COP 26- NET GAINS OR NET LOSSES?

THE CONTEXT: The 26th Conference of parties of the UN Framework Convention on Climate Change (UNFCCC), or CoP 26 was held in Glasgow, Scotland. At the summit, Prime Minister announced that India will aim to attain a net-zero emission target. What exactly is net-zero and why is it important? What has been India’s stance on it so far, and what does the new announcement by Prime Minister mean? In this article, we discuss everything from scratch from what is COP and its background and its targets.

THE COP 26 OUTCOMES

The Glasgow meeting was the 26th session of the Conference of Parties to the UN Framework Convention on Climate Change or COP26. These meetings are held every year to construct a global response to climate change. Each of these meetings produces a set of decisions that are given different names. In the current case, this has been called the Glasgow Climate Pact. The main task for COP26 was to finalize the rules and procedures for the implementation of the Paris Agreement. Most of these rules had been finalized by 2018, but a few provisions, like the one relating to the creation of new carbon markets, had remained unresolved. However, due to clear evidence of worsening of the climate crisis in the six years since the Paris Agreement was finalized, host country United Kingdom was keen to ensure that Glasgow, instead of becoming merely a “procedural” COP, was a turning point in enhancing climate actions. The effort was to push for an agreement that could put the world on a 1.5-degree Celsius pathway, instead of the 2 degree Celsius trajectory which is the main objective of the Paris Agreement.

To sum it up, COP 26 results in

- GLOBAL METHANE PLEDGE: Announced by US and EU to reduce the emissions of methane.

- The UK COP26 Presidency released the ‘Climate Delivery Plan’, outlining an agenda and a timetable for developed countries to deliver $100 billion worth of monetary help to low-income countries to manage the climate crisis.

- Initiative on Disaster Resilient infrastructure for small island countries.

- Many countries updated their NDC’s like India.

WHAT WAS ACHIEVED?

Mitigation: The Glasgow agreement has emphasised that stronger action in the current decade was most critical to achieving the 1.5-degree target.

Accordingly, it has:

- Asked countries to strengthen their 2030 climate action plans, or NDCs (nationally-determined contributions), by next year.

- Established a work program to urgently scale-up mitigation ambition and implementation.

- Decided to convene an annual meeting of ministers to raise the ambition of 2030 climate actions.

- Requested the UN Secretary-General to convene a meeting of world leaders in 2023 to scale up the ambition of climate action.

- Asked countries to make efforts to reduce the usage of coal as a source of fuel, and abolish “inefficient” subsidies on fossil fuels.

- Has called for a phase-down of coal, and phase-out of fossil fuels. This is the first time that coal has been explicitly mentioned in any COP decision. It also led to big fracas at the end, with a group of countries led by India and China forcing an amendment to the word “phase-out” in relation to coal changed to “phase-down”.

- But even this was not liking to the developing countries who then got it changed to “phase down unabated coal power and phase out inefficient fossil fuel subsidies while providing targeted support to the poorest and the most vulnerable in line with national circumstance”. Despite the dilution, the inclusion of language on the reduction of coal power is being seen as a significant move forward.

Adaptation: Most of the countries, especially the smaller and poorer ones, and the small island states, consider adaptation to be the most important component of climate action. These countries, due to their lower capacities, are already facing the worst impacts of climate change, and require immediate money, technology, and capacity building for their adaptation activities. As such, the Glasgow Climate Pact has:

- Asked the developed countries to at least double the money being provided for adaptation by 2025 from the 2019 levels. In 2019, about $15 billion was made available for adaptation that was less than 20 percent of the total climate finance flows. Developing countries have been demanding that at least half of all climate finance should be directed towards adaptation efforts.

- Created a two-year work program to define a global goal on adaptation. The Paris Agreement has a global goal on mitigation — reducing greenhouse gas emissions deep enough to keep the temperature rise within 2 degrees Celsius of pre-industrial times. A similar global goal on adaptation has been missing, primarily because of the difficulty in defining such a target. Unlike mitigation efforts that bring global benefits, the benefits from adaptation are local or regional.

- There are no uniform global criteria against which adaptation targets can be set and measured. However, this has been a long-pending demand of developing countries and the Paris Agreement also asks for defining such a goal.

Finance: Every climate action has financial implications. It is now estimated that trillions of dollars are required every year to fund all the actions necessary to achieve the climate targets. But money has been in short supply.

- Developed countries are under an obligation, due to their historical responsibility in emitting greenhouse gases, to provide finance and technology to the developing nations to help them deal with climate change. In 2009, developed countries had promised to mobilize at least $100 billion every year from 2020.

- This promise was reaffirmed during the Paris Agreement, which also asked the developed countries to scale up this amount from 2025. The 2020 deadline has long passed but the $100 billion promise has not been fulfilled. The developed nations have now said that they will arrange this amount by 2023.

