DAILY CURRENT AFFAIRS (NOVEMBER 30, 2022)

INDIAN POLITY AND CONSTITUTION

1. THE ENTRY OF WOMEN IN MASJIDS

THE CONTEXT: Recently, the Jama Masjid in Delhi prohibited the entry of single women or women in groups inside the mosque premises. The authorities reasoned that some women fail to respect the sanctity of the place of worship, making videos there.

THE EXPLANATION:

What is the Islamic law on women’s entry?

- While there is a clear difference of opinion among Islamic scholars on the right of women to visit a dargah or a cemetery, there is lesser disagreement on a woman’s right to offer prayers inside a masjid.

- Most Islamic scholars agree that a prayer can be offered at home but can only be established in a group, hence the importance of going to a mosque. Most also agree that women have been exempted, not prohibited from going to the mosque, keeping in mind their child-rearing and other domestic responsibilities.

- In fact, the Quran at no place prohibits women from going to mosques for prayers. For instance, verse 71 of Surah Taubah, says, “The believing men and women are protectors and helpers of each other. They (collaborate) to promote all that is good and oppose all that is evil; establish prayers and give charity, and obey Allah and His Messenger.” Wherever the Quran talks of establishing prayer, it talks in gender neutral terms.

- Incidentally, when Muslims go to Mecca and Medina for Hajj and Umrah (lesser pilgrimage), both men and women pray at Haram Sharif in Mecca and Masjid-e-Nabavi in Medina. Both places have separate halls earmarked for men and women. Also, across West Asia there is no ban on women coming to the masjid for prayers. In the U.S. and Canada too, women access mosques for prayers, and even gather there for special Taraweeh prayers in Ramzan and lessons on religion.

- The denial of access to mosques for women worshippers is a largely subcontinental phenomenon. In India, only a handful of mosques maintained or owned by Jamaat-e-Islami and the Ahl-e-Hadith sect have provisions for women worshippers. Most mosques while not expressly forbidding women’s entry in masjids, have no provision for women to do ablutions for prayer or a separate prayer zone for them. They are built keeping only men in mind. Under the circumstances, they are reduced to a ‘men only’ zone.

Have there been similar bans before?

- The short-lived order of the Jama Masjid administration drew parallels with the much more prolonged ban on entry of women inside the sanctum sanctorum of the Haji Ali Dargah in Mumbai. Back in 2011, a grill was put up on the premises of the vastly popular 15th century dargah, prohibiting women from going beyond it.

- Following the ‘this much and no further’ order, some women approached the dargah management for redress. However, with the requests having been denied, they started a campaign, ‘Haji Ali for All’, winning over more women in the process. Led by the Bharatiya Muslim Mahila Andolan, the women approached the Bombay High Court which ruled in their favour in 2016.

What is the legal issue?

- According to the Constitution, there is complete equality between men and women. In the Haji Ali Dargah case too, the High Court quoted Articles 15, 16 and 25 of the Constitution to grant women the desired access to the dargah. There are petitions filed before the Supreme Court wherein access has been sought for women in all mosques across the country. The apex court has clubbed them with the Sabarimala case.

HEALTH ISSUES

2. NEW NAME FOR MONKEYPOX

THE CONTEXT: The World Health Organization (WHO) announced that mpox is currently the preferred name for monkeypox.

THE EXPLANATION:

Why was monkeypox renamed?

- Monkeypox was named in 1970 – more than 10 years after the virus that causes the disease was discovered in captive monkeys.

- However, monkeypox probably did not originate in monkeys and knowledge related to its origins is still unknown.

- The monkeypox virus is currently found several other animals apart from monkeys.

- The name for the disease was given before the WHO published the best practices for naming diseases in 2015.

- Since the recent outbreak, experts have suggested changing the name of the disease to avoid discrimination and stigma, which discouraged people from testing and vaccination.

- The monkeypox had mainly affected gay men. In the United States, black and Hispanic people were disproportionately affected by the viral infection.

- Currently, both names – monkeypox and mpox – will be used simultaneously for one year until the former will be phased out gradually.

