Day-684

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

1. Consider the following statements:

1. India-UAE trade has consistently increased in the last five years.

2. India has a trade deficit with Bangladesh in recent times.

3. In the last five years, China has been India’s largest trading partner.

How many of the above statements are correct?Correct

Answer: D

Explanation:

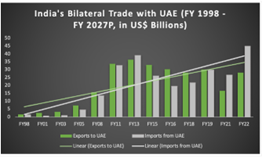

Statement 1 is incorrect: The bilateral trade between India and the UAE has touched historic highs during FY23. Trade has increased from $72.9 billion (Apr 21-Mar 2022) to $84.5 billion (Apr 22-Mar 2023) registering a year-on-year increase of 16%.

UAE is a major trade partner of India. In FY21, the trade suffered a dip due to supply chain disruptions caused by pandemic. In 2022, the two countries have signed the Comprehensive Economic Partnership Agreement (CEPA). This agreement is expected to accelerate growth of annual bilateral non-oil trade to US$100 billion in the coming five years.

Statement 2 is incorrect: Bangladesh is India’s biggest trading partner in the subcontinent and India is the second biggest export partner accounting for 12% of the total exports to Bangladesh. India has a trade surplus with Bangladesh. The trade surplus that India has had with Bangladesh over the years, however, is a sore point in the relations between the two countries. In FY 2022-23, the total bilateral trade has been reported as USD 15.9 billion in which the total exports by India has been about 14 billion USD for India.

Statement 3 is incorrect: China is a major trading partner of India. The large trade deficit that India has with Chin has been a cause for concern for Indian authorities. China was India’s top trading partner from 2013-14 till 2017-18. It was also India’s top trading partner in 2020-21. Before China, UAE used to enjoy the title of India’s top trading partner. In 2022-23, the US was India’s biggest trading partner.Incorrect

Answer: D

Explanation:

Statement 1 is incorrect: The bilateral trade between India and the UAE has touched historic highs during FY23. Trade has increased from $72.9 billion (Apr 21-Mar 2022) to $84.5 billion (Apr 22-Mar 2023) registering a year-on-year increase of 16%.

UAE is a major trade partner of India. In FY21, the trade suffered a dip due to supply chain disruptions caused by pandemic. In 2022, the two countries have signed the Comprehensive Economic Partnership Agreement (CEPA). This agreement is expected to accelerate growth of annual bilateral non-oil trade to US$100 billion in the coming five years.

Statement 2 is incorrect: Bangladesh is India’s biggest trading partner in the subcontinent and India is the second biggest export partner accounting for 12% of the total exports to Bangladesh. India has a trade surplus with Bangladesh. The trade surplus that India has had with Bangladesh over the years, however, is a sore point in the relations between the two countries. In FY 2022-23, the total bilateral trade has been reported as USD 15.9 billion in which the total exports by India has been about 14 billion USD for India.

Statement 3 is incorrect: China is a major trading partner of India. The large trade deficit that India has with Chin has been a cause for concern for Indian authorities. China was India’s top trading partner from 2013-14 till 2017-18. It was also India’s top trading partner in 2020-21. Before China, UAE used to enjoy the title of India’s top trading partner. In 2022-23, the US was India’s biggest trading partner. -

Question 2 of 5

2. Question

2. Consider the following statements:

Statement-I: Currency manipulation by the country can boost its exports.

Statement-II: It involves artificially devaluing the country’s currency.

Which one of the following is correct in respect of the above statements?Correct

Answer: A

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

Explanation:

Currency manipulation is a policy that involves artificially lowering the value of the currency. It is one way countries can shift patterns of trade in their favor.

This can be done by buying foreign currency in the market. This increases the demand for foreign currency and reduces the value of the domestic country currency. Thus, exports of the domestic country become cheaper, giving the country a competitive advantage.

• Currency devaluation can lead to trade wars and backfire on the country trying to undertake it.

• China has often been accused of currency manipulation practices in order to boost its exports.

• The US government maintains a watchlist of currency manipulators.Incorrect

Answer: A

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

Explanation:

Currency manipulation is a policy that involves artificially lowering the value of the currency. It is one way countries can shift patterns of trade in their favor.

