DAILY CURRENT AFFAIRS (NOVEMBER 29, 2022)

INDIAN ART AND CULTURE

1. REVISION SERIES: KOLKALI FOLK DANCE

- Kolkali-Parichakali is a popular folk dance in southern Kerala and Lakshwadeep. Kol refers to stick, and Paricha means shield. The dancers enact fight scenes while holding wooden mock weapons. The performance begins slowly, but gradually increases in tempo until it reaches a frenzy-like climax.

- The dancers move in a circle, striking small sticks and using unique moves to keep time. As the dance progresses, the circle widens and contracts.

- Dancers sing and dance in circles around a Nilavilakku (traditional metal lamp).

- As the accompanying music gradually rises in pitch and the performance reaches its climax, the pace and rhythm of the dance change from phase to phase.

FEATURES:

- Kolkali is a sport in which only men can compete. Women are not permitted to participate in this folk dance. This traditional rule is followed by all island residents.

- ‘Kol’ is a word that means stick.’ The dance is performed with sticks in hands to the beat of the music. As a result, the dance is known as Kolkali, which literally means “stick dance.”

- The dance’s rhythms and circular movements are mesmerizing. The dancers form pairs and move in circles in response to the musical rhythm created by the sticks.

- The sticks are mostly used as props when dancing, and the dancers hold them in their hands.

- Many of the Kolkali characters’ body postures, choreography, and footwork are based directly on Kalarippayattu.

- The kolkali dance begins slowly. As the music develops momentum, it gradually picks up speed and moves toward a quicker pace, portraying their enthusiasm, delight, and ardor. Typically, folk tunes are used to accompany this traditional dance.

INDIAN POLITY AND CONSTITUTION

2. TOWARD LEGALISING SAME-SEX MARRIAGE

THE CONTEXT: A Supreme Court Bench led by Chief Justice of India recently issued notices to the Centre and the Attorney General of India, seeking their response to two petitions filed by gay couples to allow solemnisation of same-sex marriage under the Special Marriage Act, (SMA) 1954.

THE EXPLANATION:

About Special Marriage Act, (SMA) 1954:

- The Special Marriage Act, 1954 is an Act of the Parliament of India with provision for civil marriage or “registered marriage”.

- The Act deals with inter-caste and inter-religion marriages.

- Inter caste marriage is a marriage between people of two different castes.

- Inter religion marriage is a marriage between people of two different religions.

- The fundamental requirement under this Act for a valid marriage is the consent of both parties to the marriage.

Applicability:

- Any person, irrespective of religion.

- Hindus, Muslims, Buddhists, , Sikhs, Christians, Parsis, or Jews can also perform marriage under the Special Marriage Act, 1954.

- Inter-religion marriages.

- This Act is applicable to the entire territory of India and extends to intending spouses who are both,

- Indian nationals.

- Indian national living abroad.

Conditions for marriage:

- Each party involved should have no other subsisting valid marriage.

- In other words, the resulting marriage should be monogamous for both parties.

- The groom must be at least 21 years old; the bride must be at least 18 years old.

- The parties should be competent in regard to their mental capacity to the extent that they are able to give valid consent for the marriage.

- The parties should not fall within the degree of prohibited relationship.

What is the government’s stand?

- In 2021, while responding to the pleas seeking recognition of same-sex marriages in the Delhi High Court, Solicitor General for the Centre had said that as per the law, marriage was permissible between a “biological man” and “biological woman”.

- In its affidavit opposing the pleas, the Centre had said: “The acceptance of the institution of marriage between two individuals of the same gender is neither recognised nor accepted in any uncodified personal laws or any codified statutory laws”. It also argued against the urgency of the pleas by saying nobody was “dying” in the absence of a marriage certificate.

What about other countries?

- A total of 32 countries around the world have legalised same-sex marriages, some through legislation while others through judicial pronouncements. Many countries first recognised same-sex civil unions as the escalatory step to recognise homosexual marriage.

