THE CONTEXT: Cooperatives in India play a vital role in the socio-economic development of the country by addressing the needs of various sectors, including agriculture, banking, credit, marketing, and more. However, the cooperative sector in India has faced various serious challenges in recent years as evident by the PMC Bank crisis in 2019 or the very recent case of financial irregularities in the Karuvannur Service Cooperative Bank, Kerala. The following article attempts to explore the various ills surrounding the cooperative sector in India and suggest ways to reform it from the UPSC perspective.

WHAT IS A COOPERATIVE SOCIETY?

- According to the International Cooperative Alliance, a cooperative is an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democratically controlled enterprise.

- Cooperatives, as business enterprises, have fundamental concerns like ownership and control, but these concerns are directly held by the consumers or users. As a result, they adhere to a set of overarching principles that go beyond mere profit generation. While they aim for profitability, it is balanced by the well-being of their members and the broader community’s interests.

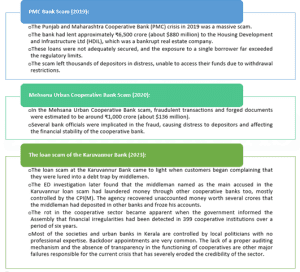

INSTANCES IN THE PAST HIGHLIGHTING THE ROT IN THE COOPERATIVES SECTOR

The Department of Financial Services on July 31, 2023, disclosed alarming figures related to fraudulent activities in the cooperative banking sector. According to their data, cooperative banks across the country reported a staggering total of 4,135 frauds during the last five years, with an involved amount reaching Rs 10,856.7 crore. As of June 14, 2023, the total number of cooperative banks in the country stands at 1,886, comprising 1,500 urban cooperative banks and 386 rural cooperative banks.

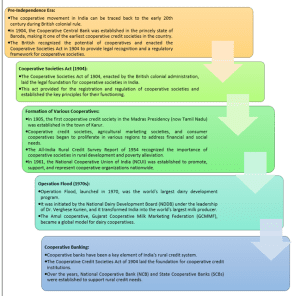

TRACING THE HISTORY OF COOPERATIVES IN INDIA

LAWS UNDER WHICH COOPERATIVE SOCIETIES CAN BE REGISTERED IN INDIA

In India, different types of cooperatives need to register under various laws based on their nature and functions. Here are some of the key laws under which different types of cooperatives are required to register:

- Multi-State Cooperative Societies Act, 2002: Multi-State Cooperative Societies register under this act when they operate in multiple states. This law governs their formation and operation, ensuring uniformity in their functioning across different regions.

- Cooperative Societies Act of the respective State: Most cooperative societies, including agricultural credit societies, housing cooperatives, and non-agricultural credit societies, register under the cooperative societies act of the respective state they are located in. Each state has its own cooperative societies act that governs the registration and functioning of these societies.

- Banking Regulation Act, 1949: Cooperative banks, including urban cooperative banks (UCBs), register under the Banking Regulation Act, 1949, and the Banking Laws (Co-operative Societies) Act, 1955. They are broadly divided into Urban and Rural cooperative banks. This act empowers the Reserve Bank of India (RBI) to regulate and supervise cooperative banks in India.

Cooperative banks are financial institutions established by individuals from the same local or professional community or those who share a common interest. These individuals come together and create a cooperative society under the legal framework of the Cooperative Societies Act. When such a cooperative society ventures into the field of banking, it is referred to as a Cooperative Bank. Before commencing banking operations, the society is required to acquire a license from the Reserve Bank of India (RBI).

- The National Cooperative Development Corporation (NCDC) Act, 1962: Cooperative societies seeking financial assistance and development support from the National Cooperative Development Corporation (NCDC) need to register under this act to access NCDC’s services and resources.

- State Cooperative Marketing Acts: Marketing cooperatives, often known as Agricultural Produce Marketing Committees (APMCs) or similar entities, register under the State Cooperative Marketing Acts. These acts govern the marketing and distribution of agricultural produce.

- The National Bank for Agriculture and Rural Development (NABARD) Act, 1981: Cooperative credit institutions, especially those in the agricultural sector, register under the NABARD Act to avail financial and developmental assistance from NABARD.

