PRICING OF ESSENTIAL DRUGS IN INDIA

THE CONTEXT: Recently in March 2022, the concerns have been raised that consumers may have to pay more for medicines and medical devices if the National Pharmaceutical Pricing Authority (NPPA) allows a price hike of over 10% in the drugs and devices listed under the National List of Essential Medicines (NLEM). The following article explains everything about the pricing of essential drugs in India.

WORKING OF PRICING MECHANISM

- All medicines under the NLEM are under price regulation. The NLEM lists drugs used to treat fever, infection, heart disease, hypertension, anemia, etc, and includes commonly used medicines like paracetamol, azithromycin, Cardiac Stents, Knee implants, etc.

- The Health Ministry prepares a list of drugs eligible for price regulation, following which the Department of Pharmaceuticals incorporates them into Schedule 1 of DPCO.

- The Standing Committee on Affordable Medicines and Health Products (SCAMHP) will advise the drug price regulator the National Pharmaceutical Pricing Authority (NPPA) on vetting the list. The NPPA then fixes the prices of drugs in this Schedule.

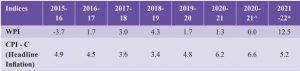

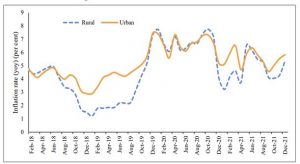

- As per the Drugs (Prices) Control Order 2013, scheduled drugs, about 15% of the pharma market, are allowed an increase by the government as per the WPI (Wholesale Price Index) while the rest 85% are allowed an automatic increase of 10% every year.

- The annual change in prices of scheduled drugs is controlled and rarely crosses 5%.

- Under the Drugs and Cosmetics Act 1940, the drugs are classified in schedules, and regulations are laid down for their storage, display, sale, dispensing, leveling, prescribing, etc.

Essential Medicines List:

- As per the World Health Organisation (WHO), Essential Medicines are those that satisfy the priority health care needs of the population. The list is made with consideration of disease prevalence, efficacy, safety, and comparative cost-effectiveness of the medicines.

- Such medicines are intended to be available in adequate amounts, inappropriate dosage forms, and strengths with assured quality. They should be available in such a way that an individual or community can afford them.

National List of Essential Medicines of India:

- The WHO EML is a model list, the decision about which medicines are essential and remains a national responsibility based on the country’s disease burden, priority health concerns, affordability concerns, etc.

- Ministry of Health and Family Welfare, Government of India hence prepared and released the first National List of Essential Medicines of India in 1996 consisting of 279 medicines. This list was subsequently revised in 2003, 2011, and 2021.

ABOUT THE NATIONAL PHARMACEUTICAL PRICING AUTHORITY

The National Pharmaceutical Pricing Authority (NPPA) is a government regulatory agency that controls the prices of pharmaceutical drugs in India. It was constituted by a Government of India Resolution dated 29th August 1997 as an attached office of the Department of Pharmaceuticals (DoP), Ministry of Chemicals and Fertilizers as an independent regulator for pricing of drugs and to ensure availability and accessibility of medicines at affordable prices with Headquarter at New Delhi, India.

Drugs (Prices) Control Order 2013:

- The Drugs Prices Control Order is an order issued by the Government of India under Sec. 3 of Essential Commodities Act, 1955 to regulate the prices of drugs.

- The Order provides the list of price-controlled drugs, procedures for fixation of prices of drugs, method of implementation of prices fixed by Govt., penalties for contravention of provisions, etc.

- For the purpose of implementing provisions of DPCO, powers of Govt. have been vested in NPPA.

- The DPCO 2013 contains more than 600 scheduled drug formulations spread across 27 therapeutic groups. However, the prices of other drugs can be regulated, if warranted in the public interest.

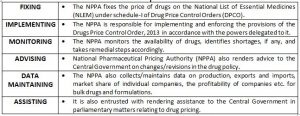

KEY FUNCTIONS OF NPPA

NPPA INITIATIVES

- The National Pharmaceutical Pricing Authority (NPPA) is headquartered in New Delhi and to increase its reach across the country, NPPA has set up a Price Monitoring and Resource Unit (PMRU) in the various Indian States and Union Territories.

- These PMRUs have been set up under the Consumer Awareness, Publicity, and Price Monitoring (CAPPM) scheme.

- As of March 2022, there are 23 states/UTs with the most recent addition of Himachal Pradesh on 23rd March 2022 as the 23rd Price Monitoring and Resource Unit (PMRU). The pharmaceutical authority aims to set up a price monitoring unit in each and every state and union territory across India.

SIGNIFICANCE OF NPPA

- It is important to fix the prices of certain important drugs so that they are affordable and accessible to every citizen of the county and the National Pharmaceutical Pricing Authority ensures the same.

- It mandates that no supplier can sell a drug for more than its Maximum Retail Price (MRP).

- NPPA also played a crucial role during the pandemic time in the country by either fixing or regulating the prices of essential drugs and devices.

AN ANALYSIS OF THE ISSUE

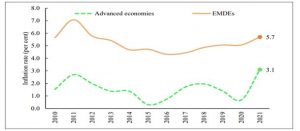

- The pharma lobby is asking for at least a 10% increase for scheduled drugs too rather than going by the WPI. Over the past few years, input costs have flared up and one of the reasons being 60%-70% of the country’s medical needs, are dependent on China.

- NPPA has been receiving applications for upward price revision under para 19 of DPCO, 2013, for the last two years citing reasons like “increase in Active Pharmaceutical Ingredient – API (key ingredient) cost, increase in the cost of production, exchange rates, etc. resulting in unavailability in sustainable production and marketing of the drugs.

- India is dependent on China for over 60% of its API requirement; higher API costs for price-controlled medicines reduce profits and sometimes even make the production of these drugs unviable in India.

THE WAY FORWARD

- We all are aware of the shortage of Remdevisir injections in May 2021 and black marketing and hoarding which led to skyrocketing prices. In this context, Bombay HC has asked the Centre to include Remdesivir in the list of Scheduled Drugs and regulate its price. Such steps should be proactively taken by the government with the foresight of emerging situations.

- The interests of pharmaceutical companies shall not be put ahead of the lives of ordinary citizens. As of 23rd March 2022, only 14% of people in low-income countries have received at least one vaccine dose against COVID-19. India and South Africa have thus, taken a firm position that when lives are at stake, such essential products should be treated as global public goods and IPRs under TRIPS Agreement must be waived.

- NPPA shall also revise the list of essential medicines at short and regular intervals to have a positive impact on the availability and rational use of medicines.

- In the longer term, India needs to build capabilities to manufacture the key ingredients for these medicines.

THE CONCLUSION: Having an Essential Medicines List (EML) results in a better quality of medical care, better management of medicines, and cost-effective use of health care resources. This is especially important for a resource-limited country like India. The decision is to ensure, that life-saving essential drugs remain available to the general public at all times. To avoid a situation where drugs become unavailable in the market and the public is forced to switch to costly alternatives this is the first time the NPPA, known to slash prices of essential and life-saving medicines, is increasing prices in the public interest.

MAINS QUESTIONS:

- Elaborate on the role of the National Pharmaceutical Pricing Authority (NPPA) in ensuring the availability of life-saving essential drugs to the general public at all times.