Day-677

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

1. Consider the following:

1. Currency in circulation

2. Bankers’ deposits with RBI

3. Net time deposits with commercial banks

4. Net demand deposits held by commercial banks

How many of the above are components of reserve money?Correct

Answer: B

Explanation:

Reserve money, monetary base or the high-powered money is the most important form of money supply.

Components of Reserve Money:

Reserve money (M0) = Currency in Circulation + Bankers’ Deposits with RBI + ‘Other’ Deposits with RBI.

Where, currency in circulation includes notes in circulation, rupee coins and small coins.

Net time deposits with the banking system is part of broad money (M3 & M4), while net demand deposits held by commercial bank is part of narrow money (M1)

The various measures of money supply vary in terms of liquidity.Incorrect

Answer: B

Explanation:

Reserve money, monetary base or the high-powered money is the most important form of money supply.

Components of Reserve Money:

Reserve money (M0) = Currency in Circulation + Bankers’ Deposits with RBI + ‘Other’ Deposits with RBI.

Where, currency in circulation includes notes in circulation, rupee coins and small coins.

Net time deposits with the banking system is part of broad money (M3 & M4), while net demand deposits held by commercial bank is part of narrow money (M1)

The various measures of money supply vary in terms of liquidity. -

Question 2 of 5

2. Question

2. Consider the following:

1. Increase in value of rupee

2. Reduced requirement of foreign exchange reserve

3. Increase in capital inflows in the economy

4. Lower cost of capital

5. Reduction in currency volatility in short-term

How many of the above-mentioned scenarios can be the potential benefits of ‘internationalisation’ of rupee?Correct

Answer: C

Explanation:

Internationalisation is a process that involves increasing the use of the rupee in cross-border transactions. It involves promoting the rupee for import and export trade and then other current account transactions, followed by its use in capital account transactions. These are all transactions between residents in India and non-residents.

Potential benefits of internationalisation of rupee:

● Option 1 is correct: If due to internationalisation of rupee, there is increased demand for Indian currency, then the value of rupee will increase, that is, there will be appreciation of rupee.

● Option 2 is correct: It reduces the need for holding foreign exchange reserves. While reserves help manage exchange rate volatility and project external stability, they impose a cost on the economy.

● Option 3 is correct: With the internalisation of rupee, liquidity and investor faith in the market will improve. Capital flows in the debt market and equity market will surge as INR becomes a stronger currency.

● Option 4 is correct: Internationalisation of rupee will lower transaction costs and reduce dependence on dollars. A more internationalized rupee can make it easier for Indian companies to access capital from foreign investors. This broader investor base can increase competition among lenders, potentially leading to lower borrowing rates.

● Option 5 is incorrect: Internalisation of rupee may result in the potential increase in volatility of its exchange rate in the initial stages. This would further have monetary policy implications as the obligation of a country to supply its currency to meet the global demand may come in conflict with its domestic monetary policies. Also, the internationalisation of a currency may accentuate an external shock, given the open channel of the flow of funds into and out of the country and from one currency to another.Incorrect

Answer: C

Explanation:

Internationalisation is a process that involves increasing the use of the rupee in cross-border transactions. It involves promoting the rupee for import and export trade and then other current account transactions, followed by its use in capital account transactions. These are all transactions between residents in India and non-residents.

Potential benefits of internationalisation of rupee:

● Option 1 is correct: If due to internationalisation of rupee, there is increased demand for Indian currency, then the value of rupee will increase, that is, there will be appreciation of rupee.

● Option 2 is correct: It reduces the need for holding foreign exchange reserves. While reserves help manage exchange rate volatility and project external stability, they impose a cost on the economy.

● Option 3 is correct: With the internalisation of rupee, liquidity and investor faith in the market will improve. Capital flows in the debt market and equity market will surge as INR becomes a stronger currency.

● Option 4 is correct: Internationalisation of rupee will lower transaction costs and reduce dependence on dollars. A more internationalized rupee can make it easier for Indian companies to access capital from foreign investors. This broader investor base can increase competition among lenders, potentially leading to lower borrowing rates.

● Option 5 is incorrect: Internalisation of rupee may result in the potential increase in volatility of its exchange rate in the initial stages. This would further have monetary policy implications as the obligation of a country to supply its currency to meet the global demand may come in conflict with its domestic monetary policies. Also, the internationalisation of a currency may accentuate an external shock, given the open channel of the flow of funds into and out of the country and from one currency to another. -

Question 3 of 5

3. Question

3. Consider the following statements:

Statement-I: The Ways and Means Advances (WMA) is a facility for both the Centre and the states to borrow from the RBI to meet their fiscal deficit targets.

Statement-II: The governments are allowed to draw amounts in excess of their WMA limits.

Which one of the following is correct in respect of the above statements?Correct

Answer: D

Explanation:

Statement-I is incorrect: The Ways and Means Advances (WMA) is a facility for both the Centre and the states to borrow from the RBI. These borrowings are meant purely to help them to tide over temporary mismatches in cash flows of their receipts and expenditures. They aren’t a source of finance per se and are not used for financing fiscal deficit. It was put in place from April 1, 1997. Under the WMA system, the Reserve Bank has been extending short-term advances up to the pre-announced half-yearly limits, fully payable within three months.

● The interest rate on WMA is the RBI’s repo rate, which is basically the rate at which it lends short-term money to banks. That rate is currently 4.4%.

