Day-662

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

1. In the context of economy, which one of the following best describes the term ‘double deflation’?

Correct

Answer: C

Explanation:

Double deflation is a method whereby gross value added is measured at constant prices by subtracting intermediate consumption at constant prices from output at constant prices.

India uses a single deflation method (deflating the nominal value added in each sector by various price indices) rather than the international standard technique of double deflation.

The failure to use double deflation matters hugely when international prices of critical inputs such as oil move sharply. If input prices diverge from output prices, single deflation can misstate growth by a big margin. The concern has been raised by many economists, like former Chief Economic Advisor Arvind Subramanian, in the Indian context.Incorrect

Answer: C

Explanation:

Double deflation is a method whereby gross value added is measured at constant prices by subtracting intermediate consumption at constant prices from output at constant prices.

India uses a single deflation method (deflating the nominal value added in each sector by various price indices) rather than the international standard technique of double deflation.

The failure to use double deflation matters hugely when international prices of critical inputs such as oil move sharply. If input prices diverge from output prices, single deflation can misstate growth by a big margin. The concern has been raised by many economists, like former Chief Economic Advisor Arvind Subramanian, in the Indian context. -

Question 2 of 5

2. Question

2. Consider the following statements about Investment Facilitation for Development:

1. It is an agreement under the World Bank, which aims to create legally binding provisions to facilitate investment flows.

2. India is one of the key supporters of this agreement.

Which of the statements given above is/are correct?Correct

Answer: D

Explanation:

Statement 1 is incorrect: Investment facilitation for development (IFD) is an agreement being negotiated under the World Trade Organization framework.

● Negotiations for an IFD agreement at the WTO were launched in 2017 on a plurilateral basis by 70 countries. This was done through a process known as the Joint Statement Initiative. The IFD agreement was finalised in November 2023. Currently, around 120 of 166 WTO member countries (more than 70% of the membership) back the IFD agreement. This agreement aims to create legally binding provisions to facilitate investment flows.

Statement 2 is incorrect: India has opposed this agreement. At the 13th Ministerial Conference (MC13) of the World Trade Organization (WTO) in Abu Dhabi, these 120 countries wanted to include the IFD Agreement as a plurilateral agreement (PA) within Annex 4 of the WTO Agreement.

● India and South Africa played a crucial role in not letting the IFD agreement become a part of the WTO rulebook.

● India’s principal concerns are twofold. First, the question of whether investment can be part of the WTO. And second, the process followed to make the IFD agreement a part of the WTO rulebook.Incorrect

Answer: D

Explanation:

Statement 1 is incorrect: Investment facilitation for development (IFD) is an agreement being negotiated under the World Trade Organization framework.

● Negotiations for an IFD agreement at the WTO were launched in 2017 on a plurilateral basis by 70 countries. This was done through a process known as the Joint Statement Initiative. The IFD agreement was finalised in November 2023. Currently, around 120 of 166 WTO member countries (more than 70% of the membership) back the IFD agreement. This agreement aims to create legally binding provisions to facilitate investment flows.

Statement 2 is incorrect: India has opposed this agreement. At the 13th Ministerial Conference (MC13) of the World Trade Organization (WTO) in Abu Dhabi, these 120 countries wanted to include the IFD Agreement as a plurilateral agreement (PA) within Annex 4 of the WTO Agreement.

● India and South Africa played a crucial role in not letting the IFD agreement become a part of the WTO rulebook.

● India’s principal concerns are twofold. First, the question of whether investment can be part of the WTO. And second, the process followed to make the IFD agreement a part of the WTO rulebook. -

Question 3 of 5

3. Question

3. Consider the following statements:

Statement-I: The scope for a contractionary monetary policy in a ‘Goldilocks’ economy is limited.

Statement-II: A Goldilocks scenario in an economy refers to an ideal situation where there is steady growth.

Which one of the following is correct in respect of the above statements?Correct

Answer: A

Explanation:

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

A Goldilocks scenario in an economy refers to an ideal situation where there is steady growth. The economic growth is neither too high to trigger inflation and nor too low for a slowdown. In simple terms, in a Goldilocks scenario, the economy is not expanding by a huge margin with inflation or shrinking into recession.

Hence, in such an economy, the scope for a contractionary monetary policy is limited in a ‘Goldilocks’ economy.

There are certain features attached with Goldilocks:

● For one, the unemployment rate in the economy is really low.

● There is steady growth in the Gross Domestic Product (GDP) numbers and companies report better earnings.

● The retail inflation and the interest rates are relatively low.

● The Goldilocks scenario is good for investors as companies perform well and stocks rally.

However, the goldilocks phase is temporary in nature and sets in typically after an adverse shock to the economy, during the recovery and growth period.Incorrect

Answer: A

Explanation:

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

A Goldilocks scenario in an economy refers to an ideal situation where there is steady growth. The economic growth is neither too high to trigger inflation and nor too low for a slowdown. In simple terms, in a Goldilocks scenario, the economy is not expanding by a huge margin with inflation or shrinking into recession.

Hence, in such an economy, the scope for a contractionary monetary policy is limited in a ‘Goldilocks’ economy.

There are certain features attached with Goldilocks:

● For one, the unemployment rate in the economy is really low.