Who is responsible for naming diseases?

- The World Health Organization (WHO) is responsible for giving new names to newly discovered diseases and existing diseases under the International Classification of Diseases (ICD) and the WHO Family of International Health Related Classifications (WHO-FIC) by consulting with the member states of WHO.

- The responsibility of naming viruses lies with the International Committee on the Taxonomy of Viruses (ICTV). It had started the process of renaming all orthopox viruses, including monkeypox virus, before the global outbreak in 2022. This will continue to be under the purview of the ICTV.

About ICTV

The International Committee on Taxonomy of Viruses, set up in 1966, is responsible for authorizing and organizing taxonomic classification of and the nomenclature of viruses. It was previously known as the International Committee on Nomenclature of Viruses (ICNV). The members of this organization are known as expert virologists. The ICTV has developed a systematic method to name, describe and classify every virus affecting living organisms.

VALUE ADDITION:

ABOUT MONKEYPOX:

- Monkeypox is an ongoing outbreak. The first case of the viral disease was reported in May 2022 in the United Kingdom. An individual reported the first case with travel links to Nigeria. Monkeypox disease is endemic to Nigeria. This disease is being reported outside Central and West Africa for the first time. It was declared a public health emergency of international concern on July 23, 2022.

- Monkeypox cases have been reported in over 80 countries. Considering this, the WHO has declared it a global health emergency. The confirmed cases have reached over 32,000. In Delhi, 5 monkeypox cases have been reported.

Symptoms of monkeypox:

- Monkeypox is a viral infection that displays a week or two after exposure to the virus. Common symptoms include fever, followed by a rash with lesions. The lesions last for 2–4 weeks before falling off.

SCIENCE AND TECHNOLOGY

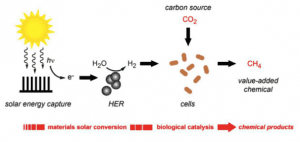

3. NEW ARTIFICIAL PHOTOSYNTHETIC SYSTEM TO CAPTURE SOLAR ENERGY

THE CONTEXT: Researchers from IISER-Thiruvananthapuram and IIT-Indore have jointly developed an artificial light-harvesting system that will help capture solar energy.

THE EXPLANATION:

About the artificial light-harvesting system

- Scientists have a novel artificial light-capturing system that imitates the process of photosynthesis to effectively capture light to conserve power. This technology addresses various challenges faced while replicating the complex process of photosynthesis as well as the problems associated with light absorbers and transmitters.

Why is the new artificial light-harvesting system significant?

- Scientists have long sought to mimic the process of photosynthesis (the process through which plants absorb sunlight and produce sugars) to be used in solar cells or artificial leaves. Many have tried to replicate the molecular and atomic structure of light-harvesting mechanism of plants in the laboratory environment. They have made use of polymeric structures, detergent-type molecules, vesicles, gels, and other bio-inspired structures to achieve this feat. Most common hurdle faced by these technologies is the aggregation or clumping of the molecules, which makes it difficult to effectively capture and conserve the light.

- The new artificial photosynthetic system makes use of clusters of silver with a nanometer dimension, which is a hundred thousand times smaller than the width of human hair. These silver nanoclusters have complicated and exotic photophysical properties. The researchers were able to stabilize them with bulky ligands and entrap the entire ensemble inside another larger molecule called cyclodextrin. This is the first time that an atom-precise nanoclusters were used for this application. It provides 93 per cent effective energy transfer because of the presence of opposite charges on the surface and the matched electronic energy distribution. The harvested energy can generate currents having higher yields than individual components.

- The new technology paves the way for designing of new light-harvesting materials that can improve the efficiency of solar cells and minimize the energy loss. Such technologies will help countries achieve their net zero carbon emissions and meet future energy needs through renewable energy sources.

4. INDIA’S FIRST PRIVATE VEHICLE LAUNCHPAD

THE CONTEXT: Chennai-based space tech startup Agnikul Cosmos recently opened India’s first private launchpad and mission control centre at the Satish Dhawan Space Centre (SDSC) in Sriharikota, Andhra Pradesh.

