Day-623 | Daily MCQs | UPSC Prelims | ECONOMY

Day-623

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

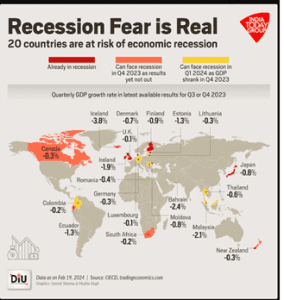

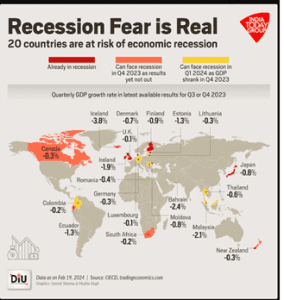

1. With reference to ‘technical recession’, consider the following statements:

1. It occurs when there is a decline in output for three consecutive quarters.

2. It is generally caused by a single event and is shorter in duration.

Which of the statements given above is/are correct?Correct

Answer: B

Explanation

Statement 1 is incorrect: A technical recession is a term used to describe two consecutive quarters of decline in output. In the case of a nation’s economy, the term usually refers to back-to-back contractions in real GDP.

Statement 2 is correct: It is most often caused by a single event and is generally shorter in duration. For example, covid-19 induced lockdown pushed many countries into technical recession.

Recently, several countries have again slipped into recession and many are at risk. The UK and Japan, Ireland and Finland are going through the phase of technical recession.

Incorrect

Incorrect

Answer: B

Explanation

Statement 1 is incorrect: A technical recession is a term used to describe two consecutive quarters of decline in output. In the case of a nation’s economy, the term usually refers to back-to-back contractions in real GDP.

Statement 2 is correct: It is most often caused by a single event and is generally shorter in duration. For example, covid-19 induced lockdown pushed many countries into technical recession.

Recently, several countries have again slipped into recession and many are at risk. The UK and Japan, Ireland and Finland are going through the phase of technical recession.

-

Question 2 of 5

2. Question

2. Consider the following:

1. Increase in the savings rate in the economy

2. Decrease in consumption activity in the economy

3. Decrease in socio-economic inequality in the country

4. Increase in investment activity in the country

How many of the above are the likely effects of increase in financial inclusion in the country?Correct

Answer: C

Explanation:

Financial inclusion is the process of ensuring access to financial products and services needed by vulnerable groups at an affordable cost in a transparent manner by institutional players.

● The term is broadly used to describe the provision of savings and loan services to the poor in an inexpensive and easy-to-use form.

● The concept of financial inclusion was first introduced in India in 2005 by the Reserve Bank of India.

An increase in financial inclusion leads to many positive effects in the economy. These includes:

● Increase in the savings rate in the economy.

● Decrease in socio-economic inequality in the country.

● Increase in investment activity in the country.

● Improving access to credit for consumption and production purposes.

It doesn’t lead to a decrease in consumption activity in the economy. In fact, research has shown that financial inclusion helps in streamlining the consumption activity of the vulnerable class during the times of economic shock as they have savings to fall back on.Incorrect

Answer: C

Explanation:

Financial inclusion is the process of ensuring access to financial products and services needed by vulnerable groups at an affordable cost in a transparent manner by institutional players.

● The term is broadly used to describe the provision of savings and loan services to the poor in an inexpensive and easy-to-use form.

● The concept of financial inclusion was first introduced in India in 2005 by the Reserve Bank of India.

An increase in financial inclusion leads to many positive effects in the economy. These includes:

● Increase in the savings rate in the economy.

● Decrease in socio-economic inequality in the country.

● Increase in investment activity in the country.

● Improving access to credit for consumption and production purposes.

It doesn’t lead to a decrease in consumption activity in the economy. In fact, research has shown that financial inclusion helps in streamlining the consumption activity of the vulnerable class during the times of economic shock as they have savings to fall back on. -

Question 3 of 5

3. Question

3. With reference to the Prompt Corrective Action Plan, consider the following statements:

1. It is a framework under which banks with weak financial metrics are put under watch by the RBI.

2. The RBI monitors majorly five parameters to determine whether it needs to put a bank under the PCA plan.

3. Lending operations are immediately prohibited for banks which are put under the framework.

How many of the above statements are correct?Correct

Answer: A

Explanation:

Statement 1 is correct: PCA is a system that the RBI imposes on banks showing signs of financial stress. It was introduced in 2002 by the RBI for scheduled commercial banks.

Statement 2 is incorrect: The RBI monitors majorly three parameters to determine whether it needs to put a bank under the PCA plan. These are Capital, Asset Quality and Leverage. Indicators to be tracked for Capital, Asset Quality and Leverage would be CRAR/ Common Equity Tier I Ratio, Net NPA Ratio and Tier-I Leverage Ratio, respectively.

Statement 3 is incorrect: When a bank is placed under PCA, one or more of the following corrective actions may be prescribed:Specifications – Mandatory actions

Risk Threshold 1 – Restriction on dividend distribution/remittance of profits. Promoters/Owners/Parent (in the case of foreign banks) to bring in capital

Risk Threshold 2 – In addition to mandatory actions of Threshold 1, i. Restriction on branch expansion; domestic and/or overseas

Risk Threshold 3 – In addition to mandatory actions of Threshold 1 & 2, Appropriate restrictions on capital expenditure, other than for technological upgradation within Board approved limits

Lending operations are not immediately prohibited.

