DAILY CURRENT AFFAIRS (OCTOBER 10, 2022)

INTERNATIONAL RELATIONS

1.WHAT IS VIRTUAL WATER TRADE?

THE CONTEXT: Recently, India banned the exports of broken rice and imposed a 20 per cent duty on the exports of various grades of rice amid high cereal inflation and uncertainties with respect to domestic supply.

THE EXPLANATION:

• The world rice market is thin, given that 90 per cent of production is consumed domestically. As a result, any small change in exports and imports has an enormous impact on prices, especially if it leads to panic buying of food grains by rich countries.

• While the actual impact of the export restriction policy on domestic prices is a matter of empirical scrutiny, and the government has intended to regulate domestic prices and safeguard food security, frequent changes in export policies undoubtedly have long-term ramifications.

• India exports rice to more than 130 countries, constituting around 40 per cent of the global rice trade. The decision to curb rice exports has, unfortunately, been taken when global food prices are already rising. The export uncertainties will affect the credibility of Indian exporters, create a disincentive for future exports, and will enable buyers to shift towards other major rice-exporting countries.

• In India, around 49 per cent of rice cultivation depends on groundwater, which is depleting rapidly. As per the latest data available from the Food and Agriculture Organisation (FAO), agricultural water withdrawal as a percentage of total available renewable water resources has increased from 26.7 per cent in 1993 to 36 per cent in 2022. Similarly, the total per capita renewable water resources have also declined from 1,909 cubic meters to 1,412 cubic meters during this period.

• The water-intensive nature of rice cultivation, along with frequent export restrictions will adversely affect the long-run sustainability of rice production. Further, India’s export restrictions will adversely affect several low-income and low-middle-income countries like Bangladesh, Senegal, Nepal and Benin, which are among the largest importers of Indian rice.

VIRTUAL WATER TRADE (VWT)

• Rice exports are leading to an indirect export of water to other countries — a phenomenon known as virtual water trade (VWT). The relative per capita water availability in India is lower than a majority of its major importing countries. The other major exporters of rice, such as Thailand and Vietnam, also have better per capita water availability in comparison to India. Out of 133 countries in which India has positive net rice exports, only 39 countries have relatively lower per capita renewable water resources. Out of these 39 countries, 12 countries are high-income countries with the ability to buy food at a higher price.

• Though Minimum Support Prices (MSPs) are announced for a large number of crops, India’s food security policies, especially how they are implemented, favour mainly rice and wheat. Furthermore, procurement is skewed towards selected northern states such as Punjab and Haryana where water availability is lower than in several other states.

• India’s rice yield is also lower than the world average. India’s yield is better than Thailand and Pakistan but worse than Vietnam, China and the US. The cost of cultivation in India is also increasing, and hence there will be a need for a higher MSP to make production remunerative. This will exacerbate the pressure to re-think its price-support-backed food security mechanism.

VALUE ADDITION: MAJOR RICE PRODUCING STATES IN INDIA

As of 2020-21, the top 3 rice-producing states of India are:

1. West Bengal

2. Uttar Pradesh

3. Punjab

Around 36% of India’s total rice production is from these 3 states. West Bengal contributed 13.62% of the total rice produced in India. Uttar Pradesh contributed 12.81% of the total rice produced in India. Punjab accounted for 9.96% of the total rice produced in India.

Rice is a Kharif crop. Rice requires an annual rainfall of more than 100 cm. It requires high humidity and high temperature. The required temperature is more than 25 degrees celsius.

ECONOMIC DEVELOPMENTS

2. PILOT LAUNCH OF E-RUPEE FOR SPECIFIC USE CASES: WHAT IS THE RBI’S PLAN

THE CONTEXT: Recently, the Reserve Bank of India (RBI) indicated that it will soon commence limited pilot launches of e-rupee (e`), or Central Bank Digital Currency (CBDC) or digital rupee, for specific use cases.

THE EXPLANATION:

It has hinted at two broad categories for the use of e-rupee — retail and wholesale — taking the payment system in the country to a new level where the common people and businesses will be able to use the digital currency seamlessly for various transactions.

What’s RBI’s plan?

• The central bank said that the development of CBDC could provide the public a risk-free virtual currency that will give them legitimate benefits without the risks of dealing in private virtual currencies.

