Day-309 | Daily MCQs | UPSC Prelims | POLITY

[WpProQuiz 354]

[WpProQuiz 354]

[WpProQuiz 353]

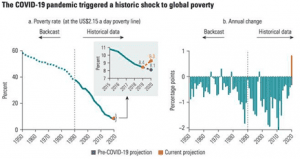

THE CONTEXT: An ongoing debate in India is whether or not Indian non-banking fi nancial companies (NBFCs) are “shadow banks”. This question appears important because we have learned from the ongoing global financial crisis that shadow banking might create systemic risks which have been defined “broadly as the expected losses from the risk that the failure of a significant part of the financial sector leads to a reduction in credit availability with the potential for adversely affecting the real estate and economy at large.

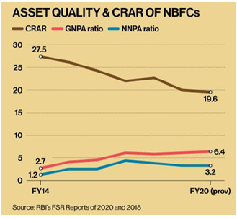

The following graph maps the NBFCs’ assets quality (GNPA and NNPA ratios) and capital-to-risk-assets ratio (CRAR) since FY14.

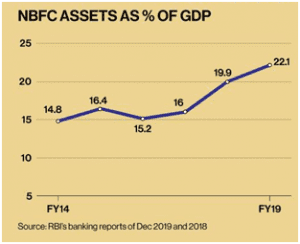

In the meanwhile, the NBFCs have grown in influence, as is evident from the RBI data mapped below, against the GDP (at constant prices).

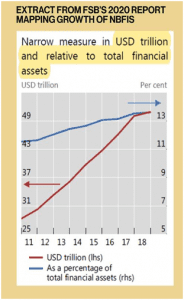

of the total financial assets ($379 trillion). Of this, OFIs accounted for $114.3 trillion (30% of the total); NBFI for $50.9 trillion (13.4% of the total), and the rest for $18 trillion.

of the total financial assets ($379 trillion). Of this, OFIs accounted for $114.3 trillion (30% of the total); NBFI for $50.9 trillion (13.4% of the total), and the rest for $18 trillion.Here are two examples –

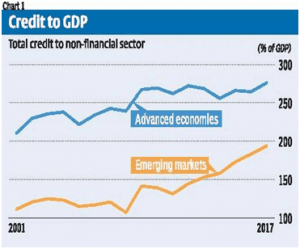

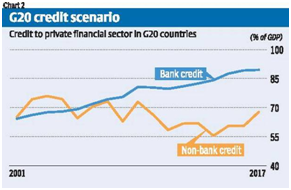

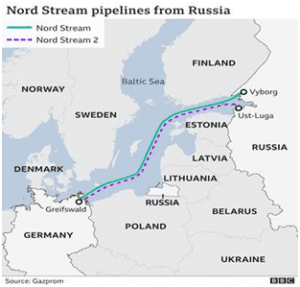

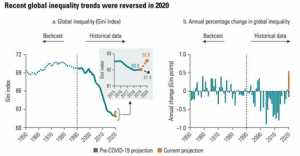

As Figure 1 indicates, the levels of credit to GDP, which were so high as to be unsustainable and resulted in the big crisis of 2008, have increased even more since then.

As Figure 1 indicates, the levels of credit to GDP, which were so high as to be unsustainable and resulted in the big crisis of 2008, have increased even more since then. lending and the potential for financial and economic crises in emerging markets that could be led by the collapse of shadow banks. This is in no small measure due to the significant role played by such shadow lending in the core capitalist countries (especially the US) in the build-up to the Great Financial Crisis in 2008.

lending and the potential for financial and economic crises in emerging markets that could be led by the collapse of shadow banks. This is in no small measure due to the significant role played by such shadow lending in the core capitalist countries (especially the US) in the build-up to the Great Financial Crisis in 2008. creation is much more a problem of the banking sector as a whole than the non-bank or shadow bank sector.

creation is much more a problem of the banking sector as a whole than the non-bank or shadow bank sector.WAY FORWARD:

CONCLUSION:

NBFC sector has been stung by a crisis set off by the shock collapse of non-bank lender IL&FS group in 2018. India’s shadow banks, which lend to everyone from teashop merchants to property tycoons, get a mixed bill of health in Bloomberg’s latest check. Revitalization of the industry, whose woes mounted when major mortgage lender Dewan Housing Finance Corp. missed repayments, is key to helping staunch a further slowdown in the nation’s economy. In a sign that creditors remain jittery, borrowing costs rose. The extra yield investors demand to hold five-year AAA rated bonds from shadow banks over government notes increased, one of the gauges shows. Shadow lender woes have made it harder for policy makers to prop up the economy, which grew at its weakest pace since 2009. The slowdown hurts borrowers’ ability to repay debt, and has prompted the central bank to predict that an improvement in banks’ bad-loan ratios will reverse. So, it is established that Indian NBFCs are shadow banks and they do pose systemic risks to certain extent. Hence, the RBI should make a long term policy for Indian NBFC sector to mitigate any risk that may crop up in the already fragile financial sector in India.

THE CONTEXT: Recently, the 11th volume of the Report of the Official Language Committee headed by Home Minister, which was submitted to President in September 2022 has triggered angry reactions from the Chief Ministers of Tamil Nadu and Kerala, who have described the Report as an attempt by the Union government to impose Hindi on non-Hindi-speaking states.

THE EXPLANATION:

What is this language panel led by Union Home Minister?

What has the panel recommended in its latest (2021) report?

Is this the first time that such recommendations have been made?

What does the new education policy say about teaching in Hindi and other regional languages?

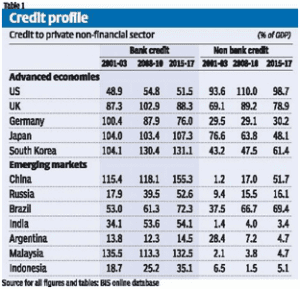

THE CONTEXT: Recently, the Constitution Bench questioned whether the government and the Reserve Bank of India (RBI) realised their stated objectives of choking black money, terror financing and fake currency through the policy to demonetise ₹500 and ₹1,000 notes in 2016.

THE EXPLANATION:

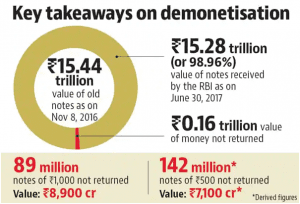

THE CONTEXT: According to the International Energy Agency (IEA), Russian oil imports into the European Union and United Kingdom fell 35% to 1.7 million barrels per day (bpd) in August from 2.6 million bpd in January 2022, but the EU was still the biggest market for Russian crude.

THE EXPLANATION:

What are the alternatives to Russian crude?

How much does the EU depend on Russian crude imports?

VALUE ADDITION:

ABOUT NORD STREAM 2 GAS PIPELINE:

THE CONTEXT: The first ever World Sloth Bear Day celebrations by Wildlife SOS in Agra in collaboration with International Union for Conservation of Nature (IUCN) and the UP-Forest Department.

THE EXPLANATION:

Barbaric tradition being resolved

A statement issued by Wildlife SOS stated that the organisation rescued and rehabilitated over hundreds of “performing dancing bears, thereby resolving a 400-year-old barbaric tradition (of dancing bears) while also providing alternative livelihoods to the nomadic Kalandar community members “.

Conservation Status:

Listed under Schedule I of The (Wildlife Protection) Act of India, 1972 the species has the same level of protection as tigers, rhinos and elephants. They can occupy a wide variety of habitats, such as grasslands, thorn scrub and forests, but their range has shrunk considerably in recent years due to habitat loss.

IUCN Status: Vulnerable.

CITES listing: Appendix I

Habitat:

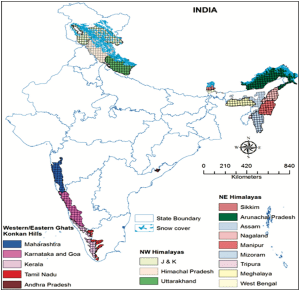

Sloth bears are one of the eight bear species found across the world, and they mainly inhabit the region of India, Nepal, Sri Lanka and presumably Bhutan.

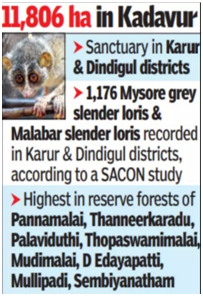

THE CONTEXT: In a first in the country, the Tamil Nadu government notified the Kadavur slender loris sanctuary covering 11,806 hectares in Karur and Dindigul districts.

THE EXPLANATION:

Habitat improvement

THREATS:

THE CONTEXT: The Union Cabinet has approved the Prime Minister’s Development Initiative for North East Region (PM-DevINE) – a new scheme for the Northeastern states which was announced in the Union Budget earlier this year. The scheme will be operational for the remaining four years of the 15th Finance Commission, from 2022-23 to 2025-26, and will have an outlay of Rs 6,600 crore.

THE EXPLANATION:

What is PM-DevINE?

What are the objectives of PM-DevINE?

The objectives of PM-DevINE are to:

(a) Fund infrastructure convergently, in the spirit of PM Gati Shakti;

(b) Support social development projects based on felt needs of the NER;

(c) Enable livelihood activities for youth and women;

(d) Fill the development gaps in various sectors.

