WSDP Bulletin (17-10-2022)

(Newspapers, PIB and other important sources)

Prelim and Main

- As wildlife diplomacy takes wing, government considers Sri Lankan proposal for translocating gaurs READ MORE

- Neutralising antibody against multiple SARS-CoV-2 variants READ MORE

- India to attract FDI worth $475 billion in 5 years: EY-CII report READ MORE

- Explained | Understanding the Global Hunger Index READ MORE

- Wildlife board nod to Kedarnath ropeway project READ MORE

- Organic fertiliser: A must for the next green revolution Govt considering proposals for extending Rs 35,000 cr PLI scheme to more sectors READ MORE

- Alzheimer’s disease: surprising new theory about what might cause it READ MORE India’s first aluminium freight rake introduced by Hindalco for Indian Railways READ MORE

Main Exam

GS Paper- 1

- Earth just had its 5th-warmest September on record READ MORE

- Do India’s women have the right to choose? READ MORE

GS Paper- 2

POLITY AND GOVERNANCE

- Explained | The issues in the Collegium’s functioning READ MORE

- The ‘plumbing’ of inner party democracy READ MORE

- In Supreme Court hijab judgment, an inversion of Indian secularism READ MORE

SOCIAL ISSUES

- Malnutrition challenge: India lags in meeting goal of zero hunger READ MORE

INTERNATIONAL ISSUES AND RELATIONS

- What a third Xi term means for India READ MORE

- India needs to play a big role to end Ukraine war READ MORE

GS Paper- 3

ECONOMIC DEVELOPMENT

- Explained | Why did bank bailout research get the Nobel? READ MORE

- Conceptual haze around CBDC READ MORE

- Strengthening the agri startup ecosystem READ MORE

- Institutions and Economy~I READ MORE

- Institutions and Economy~II READ MORE

- Despite moderate performance over 40 yrs, India’s economic growth set to be substantial in 2023 READ MORE

ENVIRONMENT AND ECOLOGY

- Ashok Gulati writes: Balancing climate change and global nutrition READ MORE

- Erratic weather, ineffective solutions: Annual stubble burning sets off pollution concerns again READ MORE

SCIENCE AND TECHNOLOGY

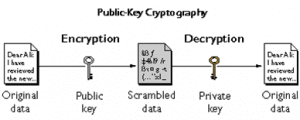

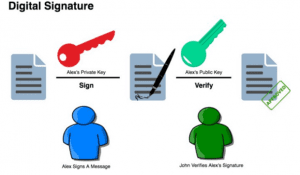

- Securing India’s cyberspace from quantum techniques READ MORE

GS Paper- 4

ETHICS EXAMPLES AND CASE STUDY

Questions for the MAIN exam

- ‘Though, the Indian Constitution is influenced by the American and European models. But the Constitution is not an unmediated legal transplant from the West’. Examine with suitable examples.

- ‘The world is moving towards an era in which the applications of quantum physics in strategic domains will soon become a reality, increasing cybersecurity risks. India needs a holistic approach with a focus on post-quantum cybersecurity to tackle these challenges’. Discuss.

QUOTATIONS AND CAPTIONS

- Never think that war, no matter how necessary, nor how justified, is not a crime.

- The Indian Constitution was indeed influenced by the American and European models. But the Constitution was not an unmediated legal transplant from the West.

- This year’s economics Nobel offers a deeper understanding of the genesis, the propagation, and the management of financial crises.

- The thankless, complex and risky endeavour of inner party elections serves as a disincentive for most parties to attempt such an exercise.

- The challenge today is to develop technologies that supply the food and nutritional needs of the world while also addressing climate change imperatives. Today, there seems to be a lack of sync between policies and technologies. It is high time India wake up.

- The world is moving towards an era in which the applications of quantum physics in strategic domains will soon become a reality, increasing cybersecurity risks. India needs a holistic approach with a focus on post-quantum cybersecurity to tackle these challenges.

- India need a coordinated institutional framework tying together the different parts of policy making in order to navigate the increasing volatility triggered by climate change and energy transition.

- The decades-old Integrated Child Development Services and Midday Meal Scheme and the recent Poshan Abhiyaan designed to address hunger and malnourishment must be integrated holistically with health projects for better results.

- The pandemic has led to an increase in the number of agri startups that work across the value chain. But the key hitch is still the small farm size, coupled with low digital adoption by small and marginal farmers. They recommend a hub-and-spoke model that nurtures these agri startup initiatives.

- Structural reform can be supported to overcome the problems of inflation by improving productivity and easing supply constraints.

- In the last decade or so, there has been a renewed urge to implement the reform process. India has reaffirmed its policy to follow fiscal prudence, with a new time path for reducing the national fiscal deficit to 3 per cent of GDP.

50-WORD TALK

- In order to enhance its regional status vis-a-vis China, India takes its role in the Quad very seriously. And yet, New Delhi’s refusal to slam Russia’s aggression risks generating tensions within the group. Firstly, this is because both China and Russia oppose the Quad. Secondly, Japan, the US and Australia have imposed some of the harshest sanctions on Moscow. India has been a party to Quad’s joint statements that support ‘democratic values’ and ‘democratic resilience’.

Things to Remember:

- For prelims-related news try to understand the context of the news and relate with its concepts so that it will be easier for you to answer (or eliminate) from given options.

- Whenever any international place will be in news, you should do map work (marking those areas in maps and exploring other geographical locations nearby including mountains, rivers, etc. same applies to the national places.)

- For economy-related news (banking, agriculture, etc.) you should focus on terms and how these are related to various economic aspects, for example, if inflation has been mentioned, try to relate with prevailing price rises, shortage of essential supplies, banking rates, etc.

- For main exam-related topics, you should focus on the various dimensions of the given topic, the most important topics which occur frequently and are important from the mains point of view will be covered in ED.

- Try to use the given content in your answer. Regular use of this content will bring more enrichment to your writing.

DAILY CURRENT AFFAIRS (OCTOBER 15, 2022)

SOCIAL ISSUES AND SOCIAL JUSTICE

1. WHAT IS THE GLOBAL HUNGER INDEX AND WHY IS INDIA TRAILING?

THE CONTEXT: Recently, India ranks 107 out of 121 countries on the Global Hunger Index in which it fares worse than all countries in South Asia barring war-torn Afghanistan.

THE EXPLANATION:

HIGHLIGHTS OF THE REPORT:

- India’s score of 29.1 places it in the ‘serious’ category.India also ranks below Sri Lanka (64), Nepal (81), Bangladesh (84), and Pakistan (99). Afghanistan (109) is the only country in South Asia that performs worse than India on the index.

- China is among the countries collectively ranked between 1 and 17 having a score of less than five.

- India’s child wasting rate (low weight for height), at 19.3%, is worse than the levels recorded in 2014 (15.1%) and even 2000 (17.15%), and is the highest for any country in the world and drives up the region’s average owing to India’s large population.

- Prevalence of undernourishment, which is a measure of the proportion of the population facing chronic deficiency of dietary energy intake, has also risen in the country from 14.6% in 2018-2020 to 16.3% in 2019-2021. This translates into 224.3 million people in India considered undernourished out of the total 828 million people undernourished globally.

- India has shown improvement in the other two indicators – child stunting has declined from 38.7% to 35.5% between 2014 and 2022 and child mortality has also dropped from 4.6% to 3.3% in the same comparative period. On the whole, India has shown a slight worsening with its GHI score increasing from 28.2 in 2014 to 29.1 in 2022. Though the GHI is an annual report, the rankings are not comparable across different years. The GHI score for 2022 can only be compared with scores for 2000, 2007 and 2014.

- There are 44 countries that currently have “serious” or “alarming” hunger levels and “without a major shift, neither the world as a whole nor approximately 46 countries are projected to achieve even low hunger as measured by the GHI by 2030”.

ABOUT THE REPORT:

The Global Hunger Index (GHI) is a tool for comprehensively measuring and tracking hunger at global, regional, and national levels. GHI scores are based on the values of four component indicators – undernourishment, child stunting, child wasting and child mortality. The GHI score is calculated on a 100-point scale reflecting the severity of hunger, where zero is the best score (no hunger) and 100 is the worst.

GHI is based on four indicators:

- The proportion of undernourished in a population

- The proportion of children under the age of five suffering from wasting (less weight in proportion to their height)

- The proportion of children under five suffering from stunting (low height in proportion to their age)

- The mortality rate of children under five

ECONOMIC DEVELOPMENTS: INFRASTRUCTURE

2. THE LEADS (LOGISTICS EASE ACROSS DIFFERENT STATES) INDEX 2022

THE CONTEXT: LEADS (Logistics Ease Across Different States) 2022 was released recently by the Ministry of Commerce and Industry.