This can be done by buying foreign currency in the market. This increases the demand for foreign currency and reduces the value of the domestic country currency. Thus, exports of the domestic country become cheaper, giving the country a competitive advantage.

• Currency devaluation can lead to trade wars and backfire on the country trying to undertake it.

• China has often been accused of currency manipulation practices in order to boost its exports.

• The US government maintains a watchlist of currency manipulators. -

Question 3 of 5

3. Question

3. Consider the following statements about Pre-Packaged Resolution under the Insolvency and Bankruptcy Code (IBC), 2016:

1. It is an alternate and speedier resolution mechanism for large corporations facing financial distress.

2. It allows a distressed company to work on a resolution plan in cooperation with its creditors before initiating formal insolvency proceedings and kicks in only after at least 66% of financial creditors approve the proposal.

Which of the statements given above is/are correct?Correct

Answer: B

Explanation:

Statement 1 is incorrect:

Insolvency and Bankruptcy Code, 2016 was passed in 2016 and governs the insolvency and bankruptcy proceedings for companies, partnership firms, and individuals.

Pre-packaged insolvency process is an alternate and speedier resolution mechanism for micro, medium and small enterprises (MSMEs) in financial distress, which was introduced in 2021 by the government.

Statement 2 is correct: It allows a distressed company to work on a resolution plan in cooperation with its creditors before initiating formal insolvency proceedings. It is initiated only after 66% of creditors approve the informal proposal.Incorrect

Answer: B

Explanation:

Statement 1 is incorrect:

Insolvency and Bankruptcy Code, 2016 was passed in 2016 and governs the insolvency and bankruptcy proceedings for companies, partnership firms, and individuals.

Pre-packaged insolvency process is an alternate and speedier resolution mechanism for micro, medium and small enterprises (MSMEs) in financial distress, which was introduced in 2021 by the government.

Statement 2 is correct: It allows a distressed company to work on a resolution plan in cooperation with its creditors before initiating formal insolvency proceedings. It is initiated only after 66% of creditors approve the informal proposal. -

Question 4 of 5

4. Question

4. Consider the following:

1. A gift worth $50000 received by a family in India from its relatives in the US.

2. Income received by a firm in India from selling of gems and jewellery to a firm located in the US.

3. Income received from providing consultancy services by a firm in India to individuals in Singapore.

4. An investment worth $5000 made by a US resident into the Indian share market.

How many of the above would be considered as part of the ‘invisibles’ in the Balance of Payments (BOP)?Correct

Answer: B

Explanation:

‘Invisibles’ in the context of Balance of Payments refer to transactions that do not involve the physical movement of goods and services across borders but represent international transactions in services, income, and transfers. These transactions are recorded in the current account of the balance of payments.

Invisibles include services, transfers and flows of income that take place between different countries.

Services trade includes both factor and non-factor income. Factor income includes net international earnings on factors of production (like labour, land and capital). Non-factor income is net sale of service products like shipping, banking, tourism, software services, etc.

● Option 1 is correct: A gift worth $15,000 received by a family in India from its relatives in the US would be considered part of the invisibles in the Balance of Payments (BOP). Gifts fall under the category of transfers in the BOP and represent non-commercial, unilateral transactions between residents and non-residents.

● Option 2 is incorrect: Income received from selling of gems and jewellery by a firm in India to a firm in the US would not be considered part of the invisibles in the Balance of Payments (BOP). Instead, it would be classified as a visible trade transaction.

● Option 3 is correct: Income received from providing financial services by a consultancy firm in India to individuals in Singapore would be considered part of the invisibles in the Balance of Payments (BOP). This transaction involves the provision of services (financial consultancy services) by residents of one country (India) to residents of another country (Singapore) without the physical movement of goods across borders.

● Option 4 is incorrect: An investment made by a US resident into the Indian share market is part of the capital account of Balance of Payment, and not the current account.Incorrect

Answer: B

Explanation:

‘Invisibles’ in the context of Balance of Payments refer to transactions that do not involve the physical movement of goods and services across borders but represent international transactions in services, income, and transfers. These transactions are recorded in the current account of the balance of payments.

