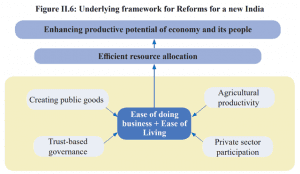

THE CONTEXT: Indian economy has undergone a transformative process of New Age reforms in the last eight years. These diverse policies converge towards improving the economy’s overall efficiency and lifting its potential growth. To achieve the broader policy goal of unleashing the productive potential of the economy and its people, the reforms aimed at enhancing the ease of living and doing business at the fundamental level. The use of technology, in particular digital technology, forms the basis of these reforms.

PRODUCT AND CAPITAL MARKET REFORMS

INITIATION OF THE REFORMS- 1991

- The macroeconomic imbalances of the late 1980s and early 1990s pushed the government towards introducing the structural reforms of 1991. The high combined deficit of the central and state governments elevated inflationary pressures, and large and unsustainable current account deficit (CAD) led to a balance of payments crisis in the Indian economy. In response to the situation, trade and investments were liberalized in 1991.

CONTINUITY IN REFORMS WITH A RENEWED IMPETUS

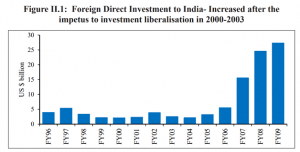

- The product and capital market reforms continued slowly over the decade of the 1990s. They got a renewed impetus from the government closer to the decade’s end. Investments were liberalized further to encourage Foreign Direct Investment as a main source of non-debt-creating capital inflows.

- The telecom sector was entirely reformed by the New Telecom Policy of 1999. It was opened for private sector participation with a strengthened regulatory regime through TRAI (Telecom Regulatory Authority of India).

- These reforms were a cornerstone for the IT sector boom in India and had widespread spillover benefits to other sectors of the economy. The policy on disinvestment and privatization also gathered steam during this period.

- This period also marked the launch of the then largest infrastructure project of independent India, the ‘Golden Quadrilateral’.

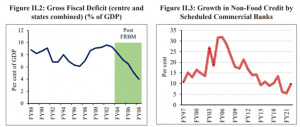

- The Fiscal Responsibility and Budget Management (FRBM) Act, 2003 was passed to address the historic highs of the combined Gross fiscal deficit of the Government.

- The banking system, which had accumulated bad debts during the period of economic resurgence after the 1991 reforms, was supported through the deregulation of interest rates and the enactment of the SARFAESI Act 2002.

ONE-OFF SHOCKS OVERSHADOWED THE REFORMS OF 1998-2002

- The sanctions imposed by the US on India after India’s nuclear test led to a sharp decline in capital flows to India during the months following the nuclear tests.

- The period between 2000 and 2002 also witnessed two successive droughts.

INDIA’S PARTICIPATION IN THE GLOBAL BOOM OF 2003-08

- The years of structural reforms had prepared the Indian economy to contribute to global growth and also benefit from it. While the global growth averaged 4.8 per cent during 2003-2008, the Indian economy grew at more than 8 per cent on average. The economic growth during the period was supported by strong capital inflows.

REFORMS FOR NEW INDIA- SABKA SAATH SABKA VIKAAS

- The reforms undertaken before 2014 primarily catered to product and capital market space. They were necessary and continued post-2014 as well. The present government, however, imparted a new dimension to these reforms in the last eight years.

- The broad principles behind the reforms were creating public goods, adopting trust-based governance, co-partnering with the private sector for development, and improving agricultural productivity.

- While the reforms undertaken in the post-2014 period have multiple socioeconomic benefits for the economy, this chapter focuses on the growth-centric aspects of these reforms.

- Creating public goods to enhance opportunities, efficiencies and ease of living

- A quantum leap in policy commitment and outlay for infrastructure is now visible in the last few years, cushioning economic growth when the non-financial corporate sector was unable to invest due to balance sheet troubles. In doing so, the government has laid a good platform for crowding in private investments and growth in the coming decade.

- With the National Infrastructure Pipeline (NIP) in 2019 and the National Monetization Pipeline in 2021, a strong baseline for infrastructure creation and development has been put in place, providing a multitude of opportunities for foreign investment and engagement.

- Besides the push to physical infrastructure, the government’s emphasis on developing public digital infrastructure during the last few years has been a game changer in enhancing the economic potential of individuals and businesses.

- Based on the pillars of a digital identity Aadhar, linking bank accounts with PM-Jan Dhan Yojana, and the penetration of mobile phones (JAM Trinity), the country has witnessed significant progress in financial inclusion in recent years.

- Unified digital interfaces that connect various initiatives/portals have simplified governance resulting in a more efficient resource allocation in the economy. The National Single Window System for business approvals, the JanSamarth portal for credit-linked Central Government scheme, and the UMANG app for access to Central and state government services are essential steps towards enhancing the ease of doing business through the integration of existing systems.

- eShram portal, with more than 28.5 crore registered workers, has been integrated with various other digital portals for easy accessibility. PM Gatishakti, the GIS-based platform that brings together multiple ministries for integrated planning and coordinated implementation of multimodal infrastructure connectivity projects, aims to reduce logistics costs.

- Trust-based Governance

- Building trust between the government and the citizens/businesses unleashes efficiency gains through improved investor sentiment, better ease of doing business, and more effective governance.

- Consistent reforms have been made in this direction during the last eight years. Simplification of regulatory frameworks through reforms such as the Insolvency and Bankruptcy Code (IBC) and the Real Estate(Regulation and Development) Act (RERA) have enhanced the ease of doing business.

- The IBC has imbibed some of the best international practices of asset resolution mechanism.

