TAG: GS 2: POLITY

THE CONTEXT: The financial relationship between the Union and State governments in India has long been a subject of intense debate. Recently, the Government of Kerala has raised concerns about the limitations imposed by the Centre on the borrowing powers of the State governments.

EXPLANATION:

- This issue underscores the broader discussion about the allocation of financial resources and responsibilities between the Union and the States.

- In India, the authority to levy taxes is primarily vested with the Union government, while a significant portion of government spending occurs at the State level.

- This arrangement results in a situation where States bear the responsibility for crucial sectors such as health and education, which directly impact the lives of citizens.

Categorization of Expenditures by the Reserve Bank of India (RBI):

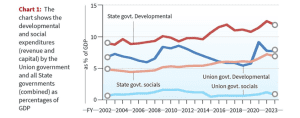

- The RBI categorizes budgetary expenditures of both Union and State governments into ‘developmental’ and ‘non-developmental’ expenditures.

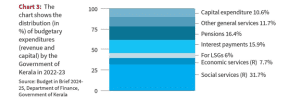

- Developmental expenditures encompass investments in social services and economic sectors, while non-developmental expenditures include interest payments, pensions, and subsidies.

Sources of State Government Funds:

- State governments derive their funds from three primary sources:

- Own Revenues: These include tax and non-tax revenues generated within the State.

- Transfers from the Union Government: These transfers consist of shares of taxes and grants allocated by the Union government to the States.

- Market Borrowings: State governments also raise funds through borrowing from financial markets.

Challenges Faced by Kerala and Other States:

- Kerala’s recent appeal to the Supreme Court highlights the challenge faced by States in balancing their expenditures with limited borrowing capacity.

- The Centre’s imposition of a borrowing limit of 3% of the State’s income or Gross State Domestic Product (GSDP) has raised concerns about federalism and the autonomy of State governments.

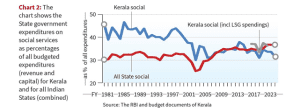

- Kerala’s historical commitment to social sector spending has been commendable, with a significant portion of its budget allocated to education, health, and other social services.

- However, the stagnation in social sector spending in Kerala since the mid-2000s raises questions about the sustainability of its development model.

Implications of Borrowing Constraints:

- The declining transfers from the Union government coupled with Kerala’s own revenue limitations have necessitated increased reliance on market borrowings.

- However, crossing the borrowing limit set by the Centre poses challenges for meeting essential expenditure requirements, especially in times of economic crisis like the COVID-19 pandemic.

The Need for Increased Government Spending:

- Advocates argue for increased government spending, particularly in areas such as higher education and research, to foster economic growth and innovation.

- However, achieving this objective requires greater flexibility in borrowing norms and a collaborative approach between the Centre and the States.

State Borrowings: The Constitutional Provisions

- Chapter II of Part XII of the Constitution of India deals with borrowing by the Central Government and State Governments.

- It comprises two provisions:

- Article 292 covers borrowing by the Central Government, and Article 293, covers borrowing by State Governments.

- Article 293 (3) requires State Governments that are indebted to the Central Government to seek the consent of the Central Government before raising further borrowings.