WHAT DOES THE GLASGOW AGREEMENT SAY?

A deal aimed at staving off dangerous climate change has been struck at the COP26 summit in Glasgow. The pact has:

- Expressed “deep regrets” over the failure of the developed countries to deliver on their $100 billion promise. It has asked them to arrange this money urgently and every year till 2025.

- Initiated discussions on setting the new target for climate finance, beyond $100 billion for the post-2025 period.

- Ask the developed countries to provide transparent information about the money they plan to provide.

INDIA’S NET ZERO PLEDGE

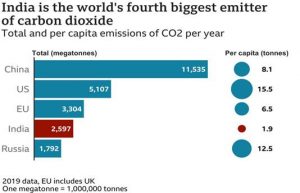

- India is the world’s fourth-biggest emitter of carbon dioxide after China, the US and the EU.

- But its huge population means its emissions per capita are much lower than other major world economies.

- India emitted 1.9 tonnes of CO2 per head of population in 2019, compared with 15.5 tonnes for the US and 12.5 tonnes for Russia that year.

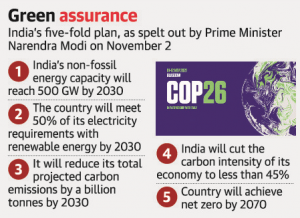

Prime Minister adds the country constitutes 17 percent of the global population and its contribution to the emission has remained only five percent. Talking about climate finance, PM said, all climate finance promises have been empty ones so far and developed countries must ensure one trillion dollar climate finance at the earliest. The idea of One Sun, One World, One Grid was mooted by Prime Minister at the Glasgow Summit and followed by a launch thereof. The initiative calls for the setting up of a global grid that would be able to transmit solar power that is clean energy anywhere and anytime. It will reduce the storage needs, make solar projects viable and reduce carbon footprints and the energy cost.

WHAT DOES IT MEAN TO BE NET-ZERO?

- Net-zero is when a country’s carbon emissions are offset by taking out equivalent carbon from the atmosphere so that emissions in balance are zero.

- Think about it like a bath – turn on the taps and you add more water, pull out the plug and water flows out. The amount of water in the bath depends on both the input from the taps and the output via the plughole. To keep the amount of water in the bath at the same level, you need to make sure that the input and output are balanced.

- This state is also referred to as carbon neutral; although zero emissions and zero carbon are slightly different, as they usually mean that no emissions were produced in the first place.

WHY DO SOME ANALYSTS SEE NET-ZERO AS CONTROVERSIAL?

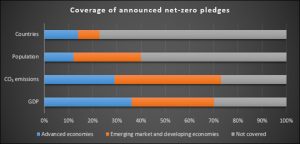

- China has announced plans for carbon neutrality by 2060, while the US and EU aim to hit net zero by 2050.

- Although a global coalition has coalesced around the concept, an increasingly vocal group views it as a distraction, helpful only to score political points.

- Carbon neutrality looks to nascent technology to suck out CO2 from the atmosphere.

- Youth movements and some scientists call this procrastination since it enables the fossil fuel industry to continue expanding. Many fossil fuel companies support net-zero goals.

ANALYSIS OF INDIA’S DECISION OF ‘NET ZERO BY 2070’

Pros:

- Impact of Global Warming & climate change on India i.e India is more vulnerable to extreme weather events like changing rainfall pattern which results into cyclones, flash floods and disasters, impact on agricultural sector etc. Hence it is the interest of India to reduce the emission to contribute towards that direction.

- India always promotes soft power historically, despite of developing country India stated that we will contribute.

- Leader of underdeveloped and small island nations like Mauritius, hence the moral obligation to do so.

- The target of 2070 comes after the target given by other countries such as the US and other European countries by 2050, China by 2060. To some extent, the 2070 target is achievable and pragmatic.

Cons:

- India is still a developing nation, where it requires huge energy.

- High Population

- Increased poverty

- CBDR principles

- Do not have clean technology

- Difficult to reduce the coal dependency immediately, as of now more than 50 percent of energy production is from coal.

- The major problem lies in the finance/resources to invest in renewable energy technology

- Overall emissions- very less when compared to developed nations.

India’s Intended Nationally Determined Contribution (INDC) to UNFCCC:

- To reduce the emissions intensity of GDP by 33%-35% by 2030 below 2005 levels.

- To achieve about 40 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030, with the help of the transfer of technology and low-cost international finance, including from Green Climate Fund.

To create an additional carbon sink of 2.5 to 3 billion tonnes of CO2 equivalent through other forest and tree cover by 2030.

HOW ARE OTHER BIG COUNTRIES PURSUING NET-ZERO?

As the largest emitter of GHGs, China told the U.N. in 2020 that it would move to net-zero by 2060. Its pledge to peak CO2 emissions before 2030 and achieve carbon neutrality three decades later is among the most high-profile commitments.