Initiatives/activities of MDoNER:

NESIDS

The North East Venture Fund (NEVF)

Q1. ‘Vyommitra’, recently seen in news, is

a) A Supercomputer developed by C-DAC.

b) A Humanoid designed and developed by ISRO to fly aboard unmanned test mission.

c) An asteroid which will be explored for minerals.

d) A space mission of ISRO to study atmosphere of Venus.

Answer: B

Explanation:

[WpProQuiz 352]

THE CONTEXT: The Indian government was planning to introduce a Bill, the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 during the recently concluded Winter Session of the Parliament to classify cryptocurrencies as financial assets while protecting the interests of small investors. The Bill also proposes to lay the groundwork for the creation of the official digital currency to be issued by the Reserve Bank of India (RBI) and regulated under the RBI Act.

Note: The Bill has not been introduced in the Winter Session.

WHAT IS CRYPTOCURRENCY?

A cryptocurrency is a medium of exchange such as the Indian Rupee, US dollar etc. Bitcoin, the first cryptocurrency, appeared in January 2009 and was the creation of a computer programmer using the pseudonym Satoshi Nakamoto.

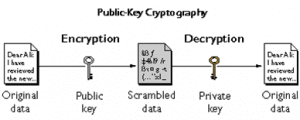

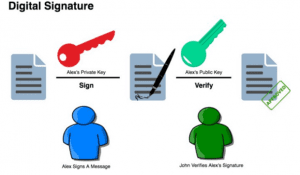

The term cryptocurrency is used because the technology is based on public-key cryptography, meaning that the communication is secure from third parties. This is a well-known technology used in both online transactions and communication systems.

Public key cryptography involves a pair of keys known as a public key and a private key (a public key pair), which are associated with an entity that needs to authenticate its identity electronically or to sign or encrypt data. Each public key is published, and the corresponding private key is kept secret. Data that is encrypted with the public key can be decrypted only with the corresponding private key.

Cryptocurrency

US Dollar ($) or Indian currency (₹)

PREVENT MARKET MANIPULATION AND PROTECT INVESTORS:

PROVIDING MARKET INFORMATION

UNDERSTANDING RISKS ASSOCIATED WITH TECHNOLOGY

ENSURING ACCOUNTABILITY

MONEY LAUNDERING

TAX ON THE TRANSACTIONS

Currently, there is no regulation or any ban on the use of cryptocurrencies in the country. The Reserve Bank of India’s (RBI) order banning banks from supporting crypto transactions, was reversed by the Supreme Court order of March 2020.

HERE WE EXAMINE THE REGULATORY JOURNEY OF CRYPTOCURRENCY IN INDIA SO FAR.

2018-2020

2021

Although, Government wants to regulate cryptocurrencies, RBI in a complete ban on such currencies. In December 2021 RBI Said that “Cryptocurrencies are a serious concern to RBI from a macroeconomic and financial stability standpoint”.

SO, IF BITCOIN IS LEGALISED IN INDIA, THE FOLLOWING WOULD HAPPEN:

HOW THE CRYPTOCURRENCIES ARE BEING REGULATED AROUND THE WORLD?

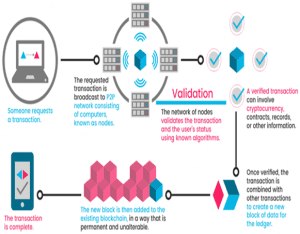

FEATURES OF BLOCKCHAIN

There are different types of blockchain: some are open and public and some are private and only accessible to people who are given permission to use them.

PUBLIC BLOCKCHAIN

PRIVATE BLOCKCHAIN

This is what Estonia has done and can be used in the Indian context to improve the efficiency of medical insurance schemes faster. Additionally, since the data is stored in the cloud, some person can sell it for clinical trials or experiments or research to a pharma company within a few seconds, since the digital data can be transferred in a few mouse clicks.

This is what Estonia has done and can be used in the Indian context to improve the efficiency of medical insurance schemes faster. Additionally, since the data is stored in the cloud, some person can sell it for clinical trials or experiments or research to a pharma company within a few seconds, since the digital data can be transferred in a few mouse clicks.TYPE OF REGULATION

WHETHER CRYPTO CAN BE REGULATED AT ALL?

CURRENCY OR COMMODITY?

CAPACITY TO REGULATE

ISSUE OF PRIVATE AND PUBLIC CRYPTO CURRENCY

THE WAY FORWARD:

THE CONCLUSION: India is considered an inspiration when it’s comes to frugal innovation. Combing the advantage of a highly skilled workforce in IT Sector, Artificial intelligence and encrypted data stored on the blockchain, India can be a scale up the efficiency of the delivery of its various schemes and the pace of delivery of justice. The need of the hour is to develop an architecture or an institution that can implement this at the grassroots level.

THE CONTEXT: Recently, the Tamil film celebrities are under the scanner after announcing that they have become parents of twin boys. The state government is now inquiring if the power couple violated the country’s surrogacy laws.

THE EXPLANATION:

What are the conditions for allowing surrogacy, as per the law?

The SRA Act says:

How does opting for surrogacy work?

THE CONTEXT: Recently,the Bombay high court has asked the Union government to consider making cases under the Indian Penal Code (IPC) Section 498A (cruelty to wife by husband, relatives) a compoundable offence.

THE EXPLANATION:

A division bench of Justices in an order said the importance of making IPC Section 498A ‘compoundable’ can hardly be overlooked or understated, noting that every day a minimum of 10 petitions are heard seeking quashing of cases under the section by consent since it is non-compoundable.

Description of IPC Section 498A:

According to section 498A of Indian penal code, Whoever, being the husband or the relative of the husband of a woman, subjects such woman to cruelty shall be punished with imprisonment for a term which may extend to three years and shall also be liable to fine.

What are Non-Compoundable Offences?

Example of Non-Compoundable Offences (Where Court’s Permission is Required):

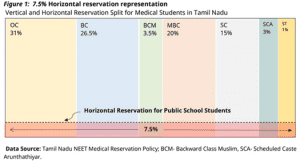

THE CONTEXT: In April 2022 the Madras High Court upheld the constitutional validity of a State law passed in October 2020 to provide 7.5% horizontal reservation to students who pass out of government schools and clear the National Entrance-cum-Eligibility Test (NEET), in medical admissions.

THE EXPLANATION:

Why was Tamil Nadu opposed to NEET?

The Special Case:

Understanding the 7.5% quota

Who goes to government schools?

What lies a head?

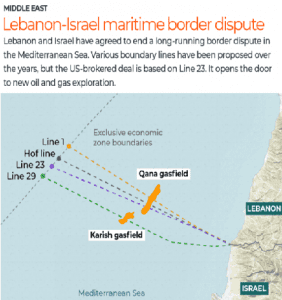

THE CONTEXT: In a major diplomatic breakthrough, Israel announced a “historic” deal with Lebanon, aimed at resolving a long-running maritime border dispute over Mediterranean waters. Israel and Lebanon do not have official diplomatic relations and the two countries remain technically at war.

THE EXPLANATION:

A long history of conflict

What the agreement does:

Crucial gas exports

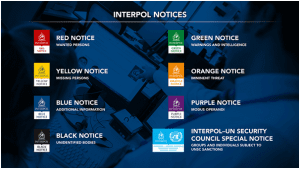

THE CONTEXT: Recently,the Interpol has rejected a second request by India to issue a Red Corner Notice against Gurpatwant Singh Pannun, the Canada-based founder and legal advisor of the pro-Khalistan outfit Sikhs for Justice (SFJ), whom the Union Ministry of Home Affairs has listed as a “terrorist” under the Unlawful Activities (Prevention) Act (UAPA).

THE EXPLANATION:

What is the Interpol?

TYPES OF NOTICES:

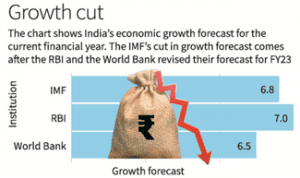

THE CONTEXT: According to the International Monetary Fund,the world, including India, will experience an overall slowdown in the next year (2023) owing to the impact of the Russia-Ukraine war, tightening monetary conditions globally, the highest inflation in decades, and lingering effects of the pandemic.

THE EXPLANATION:

ended March 31 as per figures released in the IMF’s October 2022 World Economic Outlook: Countering the Cost-of-Living Crisis at the start of the World Bank IMF Annual Meetings.

ended March 31 as per figures released in the IMF’s October 2022 World Economic Outlook: Countering the Cost-of-Living Crisis at the start of the World Bank IMF Annual Meetings.Inflation above target

VALUE ADDITION:

About IMF:

The IMF is a specialized agency of UN.