• The approach for issuance of CBDC will be governed by two basic considerations — to create a digital rupee that is as close as possible to a paper currency and to manage the process of introducing digital rupee in a seamless manner. The central bank also feels that it is desirable for CBDCs to have offline capabilities to make it a more attractive and accessible medium of payment for a wide category of users.

• E-rupee is the same as a fiat currency and is exchangeable one-to-one with the fiat currency. Only its form is different. It can be accepted as a medium of payment, legal tender and a safe store of value. The digital rupee would appear as liability on a central bank’s balance sheet.

What are the types of e-rupee?

• Based on the usage and the functions performed by the digital rupee and considering the different levels of accessibility, CBDC can be demarcated into two broad categories — general purpose (retail) (CBDC-R) and wholesale (CBDC-W), the RBI’s concept note says.

• Retail CBDC is an electronic version of cash primarily meant for retail transactions. It will be potentially available for use by all — private sector, non-financial consumers and businesses — and can provide access to safe money for payment and settlement as it is a direct liability of the central bank.

• However, the RBI has not explained how e-rupee can be used in merchant transactions in the retail trade.

What are the forms of CBDC?

• The central bank says e-rupee, or CBDC, can be structured as token-based or account-based. A token-based CBDC would be a bearer instrument like banknotes, meaning whosoever holds the tokens at a given point in time would be presumed to own them. In a token-based CBDC, the person receiving a token will verify that his ownership of the token is genuine.

• A token-based CBDC is viewed as a preferred mode for CBDC-R as it would be closer to physical cash.

• An account-based system would require maintenance of record of balances and transactions of all holders of the CBDC and indicate the ownership of the monetary balances. In this case, an intermediary will verify the identity of an account holder. This system can be considered for CBDC-W.

What’s the model for issuance?

There are two models for issuance and management of CBDCs under the RBI’s consideration — direct model (single tier model) and indirect model (two-tier model). In the direct model, the central bank will be responsible for managing all aspects of the digital rupee system such as issuance, account-keeping and transaction verification.

VALUE ADDITION:

What is Fiat Currency?

• Fiat money is government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it.

• The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it as is the case for commodity money.

• Most modern paper currencies are fiat currencies, including the U.S. dollar, the euro, and other major global currencies.

Fiat Money vs Legal Tender

• Fiat money has no intrinsic value, while legal tender is any currency declared legal by a government.

• Governments can issue fiat currency and make it legal tender by setting it as the standard for debt repayment.

• The benefit of fiat money is that it gives central banks greater control over the economy, but governments can print too much money and create hyperinflation.

• The U.S. dollar , Indian Rupee etc are both fiat money and legal tender.

3. THE NOBEL PRIZE IN ECONOMICS: BERNANKE, DIAMOND, DYBVIG

THE CONTEXT: According to Royal Swedish Academy of Sciences, Ben Bernanke, Douglas Diamond and Philip Dybvig won the 2022 Nobel Economics Prize “for research on banks and financial crises”.

THE EXPLANATION:

• The Economics Prize has gone to the three individuals for their role in research related to how banks function. “Modern banking research clarifies why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises.

“Modern banking research clarifies why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises.

• The foundations of this research were laid by Ben Bernanke, Douglas Diamond and Philip Dybvig in the early 1980s. Their analyses have been of great practical importance in regulating financial markets and dealing with financial crises.

It also noted, “Later, when the pandemic hit in 2020, significant measures were taken to avoid a global financial crisis. The laureates’ insights have played an important role in ensuring these latter crises did not develop into new depressions with devastating consequences for society.” Here is the role each of them played in the development of this research.

Ben S. Bernanke

According to sources, the research laid the foundation of some crucial questions on banks: “If banking collapses can cause so much damage, could we manage without banks? Must banks be so unstable and, if so, why? How can society improve the stability of the banking system? Why do the consequences of a banking crisis last so long? And, if banks fail, why can’t new ones immediately be established so the economy quickly gets back on its feet?”

Douglas W. Diamond and Philip H. Dybvig

• Both Diamond and Dybvig worked together to develop theoretical models explaining why banks exist, how their role in society makes them vulnerable to rumours about their impending collapse, and how society can lessen this vulnerability. These insights “form the foundation of modern bank regulation”.

• The model captures the central mechanisms of banking, as well as its weaknesses. It is based upon households saving some of their income, as well as needing to be able to withdraw their money when they wish. That this does not happen at the same time for every household allows for money to be invested into projects that need financing. They argue, therefore, that banks emerge as natural intermediaries that help ease liquidity.