THE EXPLANATION:

About the facility

- The Agnikul launchpad and the Agnikul mission control centre are four kilometres apart. They are connected with each other via various critical systems to ensure 100 per operationality during the countdown.

- This facility was designed by the startupAgnikul Cosmos and executed with the support from ISRO and the IN-SPACe.

- It is first exclusive Launchpad for launching private launch vehicles.

- It is designed specifically to support liquid stage-controlled launches and help ISRO range operations team to monitor flight safety parameters during launches.

- This facility can share data and other important information with ISRO’s mission control centre whenever necessary.

- Agnikul’s inaugural launch of the Agnibaan rocket will take place from this Launchpad. This mission is intended to be a technology demonstrator, mirroring Agnikul’s orbital launch but at a reduced scale.

What is Agnibaan rocket?

- Agnibaan rocket is a customizable two-stage launch vehicle capable of carrying up to 100 kg payload to orbits some 700 km high (low earth orbits) and enable plug-and-play configuration. This mobile launch system is fully made using 3D printing. The rocket has three stages. The first stage is powered by 7 Agnite engines. The second stage uses an Agnilet engine optimized for vacuum use.

- The Agnilet is the world’s first single-piece 3D printed engine to be fully designed and manufactured in India. It uses liquid oxygen and kerosene as oxidizer and fuel. It was successfully tested in 2021, making Agnikul the first company in India to test its engines in ISRO.

THE SECURITY AFFAIRS

5. INDIA’S THIRD SURVEY VEHICLE SHIP ‘IKSHAK’ IS LAUNCHED FOR THE INDIAN NAVY

THE CONTEXT: Indian Navy’s third Survey Vehicle ‘Ikshak’ has been launched in Chennai which is being built by GRSE and L&T. This is the third of the third of the four Survey Vessels (Large) (SVL) Project, being built by GRSE and L&T for Indian Navy.

THE EXPLANATION:

The ship has been named ‘Ikshak’ which means ‘Guide’. The ship has been named to signify the contribution of the Survey ships towards facilitating safe passage for Mariners at Sea.

About Ikshak

- Ikshak is the third of the four survey vessels built under the Survey Vessels (Large) (SVL) Project for the Indian Navy.

- It was built by the Garden Reach Shipbuilders & Engineers (GRSE) Ltd in partnership with the Larsen and Toubro (L&T).

- The vessel has been named ‘Ikshak’, which means “Guide”. The name signifies the contribution of survey vessels towards facilitating safe passage for Mariners at Sea.

About the SVL project

- The GRSE and the Ministry of Defence have signed a Rs.2,435 crore contract to build four Survey Vessels (Large) (SVL) in 2018. Under this project, the first ship was at GRSE, Kolkata. The remaining three ships are being constructed (upto outfitting stage) by the subcontractor L&T Shipbuilding. The first SVL under this contract, ‘Sandhayak’, was delivered in December 2021 at GRSE in Kolkata.

- The vessels developed under this project will replace the existing Sandhayak Class survey ships. The new SVL ships are 110 meters long and 16 meters wide, with deep displacement of 3400 tons. A single SVL vessel is capable of accommodating 231 personnel. The hull of these vessels is made of indigenously developed DMR 249-A steel manufactured by the Steel Authority of India Limited. These ships have some 80 per cent of indigenous content by cost.

- Their propulsion system of the SVL has two Main Engines in twin shaft configuration, designed to reach a maximum speed of 18 knots. It has new-generation hydrographic equipment capable of collecting accurate oceanographic data. One of the key features of this vessel is the integration of Bow & Stern Thrusters that improve the low-speed maneuverability, which is required during surveys conducted in shallow waters.

What are the uses of the survey vessel?

The SVL is capable of carrying four Survey Motor Boats and an integral helicopter. It can undertake full-scale coastal and deep-water hydrographic surveys of ports and navigation channels. This vessel will be deployed for collecting oceanographic and geophysical data for civil and defence applications. It is also capable of providing limited defence and serving as a hospital ship during the times of emergencies.