Q1. Consider the following statements about Mahakal Temple of Ujjain:

1. It is the only jyotirlinga facing north, while all other face south direction.

2. Kalidasa has described temple in Meghadutam.

3. The present structure of temple is built by Maratha general Ranoji Shinde.

Which of the statements given above is/are correct?

a) 1 and 2 only

b) 2 and 3 only

c) 3 only

d) 1 and 3 only

Answer: B

Explanation:

About Mahakal temple:

[WpProQuiz 351]

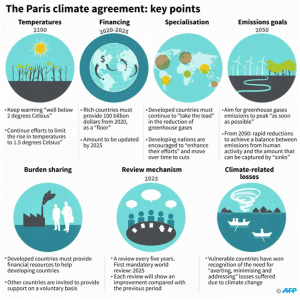

THE CONTEXT: December 12 marked the five-year anniversary of the Paris Agreement. The international community, including the European Union (EU) and India, gathered at the Climate Ambition Summit 2020 to celebrate and recognize our resolve in working towards a safer, more resilient world with net-zero emissions.

Implementation of the Paris Agreement requires economic and social transformation, based on the best available science. The Paris Agreement works on a 5- year cycle of increasingly ambitious climate action carried out by countries. By 2020, countries submit their plans for climate action known as nationally determined contributions (NDCs).

Nationally Determined Contributions (NDCs)

In their NDCs, countries communicate actions they will take to reduce their Greenhouse Gas emissions in order to reach the goals of the Paris Agreement. Countries also communicate in the NDCs actions they will take to build resilience to adapt to the impacts of rising temperatures.

Long-Term Strategies

To better frame the efforts towards the long-term goal, the Paris Agreement invites countries to formulate and submit by 2020 long-term low greenhouse gas emission development strategies (LT-LEDS).

LT-LEDS provide the long-term horizon to the NDCs. Unlike NDCs, they are not mandatory. Nevertheless, they place the NDCs into the context of countries’ long-term planning and development priorities, providing a vision and direction for future development.

Is the Paris agreement binding?

The legal nature of the deal–whether it will be binding–had been a hotly debated topic in the lead up to the negotiations. The agreement walks a fine line, binding in some elements like reporting requirements, while leaving other aspects of the deal—such as the setting of emissions targets for any individual country—as non-binding.

Difference between Paris Climate and Kyoto Protocol

The Paris Agreement provides a framework for financial, technical and capacity building support to those countries who need it.

Finance

The Paris Agreement reaffirms that developed countries should take the lead in providing financial assistance to countries that are less endowed and more vulnerable, while for the first time also encouraging voluntary contributions by other Parties. Climate finance is needed for mitigation, because large-scale investments are required to significantly reduce emissions. Climate finance is equally important for adaptation, as significant financial resources are needed to adapt to the adverse effects and reduce the impacts of a changing climate.

Technology

The Paris Agreement speaks of the vision of fully realizing technology development and transfer for both improving resilience to climate change and reducing GHG emissions. It establishes a technology framework to provide overarching guidance to the well-functioning Technology Mechanism. The mechanism is accelerating technology development and transfer through it’s policy and implementation arms.

Capacity-Building

Not all developing countries have sufficient capacities to deal with many of the challenges brought by climate change. As a result, the Paris Agreement places great emphasis on climate-related capacity-building for developing countries and requests all developed countries to enhance support for capacity-building actions in developing countries.

With the Paris Agreement, countries established an enhanced transparency framework (ETF). Under ETF, starting in 2024, countries will report transparently on actions taken and progress in climate change mitigation, adaptation measures and support provided or received. It also provides for international procedures for the review of the submitted reports.

The information gathered through the ETF will feed into the Global stocktake which will assess the collective progress towards the long-term climate goals.

This will lead to recommendations for countries to set more ambitious plans in the next round.

India has not only achieved its targets but has exceeded them beyond expectations as per the Prime Minister. He delivered a virtual speech at the Climate Ambition Summit that India has reduced its global emissions by 21 percent compared to 2005 and is on its way to do more.

India’s Intended Nationally Determined Contribution (INDC)

India’s effort to address Climate Change

The Government of India has launched eight Missions under the National Action Plan on Climate Change (NAPCC) for assessment of the impact and actions required to address climate change. These eight missions are:

Recent developments

All states have submitted their national contributions to mitigate and adapt to climate change. Distant hypothetical targets are being set. Seems like we are still speeding in the wrong direction or we are lagging far behind.

(1) Unclear targets and response

The world is still unclear since five years as to how the net-zero pledges will translate into shorter term targets. Few of the countries that have announced ambitious long-term goals have implemented national policies to reach them in time.

(2) Degradation isn’t stopped

Meanwhile, we continue to destroy the world’s carbon sinks, by cutting down forests – the world is still losing an area of forest the size of the UK each year, despite commitments to stop deforestation – as well as drying out peatlands and wetlands, and reducing the ocean’s capacity to absorb carbon from the air.

(3) Countries aren’t scaling up their targets

Although 151 states have indicated that they will submit stronger targets before December 31, only 13 of them, covering 2.4 per cent of global emissions, have submitted such targets. While states have been slow to update their national contributions for 2025-2030, several have announced exaggeratedly high “net zero” targets in the recent past.

WAY FORWARD:

CONCLUSION:

For many, there is a mismatch between short-term actions and long-term commitments. A credible short-term commitment with a clear pathway is the key. Not all states will be in a position to pledge net-zero targets, nor should they be expected to. All states, including India, can, however, pledge actions that are credible, accountable and fair. Our real test on climate change is on building a new domestic consensus that can address the economic and political costs associated with an internal adjustment to the prospect of a great global reset.

THE CONTEXT: Chief Justice of India U U Lalit recommended the second most senior judge of the Supreme Court Justice Dhananjaya Yashwant Chandrachud as his successor.

THE EXPLANATION:

The Collegium system

THE CONTEXT: On World Mental Health Day, (10th October) the Lancet released a new report calling for radical action to end stigma and discrimination in mental health, indicating that 90% of people living with mental health conditions feel negatively impacted by stigma and discrimination.

THE EXPLANATION:

THE CONTEXT: Recently,India has received the fourth set of Swiss bank account details of its nationals and organisations as part of an annual information exchange, under which Switzerland has shared particulars of nearly 34 lakh financial accounts with 101 countries.

THE EXPLANATION:

Significance of India receiving information from Switzerland

What is the volume, nature of data?

Guidelines for exchange of such sensitive banking information

What is the scope of India’s AEOI network?

VALUE ADDITION:

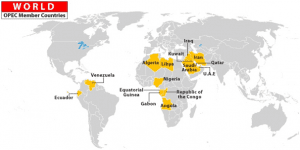

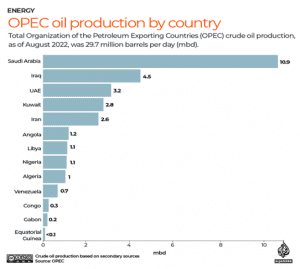

OPEC

THE CONTEXT: Recently, Pakistan has been invited to the closing ceremony, of the ongoing Joint Anti-Terror Exercise (JATE) under the ambit of the Shanghai Cooperation Organisation (SCO) being hosted by India.

THE EXPLANATION:

AIM OF THE EXERCISE

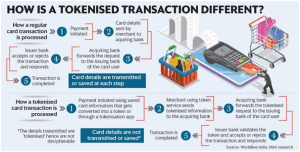

THE CONTEXT: Recently, the Reserve Bank of India’s card-on-file (CoF) tokenisation norms have kicked in, which aim at improved safety and security of card transactions.

THE EXPLANATION:

What is tokenisation?

Tokenisation refers to the replacement of actual card details with a unique alternate code called the ‘token’, which shall be unique for a combination of card, token requester, (i.e. the entity which accepts requests from the customer for tokenisation of a card and passes it on to the card network to issue a corresponding token) and the device.

How did India decide to carry out tokenisation?

THE CONTEXT: According to a joint report prepared by EY and the Indian Space Association (ISpA), an apex industry association of space and satellite companies in the country stated Indian space economy is set to reach $13 billion by 2025.

THE EXPLANATION:

VALUE ADDITION:

Q1. India is hosting ‘Manesar Anti-Terror 2022’ under the ambit of –

a) SCO

b) SAARC

c) ASEAN

d) QUAD

Answer: A

Explanation:

THE CONTEXT: On February 11, 2022,the Securities and Exchange Board of India (SEBI) passed an order involving the country’s largest stock exchange-The National Stock Exchange. Apart from highlighting the issue of corporate misgovernance, the whole episode has raised questions on the role of the capital market regulator. In this article, we examine the issue in detail.

THE SEBI FINDINGS

IMPROPER PERSONNEL MANAGEMENT

DIVULGING CONFIDENTIAL INFORMATION

FAILURE OF THE NSE BOARD

PENALTIES IMPOSED

BLOW TO CAPITAL MARKETS

POOR CORPORATE GOVERNANCE

REWARDING MALFEASANCE

CONDUCT OF DIRECTORS OF GOVT COMPANIES/BANKS

REGULATOR’S CONDUCT

A SERIES OF SCAMS IN NSE

WHAT ARE CO-LOCATION FACILITIES?

BENEFITS OF THESE FACILITIES

UNFAIR ACCESS TO SERVERS

ROLE OF WHISTLEBLOWER AND MEDIA

EXTENT OF LOSS

PENALTY ON NSE

CORRECTIVE MEASURES

CONSTITUTION OF SEBI

PROTECTIVE FUNCTION OF SEBI

REGULATORY FUNCTION OF SEBI

DEVELOPMENT FUNCTION OF SEBI

OBJECTIVES OF SEBI

POWERS OF SEBI

SEBI is a quasi-legislative, quasi-judicial and quasi-executive body.