- Another significant reform to enhance doing business has been the decriminalization of minor economic offences under the Companies Act of 2013.

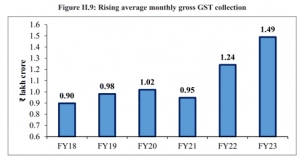

- Tax policy reforms such as adopting a unified GST, reducing corporate tax rates, exemption of sovereign wealth funds and pension funds from taxes, and removing the Dividend Distribution tax have reduced the tax burden on individuals and businesses.

- Despite tax rationalization, a positive trend of higher tax buoyancy is visible in the economy.

- CBDT and CBIC on an automatic and regular basis is a promising reform, and it would result in efficiency gains in the tax system.

III. Promoting the private sector as a co-partner in the development

- A fundamental principle behind the government’s policy in the post- 2014 period has been the engagement with the private sector as a partner in the development process.

- The government’s disinvestment policy has been revived in the last eight years with stake sales and the successful listing of PSEs on the stock market.

- Significant initiatives have been introduced under Aatmanirbhar Bharat and Make in India programmes to enhance India’s manufacturing capabilities and exports across the industries.

- Sector-specific Production Linked incentives (PLI) have been introduced in the aftermath of the pandemic to incentivize domestic and foreign investments and to develop global Champions in the manufacturing industry.

- The last eight years have seen further liberalization of the policy towards foreign investors, with most sectors now open for 100% Foreign Direct Investment (FDI) under the automatic route.

- The government is developing infrastructure for making India a cost-effective production hub.

- The National Logistics Policy (2022) has been launched to create an overarching logistics ecosystem for lowering the cost of logistics and bringing it to par with other developed countries.

- The number of recognized Start-ups has increased from 452 in 2016 to 84,012 in 2022.

- Support measures for MSMEs during the pandemic in the form of the Emergency Credit Line Guarantee Scheme (ECLGS) and revision in the definition of MSMEs under the ambit of Aatmanirbhar Bharat helped them face the crisis shock.

- Enhancing productivity in agriculture

- The agriculture sector in India has grown at an average annual growth rate of 4.6 per cent during the last six years. This growth is partly attributable to good monsoon years and partly to the various reforms undertaken by the government to enhance agricultural productivity.

- Policies such as Soil Health Cards, the Micro irrigation Fund, and organic and natural farming have helped the farmers optimize resource use and reduce the cultivation cost.

- The promotion of Farmer Producer Organisations (FPOs) and the National Agriculture Market (e-NAM) extension Platform have empowered farmers, enhanced their resources, and enabled them to get good returns.

- Agriculture Infrastructure Fund (AIF) has supported the creation of various agriculture infrastructures. Kisan Rail exclusively caters to the movement of perishable Agri Horti commodities.

- The Cluster Development Programme (CDP) has promoted integrated and market-led development for horticulture clusters.

RETURNS TO THE ECONOMIC AND STRUCTURAL REFORMS AFTER 2014

SHOCKS THAT THE ECONOMY FACED DURING 2014-22

- As per data from the Bank for International Settlements, India’s non-financial private sector debt to GDP ratio went up from 72.9 per cent in March 2004 to 113.6 per cent by December 2010. That is an increase of 40.7 percentage points in just over six years.

- In rupee terms, the amount of debt accumulated by the non-financial sector went up from nearly 44 lakh crore to almost 133 lakh crore. It trebled in six years.

- Despite limited economic reforms, global capital flows and optimism about BRICS (Brazil, Russia, India, China and South Africa) triggered a domestic credit and investment boom that eventually proved unsustainable, as the twin deficit – fiscal and external – crisis of 2013 revealed.

- Thereafter the non-financial private sector debt to GDP ratio began to come down meaningfully only from 2015 onwards, dropping to a low of 83.8 per cent by December 2018. That is nearly a 30-percentage point reduction from 113.6 per cent in December 2010 over eight years.

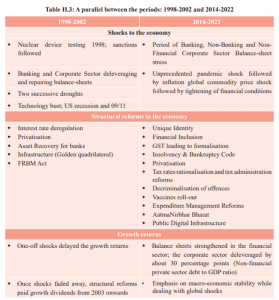

THE PERIOD 2014-2022 IS ANALOGOUS TO THE PERIOD 1998-2002

India’s recent economic history provides a similar parallel to this situation. During 1998- 2002, transformative reforms were launched but yielded lagged growth dividends.

GROWTH MAGNETS IN THIS DECADE (2023-2030)

- As the health and economic shocks of the pandemic and the spike in commodity prices in 2022 wear off, the Indian economy is thus well placed to grow at its potential in the coming decade, similar to the growth experience of the economy after 2003. This is the primary reason for expecting India’s growth outlook to be better than it was in the pre-pandemic years.

- The digitalization reforms and the resulting efficiency gains in terms of greater formalization, higher financial inclusion, and more economic opportunities will be the second most important driver of India’s economic growth in the medium term.

- The evolving geo-political situation also presents an opportunity for India to benefit from the diversification of global supply chains.

- While the new age reforms undertaken over the last eight years form the foundation of a resilient, partnership-based governance ecosystem and restore the ability of the economy to grow healthily, further reforms are needed to ensure that economic growth can both accelerate and be sustained at higher levels, to deliver a better quality of life.

THE CONCLUSION: The Indian economy had not lost its vigour, nor have government reform measures their effectiveness. The Indian economy could have grown faster in the absence of the financial and corporate sector balance sheet stress. We were now looking forward to the economy being able to reap the benefits of improved and healthier balance sheets in the new decade.

Spread the Word