- State Specific Acts and Regulations: Some specific types of cooperatives may be governed by state-specific acts and regulations. For example, cooperative housing societies in Maharashtra register under the Maharashtra Cooperative Societies Act, 1960, and the Maharashtra Ownership Flats (Regulation of the Promotion of Construction, Sale, Management, and Transfer) Act, 1963.

EXTENT OF POWERS OF THE RBI & STATE GOVERNMENTS IN THE REGULATION OF COOPERATIVE SOCIETIES

Reserve Bank of India (RBI):

- Urban Cooperative Banks (UCBs): The RBI has significant regulatory powers over UCBs. It issues licenses for the establishment of UCBs and provides them with guidelines for their operations. The RBI also conducts inspections and audits of UCBs to ensure their compliance with banking regulations. For example, the RBI can issue directions to UCBs to rectify deficiencies, freeze assets, or supersede the board of directors in cases of financial distress.

- Policy Formulation: The RBI plays a role in formulating policies related to cooperative banks, which includes setting guidelines for capital adequacy, asset classification, income recognition, and provisioning.

- Resolution and Amalgamation: The RBI has the authority to take corrective measures, such as supersession of the board and imposition of restrictions, to address financial distress in UCBs. It also encourages amalgamation and restructuring of weak UCBs. For example, the amalgamation of Rupee Cooperative Bank with Saraswat Cooperative Bank in 2013.

State Governments:

- Registration and Governance: State governments are primarily responsible for the registration and governance of cooperative societies. They enact Cooperative Societies Acts that define the legal framework for the formation, registration, and operation of cooperatives.

- Registrar of Cooperative Societies: State governments appoint a Registrar of Cooperative Societies who is responsible for granting registration to cooperative societies, ensuring their compliance with state laws, and overseeing their governance. The Registrar has the authority to grant or cancel the registration of cooperative societies.

- Agricultural Cooperatives: State governments regulate and support agricultural cooperatives, particularly Agricultural Produce Marketing Committees (APMCs), which play a crucial role in marketing agricultural produce.

- Housing Cooperative Societies: The formation, governance, and dispute resolution related to housing cooperative societies are largely under state government jurisdiction. They enforce laws such as the Maharashtra Cooperative Societies Act, 1960, to govern these societies. The rules for housing societies differ from one state to another, based on the respective state’s Cooperative Societies Act.

- Financial Cooperatives: State governments also regulate certain financial cooperatives, especially rural cooperative banks. These institutions are subject to the rules and regulations specified in the state’s Cooperative Societies Act. For example, the Kerala State Cooperative Bank operates under the regulatory framework of the Kerala Cooperative Societies Act.

In summary, while the RBI has a predominant regulatory role in overseeing UCBs at the national level, state governments hold substantial regulatory powers when it comes to the registration and governance of various types of cooperative societies. State governments define the legal framework, appoint registrars, and regulate cooperative societies based on their specific Cooperative Societies Acts. Cooperative societies in India are thus subject to a dual regulatory framework, with each entity overseeing aspects within its jurisdiction.

CONSTITUTIONAL PROVISIONS REGARDING COOPERATIVE SOCIETIES

The Indian Constitution contains several provisions that pertain to cooperative societies and their governance. While the Constitution does not explicitly define cooperative societies or provide detailed guidelines for their formation and functioning, it does lay the foundation for the legal framework through various principles and articles

- Article 19(1)(c): This provision falls under the Right to Freedom, and it grants Indian citizens the right to form associations or unions, including cooperative societies. It ensures the freedom to establish and operate cooperatives without undue government interference.

- Article 43-B (Directive Principles of State Policy): Article 43-B was inserted into the Constitution through the 97th Amendment in 2011. It emphasizes the promotion of cooperative societies, especially those in rural areas, as a means of economic and social development. The state is directed to encourage and support these cooperatives.

- Article 243-ZT (Part IX-B of the Constitution): This article is part of the provisions related to the Panchayats in rural areas. It recognizes the importance of cooperative societies and empowers Panchayats to take measures to strengthen and promote them.