GOVERNANCE OF SEBI

The SEBI Board consist of nine members-

ENFORCEMENT OF LAWS

INEXPLICABLE DELAY

DILUTION OF OFFENCE

POOR CAPACITY OF SEBI

NO FEAR FOR REGULATOR

LOST OPPORTUNITY FOR REFORMS

SEBI’S FAILURE TO UPHOLD NATIONAL INTEREST

ABDICATION OF AUTHORITY

SCALE UP THE RESOURCE BASE

FAST TRACK REFORMS IN NSE

ACTIONS BY SEBI

FULFILLING SEBI’S MANDATE

EXPECTATION FROM THE NEW SEBI CHIEF

ROLE OF PMO AND OTHERS

REGULATING THE REGULATOR

RESTRUCTURING THE BOARD OF NSE

WHISTLEBLOWER PROTECTION

1. The identity of the whistle-blower must be strictly protected to prevent vindictive action.

PROFESSIONAL CONDUCT OF THE GOVT COMPANY/BANK REPRESENTATIVES

THE CONCLUSION: Despite the capture of power by a few individuals and the governance infractions they indulged in, few can dispute that the National Stock Exchange (NSE) has served Indian financial markets extremely well in the three decades of its existence. Its state-of-the-art electronic platform and reliable trading and settlement systems have ensured that there were no systemic failures through the worst of upheavals. It is therefore critical for the government and the regulator to get to work on fixing the loopholes in the governance structures at the NSE so that such infractions don’t recur. Clearly, the regulator needs to introspect on its actions both in the co-location and ‘yogi’ scams and learn from the mistakes.

[WpProQuiz 350]

THE CONTEXT: Recently, India banned the exports of broken rice and imposed a 20 per cent duty on the exports of various grades of rice amid high cereal inflation and uncertainties with respect to domestic supply.

THE EXPLANATION:

• The world rice market is thin, given that 90 per cent of production is consumed domestically. As a result, any small change in exports and imports has an enormous impact on prices, especially if it leads to panic buying of food grains by rich countries.

• While the actual impact of the export restriction policy on domestic prices is a matter of empirical scrutiny, and the government has intended to regulate domestic prices and safeguard food security, frequent changes in export policies undoubtedly have long-term ramifications.

• India exports rice to more than 130 countries, constituting around 40 per cent of the global rice trade. The decision to curb rice exports has, unfortunately, been taken when global food prices are already rising. The export uncertainties will affect the credibility of Indian exporters, create a disincentive for future exports, and will enable buyers to shift towards other major rice-exporting countries.

• In India, around 49 per cent of rice cultivation depends on groundwater, which is depleting rapidly. As per the latest data available from the Food and Agriculture Organisation (FAO), agricultural water withdrawal as a percentage of total available renewable water resources has increased from 26.7 per cent in 1993 to 36 per cent in 2022. Similarly, the total per capita renewable water resources have also declined from 1,909 cubic meters to 1,412 cubic meters during this period.

• The water-intensive nature of rice cultivation, along with frequent export restrictions will adversely affect the long-run sustainability of rice production. Further, India’s export restrictions will adversely affect several low-income and low-middle-income countries like Bangladesh, Senegal, Nepal and Benin, which are among the largest importers of Indian rice.

VIRTUAL WATER TRADE (VWT)

• Rice exports are leading to an indirect export of water to other countries — a phenomenon known as virtual water trade (VWT). The relative per capita water availability in India is lower than a majority of its major importing countries. The other major exporters of rice, such as Thailand and Vietnam, also have better per capita water availability in comparison to India. Out of 133 countries in which India has positive net rice exports, only 39 countries have relatively lower per capita renewable water resources. Out of these 39 countries, 12 countries are high-income countries with the ability to buy food at a higher price.

• Though Minimum Support Prices (MSPs) are announced for a large number of crops, India’s food security policies, especially how they are implemented, favour mainly rice and wheat. Furthermore, procurement is skewed towards selected northern states such as Punjab and Haryana where water availability is lower than in several other states.

• India’s rice yield is also lower than the world average. India’s yield is better than Thailand and Pakistan but worse than Vietnam, China and the US. The cost of cultivation in India is also increasing, and hence there will be a need for a higher MSP to make production remunerative. This will exacerbate the pressure to re-think its price-support-backed food security mechanism.

VALUE ADDITION: MAJOR RICE PRODUCING STATES IN INDIA

As of 2020-21, the top 3 rice-producing states of India are:

1. West Bengal

2. Uttar Pradesh

3. Punjab

Around 36% of India’s total rice production is from these 3 states. West Bengal contributed 13.62% of the total rice produced in India. Uttar Pradesh contributed 12.81% of the total rice produced in India. Punjab accounted for 9.96% of the total rice produced in India.

Rice is a Kharif crop. Rice requires an annual rainfall of more than 100 cm. It requires high humidity and high temperature. The required temperature is more than 25 degrees celsius.

THE CONTEXT: Recently, the Reserve Bank of India (RBI) indicated that it will soon commence limited pilot launches of e-rupee (e`), or Central Bank Digital Currency (CBDC) or digital rupee, for specific use cases.

THE EXPLANATION:

It has hinted at two broad categories for the use of e-rupee — retail and wholesale — taking the payment system in the country to a new level where the common people and businesses will be able to use the digital currency seamlessly for various transactions.

What’s RBI’s plan?

• The central bank said that the development of CBDC could provide the public a risk-free virtual currency that will give them legitimate benefits without the risks of dealing in private virtual currencies.

• The approach for issuance of CBDC will be governed by two basic considerations — to create a digital rupee that is as close as possible to a paper currency and to manage the process of introducing digital rupee in a seamless manner. The central bank also feels that it is desirable for CBDCs to have offline capabilities to make it a more attractive and accessible medium of payment for a wide category of users.

• E-rupee is the same as a fiat currency and is exchangeable one-to-one with the fiat currency. Only its form is different. It can be accepted as a medium of payment, legal tender and a safe store of value. The digital rupee would appear as liability on a central bank’s balance sheet.

What are the types of e-rupee?

• Based on the usage and the functions performed by the digital rupee and considering the different levels of accessibility, CBDC can be demarcated into two broad categories — general purpose (retail) (CBDC-R) and wholesale (CBDC-W), the RBI’s concept note says.

• Retail CBDC is an electronic version of cash primarily meant for retail transactions. It will be potentially available for use by all — private sector, non-financial consumers and businesses — and can provide access to safe money for payment and settlement as it is a direct liability of the central bank.

• However, the RBI has not explained how e-rupee can be used in merchant transactions in the retail trade.

What are the forms of CBDC?

• The central bank says e-rupee, or CBDC, can be structured as token-based or account-based. A token-based CBDC would be a bearer instrument like banknotes, meaning whosoever holds the tokens at a given point in time would be presumed to own them. In a token-based CBDC, the person receiving a token will verify that his ownership of the token is genuine.

• A token-based CBDC is viewed as a preferred mode for CBDC-R as it would be closer to physical cash.

• An account-based system would require maintenance of record of balances and transactions of all holders of the CBDC and indicate the ownership of the monetary balances. In this case, an intermediary will verify the identity of an account holder. This system can be considered for CBDC-W.

What’s the model for issuance?

There are two models for issuance and management of CBDCs under the RBI’s consideration — direct model (single tier model) and indirect model (two-tier model). In the direct model, the central bank will be responsible for managing all aspects of the digital rupee system such as issuance, account-keeping and transaction verification.

VALUE ADDITION:

What is Fiat Currency?

• Fiat money is government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it.

• The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it as is the case for commodity money.

• Most modern paper currencies are fiat currencies, including the U.S. dollar, the euro, and other major global currencies.

Fiat Money vs Legal Tender

• Fiat money has no intrinsic value, while legal tender is any currency declared legal by a government.

• Governments can issue fiat currency and make it legal tender by setting it as the standard for debt repayment.

• The benefit of fiat money is that it gives central banks greater control over the economy, but governments can print too much money and create hyperinflation.

• The U.S. dollar , Indian Rupee etc are both fiat money and legal tender.

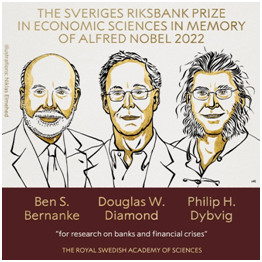

THE CONTEXT: According to Royal Swedish Academy of Sciences, Ben Bernanke, Douglas Diamond and Philip Dybvig won the 2022 Nobel Economics Prize “for research on banks and financial crises”.

THE EXPLANATION:

• The Economics Prize has gone to the three individuals for their role in research related to how banks function. “Modern banking research clarifies why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises.

“Modern banking research clarifies why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises.

• The foundations of this research were laid by Ben Bernanke, Douglas Diamond and Philip Dybvig in the early 1980s. Their analyses have been of great practical importance in regulating financial markets and dealing with financial crises.