- As the second biggest emitter with large historical emissions returned to the Paris Agreement under President Joe Biden with an ambitious 2050 net-zero plan.

- The European Union (E.U.) member-states have committed themselves to reduce emissions by at least 55% by 2030 over 1990 levels.

- In July, the E.U. published a climate law that binds the bloc to its 2030 emissions target and carbon neutrality by 2050.

WHAT ARE INDIA’S CORE DEMANDS?

India has said it is “open to all options” provided it gets assurances that commitments in previous COPs such as developing countries getting compensated to the tune of $100 billion annually, the carbon-credit markets be reinvigorated and the countries historically responsible for the climate crisis be compensated by way of “Loss and Damages,” and clean development technologies be made available in ways that its industries can painlessly adapt to.

Loss and Damage: The frequency of climate disasters has been rising rapidly, and many of these cause largescale devastation. The worst affected are the poor and small countries and the island states. There is no institutional mechanism to compensate these nations for the losses or provide them help in the form of relief and rehabilitation. The loss and damage provision in the Paris Agreement seeks to address that.

What is Climate Justice?

Climate justice is a term used for framing global warming as an ethical and political issue, rather than one that is purely environmental or physical in nature.

- Climate Litigations

- Protests

- Dedicated Judicial/Quasi-Judicial

- Political Cooperation. (CBDR)

INDIA’S MEASURES

- India is working to reduce its emissions, aligned with the goal of less than two °C global temperature rise, seen in its headline pledge to cut the emissions intensity of GDP by 33%-35% by 2030 over the 2005 level. But it has not favored a binding commitment towards carbon neutrality.

- It is also not aligned with the more ambitious goal of a 1.5°C temperature rise. Among the contentious issues it faces is heavy reliance on coal. According to the International Energy Agency’s India Energy Outlook 2021, coal accounts for close to 70% of electricity generation.

- Cutting greenhouse gases that heat the atmosphere and contribute to climate change involves shifting power production away from coal, greater adoption of renewables, and transforming mobility through electric vehicles. Some praise India for its renewables target: scaling up power from renewables such as solar and wind to 450 GW by 2030.

- Some politicians support a net-zero target as it can put India on a green development trajectory, attracting investment in innovative technologies.

- The National Electric Mobility Mission Plan (NEMM) intends to allow hybrid and electric vehicles to become the first choice for the purchasers so that these vehicles can replace the conventional vehicles and thus reduce liquid fuel consumption in the country from the automobile sector.

- Pradhan Mantri JI-VAN Yojana, 2019: The objective of the scheme is to create an ecosystem for setting up commercial projects and to boost Research and Development in the 2G Ethanol sector. The 2018 Biofuel Policy has the objective of reaching 20% ethanol-blending and 5% biodiesel-blending by the year 2030.

- GOBAR (Galvanizing Organic Bio-Agro Resources) DHAN scheme, 2018: It focuses on managing and converting cattle dung and solid waste in farms to useful compost, biogas, and bio-CNG, thus keeping villages clean and increasing the income of rural households. It was launched under Swachh Bharat Mission (Gramin).

THE WAY FORWARD

What India must do to follow through on COP26 commitments

There must be transparent, credible action that would allow India to demonstrate genuine climate leadership for the rest of the developing world, and secure a better, greener future for its citizens. To meet the challenge at hand, we see three guiding principles that could help bring this week’s bold pledges to life.

- First, India must combine emissions reductions with climate adaptation, embedding environmental justice for people and nature. Justice will involve strengthening a suite of social protection programs, especially for those facing growing rural distress, and investing in disaster preparedness as extreme weather becomes more common. Inspired by civic movements of the 20th century, India can build climate vocabularies and actions for citizens so they can be agents of change and protect those who speak up for environmental justice.

- Second, corporate India has a vital role to play in complementing government policy. Much like how the independence movement galvanized home-grown industry around a shared vision, India Inc’s 21st-century objective must be to foster innovative, inclusive green development. Swadeshi practices weren’t limited to the big players alone — today, MSMEs must accelerate their decarbonization trajectories, too.

- Third, to deliver decarbonization and development, India will need data and democratic deliberation. Building state capacity can help the country move from reactive decision-making to proactive planning and execution. But India will also require the analytical horsepower to craft and implement evidence-based policies.

A Low-Carbon Development Commission supported by the overarching framework of climate law, as proposed by the Centre for Policy Research, could play this role. Beyond stakeholder engagement, this would also foster coordinated climate governance across India’s institutional arrangement, which is currently scattered across a range of often siloed ministries, agencies, and bodies.

