Day-692

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

1. Consider the following sectors:

1. Food processing

2. Ports and shipping

3. Multi-brand retailing

4. Space sector

5. Chit Funds

In how many of the above-mentioned sectors 100% Foreign Direct Investment through automatic route is allowed?Correct

Answer: A

The government has, recently, changed the policy to allow up to 74% FDI under the automatic route in satellite manufacturing and operation, satellite data products and ground and user segments. Beyond this limit, government approval will be required. Hence, 100% FDI is not allowed through the automatic route.

Foreign Direct Investment (FDI) in India is regulated primarily by the Department of Promotion of Industry and International Trade (DPIIT), under the Foreign Exchange Management Act regime (FEMA).

There are two routes governing FDI into India: (i) the automatic route and (ii) the government approval route.

Automatic route: FDI is allowed without the need to obtain any approval or licence from the government. The amount of investment permitted would depend on the sector in which the investee operates. For example, some sectors, such as the manufacturing, telecom and financial services sectors, allow foreign investors to invest up to 100% of an Indian entity.

Government route: Under this, prior to investment, approval from the Government of India is required. Proposals for foreign direct investment are considered by the respective administrative ministry/ department.

Some of the sectors where 100% FDI through automatic route is allowed:

● Food processing

● Ports and shipping

● Renewable energy

● Automobiles

● Airports

● Construction of hospitals

● Healthcare (greenfield)

● Telecom services

● In multi-brand retailing, 51% FDI is permitted through the government route.

● FDI is prohibited in Chit Funds.Incorrect

Answer: A

The government has, recently, changed the policy to allow up to 74% FDI under the automatic route in satellite manufacturing and operation, satellite data products and ground and user segments. Beyond this limit, government approval will be required. Hence, 100% FDI is not allowed through the automatic route.

Foreign Direct Investment (FDI) in India is regulated primarily by the Department of Promotion of Industry and International Trade (DPIIT), under the Foreign Exchange Management Act regime (FEMA).

There are two routes governing FDI into India: (i) the automatic route and (ii) the government approval route.

Automatic route: FDI is allowed without the need to obtain any approval or licence from the government. The amount of investment permitted would depend on the sector in which the investee operates. For example, some sectors, such as the manufacturing, telecom and financial services sectors, allow foreign investors to invest up to 100% of an Indian entity.

Government route: Under this, prior to investment, approval from the Government of India is required. Proposals for foreign direct investment are considered by the respective administrative ministry/ department.

Some of the sectors where 100% FDI through automatic route is allowed:

● Food processing

● Ports and shipping

● Renewable energy

● Automobiles

● Airports

● Construction of hospitals

● Healthcare (greenfield)

● Telecom services

● In multi-brand retailing, 51% FDI is permitted through the government route.

● FDI is prohibited in Chit Funds. -

Question 2 of 5

2. Question

2. The term ‘DeFi’, often mentioned in the news, is related to-

Correct

Answer: A

Explanation:

Decentralised Finance (DeFi) is based on the peer-to-peer concept that removes intermediaries from the system. By relying on peer-to-peer philosophy and self-executing “smart contracts” on the blockchain network, DeFi democratizes finance and replaces traditional centralized institutions such as banks, brokerages, and NBFCs (Non-Banking Financial Companies).

DeFi uses smart contract technology on the blockchain network with zero human intervention. This reduces the chances of errors and increases efficiency.

The source code of most of the DeFi projects are available for anyone in the world to check and audit. Users of the DeFi protocol can communicate with these smart contracts using their wallets to transfer funds, borrow, lend or avail any service that the DeFi provides.

• One of the most impactful use cases of DeFi has been in the insurance industry. While the present-day insurance system suffers from complex audit systems, paperwork and bureaucratic claiming procedures, the usage of smart contracts could make it much more efficient.Incorrect

Answer: A

Explanation:

Decentralised Finance (DeFi) is based on the peer-to-peer concept that removes intermediaries from the system. By relying on peer-to-peer philosophy and self-executing “smart contracts” on the blockchain network, DeFi democratizes finance and replaces traditional centralized institutions such as banks, brokerages, and NBFCs (Non-Banking Financial Companies).

DeFi uses smart contract technology on the blockchain network with zero human intervention. This reduces the chances of errors and increases efficiency.

The source code of most of the DeFi projects are available for anyone in the world to check and audit. Users of the DeFi protocol can communicate with these smart contracts using their wallets to transfer funds, borrow, lend or avail any service that the DeFi provides.

• One of the most impactful use cases of DeFi has been in the insurance industry. While the present-day insurance system suffers from complex audit systems, paperwork and bureaucratic claiming procedures, the usage of smart contracts could make it much more efficient. -

Question 3 of 5

3. Question

3. Consider the following statements:

Statement-I: A higher Provisioning Coverage Ratio is considered healthy for banks.

Statement-II: Provisioning Coverage Ratio is the percentage of funds that a bank sets aside for losses due to bad assets.