- Article 243-ZV (Part IX-B of the Constitution): This article, related to the Panchayats as well, states that Panchayats can levy taxes, duties, tolls, and fees for various purposes, including promoting cooperative societies.

- Article 243-ZW (Part IX-B of the Constitution): This article allows for the delegation of powers and responsibilities to Panchayats by the state legislature, including those pertaining to cooperative societies. It emphasizes local self-governance and management of resources.

- In Schedule 7 as Entries 43 and 44 in the Union list and Entry 32 in the State list

IMPORTANCE OF COOPERATIVE BANKS IN INDIA

Financial Inclusion and Rural Development

- Cooperative banks are often the primary source of banking services in rural and semi-urban areas where commercial banks may not have a significant presence. They facilitate financial inclusion by bringing banking services to remote regions.

- Example: Regional Rural Banks (RRBs) in India, which have a cooperative bank structure, have been instrumental in providing banking services to underserved areas.

- It has an extensive branch network all over the country, making credit easily available even to rural areas. It accounts for 67 per cent of total rural credit.

Agricultural Lending

- Cooperative banks are at the forefront of providing credit to the agricultural sector, supporting farmers with agricultural loans, crop loans, and allied activities.

- According to the Reserve Bank of India (RBI), cooperative banks contribute a significant share of agricultural credit in the country.

- Example: The Gujarat State Cooperative Agricultural and Rural Development Bank Limited (GSCARDB) has played a pivotal role in promoting agricultural activities in the state.

- The National Cooperative Database (NCD) has mapped 2.5 lakh primary agricultural, dairy, and fishery societies and over five lakh societies in the remaining sectors.

Savings Mobilization

- Cooperative banks encourage savings in rural and urban areas, fostering a culture of thrift and financial discipline.

- They offer savings accounts with attractive interest rates and serve as a secure place for individuals to deposit their savings.

- Example: Kerala State Co-operative Bank is known for its robust savings products, attracting depositors from different walks of life.

Credit to Small and Medium Enterprises (SMEs)

- Cooperative banks often focus on providing credit to small and medium-sized enterprises (SMEs) and micro-enterprises, supporting entrepreneurship and economic development.

- Example: The Tamil Nadu State Apex Cooperative Bank (TNSCB) provides financial assistance to SMEs, promoting economic growth in the state.

Support for Women Empowerment

- Women’s cooperative banks and self-help groups (SHGs) supported by cooperative institutions have empowered women economically and socially.

- These initiatives provide women with access to credit, allowing them to engage in income-generating activities.

- Example: Mann Deshi Mahila Sahakari Bank in Maharashtra, a women’s cooperative bank, empowers rural women by providing financial services tailored to their needs.

Community Development

- Cooperative banks are deeply rooted in their communities and often engage in various social and community development initiatives.

- They support local development projects, educational programs, and healthcare services.

- Example: The Kerala State Co-operative Agricultural and Rural Development Bank (KSCARDB) is involved in community initiatives, including projects related to agriculture, education, and rural infrastructure.

Stabilizing the Financial System

- Cooperative banks provide stability to the financial system by offering a safe place for deposits and promoting financial intermediation in underserved areas.

- They complement the services of commercial banks and prevent financial exclusion in various regions.

- Example: Urban Cooperative Banks (UCBs) in cities like Mumbai provide banking services to urban populations and serve as important pillars of the financial system.

Empowering Local Governance

- Cooperative banks often work closely with local bodies and panchayats, promoting cooperative federalism and decentralized financial management.

- They strengthen local governance by supporting rural development projects at the grassroots level.

- Example: Cooperative banks collaborate with Gram Panchayats in West Bengal to implement various development programs and uplift rural areas.

Job Creation

- Cooperative banks create employment opportunities in both urban and rural areas, fostering economic growth.

- They generate jobs for banking professionals, support staff, and other ancillary roles.

- Example: Cooperative banks often employ local residents, providing livelihoods in areas where employment opportunities may be limited.

Economic Diversification

- Cooperative banks diversify economic activities by providing financial services to a wide range of sectors, including agriculture, housing, education, and more.

