IN THE DOCK: CHILD ABUSE ON SOCIAL MEDIA PLATFORM

THE CONTEXT: Recently, the CEOs of Meta, TikTok, Snapchat and Discord appeared before a bipartisan committee of the US Senate to answer for how these platforms are used by predators against children. Mark Zuckerberg has apologised to parents of children victimised on Meta platforms.

ISSUES:

- Rapidly evolving Digital Landscape: Advances in information technology have given rise to better encryption services and the dark net, which provide a safe cover to offenders, allowing them to engage in illegal activities. The extensive nature of the internet and online interaction has made it so that almost all cases of child sexual abuse feature a virtual aspect.

- Rising child abuse online: An investigation by the Guardian in 2023 found in Meta’s internal documents that 1 lakh minors, a majority of them female, face some form of harassment on its platforms every day. Platforms and apps are used by predators to “groom” minors and as a tool for human trafficking. Two Amnesty International reports published in 2023 highlighted “the abuses experienced by children and young people using TikTok, and how these abuses are caused by TikTok’s recommender system and the underlying business model”.

- Non responsible behaviours: Time and again, studies have shown that social media platforms, reliant as they are on “engagement” and “attention”, have not done enough to address the harms caused by their amoral algorithms. Between 2021 and 2023, whistleblowers revealed that Meta has long been aware of the fact that its products cause harm to children and young people. US Senators criticized the chief executives of Meta, TikTok, Snap, X and Discord for not doing enough to prevent child sexual abuse online, amid rising fears over how the platforms affect youths.

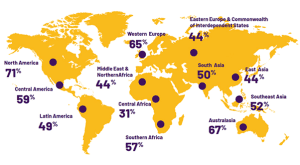

- Global issue: The issue, however, does not concern the US alone but parents, policy-makers and society, including and especially in India.

- India specific data: India has over 600 million smartphone users, and teenagers are among the fastest-growing segments within this category. According to the NCRB, about 28 per cent of the entire minor population has faced some form of sexual abuse, but many victims do not come forward to register a complaint.

- Fewer regulation and content moderations: India, despite being the largest market for Meta, has fewer content moderators both proportionally and in absolute numbers than the US or Europe. Law enforcement too needs the requisite resources and training to deal with crimes online even as the police finds its feet on social media misuse, AI-created deepfakes are becoming increasingly common.

THE WAY FORWARD:

- Multi Stakeholder Approach: There is a need to develop a comprehensive outreach system to engage parents, schools, communities, NGO partners and local governments as well as police and lawyers. It will ensure better implementation of the legal framework, policies, national strategies and standards.

- Stricter legislations: There is a need to make stricter legislation against offenders with proper implementation. There should be further development of clear mandates and creation of a logical framework of roles and duties of all relevant stakeholders within standard operating procedures for investigation.

- Collaborative approach: Close collaboration between non-traditional partners from the industry, government ministries dealing in technological communication, and law enforcement is needed.

- Awareness: It is also important to have mass awareness and education campaigns on safe and responsible smartphone use for parents and children, in schools and beyond, especially in non-metro towns and villages. Children should be made aware of Acts like POCSO so as to make them aware of their legal right. Community awareness program should be encouraged to increase awareness among children about the evil of abuse.

- Role of media: Media should play a proactive role and should be prohibited from disclosing the personal identity of the victim categorically in line with the Juvenile Justice Act.

THE CONCLUSION:

Children are the future of the nation and it is needed that they should be prevented from such crimes. There is an urgent need to urgently devise ways to bolster the existing criminal justice and child protection systems and ensure higher convictions.

UPSC PREVIOUS YEAR QUESTIONS

Q.1 Explain why suicide among young women is increasing in Indian society. (2023)

Q.2 Child cuddling is now being replaced by mobile phones. Discuss its impact on the socialization of children. (2023)

MAINS PRACTICE QUESTIONS

Q.1 With the increasing popularity of social media platforms, children these days have a much higher chance of being exposed to harmful content. Comment.

Q.2 Highlight the challenges in fight against online child exploitation and abuse. What steps can be taken to tackle the abuse and hold the social media platform accountable?

SOURCE: https://indianexpress.com/article/opinion/editorials/in-the-dock-9-9141499/