Which one of the following is correct in respect of the above statements?Correct

Answer: A

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

A higher PCR ratio reflects that the bank has sufficient capital to withstand asset quality pressures and will not need significant incremental capital in case there is extreme stress. According to the Reserve Bank of India, a PCR of over 70% is an ideal level of the ratio. Thus, statement 1 is correct.

Banks create a large pool of funds to cover their non-performing or potential bad assets. These funds are classified as provisions. Thus, Provision coverage Ratio refers to the percentage of funds created against NPAs. Thus, statement 2 is correct.Incorrect

Answer: A

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

A higher PCR ratio reflects that the bank has sufficient capital to withstand asset quality pressures and will not need significant incremental capital in case there is extreme stress. According to the Reserve Bank of India, a PCR of over 70% is an ideal level of the ratio. Thus, statement 1 is correct.

Banks create a large pool of funds to cover their non-performing or potential bad assets. These funds are classified as provisions. Thus, Provision coverage Ratio refers to the percentage of funds created against NPAs. Thus, statement 2 is correct. -

Question 4 of 5

4. Question

4. Consider the following statements:

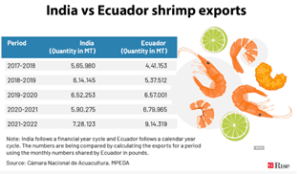

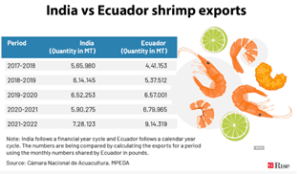

1. India is the largest exporter of shrimps in the world.

2. Ecuador is the largest producer of shrimps in the world.

3. Tamil Nadu is the largest producer state of shrimps in India.

4. Japan is the largest market of India’s shrimp exports.

How many of the above statements are correct?Correct

Answer: A

Explanation:

Statement 1 is incorrect: India is the second largest exporter of shrimps globally, with Ecuador acquiring the first position. India used to be the largest exporter of shrimps, but that position was lost to Ecuador in 2019-20.

Recently, the Chicago-based human rights group alleged human rights and environmental abuses at India’s shrimps hatcheries.

Statement 2 is correct: Ecuador has traditionally been the largest producer of shrimps in the world. The top five producers in 2023 include, in order, Ecuador, China, India, Vietnam and Indonesia; these countries will account for about 74 percent of global production in 2023.

Statement 3 is incorrect: Andhra Pradesh is the largest producer of shrimps in India. It accounts for 70% of India’s total shrimps’ output.

Statement 4 is incorrect: The US is India’s largest market for shrimp exports. In 2022, the US accounted for 59% of India’s shrimps’ exports, followed by China (1,25,667 MT), European Union (90,549 MT), South East Asia (44,683 MT), Japan (38,492 MT), and the Middle East (37,158 MT).Incorrect

Answer: A

Explanation:

Statement 1 is incorrect: India is the second largest exporter of shrimps globally, with Ecuador acquiring the first position. India used to be the largest exporter of shrimps, but that position was lost to Ecuador in 2019-20.

Recently, the Chicago-based human rights group alleged human rights and environmental abuses at India’s shrimps hatcheries.

Statement 2 is correct: Ecuador has traditionally been the largest producer of shrimps in the world. The top five producers in 2023 include, in order, Ecuador, China, India, Vietnam and Indonesia; these countries will account for about 74 percent of global production in 2023.

Statement 3 is incorrect: Andhra Pradesh is the largest producer of shrimps in India. It accounts for 70% of India’s total shrimps’ output.

Statement 4 is incorrect: The US is India’s largest market for shrimp exports. In 2022, the US accounted for 59% of India’s shrimps’ exports, followed by China (1,25,667 MT), European Union (90,549 MT), South East Asia (44,683 MT), Japan (38,492 MT), and the Middle East (37,158 MT). -

Question 5 of 5

5. Question

5. Consider the following statements:

Statement-I: High fiscal deficit can be inflationary in nature.

Statement-II: Fiscal deficit financed by borrowings can drive up interest rates and increase production cost.

Which one of the following is correct in respect of the above statements?Correct

Answer: A

Explanation:

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

Fiscal deficit can lead to cost-push inflation. The government being a major player in the market for borrowings exerts an upward pressure on interest rates. This phenomenon is known as the crowding out effect as it drives away private players from borrowing in the markets. Higher interest rates increase production cost for the businesses, which is passed on to consumers, thereby leading to higher prices. The degree of impact on inflation is dependent on the quality of expenditure.Incorrect

Answer: A

Explanation:

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

Fiscal deficit can lead to cost-push inflation. The government being a major player in the market for borrowings exerts an upward pressure on interest rates. This phenomenon is known as the crowding out effect as it drives away private players from borrowing in the markets. Higher interest rates increase production cost for the businesses, which is passed on to consumers, thereby leading to higher prices. The degree of impact on inflation is dependent on the quality of expenditure.