THE CONCLUSION: The COP26 represents a bold step, but the devil is in the details. Following through on these commitments with transparent, credible action would allow India to demonstrate genuine climate leadership for the rest of the developing world, and secure a better, greener future for its citizens. On balance, COP26 took many steps forward. But for the miracle of 1.5-degree C to come true, policies, research, and funding must drive rapid adoption of available climate technologies and make new technologies like clean hydrogen, flexible solar films, high-density storage batteries, and carbon capture and usage a reality. Every commitment, policy, and action in this direction is a ray of hope.

ADD TO YOUR KNOWLEDGE

THE WORLD SHOULD SHUT NEARLY 3,000 COAL PLANTS TO KEEP ON CLIMATE TRACK

According to research by climate think tank TransitionZero, the world will need to shut down nearly 3,000 coal-fired power plants before 2030 if it is to have a chance of keeping temperature rises within 1.5 Celsius.

- TransitionZero said there are currently more than 2,000 GW of coal-fired power in operation across the world, and that needs to be slashed by nearly half, requiring the closure of nearly one unit per day from now until the end of the decade.

- The need to close nearly 1,000 gigawatts of coal-fired capacity would put the onus on China – the world’s biggest source of climate-warming greenhouse gas and owner of around half of the world’s coal-fuelled plants – to accelerate its shift towards cleaner electricity.

- China has reduced the share of coal in its total energy mix from 72.4% in 2005 to 56.8% last year, but absolute consumption volume has continued to rise.

THE BACKGROUND

About the UNFCCC:

UNFCCC is an acronym for the United Nations Framework Convention on Climate Change, signed in 1992 in New York. It came into force on 21st March 1994 for the reduction of Greenhouse gases from the atmosphere to reduce Global warming. It has been ratified by 197 countries and is called to have a near-universal membership and is the parent treaty of the 2015 Paris Climate Change Agreement. The countries that have ratified the convention are called the UNFCCC conference of parties (COP).

- The main aim of the Paris Agreement is to keep a global average temperature rise this century well below 2 Celsius and to drive efforts to limit the temperature increase even further to 1.5 degrees Celsius above pre-industrial levels.

The UNFCCC was established to work towards “stabilization of greenhouse gas concentrations in the atmosphere.”

It laid out a list of responsibilities for the member states which included:

- Formulating measures to mitigate climate change

- Cooperating in preparing for adaptation to the impact of climate change

- Promoting education, training, and public awareness related to climate change

What is the COP?

The Conference of Parties or COP is the supreme decision-making body of the Convention. All States that are Parties to the Convention are represented at the COP, at which they review the implementation of the Convention and any other legal instruments that the COP adopts and take decisions necessary to promote the effective implementation of the Convention, including institutional and administrative arrangements.

HISTORY OF IMPORTANT COP’S AND ITS OUTCOMES

COP 1, Berlin, 1995: At the first conference, the signatories agree to meet annually to maintain control over global warming and see the need to reduce emissions of polluting gases.

COP 3, Kyoto. 1997: The Kyoto Protocol is adopted with the commitment to reduce emissions of greenhouse gases in industrialized countries. Lays the foundation of the carbon market.

Quick Facts:

- India ratified Kyoto Protocol in 2002.

- The Kyoto Protocol came into force in February 2005.

- There are currently 192 Parties.

- The USA never ratified Kyoto Protocol.

- Canada withdrew in 2012.

- Goal: Fight global warming by reducing greenhouse gas concentrations in the atmosphere to “a level that would prevent dangerous anthropogenic interference with the climate system.”

- Kyoto protocol aimed to cut emissions of greenhouse gases across the developed world by about 5 per cent by 2012 compared with 1990 levels.

- The Protocol is based on the principle of common but differentiated responsibilities.

Kyoto Protocol is the only global treaty with binding limits on GHG emissions.

The Kyoto Protocol emission target gases include

- Carbon dioxide (CO2),

- Methane (CH4),

- Nitrous oxide (N2O),

- Sulphur hexafluoride (SF6),

- Groups of hydrofluorocarbons (HCFs) and

- Groups of Perfluorocarbons (PFCs).

Two commitments Periods:

- 2008-2012

- 2013-2020.

The Kyoto Flexible Market Protocol mechanisms include:

- Clean Development Mechanism (CDM)

- Emission Trading

- Joint Implementation (JI)

COP 13, Bali, 2007: The Bali Roadmap sets a timetable for negotiations for a new international agreement to replace the Kyoto Protocol and include all countries, not only the developed ones.

COP 15, Copenhagen, 2009: The objective of keeping global warming below 2 ºC is validated and developed countries commit to financing developing countries in the long term.

COP16, Cancun, 2010: The Cancun Agreements, which formalizes the commitments set out in Copenhagen, is written and the Green Climate Fund is created mainly for climate actions in developing countries.