THE EXPLANATION:

- The LEADS survey assesses the views of various users and stakeholders involved in the value chain of logistics sector. This survey is conducted recognize the enablers, hindrances and gaps within the logistics ecosystem.

- This annual survey ranks logistics ecosystem of each state and union territory across India using data received from stakeholders (perception data) and states and union territories (objective data).

- The LEAD 2022, unlike the former versions, adopted the classification-based grading, with states and union territories classified under four broad categories – coastal states, hinterland/landlocked states, northeastern states and union territories.

- This indigenous data-backed index assesses the logistics infrastructure, services, and human resources across 36 states and union territories.

- It provides three performance categories – Achievers (states and UTs achieving 90 per cent or more), Fast Movers (states and UTs scoring between 80 and 90 per cent), and aspirers (states and UTs with percentage scoring below 80 per cent).

- The 15 states and UTs that have been categorized as achievers in the logistics index chart 2022 are Andhra Pradesh, Assam, Chandigarh, Delhi, Gujarat, Haryana, Himachal Pradesh, Karnataka, Maharashtra, Odisha, Punjab, Tamil Nadu, Telangana, Uttar Pradesh and Uttarakhand.

- The fast movers in the latest report are Kerala, Madhya Pradesh, Rajasthan, Puducherry, Sikkim and Tripura.

- 15 states and UTs categorized as aspirers are Bihar, Chhattisgarh, Goa, Mizoram, Andaman and Nicobar Islands, Lakshadweep, Ladakh, Nagaland, Jammu and Kashmir, and Arunachal Pradesh.

- The index aims to boost the logistics performance across India, which is critical for reducing the cost of transactions and boosting international and domestic trade.

- The LEADS 2022 will assist in the implementation of the PM Gati Shakti National Master Plan (PMGS-NMP) and the National Logistics Policy (NLP) by identifying gaps in the existing logistics services, infrastructure and regulatory environment.

ENVIRONMENT, ECOLOGY AND CLIMATE CHANGE

3. NITI AAYOG REPORT ON LEAD POISONING IN INDIA

THE CONTEXT: The report, prepared jointly by government think tank Niti Aayog and the Council of Scientific & Industrial Research (CSIR), it highlighted the growing concern of lead poisoning among children under 19 years of age in India.

THE EXPLANATION:

- A new report by the CSIR and NITI Aayog found that India has the highest health and economic burden caused by lead poisoning.

- It analysed 89 data sets from 36 researches that were carried out between 1970 and 2014 to confirm the findings of the 2020 report of the UNICEF and the non-profit Pure Earth.

- The 2020 report found that India accounted for 275,561,163 of the total 800 million children who were poisoned by lead across the world. This means that 50 per cent of children in India suffered lead poisoning.

- This report also found that lead poisoning costed 5 per cent of the Indian GDP because of low economic productivity and lesser lifetime earnings. It also caused 2.3 lakh premature deaths in the country.

- The NITI Aayog-CSIR report assessed lead poisoning caused by battery recycling, occupational hazards like lead mining, smelting, welding, soldering and automobile repatriating as well as other sources like adulterated spices, cosmetics and traditional medicines.

- It found that lead poisoning continues to spike in India despite the phasing out of usage of lead in petrol – the major source of lead poisoning – by the year 2000.

- The recent study confirmed that India has the highest prevalence of lead poisoning among children under the age of 19.

- This is causing slow, irreversible brain damages that are adversely affecting the children’s intellectual capabilities and causing other health complications.

- The report found that Bihar, Uttar Pradesh, Madhya Pradesh, Jharkhand, Chhattisgarh and Andhra Pradesh have the highest average blood lead levels (BLL) among the Indian states. They accounted for 40% the total Indian population with high average BBL.

- The report called for the implementation of national and state-level policies to tackle the issue of lead poisoning.

- These include identification of at-risk population through BLL monitoring, finding the sources of spike in BLLs and sensitization of healthcare workers to strengthen the monitoring, detection and treatment against lead poisoning.

- It also recommends conducting targeted research and intervention to identify new sources of lead poisoning.

VALUE ADDITION:

About Lead Poisoning:

Lead is a naturally occurring toxic metal found in the Earth’s crust. Its widespread use has resulted in extensive environmental contamination, human exposure and significant public health problems in many parts of the world.

KEY FACTS:

- Lead is a cumulative toxicant that affects multiple body systems and is particularly harmful to young children.

- Lead in the body is distributed to the brain, liver, kidney and bones. It is stored in the teeth and bones, where it accumulates over time. Human exposure is usually assessed through the measurement of lead in blood.

- Lead in bone is released into blood during pregnancy and becomes a source of exposure to the developing fetus.

- There is no level of exposure to lead that is known to be without harmful effects.

- Lead exposure is preventable.

DISASTER MANAGEMENT

4. GLOBAL STATUS OF MULTI-HAZARD EARLY WARNING SYSTEMS — TARGET G

THE CONTEXT: The report titled “Global Status of Multi-Hazard Early Warning Systems — Target G” was jointly released by United Nations Office for Disaster Risk Reduction (UNDRR) and the World Meteorological Organization (WMO) on the occasion of International Day for Disaster Reduction (October 13).

THE EXPLANATION:

- The findings of the report are based on the assessment of the data from the Sendai Framework Monitor (SFM) – an online tool the enables the member states to report their progress on the targets of The Sendai Framework (2015-2030).

- Target G of the Sendai Framework seeks to increase the availability of and access to multi-hazard early warning systems (MHEWS) and disaster risk information and assessment by the year 2030.

- The recently released report found that 50 per cent the countries in the world do not have early warning systems to prepare against natural disasters.

- Africa, South America and several countries in Arab and Caribbean region have very low coverage of MHEWS.

- On average, at least 40% of countries in every region have reported the use of MHEWS.

- Less than half of Least Developing Countries (LDC) and only 33 per cent of Small Island Developing Countries have MHEWS.

- The number of deaths in countries with limited early warming coverage is eight times higher than in countries with substantial to comprehensive coverage.

- An early warning system is up to the mark if it covers the four elements – risk knowledge, technical warning and monitoring service, communication and dissemination of warnings and community response capability.

- The recent report called for the increased investment in all these elements, with a particular focus on risk knowledge to improve disaster planning and boosting capacity of at-risk community for early action.

- It also called for increasing investments in data and technology for strengthening hazard monitoring, faster warning dissemination and better tracking of progress.

- It also recommends rating of effectiveness of the MHEWS, especially in Least Developed Countries and Small Island Developing countries.

About United Nations Office for Disaster Risk Reduction (UNDRR):

- UNDRR (formerly UNISDR) is the United Nations focal point for disaster risk reduction. UNDRR oversees the implementation of the Sendai Framework for Disaster Risk Reduction 2015-2030, supporting countries in its implementation, monitoring and sharing what works in reducing existing risk and preventing the creation of new risk.

- UNISDR’s Strategic Framework 2016-2021 has a vision to substantially reduce disaster risk and losses for a sustainable future with the mandate to act as the custodian of the Sendai Framework, supporting countries and societies in its implementation, monitoring and review of progress.

SCIENCE AND TECHNOLOGY

5. SCIENTISTS HAVE SUCCESSFULLY IMPLANTED AND INTEGRATED HUMAN BRAIN CELLS INTO NEWBORN RATS

THE CONTEXT: Scientists have successfully implanted and integrated human neurons into new-born rats.

THE EXPLANATION:

- Studying of complex psychiatric disorders like schizophrenia and autism is difficult since animals do not experience them like people and human beings cannot be used for the research.

- Human brain cells made using stem cells in perti dishes do not grow to the size of human neurons and their isolation from human body makes it difficult to study the symptoms of the neurological disorders.

- These limitations are addressed by implanting and integrating a group of human brain cells called organoid into the brains of new-born rats.

- Integration of human brain cells in new-born rats helps research psychiatric disorders and test treatment against them.

- Only young rats are used for the implantation since brain stops developing after a certain age in rats. This limits how the implanted brain cells integrate.

- The researchers found that the organoids can grow relatively large in young rats, covering about one-third of the rat’s brain.

- The integration was tested by blowing air across the rats’ whiskers, which triggered electrical activity in the human neurons. This means that the human tissue in the brain was able to process the external stimulation of the rat’s body.

- The researchers also tested and concluded that the implanted human neuron can send signals back to the rat’s body.

- The technique was recently used to study the Timothy Syndrome. The researchers found that organoids made using brain cells of patients with Timothy Syndrome grew more slowly and displayed less electrical activity than those from healthy people.

- This study will play a major role in improving the current understanding about human brain development and neurodevelopment disorders.

- However, implanted neurons did not replicate the key features of the developing human brain.

- The implantation of human neurons in rats does not make them more human-like because of the limitations on how deeply these neurons integrate with the rat brain.