THE PRELIMS PERSPECTIVE

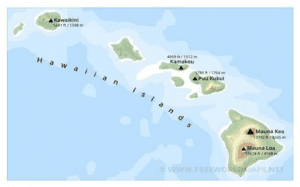

6. PLACES IN NEWS: MAUNA LOA

THE CONTEXT: Recently, the Mauna Loa, world’s largest volcano, erupted for the first time in 38 years.

THE EXPLANATION:

- Mauna Loa is one of five volcanoes that together make up the Big Island of Hawaii, which is the southernmost island in the Hawaiian archipelago.

- It’s not the tallest (that title goes to Mauna Kea) but it’s the largest and makes up about half of the island’s land mass.

- It sits immediately north of Kilauea volcano, which is currently erupting from its summit crater.

- Kilauea is well-known for a 2018 eruption that destroyed 700 homes and sent rivers of lava spreading across farms and into the ocean.

- Mauna Loa last erupted in 1984. It has erupted 33 times since 1843. The recent 2022 eruption is the 34th since the written history began in 1843. This volcano is situated at immediate north of Kilauea Volcano, which is infamous for the 2018 eruption that destroyed 700 homes and sent lava that purged farms before entering into the ocean.

THE PRELIMS PRACTICE QUESTION

QUESTION OF THE DAY

Q1. Consider the following statements about iNCOVACC vaccine:

1. It was developed by Bharat Biotech company in partnership with Washington University.

2. It requires sub-zero temperatures for storage and distribution.

3. Its development was partly funded by Government of India.

Which of the statements given above are correct?

a) 1 and 2 only

b) 2 and 3 only

c) 1 and 3 only

d) 1, 2 and 3

Answer: C

Explanation:

- Bharat Biotech International Limited (BBIL) announced that iNCOVACC (BBV154), an intranasal vaccine against coronavirus disease, has received approval from the Central Drugs Standard Control Organisation (CDSCO) under Restricted Use in Emergency Situation for all adults in India, for heterologous booster doses.

- iNCOVACC is the world’s first intranasal Covid vaccine to receive approval for the primary 2-dose schedule and heterologous booster dose.

- iNCOVACC is stable at 2-8°C for easy storage and distribution.

- iNCOVACC is a recombinant replication deficient adenovirus vectored vaccine with a pre-fusion stabilized SARS-CoV-2 spike protein.

- iNCOVACC has been specifically formulated to allow intranasal delivery through nasal drops. The nasal delivery system has been designed and developed to be cost-effective in low and middle-income countries.

- iNCOVACC was developed in partnership with Washington University, St Louis.

- Product development and clinical trials were funded in part by the Government of India.

region. The issues may include scientific research and the peaceful and sustainable use of resources in the region.

region. The issues may include scientific research and the peaceful and sustainable use of resources in the region.

subcontinent. It is grown across the length and breadth of the sub-Himalayan region, extending from Assam in the east to River Indus.

subcontinent. It is grown across the length and breadth of the sub-Himalayan region, extending from Assam in the east to River Indus. including those that are capable of wiping out the majority of known species. Various species of tardigrades are found across diverse terrains, from mountains to oceans to ice sheets. Due to their adaptability, opportunities exist outside tardigrades’ natural habitats.

including those that are capable of wiping out the majority of known species. Various species of tardigrades are found across diverse terrains, from mountains to oceans to ice sheets. Due to their adaptability, opportunities exist outside tardigrades’ natural habitats. receive a share of 83 MW power. In 2022-23, the state is likely to have a power surplus both in terms of peak demand and energy requirements on yearly basis for the year 2022-23. The yearly demand for power in Arunachal Pradesh is 851 million units. The state will have 1,373 million units available. This creates a surplus of 521 million units.

receive a share of 83 MW power. In 2022-23, the state is likely to have a power surplus both in terms of peak demand and energy requirements on yearly basis for the year 2022-23. The yearly demand for power in Arunachal Pradesh is 851 million units. The state will have 1,373 million units available. This creates a surplus of 521 million units.