1. ‘SENGOL’ TO BE INSTALLED IN THE NEW PARLIAMENT

TAGS: GS 1: ART AND CULTURE

THE CONTEXT: Prime Minister will install the ‘Sengol’, a historical sceptre from Tamil Nadu, in the new Parliament building which is scheduled to be inaugurated in May, 2023. The ‘Sengol’ was received by Independent India’s first Prime Minister from Lord Mountbatten to symbolically represent the transfer of power from the British and was later kept in a museum in Allahabad.

EXPLANATION:

Background:

- Rajagopalachari suggested that Ceremony that should be followed to symbolise the transfer of power from British to Indian hands should follow Chola model where the transfer of power from one king to another was sanctified and blessed by a high ruler.

- The symbol used was the handover of ‘sengol’ or sceptre from one king to his successor.

- It was the head of ancient Shaivite math Thiruvavaduthurai Aadeenam math that presented the Sengol to Indian Prime Minister in 1947.

- A golden sceptre was crafted by Vummidi Bangaru Chetty, a famous jeweller in the Madras Presidency.

Highlights of inauguration of new Parliament building:

- A group of musicians playing Tamil Nadu’s traditional instrument, the Nadaswaram, would lead the procession.

- Additionally, “Adheenams,” or priests from Shaivite mutts in Tamil Nadu, will be present in the Lok Sabha’s Well.

- The “Oduvars,” or Tamil temple singers, will lyrically recite the “Kolaru Padhigam” in the background as the Nadaswaram musicians enchant with their soulful music.

- The Sengol will be presented to the prime minister after this revered ceremony and placed in a glass case next to the Speaker’s seat in the House.

Sengol and its significance:

- It is derived from the Tamil word “Semmai”, meaning “Righteousness”.

- The sceptre measures five feet in length and has a ‘Nandi’ bull on top, symbolising justice.

- “Tamil kings had this sengol (a Tamil word for sceptre), which is a symbol of justice and good governance.

- The two great epics Silapathikaram and Manimekalai records the significance of a sengo

Oduvars or Tamil temple singers:

- The tradition of Oduvars is over 1,000 years old and the King Raja Raja Chola I set up grants for their services at temples.

- Rituals in Saivaite temples are considered incomplete without their singing Thirumuraigal: Thevaram and Thiruvachagam.

Nadaswaram

- Nadaswaram, sometimes known as nagaswaram, nadhaswaram, or nathaswaram is a prominent South Indian classical musical instrument resembling the western oboe.

- The Nadaswaram’s body is traditionally constructed of aacha tree, although bamboo, sandalwood, copper, bronze, ebony, and ivory are also used nowadays.

- It is played at practically all Hindu weddings and temples in the South Indian tradition and is regarded as particularly auspiciou

2. FORUM FOR INDIA-PACIFIC ISLANDS COOPERATION (FIPIC)

TAGS: GS 2: INTERNATIONAL RELATIONS

THE CONTEXT: Indian PM landed in the capital city of Port Moresby for his first visit to the country, and also is the first by any Indian prime minister, for the Forum for India-Pacific Islands Cooperation (FIPIC) summit, 2023.

EXPLANATION:

Forum for India-Pacific Islands Cooperation (FIPIC):

- FIPIC was launched by Indian Minsitry in Fiji in November 2014.

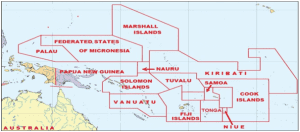

- FIPIC includes 14 island countries – Cook Islands, Fiji, Kiribati, Marshall Islands, Micronesia, Nauru, Niue, Palau, Papua New Guinea, Samoa, Solomon Islands, Tonga, Tuvalu, and Vanuatu – that are located in the Pacific Ocean, to the northeast of Australia.

Idea behind FIPIC:

- Despite their relatively small size and considerable distance from India, many of these islands have large exclusive economic zones (EEZs).

- India’s larger focus is on the Indian Ocean where it has sought to play a major role and protect its strategic and commercial interests.

