TAG: GS 3: ECONOMY

THE CONTEXT: The findings from the paper released by the World Inequality Lab shed light on the alarming levels of income and wealth inequality in India.

EXPLANATION:

- The study reveals a historical high in the concentration of wealth and income among the top 1% of earners, surpassing even global benchmarks.

- It emphasizes the need for comprehensive tax reform and broad-based public investments to address this disparity.

Key Insights from the Paper

- Historical Highs in Income and Wealth Shares:

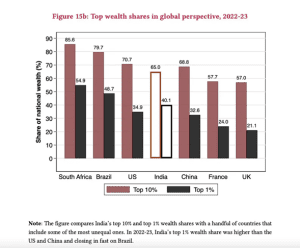

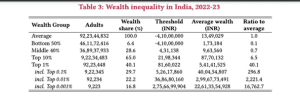

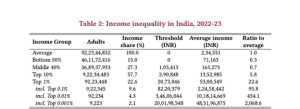

- By 2022-23, the top 1% income share in India reached 22.6%, while the top 1% wealth share rose to 40.1%, marking historical highs.

- These levels of inequality place India among the top-ranking countries globally, surpassing even South Africa, Brazil, and the US in income concentration.

- Wealth Concentration within the Top 1%:

- Wealth concentration within the top 1% is staggering, with 39.5% of the nation’s wealth held by this elite group.

- Within this top 1%, significant disparities exist, with a substantial portion of wealth (29 percentage points) held by the top 0.1%.

- Decline in Inequality Post-Independence:

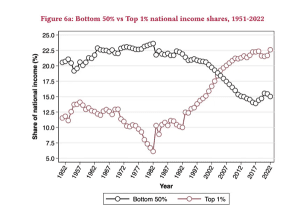

- The paper notes a decline in inequality post-independence until the early 1980s, followed by a steady rise, particularly since the early 2000s.

- The rise in inequality has been particularly pronounced in terms of wealth concentration since 2014-15.

- Impact on Bottom 50% and Middle 40%:

- The rise in top-end inequality has come at the expense of the bottom 50% and middle 40%, whose share of national income has dwindled over the years.

- Despite economic growth, these segments have seen stagnating or declining income shares, reflecting a skewed distribution of economic gains.

- Regressive Tax System:

- The paper suggests evidence that the Indian tax system may be regressive when viewed from the lens of net wealth, exacerbating income and wealth disparities.

- It calls for a restructuring of the tax code to address both income and wealth inequality, proposing a “super tax” on the net wealth of the wealthiest families.

- Need for Public Investments:

- To counteract inequality and ensure broader benefits from globalization, the paper emphasizes the necessity of broad-based public investments in health, education, and nutrition.

- It argues that such investments not only address inequality but also create valuable fiscal space for social welfare programs.