THE CONTEXT: The fiscal relationship between India’s Union government and states is marked by a significant Vertical Fiscal Imbalance (VFI), where states bear a disproportionate share of expenditure responsibilities compared to their revenue-generating capabilities. Addressing this imbalance is crucial for enhancing fiscal autonomy, efficiency, and cooperative federalism.

VERTICAL FISCAL IMBALANCE:

Vertical Fiscal Imbalance (VFI) refers to the structural mismatch between the revenue-raising powers and expenditure responsibilities of different levels of government in India’s federal system. Specifically, it describes the situation where states bear a disproportionately higher share of expenditure responsibilities (61% of revenue expenditure) than their limited revenue-generating capabilities (only 38% of revenue receipts).

On the contrary, Horizontal fiscal imbalance (HFI) refers to the disparities in fiscal capacities and needs among states at the same level of government. In the Indian context, HFI is a significant concern due to the wide variations in economic development, resource endowments, and fiscal capacities across different states. The 15th Finance Commission used criteria like income distance, area, forest cover, and demographic performance to determine inter-se shares of states.

ABOUT FINANCE COMMISSION:

Constitution and Composition: The Finance Commission is constituted by the President of India every five years or earlier if necessary. It consists of a chairman and four other members, all appointed by the President. Parliament determines members’ qualifications and selection methods through legislation, specifically the Finance Commission (Miscellaneous Provisions) Act, 1951.

Constitutional Provisions: Several constitutional provisions govern the Finance Commission’s existence and functions:

- Article 280: This article establishes the Finance Commission and outlines its basic structure and functions. It mandates the constitution of the Commission every five years or earlier.

- Article 281: This provision requires the President to cause every recommendation made by the Finance Commission to be laid before each House of Parliament.

- 73rd Constitutional Amendment Act, 1992: This amendment mandated state governments to constitute their own State Finance Commissions every five years to review the financial position of local bodies.

Terms Of Reference: The President sets specific Terms of Reference for each Finance Commission, which guide its deliberations and recommendations. These terms typically cover aspects such as:

- The formula for tax devolution between the Centre and States.

- Principles governing grants-in-aid to States.

- Measures for fiscal consolidation and management.

- Recommendations on sector-specific or state-specific issues.

The Finance Commission’s primary responsibilities include:

- Making recommendations on the distribution of net proceeds of taxes between the Union and the States and among the States themselves.

- Determining the principles governing grants-in-aid to States from the Consolidated Fund of India.

- Suggesting measures to augment the Consolidated Fund of a State to supplement the resources of Panchayats and Municipalities based on the recommendations of the State Finance Commission.

- Address any other matters referred to by the President in the interest of sound finance.

THE ISSUES:

- Asymmetry in revenue and expenditure responsibilities: States incur 61% of revenue expenditure but collect only 38% of revenue receipts. This creates a dependency of states on transfers from the Union government. Expenditure decentralization overwhelms the revenue-raising powers of states.

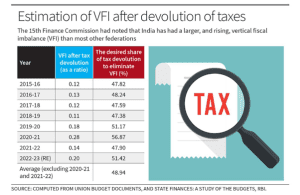

- Rising vertical imbalance compared to other federations: The 15th Finance Commission noted India has a larger and increasing vertical imbalance than most other federations. This imbalance is magnified during crises like the COVID-19 pandemic. Creates a large gap between states’ own revenues and expenditure responsibilities

- Inadequate tax devolution to eliminate VFI: To eliminate VFI, the average share of net proceeds devolved to states between 2015-16 and 2022-23 should have been 48.94%. However, the 14th and 15th Finance Commissions recommended only 42% and 41%, respectively. Current devolution is insufficient to meet states’ expenditure needs.

- Exclusion of cesses and surcharges from the divisible pool: Substantial amounts collected as cesses and surcharges are excluded from the net proceeds shared with states. This truncates the divisible pool available for devolution. It reduces overall resources transferred to states.

- Limited fiscal autonomy for states: The current level of devolution provides inadequate untied resources to states. It restricts states’ ability to respond to local needs and priorities and impacts the efficiency of expenditures at the state level.

THE WAY FORWARD:

- Inclusion of Cesses and Surcharges in the Divisible Pool: Currently, cessation and surcharges are not shared with the states, reducing the size of the divisible pool. Including them in the divisible pool could significantly increase the resources available to states. For instance, if the cesses and surcharges collected in 2021-22 were shared, states would receive an additional Rs 1,53,533 crore. This inclusion would align with the principles of cooperative federalism and ensure states have adequate resources to meet their expenditure responsibilities.

- Increase in Tax Devolution Rates: To address VFI, raising the tax devolution rate to 50% has been suggested. This would give states more untied funds, allowing them to effectively cater to local needs. The 15th Finance Commission recommended a 41% devolution rate, but increasing this to 50% would align with demands from various states and provide an additional fiscal space of Rs 2.24 lakh crore.

- Rationalization of Centrally Sponsored Schemes (CSS): Reducing the number of CSS and focusing them on critical areas like healthcare, education, and poverty alleviation could decrease the financial burden on the Union and provide states with more flexibility. This approach would also reduce the need for cesses and surcharges, as funds could be reallocated to more pressing state needs.

- Strengthening State Revenue Mobilization: States should explore untapped revenue sources such as property taxes and improve tax compliance to enhance their revenue base. Integrating computerized property records with transaction registrations and rationalizing GST rates are steps in this direction. This would reduce states’ dependency on central transfers and improve fiscal autonomy.

- Establishment of an Independent Fiscal Council: Creating an independent body to oversee fiscal management could ensure transparency and accountability in financial practices. This council could assess fiscal policies at both central and state levels, provide guidance on sustainable fiscal practices, and help bridge the fiscal gap.

- Reform of Public Financial Management (PFM) Systems: Improving PFM systems through adopting accrual-based accounting and performance-oriented budgeting can enhance the efficiency of government spending. Implementing recommendations from various committees, such as the Second Expert Committee on Expenditure Management, can lead to better fiscal outcomes and ensure that resources are utilized effectively.

THE CONCLUSION:

Implementing increased tax devolution, including cesses in the divisible pool, and enhanced state revenue mobilization can effectively reduce VFI. These measures will empower states, promote efficient governance, and strengthen India’s federal structure.

UPSC PAST YEAR QUESTIONS:

Q.1 How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? 2022

Q.2 How is the Finance Commission of India constituted? What do you think about the terms of reference of the recently constituted Finance Commission? Discuss. 2018

MAINS PRACTICE QUESTION:

Q.1 Discuss the challenges of Vertical Fiscal Imbalance (VFI) in India’s fiscal federalism. Critically analyze the role of Finance Commissions in addressing these challenges.

SOURCE:

Spread the Word