- Civil unions or partnerships are similar arrangements as marriages which provide legal recognition of unmarried couples of the same or opposite sex in order to grant them some of the rights that come with marriage — such as inheritance, medical benefits, employee benefits to spouses, managing joint taxes and finances, and in some cases even adoption.

- The Netherlands was the first country in 2001 to legalise same-sex marriage by amending one line in its civil marriage law. In some countries, the decriminalisation of homosexuality was not followed for years by the recognition of same-sex marriage, for instance, in the U.S. the former happened in 2003 while the latter in 2015.

SCIENCE AND TECHNOLOGY

3. WHAT IS BLUEBUGGING, AND HOW IS IT USED TO HACK BLUETOOTH-ENABLED DEVICES?

THE CONTEXT: Recently, cybersecurity experts note that apps that let users connect smartphones or laptops to wireless earplugs can record conversations, and are vulnerable to hacks.

THE EXPLANATION:

- Even the most secure smartphones like iPhones are vulnerable to such attacks.

- Any app with access to Bluetooth can record users’ conversations with Siri and audio from the iOS keyboard dictation feature when using AirPods or Beats headsets, some app developers say. Through a process called bluebugging, a hacker can gain unauthorised access to these apps and devices and control them as per their wish.

What is bluebugging?

- It is a form of hacking that lets attackers access a device through its discoverable Bluetooth connection. Once a device or phone is blue bugged, a hacker can listen to the calls, read and send messages and steal and modify contacts. It started out as a threat for laptops with Bluetooth capability. Later hackers used the technique to target mobile phones and other devices.

- Independent security researcher blogged about the threat of bluebugging as early as 2004. They noted that the bug exploited a loophole in Bluetooth protocol, enabling it to download phone books and call lists from the attacked user’s phone.

How does bluebugging hack devices?

- Bluebugging attacks work by exploiting Bluetooth-enabled devices. The device’s Bluetooth must be in discoverable mode, which is the default setting on most devices. The hacker then tries to pair with the device via Bluetooth.

- Once a connection is established, hackers can use brute force attacks to bypass authentication. They can install malware in the compromised device to gain unauthorised access to it.

- Bluebugging can happen whenever a Bluetooth enabled device is within a 10-metre radius of the hacker. However, according to a blog by VPN service provider NordVPN, hackers can use booster antennas to widen the attack range.

4. WHAT IS SARAS 3?

THE CONTEXT: Recently, a SARAS 3, a radio telescope designed and built at the Raman Research Institute (RRI) here, has provided clues to the nature of the universe’s first stars and galaxies.

THE EXPLANATION:

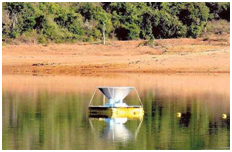

- Using data from the telescope which has been deployed over the Dandiganahalli Lake and Sharavati backwaters since 2020, astronomers and researchers have been able to determine properties of radio luminous galaxies formed just 200 million years post the Big Bang, a period known as the Cosmic Dawn.

- Researchers from the Commonwealth Scientific and Industrial Research Organisation (CSIRO) in Australia, along with collaborators at the University of Cambridge and University of Tel Aviv, have used data from SARAS 3 to throw light on the energy output, luminosity, and masses of the first generation of galaxies that are bright in radio wavelengths.

Deeper insight

- “The results from the SARAS 3 telescope are the first time that radio observations of the averaged 21-centimetre line have been able to provide an insight into the properties of the earliest radio loud galaxies that are usually powered by supermassive black holes,” according to researcher.

- Explaining the findings, Professor Singh said SARAS 3 had improved the understanding of astrophysics of Cosmic Dawn by telling astronomers that less than 3% of the gaseous matter within early galaxies was converted into stars, and that the earliest galaxies that were bright in radio emission were also strong in X-rays, which heated the cosmic gas in and around the early galaxies.