- FIPIC initiative then marks a serious effort to expand India’s engagement in the Pacific region as well.

Exclusive Economic Zones (EEZs) is the distance up to which a coastal nation has jurisdiction over the ocean, including both living and non-living resources. It generally goes to 200 nautical miles or 230 miles (around 370 km) beyond a nation’s territorial sea.

1st FIPIC Summit:

- FIPIC-I took place in 2014 at Suva, Fiji’s capital city.

- India announced various development assistance initiatives and other cooperation projects in areas of climate change, trade, economy, telemedicine and teleeducation, IT, grants for community development projects, etc.

2nd FIPIC Summit:

- FIPIC-II took place in 2015 at Jaipur City, India.

- India approached the event from a large diplomatic perspective, calling for a “dedicated seat for Small Island Developing States in an expanded and reformed UN Security Council in both categories”.

- Seek for concrete and effective outcome on climate change conference at COP 21 in Paris t

India-Pacific Small Island Developing States (PSIDS) Leaders’ Meeting:

- It was held in 2019 comprising delegations of 12 out of the 14 Pacific Islands countries in New York on the sidelines of the 74th UN General Assembly.

- The Indian government then announced an allocation of $12 million grant ($1 million to each PSIDS) towards implementation of high-impact developmental projects in the area of their choice.

Initiatives by India at 3rd FIPIC summit 2023:

- Establishment of a super-specialty cardiology hospital in Fiji.

- Sea ambulances will be provided to all the 14 Pacific island countries.

- Similar to Jaipur Foot Camp, 2022 which was conducted in Fiji where prosthetic limbs were provided free of cost to people , similar camp will be set up in Papua New guinea this year and starting from 2024, two such camps will be organised every year in the Pacific island countries.

Small Island Developing States:

- Small Island Developing States (SIDS) are a distinct group of 37 UN Member States and 20 Non-UN Members/Associate Members of United Nations regional commissions that face unique social, economic and environmental vulnerabilities.

- The three geographical regions in which SIDS are located are: the Caribbean, the Pacific, and the Atlantic, Indian Ocean and South China Sea (AIS).

- SIDS were recognized as a special case both for their environment and development at the 1992 United Nations Conference on Environment and Development held in Rio de Janeiro, Brazil.

- The aggregate population of all the SIDS is 65 million, slightly less than 1% of the world’s population, yet this group faces unique social, economic, and environmental challenges.

3. NEW TAX RULES FOR ONLINE GAMING

TAGS: GS 3: ECONOMY

THE CONTEXT: The Central Board of Direct Taxes (CBDT) has come out with guidelines for Tax Deducted at Source (TDS) for online gaming platforms, defining a threshold of Rs 100 for deducting tax for winnings from online gaming. Bonus, referral bonus, and incentives will also be counted towards the taxable winnings on an online gaming platform.

EXPLANATION:

New guidelines for TDS for online gaming:

- Online gaming platforms will not be required to deduct tax at the source for a player if the net winning does not exceed Rs 100.

- CBDT circular also said that bonus, referral bonus, incentives etc are given by the online gaming company to the intermediate user and they are to be considered as taxable deposit under Rule 133 of the Income-tax Act.

- CBDTsaid that in order to remove the difficulty in deducting tax at source under section 194BA of the Act for “insignificant withdrawal”, it is clarified that tax may not be deducted on withdrawal on the satisfaction of all of the following conditions:

- net winnings comprised in the amount withdrawn does not exceed Rs 100 in a month

- tax not deducted on account of this concession is deducted at a time when the net winnings comprised in withdrawal exceeds Rs 100 in the same month or subsequent month or if there is no such withdrawal, at the end of the financial year

- the deductor undertakes the responsibility of paying the difference if the balance in the user account at the time of tax deduction under section 194BA of the Act is not sufficient to discharge the tax deduction liability calculated in accordance with Rule 133

Online gaming regulations:

- The Ministry of Electronics and Information Technology (MEITY) notified as nodal ministry for all matters pertaining to online gaming industry and e-sports

- MEITY notified amendment to the Existing IT Rules 2021 i.e. the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Amendment Rules, 2023 (“Amended Rules”) with aim to regulate online gaming.