• But with massive financial crises that have been witnessed in history, particularly in the US, it is often discussed how banks need to be more careful about assessing the loans they give out, or how bailing out banks in crisis.

INDIAN AGRICULTURE

4. WHY INDIA’S AGRI PRODUCTION STATS NEED A GROUND REALITY CHECK

THE CONTEXT: According to the National Statistical Office’s (NSO) household consumer expenditure (HCE) survey for 2011-12, the monthly per capita consumption of milk was 4.33 litres in rural India and 5.42 litres in urban India.

THE EXPLANATION:

• Taking an average of 5 litres (5.15 kg; 1 litre of milk = 1.03 kg), this translates into an annual consumption of nearly 75 million tonnes (mt) for a population of 1,210.85 million as per the 2011 Census.

• This figure includes only milk consumed by households — directly and as curd, butter, ghee, paneer, etc. at home. It excludes milk consumed by businesses — tea shops, hotels, and ice-cream, sweetmeat, chocolate and biscuit makers. If this milk is assumed to be 25% over and above that consumed by households, it adds up to about 94 mt — or a daily per capita availability of 212 gm.

What production data show?

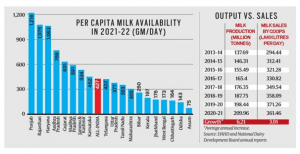

• Going by Department of Animal Husbandry & Dairying (DAHD) statistics, India’s milk production in 2011-12 was 127.9 mt with a daily per capita availability of 289 gm. These were 210 mt and 427 gm respectively in 2020-21.

• Unfortunately, there is no published HCE survey data after 2011-12. In all likelihood, the gap between the NSO’s consumption-based estimates and the DAHD’s production numbers would only have widened.

• Between 2013-14 and 2020-21, India’s milk production grew at an average 6.2% a year. (Table) But this isn’t reflected in the marketing of liquid milk by dairy cooperatives, which grew by just over 3% annually in volume terms during this period.

• In the private sector, growth in the average sales of 12 major dairy companies averaged 4.93% in nominal terms between 2014-15 and 2020-21. After adjusting for an average wholesale price inflation of 3% for “dairy products” over this period, their real sales growth was slightly more than 1.9%.

Demand is the key

• Knowing what and how much Indians are consuming — which only a comprehensive nationwide HCE survey can reveal — is useful for analysis of demand and supply in other farm produce too. It helps in framing policies better, whether on fixation of minimum support prices and tariffs or on crop diversification.

• For example, the monthly per capita household consumption of all cereals in the 2011-12 survey was assessed at 11.22 kg for rural India, and 9.28 kg for urban India. At an average of 10 kg, the annual household cereal consumption requirement for 1,400 million people today would be around 168 mt.

• Assuming 25% additional consumption in processed form (bread, biscuits, cakes, noodles, vermicelli, flakes, etc.), and another 25 mt of grain (mainly maize) for feed or starch, the total yearly demand would be around 235 mt.

ENVIRONMENT, ECOLOGY AND CLIMATE CHANGE

5. THE GLOBAL FOREST SECTOR OUTLOOK 2050

THE CONTEXT: The report titled “The global forest sector outlook 2050: Assessing future demand and sources of timber for a sustainable economy” was released recently by the United Nations Food and Agriculture Organization (FAO) at the 26th Session of the Food and Agriculture Organization Committee on Forestry in Rome.

THE EXPLANATION:

• The newly released report estimates an increased demand for wood products like mass timber and manmade cellulose fibre that are used as alternatives to non-renewable materials. Their demand may surge by up to 272 million cubic metres by 2050.

• This is expected to create over 1 million jobs in developing countries. The report forecasts that the consumption of primary processed wood products will increase to 3.1 billion cubic meters by 2050. This estimation is based on the Global Forest Products Model, which uses historical patterns of the production and trade of wood products.

• The report also forecasted that the industrial roundwood (IRW) will be vulnerable to uncertainties caused by climate-change influenced government interventions in naturally regenerated production forests and the expansion of planted forests. The future demands for IRW will be met by both planted forests mainly from Global South and naturally regenerated temperate and boreal forests.

• In 2020, about 44 per cent of the IRW production was provided by regenerated temperate and boreal forests. During the same year, the planted forests contributed to around 46 per cent of the IRW supply.