COP17, Durban, 2011: This time, all countries agree to start reducing emissions, including the US, and emerging countries (Brazil, China, India, and South Africa). It was decided to negotiate a global agreement that would come into force in 2020.

COP18, Doha, 2012: It is decided to extend the Kyoto Protocol until 2020. Countries like the US, China, Russia, and Canada did not support the extension.

COP20, Lima, 2014: For the first time, all countries agree to develop and share their commitment to reducing emissions of greenhouse gases. Apart from no agreements were reached.

COP21, Paris, 2015: Results in Paris Agreement came into force in 2016. The conference objective is to achieve a legally binding and universal agreement on climate to be signed in 2015 and implemented by 2020.

Signatories: 195 as of 2019; 180+ countries have ratified; India signed and ratified in 2016.

Outcomes:

- The expected key result was an agreement to set a goal of limiting global warming to “well below 2 °C” Celsius compared to pre-industrial levels.

- The agreement calls for zero net anthropogenic greenhouse gas emissions to be reached during the second half of the 21st century.

- In the adopted version of the Paris Agreement, the parties will also “pursue efforts to limit the temperature increase to 1.5 °C.”

- The 1.5 °C goals will require zero-emissions sometime between 2030 and 2050, according to some scientists.

- The developed countries reaffirmed the commitment to mobilize $100 billion a year in climate finance by 2020 and agreed to continue mobilizing finance at the level of $100 billion a year until 2025.

- In 2017, the United States announced that the U.S. would cease all participation in the 2015 Paris Agreement on climate change mitigation.

- In accordance with Article 28 of the Paris Agreement, the earliest possible effective withdrawal date by the United States cannot be before November 2020. Thus, The U.S. will remain a signatory till November 2020.

Kyoto Protocol VS Paris Agreement

Kyoto Protocol:

- Categorization of Countries

- Binding emission norms on developed countries.

- Principle of CBDR implemented.

Paris Agreement:

- No categorization

- No binding emission rather Voluntary norms (NDC’s).

- Diluted the CBDR.

NOTE: In Paris Agreement, India and France launched the “International Solar Alliance”.

COP22, Marrakesh, 2016: Against all expectations, the Paris Agreement came into force a few days before the Summit, after being ratified by most nations. The result of the negotiations at this meeting was encapsulated in three documents: the Marrakesh Action Proclamation, a strong political message supporting the Paris Agreement at a time when the change in the White House was generating uncertainty; the Marrakesh Partnership to strengthen climate collaboration for the period up to 2020, and the first meeting of the CMA, the decision-making body for the Paris Agreement.

COP23, Bonn, 2017: At this Climate Summit, progress was made on the Rulebook to detail how the Paris Agreement will work in practice (Paris Rulebook), with the aim of concluding it in 2018. Facilitative Dialogues, known as the Talanoa Dialogue, were also created, a process allowing countries to share experiences and good practices to achieve the Agreement objectives. The Talanoa Dialogue Platform was launched to promote the participation and dialogue of local and indigenous communities. A Gender Action Plan was adopted to ensure the role of women in decision-making related to climate change.

COP24, Katowice, 2018: Little over two months before the Summit began, the IPCC published its report analyzing the impacts of a 1.5°C global temperature increase, which focused debate on a need for greater urgency in reducing polluting emissions. Nevertheless, although this was mentioned, it was not considered to be a guide for action in the texts agreed. Meanwhile, the Talanoa Dialogue ended, the next step being to review the 2020 climate plans to align them with the set objective of limiting global warming. Finally, one of the most important articles of the negotiation was left unresolved: Article 6 permitting the development of carbon markets.

COP25, Madrid, Spain 2019: It is worrisome that COP25, which was meant to prepare the way for implementation of the Paris Agreement post-2020, did not make much progress. Nevertheless, states should take the period prior to COP26 as an opportunity to renew their commitments and appropriately plan for climate action. COP26 is expected to initiate the implementation of the Paris Agreement.

AAU (Assigned amount unit): A Kyoto Protocol unit equal to 1 metric ton of CO2 equivalent. Each Annex I Party issues AAUs up to the level of its assigned amount, established pursuant to the Kyoto Protocol. Assigned amount units may be exchanged through emissions trading.

Abatement: Abatement is the word that is used to denote the result of decreased Greenhouse Gases emissions. This can also be taken as an activity to lessen the effects of the Greenhouse Effect.

Adaptation Fund: The Adaptation Fund was established to finance concrete adaptation projects and programs in developing countries that are particularly vulnerable and are Parties to the Kyoto Protocol. The Fund is to be financed with a share of proceeds from clean development mechanism (CDM) project activities and receive funds from other sources. It is operated by the Adaptation Fund Board.