- Key Highlights of the Amended Rules are as follows:

- self-regulatory structure for the online gaming industry

- introduction of new definitions like ‘online games’, ‘online real money games’, ‘permissible online games’, and ‘permissible online real money games’

- Introduced the concept of “Intermediaries”e. entities that store or transmit data on behalf of other persons and include telecom and internet service providers, online marketplaces, search engines and social media sites

- With an aim to track such transactions, the government had inserted a new section 194BA in the Income-tax Act, 1961 through Finance Act 2023, which mandated online gaming platforms to deduct income-tax on the net winnings in the person’s user account.

- Tax is required to be deducted at the time of withdrawal as well as at the end of the financial year. As per section 194BA, TDS will be applicable at the rate of 30 per cent on the net winnings from any online gaming.

Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Amendment Rules, 2023:

- Social media intermediaries, with registered users in India above a notified threshold, have been classified as significant social media intermediaries (SSMIs). SSMIs are required to observe certain additional due diligence such as appointing certain personnel for compliance, enabling identification of the first originator of the information on its platform under certain conditions, and deploying technology-based measures on a best-effort basis to identify certain types of content.

- The Rules prescribe a framework for the regulation of content by online publishers of news and current affairs content, and curated audio-visual content.

- All intermediaries are required to provide a grievance redressal mechanism for resolving complaints from users or victims. A three-tier grievance redressal mechanism with varying levels of self-regulation has been prescribed for publishers.

Central Board of Direct Taxes (CBDT)

- The Central Board of Direct Taxes is a statutory authority functioning under the Central Board of Revenue Act, 1963.

- It comes under Department of Revenue under the Ministry of Finance.

- The officials of the Board in their ex-officio capacity also function as a Division of the Ministry dealing with matters relating to levy and collection of direct taxes.

- The Central Board of Direct Taxes consists of a Chairman and following six Members:

- Chairman

- Member (Income Tax & Revenue)

- Member (Legislation & Systems)

- Member (Administration & Faceless Scheme)

- Member (Investigation)

- Member (Tax Payer Services)

- Member (Audit & Judicial)

4. CARBON BORDER ADJUSTMENT MECHANISM (CBAM)

TAGS: GS 3: ENVIRONMENT

THE CONTEXT: Co-legislators at the European Commission signed the Carbon Border Adjustment Mechanism (CBAM).

EXPLANATION:

Carbon Border Adjustment Mechanism (CBAM):

- EU’s Carbon Border Adjustment Mechanism (CBAM) is landmark tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries.

- The gradual introduction of the CBAM is aligned with the phase-out of the allocation of free allowances under the EU Emissions Trading System (ETS) to support the decarbonisation of EU industry.

- CBAM will ensure the carbon price of imports is equivalent to the carbon price of domestic production by confirming that a price has been paid for the embedded carbon emissions generated in the production of certain goods imported into the EU.

- The CBAM is designed to be compatible with WTO-rules.

Key Features:

- Its primary objective is to avert ‘carbon leakage’ by subjecting the import of certain groups of products from 3rd (non-EU and non-EFTA) countries to a carbon levy linked to the carbon price payable under the EU Emissions Trading System (ETS) when the same goods are produced within the EU alongside encouraging producers in non-EU countries to green their manufacturing processes.

- It refers to a phenomenon where a EU manufacturer moves carbon-intensive production to countries outside the region with less stringent climate policies.

- It replace EU-manufactured products with more carbon-intensive imports.

- The CBAM will initially apply to imports of certain goods and selected precursors whose production is carbon intensive and at most significant risk of carbon leakage: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen.

- Further scope extensions to include additional products (such as chemicals and polymers) are to be determined by 2026, and the full inclusion of all EU ETS products is planned by 2030.