- However, these barriers may not exist in species closely related to humans like primates and thus causes ethical concerns over progressing further into the experiment.

GOVERNMENT SCHEMES AND INITIATIVES IN NEWS

6. WHAT ARE RYTHU BHAROSA KENDRAS?

THE CONTEXT: Recently, an Ethiopian delegation led by the country’s Agricultural Minister Dr Meles MekonenYimer is in Andhra Pradesh (AP) to study the first-of-its kind Rythu Bharosa Kendras (RBKs), which have been set up by the AP Government.

THE EXPLANATION:

According to the officials, that Ethiopia has shown keen interest in the RBKs. Since the country wants to increase its agriculture output, it seeks to improve the quantity and quality of yields, reduce production costs, and provide newer skills to its farmers.

What are Rythu Bharosa Kendras?

- Set up for the first time in the country, the RBKs are unique seeds-to-sales, single-window service centres for farmers that have been set up across the state.

- They are a one-stop solution to all farmers’ needs and grievances. RBKs sell pre-tested quality seeds, certified fertilisers and animal feed. Farmers can purchase or hire farm equipment, and even sell their produce at the prevailing MSP in the RBKs.

- Touted as role models for the country, agriculture and horticulture officials manning the RBKs also provide services like soil testing and make recommendations — on which crops to sow, and quantity and type of fertiliser to be used. The state government also pays crop insurance, procures grains and makes payments to farmers through the RBKs.

Have the RBKs proved to be helpful to farmers?

- RBKs facilitate interaction between farmers, agriculture scientists, and agriculture extension officers right at the village level. Apart from providing services and items for sale, RBK officials demonstrate new farm equipment and provide training to farmers.

- Based on inputs provided by officials after soil testing and weather conditions, many farmers have changed their cropping patterns and benefited immensely, according to the state Agriculture Department. The RBKs have been responsible for elimination of spurious seeds and uncertified and dangerous fertilisers, which can cause crop damage and failures.

- Over 10,700 RBKs — multi-functional kiosks with digital Aadhar authentication equipment — have been set up across the state. The RBKs, staffed by agriculture and horticulture graduates, help farmers decide the crops they should cultivate in a scientific manner.

- They also assist in selling their produce at MSPs, through supporting systems of e-cropping, geo-tagging, and the CM App through which payments are made to farmers. AP CM who floated the RBK concept says it is a game-changer for Andhra Pradesh’s farmers.

- The Centre has recently nominated the RBK concept for the Food and Agriculture Organisation’s “Champion’’ award. Officials say several agrarian countries are expressing interest in understanding the RBK concept and seek to implement it in their countries.

TOPIC : BANK-NBFC CO-LENDING MODEL

THE CONTEXT: A November 2020 decision by the Reserve Bank of India (RBI) to permit banks to “co-lend with all registered NBFCs (including HFCs) based on a prior agreement” has led to unusual tie-ups like the one announced in December 2021 between the State Bank of India (SBI) and Adani Capital. This article analyses the issue in detail.

THE ‘CO-LENDING MODEL’

- In September 2018, the RBI had announced “co-origination of loans” by banks and Non-Banking Financial Companies (NBFCs) for lending to the priority sector. The arrangement entailed joint contribution of credit at the facility level by both the lenders as also sharing of risks and rewards”, the RBI said.

- Subsequently, based on feedback from stakeholders and “to better leverage the respective comparative advantages of the banks and NBFCs in a collaborative effort”, the central bank allowed the lenders greater operational flexibility while requiring them to conform to regulatory guidelines.

- The primary focus of the revised scheme, rechristened as ‘Co-Lending Model’ (CLM), was to “improve the flow of credit to the unserved and underserved sector of the economy and make available funds to the ultimate beneficiary at an affordable cost, considering the lower cost of funds from banks and the greater reach of the NBFCs.

HOW DOES A CO-LENDING MODEL WORK?

- The Reserve Bank of India (RBI) came out with the co-origination framework in 2018, allowing banks and NBFCs to co-originate loans. These guidelines were later amended in 2020 and rechristened as co-lending models (CML) by including Housing Finance Companies and some changes in the framework.

- The primary aim of CLM is to improve the flow of credit to the unserved and underserved segments of the economy at an affordable cost. This happens as banks have lower costs of funds and NBFCs have greater reach beyond tier-2 centres.

- A minimum of 20 percent of the credit risk by way of direct exposure shall be on NBFC’s books till maturity and the balance are on the bank’s books. Upon maturity, the repayment or recovery of interest is shared by the bank and NBFC in proportion to their share of credit and interest.

- This joint origination allows banks to claim priority sector status in respect of their share of the credit. NBFCs act as the single point of interface for the customers and a tripartite agreement is done between the customers, banks and NBFCs.

BANK-NBFC TIE-UPS

- Several banks have entered into co-lending ‘master agreements’ with NBFCs, and more are in the pipeline.

- In December 2021, SBI, the country’s largest lender, signed a deal with Adani Capital, a small NBFC of a big corporate house, for co-lending to farmers to help them buy tractors and farm implements.

- SBI’s giant network includes 22,230 branches, 64,122 automated teller machines (ATMs) and cash deposit machines (CDMs), and 70,786 business correspondent (BC) outlets across the country. Adani Capital has a network of just 60 branches and has disbursed around Rs 1,000 crore, according to its website.

- On November 24, Union Bank of India entered into a co-lending agreement with Capri Global Capital Ltd (GCC), with the aim “to enhance last-mile finance and drive financial inclusion to MSMEs by offering secured loans between Rs 10 lakh to Rs 100 lakh” initially through “100+ touch points pan-India”.

CORPORATES IN BANKING

- While the RBI hasn’t officially allowed the entry of big corporate houses into the banking space, NBFCs, mostly floated by corporate houses, were already accepting public deposits. They now have more opportunities on the lending side through direct co-lending arrangements.

- This had come at a time when four big finance firms — IL&FS, DHFL, SREI and Reliance Capital — which collected public funds through fixed deposits and non-convertible debentures, have collapsed in the last three years despite tight monitoring by the RBI. Collectively, these firms owe around Rs 1 lakh crore to investors.

- While the RBI has referred to “the greater reach of the NBFCs”, many bankers point out that the reach of banks is far wider than small NBFCs with 100-branch networks in serving underserved and unserved segments.

WHAT TOOK SO LONG FOR CO-LENDING TO TAKE OFF?

- On several occasions, the Ministry of Finance has pushed for PSU banks to adopt co-lending models. Some of the PSU banks in the initial days had tied up with large non-banks. For instance, SBI had tied up with ECL Finance, a subsidiary of Edelweiss Financial Services, in September 2019.

- But some of these tie-ups didn’t take off as expected. According to bankers, banks and NBFCs both are open for these kinds of tie-ups, but the challenge was in execution at ground level.

- Some of the main hurdles were IT integration of systems as both banks and NBFCs would operate on different systems, different underwriting processes and parameters. All of these took a lot of time to solve for the marriage to happen.

- In the co-lending model, beyond technology challenges, the longevity of the relationship of Banks and NBFCs is a concern.

- The co-lending model is still in the nascent stages, and one may enter into an agreement, but over a period of time, the relationship should sustain.

- Most of these arrangements are with NBFCs that have sizable distribution but are low on capital. Most of the mid-sized well-rated NBFCs still opt for term loans over entering into co-lending models, given the complexities around integration and processes.

WHAT ARE THE OPPORTUNITIES?

- The co-lending model, if it takes off and is executed rightly, will ensure delivery of credit to the unserved and underserved.

- The real gap of credit exists with the segments such as small and medium businesses, credit to lower and middle-income groups, rural areas, etc.

- The opportunity can be taken up by digital lending start-ups and mid-size NBFCs, and they can actually marry their strength of distribution with bank’s funds.

- As banks are flushed with funds, they can cater to vast customers as NBFCs have reached in tier-3 and tier-4 cities. On the execution side, it really needs to be tested at ground level.

RISK IN CO-LENDING

- The move by big banks to tie up with small NBFCs for co-lending has come in for criticism from several quarters.

- Under the CLM, NBFCs are required to retain at least a 20 per cent share of individual loans on their books. This means 80 per cent of the risk will be with the banks — who will take the big hit in case of a default.

- The terms of the master agreement may provide for the banks to either mandatorily take their share of the individual loans originated by the NBFCs on their books or to retain the discretion to reject certain loans after due diligence prior to taking them on their books.

- Interestingly, the RBI guidelines provide for the NBFCs to be the single point of interface for customers and to enter into loan agreements with borrowers, which should lay down the features of the arrangement and the roles and responsibilities of the NBFCs and banks. In effect, while the banks fund the major chunk of the loan, the NBFC decides the borrower.