Statement-II is correct: The governments are allowed to draw amounts in excess of their WMA limits. The interest on such overdraft is 2 percentage points above the repo rate, which now works out to 6.4%. Further, no state can run an overdraft with the RBI for more than a certain period.Incorrect

Answer: D

Explanation:

Statement-I is incorrect: The Ways and Means Advances (WMA) is a facility for both the Centre and the states to borrow from the RBI. These borrowings are meant purely to help them to tide over temporary mismatches in cash flows of their receipts and expenditures. They aren’t a source of finance per se and are not used for financing fiscal deficit. It was put in place from April 1, 1997. Under the WMA system, the Reserve Bank has been extending short-term advances up to the pre-announced half-yearly limits, fully payable within three months.

● The interest rate on WMA is the RBI’s repo rate, which is basically the rate at which it lends short-term money to banks. That rate is currently 4.4%.

Statement-II is correct: The governments are allowed to draw amounts in excess of their WMA limits. The interest on such overdraft is 2 percentage points above the repo rate, which now works out to 6.4%. Further, no state can run an overdraft with the RBI for more than a certain period. -

Question 4 of 5

4. Question

4. With reference to speculative demand for money, consider the following statements:

1. It is inversely related to the rate of interest.

2. When speculative demand for money is extremely high, fiscal policy is ineffective.

3. It is positively related to income level.

How many of the above statements are correct?Correct

Answer: A

Explanation:

Statement 1 is correct: Demand for money, according to Keynes, can be divided into three forms: Speculative demand, transaction demand and precautionary demand.

The speculative demand for money is inversely related to the market interest rate. This is because at a lower interest rate, more people will expect a rise in the interest rate (and thus a fall in bond prices). As a result, more people will hold their wealth in money rather than bonds, i.e. the speculative balances will be greater at a lower interest rate.

Statement 2 is incorrect: When speculative demand for money is extremely high, monetary policy is ineffective. This is because the interest rate is too low and gives rise to the situation of liquidity trap. Monetary policy works by intervening with the money market, but when speculative demand for money is too high, it means people are willing to hold any amount of cash, irrespective of the interest rate prevailing. This occurs during the period of recession. In those situations, adoption of fiscal policy is more feasible.

Statement 3 is incorrect: According to Keynes, transaction demand for money is directly proportional to income level. Speculative demand for money has a relationship with interest rate and not income level. As income rises, we demand more money for transaction purposes and vice versa.Incorrect

Answer: A

Explanation:

Statement 1 is correct: Demand for money, according to Keynes, can be divided into three forms: Speculative demand, transaction demand and precautionary demand.

The speculative demand for money is inversely related to the market interest rate. This is because at a lower interest rate, more people will expect a rise in the interest rate (and thus a fall in bond prices). As a result, more people will hold their wealth in money rather than bonds, i.e. the speculative balances will be greater at a lower interest rate.

Statement 2 is incorrect: When speculative demand for money is extremely high, monetary policy is ineffective. This is because the interest rate is too low and gives rise to the situation of liquidity trap. Monetary policy works by intervening with the money market, but when speculative demand for money is too high, it means people are willing to hold any amount of cash, irrespective of the interest rate prevailing. This occurs during the period of recession. In those situations, adoption of fiscal policy is more feasible.

Statement 3 is incorrect: According to Keynes, transaction demand for money is directly proportional to income level. Speculative demand for money has a relationship with interest rate and not income level. As income rises, we demand more money for transaction purposes and vice versa. -

Question 5 of 5

5. Question

5. Consider the following statements:

1. A higher tax-to-GDP ratio indicates lower reliance on borrowings.

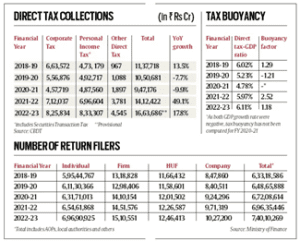

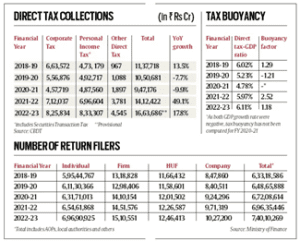

2. India’s tax buoyancy has increased consistently in the last five years.

3. The number of Indian tax filers has increased consistently in the last five years.

How many of the above statements are correct?Correct

Answer: B

Explanation:

Statement 1 is correct: The tax-to-GDP ratio represents a country’s tax kitty relative to its GDP, indicating the government’s ability to finance its expenditure. A higher ratio denotes a wider fiscal net and reduced dependence on borrowings.

Statement 2 is incorrect: Tax buoyancy had stood at (-)1.21 in 2019-20 and it was not computed for the financial year 2020-21 as both the nominal GDP and tax collections contracted from the previous year. Tax buoyancy had improved to 2.52 in 2021-22 due to a low base effect. Now, tax buoyancy inched lower to 1.18 in 2022-23 even as the growth rate for taxes was recorded at 17.79 per cent in 2022-23, higher than 15.11 per cent nominal GDP growth.

Statement 3 is correct: The number of tax filers has increased consistently in the last five years.

Incorrect

Incorrect

Answer: B

Explanation:

Statement 1 is correct: The tax-to-GDP ratio represents a country’s tax kitty relative to its GDP, indicating the government’s ability to finance its expenditure. A higher ratio denotes a wider fiscal net and reduced dependence on borrowings.

Statement 2 is incorrect: Tax buoyancy had stood at (-)1.21 in 2019-20 and it was not computed for the financial year 2020-21 as both the nominal GDP and tax collections contracted from the previous year. Tax buoyancy had improved to 2.52 in 2021-22 due to a low base effect. Now, tax buoyancy inched lower to 1.18 in 2022-23 even as the growth rate for taxes was recorded at 17.79 per cent in 2022-23, higher than 15.11 per cent nominal GDP growth.

Statement 3 is correct: The number of tax filers has increased consistently in the last five years.