- CBAM will enter into force in its transitional phase as of 1 October 2023 during which EU importers must submit quarterly CBAM-reports, stating their imports of the CBAM products, as well as the emissions ‘embedded’ in their imported products. Such emissions are proposed to include direct and indirect emissions occurring during the production process of the imported goods.

- Once the permanent system enters into force on 1 January 2026, importers will need to declare each year the quantity of goods imported into the EU in the preceding year and their embedded GHG.

- They will then surrender the corresponding number of CBAM certificates. The price of the certificates will be calculated depending on the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted. The phasing-out of free allocation under the EU ETS will take place in parallel with the phasing-in of CBAM in the period 2026-2034.

- Moreover, it will ensure a level playing field between imports and EU products.

- This would also form part of the continent’s broader European Green Deal which endeavours to achieve 55% reduction in carbon emissions compared to 1990 levels by 2030 and become a climate neutral continent by 205

EU Emissions Trading System (ETS):

- It also aimed at supporting the decarbonisation of the region’s industries.

- The ETS had set a cap on the amount of greenhouse gas emissions that can be released from industrial installations in certain sectors.

- Allowances were to be bought on the open decentralised ETS trading market, however, certain allowances were given out for free to prevent carbon leakage.

- Though effective in addressing the issue of leakage, EU concluded it dampened the incentive to invest in greener production at home and abroad because of the tendency to rely on free allowances to meet operational requirements and obligations.

5. SUPER COMPUTER

TAGS: GS-3: SCIENCE AND TECHNOLOGY

THE CONTEXT: Ministry of Earth Sciences (MoES) stated that India is set to dramatically scale up its super-computing prowess and install an 18-petaflop system over the course of the year 2023.

EXPLANATION:

What is Supercomputer?

- Supercomputer is any of a class of extremely powerful computers. The term is commonly applied to the fastest high-performance systems available at any given time.

- Such computers have been used primarily for scientific and engineering work requiring exceedingly high-speed computations.

- Common applications for supercomputers include testing mathematical models for complex physical phenomena or designs, such as climate and weather, evolution of the cosmos, nuclear weapons and reactors, new chemical compounds (especially for pharmaceutical purposes), and cryptology.

Supercomputers in India:

- Currently India’s hosts most powerful, civilian supercomputers Pratyush and Mihir with a combined capacity of 6.8 petaflops are housed at the Indian Institute of Tropical Meteorology (IITM), Pune, and the National Centre for Medium Range Weather Forecasting (NCMRWF), Noida, respectively.

- They were made operational in 2018 at an investment of ₹438 crore. Both these organisations are affiliated to the Ministry of Earth Sciences(MoES).

- Pratyush is the fourth fastest supercomputer in the world dedicated for weather and climate research, and follows machines in Japan, USA and the United Kingdom.

Features of Upcoming Supercomputers:

- The new supercomputers, yet to be named, are imported from French corporation, ATOS an information technology service and consulting company.

- The new supercomputers too will be housed at the IITM and NCMRWF.

- It aims to accelerate processing power to such a degree that greatly eases complex mathematical calculations required, for among other things, and forecasting weather over the next few days.

- The goal is eventually to be able to represent an area by 1 km-square grids and that can be used to warn of cloudburst and such rapidly evolving weather systems.

Supercomputer around world:

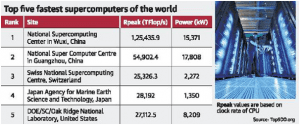

- The fastest high-performance computing system in the world is currently the Frontier-Cray system at Oakridge National Laboratory, United States. This has a peak speed of 1 exa-flop (or about 1,000 petaflops). The top 10 other systems, based on speed, range from about 400 petaflops to 60 petaflops.

FLOPS (Floating-Point Operations Per Second)

- Floating-point according to IBM is a method of encoding real numbers within the limits of finite precision available on computers.

- Using floating-point encoding, extremely long numbers can be handled relatively easily.

- Flops (floating point operations per second) are an indicator of computers processing speed and a petaflop refers to a 1,000 trillion flops.