CAN CHANGES IN THE CO-LENDING MODEL EASE CREDIT AVAILABILITY FOR THE PRIORITY SECTOR?

Though, direct assignment in a co-lending model typically with a bank calls for various critical challenges, as below.

COMPLIANCE WITH DIRECT ASSIGNMENT GUIDELINES

- The co-lending model requires that the taking over bank shall ensure compliance with all the requirements of direct assignment guidelines except the Minimum Holding Period (MHP) requirement.

- In a traditional direct assignment transaction, the direct assignment happens for a pool of assets through execution of an assignment deed, payment of stamp duty on the deed, seeking legal opinion on true sale, among others.

- Replicating the same in co-lending would mean the execution of assignment deeds for each customer, payment of stamp duty on a case-to-case basis and so on.

- This will not only increase the documentation/ procedures but also add to the cost of lending to the end borrower.

SECURITY CREATION AND RECOVERY

- The co-lending model very conveniently mentions that the co-lenders shall arrange for the creation of security and charge as per mutually agreeable terms and same for monitoring and recovery too.

- The bank which is to typically own a larger share in the exposure, would want the security to be created in its name.

- The loan is getting disbursed by the NBFC, and the security is created before even knowing the bank’s decision on its participation. It is not practically possible to create security in the name of a bank.

TAKEOVER OF LOAN AND CREDIT ENHANCEMENT

- The transaction in the co-lending arrangement involving post disbursal takeover of the bank’s share in the loan is akin to direct assignment, and the cases will be sourced as per the pre-agreed parameters.]

- Banks still want to do a 360-degree diligence within their internal policies while cherry-picking the loans and tend to follow an ideal co-origination approach.

- PSUs have always been unconvinced about the processes and practices of NBFCs.

Bottom line: Despite its multiple operational challenges, the direct assignment mode of co-lending has done justification in drawing a lot of confidence amongst the banks. The attributing factor is the familiarity of its structure and practical aspects. Riding on the same, combined with the greater objective of leveraging the collaborative efforts effectively towards financial inclusion, would certainly garner positive results in the time to come.

THE WAY FORWARD:

- To address the huge credit gap, the co-lending model is one of the right ways to go forward, but challenges around tech integrations and ground-level executions should be addressed.

- The country’s largest lender, SBI, it is actively looking at co-lending opportunities with multiple NBFCs / NBFC-MFIs for financing farm mechanisation, warehouse receipt finance, farmer producer organisations (FPOs), etc., for enhancing credit flow to double the farmers’/individuals’ income.

- The bank entered into a co-lending agreement with Vedika Credit Capital Ltd (VCCL), Save Microfinance Pvt Ltd (SMPL) and Paisalo Digital Ltd (PDL); it is a good move.

- Finance Minister Nirmala Sitharaman in visited to Mumbai in August to meet MDs of PSU banks. The focus should be towards credit growth to support MSMEs and underserved segments.

- The necessity of making the co-lending model work to enhance affordable credit to MSME and retail sectors.

- As the economy recovers coupled with pent-up demand, these kinds of models will evolve and grow to fulfil the credit requirements of the priority sector segments.

THE CONCLUSION: The co-lending model is a necessary step to help the priority sector. Though it has many challenges, it brings confidence in India’s banking sector that is much needed to address the challenges in a pandemic time. The collaboration is an effective effort for financial inclusion would certainly garner positive results in the time upcoming time.

Day-309 | Daily MCQs | UPSC Prelims | POLITY

[WpProQuiz 354]

Ethics Through Current Development (15-10-2022)

Today’s Important Articles for Sociology (15-10-2022)

Today’s Important Articles for Geography (15-10-2022)

Today’s Important Articles for Pub Ad (15-10-2022)

WSDP Bulletin (15/10/2022)

(Newspapers, PIB and other important sources)

Prelim and Main

- Dangerous to push policy rate above neutral rate when growth outlook fragile: RBI Monetary Policy Committee member READ MORE

- India ranks 107th out of 121 countries on Global Hunger Index READ MORE

- Nuclear-powered INS Arihant carries out successful launch of SLBM READ MORE

- ISRO’s LVM3 to make commercial foray with launch of 36 OneWeb satellites on October 23 READ MORE

- Xi Jinping, the Chinese Communist Party, and India READ MORE

- Organic fertiliser: A must for the next green revolution READ MORE

- India’s green push for second-generation bioethanol READ MORE

- Ocean currents protect Galápagos Islands from global warming; but are they safe forever? READ MORE

- Heavy metal out there: Researchers detect barium in atmospheres of 2 exoplanets READ MORE

Main Exam

GS Paper- 1

- Do India’s women have the right to choose? READ MORE

GS Paper- 2

POLITY AND GOVERNANCE

- No time for placebo: India has to work harder on its image of having an independent drug regulator READ MORE

- Onus of salvaging democracy lies with us READ MORE

- Liberal values are absolute READ MORE

SOCIAL ISSUES

- Ramana’s collegium didn’t diversify judiciary. Data shows most judges are upper-caste Hindus READ MORE

INTERNATIONAL ISSUES AND RELATIONS

- FOREIGN POLICY IN FLUID WORLD ORDER READ MORE

GS Paper- 3

ECONOMIC DEVELOPMENT

- Indian Deep Tech and a case for a strategic fund READ MORE

- Economics Nobel Has Lessons for India’s Macro-Economic Policy Thought READ MORE

- The Digital Rupee: The launch of the central bank digital currency is a bold step in the right direction. READ MORE

ENVIRONMENT AND ECOLOGY

- Shrinking biodiversity: An alarming wake-up call to halt unsustainable growth READ MORE

- Lesson From Nepal: Decentralisation Alone Won’t Enable a Local Climate Response READ MORE

- Pollution is blackening Ladakh’s glaciers and the repercussions could be devastating READ MORE

GS Paper- 4

ETHICS EXAMPLES AND CASE STUDY

Questions for the MAIN exam

- India needs a better, broad-based and transparent method of appointing senior judges to the High Courts and the Supreme Court. In the light of the statement discuss whether the mechanism of collegium should be preplaced with new mechanism?

- ‘Inclusive economic growth requires reaching out to the poorest of the poor’. Discuss why India needs dedicated and sustained efforts are made to pull millions of destitute citizens out of poverty and how can India achieve it?

- India Judiciary has become a more public Judiciary in recent times but is hampering the image of this institution. Critically examine.

QUOTATIONS AND CAPTIONS

- The heresy of one age becomes the orthodoxy of the next.

- Holding peaceful assemblies only at “designated” spaces makes them inferior to other “regular” activities conducted in a public space.

- If correctly aligned with the Government’s programmes, CSR funds and tax incentives can boost a nascent Indian Deep Tech ecosystem.

- India has to work harder on its image of having an independent drug regulator.

- India has to work harder at its image of having an impartial and independent regulator that can be trusted internationally as well as domestically.

- Our apex court understands that their adjudicative obligation is to be able to discern changing mores — in this case, the varied contexts of relationships and families.

- There is also a need to strengthen our drug alert and pharmacovigilance programmes. These are ways to ensure the safety of our products post-marketing.

- Policy-makers must step up conservation and restoration efforts to mitigate the crisis before it is too late.

- Democracy’s demise is not only about the capture of institutions by populists; it is about us, the people, who have not taken on the responsibilities of a political public.

- India actively maintained a neutral stance on Russia’s attack on Ukraine, but gradually it is fine-tuning the narrative to sound more and more critical of Russian action.

50-WORD TALK

- While the transition towards other sources of energy and increasing the fossil fuel output is an ongoing process, India due to its sheer consumer base can bargain on price, if it remains consistent in its approach and does not buckle under international pressure as it did during the Iran sanctions.

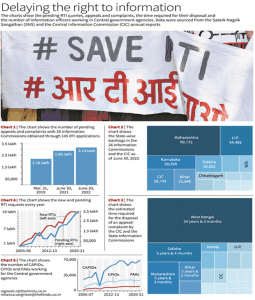

- An RTI application is the cheapest and most effective weapon to redress governmental apathy. It has led to the uncovering of several corruption scandals in the public sector and inspired persistent efforts to dig out information by RTI activists and common citizens, several of whom have been at the receiving end.

Things to Remember:

- For prelims-related news try to understand the context of the news and relate with its concepts so that it will be easier for you to answer (or eliminate) from given options.

- Whenever any international place will be in news, you should do map work (marking those areas in maps and exploring other geographical locations nearby including mountains, rivers, etc. same applies to the national places.)

- For economy-related news (banking, agriculture, etc.) you should focus on terms and how these are related to various economic aspects, for example, if inflation has been mentioned, try to relate with prevailing price rises, shortage of essential supplies, banking rates, etc.

- For main exam-related topics, you should focus on the various dimensions of the given topic, the most important topics which occur frequently and are important from the mains point of view will be covered in ED.