It also noted, “Later, when the pandemic hit in 2020, significant measures were taken to avoid a global financial crisis. The laureates’ insights have played an important role in ensuring these latter crises did not develop into new depressions with devastating consequences for society.” Here is the role each of them played in the development of this research.

Ben S. Bernanke

According to sources, the research laid the foundation of some crucial questions on banks: “If banking collapses can cause so much damage, could we manage without banks? Must banks be so unstable and, if so, why? How can society improve the stability of the banking system? Why do the consequences of a banking crisis last so long? And, if banks fail, why can’t new ones immediately be established so the economy quickly gets back on its feet?”

Douglas W. Diamond and Philip H. Dybvig

• Both Diamond and Dybvig worked together to develop theoretical models explaining why banks exist, how their role in society makes them vulnerable to rumours about their impending collapse, and how society can lessen this vulnerability. These insights “form the foundation of modern bank regulation”.

• The model captures the central mechanisms of banking, as well as its weaknesses. It is based upon households saving some of their income, as well as needing to be able to withdraw their money when they wish. That this does not happen at the same time for every household allows for money to be invested into projects that need financing. They argue, therefore, that banks emerge as natural intermediaries that help ease liquidity.

• But with massive financial crises that have been witnessed in history, particularly in the US, it is often discussed how banks need to be more careful about assessing the loans they give out, or how bailing out banks in crisis.

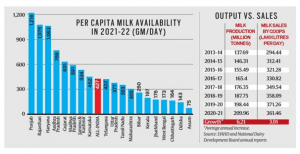

THE CONTEXT: According to the National Statistical Office’s (NSO) household consumer expenditure (HCE) survey for 2011-12, the monthly per capita consumption of milk was 4.33 litres in rural India and 5.42 litres in urban India.

THE EXPLANATION:

• Taking an average of 5 litres (5.15 kg; 1 litre of milk = 1.03 kg), this translates into an annual consumption of nearly 75 million tonnes (mt) for a population of 1,210.85 million as per the 2011 Census.

• This figure includes only milk consumed by households — directly and as curd, butter, ghee, paneer, etc. at home. It excludes milk consumed by businesses — tea shops, hotels, and ice-cream, sweetmeat, chocolate and biscuit makers. If this milk is assumed to be 25% over and above that consumed by households, it adds up to about 94 mt — or a daily per capita availability of 212 gm.

What production data show?

• Going by Department of Animal Husbandry & Dairying (DAHD) statistics, India’s milk production in 2011-12 was 127.9 mt with a daily per capita availability of 289 gm. These were 210 mt and 427 gm respectively in 2020-21.

• Unfortunately, there is no published HCE survey data after 2011-12. In all likelihood, the gap between the NSO’s consumption-based estimates and the DAHD’s production numbers would only have widened.

• Between 2013-14 and 2020-21, India’s milk production grew at an average 6.2% a year. (Table) But this isn’t reflected in the marketing of liquid milk by dairy cooperatives, which grew by just over 3% annually in volume terms during this period.

• In the private sector, growth in the average sales of 12 major dairy companies averaged 4.93% in nominal terms between 2014-15 and 2020-21. After adjusting for an average wholesale price inflation of 3% for “dairy products” over this period, their real sales growth was slightly more than 1.9%.

Demand is the key

• Knowing what and how much Indians are consuming — which only a comprehensive nationwide HCE survey can reveal — is useful for analysis of demand and supply in other farm produce too. It helps in framing policies better, whether on fixation of minimum support prices and tariffs or on crop diversification.

• For example, the monthly per capita household consumption of all cereals in the 2011-12 survey was assessed at 11.22 kg for rural India, and 9.28 kg for urban India. At an average of 10 kg, the annual household cereal consumption requirement for 1,400 million people today would be around 168 mt.

• Assuming 25% additional consumption in processed form (bread, biscuits, cakes, noodles, vermicelli, flakes, etc.), and another 25 mt of grain (mainly maize) for feed or starch, the total yearly demand would be around 235 mt.

THE CONTEXT: The report titled “The global forest sector outlook 2050: Assessing future demand and sources of timber for a sustainable economy” was released recently by the United Nations Food and Agriculture Organization (FAO) at the 26th Session of the Food and Agriculture Organization Committee on Forestry in Rome.

THE EXPLANATION:

• The newly released report estimates an increased demand for wood products like mass timber and manmade cellulose fibre that are used as alternatives to non-renewable materials. Their demand may surge by up to 272 million cubic metres by 2050.

• This is expected to create over 1 million jobs in developing countries. The report forecasts that the consumption of primary processed wood products will increase to 3.1 billion cubic meters by 2050. This estimation is based on the Global Forest Products Model, which uses historical patterns of the production and trade of wood products.

• The report also forecasted that the industrial roundwood (IRW) will be vulnerable to uncertainties caused by climate-change influenced government interventions in naturally regenerated production forests and the expansion of planted forests. The future demands for IRW will be met by both planted forests mainly from Global South and naturally regenerated temperate and boreal forests.

• In 2020, about 44 per cent of the IRW production was provided by regenerated temperate and boreal forests. During the same year, the planted forests contributed to around 46 per cent of the IRW supply.

• In the future, an additional 33 million hectares of “highly productive plantation forest” will be required to meet the demand in 2050, if the area of naturally regenerated forests remain intact.

• A total annual investment of 40 billion USD will be required to maintain and expand the IRW production by 2050. Another yearly funding of 25 million USD will be required for the modernization and establishment of industries.

• In 2050, consumption of wood energy will be concentrated in sub-Saharan Africa and South Asia, where fuelwood is traditionally used by communities. Firewood will also be used in modern biomass to generate renewable energy.

• In 2020, the global consumption of fuelwood was 1.9 billion cubic meters. In 2050, this figure is expected to increase 11 to 42 per cent by reaching 2.1 to 2.7 billion cubic meters.

VALUE ADDITION:

FAO:

• It is a specialized agency of the United Nations that leads international efforts to defeat hunger. Headquarters: Rome, Italy.

• Founded: 16 October 1945.

• Goal of FAO: Their goal is to achieve food security for all and make sure that people have regular access to enough high-quality food to lead active, healthy lives.

Important reports and Programmes:

• Global Report on Food Crises.

• Every two years, FAO publishes the State of the World’s Forests.

• FAO and the World Health Organization created the Codex Alimentarius Commission in 1961 to develop food standards, guidelines and texts.

• In 1996, FAO organized the World Food Summit. The Summit concluded with the signing of the Rome Declaration, which established the goal of halving the number of people who suffer from hunger by the year 2015.

• In 1997, FAO launched TeleFood, a campaign of concerts, sporting events and other activities to harness the power of media, celebrities and concerned citizens to help fight hunger.

THE CONTEXT: The Prime Minister who is on visit to his home state of Gujarat ahead of the state assembly elections visited Modhera which is famous for its Sun Temple.

THE EXPLANATION:

• During his visit he declared Modhera village in Gujarat as India’s first 24×7 solar-powered village, talked about how invaders in the past tried their best to raze the historic Sun Temple in Modhera and the atrocities they committed on the people of the region.

invaders in the past tried their best to raze the historic Sun Temple in Modhera and the atrocities they committed on the people of the region.

• Sun Temple Modhera Sun Temple at Modhera is one of the few shrines that are dedicated to the Sun God. Situated on the banks of Pushpavati River in Modhera, Sun Temple is easily accessible from Ahmedabad, the largest city of Gujarat.

• In 1026, the temple was built by King Bhimdev of the Solanki dynasty (believed to be the descendants of the lineage of Sun God). This ancient temple revives the reminiscences of Sun Temple at Konark in Orissa. Turning in the pages of history, one can notice the mention of Modhera in the scriptures like Skanda Purana and Brahma Purana.

Architecture

• The brilliant architecture of the temple is one of its own class. The temple encompasses three different yet axially-aligned and integrated constituents.

• As per the Konark Temple, this shrine is designed in a manner, so that the first rays of the Sun cast on the image of the Lord Surya. The Temple was plundered by Mahmud Ghazni; still the architectural grandeur is not vanished.

OTHER SUN TEMPLES IN INDIA- PRELIMS PERSPECTIVE

1. Bhramanya Dev Temple At Unao, Madhya Pradesh.

2. Dakshinaarka Temple At Gaya, Bihar. …

3. Konark Sun Temple, Odisha. …

4. Sun Temple At Modhera, Gujarat. …

5. Vivasvan Sun Temple, Gwalior, Madhya Pradesh.

6. Arasavalli- Suryanarayana Temple, Andhra Pradesh.

Q1. The term Solidity, Rusk, Haskell, sometimes seen in news, are –

a) Exo-planets explored by NASA missions

b) Programming languages used in crypto-currency

c) International initiatives for climate change actions

d) Non-profit organisations working for human rights protection

Answer: B

Explanation:

• Solidity is the programming language mainly used on the blockchain platform Ethereum.

• In the crypto world, Rust is commonly associated with the Solana blockchain, which is known for its high speeds and relatively low transaction fees.

• Haskell is not well-known, and that it is not a popular programming language for beginners. Haskell is classified as a purely functional programming language, and is hard to learn.