- This diversification contributes to the overall economic stability and development of the regions they serve.

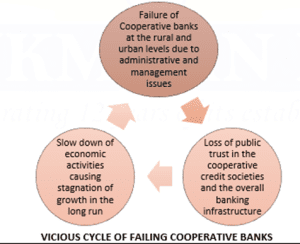

ISSUES SURROUNDING COOPERATIVE BANKS IN INDIA

Financial Mismanagement and Scams

- Several cooperative banks and credit societies have been involved in financial mismanagement and scams, leading to significant losses for depositors and members.

- For instance, the PMC Bank crisis in 2019, where the Punjab and Maharashtra Cooperative Bank faced a massive financial fraud, left thousands of depositors in distress.

Lack of Transparency and Accountability

- Transparency and accountability within many cooperatives have been questioned.

- Audits of cooperative banks are often conducted by government officials and are neither regular nor comprehensive. Delays in audit processes and the submission of reports are common. The lack of transparent financial reporting and auditing practices has raised concerns about the safety of members’ investments.

Political Interference

- Political interference in the management and functioning of cooperatives is a persistent issue. Many cooperatives are influenced by political leaders, which can lead to mismanagement and inefficiency.

- Many of them are in cooperatives because they want to use this position as a steppingstone for their political ambitions.

Rural-Urban Divide

- There is a significant divide between urban and rural cooperatives in terms of access to resources, technology, and government support. Rural cooperatives often face more challenges in accessing credit, markets, and infrastructure.

Poor Management and Lack of Professionalism (on part of RBI & leadership in respective Cooperative societies/banks)

- Many cooperatives lack professional management and governance. This results in inefficiencies and a lack of competitiveness. The absence of skilled professionals in leadership positions can hinder the growth of cooperatives.

- Previously, UCBs were subject to dual regulation by both the state registrar of societies and the Reserve Bank of India (RBI). However, in 2020, the RBI took over the supervision of all UCBs and multi-state cooperatives.

- Even after RBI’s supervision, scams and corruption continue to take place as seen in the recent Karuvannur Service Cooperative Bank in Thrissur, Kerala.

- Cooperatives have sometimes been used for regulatory arbitrage, circumventing lending and anti-money laundering regulations. Notably, the investigation into the Punjab and Maharashtra Cooperative (PMC) Bank scam revealed severe financial mismanagement and a breakdown of internal control mechanisms.

Poor lending standards

- The RBI’s report indicated a significant decline in agricultural lending by UCBs. While these banks once played a crucial role in this sector, their share in total agricultural lending has decreased significantly, from 64% in 1992-93 to just 11.3% in 2019-20.

Competition and Technology Challenges

- Cooperative sectors such as retail and consumer cooperatives are facing stiff competition from e-commerce platforms and modern retail chains. Adapting to changing consumer preferences and technology is a challenge.

- Evolving trends in the financial sector, including the rise of microfinance, FinTech companies, payment gateways, e-commerce firms, and Non-Banking Financial Companies (NBFCs), pose challenges to the continued presence of Urban Cooperative Banks (UCBs). UCBs are often small in size, lack professional management, and have limited geographic diversity in their operations.

Crisis of the non-performing assets (NPAs)

- Many of the co-operative banks have higher Non-Performing Assets (NPA) than commercial banks. This is because co-operative institutions have the leeway to extend credit to local consumers, often on the basis of trust or compassion or due to pressure from local social or political groups. Reserve Bank of India (RBI) governor has also expressed concern over high gross non-performing assets (GNPA) ratio of 8.7% in urban cooperative banks (UCBs).

STEPS TAKEN BY THE GOVERNMENT TO PROMOTE COOPERATIVE SECTOR IN INDIA

ADMINISTRATIVE & POLICY STEPS

Ministry of Cooperation

A new Ministry of cooperation has been created to streamline the cooperative sector in India. It provides a separate administrative, legal and policy framework mechanism for strengthening the cooperative sector in the country

Tax Benefits and Incentives

Tax benefits and incentives are offered to cooperative societies. For instance, under Section 80P of the Income Tax Act, cooperative societies enjoy tax exemptions on their income.