- Try to use the given content in your answer. Regular use of this content will bring more enrichment to your writing.

Day-308 | Daily MCQs | UPSC Prelims | ECONOMY

[WpProQuiz 353]

TOPIC : ARE INDIAN NBFCs SHADOW BANKS? DO THEY POSE SYSTEMIC RISKS

THE CONTEXT: An ongoing debate in India is whether or not Indian non-banking fi nancial companies (NBFCs) are “shadow banks”. This question appears important because we have learned from the ongoing global financial crisis that shadow banking might create systemic risks which have been defined “broadly as the expected losses from the risk that the failure of a significant part of the financial sector leads to a reduction in credit availability with the potential for adversely affecting the real estate and economy at large.

WHAT IS SHADOW BANKING?

- Shadow banking is a blanket term to describe financial activities that take place among non-bank financial institutions outside the scope of federal regulators. These include investment banks, mortgage lenders, money market funds, insurance companies, hedge funds, private equity funds and payday lenders, all of which are a significant and growing source of credit in the economy.

- Although these entities do not accept traditional demand deposits offered by banks, they do provide services similar to what commercial banks offer.

- The shadow banking system had overtaken the regular banking system in offering loans in US before the financial crisis erupted in 2008.

WHAT ARE THE RISKS ASSOCIATED WITH SHADOW BANKING?

- The 2008 financial crisis has shown that shadow banking can be a source of systemic risk to the banking system. The risks can be transmitted directly and through the interconnectedness of partially-regulated entities with the banking system.

WHY IS RBI TIGHTENING SHADOW BANKING RULES?

- The Reserve Bank is simply following the trend of global central banks increasing surveillance on shadow banking. Basel III norms require central banks to tighten supervision on shadow banks across the globe through steps such as defining minimum capital.

WHAT STEPS ARE RBI TAKING?

- The Usha Thorat committee has come out with draft regulations on NBFCs, such as increasing tier I capital and risk weight on certain assets. After the recommendations, smaller NBFCs with asset size of less then 25 crore are likely to go out of business.

WHAT IS THE GLOBAL SITUATION?

- The size of shadow banking has reached a record $67 trillion in 2011, according to a report by the Finance Stability Board, a regulatory task force for the world’s group of 20 economies. America has the biggest shadow banking system, followed by the Eurozone and the United Kingdom.

Key Takeaways:

- The shadow banking system consists of lenders, brokers, and other credit intermediaries who fall outside the realm of traditional regulated banking.

- It is generally unregulated and not subject to the same kinds of risk, liquidity, and capital restrictions as traditional banks are.

- The shadow banking system played a major role in the expansion of housing credit in the run up to the 2008 financial crisis, but has grown in size and largely escaped government oversight even since then.

WHY SHADOW BANKING SHOULD WORRY POLICYMAKERS?

- RBI has warned that economic disruptions may intensify systemic risks to India’s financial sector primarily because NBFCs remain vulnerable with their deteriorating asset quality and reluctance of the market to lend them money.

- The banking regulator RBI issued a clear warning in its Fiscal Stability Report, that the economic disruptions may intensify risks to its shadow banking firms, the Non-Banking Financial Companies (NBFCs), “and consequently” the systemic risks to the entire financial sector.

THREAT TO INDIA’S FINANCIAL SYSTEM

- The threats to the NBFCs come from two sources: (i) their deteriorating asset quality and (ii) continued reluctance of market to lend money in the aftermath of implosion in two leading NBFC players, Infrastructure Leasing & Financial Services Limited (IL&FS) and Dewan Housing Finance Corporation Ltd (DHFL) in 2018 and 2019. Both were taken over by the RBI for loan defaults and now face bankruptcy proceedings.

- About 50% of the NBFCs’ aggregate assets were under the moratorium on loan repayment as per the latest analysis. Banks, which have been fighting shy of lending directly to the industry because of growing threat of bad loans (non-performing assets or NPAs), increased their lending to the NBFCs in recent years, as a result of which bank lending accounted for 28.9% of the total NBFC borrowings in December 2019 – up from 23.1% in March 2017.

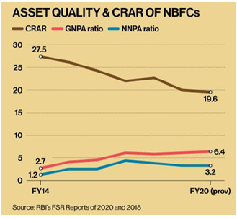

- The RBI noted that notwithstanding this support from banks, the real risks to the NBFCs’ liquidity come from declining market borrowings. It said that under the stress tests, 11.2% to 19.5% of NBFCs would not be able to comply with the minimum regulatory capital requirements (CRAR) of 15%.

The following graph maps the NBFCs’ assets quality (GNPA and NNPA ratios) and capital-to-risk-assets ratio (CRAR) since FY14.

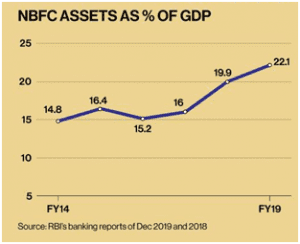

In the meanwhile, the NBFCs have grown in influence, as is evident from the RBI data mapped below, against the GDP (at constant prices).

- Shadow banking not only poses a threat to India but is equally a risk to the global financial order. For better appreciation, the 2007-08 financial crisis needs to be revisited.

ENDURING OVERALL GROWTH IN SHADOW BANKING

- When the world woke up and started monitoring shadow banking, Kodres recorded the growth in their assets. In 2015, she wrote, their assets in the US was 28% of the total financial sector (down from 32% in 2011); in the euro area, it was 33% (up from 32% in 2011) and globally they accounted for $92 trillion (up from $62 trillion in 2007 and $59 trillion during the crisis).

- One big initiative to monitor shadow banking was the multinational Financial Stability Board (FSB), set up in 2011. India is a part of this initiative.

- But Kodres was not happy. She commented: “The authorities (monitoring shadow banking) are making progress, but they work in the shadows themselves – trying to piece together disparate and incomplete data to see what, if any, systemic risks are associated with the various activities, entities, and instruments that comprise the shadow banking system.”

- Initially, the FSB defined shadow banks broadly to include all entities “outside the regulated banking system that perform core banking function”, which meant credit intermediation (taking money from savers and lending it to borrowers) and they were called Non-Banking Financial Intermediation (NBFI).

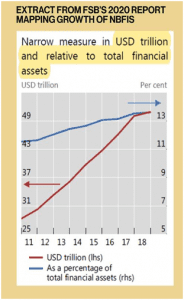

- In its latest report of January 2020, the FSB divided those into three categories: (a) MUNFI (Monitoring Universe of Non-bank Financial Intermediation): “broad measure” of all NBFIs that are not central banks, banks or public financial institutions (b) OFIs (Other Financial Intermediaries): a subset of MUNFI that excludes insurance corporations, pension funds or financial auxiliaries and (c) NBFIs: “narrow measure” of NBFI comprising of non-banks that authorities have identified as the ones that may pose bank-like financial stability risks and/or regulatory arbitrage.

- The NBFIs (narrow measure) are the ones identified as posing systemic risks.

HEIGHTENED SYSTEMIC RISKS FROM SHADOW BANKING

- The 2020 FSB report shows that global estimates for the MUNFI assets stood at $183.6 trillion in 2018 or 49%

of the total financial assets ($379 trillion). Of this, OFIs accounted for $114.3 trillion (30% of the total); NBFI for $50.9 trillion (13.4% of the total), and the rest for $18 trillion.

of the total financial assets ($379 trillion). Of this, OFIs accounted for $114.3 trillion (30% of the total); NBFI for $50.9 trillion (13.4% of the total), and the rest for $18 trillion. - The FSB 2020 report says the “systemic risk” comes from activities that are “typically performed by banks, such as maturity/liquidity transformation and the creation of leverage”.

- The alarming aspect of the NBFI is that it is growing.

- The FSB 2020 report says it “has grown faster than GDP since 2012, increasing to 77% of all participating jurisdictions’ GDP in 2018 from 64% in 2012. This trend is observed in most jurisdictions”.

- The FSB measures 29 jurisdictions (including India and China), representing over 80% of global GDP.

GROWTH IN INDIA’S SHADOW BANKING (NBFCS)

- What does the FSB of 2020 say about India? (India’s NBFCs correspond to the NBFIs.) It shows India is an outlier – in a negative way.

Here are two examples –

- India recorded 22.4% growth in OFI assets in 2018, while the global growth was 0.4%.

- As for NBFIs (NBFCs in India), a major drawback is their over-dependence on short-term funding for long-term lending (technically called EF2 function).

- Globally, such funding accounted for 7% of the total in 2018 and it grew 6.9%. In sharp contrast, India recorded a 17.4% growth in 2018. As for its share in the total NBFC funding, the RBI’s banking trend report released in December 2017 revealed that it stood at an unbelievably high of 99.7%.

