Day-669

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

1. Consider the following statements:

1. Withdrawal of Rs 2000 from circulation

2. Purchase of Government securities by the RBI

3. Decrease of Cash Reserve Ratio

4. Withdrawal of cash by the public during festive season

How many of the above can result in decreasing the liquidity in the Indian banking system?Correct

Answer: A

Explanation:

Banking system liquidity refers to readily available cash that banks need to meet short-term business and financial needs.

● Withdrawal of Rs 2000 from the circulation would result in surplus liquidity with the banks. Customers holding these notes were required to deposit them or get it exchanged for smaller denominations from banks. This results in surplus liquidity with the banks, as happened during the demonetisation move of 2016.

● Purchase of Government securities by the RBI increases the liquidity. When the Central Bank purchases Government bonds or securities, it disburses funds in the market, resulting in the expansion of the money supply. The liquidity with the banks increases so that they can create more credit.

● Decrease of Cash Reserve Ratio increases the liquidity with the banking system. It is the amount of cash banks must maintain as reserve, which cannot be given for loans further. Thus, any decrease in its ratio will increase the liquidity of the banking system.

● Withdrawal of cash by the public during the festive season decreases the liquidity in the banking system as demand for cash increases during the festivals.Incorrect

Answer: A

Explanation:

Banking system liquidity refers to readily available cash that banks need to meet short-term business and financial needs.

● Withdrawal of Rs 2000 from the circulation would result in surplus liquidity with the banks. Customers holding these notes were required to deposit them or get it exchanged for smaller denominations from banks. This results in surplus liquidity with the banks, as happened during the demonetisation move of 2016.

● Purchase of Government securities by the RBI increases the liquidity. When the Central Bank purchases Government bonds or securities, it disburses funds in the market, resulting in the expansion of the money supply. The liquidity with the banks increases so that they can create more credit.

● Decrease of Cash Reserve Ratio increases the liquidity with the banking system. It is the amount of cash banks must maintain as reserve, which cannot be given for loans further. Thus, any decrease in its ratio will increase the liquidity of the banking system.

● Withdrawal of cash by the public during the festive season decreases the liquidity in the banking system as demand for cash increases during the festivals. -

Question 2 of 5

2. Question

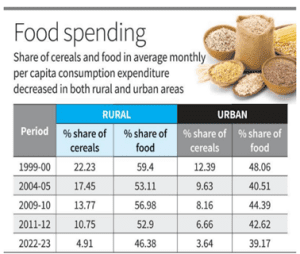

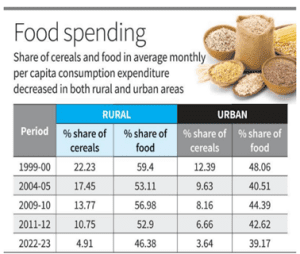

2. Consider the following statements about the Consumption Expenditure Survey (2022-23):

1. Expenditure on food items accounts for more than 50% in rural India, while it is less than 40% in urban India.

2. The average monthly per capita consumption expenditure (MPCE) has shown higher growth in rural areas than in urban areas.

3. Among the states, Gujarat has the highest average MPCE for both rural and urban areas.

How many of the above statements are correct?Correct

Answer: A

Explanation:

The National Statistical Office (NSO) released the All India Household Consumption Expenditure Survey (2022-23) after a gap of 11 years. Generally, the data is revealed every five years, but the 2017-18 version was junked by the government, citing data quality issues.

Statement 1 is incorrect: The numbers show that the proportion of spending on food has dropped to 46.4% for rural households from 52.9% in 2011-12, while their urban peers spent just 39.2% of their overall monthly outgoes on food compared with 42.6% incurred 11 years earlier. This reduction could translate into a lower weightage for food prices in the country’s retail inflation calculations.

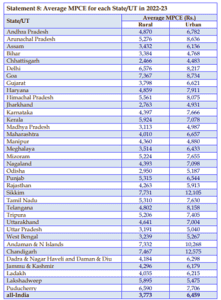

Statement 2 is correct: The average monthly per capita consumption expenditure (MPCE) in Indian households rose by 33.5% since 2011-12 in urban households to ₹3,510, with rural India’s MPCE seeing a 40.42% increase over the same period to hit ₹2,008.

Statement 3 is incorrect: Among the States, the MPCE is the highest in Sikkim for both rural (₹7,731) and urban areas (₹12,105). It is the lowest in Chhattisgarh, where it was ₹2,466 for rural households and ₹4,483 for urban household members.

The estimates of the MPCE are based on data collected from 2,61,746 households, of which 1,55,014 were in rural areas, spread over all States and Union Territories.Incorrect

Answer: A

Explanation:

The National Statistical Office (NSO) released the All India Household Consumption Expenditure Survey (2022-23) after a gap of 11 years. Generally, the data is revealed every five years, but the 2017-18 version was junked by the government, citing data quality issues.

Statement 1 is incorrect: The numbers show that the proportion of spending on food has dropped to 46.4% for rural households from 52.9% in 2011-12, while their urban peers spent just 39.2% of their overall monthly outgoes on food compared with 42.6% incurred 11 years earlier. This reduction could translate into a lower weightage for food prices in the country’s retail inflation calculations.