Support for Women’s Cooperatives

The government encourages the formation of women’s cooperative societies and self-help groups (SHGs). These entities empower women economically and socially. An example is the National Rural Livelihood Mission (NRLM), which promotes the creation of SHGs.

Credit Facilities and Interest Subsidies

Various government programs offer credit facilities and interest subsidies to cooperative societies. For instance, the National Cooperative Development Corporation (NCDC) provides financial assistance to cooperatives in different sectors.

Training and Capacity Building

The National Cooperative Union of India (NCUI) and the National Bank for Agriculture and Rural Development (NABARD) conduct training programs to enhance the skills and knowledge of cooperative bank staff, ensuring they are well-equipped to meet modern banking requirements.

Promotion of Agricultural Cooperatives

- The government actively promotes agricultural cooperatives, which are instrumental in providing credit and marketing support to farmers. One of the notable examples is the National Agriculture Cooperative Marketing Federation of India (NAFED), which procures and markets agricultural produce on behalf of farmers.

- The government has actively promoted the formation of Farmer Producer Organizations to improve the income and livelihood of farmers. FPOs are essentially cooperative structures that allow farmers to collectively engage in agricultural and marketing activities.

LEGISLATIVE STEPS

Implementation of the 97th Amendment

The 97th Amendment to the Constitution in 2011 gave cooperatives a constitutional status and emphasized democratic functioning and accountability within these organizations. This amendment aimed to promote transparency and strengthen the cooperative movement in the country.

Increasing RBI oversight

In June 2020, the Central government passed an Ordinance to place all urban and multi-state cooperative banks directly under the regulatory oversight of the RBI.

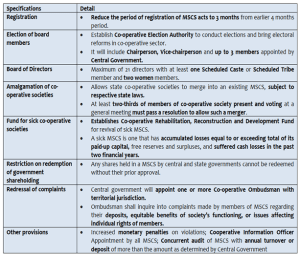

The Multistate Cooperative Societies Amendment Act, 2022

It amends the Multi-State Cooperative Societies Act, 2002, To enhance transparency, accountability, improve ease of doing business, and promote better financial discipline among multi-state cooperatives.

STEPS TAKEN BY RBI

Regulatory oversight

- In January 2020, the Reserve Bank of India (RBI) updated the Supervisory Action Framework (SAF) for Urban Cooperative Banks (UCBs).

- In 2021, the RBI established a committee that proposed a four-tier structure for UCBs.

Amalgamation and strengthening

The Reserve Bank of India (RBI) has been actively encouraging the amalgamation of weak cooperative banks to improve their financial health. It also provides financial assistance and regulatory guidance to strengthen these banks.

Prudential Norms and Regulations

RBI has introduced prudential norms and regulations for cooperative banks to ensure their financial stability and protect depositors’ interests. This includes measures for asset classification, income recognition, and provisioning. Also, there’s regulatory oversight over the earmarked priority sector lending commitments.

Technology Adoption

Cooperative banks are encouraged to adopt modern technology for efficient operations and better customer service. This includes the use of core banking solutions, online banking, and digital payment systems.

THE WAY FORWARD

- High Powered Committee on Co-operatives (2009) had recommended that central government should create a National Co-operative Rehabilitation and Institutional Protection Fund to revive sick units and states should contribute to the fund.

- In 2015, a committee headed by R. Gandhi, a former deputy governor at the Reserve Bank of India (RBI), suggested a series of governance reforms for the cooperative banking sector. Some of these recommendations included:

- Enhanced RBI Oversight: Strengthening the RBI’s control and supervision over cooperative banks. This entails providing the RBI with greater authority and involvement in overseeing the functioning of these banks.

- Professional Management: Advocating for professional management of these banks, similar to the corporate banking sector. This implies granting the board of directors’ powers akin to those held by directors in commercial banks, allowing them to independently assess and supervise the bank’s operations. The board should have the authority to question the representation of shareholders.

- Amendments to Banking Regulation Act, 1949: Proposing changes to the Banking Regulation Act, 1949, to expand the RBI’s authority to wind up and liquidate banks without the involvement of other regulators, particularly under the cooperative societies’ laws.