- In the NBFC context, short-term means a period of up to three years and long-term for up to 15 years, as in the case of housing and infrastructure loans. Why such anomaly continues in the NBFCs’ functioning is an abiding mystery.

- Little wonder, when the NBFC crisis hit India in 2018 and 2019, the two big players to implode (IL&FS and DHIL) were associated with infrastructure and housing sectors, though this is only one part of the saga.

IS SHADOW BANKING A SERIOUS THREAT IN EMERGING MARKETS?

- The IL&FS crisis has exposed the vulnerabilities of non-bank lending. But in India,the problem is one of a huge bad debt pile-up despite low credit disbursal.

- Everyone seems to have woken up to the fact that global debt levels are too high and portent difficulties ahead.

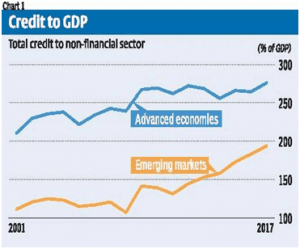

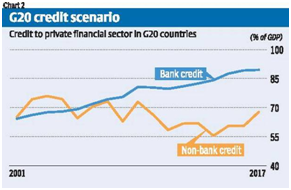

As Figure 1 indicates, the levels of credit to GDP, which were so high as to be unsustainable and resulted in the big crisis of 2008, have increased even more since then.

As Figure 1 indicates, the levels of credit to GDP, which were so high as to be unsustainable and resulted in the big crisis of 2008, have increased even more since then. - There was a phase of deleveraging in the advanced economies until around 2014, and in developing countries and emerging markets until 2011, but since then, credit/debt has been expanding again.

- So much so that the credit GDP levels in 2017 were 15 per cent higher than in 2008 in the advanced economies, and more than 80 per cent higher for emerging markets (Figure 1).

- More recently, the attention has shifted from bank lending to shadow banking activities, which are by those institutions that do not collect deposits but still provide loans. These include a variety of institutions, ranging from trusts, investment funds and similar corporations to kerb lenders.

- Because they do not come under the regulatory framework for banks, yet tend to be interlinked with them in various ways, there are concerns that over lending and default in such institutions can destabilise the financial system.

LINGERING FRAGILITIES

- Ever since the IL&FS crisis broke in India, there has been much discussion of the fragilities posed by non-bank

lending and the potential for financial and economic crises in emerging markets that could be led by the collapse of shadow banks. This is in no small measure due to the significant role played by such shadow lending in the core capitalist countries (especially the US) in the build-up to the Great Financial Crisis in 2008.

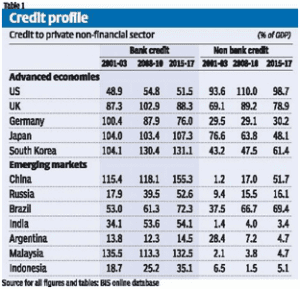

lending and the potential for financial and economic crises in emerging markets that could be led by the collapse of shadow banks. This is in no small measure due to the significant role played by such shadow lending in the core capitalist countries (especially the US) in the build-up to the Great Financial Crisis in 2008. - However, since then, shadow lending appears to have reduced, or at least been contained relative to GDP, as indicated by Figure 2. For the G20 countries taken as a group, credit from non-banks as a per cent of GDP was about 6 percentage points lower in 2017 than in 2007, while bank credit had actually increased by 15 percentage points. This suggests that excessive debt

creation is much more a problem of the banking sector as a whole than the non-bank or shadow bank sector.

creation is much more a problem of the banking sector as a whole than the non-bank or shadow bank sector. - Table 1 provides data for some important advanced and emerging economies to assess the extent to which this argument is valid. Significantly, the reliance on shadow banking appears to have reduced significantly in the advanced economies by 2015-17 from what it was during 2008-10, other than in Germany where it seems to have remained at roughly the same level of around 30 per cent. Even the increase in bank credit was confined to Japan and South Korea, rather than the US, UK or Germany, where it has fallen relative to the levels of 2008-10.

WAY FORWARD:

- It is also increasingly suggested that the problem of shadow banking has become more significant in emerging markets rather than in advanced economies, and that the dramatic increase in such loans in these economies is what will be associated with the next big systemic risk to global finance.

- In particular, it is suggested that the rapid increase of shadow banking in Asia, especially China, points to the likely area of greatest future concern.

CONCLUSION:

NBFC sector has been stung by a crisis set off by the shock collapse of non-bank lender IL&FS group in 2018. India’s shadow banks, which lend to everyone from teashop merchants to property tycoons, get a mixed bill of health in Bloomberg’s latest check. Revitalization of the industry, whose woes mounted when major mortgage lender Dewan Housing Finance Corp. missed repayments, is key to helping staunch a further slowdown in the nation’s economy. In a sign that creditors remain jittery, borrowing costs rose. The extra yield investors demand to hold five-year AAA rated bonds from shadow banks over government notes increased, one of the gauges shows. Shadow lender woes have made it harder for policy makers to prop up the economy, which grew at its weakest pace since 2009. The slowdown hurts borrowers’ ability to repay debt, and has prompted the central bank to predict that an improvement in banks’ bad-loan ratios will reverse. So, it is established that Indian NBFCs are shadow banks and they do pose systemic risks to certain extent. Hence, the RBI should make a long term policy for Indian NBFC sector to mitigate any risk that may crop up in the already fragile financial sector in India.

DAILY CURRENT AFFAIRS (OCTOBER 13, 2022)

POLITY AND CONSTITUTION

1. LANGUAGES PANEL RECOMMENDATIONS AND A FRESH ‘HINDI IMPOSITION’ ROW

THE CONTEXT: Recently, the 11th volume of the Report of the Official Language Committee headed by Home Minister, which was submitted to President in September 2022 has triggered angry reactions from the Chief Ministers of Tamil Nadu and Kerala, who have described the Report as an attempt by the Union government to impose Hindi on non-Hindi-speaking states.

THE EXPLANATION:

What is this language panel led by Union Home Minister?

- The Committee of Parliament on Official Language was set up in 1976 under Section 4 of The Official Languages Act, 1963. Section 4 of the Act says “there shall be constituted a Committee on Official language, on a resolution to that effect being moved in either House of Parliament with the previous sanction of the President and passed by both Houses”.

- The Committee is chaired by the union Home minister, and has, in accordance with the provisions of the 1963 Act, 30 members — 20 MPs from Lok Sabha and 10 MPs from Rajya Sabha. The job of the Committee is to review the progress made in the use of Hindi for official purposes, and to make recommendations to increase the use of Hindi in official communications.

What has the panel recommended in its latest (2021) report?

- The contents of the report submitted to President on September 9 by Union Home Minister and other members of the Committee are not in the public domain. Sources close to the Committee said it has made around 100 recommendations, including that Hindi should be the medium of instruction in IITs, IIMs, and central universities in the Hindi-speaking states.

- “The language used for communication in the administration should be Hindi, and efforts should be made to teach the curriculum in Hindi, but the latter is not mandatory. Lower courts in Uttar Pradesh, Uttarakhand, Madhya Pradesh, Bihar, Haryana, and Rajasthan already use Hindi.

- High Courts in other states, where proceedings are recorded in English or a regional language can make available translations in Hindi, because verdicts of High Court of other states are often cited in judgments,” according to sources, referring to the recommendations.

Is this the first time that such recommendations have been made?

- The makers of the Constitution had decided that both Hindi and English should be used as official languages for the first 15 years of the Republic, but in the wake of intense anti-Hindi agitations in the south, the Centre announced that English would continue to be used even after 1965.

- On January 18, 1968, Parliament passed the Official Language Resolution to build a comprehensive programme to increase the use of Hindi for official purposes by the Union of India.

- With the active promotion of Hindi being mandated by Article 351 of the Constitution, the Official Language Committee was set up to review and promote the use of Hindi in official communications. The first Report of the Committee was submitted in 1987.

- The ninth Report, submitted in 2011 by the panel headed by then Home Minister, made 117 recommendations, including suggestions to increase the use of Hindi in computers in government offices.

What does the new education policy say about teaching in Hindi and other regional languages?

- The announcement of the new National Education Policy (NEP) in 2020 too had triggered controversy over this issue. Politicians from Southern India had alleged attempts to “impose Hindi and Sanskrit”; however, the Centre had said it was only promoting regional languages.

- The NEP says that mother tongue or the regional language would be the “preferred” mode of instruction until Class 5, and possibly Class 8.

2. THE SUPREME COURT TO EXAMINE VALIDITY OF 2016 NOTE BAN AND HOW IT WAS DONE

THE CONTEXT: Recently, the Constitution Bench questioned whether the government and the Reserve Bank of India (RBI) realised their stated objectives of choking black money, terror financing and fake currency through the policy to demonetise ₹500 and ₹1,000 notes in 2016.

