DAILY CURRENT AFFAIRS (NOVEMBER 14, 2022)

INTERNATIONAL RELATIONS

1. INDIA TO HOST “NO MONEY FOR TERROR” CONFERENCE

THE CONTEXT: The 3rd Ministerial “No Money for Terror” Conference will set to be held on November 18 and 19 this year in New Delhi, India.

THE EXPLANATION:

What is the NMFT conference?

- The Ministerial No Money for Terror (NMFT) Conference aims to create platform for international discussions on countering terror financing.

- The conference includes discussions on technical, legal, regulatory and cooperative aspects of the terrorism financing.

- It aims to set pace for other high-level official and political discussions focusing on terror finance.

- The inaugural edition of this conference was held in Paris, France, in 2018. The second edition of the NMFT took place in Melbourne, Australia, in 2019.

- The third edition was set to take place in India in 2020 but was postponed because of COVID-19 pandemic that caused the global-level restrictions on travel.

3rd Ministerial ‘No Money for Terror’ Conference

- The third edition will be organized by the Ministry of Home Affairs.

- The event will witness participation from over 75 countries.

- This is the second major conference hosted by India this year.

- It earlier hosted the meeting of the United Nations Security Council’s Counter-Terrorism Committee (CTC). This is the first time that the UNSC CTC met in India and only seventh time that it was held outside New York.

What are the focus areas of the 3rd NMFT conference?

- Discussions at the 3rd NMFT conference will focus on global trends of terrorism and terrorist financing, emerging technologies’ role in terrorism financing and importance of global cooperation to address related challenges.

- The meeting will seek global cooperation in addressing the challenges in countering terror funding obtained via formal and informal channels.

- It will focus on the role of cryptocurrency in funding terrorist activities. It will deliberate on the concerns related the decentralized nature and the lack of regulation of cryptocurrencies.

- The focus will also be given to dark web’s role in promoting transfer or crowdsourcing of funds for terrorism.

- It also aims to strengthen the role of Financial Action Task Force (FATF) in setting global standards that can create an effective mechanism to combat terror funding.

ENVIRONMENT, ECOLOGY AND CLIMATE CHANGE

2. E-WASTE (MANAGEMENT) RULES, 2022

THE CONTEXT: The Indian Government issued notification on E-Waste (Management) Rules, 2022, which will come to effect from next financial year.

THE EXPLANATION:

What is E-Waste (Management) Rules, 2022?

- The E-Waste (Management) Rules, 2022 was published by the Ministry of Environment, forest and climate change on November 2, 2022.

- They will apply to all businesses and individuals involved in manufacturing, sales, transfer, purchase, refurbishing, dismantling, recycling and processing of e-waste or electrical and electronic equipment.

- Under the new rules, the number of items that have been categorized as e-waste has been increased from 21 to 106.

- It includes all electrical devices and radiotherapy equipment, nuclear medicine equipment and accessories, Magnetic Resonance Imaging (MRI), electric toys, air conditioners, microwaves, tablets, washing machine, refrigerator, iPad and others.

- This includes electronic components, consumables, parts and spares that make the electronic products operational.

- The new rules are not applicable for waste batteries, which are covered under the Battery Waste Management Rules, 2022.

- It is also not applicable for packaging plastics, which are covered under the Plastic Waste Management Rules, 2016.

- It also does not apply for micro enterprises and radio-active wastes, which are covered under the Micro, Small and Medium Enterprises Development Act, 2006 and Atomic Energy Act, 1962 respectively.

What are the key features of the rules?

- The rules restrict the use of hazardous substances for manufacturing electrical and electronic equipment. This comes in response to the deaths caused by exposure to radioactive materials.

- Manufacturers of electronic equipment are mandated to reduce the use of lead, mercury, cadmium and other others that can harm human health and environment.

- These materials can adversely affect brain, heart, liver, kidneys and skeletal system. It also causes harmful effects on neurological and reproductive systems.

- Under the new rules, the Central Pollution Control Board (CPCB) will conduct random sampling of electrical and electronic equipment placed in the market to monitor and verify compliance of reduced use of hazardous substances.

- Manufacturers are required to use technologies and methods that make the end product recyclable. They are also required to ensure the compatibility of components or parts developed by different manufacturers. This will minimise the generation of e-wastes.