The RBI has recently mandated extending the Prompt Corrective Action plan to government NBFCs from October 2024 onwards.Incorrect

Answer: A

Explanation:

Statement 1 is correct: PCA is a system that the RBI imposes on banks showing signs of financial stress. It was introduced in 2002 by the RBI for scheduled commercial banks.

Statement 2 is incorrect: The RBI monitors majorly three parameters to determine whether it needs to put a bank under the PCA plan. These are Capital, Asset Quality and Leverage. Indicators to be tracked for Capital, Asset Quality and Leverage would be CRAR/ Common Equity Tier I Ratio, Net NPA Ratio and Tier-I Leverage Ratio, respectively.

Statement 3 is incorrect: When a bank is placed under PCA, one or more of the following corrective actions may be prescribed:Specifications – Mandatory actions

Risk Threshold 1 – Restriction on dividend distribution/remittance of profits. Promoters/Owners/Parent (in the case of foreign banks) to bring in capital

Risk Threshold 2 – In addition to mandatory actions of Threshold 1, i. Restriction on branch expansion; domestic and/or overseas

Risk Threshold 3 – In addition to mandatory actions of Threshold 1 & 2, Appropriate restrictions on capital expenditure, other than for technological upgradation within Board approved limits

Lending operations are not immediately prohibited.

The RBI has recently mandated extending the Prompt Corrective Action plan to government NBFCs from October 2024 onwards. -

Question 4 of 5

4. Question

4. With reference to financial instruments, consider the following statements:

1. Under the call money market, funds are transacted for the period between 2 days and 14 days.

2. Under the notice money market, funds are transacted on an overnight basis.

3. Both are categorized as capital market instruments.

How many of the above statements are correct?Correct

Answer: D

Explanation:

Statement 1 is incorrect: Under the call money market, funds are transacted on an overnight basis.

Statement 2 is incorrect: Under the notice money market, funds are transacted for the period between 2 days and 14 days.

Participants in the call/notice money market currently include banks (excluding RRBs) and Primary Dealers (PDs), both as borrowers and lenders.

Statement 3 is incorrect: The call/notice money market forms an important segment of the Money Market.

● The money market is a market for short-term financial assets that are close substitutes of money. The most important feature of a money market instrument is that it is liquid and can be turned over quickly at low cost and provides an avenue for equilibrating the short-term surplus funds of lenders and the requirements of borrowers.Incorrect

Answer: D

Explanation:

Statement 1 is incorrect: Under the call money market, funds are transacted on an overnight basis.

Statement 2 is incorrect: Under the notice money market, funds are transacted for the period between 2 days and 14 days.

Participants in the call/notice money market currently include banks (excluding RRBs) and Primary Dealers (PDs), both as borrowers and lenders.

Statement 3 is incorrect: The call/notice money market forms an important segment of the Money Market.

● The money market is a market for short-term financial assets that are close substitutes of money. The most important feature of a money market instrument is that it is liquid and can be turned over quickly at low cost and provides an avenue for equilibrating the short-term surplus funds of lenders and the requirements of borrowers. -

Question 5 of 5

5. Question

5. With reference to India’s Five-Year Plans, consider the following statements:

1. The Green Revolution was introduced in the fifth Five-Year Plan.

2. The Monopolistic and Restrictive Trade Practices Act was introduced in the fourth Five-Year Plan.

3. The Mid-Day Meal Scheme was introduced in the eighth Five-Year Plan.

How many of the above statements are correct?Correct

Answer: B

Explanation:

Statement 1 is incorrect: Green Revolution as a strategy was introduced during the annual plans of 1966-69. The period was termed as Plan holiday as there was a departure from the five-year plans. The tenure for fifth FYP was 1974-79.

Statement 2 is correct: The Monopolistic and Restrictive Trade Practices Act, 1969 was introduced in the fourth five-year plan (1969-74). It was aimed at preventing the monopolistic and restrictive trade practices that could be detrimental to fair competition and consumer interests.

It was replaced by the Competition Commission Act, 2002.

Statement 3 is correct: Mid-day meal scheme was introduced in 1995, which was the eighth plan (1992-97).

The scheme was introduced under the National Program of Nutritional Support to Primary Education for enhancement of enrolment, retention, improvement of attendance and quality of education and improving nutritional levels among children. By the year 1997-98, the program was introduced in all districts of the country.Incorrect

Answer: B

Explanation:

Statement 1 is incorrect: Green Revolution as a strategy was introduced during the annual plans of 1966-69. The period was termed as Plan holiday as there was a departure from the five-year plans. The tenure for fifth FYP was 1974-79.

Statement 2 is correct: The Monopolistic and Restrictive Trade Practices Act, 1969 was introduced in the fourth five-year plan (1969-74). It was aimed at preventing the monopolistic and restrictive trade practices that could be detrimental to fair competition and consumer interests.

It was replaced by the Competition Commission Act, 2002.

Statement 3 is correct: Mid-day meal scheme was introduced in 1995, which was the eighth plan (1992-97).

The scheme was introduced under the National Program of Nutritional Support to Primary Education for enhancement of enrolment, retention, improvement of attendance and quality of education and improving nutritional levels among children. By the year 1997-98, the program was introduced in all districts of the country.