THE EXPLANATION:

- According to Solicitor-General questioned the very maintainability of the case which concerned a purely economic policy of the government.

- Also, it must be noted that Demonetisation in 1946 and 1978 were implemented through separate Acts debated by Parliament. In 2016, it was done through a mere notification issued under provisions of the Reserve Bank of India Act, 1934. The court should declare the law or nothing would stop the government from repeating the exercise which had seen “horrendous consequences”.

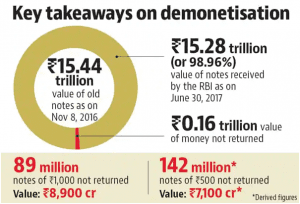

- Citing the RBI’s annual report, submitted that ₹15.44 lakh crore worth of currency was demonetised. The withdrawn money amounted to 86.4% of the currency in circulation at the time. Only ₹16,000 crore out of the ₹15.44 lakh crore was not returned. According to experts only .0027% fake currency was “captured” following demonetisation.

- The court wondered whether the government had thought about the consequences before going ahead with the withdrawal of the banknotes. It scheduled the next hearing on November 9, 2022 and directed the government and the RBI to file comprehensive affidavits in response to then opponent’s submissions.

INTERNATIONAL RELATIONS

3. HOW MUCH CRUDE OIL DOES THE EU STILL IMPORT FROM RUSSIA?

THE CONTEXT: According to the International Energy Agency (IEA), Russian oil imports into the European Union and United Kingdom fell 35% to 1.7 million barrels per day (bpd) in August from 2.6 million bpd in January 2022, but the EU was still the biggest market for Russian crude.

THE EXPLANATION:

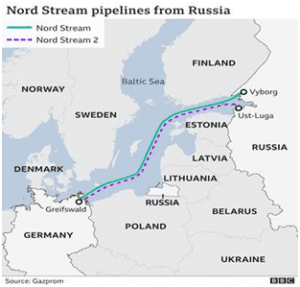

- Recently Poland said it had detected a leak in one pipeline in the Druzhba system that carries oil from Russia to Europe, an event that will add to concerns about Europe’s energy security after the Nord Stream gas pipeline leak.

- The UK has already stopped importing Russian crude following Moscow’s invasion of Ukraine, and the EU will ban imports from December in an attempt to strip the Kremlin of revenue to fund the war.

- The ban will most likely create a shortage of oil due to a general lack of spare crude volumes in the world.

What are the alternatives to Russian crude?

- Under the looming ban, the EU will need to replace an additional 1.4 million barrels of Russian crude, with some 300,000 bpd potentially coming from the United States and 400,000 bpd from Kazakhstan, the IEA has said.

- Norway’s largest oilfield Johan Sverdrup, which produces medium-heavy crude similar to Russia’s Urals, also plans to ramp-up production in the fourth-quarter, potentially by 220,000 bpd.

- The IEA says imports from other areas such as the Middle East and Latin America would be needed to fully meet EU demand.

- Some Russian oil will continue to flow into the EU via pipelines as the ban excludes some landlocked refineries unless Russia decides to stop the flows.

How much does the EU depend on Russian crude imports?

- Germany, the Netherlands and Poland were the top importers of Russian oil in Europe last year, but all three have capacity to bring in seaborne crude.

- Landlocked countries in Eastern Europe, such as Slovakia or Hungary, however, have few alternatives to pipeline supplies from Russia.

- The EU’s dependence on Russia has also been underpinned by companies such as Rosneft and Lukoil, controlling some of the bloc’s largest refineries.

- According to the IEA, Russian crude oil flows, based on loading data in August, rose month-on-month to Italy and the Netherlands, where Russian oil major Lukoil owns refineries.

VALUE ADDITION:

ABOUT NORD STREAM 2 GAS PIPELINE:

- In 2015, the Russian energy major Gazprom and five other European firms decided to build Nord Stream 2 which is valued at around $11 billion.

- The Approx 1,200-km pipeline will run from Ust-Luga in Russia to Greifswald in Germany through the Baltic Sea and will carry 55 billion cubic metres of gas per year.

- The under-construction pipeline will run along with the already completed Nord Stream 1 system, and the two together will supply an aggregate of 110 billion cubic metres of gas to Germany per year.

- The pipeline falls in the territory of EU members Germany and Denmark and is about 98% complete.

ENVIRONMENT, ECOLOGY AND CLIMATE CHANGE

4. THE FIRST WORLD SLOTH BEAR DAY-12TH OCTOBER

THE CONTEXT: The first ever World Sloth Bear Day celebrations by Wildlife SOS in Agra in collaboration with International Union for Conservation of Nature (IUCN) and the UP-Forest Department.

THE EXPLANATION:

- It was observed to generate awareness and strengthen conservation efforts around the unique bear species endemic to the Indian subcontinent.

- A proposal for observing the World Sloth Bear Day was mooted by Wildlife SOS India, an organisation involved in sloth bear conservation and protection for over two decades and the IUCN-Species Survival Commission sloth bear expert team accepted the proposal and declared the day to be celebrated worldwide.

- Sloth bears are identified by their very distinct long, shaggy dark brown or black fur, distinct white V-shaped chest patch and four-inch long ivory-coloured curved claws used for digging out termites and ants from rock-hard mounds.

Barbaric tradition being resolved

A statement issued by Wildlife SOS stated that the organisation rescued and rehabilitated over hundreds of “performing dancing bears, thereby resolving a 400-year-old barbaric tradition (of dancing bears) while also providing alternative livelihoods to the nomadic Kalandar community members “.

Conservation Status:

Listed under Schedule I of The (Wildlife Protection) Act of India, 1972 the species has the same level of protection as tigers, rhinos and elephants. They can occupy a wide variety of habitats, such as grasslands, thorn scrub and forests, but their range has shrunk considerably in recent years due to habitat loss.

IUCN Status: Vulnerable.

CITES listing: Appendix I

Habitat:

Sloth bears are one of the eight bear species found across the world, and they mainly inhabit the region of India, Nepal, Sri Lanka and presumably Bhutan.

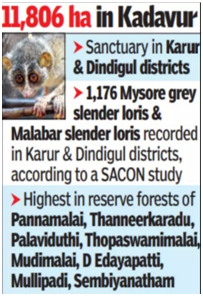

5. TAMIL NADU NOTIFIES INDIA’S FIRST SLENDER LORIS SANCTUARY

THE CONTEXT: In a first in the country, the Tamil Nadu government notified the Kadavur slender loris sanctuary covering 11,806 hectares in Karur and Dindigul districts.

THE EXPLANATION:

- Slender lorises, which are small nocturnal mammals, are arboreal as they spend most of their life on trees.

- The species acts as a biological predator of pests in agricultural crops and benefits farmers. Listed as an endangered species by the International Union for Conservation of Nature, slender loris has a wide range of ecological roles in the terrestrial ecosystem.

- Also, it has been brought under Schedule I of the Wild Life (Protection) Act, 1972 in order to provide the highest level of legal protection

Habitat improvement

- The survival of the species depends on habitat improvement, conservation and mitigation of threats,

- The sanctuary will cover Vedasandur, Dindigul East and Natham taluks in Dindigul district and Kadavur taluk in Karur district.

- In significant steps towards conservation of wildlife, the State government notified India’s first Dugong Conservation Reserve in the Palk Bay,Kazhuveli bird sanctuary in Villupuram, Nanjarayan Tank birds sanctuary in Tiruppur and the State’s fifth elephant reserve at Agasthyamalai in Tirunelveli. Further, 13 wetlands were declared as Ramsar sites. These path-breaking initiatives in 15 months have put Tamil Nadu at a pivotal position in the field of conservation.

THREATS:

- As it is believed that these animals have some medicinal properties, they are captured and sold.

- Since there is great demand for keeping these animals as pets, they are illegally smuggled.

- Habitat loss, electrocution of live wires, and road accidents are other threats that have caused its populations to dwindle.

GOVERNMENT SCHEMES AND INITIATIVES IN NEWS

6. THE PM-DEVINE SCHEME

THE CONTEXT: The Union Cabinet has approved the Prime Minister’s Development Initiative for North East Region (PM-DevINE) – a new scheme for the Northeastern states which was announced in the Union Budget earlier this year. The scheme will be operational for the remaining four years of the 15th Finance Commission, from 2022-23 to 2025-26, and will have an outlay of Rs 6,600 crore.

THE EXPLANATION:

What is PM-DevINE?

- The new scheme, PM-DevINE, is a Central Sector Scheme with 100% Central funding and will be implemented by Ministry of Development of North Eastern Region (DoNER) through North Eastern Council or Central Ministries/ agencies.