- Conversion to Small Finance Banks: Recommending that cooperative banks be permitted to convert into small finance banks under RBI regulations, provided they meet specific criteria and conditions.

- Establishment of an Umbrella Organization: Suggesting the creation of an overarching organization responsible for supervising and coordinating the activities of all cooperative banks. This organization should report directly to the RBI, thus subjecting it to more rigorous control.

- The Multistate Cooperative Societies Amendment Act, 2022, was long due as there was no centralized legislation for multistate cooperatives Which were reeling under mismanagement and misuse of funds. However, the government must look towards creating a more decentralized and autonomous ground for the cooperative societies by overcoming centralizing provisions in the amendment bill.

- Cooperative societies must be brought under the purview of the RTI act to ensure greater efficiency and transparency in the overall functioning and management.

- Steps should be taken to implement regular audits from autonomous bodies and also make ground for efficient social audits of various policies and fund allocation by the stakeholders of respective cooperative societies.

- The 2nd report of Administrative Reforms Commission (ARC) recommended that under Article 19, 19(1)(h) may be added as follows: “(h) to form and run cooperatives based on principles of voluntary and open membership, democratic member control, member economic participation, and autonomous functioning free from State control.” This would ensure more transparency and autonomy to cooperative structure in India.

THE CONCLUSION: In summary, cooperative banks in India are not just financial institutions; they are essential pillars of economic development, financial inclusion, and community empowerment. Their contributions to agricultural lending, rural development, financial inclusion, and social development are instrumental in shaping India’s economic landscape. With a strong focus on cooperative principles and community well-being, these banks continue to play a pivotal role in India’s journey towards economic growth and social equity. Thus, only a prudent, proficient and transparent cooperative banking sector can fulfill the aim of financial inclusivity in India.

QUESTIONS:

Q.1 “Cooperative banks should focus more on the quality of governance, which is based on three pillars of compliance, risk management, and internal audit.” Analyse the statement in the light of recent scams surrounding the cooperative banking system in India.

Q.2 “The Indian cooperative sector suffers from regulatory inflation and multiplicity of control at various levels of government.” Critically analyze

ADDITIONAL INFORMATION

EXAMPLES OF SUCCESSFUL COOPERATIVE IN INDIA:

- Amul (Gujarat Cooperative Milk Marketing Federation Ltd):

o Type: Dairy Cooperative

o Success Story: Amul is one of India’s most iconic cooperatives, bringing together millions of dairy farmers in Gujarat. It has empowered farmers by providing a platform to market their milk and dairy products collectively. Amul is a symbol of cooperative success, significantly improving the livelihoods of its members.

o Amul, with over 3.6 million milk producer members, has become the world’s largest producer of milk and milk products. It processes around 23 million liters of milk daily and has increased the income of dairy farmers significantly.

- Indian Farmers Fertilizer Cooperative Limited (IFFCO):

o Type: Agricultural Cooperative

o Success Story: IFFCO is one of the world’s largest fertilizer cooperatives, catering to the agricultural needs of farmers across India. It has been instrumental in providing quality fertilizers, agricultural inputs, and education to promote sustainable farming practices.

o IFFCO, owned by over 36,000 member cooperatives, is the largest fertilizer cooperative in the world. It produces more than 8 million metric tons of fertilizers annually, directly benefiting millions of farmers in India.

- Indian Cooperative Movement (ICM):

o Type: Cooperative Union

o Success Story: The Indian Cooperative Movement is a federation of cooperatives working to promote cooperative values and principles. It plays a vital role in coordinating the activities of various cooperative societies in India, fostering cooperation and development.

o The Indian Cooperative Movement is an umbrella organization representing over 600,000 cooperatives in India. It plays a pivotal role in coordinating cooperative activities across sectors, contributing to the livelihoods of millions.

- SEWA (Self-Employed Women’s Association):

o Type: Women’s Cooperative

o Success Story: SEWA is a renowned women’s cooperative that empowers self-employed women across various sectors, including agriculture, crafts, and small businesses. It provides access to financial services, skill development, and advocacy, improving the socio-economic status of women.

o SEWA, with a membership of nearly 2 million self-employed women, provides access to financial services, healthcare, and employment opportunities. It has been instrumental in improving the economic status of women in India.