- Imports or sales of new electrical and electronic equipment are allowed only if they comply with the government regulations. If the product does not comply with the rules, the manufacturer must withdraw all samples from the market.

- It is the responsibility of the manufacturer to collect e-wastes generated during the manufacturing process and ensure that they are recycled or disposed as per the rules.

3. THE GLOBAL CARBON BUDGET 2022

THE CONTEXT: The Global Climate Budget 2022, released at The 2022 United Nations Climate Change Conference or COP27, indicates that India will record a higher rise in carbon emissions this year than other major countries.

THE EXPLANATION:

What are the key findings of the Global Carbon Budget, 2022?

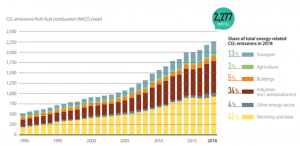

- The global carbon emissions are expected to reach 40.6 billion tonnes of carbon dioxide into the atmosphere in 2022.

- This projection is close to the highest-ever annual total of 40.9 billion tonnes of CO2 emitted in 2019.

- There is no sign of carbon emission decline required for limiting the global warming to 1.5 degree Celsius.

- If the current emission levels continue, there is a 50 per change that the warming of 1.5°C exceed in the next 9 years.

- Record level droughts, wildfires and flooding across is world is caused because the Earth’s global surface temperature has risen by around 1.1°C when compared with the average in pre-industrial levels.

- In 2021, China (31 per cent), the United States (14 per cent) and the European Union (8 per cent) are the major contributors of the global carbon emissions. India accounted to 7 per cent of the global carbon emissions.

- The report estimates a decrease in the carbon emissions in 2022 in China (0.9 percent) and the EU (0.8 per cent). However, there will be a 1.5 per cent increase in the US and a 6 per cent increase in India.

- India is expected to witness the highest increase in carbon emissions in the world in 2022 when compared with the previous year. The United States is estimated to record the second-highest increase in the carbon emissions.

- The 2022 carbon emissions will increase in India due to coal emissions (5% increase) and oil emissions (10% increase). This returns the carbon emission back to the 2019 levels. The country is already responsible for around a twelfth of global emissions. It is ranked third globally in terms of gross emission volume and ranked very low in per capita emissions.

ECONOMIC DEVELOPMENTS

4. AMENDMENT IN ELECTORAL BONDS SCHEME

THE CONTEXT: The Government of India has approved the issuance of the 23rd tranche of electoral bonds for sale from November 9-15 following an amendment.

THE EXPLANATION:

- According to the finance ministry, State Bank of India (SBI) has been authorised to issue and encash electoral bonds through 29 of its authorised branches, which would be valid for 15 days from the date of issuance.

- As per the law, no payment would be made to any political party if the bond is deposited after expiry of the validity period.

What are the changes made in the scheme?

- The Union Finance Ministry issued a notification amending the Electoral Bonds Scheme to allow the sale of electoral bonds for extra 15 days in the year of general elections to the Legislative Assembly of States and UTs with legislature.

- The notification allows the Central Government to open additional one-week window for issuing electoral bond starting from November 9, 2022.

- Prior to this notification, these bonds can be bought by any individual in a period of 10 days each in the months of January, April, July and October as specified by the Central Government.

- Since assembly elections to various states and union territories are held each year, the amendment allows additional 15 days of bond sales annually.

- The changes came days before the Himachal Pradesh Assembly Elections (November 12) and weeks before Gujarat assembly elections that are set to be held in early December 2022.

Value Addition:

What are electoral bonds?

- The Electoral Bonds Scheme was launched in 2018 to provide an alternative for cash donations to political parties. Electoral bonds are financial instruments through which anyone can donate money to political parties.

- The electoral bonds can be bought by donors from authorized branches of the State Bank of India using cheque or a digital mechanism. The donor can give these bonds to the political party or parties of their choice. The political parties can choose to encash electoral bonds within 15 days of receiving them and fund their electoral expenses. This retains the anonymity of the donor while also ensuring transparency.

- Bonds are issued only to those political parties that are registered under Section 29A of the Representation of the People Act, 1951 and those that secured not less than 1 per cent of votes polled in the last General Elections to the Lok Sabha or the Legislative Assembly of the State.

