TOPIC : RBI REVISED PCA FRAMEWORK FOR BANKS

THE CONTEXT: In November 2021, RBI issued a revised Prompt Corrective Action (PCA) Framework for Scheduled Commercial Banks (SCBs) excluding Small Finance Banks, Payment Banks, and Regional Rural Banks to enable intervention at the appropriate time and require the SCB to initiate and implement remedial measures in a timely manner. The provisions of the revised PCA framework will be effective from January 1, 2022. The detailed analysis of the development is as follows.

THE DEVELOPMENT

- The revised framework excludes return on assets as a parameter that may trigger action under the framework.

- Payments banks and small finance banks (SFBs) have also been removed from the list of lenders where prompt corrective action can be initiated. Capital, asset quality and leverage will be the key areas for monitoring in the revised framework.

- Indicators to be tracked for capital, asset quality and leverage would be CRAR/ common equity tier I ratio, net NPA ratio and tier I leverage ratio, respectively.

- In governance-related actions, the RBI can supersede the board under Section 36ACA of the BR Act, 1949.

- The framework will apply to all banks operating in India, including foreign banks operating through branches or subsidiaries based on breach of risk thresholds of identified indicators.

WHAT HAS CHANGED?

2017 (Revised) Framework

Key Monitoring areas

Capital, asset quality and profitability, while leverage would be monitored additionally.

Indicators to be tracked

Capital, asset quality and profitability would be CRAR/ Common Equity Tier I ratio, Net NPA ratio and Return on Assets, respectively.

Profitability – ROA

Negative ROA for 2/3/4 consecutive years

Leverage

Tier 1 Leverage ratio:

- Threshold 1: <=4.0% but > = 3.5% (leverage is over 25 times Tier 1 capital)

- Threshold 2: < 3.5% (leverage is over 28.6 times Tier 1 capital)

Expense monitoring

The following points were mandatory:

- Threshold 2: Higher provisions as part of the coverage regime

- Threshold 3: Restriction on management compensation and directors’ fees, as applicable

Discretionary Corrective Actions – Special Supervisory Actions

RBI could amalgamate/ reconstruct a bank under extant regulations

Exit from PCA and Withdrawal of Restrictions under PCA

Exit of a bank from the PCA framework was based on RBI’s assessment on multiple parameters based on the financials of the bank.

New Framework

Key Monitoring areas

Capital, Asset Quality and Leverage

Indicators to be tracked

Capital, Asset Quality and Leverage would be CRAR/ Common Equity Tier I Ratio, Net NPA Ratio, and Tier I Leverage Ratio, respectively.

Profitability – ROA

Has been removed from the New Framework

Capital – Risk Threshold 3

RBI has specifically included this level of 400 bps below CRAR as a monitorable

Leverage

Monitoring of leverage has been made explicit and levels have been made explicit across thresholds

- Threshold 1: Up to 50 bps below the regulatory minimum

- Threshold 2: More than 50 bps but not exceeding 100 bps below the regulatory minimum

- Threshold 3: More than 100 bps below the regulatory minimum

Expense monitoring

These actions have been included in discretionary activities and have been made applicable across all thresholds. They have been combined and made more stringent by restriction/ reduction on variable operating costs, outsourcing activities, and restriction/reduction of outsourcing activities. Further restrictions on capital expenditure, other than for technological up-gradation within board-approved limits, have been made mandatory in risk threshold 3.

Discretionary Corrective Actions – Special Supervisory Actions

The RBI has specifically included resolution of the bank by Amalgamation or Reconstruction (Ref. Section 45 of Banking Regulation Act 1949) under the revised framework.

Exit from PCA and Withdrawal of Restrictions under PCA

The new framework has laid down an explicit framework for a bank to exit the PCA framework as follows:

Once a bank is placed under PCA, taking the bank out of PCA Framework and/or withdrawal of restrictions imposed under the PCA Framework will be considered: a) if no breaches in risk thresholds in any of the parameters are observed as per four continuous quarterly financial statements, one of which should be Audited Annual Financial Statement (subject to assessment by RBI); and b) based on Supervisory comfort of the RBI, including an assessment on sustainability of profitability of the bank.