Albedo: A measure of the reflectivity of a surface ranging from 0 to 1; albedo is calculated by taking the ratio of reflected radiation to incoming radiation, such that a surface that reflects 100% of the light hitting it has an albedo of 1 and a surface that absorbs 100% of the light hitting it has an albedo of 0

Black carbon (BC): Operationally defined aerosol species based on measurement of light absorption and chemical reactivity and/or thermal stability. It is sometimes referred to as soot. BC is mostly formed by the incomplete combustion of fossil fuels, biofuels, and biomass but it also occurs naturally. It stays in the atmosphere only for days or weeks. It is the most strongly light-absorbing component of particulate matter (PM) and has a warming effect by absorbing heat into the atmosphere and reducing the albedo when deposited on snow or ice.

Blue carbon: It is the carbon captured by living organisms in coastal (e.g., mangroves, salt marshes, seagrasses) and marine ecosystems, and stored in biomass and sediments

Biocarbon: It is the carbon that trees, plants and healthy soils naturally absorb and store. Plants absorb carbon from the atmosphere through photosynthesis. This helps to reduce CO₂ pollution that is changing our climate

Bio-Carbon Fund: The Bio-Carbon Fund provides carbon finance for projects that sequester or conserve greenhouse gases in forests, agro- and other ecosystems. Through its focus on bio-carbon, or ‘sinks’, it delivers carbon finance to many developing countries that otherwise have few opportunities to participate in the Clean Development Mechanism (CDM), or to countries with economies in transition through Joint Implementation (JI). The Bio-Carbon Fund tests and demonstrates how Land use, Land-use Change, and Forestry (LULUCF) activities can generate high-quality Ecological Resilience (ERs) with environmental and livelihood benefits that can be measured, monitored, and certified and stand the test of time.

Carbon market: A popular (but misleading) term for a trading system through which countries may buy or sell units of greenhouse-gas emissions in an effort to meet their national limits on emissions, either under the Kyoto Protocol or under other agreements, such as that among member states of the European Union. The term comes from the fact that carbon dioxide is the predominant greenhouse gas, and other gases are measured in units called “carbon-dioxide equivalents.”

Carbon Finance: Carbon finance is a new branch of environmental finance. Carbon finance explores the financial implications of living in a carbon-constrained world, a world in which emissions of carbon dioxide and other greenhouse gases (GHGs) carry a price. The general term is applied to investments in GHG emission reduction projects and the creation (origination) of financial instruments that are tradable on the carbon market.

Carbon budget: This term refers to three concepts in the literature:

- An assessment of carbon cycle sources and sinks on a global level, through the synthesis of evidence for fossil fuel and cement emissions, land-use change emissions, ocean and land CO2 sinks, and the resulting atmospheric CO2 growth rate. This is referred to as the global carbon budget;

- The estimated cumulative amount of global carbon dioxide emissions that that is estimated to limit global surface temperature to a given level above a reference period, taking into account global surface temperature contributions of other GHGs and climate forcers;

- The distribution of the carbon budget is defined under the regional, national, or sub-national level based on considerations of equity, costs, or efficiency.

Carbon dioxide removal (CDR): Anthropogenic activities remove CO2 from the atmosphere and durably store it in geological, terrestrial, or ocean reservoirs, or in products. It includes existing and potential anthropogenic enhancement of biological or geochemical sinks and direct air capture and storage but excludes natural CO2 uptake not directly caused by human activities.

Carbon Rights: A carbon right is a new and unique form of land interest that confers upon the holder a right to the intangible benefit of carbon sequestration on a piece of forested land.

Carbon Offset: (Also known as Carbon Credits) A mechanism for individuals and businesses to neutralize rather than actually reduce their greenhouse gas emissions by purchasing the right to claim someone else’s reductions as their own is known as a carbon offset.

Carbon Stock: The quantity of carbon held within a pool is known as carbon stock. It is measured in metric tons of CO2.

Carbon Pools: A reservoir of carbon that has the potential to accumulate (or lose) carbon over time is known as a carbon pool. In Agriculture Forestry and Other Land Use (AFOLU), this encompasses aboveground biomass, belowground biomass, litter, deadwood, and soil organic carbon.

Emission intensity: It is defined as the total amount of greenhouse gas emissions emitted for every unit of GDP. Importantly, it counts emissions beyond those related to energy (such as emissions from agriculture) and greenhouse gases beyond carbon dioxide (such as methane).

Carbon price: The price for avoided or released carbon dioxide (CO2) or CO2-equivalent emissions. This may refer to the rate of a carbon tax, or the price of emission permits. In many models that are used to assess the economic costs of mitigation, carbon prices are used as a proxy to represent the level of effort in mitigation policies.

Carbon Trade: Carbon trading is an exchange of credits between nations designed to reduce emissions of carbon dioxide. Carbon trading is also referred to as carbon emissions trading. Carbon emissions trading accounts for most emissions trading.

