Day-717

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

1. Consider the following:

1. Personal income tax

2. Open market operations

3. Unemployment allowance

4. Marginal Standing Facility

5. Corporate tax

How many of the above-mentioned tools can be classified as ‘automatic stabilisers’ in an economy?Correct

Answer: B

Explanation:

Automatic stabilizers are features of the tax and transfer systems that temper the economy when it overheats and stimulate the economy when it slumps, without direct intervention by policymakers.

Mechanism:

• When incomes are high, tax liabilities rise and eligibility for government benefits falls, without any change in the tax code or other legislation. Conversely, when incomes slip, tax liabilities drop and more families become eligible for government transfer programs, such as food stamps and unemployment insurance. Hence, Personal income tax, corporate tax, and unemployment allowance work as automatic stabilizers.

• While Open Market Operations (OMO) and Marginal Standing Facility (MSF) are monetary policy tools. The decision to utilize the MSF and OMO and the terms associated with it (like the interest rate) are at the discretion of the central bank. This differentiates it from automatic stabilizers, which react passively to economic changes. Hence, only 3 are correct.Incorrect

Answer: B

Explanation:

Automatic stabilizers are features of the tax and transfer systems that temper the economy when it overheats and stimulate the economy when it slumps, without direct intervention by policymakers.

Mechanism:

• When incomes are high, tax liabilities rise and eligibility for government benefits falls, without any change in the tax code or other legislation. Conversely, when incomes slip, tax liabilities drop and more families become eligible for government transfer programs, such as food stamps and unemployment insurance. Hence, Personal income tax, corporate tax, and unemployment allowance work as automatic stabilizers.

• While Open Market Operations (OMO) and Marginal Standing Facility (MSF) are monetary policy tools. The decision to utilize the MSF and OMO and the terms associated with it (like the interest rate) are at the discretion of the central bank. This differentiates it from automatic stabilizers, which react passively to economic changes. Hence, only 3 are correct. -

Question 2 of 5

2. Question

2. With reference to Digital Banking Units (DBUs), consider the following statements:

1. They provide online banking services to customers without having any physical presence.

2. Only public sector banks have been allowed to set up DBUs.

Which of the statements given above is/are correct?Correct

Answer: D

Explanation:

Statement 1 is incorrect: DBUs are brick-and-mortar outlets that provide a variety of digital banking facilities to people such as the opening of savings accounts, balance-check, printing passbooks, transfer of funds, investment in fixed deposits, loan applications, stop-payment instructions for cheques issued, applications for credit and debit cards, tax and bill payment and nominations.

• They were set up to increase financial inclusion and enhance the banking experience for citizens.

Statement 2 is incorrect: The government has allowed not just the public sector banks, but also private banks and small finance banks to set up the DBUs. In 2022, when they were launched, 11 banks in the public sector, 12 in the private sector and one Small Finance Bank participated to launch DBUs. Around 100 DBUs operate currently.Incorrect

Answer: D

Explanation:

Statement 1 is incorrect: DBUs are brick-and-mortar outlets that provide a variety of digital banking facilities to people such as the opening of savings accounts, balance-check, printing passbooks, transfer of funds, investment in fixed deposits, loan applications, stop-payment instructions for cheques issued, applications for credit and debit cards, tax and bill payment and nominations.

• They were set up to increase financial inclusion and enhance the banking experience for citizens.

Statement 2 is incorrect: The government has allowed not just the public sector banks, but also private banks and small finance banks to set up the DBUs. In 2022, when they were launched, 11 banks in the public sector, 12 in the private sector and one Small Finance Bank participated to launch DBUs. Around 100 DBUs operate currently. -

Question 3 of 5

3. Question

3. With reference to the status of the Indian economy in the last five years, consider the following statements:

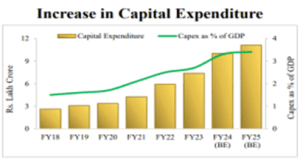

1. The capital expenditure by the government has consistently increased.

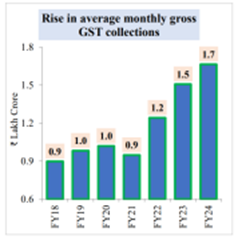

2. The average monthly gross GST collections have consistently increased.

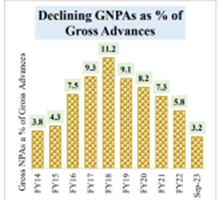

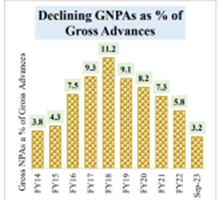

3. The gross non-performing assets have steadily decreased as a percentage of gross advances.

Which of the statements given above is/are correct?Correct

Answer: D

Explanation:

Statement 1 is correct: Capital expenditure refers to the expenditure which either creates an asset or causes a reduction in the liabilities of the government.