5. BHIM APP OPEN-SOURCE LICENSE MODEL

THE CONTEXT: Recently, the BHIM App open-source license model was announced by the National Payments Corporation of India (NPCI).

THE EXPLANATION:

What is BHIM App open-source license model?

- Under the BHIM App open-source license model, regulated entities in the UPI ecosystem can get license for accessing source code of the BHIM app. New features that will be included in the application in the future can also be accessed by these licensees.

Why was open-source license model launched?

- Currently, many banks do not have their own mobile banking applications. Therefore, they are unable to provide the benefits of UPI to their customer base. The NPCI aims to address this gap by providing readily available features of UPI to these banks via the BHIM App licensing model. It will act as an economic and quick-to-market solution for these entities.

- The BHIM licensing model will empower the banking entities to provide benefits of the UPI to their customer base with a readily-available UPI application. This will minimise time, efforts and costs incurred for promoting the UPI based transactions.

What is Unified Payments Interface (UPI)?

- Unified Payments Interface (UPI) is an instant real-time payment system that is used on mobile devices to instantly transfer money between two bank accounts. It was developed by the NPCI. The UPI enabled 45.6 billion transactions during Financial Year 2022. It is currently one of the most prominent forms of digital payments in India.

- The NPCI International Payments Ltd (NIPL) – the international arm of the NPCI – announced that the BHIM UPI is live at NEOPAY terminals in the United Arab Emirates. This enables millions of Indians traveling to the UAE to make payments using BHIM UPI. This feat was achieved after NIPL and NEOPAY (payment subsidiary of Mashreq bank) collaborated to create the acceptance infrastructure in the UAE. It allows Indian tourists to make UPI transactions across NEOPAY enabled shops and merchant stores.

VALUE ADDITION:

National Payments Corporation of India (NPCI)

- National Payments Corporation of India (NPCI), an umbrella organisation for operating retail payments and settlement systems in India, is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, for creating a robust Payment & Settlement Infrastructure in India.

- Considering the utility nature of the objects of NPCI, it has been incorporated as a “Not for Profit” Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013), with an intention to provide infrastructure to the entire Banking system in India for physical as well as electronic payment and settlement systems.

GOVERNMENT SCHEMES AND INTERVENTIONS

6. INDIAN BIOLOGICAL DATA CENTER (IBDC)

THE CONTEXT: Union Minister of state for Science and Technology recently dedicated Indian Biological Data Center (IBDC) to the nation.

THE EXPLANATION:

- The Indian Biological Data Center is India’s first national repository for life science data.

- It will store all life science data generated from publicly funded research in the country.

- It operates with the assistance from the Department of Biotechnology (DBT).

- In long-term, IBDC seeks to become a major data repository for all life science data originating from India.

- It was established at the Regional Centre of Biotechnology (RCB) in Faridabad, Haryana. It has a data “disaster recovery” site in National Informatics Centre (NIC) in Bhubaneshwar.

- It has a data storage capacity of around 4 petabytes.

- It hosts the ‘Brahm’ High Performance Computing (HPC) facility.

What are its objectives?

The objectives of IBDC are:

1. Provide IT platform for archiving of biological data originating from India.

2. Develop standard operating procedures for storing and sharing of life sciences data based on FAIR (Findable, Accessible, Interoperable and Reusable) principle.

3. Perform quality control and curation of data, maintain data backup and manage data life cycle.

4. Develop web-based tools/APIs for data sharing or retrieval

5. Organize training programme for analysing of large data and create awareness about the benefits of data sharing.

What are the current tasks of the IBDC?

- Since life science data is highly complex and heterogeneous, IDBC is being developed in a modular fashion. This means that different sections deal with different types of data sets. Therefore, the IBDC had initiated nucleotide data submission services via two different data portals – the Indian Nucleotide Data Archive (INDA) and the Indian Nucleotide Data Archive – Controlled Access (INDA-CA).

- The IBDC also hosts an online “Dashboard” to archive the genomic surveillance data generated by the INSACOG labs. This online dashboard facilitates customized data submission, access, data analysis, surveillance and real-time monitoring of SARS-CoV-2 variants across India.

- The computational infrastructure at the IBDC can be accessed by interested researchers who are involved in computational-intensive analysis. The IBDC will also conduct frequent workshops and orientations to help users submit the data they collected.