doha Development Agenda has been the most successful round till date.

Which of the statements given above is/are correct?Correct

Answer: A

Explanation:

Statement 1 is correct: In the Bali conference 2013, ministers agreed on an interim “peace clause” allowing developing countries to provide subsidies under public stockholding programmes without being legally challenged in the WTO’s dispute settlement system. Provided these countries meet the conditions specified in the Decision, the peace clause applies even if the country exceeds its agreed limits for trade-distorting domestic support.

Statement 2 is incorrect: The Doha Round failed in November 2011, after ten years of talks, despite official efforts by many countries. The Doha Development Agenda included a wide range of issues, covering agriculture, services, intellectual property rights, trade facilitation, etc. Its talks broke down over a non-consensus between developed and non-developing countries. Although some progress has been made on many issues, it remains an inconclusive agreement.Incorrect

Answer: A

Explanation:

Statement 1 is correct: In the Bali conference 2013, ministers agreed on an interim “peace clause” allowing developing countries to provide subsidies under public stockholding programmes without being legally challenged in the WTO’s dispute settlement system. Provided these countries meet the conditions specified in the Decision, the peace clause applies even if the country exceeds its agreed limits for trade-distorting domestic support.

Statement 2 is incorrect: The Doha Round failed in November 2011, after ten years of talks, despite official efforts by many countries. The Doha Development Agenda included a wide range of issues, covering agriculture, services, intellectual property rights, trade facilitation, etc. Its talks broke down over a non-consensus between developed and non-developing countries. Although some progress has been made on many issues, it remains an inconclusive agreement. -

Question 4 of 5

4. Question

4. In the context of India’s share market, consider the following statements:

1. Ownership by retail investors has steadily declined in the last 5 years.

2. Foreign ownership has steadily increased in the last 5 years.

Which of the statements given above is/are correct?Correct

Answer: D

Explanation:

Statement 1 is incorrect: According to data, there is a steady rise in the ownership of the Indian share market by the retail investors. There is a record inflow by retail investors in mutual funds since the pandemic.

• The number of demat accounts have gone up from about 40 million in March 2020 to almost 140 million in December 2023, leading to a significant increase in the number of retail investors transacting in the market every month.

Statement 2 is incorrect: While domestic Institutional Investors holdings in the Indian stock market have been on the rise, foreign ownership has dropped in the past 10 years. Foreign holdings in NSE listed companies was at 18.19% as of December 2023 down from 19.66% in December 2018.Incorrect

Answer: D

Explanation:

Statement 1 is incorrect: According to data, there is a steady rise in the ownership of the Indian share market by the retail investors. There is a record inflow by retail investors in mutual funds since the pandemic.

• The number of demat accounts have gone up from about 40 million in March 2020 to almost 140 million in December 2023, leading to a significant increase in the number of retail investors transacting in the market every month.

Statement 2 is incorrect: While domestic Institutional Investors holdings in the Indian stock market have been on the rise, foreign ownership has dropped in the past 10 years. Foreign holdings in NSE listed companies was at 18.19% as of December 2023 down from 19.66% in December 2018. -

Question 5 of 5

5. Question

5. Consider the following statements:

Statement-I: Over-leveraging by banks may lead to bank run.

Statement-II: High provisioning by the bank may reduce credit supply.

Which one of the following is correct in respect of the above statements?Correct

Answer: B

Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

Explanation:

Statement-I is correct: A bank run occurs when a large group of depositors withdraw their money from banks at the same time. In case of over-leveraging by a bank, the credit extended by banks highly overshoots its depositors’ base. This creates a systemic risk in the banking system, particularly the investors may lose confidence in the bank, with people withdrawing their funds. This was what unfolded in the Yes Bank saga.

Statement-II is correct: High non-performing assets require a bank to make higher provisions for these loans, which means it has to set aside funds from its profits to cover potential losses. This may reduce the availability of sufficient funds for loan advancement, hence reducing credit supply.

Thus, both the statements are correct, but these are independent and there is no causal relationship between the two statements. Thus, B is the correct answer.Incorrect

Answer: B

Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

Explanation:

Statement-I is correct: A bank run occurs when a large group of depositors withdraw their money from banks at the same time. In case of over-leveraging by a bank, the credit extended by banks highly overshoots its depositors’ base. This creates a systemic risk in the banking system, particularly the investors may lose confidence in the bank, with people withdrawing their funds. This was what unfolded in the Yes Bank saga.

Statement-II is correct: High non-performing assets require a bank to make higher provisions for these loans, which means it has to set aside funds from its profits to cover potential losses. This may reduce the availability of sufficient funds for loan advancement, hence reducing credit supply.

Thus, both the statements are correct, but these are independent and there is no causal relationship between the two statements. Thus, B is the correct answer.