The capital expenditure by the government has consistently increased. In the budget 2023-24, the government had earmarked Rs 10 lakh crore for capex, a rise of 37.5%. In the interim budget, there is a jump of 11.1% to Rs. 11.11 lakh crore, representing 3.4% of the GDP.

Statement 2 is incorrect: Although the average gross monthly GST collections have been increasing, they suffered a blip during the pandemic year of xxx when it declined.

Statement 3 is correct: The gross non- performing assets as a percentage of gross advances have steadily decreased in the last five years. This is due to various steps taken by the regulator.

Incorrect

Incorrect

Answer: D

Explanation:

Statement 1 is correct: Capital expenditure refers to the expenditure which either creates an asset or causes a reduction in the liabilities of the government.

The capital expenditure by the government has consistently increased. In the budget 2023-24, the government had earmarked Rs 10 lakh crore for capex, a rise of 37.5%. In the interim budget, there is a jump of 11.1% to Rs. 11.11 lakh crore, representing 3.4% of the GDP.

Statement 2 is incorrect: Although the average gross monthly GST collections have been increasing, they suffered a blip during the pandemic year of xxx when it declined.

Statement 3 is correct: The gross non- performing assets as a percentage of gross advances have steadily decreased in the last five years. This is due to various steps taken by the regulator.

-

Question 4 of 5

4. Question

4. Which of the following could be the reason(s) behind the failure of monetary policy transmission in the banking system?

1. Banks increasing their parking of funds with the central banks under the reverse repo rate mechanism

2. Depressed sentiments in the market during economic recession, leading to low credit uptake

3. Increase in currency-deposit ratio

Select the correct answer using the code given below:Correct

Answer: D

Explanation:

• Statement 1 is correct: If the commercial banks increase their parking of money with the central bank under the reverse repo rate mechanism, this means they are creating less credit in the market and instead earning interest on their deposits with the central bank although that is at a lower rate.

• Statement 2 is correct: During the economic recession, consumer sentiments are depressed as they are uncertain about the future. This could lead to low credit uptake by them, which will depress the money multiplier effect.

• Statement 3 is correct. If a significant amount of cash is withdrawn from the banking system, this could reduce the deposits available with the banks which could have been used for creating new loans.Incorrect

Answer: D

Explanation:

• Statement 1 is correct: If the commercial banks increase their parking of money with the central bank under the reverse repo rate mechanism, this means they are creating less credit in the market and instead earning interest on their deposits with the central bank although that is at a lower rate.

• Statement 2 is correct: During the economic recession, consumer sentiments are depressed as they are uncertain about the future. This could lead to low credit uptake by them, which will depress the money multiplier effect.

• Statement 3 is correct. If a significant amount of cash is withdrawn from the banking system, this could reduce the deposits available with the banks which could have been used for creating new loans. -

Question 5 of 5

5. Question

5. Consider the following statements about poverty estimation in the post-independent India:

1. The Lakdawala committee was the first one to use calorie intake for defining the poverty line.

2. The Tendulkar committee shifted the focus from calorie intake to a broader consumption basket that included health and education.

3. The Rangarajan committee suggested a higher poverty line than the Tendulkar Committee.

How many of the above statements are correct?Correct

Answer: B

Explanation:

Statement 1 is incorrect: Post independence, VM Dandekar and N Rath (1971), were the first ones to make the first systematic assessment of poverty in India. They used the calorie intake to decide (of 2250 per day for both rural and urban areas) the poverty line.

Subsequent poverty estimation committees constituted by the Planning Commission:

• Y K Alagh committee of 1979

• Lakdawala Committee (1993)

Statement 2 is correct: The Tendulkar Committee (2009) introduced a significant shift in poverty estimation methodology. It moved away from the calorie intake norm to a broader definition that included spending on health, education, sanitation along with food consumption. This was done to reflect the changes in consumption patterns and the importance of non-food essentials.

Statement 3 is correct: The Rangarajan Committee (2014) reviewed the poverty estimation again and suggested a higher poverty line than that recommended by the Tendulkar Committee. This committee considered a broader range of consumption needs and suggested that the Tendulkar poverty line was too low to be realistic.Incorrect

Answer: B

Explanation:

Statement 1 is incorrect: Post independence, VM Dandekar and N Rath (1971), were the first ones to make the first systematic assessment of poverty in India. They used the calorie intake to decide (of 2250 per day for both rural and urban areas) the poverty line.

Subsequent poverty estimation committees constituted by the Planning Commission:

• Y K Alagh committee of 1979

• Lakdawala Committee (1993)

Statement 2 is correct: The Tendulkar Committee (2009) introduced a significant shift in poverty estimation methodology. It moved away from the calorie intake norm to a broader definition that included spending on health, education, sanitation along with food consumption. This was done to reflect the changes in consumption patterns and the importance of non-food essentials.

Statement 3 is correct: The Rangarajan Committee (2014) reviewed the poverty estimation again and suggested a higher poverty line than that recommended by the Tendulkar Committee. This committee considered a broader range of consumption needs and suggested that the Tendulkar poverty line was too low to be realistic.