- The PM-DevINE Scheme will have an outlay of Rs.6,600 crore for the four-year period from 2022-23 to 2025-26 (remaining years of 15th Finance Commission period).

- PM-DevINE will lead to creation of infrastructure, support industries, social development projects and create livelihood activities for youth and women, thus leading to employment generation.

- Measures would be taken to ensure adequate operation and maintenance of the projects sanctioned under PM-DevINE so that they are sustainable.

- To limit construction risks of time and cost overrun, falling on the Government projects would be implemented on Engineering-procurement-Construction (EPC) basis, to the extent possible.

- Efforts will be made to complete the PM-DevINE projects by 2025-26 so that there are no committed liabilities beyond this year.

What are the objectives of PM-DevINE?

The objectives of PM-DevINE are to:

(a) Fund infrastructure convergently, in the spirit of PM Gati Shakti;

(b) Support social development projects based on felt needs of the NER;

(c) Enable livelihood activities for youth and women;

(d) Fill the development gaps in various sectors.

Initiatives/activities of MDoNER:

NESIDS

- North East Special Infrastructure Development Scheme” (NESIDS) was approved by the Government of India as a Central Sector Scheme. Under the Scheme guidelines of NESIDS, 100% centrally funding is provided to the State Governments of North Eastern Region for the projects of physical infrastructure relating to water supply, power and connectivity enhancing tourism and Social infrastructure relating to primary and secondary sectors of education and health.

The North East Venture Fund (NEVF)

- Ministry of DoNER had joined with North Eastern Development Finance Corporation Ltd (NEDFi) to set up the North East Venture Fund, the first and the only Venture Fund for Northeast with an initial corpus of Rs. 100 crores.

- The fund targets to invest in Start-Ups and unique business opportunities to provide resources for new entrepreneurships. The main focus of North East Venture Fund (NEVF) is for mostly the enterprises involved in Food Processing, Healthcare, Tourism, segregation of services, IT, etc.

THE DATA POINT

THE PRELIMS PRACTICE QUESTION

QUESTION OF THE DAY

Q1. ‘Vyommitra’, recently seen in news, is

a) A Supercomputer developed by C-DAC.

b) A Humanoid designed and developed by ISRO to fly aboard unmanned test mission.

c) An asteroid which will be explored for minerals.

d) A space mission of ISRO to study atmosphere of Venus.

Answer: B

Explanation:

- Vyommitra, the humanoid designed and developed by the Indian Space Research Organisation (ISRO) to fly aboard unmanned test missions ahead of the Gaganyaan human spaceflight mission.

- The ISRO and the IISU were in the news when they unveiled Vyommitra, a “female” robot astronaut, in 2020. Vyommitra is a half-humanoid lacking lower limbs.

- The IISU was responsible for the design, development, and integration of the robot, while the Vikram Sarabhai Space Centre (VSSC) at Thumba here developed its fingers. The AI-enabled robot is designed to fly aboard a rocket, withstanding vibrations and shock during the flight.

Ethics Through Current Development (13-10-2022)

Today’s Important Articles for Sociology (13-10-2022)

Today’s Important Articles for Geography (13-10-2022)

- We need a forest-led COP27: Technology, at best, can assist us, not lead us, on the pathway to a sustainable, regenerative and equitable world READ MORE

- In maps: The extent of destruction being unleashed on the forests of Great Nicobar Island READ MORE

- Climate litigation demands an environmental consciousness READ MORE

Today’s Important Articles for Pub Ad (13-10-2022)

- The Court and the problem with its collegium: There needs to be a better, broad-based and transparent method of appointing senior judges to the High Courts and the Supreme Court READ MORE

- Measure topography to ensure the equitable delivery of goods and services to all READ MORE

- Are Indian judges now playing a more public role from interviews to speeches? READ MORE

WSDP Bulletin (13-10-2022)

(Newspapers, PIB and other important sources)

Prelim and Main

- The grandeur of the Chola Empire, one of the longest ruling dynasties in South India READ MORE

- Experts call for protection of sloth bear on first World Sloth Bear Day READ MORE

- After inspection, India stops Maiden Pharma unit from making drugs READ MORE

- Putin says Russia can supply EU via Nord Stream 2 READ MORE

- August industrial production shrinks 0.8%, inflation drags READ MORE

- India’s first sanctuary for endangered Slender Loris to be set up in Tamil Nadu READ MORE

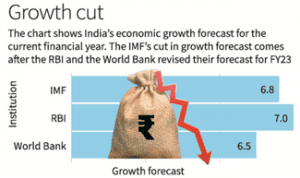

- IMF’s latest world economy report: Red flags for India READ MORE

- NASA Confirms DART Mission Impact Changed Asteroid’s Motion in Space READ MORE

- Under cheetah deal, sought India’s support on lifting ivory ban: Namibia READ MORE

Main Exam

GS Paper- 1

- We need a forest-led COP27: Technology, at best, can assist us, not lead us, on the pathway to a sustainable, regenerative and equitable world READ MORE

- In maps: The extent of destruction being unleashed on the forests of Great Nicobar Island READ MORE

- Enforce laws firmly to eradicate caste crimes READ MORE

GS Paper- 2

POLITY AND GOVERNANCE

- The Court and the problem with its collegium: There needs to be a better, broad-based and transparent method of appointing senior judges to the High Courts and the Supreme Court READ MORE

- Measure topography to ensure the equitable delivery of goods and services to all READ MORE

- Are Indian judges now playing a more public role from interviews to speeches? READ MORE

SOCIAL ISSUES

- Vishwaguru needs high HEI ranking READ MORE

INTERNATIONAL ISSUES AND RELATIONS

- Dangerous spiral: Only a compromise through talks can end the hostilities in Ukraine READ MORE

- India needn’t worry about the US-Pak relationship READ MORE

GS Paper- 3

ECONOMIC DEVELOPMENT

- Winter is coming: India’s growth impulses slowing; the IMF warns ‘worst yet to come’ READ MORE

- Spend wisely: Global slowdown and domestic food inflation are growth constraints. Govts must stop freebies & hike capex READ MORE

- Breathe easy when the rupee falls: Free currency depreciation will counter slowing growth without worsening other problems READ MORE

- Green shoots: Reducing poverty, unemployment should be top priorities READ MORE

ENVIRONMENT AND ECOLOGY

- Climate litigation demands an environmental consciousness READ MORE

GS Paper- 4

ETHICS EXAMPLES AND CASE STUDY

- Man’s search for something not man-made READ MORE

- Adapt yourself READ MORE

- Two tragic Heroes READ MORE

Questions for the MAIN exam

- India needs a better, broad-based and transparent method of appointing senior judges to the High Courts and the Supreme Court. In the light of the statement discuss whether the mechanism of collegium should be preplaced with new mechanism?

- ‘Inclusive economic growth requires reaching out to the poorest of the poor’. Discuss why India needs dedicated and sustained efforts are made to pull millions of destitute citizens out of poverty and how can India achieve it?

- India’s Judiciary has become a more public Judiciary in recent times but is hampering the image of this institution. Critically examine.

WSDP Bulletin

(13/10/2022)

- It is good that war is so horrible, or we might grow to like it.

- Technology, at best, can assist us, not lead us, on the pathway to a sustainable, regenerative and equitable world.

- There needs to be a better, broad-based, transparent method of appointing senior judges to the High Courts and the Supreme Court.

- Only a compromise through talks can end the hostilities in Ukraine.

- States can have differential sources of revenue. Alternatively, the cost of delivering that basket may vary across geographical zones. Measuring topography might be an idea worth toying with.

- Incidents of attacks on Dalits are depressingly common across the country, partly due to persistent feudal attitudes among a section of the upper caste population and the marginalised castes’ continuing social and economic vulnerability.

- Inclusive economic growth requires reaching out to the poorest of the poor.

50-WORD TALK

- Finance Minister Nirmala Sitharaman is correct to warn the West that current high gas prices will compel India to return to thermal power. Developed countries will have to choose between their political interests–exhibited by their sanctions on countries like Venezuela, Iran, and Russia–and their climate goals. They can’t have everything.

- The latest imbroglio over appointing SC judges has again exposed the collegium system’s weaknesses. With its opacity and inherent distrust among members, the system is caught in a trap of its own making. It’s time judges realise what they want the world to believe – that sunlight is the best disinfectant.

Things to Remember:

- For prelims-related news try to understand the context of the news and relate with its concepts so that it will be easier for you to answer (or eliminate) from given options.

- Whenever any international place will be in news, you should do map work (marking those areas in maps and exploring other geographical locations nearby including mountains, rivers, etc. same applies to the national places.)

- For economy-related news (banking, agriculture, etc.) you should focus on terms and how these are related to various economic aspects, for example, if inflation has been mentioned, try to relate with prevailing price rises, shortage of essential supplies, banking rates, etc.