Invisibles include services, transfers and flows of income that take place between different countries.

Services trade includes both factor and non-factor income. Factor income includes net international earnings on factors of production (like labour, land and capital). Non-factor income is net sale of service products like shipping, banking, tourism, software services, etc.

● Option 1 is correct: A gift worth $15,000 received by a family in India from its relatives in the US would be considered part of the invisibles in the Balance of Payments (BOP). Gifts fall under the category of transfers in the BOP and represent non-commercial, unilateral transactions between residents and non-residents.

● Option 2 is incorrect: Income received from selling of gems and jewellery by a firm in India to a firm in the US would not be considered part of the invisibles in the Balance of Payments (BOP). Instead, it would be classified as a visible trade transaction.

● Option 3 is correct: Income received from providing financial services by a consultancy firm in India to individuals in Singapore would be considered part of the invisibles in the Balance of Payments (BOP). This transaction involves the provision of services (financial consultancy services) by residents of one country (India) to residents of another country (Singapore) without the physical movement of goods across borders.

● Option 4 is incorrect: An investment made by a US resident into the Indian share market is part of the capital account of Balance of Payment, and not the current account. -

Question 5 of 5

5. Question

5. Consider the following statements:

1. In case of depreciation of rupee, RBI will sell dollars and buy rupees.

2. In case of appreciation of rupee, exports from India become more expensive.

Which of the statements given above is/are correct?Correct

Answer: C

Explanation:

The foreign exchange market is guided by the principle of demand and supply.

Statement 1 is correct: When the rupee depreciates in the market, it means its demand has reduced. In order to prop up its demand, the RBI will sell dollars and buy rupees, which increases the supply of dollars, while increasing the demand for rupee.

The mechanism

Suppose the RBI offers to sell $100 million at the cost of Rs 80 per dollar.

And then seeing the interest of the currency market, it announces that it will sell off $200 million more, hence the buyers get an opportunity to buy more US dollars at a time when demand for it is very high.

However, by doing so the INR in the currency market gets reduced by Rs 8,000 million, so there is less INR left in the market. And lower supply of INR causes the value of INR to rise or it gets costlier, so the next $200 million will get sold at Rs 79 per dollar. And this way the bidding process will continue.

Thus, the INR will appreciate against the USD shoring up its value and the confidence level in the currency.

Statement 2 is correct: In case of appreciation of rupee, exports from India will become expensive. Let’s understand with the help of an example: Suppose the $1 is equal to Rs 100. In case of depreciation of rupee, the value of rupee will increase to, suppose, Rs 80. Now, a resident in the US would be able to buy less goods in the same dollar as would have been able to when the dollar price was Rs 100. Hence, in case of appreciation of rupee, exports become expensive.Incorrect

Answer: C

Explanation:

The foreign exchange market is guided by the principle of demand and supply.

Statement 1 is correct: When the rupee depreciates in the market, it means its demand has reduced. In order to prop up its demand, the RBI will sell dollars and buy rupees, which increases the supply of dollars, while increasing the demand for rupee.

The mechanism

Suppose the RBI offers to sell $100 million at the cost of Rs 80 per dollar.

And then seeing the interest of the currency market, it announces that it will sell off $200 million more, hence the buyers get an opportunity to buy more US dollars at a time when demand for it is very high.

However, by doing so the INR in the currency market gets reduced by Rs 8,000 million, so there is less INR left in the market. And lower supply of INR causes the value of INR to rise or it gets costlier, so the next $200 million will get sold at Rs 79 per dollar. And this way the bidding process will continue.

Thus, the INR will appreciate against the USD shoring up its value and the confidence level in the currency.

Statement 2 is correct: In case of appreciation of rupee, exports from India will become expensive. Let’s understand with the help of an example: Suppose the $1 is equal to Rs 100. In case of depreciation of rupee, the value of rupee will increase to, suppose, Rs 80. Now, a resident in the US would be able to buy less goods in the same dollar as would have been able to when the dollar price was Rs 100. Hence, in case of appreciation of rupee, exports become expensive.