Carbon leakage: A term used to refer to the problem whereby industry relocates to countries where emission regimes are weaker, or non-existent.

Carbon Sink: A carbon pool that is increasing in size is known as a carbon sink. A carbon pool can be a sink for atmospheric carbon if during a given time interval more carbon is flowing into it than out of it.

Carbon sequestration: It is the long-term storage of carbon in plants, soils, geologic formations, and the ocean. Carbon sequestration occurs both naturally and as a result of anthropogenic activities and typically refers to the storage of carbon

Carbon tax: It is a tax levied on firms that produce carbon dioxide (CO2) through their operations. It is used as an incentive to reduce the economy-wide usage of high-carbon fuels and to protect the environment from the harmful effects of excessive carbon dioxide emissions.

Carbon Footprint: A carbon footprint is the total amount of greenhouse gases (including carbon dioxide and methane) that are generated by our actions. … To have the best chance of avoiding a 2℃ rise in global temperatures, the average global carbon footprint per year needs to drop under 2 tons by 2050.

Carbon cycle: The term used to describe the flow of carbon (in various forms, e.g., as carbon dioxide (CO2), carbon in biomass, and carbon dissolved in the ocean as carbonate and bicarbonate) through the atmosphere, hydrosphere, terrestrial and marine biosphere, and lithosphere. The reference unit for the global carbon cycle is GtCO2 or GtC (Gigatonne of carbon = 1 GtC = 1015 grams of carbon. Which corresponds to 3.667 GtCO2).

Cleantech: It is any technology that aims to reduce or limit environmental impacts. These technologies are developed by a broad array of companies, including new ‘start up’ businesses, that operate across different aspects of the economy. Examples of cleantech include electric vehicles and wave-power turbines, to materials that make buildings more energy-efficient.

Climate neutrality: Concept of a state in which human activities result in no net effect on the climate system. Achieving such a state would require a balancing of residual emissions with emission (carbon dioxide) removal as well as accounting for regional or local biogeophysical effects of human activities that, for example, affect surface albedo or local climate.

Climate target: A climate target refers to a temperature limit, concentration level, or emissions reduction goal used towards the aim of avoiding dangerous anthropogenic interference with the climate system. For example, national climate targets may aim to reduce greenhouse gas emissions by a certain amount over a given time horizon, for example, those under the Kyoto Protocol.

Climate sensitivity: Climate sensitivity refers to the change in the annual global mean surface temperature in response to a change in the atmospheric CO2 concentration or another radiative forcing.

Climate variability: Climate variability refers to variations in the mean state and other statistics (such as standard deviations, the occurrence of extremes, etc.) of the climate on all spatial and temporal scales beyond that of individual weather events. Variability may be due to natural internal processes within the climate system (internal variability), or to variations in natural or anthropogenic external forcing (external variability).

Environmental democracy: It is based on the idea that land and natural resource decisions adequately and equitably address citizens’ interests. Rather than setting a standard for what determines a good outcome, environmental democracy sets a standard for how decisions should be made.

Enhanced weathering: Enhancing the removal of carbon dioxide (CO2) from the atmosphere through the dissolution of silicate and carbonate rocks by grinding these minerals to small particles and actively applying them to soils, coasts, or oceans.

Carrying Capacity: The carrying capacity of a biological species in an environment is the population size of the species that the environment can sustain indefinitely, given the food, habitat, water, and other necessities available in the environment.

Certified emission reductions (CER): A Kyoto Protocol unit equal to 1 metric tonne of CO2 equivalent. CERs are issued for emission reductions from CDM project activities. Two special types of CERs called temporary certified emission reduction (tCERs) and long-term certified emission reductions (lCERs) are issued for emission removals from afforestation and reforestation CDM projects.

Climate Governance: It is the diplomacy, mechanisms, and response measures “aimed at steering social systems towards preventing, mitigating or adapting to the risks posed by climate change.”

Decarbonization: The process by which countries, individuals, or other entities aim to achieve zero fossil carbon existence. Typically refers to a reduction of the carbon emissions associated with electricity, industry, and transport.

Emissions trading: A market-based instrument aiming at meeting a mitigation objective in an efficient way. A cap on GHG emissions is divided into tradeable emission permits that are allocated by a combination of auctioning and handing out free allowances to entities within the jurisdiction of the trading scheme. Entities need to surrender emission permits equal to the number of their emissions (e.g., tonnes of CO2). An entity may sell excess permits to entities that can avoid the same amount of emissions in a cheaper way. Trading schemes may occur at the intra-company, domestic, or international level (e.g., the flexibility mechanisms under the Kyoto Protocol and the EU-ETS) and may apply to carbon dioxide (CO2), other greenhouse gases (GHGs), or other substances.

Emission Trading Scheme (ETS): A scheme set up to allow the trading of emissions permits between businesses and/or countries as part of a cap-and-trade approach to limiting greenhouse gas emissions. The best-developed example is the EU’s trading scheme, launched in 2005.