• In the future, an additional 33 million hectares of “highly productive plantation forest” will be required to meet the demand in 2050, if the area of naturally regenerated forests remain intact.

• A total annual investment of 40 billion USD will be required to maintain and expand the IRW production by 2050. Another yearly funding of 25 million USD will be required for the modernization and establishment of industries.

• In 2050, consumption of wood energy will be concentrated in sub-Saharan Africa and South Asia, where fuelwood is traditionally used by communities. Firewood will also be used in modern biomass to generate renewable energy.

• In 2020, the global consumption of fuelwood was 1.9 billion cubic meters. In 2050, this figure is expected to increase 11 to 42 per cent by reaching 2.1 to 2.7 billion cubic meters.

VALUE ADDITION:

FAO:

• It is a specialized agency of the United Nations that leads international efforts to defeat hunger. Headquarters: Rome, Italy.

• Founded: 16 October 1945.

• Goal of FAO: Their goal is to achieve food security for all and make sure that people have regular access to enough high-quality food to lead active, healthy lives.

Important reports and Programmes:

• Global Report on Food Crises.

• Every two years, FAO publishes the State of the World’s Forests.

• FAO and the World Health Organization created the Codex Alimentarius Commission in 1961 to develop food standards, guidelines and texts.

• In 1996, FAO organized the World Food Summit. The Summit concluded with the signing of the Rome Declaration, which established the goal of halving the number of people who suffer from hunger by the year 2015.

• In 1997, FAO launched TeleFood, a campaign of concerts, sporting events and other activities to harness the power of media, celebrities and concerned citizens to help fight hunger.

PRELIMS PERSPECTIVE

6. THE SUN TEMPLE MODHERA

THE CONTEXT: The Prime Minister who is on visit to his home state of Gujarat ahead of the state assembly elections visited Modhera which is famous for its Sun Temple.

THE EXPLANATION:

• During his visit he declared Modhera village in Gujarat as India’s first 24×7 solar-powered village, talked about how invaders in the past tried their best to raze the historic Sun Temple in Modhera and the atrocities they committed on the people of the region.

invaders in the past tried their best to raze the historic Sun Temple in Modhera and the atrocities they committed on the people of the region.

• Sun Temple Modhera Sun Temple at Modhera is one of the few shrines that are dedicated to the Sun God. Situated on the banks of Pushpavati River in Modhera, Sun Temple is easily accessible from Ahmedabad, the largest city of Gujarat.

• In 1026, the temple was built by King Bhimdev of the Solanki dynasty (believed to be the descendants of the lineage of Sun God). This ancient temple revives the reminiscences of Sun Temple at Konark in Orissa. Turning in the pages of history, one can notice the mention of Modhera in the scriptures like Skanda Purana and Brahma Purana.

Architecture

• The brilliant architecture of the temple is one of its own class. The temple encompasses three different yet axially-aligned and integrated constituents.

• As per the Konark Temple, this shrine is designed in a manner, so that the first rays of the Sun cast on the image of the Lord Surya. The Temple was plundered by Mahmud Ghazni; still the architectural grandeur is not vanished.

OTHER SUN TEMPLES IN INDIA- PRELIMS PERSPECTIVE

1. Bhramanya Dev Temple At Unao, Madhya Pradesh.

2. Dakshinaarka Temple At Gaya, Bihar. …

3. Konark Sun Temple, Odisha. …

4. Sun Temple At Modhera, Gujarat. …

5. Vivasvan Sun Temple, Gwalior, Madhya Pradesh.

6. Arasavalli- Suryanarayana Temple, Andhra Pradesh.

THE PRELIMS PRACTICE QUESTIONS

QUESTION OF THE DAY

Q1. The term Solidity, Rusk, Haskell, sometimes seen in news, are –

a) Exo-planets explored by NASA missions

b) Programming languages used in crypto-currency

c) International initiatives for climate change actions

d) Non-profit organisations working for human rights protection

Answer: B

Explanation:

• Solidity is the programming language mainly used on the blockchain platform Ethereum.

• In the crypto world, Rust is commonly associated with the Solana blockchain, which is known for its high speeds and relatively low transaction fees.

• Haskell is not well-known, and that it is not a popular programming language for beginners. Haskell is classified as a purely functional programming language, and is hard to learn.