[WpProQuiz 349]

THE CONTEXT: A WTO panel, in its ruling on December 14, 2021, recommended India to withdraw its subsidies on sugar under the Production Assistance, the Buffer Stock, and the Marketing and Transportation Schemes as they are violative of the WTO norms and rules. Ruling in favour of Brazil, Australia and Guatemala in their trade dispute against India over its sugar subsidies, the WTO panel has stated that the support measures are inconsistent with WTO trade rules. This article analyse this issue in detail.

COMPLAINT AGAINST INDIA

SUBSIDIES BEYOND DE MINIMIS LEVEL

OTHER POINTS OF CHALLENGES.

PROCESS AT WTO

THE PANELS’ FINDINGS.

THE PANELS’ RECOMMENDATIONS

RESPONSE OF THE COMMERCE MINISTRY

ON DOMESTIC SUPPORT/SUBSIDY.

APPEAL TO APPELLATE BODY(AB)

WHAT IS AoA?

To reform the agriculture trade and to improve the predictability and security of importing and exporting countries, the World Trade Organization came up with the agriculture agreement. It was negotiated during the Uruguay Round of the General Agreement on Tariffs and Trade, and entered into force with the establishment of the WTO on January 1, 1995. The three provisions/pillars that the agriculture agreement focuses on are –

DOMESTIC SUPPORT

DE MINIMIS LEVEL

AGGREGATE MEASUREMENT OF SUPPORT

SCM

DISPUTE SETTLEMENT BODY (DSB)

APPELLATE BODY

NAIROBI PACKAGE

BALI PACKAGE 2013

Some governments use public stockholding programmes to purchase, stockpile and distribute food to people in need. While food security is a legitimate policy objective, some stockholding programmes are considered to distort trade when they involve purchases from farmers at prices fixed by the governments, known as “supported” or “administered” prices.

In India’s case the subsidies provided to run the food security programme (NFSA) as per the developed member countries are trade distorting and they fall under the Amber box. As per AMS, the total support in monetary terns should not exceed 10 percent of the total value of agri production as on 1986-88. The government buys the produce at MSP which subsidises the prices of food grains. In the instant case (sugar subsidy), the public stock holding programme per se was not challenged but one specific component “buffer stock” of sugar, presumably related to the subsidised sugar provision to the Antyodaya Anna Yojna category under the NFSA. But India argues that the public stockholding programme is vital for its food security, nutritional needs, supporting the marginalised farmers, and meeting the goals of SDGs.

At the 2013 Bali Ministerial Conference, ministers agreed that, on an interim basis, public stockholding programmes in developing countries would not be challenged legally even if a country’s agreed limits for trade-distorting domestic support were breached. They also agreed to negotiate a permanent solution to this issue.

A decision on public stockholding taken at the 2015 Nairobi Ministerial Conference reaffirmed this commitment and encouraged WTO members to make all concerted efforts to agree on a permanent solution.

In the MC III, the G 33 is seeking a permanent solution to the stockholding issue.

SCHEME FOR EXTENDING FINANCIAL ASSISTANCE TO SUGAR UNDERTAKINGS (SEFASU-2014)

SOFT LOAN TO SUGAR MILLS TO FACILITATE CLEARANCE OF CANE PRICE ARREARS

OTHERS

EXPORT SUBSIDY

WHAT IS THE WAY FORWARD?

OVERHAULING THE AoA

RE WORKING OF SUBSIDIES AND RE DEFINITION OF “ BOXES”.

PRO ACTIVE LOBBYING BY G-33

APPEALING THE DECISION

LEARNING FROM SETBACKS.

THE CONCLUSION: The WTO system is the sheet anchor for a rule based multilateral trading system. Thus, the dispute setline and adherence to the rulings is necessary for realizing the objective. But that does not mean the sovereign rights of a country to devise policies for the welfare and development of a country should be forfeited. What is necessary is to create a healthy balance between the two and that’s why there has to be synergy between foreign trade policy and domestic agricultural policies which are dynamically linked with the WTO norm and rules.

THE CONTEXT: Recently, an inter-ministerial task force, set up by the Ministry of Electronics and Information Technology (MeitY) to propose contours of a national-level legislation to regulate online gaming, has proposed the creation of a central regulatory body for the sector, clearly defining what games of skill and chance are, and bringing online gaming under the purview of the Prevention of Money Laundering Act, 2002, among other things.

THE EXPLANATION:

The task force, set up by MeitY in May 2022, included the CEO of government think tank Niti Aayog, and secretaries of ministries including IT, Home, Finance, Information and Broadcasting, and Consumer Affairs, among others. The task force is understood to have prepared a final report of its recommendations and submitted it to the IT Ministry.

Why a central-level law?

How big is the online gaming market in India?

What are the recommendations of the task force?

Which ministry will be in charge of the regulation?

THE CONTEXT: The recent coup d’état resulted in the overthrowing of the Interim President Paul-Henri SandaogoDamiba and army Captain Ibrahim Traore taking over the government.

THE EXPLANATION:

Islamic insurgency.

Islamic insurgency.THE CONTEXT: According to a study released by the Stockholm International Peace Research Institute (SIPRI), a widely respected independent resource on global security, India ranks fourth among 12 Indo-Pacific nations in self-reliant arms production capabilities

THE EXPLANATION:

THE CONTEXT: The SASTRA Ramanujan Prize was recently bestowed to Yunqing Tang – an Assistant Professor at the University of California.

THE EXPLANATION

About SASTRA Ramanujan Prize

The prestigious award was instituted by the Shanmugha Arts, Science, Technology & Research Academy (SASTRA) in the year 2005. It includes a cash prize of 10,000 USD. The award recognizes individuals aging 32 and below who have made significant contributions in the field of mathematics that is broadly influenced by Srinivasa Ramanjuan. The first to receive this award was Manjul Bhargava and Kannan Soundararajan.

Who was Srinivasa Ramanujan?

THE CONTEXT: Bharat Skills Forum is a new feature of the Bharat skills learning platform.

THE EXPLANATION:

What is Bharat skills platform?

About Directorate General of Training (DGT)

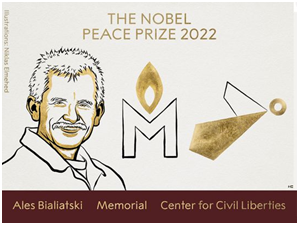

THE CONTEXT: The Nobel Peace Prize for 2022 has been awarded to human rights advocate Ales Bialiatski from Belarus, the Russian human rights organisation Memorial, and the Ukrainian human rights organisation Center for Civil Liberties, the Norwegian Nobel Committee announced.

THE EXPLANATION:

promoted the right to criticise power and protect the fundamental rights of citizens. They have made an outstanding effort to document war crimes, human right abuses and the abuse of power. Together they demonstrate the significance of civil society for peace and democracy”.

promoted the right to criticise power and protect the fundamental rights of citizens. They have made an outstanding effort to document war crimes, human right abuses and the abuse of power. Together they demonstrate the significance of civil society for peace and democracy”.Russian human rights organisation, Memorial

The committee said the organisation was established in 1987, “by human rights activists in the former Soviet Union who wanted to ensure that the victims of the communist regime’s oppression would never be forgotten.” Nobel Peace Prize laureate Andrei Sakharov, who won the prize in 1954, and human rights advocate Svetlana Gannushkina were among the organisation’s founders. “Memorial is based on the notion that confronting past crimes is essential in preventing new ones”.

Q1. There has been a recent proposal to establish International Dark Sky Reserve in India. In which of the following state/U.T is it proposed to be located?

a) Maharashtra

b) Pondicherry

c) Chandigarh

d) Ladakh

Answer: D

Explanation:

THE CONTEXT: To understand why, how and what of the COVID-19 being declared as a ‘notified disaster’, one should know first about disaster, how disaster is categorized and funding is determined by the Centre. In brief, one should have understanding of some legal and procedural aspects of the NDMA 2005.

DO YOU KNOW?

As you are aware that the NDMA 2005 was one of the very significant legislation of 2005 and first important landmark legislation for a holistic disaster management in India which is blueprint for making India a disaster resilient country. The law has become basis for taking a series of steps by the government to establish policy, procedural and institutional mechanisms for disaster management in India.

The law lays down following key mechanisms to make India a disaster resilient country and match to the global standards in disaster management. The key features are:

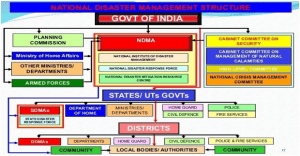

At the apex, it is the national disaster management authority headed by the Prime Minister which is responsible for taking important decisions related to disaster management in India followed by several committees, ministries and departments.

HOW DOES THE TERM ‘DISASTER’ IS DEFINED BY THE NDMA?

As per the Disaster Management Act, 2005, “disaster” means a catastrophe, mishap, calamity or grave occurrence in any area, arising from natural or man-made causes, or by accident or negligence which results in substantial loss of life or human suffering or damage to, and destruction of, property, or damage to, or degradation of, environment, and is of such a nature or magnitude as to be beyond the coping capacity of the community of the affected area. A natural disaster includes earthquake, flood, landslide, cyclone, tsunami, urban flood, heatwave; a man-made disaster can be nuclear, biological and chemical.