WHAT IS PCA FRAMEWORK?

- Prompt Corrective Action or PCA is a framework under which banks with weak financial metrics are put under watch by the RBI. The PCA framework deems banks as risky if they slip below certain norms on three parameters — capital ratios, asset quality and profitability.

- Based on where a bank stands on these ratios, it has three risk threshold levels (1 being the lowest and 3 the highest). Banks with capital to risk-weighted assets ratio (CRAR) of less than 10.25 per cent but more than 7.75 per cent fall under threshold 1.

- Those with CRAR of more than 6.25 per cent but less than 7.75 per cent fall in the second threshold. In case a bank’s common equity Tier 1 (the bare minimum capital under CRAR) falls below 3.625 per cent, it gets categorised under the third threshold level.

- Banks that have a net NPA of 6 per cent or more but less than 9 per cent fall under threshold 1, and those with 12 per cent or more fall under the third threshold level.

- On profitability, banks with negative return on assets for two, three, and four years fall under threshold 1, threshold 2 and threshold 3, respectively.

WHAT IS THE PURPOSE OF THE PCA FRAMEWORK?

- The objective of the PCA framework is to enable supervisory intervention at the appropriate time and require the supervised entity to initiate and implement remedial measures in a timely manner to restore its financial health.

- Act as a tool for effective market discipline.

- It does not preclude the Reserve Bank of India from taking any other action as it deems fit at any time, in addition to the corrective actions prescribed in the framework”.

- In the last almost two decades — the PCA was first notified in December 2002 — several banks have been placed under the framework, with their operations restricted. In 2021, UCO Bank, IDBI Bank and Indian Overseas Bank exited the framework on improved performance. Only the Central Bank of India remains under it now.

HOW DO BANKS BENEFIT FROM PCA?

- One of the objectives of PCA is to amend a bank’s mistakes before they lead to a crisis.

- RBI controls the loan disbursal of banks belonging to the PCA watchlist. That said, note that the regulator does not entirely prohibit PCA banks from disbursing loans.

- RBI’s PCA framework has been designed to improve a bank’s financial performance by tracking vital metrics. In other words, it involves the RBI taking remedial measures.

- PCA banks cannot enter a new line of business, which improves their core financials.

- In some rare cases RBI might choose to close non-compliant banks or initiate amalgamation for them.

WHEN DOES RBI INVOKE PROMPT CORRECTIVE ACTION?

RBI considers four factors to determine whether it needs to put a bank under the PCA framework. These include profitability, asset quality, capital ratios and debt level. The central bank grades each of these factors based on actions depending upon the grade/threshold level, categorised from one to three, where 1 is the lowest of the lot and 3 being the highest based on how banks stand with respective frameworks.

Following is a look at these factors and their grades:

CAPITAL ADEQUACY RATIO (CRAR)

- The CRAR is the capital needed for a bank measured in assets (mostly loans) disbursed by the banks. The higher the assets, the higher should be the capital retained by the bank. This measures how much debt and equity capital banks possess to cover their asset book risk. If CRAR is less than 10.25%, but above 7.75%, the bank falls in the first grade. Banks having a CRAR of over 6.25%, but below 7.75%, fall under grade 2. However, if a bank’s capital adequacy ratio is less than 3.625%, it is categorised under grade 3.

ASSET QUALITY

- This parameter refers to the non-performing assets of a bank. If the net NPA of a bank is more than 6%, but less than 9%, it falls under the first threshold. If Net NPA crosses the 9% mark, it triggers the second grade. That said, if this metric is 12% or more, the bank will fall in the third grade of PCA.

PROFITABILITY

- The regulator considers the bank’s return on assets (ROA) as the key measure for profitability. Note that if a bank’s ROA is negative for two, three and four years in a row, it will be categorised as grade 1, grade 2 and grade 3, respectively.