- Punjab State Cooperative Bank (PSCB):

o Type: Cooperative Bank

o Success Story: The Punjab State Cooperative Bank is a prominent cooperative bank that serves the financial needs of farmers and the rural population in Punjab. It offers agricultural credit, savings accounts, and other banking services, contributing to the economic well-being of its members.

o PSCB serves over 4,000 primary cooperative societies and millions of farmers in Punjab. It has provided agricultural credit amounting to hundreds of crores of rupees, supporting agricultural activities and rural development in the state.

These examples represent the diversity and success of cooperative societies in India, embodying the core cooperative principles of self-help, democratic governance, and the collective pursuit of common economic and social objectives.

The Multistate Cooperative Societies (MSCSs) Amendment Bill, 2022

Key issues regarding the bill:

- The bill is said to be culminating into the concentration of power of the central government, which may impact the autonomy and free functioning of multistate cooperative societies creating a potential for their misuse.

- Granting veto powers to the central and state governments over the redemption of their shareholding could potentially undermine the principle of Democratic member control and organizational autonomy which form the essence of cooperative societies.

- It imposes financial burden on successful cooperatives to support struggling ones which can potentially undermine growth capacity of well-functioning cooperatives.

Task Force on Revival of Cooperative Credit Institutions (2004)

- Formed by the honorable Prime Minister in the year 2004 for the revival of cooperatives in India, so as to holistically overcome the various challenges they face.

- Based on the recommendations of the above task force, the Union Government has introduced The Constitutional (One Hundred and Sixth Amendment) Bill, 2006 in the Parliament on 22nd May, 2006.

- The Task Force on the Revival of Cooperative Credit Institutions in its Report (December, 2004) examined the enabling legislations for cooperatives in detail and suggested a Model Mutually Aided Cooperative Societies Act to be adopted by all the States. The salient features of the draft model law suggested by the Task Force are as under:

o The law is based on internationally accepted principles of cooperation and ensures that cooperatives function in a democratic manner.

o The model law is member-centric. It ensures that members are in control of their organisation, and that they can hold accountable those they elect. It places responsibilities on members, and it gives them the right to manage their own affairs, based on the responsibilities that they choose to fix for themselves.

o It places responsibilities on elected Directors in such a manner, that elected positions are positions of responsibility and not only of power and authority. Accountability of the Directors to the General Body is in-built, and any lapse is treated seriously. A Director’s behaviour is expected to be reported to the General Body for its scrutiny.

o The Model Law makes it clear that cooperative societies are not the creatures of the State–nor are they statutory creatures. Membership in these societies is voluntary and therefore as in the case of Companies, Societies, Trade Unions, and unincorporated Associations, elections should be an internal affair of each organisation.

o For similar reasons, an Audit Board is not envisaged under this law. The General Body of each cooperative society will appoint an auditor, and the responsibilities of the auditor have been made explicit. Presentation of copies of the audited statements of accounts for the previous year, along with audit objections, to each member has been made compulsory.

o Recruitment of staff will be the responsibility of each cooperative society. Common cadres and recruitment boards are not envisaged. Just as other forms of citizens’-organisations (Companies, Societies, Trade Unions, unincorporated Associations) take responsibility for staff recruitment and personnel management, cooperative societies too should have the right to make all staff related decisions. Labour laws are expected to apply.

o Profit (surplus) and loss (deficit) are to be shared among members. Cooperatives are expected to be professionally managed in the truest sense of the phrase, as Directors have to face their General Body each year and recommend surplus/ deficit sharing to members.

o The law envisages creation of cooperative societies based on mutual aid and trust amongst members. While cooperative societies are permitted to accept member savings and deposits, and borrowings from others, they are not permitted to accept savings from non-members. In case a cooperative wish to accept public (non-voting member) deposits, it will need to be licensed by the RBI and follow such other regulatory norms as prescribed by the RBI.

o The manner of recovery of dues from members is required to be in-built in the Articles of Association.

Spread the Word