HOW THE TERM DISASTER IS CLASSIFIED?

We often hear demands by the states to declare a calamity as national disaster from the Centre. You also know that at times there is difference in view on whether a disaster should be declared as national disaster.

But you will wonder to notice the fact that there is no any defined standards or legal provision for the categorization of disasters. The NDMA is silent on this provision that it doesn’t have a clearly defined mechanism for the classification of the disasters. Rather, the classification is done on the case by case basis. For instance, learning from the past experiences, the disasters have been classified as

CLASSIFICATIONS

DISASTERS

A. A calamity of unprecedented severity

B. Calamities of severe nature

C. Notified disaster

DOES IT MEAN THE TERM NATIONAL DISASTER WHICH IS OFTEN USED HAS NO LEGAL BASIS?

Yes, the term has no legal basis and it is used in general parlance by the governments and media. For instance, the state of Kerala demanded that the flood should be declared as National Disaster but the central government replied that there is no such term like national disaster.

The central government examine the proposal of the Kerala and the MoS (Home) replied to a question in Parliament “The existing guidelines of State Disaster Response Fund (SDRF)/ National Disaster Response Fund (NDRF), do not contemplate declaring a disaster as a ‘National Calamity’.” There is no provision, executive or legal, to declare a natural calamity as a national calamity. It is used more in general parlance.

Therefore, there is no provision in the law or rules for the government to designate a disaster a “national calamity” and the guidelines of the NDRF and SDRFs don’t contemplate declaring a disaster a national calamity. The Centre also informed the Kerala High Court that there was no legal provision to declare a disaster as a national calamity, amid demands for declaring the floods as a national disaster.

DOES IT MEAN THERE HAS BEEN NO EFFORTS TO DEFINE THE STANDARDS OF DISASTERS?

In 2001, the National Committee on Disaster Management under the chairmanship of the then Prime Minister was mandated to look into the parameters that should define a national calamity. However, the committee did not suggest any fixed criterion.

The 10th Finance Commission (1995-2000) examined a proposal that a disaster be termed “a national calamity of rarest severity” if it affects one-third of the population of a state. The panel did not define a “calamity of rare severity” but stated that a calamity of rare severity would necessarily have to be adjudged on a case-to-case basis taking into account, inter-alia,

WHY IS IT IMPORTANT TO CLASSIFY A CALAMITY OR DISASTER?

Simply because it is the categorization which ultimately determines the quantum of relief sanctioned by the CENTRE to the states under the SDRFs. If a disaster is categorized as ‘rare severe nature’ then accordingly the state will receive the relief from the Centre.

WHICH AUTHORITY IS RESPONSIBLE FOR CATEGORISING THE DISASTERS?

The classification is the responsibility of the NDMA which is headed by the Prime Minister. But in actual practice, it is done by the national executive committee headed by the Home Secretary and is notified by the Ministry of Home Affairs. In general, it can be said that disasters are categorized and notified by the Ministry of Home Affairs.

WHAT HAPPENS IF A CALAMITY IS SO CATEGORISED?

HOW IS THE FUNDING DECIDED?

HOW MUCH FUNDS HAS THE CENTRE BEEN DISBURSING UNDER THE NDRF?

According to a reply in Parliament by MoS (Home) in January 2020, the Centre released Rs 3,460.88 crore in 2014-15, Rs 12,451.9 crore in 2015-16, and Rs 11,441.30 crore in 2016-17 under the NDRF to various states. In 2017-18 until December 27, it had disbursed Rs 2,082.45 crore. State-wise figures showed that the highest amounts for 2016-17 were released to

HOW ARE THE NDRF AND THE SDRFS FUNDED?

The funding of the NDRF: The NDRF is funded through a National Calamity Contingent Duty levied on pan masala, chewing tobacco and cigarettes, and with budgetary provisions as and when needed. A provision exists to encourage any person or institution to make a contribution to the NDRF.

The 14th Finance Commission recommended changes to this structure once the cess was discontinued or subsumed within the Goods and Services Tax. However, the government, instead, decided to continue with the National Calamity Contingent Duty even in the GST regime.

The funding of the SDRF:

What has been the trend in budgetary allocations to the NDRF and SDRFs?

The Union government has maintained a steady flow of funds to the NDRF each year, ranging from ₹5,690 crore in 2015-16 to a budgeted amount of ₹2,500 crore for the current financial year. In addition, the Centre has also been contributing to the SDRFs every year, amounting to ₹ 8,374.95 crore in 2016-17 and ₹7,281.76 crore in 2017-18.

HOW DO OTHER COUNTRIES CLASSIFY DISASTERS?

In the US, the Federal Emergency Management Agency (FEMA) coordinates the government’s role in disaster management. When an incident is of such severity and magnitude that effective response is beyond the capabilities of state and local governments, the Governor or Chief Executive of a tribe can request federal assistance under the Stafford Act. In special cases, the US President may declare an emergency without a request from a Governor. The Stafford Act authorises the President to provide financial and other assistance to local and state governments, certain private non-profit organisations, and individuals following declaration as a Stafford Act Emergency (limited) or Major Disaster (more severe).

WEAKNESSES IN CATEGORISATION AND FUNDING OF DISASTERS

When there is lack of institutionalized and standardized mechanisms for the categorization and determining the quantum of funds to states then it results into

CONCLUSION AND WAY FORWARD

To deal effectively with the disasters when they strike, it is essential to have a robust mechanism for categorization and immediate relief package to the states. Since India is a federal state in which the states are heavily dependent on the Centre, hence without an institutionalized standard for the transfer of disaster funds, there can be huge loss to human life, resources and will become a hurdle in making Indian society disaster resilient.

Hence, the government should improve the NDMA 2005 by taking the following steps:

The disaster management in India has improved since 2005 due to adoption of a new legal and institutional framework according to which the Centre has also come up with the National Disaster Management Policy 2009 and the National Disaster Management Plan 2016. The states have also taken similar steps. But still there is huge scope for improvement in disaster management in India based on the COVID-19 experiences and other recent disasters like Kerala flood and cyclones in South India.

THE CONTEXT: Recently India abstained from voting on a resolution on Sri Lanka at the UN Human Rights Council, while observing that Sri Lanka’s progress in implementing commitments on the 13th Amendment, meaningful devolution and early provincial elections remains “inadequate”.

THE EXPLANATION:

What is the legislation?

Why is the 13th Amendment significant?

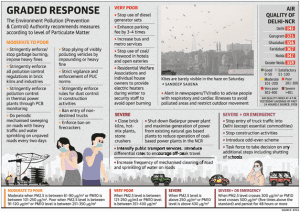

THE CONTEXT: Recently, the Commission for Air Quality Management (CAQM) that measures under ‘Stage-1’ of the Graded Response Action Plan (GRAP) will be enforced in the NCR with immediate effect.

THE EXPLANATION:

What is the Graded Response Action Plan?

How is the GRAP different this year?

What are the measures that will be enforced this year?

What are some other measures being considered

What are citizens required to do?

VALUE ADDITION:

About the Commission for Air Quality Management (CAQM):

Composition:

Chairperson: To be chaired by a government official of the rank of Secretary or Chief Secretary.

THE CONTEXT: Recently, the National Zoological Park has come up with an amazing animal adoption scheme which will offer the animal lovers to participate in wildlife conservation. In this scheme, zoos offer the zoo animals/animal species in their collection to the general public for taking care of them.

THE EXPLANATION:

How does an Animal Adoption Scheme Work?

What is the rate list for adopting animals?

What is the validity of an adoption membership card?

THE CONTEXT: In July 2022, Kotak Securities said in a study that at least 60% of 400 employees surveyed said they themselves had or knew someone who had engaged in moonlighting.

THE EXPLANATION:

What is meant by Moonlighting?

What does the law say?

THE CONTEXT: The first week of October is said to mark the 200th anniversary of the completion of the Basilica of Our Lady of Graces, one of India’s minor basilicas situated in Sardhana in Uttar Pradesh.

THE EXPLANATION:

Who was Begum Samru?

Catholicism, a nautch-girl (dancing girl) who became a warrior and an aristocrat, and was described by her contemporaries as dressing more like a man than a woman, sporting a dark turban and ever-puffing away at a hookah.

Catholicism, a nautch-girl (dancing girl) who became a warrior and an aristocrat, and was described by her contemporaries as dressing more like a man than a woman, sporting a dark turban and ever-puffing away at a hookah.THE CONTEXT: The Nobel Prize for Literature 2022 has gone to French author Annie Ernaux, for, according to the Swedish Academy, “the courage and clinical acuity with which she uncovers the roots, estrangements and collective restraints of personal memory”.