DEBT LEVEL/LEVERAGE

- The last factor that RBI considers to measure the financial risk of any bank is its overall debt level/leverage. The regulator triggers grade 1 if the overall leverage is more than 25 times its Tier 1 capital. However, when total leverage is over 28.5 times its core capital (including disclosed reserves), RBI acts according to grade 2 of PCA.

WHAT HAPPENS WHEN RBI PUTS A BANK UNDER PCA?

When RBI puts a bank on its PCA watchlist, it imposes two types of limitations on it – mandatory and discretionary. These include restrictions related to the expansion of a branch, dividend, and director’s remuneration and so on.

Nevertheless, the Central Bank may choose to take these actions at their discretion, where the RBI can:

- Ask the bank’s board to reassess its business model and evaluate the profitability of the business line and operations.

- Advise banks to reassess their business plans and strategy to take remedial measures, including dismissing certain officials from employment.

- Ask a Bank’s board to implement a resolution plan after seeking approval from the supervisor.

- Advise banks to gauge their viability over the medium to long term besides evaluating balance sheet estimates.

- PCA banks might not be able to hire more employees or fill up vacant positions.

- Lastly, RBI may allow PCA banks to incur capital expenditure only to upgrade technology. However, the allocation of funds for the same has to be within pre-approved limits.

ANALYSIS OF NEW FRAMEWORK

- The revised rules propose changes on three fronts —

- the triggers to invoke PCA against a bank,

- the mandatory actions RBI may take after it

- conditions for a bank to exit it.

- Rules currently allow RBI to invoke PCA, if a bank’s capital-to-risk weighted assets ratio and Tier 1 capital ratio, Return on Assets (ROA), net Non-Performing Assets and leverage fall well short of statutory thresholds.

- Under the new regime, a negative ROA will no longer trigger a bank to invite corrective action. This appears sensible because the accounting profit for a bank is the residual sum left over after provisioning for bad and doubtful loans.

- A bank that proactively provisions for possible NPAs and maintains high provision coverage may report losses, but is better protecting the interests of its stakeholders than a bank that skimps provisioning to show a profit.

- Some of the corrective actions to be taken by RBI once a bank falls under PCA, have been left to its discretion instead of being mandated.

- PCA rules require RBI to enforce higher provisioning norms and cap management compensation. The new rules allow it to take a discretionary call, perhaps to avoid denting depositor confidence.

- The existing curbs placed by the RBI on PCA banks lending to lower-rated or unsecured borrowers have been diluted and replaced with more generic powers, which is a good step.

THE CONCLUSION: While the new framework rightly affords RBI greater flexibility in resolving stressed banks on a case-to-case basis, the roadmap it offers for a bank’s exit from PCA appears to run counter to this. While such exit was earlier left to RBI’s discretion, the new regime requires a bank to stay above-mandated capital, NPA and leverage thresholds for four consecutive quarters to apply for the exit. This may be a rather high bar. A troubled bank can mend its capital adequacy or leverage quickly with an infusion from its promoter. But resolving legacy NPAs often requires it to pursue business growth or margin-improving strategies that may not be possible while PCA ties its hands.

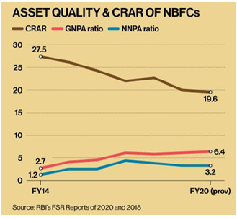

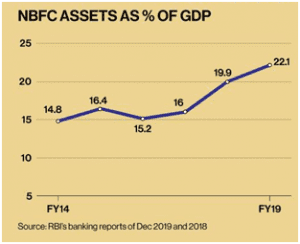

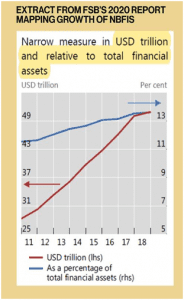

of the total financial assets ($379 trillion). Of this, OFIs accounted for $114.3 trillion (30% of the total); NBFI for $50.9 trillion (13.4% of the total), and the rest for $18 trillion.