Statement 2 is correct: The average monthly per capita consumption expenditure (MPCE) in Indian households rose by 33.5% since 2011-12 in urban households to ₹3,510, with rural India’s MPCE seeing a 40.42% increase over the same period to hit ₹2,008.

Statement 3 is incorrect: Among the States, the MPCE is the highest in Sikkim for both rural (₹7,731) and urban areas (₹12,105). It is the lowest in Chhattisgarh, where it was ₹2,466 for rural households and ₹4,483 for urban household members.

The estimates of the MPCE are based on data collected from 2,61,746 households, of which 1,55,014 were in rural areas, spread over all States and Union Territories. -

Question 3 of 5

3. Question

3. Despite the RBI adopting the contractionary monetary policy to curb inflation, sometimes inflation may not come down due to:

Correct

Answer: D

Explanation:

Contractionary monetary policy by the Reserve Bank of India can mainly cater to inflation which is caused by the demand-side. In case, the inflation is caused due to supply-side bottlenecks, raising the interest rate may not be effective.

Options a, b and c are incorrect as all of these scenarios are caused by demand-side dynamics.

Supply-side bottlenecks may include:

● Rise in crude oil prices

● Fall in production of foodgrains

● Rise in input costsIncorrect

Answer: D

Explanation:

Contractionary monetary policy by the Reserve Bank of India can mainly cater to inflation which is caused by the demand-side. In case, the inflation is caused due to supply-side bottlenecks, raising the interest rate may not be effective.

Options a, b and c are incorrect as all of these scenarios are caused by demand-side dynamics.

Supply-side bottlenecks may include:

● Rise in crude oil prices

● Fall in production of foodgrains

● Rise in input costs -

Question 4 of 5

4. Question

4. Consider the following statements:

Statement-I: For policy-making, real GDP numbers are looked at rather than nominal GDP numbers.

Statement-II: Real GDP numbers eliminate any distortion caused by price movements or base effect.

Which one of the following is correct in respect of the above statements?Correct

Answer: C

Explanation:

Statement-I is correct but Statement-II is incorrect

Statement 1 is correct: For the purpose of policy-making, real GDP numbers are normally considered by economists to gauge the growth of the economy.

Real GDP is adjusted for inflation.

Statement 2 is incorrect: After adjusting for inflation, the real GDP numbers eliminate the distortion caused by price movements, that is, inflation or deflation. It doesn’t eliminate the distortion which can be caused by the base effect.Incorrect

Answer: C

Explanation:

Statement-I is correct but Statement-II is incorrect

Statement 1 is correct: For the purpose of policy-making, real GDP numbers are normally considered by economists to gauge the growth of the economy.

Real GDP is adjusted for inflation.

Statement 2 is incorrect: After adjusting for inflation, the real GDP numbers eliminate the distortion caused by price movements, that is, inflation or deflation. It doesn’t eliminate the distortion which can be caused by the base effect. -

Question 5 of 5

5. Question

5. In the context of Indian economy, consider the following statements about Sovereign Green Bonds:

1. These are government debt that are specifically earmarked to finance environmentally sustainable projects.

2. They generally have higher yield than the conventional G-Secs.

3. Foreign Institutional Investors have been allowed to invest in them.

4. They cannot be treated as part of the Statutory Liquidity Ratio.

How many of the above statements are correct?Correct

Answer: B

Explanation:

Statement 1 is correct: Sovereign Green Bonds (SGrBs) are a kind of government debt that specifically funds projects that are environment friendly.

Statement 2 is incorrect: They yield lower interest than conventional G-Secs, and the amount foregone by a bank by investing in them is called a Greenium.

Statement 3 is correct: The Reserve Bank of India (RBI) has recently green lighted investments in the country’s SGrBs by Foreign Institutional Investors (FIIS) — investors such as insurance companies, pension funds and nation-states’ sovereign wealth funds. The move will enable availability of more funds for greener projects which will help in smoother transition to a low-carbon economy.

Statement 4 is incorrect: They have been classified under the Statutory Liquidity Ratio (SLR), a liquidity rate fixed by the RBI that financial institutions must maintain with themselves before they lend to their customer.Incorrect

Answer: B

Explanation:

Statement 1 is correct: Sovereign Green Bonds (SGrBs) are a kind of government debt that specifically funds projects that are environment friendly.

Statement 2 is incorrect: They yield lower interest than conventional G-Secs, and the amount foregone by a bank by investing in them is called a Greenium.

Statement 3 is correct: The Reserve Bank of India (RBI) has recently green lighted investments in the country’s SGrBs by Foreign Institutional Investors (FIIS) — investors such as insurance companies, pension funds and nation-states’ sovereign wealth funds. The move will enable availability of more funds for greener projects which will help in smoother transition to a low-carbon economy.

Statement 4 is incorrect: They have been classified under the Statutory Liquidity Ratio (SLR), a liquidity rate fixed by the RBI that financial institutions must maintain with themselves before they lend to their customer.