Forest Carbon Partnership Facility: The Forest Carbon Partnership Facility (FCPF) which became operational in June 2008, is a global partnership focused on reducing emissions from deforestation and forest degradation, forest carbon stock conservation, sustainable management of forests, and enhancement of forest carbon stocks (REDD+)

Fugitive fuel emissions: Greenhouse-gas emissions as by-products or waste or loss in the process of fuel production, storage, or transport, such as methane given off during oil and gas drilling and refining, or leakage of natural gas from pipelines.

Green bonds: Green bonds raise capital for projects that have environmental benefits. They require the borrower to report on how the funds raised have been used. They’re not to be confused with sustainability bonds, which fund a combination of green and social projects, such as affordable housing.

“Green Carbon“: Green carbon is carbon removed by photosynthesis and stored in the plants and soil of natural ecosystems and is a vital part of the global carbon cycle. Many plants and most crops, have short lives and release much of their carbon at the end of each season, but forest biomass accumulates carbon over decades and centuries. Furthermore, forests can accumulate large amounts of CO2 in relatively short periods, typically several decades. Afforestation and reforestation are measures that can be taken to enhance biological carbon sequestration.

Geological sequestration: The injection of carbon dioxide into underground geological formations. When CO2 is injected into declining oil fields it can help to recover more of the oil.

Global Environment Facility (GEF): The GEF is an independent financial organization that provides grants to developing countries for projects that benefit the global environment and promote sustainable livelihoods in local communities. The Parties to the Convention assigned operation of the financial mechanism to the GEF on an ongoing basis, subject to review every four years. The financial mechanism is accountable to the COP.

Global average temperature: The mean surface temperature of the Earth was measured from three main sources: satellites, monthly readings from a network of over 3,000 surface temperature observation stations and sea surface temperature measurements taken mainly from the fleet of merchant ships, naval ships, and data buoys.

Global energy budget: The balance between the Earth’s incoming and outgoing energy. The current global climate system must adjust to rising greenhouse gas levels and, in the very long term, the Earth must get rid of energy at the same rate at which it receives energy from the sun.

Global dimming: An observed widespread reduction in sunlight at the surface of the Earth, which varies significantly between regions. The most likely cause of global dimming is an interaction between sunlight and microscopic aerosol particles from human activities. In some regions, such as Europe, global dimming no longer occurs, thanks to clean air regulations.

Internal Climate Variability: Variability may result from natural internal processes within the climate system is known as internal climate variability.

Joint Liaison Group (JLG): Group of representatives of UNFCCC, CBD, and UNCCD Secretariats set up to explore common activities to confront problems related to climate change, biodiversity, and desertification.

JUSSCANNZ: An acronym representing non-EU industrialized countries that occasionally meet to discuss various issues related to climate change. The members are Japan, the United States, Switzerland, Canada, Australia, Norway, and New Zealand. Iceland, Mexico, and the Republic of Korea may also attend JUSSCANZ meetings.

Net negative emissions: A situation of net negative emissions is achieved when, as a result of human activities, more greenhouse gases are removed from the atmosphere than are emitted into it. Where multiple greenhouse gases are involved, the quantification of negative emissions depends on the climate metric chosen to compare emissions of different gases (such as global warming potential, global temperature change potential, and others, as well as the chosen time horizon).

Ocean acidification (OA): Ocean acidification refers to a reduction in the pH of the ocean over an extended period, typically decades or longer, which is caused primarily by uptake of carbon dioxide (CO2) from the atmosphere, but can also be caused by other chemical additions or subtractions from the ocean. Anthropogenic ocean acidification refers to the component of pH reduction that is caused by human activity (IPCC, 2011, p. 37).

Ocean fertilization: Deliberate increase of nutrient supply to the near-surface ocean in order to enhance biological production through which additional carbon dioxide (CO2) from the atmosphere is sequestered. This can be achieved by the addition of micro-nutrients or macro-nutrients. Ocean fertilization is regulated by the London Protocol.

Temperature overshoot The temporary exceedance of a specified level of global warmings, such as 1.5°C. Overshoot implies a peak followed by a decline in global warming, achieved through anthropogenic removal of CO2 exceeding remaining CO2 emissions globally.

“Spill-over effects” (also referred to as “rebound effects” or “take-back effects”): Reverberations in developing countries caused by actions taken by developed countries to cut greenhouse-gas emissions. For example, emissions reductions in developed countries could lower demand for oil and thus international oil prices, leading to more use of oil and greater emissions in developing nations, partially off-setting the original cuts. Current estimates are that full-scale implementation of the Kyoto Protocol may cause 5 to 20 percent of emissions reductions in industrialized countries to “leak” into developing countries.