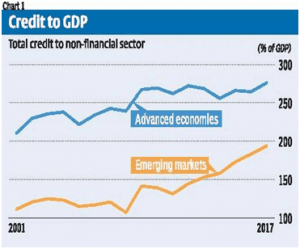

of the total financial assets ($379 trillion). Of this, OFIs accounted for $114.3 trillion (30% of the total); NBFI for $50.9 trillion (13.4% of the total), and the rest for $18 trillion. As Figure 1 indicates, the levels of credit to GDP, which were so high as to be unsustainable and resulted in the big crisis of 2008, have increased even more since then.

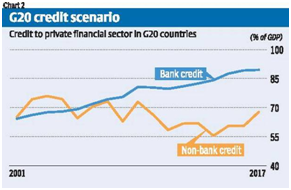

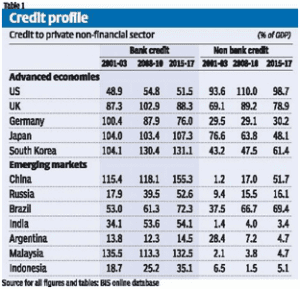

As Figure 1 indicates, the levels of credit to GDP, which were so high as to be unsustainable and resulted in the big crisis of 2008, have increased even more since then. lending and the potential for financial and economic crises in emerging markets that could be led by the collapse of shadow banks. This is in no small measure due to the significant role played by such shadow lending in the core capitalist countries (especially the US) in the build-up to the Great Financial Crisis in 2008.

lending and the potential for financial and economic crises in emerging markets that could be led by the collapse of shadow banks. This is in no small measure due to the significant role played by such shadow lending in the core capitalist countries (especially the US) in the build-up to the Great Financial Crisis in 2008. creation is much more a problem of the banking sector as a whole than the non-bank or shadow bank sector.

creation is much more a problem of the banking sector as a whole than the non-bank or shadow bank sector.

This is what Estonia has done and can be used in the Indian context to improve the efficiency of medical insurance schemes faster. Additionally, since the data is stored in the cloud, some person can sell it for clinical trials or experiments or research to a pharma company within a few seconds, since the digital data can be transferred in a few mouse clicks.

This is what Estonia has done and can be used in the Indian context to improve the efficiency of medical insurance schemes faster. Additionally, since the data is stored in the cloud, some person can sell it for clinical trials or experiments or research to a pharma company within a few seconds, since the digital data can be transferred in a few mouse clicks.

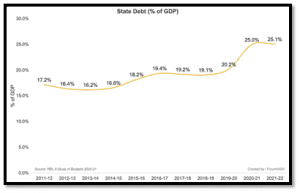

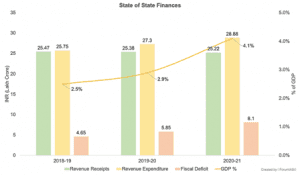

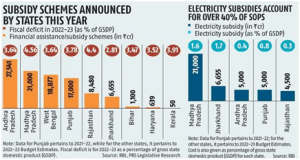

its fiscal situation and a predicted debt-to-GSDP ratio that would reach 45% in 2026–2027. By 2026–2027, it is anticipated that Rajasthan, Kerala, and West Bengal will have debt-to-GSDP ratios higher than 35%. To stabilize their debt levels, these states will need to take major remedial action.

its fiscal situation and a predicted debt-to-GSDP ratio that would reach 45% in 2026–2027. By 2026–2027, it is anticipated that Rajasthan, Kerala, and West Bengal will have debt-to-GSDP ratios higher than 35%. To stabilize their debt levels, these states will need to take major remedial action.

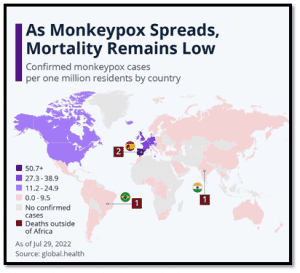

seen in the past in smallpox patients, although it is clinically less severe.

seen in the past in smallpox patients, although it is clinically less severe.