About SARAS 3

- SARAS 3 is an indigenously invented and built radio telescope that can detect extremely faint radio wave signals from the depths of time.

- It can detect faint cosmological signals, especially radiation emitted by hydrogen atoms at the 21-cm wavelength (1.4 GHz) arising from the depths of the cosmos.

- Note: Detecting a faint signal from such an early period of the Universe is extremely difficult. The celestial signal is exceptionally faint – buried in sky radio waves that come to us from the gas in our own Galaxy, the Milky Way, which are a million times brighter.

THE PRELIMS PERSPECTIVE

5. WHAT IS WET LEASING & DRY LEASING OF AIRCRAFT?

THE CONTEXT: In efforts to boost international air traffic, the civil aviation ministry has allowed Indian airlines to take wide-body planes on wet lease for up to one year. According to sources, that the rules had been relaxed, allowing the wet leasing for a year as opposed to the six months permitted so far.

THE EXPLANATION:

What is wet and dry leasing?

- Wet leasing means taking the plane along with operating crew and engineers, while dry leasing refers to taking only the aircraft on rent.

- “The technical term for wet leasing is ACMI which stands for aircraft, crew, maintenance and insurance. These are the aspects of the operation that the wet lease airline takes care of, while the airline client will still be responsible for paying for direct operating costs such catering and fuel as well as fees such as airport fees, ground handling charges and navigation fees.”

- Operations of an aircraft on wet lease are more difficult for the Directorate General of Civil Aviation (DGCA) to monitor, which is why it is allowed for shorter durations.

SECURITY AFFAIRS

6. AUSTRA HIND 22

THE CONTEXT: The Austra Hind 22 exercise commenced recently in Rajasthan. It is being held after the 26th edition of the quadrilateral maritime drill Exercise Malabar was concluded off the coast of Japan in early November 2022.

THE EXPLANATION:

What is Austra Hind 22?

- The Austra Hind 22 is a bilateral training exercise between the Indian Army and the Australian Army.

- It is being held from November 28 to December 11 this year in Mahajan Field Firing Ranges (Rajasthan).

- The Australian Army is represented by soldiers from the 13th Brigade of the 2nd Division.

- The Indian side is represented by the troops belonging to the Dogra Regiment.

- This is the inaugural edition of the Austra Hind series. This joint exercise will involve all arms and services contingents of both countries’ armies. It will be hosted alternatively by India and Australia.

What is the objective of this exercise?

- The objective of the Austra Hind series is to build positive military relations between India and Australia. It enables both the Indian Army and the Australian Army to share each other’s best practices. It also seeks to promote interoperability between them while undertaking multi-domain operations in semi-desert terrain under the UN peace enforcement mandate.

- The joint exercise enables the armies of India and Australia to share best practices in tactics, techniques and procedures to conduct tactical operations at the company and platoon levels for neutralizing hostile threats. It will also focus on casualty management, casualty evacuation and logistics planning at battalion or company level. Joint planning, joint tactical drills, sharing of special arms skills and joint raids of hostile entities are also included in this exercise.

About Dogra Regiment

The Dogra Regiment is the Indian Army’s infantry regiment. Its origins can be traced back to the 17th Dogra Regiment of the British Indian Army. It obtained its present name after it was transferred to the Indian Army. This regiment has taken part in all conflicts that occurred after the Indian independence.

THE PRELIMS PRACTICE QUESTION

QUESTION OF THE DAY

Q1. Consider the following statements:

1. Sharavati river is tributary of Cauvery River.

2. Jog falls are formed by this river in Karnataka.

3. Linganamakki dam is built across this river in Tamil Nadu.

Which of the statements given above is/are correct?

a) 1 only

b) 1 and 2 only

c) 2 only

d) 2 and 3 only

Answer: C

Explanation:

- Sharavati is a river which originates and flows entirely within the state of Karnataka in India. It directly drains into Arabian Sea.

- Famous Jog Falls are formed by this river.

- Linganamakki dam is built across this river.