THE EXPLANATION:

work ‘The Years’, translated by Alison L Strayer, was shortlisted for the Man Booker international prize. Her book on her illegal abortion in the 1960s, ‘Happening’ (first published in 2001) has also been in the limelight after abortion rights were curtailed in the US.

work ‘The Years’, translated by Alison L Strayer, was shortlisted for the Man Booker international prize. Her book on her illegal abortion in the 1960s, ‘Happening’ (first published in 2001) has also been in the limelight after abortion rights were curtailed in the US.1.Consider the following statements about Pharmaceutical Export Promotion Council of India (Pharmexcil):

Which of the statements given above is/are correct?

a) 1 and 2 only

b) 2 only

c) 2 and 3 only

d) 1 and 3 only

Answer: C

Explanation:

Pharmaceutical Export Promotion Council of India (Pharmexcil)

[WpProQuiz 348]

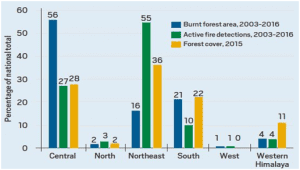

THE CONTEXT: Australia has declared a state of emergency for the state of New South Wales (NSW) along with a catastrophic fire warning the highest level of bush fire danger in light of widespread bushfires that have left at least three people dead. Bushfires are a routine occurrence in the country, but this bushfire season is believed to be the worst and has started even before the beginning of the Southern Hemisphere summer.

AMAZON FOREST FIRE

CALIFORNIA FIRE

BANDIPUR NATIONAL PARK

Causes of forest fires can be divided into two broad categories

Environmental causes

Human related causes

Result from human activity as well as methods of forest management. These can be intentional or unintentional, for example:

Classification of Forest Fire Forest fire can broadly be classified into three categories;

Types of Forest Fire: There are two types of forest fire

Surface Fire

Crown Fire

EFFECT OF FOREST FIRE

Fires are a major cause of forest degradation and have wide ranging adverse ecological, economic and social impacts, including:

MoEFCC guidelines

MoEFCC issued a set of national guidelines for forest fire prevention and control in 2000. These guidelines call for:

National Master Plan for Forest Fire Control

The main objectives are:

Forest Fire Prevention and Management Scheme

In 2017, Intensification of Forest Management Scheme was revised and replaced as Forest Fire Prevention & Management Scheme. The main objectives of the scheme are as follows:

Pre-Warning Alert System

NDMA Guidelines

Major recommendations include:

Draft National Forest Policy, 2018

FAO Recommendations on Forest Fire Management

ISSUES AND CHALLENGES:

WAY FORWARD:

Policy

At the national level, a cohesive policy or action plan should be formulated to set forth the guiding principles and framework for FFPM. The policy and programmes for forest fire management should incorporate the dimension of climate change

Management

Forest fire prevention and management practices used by state forest departments also need to be strengthened

Funding and Human Resource

Greater funding for construction of watchtowers and crew stations and for frontline officers and seasonal firewatchers to spot fires is needed. Further, adequate training should be provided to field officers, seasonal firewatchers, and community volunteers involved in firefighting.

Technology

Modern firefighting techniques such as the radio-acoustic sound system for early fire detection and Doppler radar should be adopted.

Data and information

There is a need to support forest fire management through improved data and research to fill critical knowledge gaps

Awareness

Awareness generation for forest communities and visitors is important to prevent loss of life and injuries. Further, regular drills on escape methods and routes based on forest types should be conducted.

Best Practices:

1.Canadian Forest fire Danger Rating System:

2. Role of forest community: Best Practice in India:

CONCLUSION: A significant amount of technical options to assist Forest Department in increasing their resilience, preparedness and response capacities against forest fire are known and available at regional, national and international levels. However, the spectrum of available options is often not known or easily accessible. To make Forest Fire Management more effective, it is of utmost significance that available options are systematically assessed, documented, shared and adapted to location specific needs in a participatory way.

STATISTICAL REPORT:

Forest Fires Report in India:

Highlights:

What are the proposed reasons?

Significance:

THE CONTEXT: The Supreme Court of India has sought the most recent position of the Union government on a batch of petitions challenging the Constitution (Scheduled Castes) Order of 1950, which allows only members of Hindu, Sikh and Buddhist religions to be recognised as SCs.

THE EXPLANATION:

Who all are included in the Constitution Order of 1950?

• When enacted, the Constitution (Scheduled Castes) Order of 1950, initially provided for recognising only Hindus as SCs, to address the social disability arising out of the practice of untouchability.

• The Order was amended in 1956 to include Dalits who had converted to Sikhism and once more in 1990 to include Dalits who had converted to Buddhism. Both amendments were aided by the reports of the Kaka Kalelkar Commission in 1955 and the High Powered Panel (HPP) on Minorities, Scheduled Castes and Scheduled Tribes in 1983 respectively.

• On the other hand, the Union government in 2019 rejected the possibility of including Dalit Christians as members of SCs, rooting the exclusion on an Imperial Order of 1936 of the then colonial government, which had first classified a list of the Depressed Classes and specifically excluded “Indian Christians” from it.

Why are Dalit Christians excluded?

• Ever since the amendment to include Sikhs as SCs in 1956, the Office of the Registrar General of India (RGI) has been reluctant in expanding the ambit of the Order beyond members of Hinduism or Sikhism. Responding to the Ministry of Home Affairs’s (MHA) 1978 request for an opinion on the inclusion of Dalit Buddhists and Christians, the RGI had cautioned the government that SC status is meant for communities suffering from social disabilities arising out of the practice of untouchability, which it noted was prevalent in Hindu and Sikh communities.

• It also noted that such a move would significantly swell the population of SCs across the country. However, the amendment to include Buddhist converts as SCs was passed in 1990, which at the time did not require the approval of the RGI — a mandate introduced in the rules for inclusion framed in 1999.

• In 2001, when the RGI again opined against including Dalit Christians and Muslims as SCs, it referred to its 1978 note and added that like Dalit Buddhists, Dalits who converted to Islam or Christianity belonged to different sets of caste groups and not just one, as a result of which they cannot be categorised as a “single ethnic group”, which is required by Clause (2) of Article 341 for inclusion.

• Moreover, the RGI opined that since the practice of “untouchability” was a feature of Hindu religion and its branches, allowing the inclusion of Dalit Muslims and Dalit Christians as SCs could result in being “misunderstood internationally” as India trying to “impose its caste system” upon Christians and Muslims.

• The 2001 note also stated that Christians and Muslims of Dalit origin had lost their caste identity by way of their conversion and that in their new religious community, the practice of untouchability is not prevalent.

Is there a case for inclusion?

• The petitions arguing for inclusion have cited several independent Commission reports that have documented the existence of caste and caste inequalities among Indian Christians and Indian Muslims, noting that even after conversion, members who were originally from SCs continued to experience the same social disabilities.

• This was substantiated in the First Backward Classes Commission’s report in 1953, the Report of the Committee on Untouchability Economic and Educational Development Of the Scheduled Castes in 1969, the HPP report on SCs, STs, and Minorities in 1983, the Mandal Commission Report, the report of the Prime Minister’s High-Level Committee formed in 2006, a 2008 study conducted by the National Commission for Minorities, the Ranganath Misra Commission Report and several other studies.

• In addition to this, the petitions have argued against the proposition that caste identity is lost upon conversion, noting that even in Sikhism and Buddhism, casteism is not present and yet they have been included as SCs. Furthermore, the above-mentioned reports argue that caste-based discrimination continues even after conversion, hence entitling these communities to SC status.

• However, the Union government refuses to accept the reports of the Commissions on the basis that these reports do not have enough empirical evidence to support their claims.

THE CONTEXT: According to opposition party, a revamp of the Standing Committees of Parliament could potentially worsen the relations between the government and opposition parties.

THE EXPLANATION:

Of the 22 committees announced the Congress has the post of chairperson in only one, and the second largest opposition party, Trinamool Congress, none. The ruling NDA has the chairmanship of the important committees on Home, Finance, IT, Defence and External Affairs.

What are Committees of Parliament, and what do they do?

• Legislative business begins when a Bill is introduced in either House of Parliament. But the process of lawmaking is often complex, and Parliament has limited time for detailed discussions. Also, the political polarization and shrinking middle ground has been leading to increasingly rancorous and inconclusive debates in Parliament — as a result of which a great deal of legislative business ends up taking place in the Parliamentary Committees instead.

• A Parliamentary Committee is a panel of MPs that is appointed or elected by the House or nominated by the Speaker, and which works under the direction of the Speaker. It presents its report to the House or to the Speaker.

• Parliamentary Committees have their origins in the British Parliament. They draw their authority from Article 105, which deals with the privileges of MPs, and Article 118, which gives Parliament authority to make rules to regulate its procedure and conduct of business.

What are the various Committees of Parliament?

• Broadly, Parliamentary Committees can be classified into Financial Committees, Departmentally Related Standing Committees, Other Parliamentary Standing Committees, and Ad hoc Committees.

• The Financial Committees include the Estimates Committee, Public Accounts Committee, and the Committee on Public Undertakings. These committees were constituted in 1950.

• Seventeen Departmentally Related Standing Committees came into being in 1993, when Shivraj Patil was Speaker of Lok Sabha, to examine budgetary proposals and crucial government policies. The aim was to increase Parliamentary scrutiny, and to give members more time and a wider role in examining important legislation.

• The number of Committees was subsequently increased to 24. Each of these Committees has 31 members — 21 from Lok Sabha and 10 from Rajya Sabha.