● There is steady growth in the Gross Domestic Product (GDP) numbers and companies report better earnings.

● The retail inflation and the interest rates are relatively low.

● The Goldilocks scenario is good for investors as companies perform well and stocks rally.

However, the goldilocks phase is temporary in nature and sets in typically after an adverse shock to the economy, during the recovery and growth period. -

Question 4 of 5

4. Question

4. Which of the following is not correct about the Lead Bank Scheme?

Correct

Answer: D

Explanation:

The Lead Bank Scheme has been administered by the Reserve Bank of India since 1969.

Statement 1 is correct: Its main objective has been to promote financial inclusion and increase the credit flow to priority sectors.

Statement 2 is correct: Initially, only public sector banks were made part of the scheme. However, in 2009, Usha Thorat review committee suggested giving a greater role to the private sector under the scheme.

Statement 3 is correct: The genesis of the Lead Bank Scheme (LBS) can be traced to the Study Group headed by Prof. D. R. Gadgil (Gadgil Study Group) on the Organizational Framework for the Implementation of the Social Objectives, which submitted its report in October 1969. It recommended the ‘Area Approach’ to evolve plans and programmes for the development of an adequate banking and credit structure in the rural areas. Later on, a Committee of Bankers on Branch Expansion Programme of Public Sector Banks was appointed by the Reserve Bank of India under the Chairmanship of Shri F. K. F. Nariman endorsed the idea of an ‘Area Approach’, and recommended that in order to enable the PSBs to discharge their social responsibilities, each bank should concentrate on certain districts where it should act as a ‘Lead Bank’.

Statement 4 is incorrect: Initially, the Lead Bank Scheme (LBS) was applicable to all districts in the country except districts in metropolitan areas. However, in view of the widespread challenge of financial exclusion in metropolitan areas, especially among the disadvantaged and low-income groups, it was decided to cover metropolitan areas as well.Incorrect

Answer: D

Explanation:

The Lead Bank Scheme has been administered by the Reserve Bank of India since 1969.

Statement 1 is correct: Its main objective has been to promote financial inclusion and increase the credit flow to priority sectors.

Statement 2 is correct: Initially, only public sector banks were made part of the scheme. However, in 2009, Usha Thorat review committee suggested giving a greater role to the private sector under the scheme.

Statement 3 is correct: The genesis of the Lead Bank Scheme (LBS) can be traced to the Study Group headed by Prof. D. R. Gadgil (Gadgil Study Group) on the Organizational Framework for the Implementation of the Social Objectives, which submitted its report in October 1969. It recommended the ‘Area Approach’ to evolve plans and programmes for the development of an adequate banking and credit structure in the rural areas. Later on, a Committee of Bankers on Branch Expansion Programme of Public Sector Banks was appointed by the Reserve Bank of India under the Chairmanship of Shri F. K. F. Nariman endorsed the idea of an ‘Area Approach’, and recommended that in order to enable the PSBs to discharge their social responsibilities, each bank should concentrate on certain districts where it should act as a ‘Lead Bank’.

Statement 4 is incorrect: Initially, the Lead Bank Scheme (LBS) was applicable to all districts in the country except districts in metropolitan areas. However, in view of the widespread challenge of financial exclusion in metropolitan areas, especially among the disadvantaged and low-income groups, it was decided to cover metropolitan areas as well. -

Question 5 of 5

5. Question

5. Which of the following best describes the term ‘Buffett Indicator’?

Correct

Answer: A

Explanation

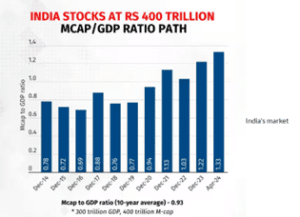

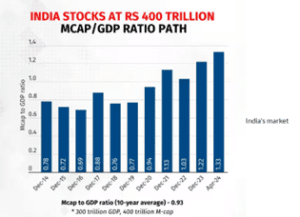

The Buffet Indicator (BI) refers to the ratio of market capitalisation of all listed companies to the GDP of a country.

BI reading above 100% generally depicts that the market is overvalued relative to its GDP.

The Indian stock market’s bull run (A long, extended period in the market when overall stock prices are on the rise) is unparalleled in terms of wealth generation.

India’s m-cap to GDP ratio currently stands at 1.33, or 133 percent (on April 8). This is higher than the 10-year average of 0.93. That’s a considerable deviation from the trend but not the highest level this indicator has touched in India. In 2007, the m-cap to GDP ratio touched an all-time high of 1.464, before falling under 1 in 2008.Incorrect

Answer: A

Explanation

The Buffet Indicator (BI) refers to the ratio of market capitalisation of all listed companies to the GDP of a country.

BI reading above 100% generally depicts that the market is overvalued relative to its GDP.

The Indian stock market’s bull run (A long, extended period in the market when overall stock prices are on the rise) is unparalleled in terms of wealth generation.

India’s m-cap to GDP ratio currently stands at 1.33, or 133 percent (on April 8). This is higher than the 10-year average of 0.93. That’s a considerable deviation from the trend but not the highest level this indicator has touched in India. In 2007, the m-cap to GDP ratio touched an all-time high of 1.464, before falling under 1 in 2008.