Today’s Important Articles for Pub Ad (26-10-2022)

WSDP Bulletin (26-10-2022)

(Newspapers, PIB and other important sources)

Prelim and Main

- Updates: Russia mulls secure zone around Zaporizhzhia plant READ MORE

- Focus on India-U.K. ties as Sunak becomes British PM READ MORE

- Credit offtake hits decade’s high of 17.9% on higher retail, working capital demand READ MORE

- The heaviness of rockets, why it matters in space flight READ MORE

- Climate change amplifying health impacts of multiple crises, says The Lancet report ahead of COP27 READ MORE

- Are critically endangered Great Indian Bustards now migrating to Pakistan? READ MORE

- This Word Means | HAWK air defence equipment READ MORE

Main Exam

GS Paper- 1

- Why cyclones like Sitrang stoke fear? Loss & damage worth billions due to Indian Ocean storms READ MORE

- ‘Divide and rule’ does not work READ MORE

- Can artificial intelligence help predict suicides? READ MORE

- Vast ice sheet facing climate fight on two fronts READ MORE

GS Paper- 2

POLITY AND GOVERNANCE

- Children, children: Governors and state govts’ unedifying fights harm universities most. Make institutions independent READ MORE

- Long years of apathy on constitution bench over. Supreme court set to make more headlines READ MORE

SOCIAL ISSUES

- Maternity Benefits Should be Available to the Mother in Case of Neonatal Death READ MORE

- Bad News on the Poverty Front READ MORE

INTERNATIONAL ISSUES

- Betting on change: an American dream: There is chaos aplenty on the horizon as the West imagines a new regime in Iran, Russia and China READ MORE

- In the North of South Asia, an arc of peace READ MORE

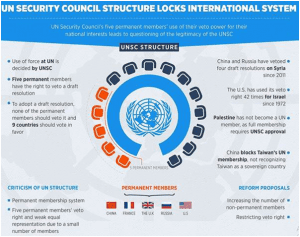

- Why the UN must evolve to fight modern-day terror READ MORE

GS Paper- 3

ECONOMIC DEVELOPMENT

- PLI scheme and Atmanirbharta READ MORE

- Banks, finance and the 2022 Economics Nobel Prize READ MORE

- PM Kisan’s direct transfers can help food distribution. But there are four challenges READ MORE

ENVIRONMENT AND ECOLOGY

- Using the ocean to fight climate change raises serious environmental justice and technical questions READ MORE

SECURITY

- Why development projects are critical for rooting out extremism READ MORE

GS Paper- 4

ETHICS EXAMPLES AND CASE STUDY

Questions for the MAIN exam

- ‘The battle against internal terror cannot be fought without the help of the people’. Discuss, why development projects are critical for rooting out extremism?

- How far do you agree with this view that the recent supreme court concern against hate speech is a good move, but this is the administration and executive that can work effectively against the propagation of hate? Justify your view.

QUOTATIONS AND CAPTIONS

- History reminds us that dictators and despots arise during times of severe economic crisis.

- The Global Hunger Index exposes the falsity of poverty estimates that do not take into account the true rise in cost of living.

- Grazing by mammalian herbivores can be a climate mitigation strategy.

- The quest for Atmanirbharta has to be an ongoing and long-term endeavour that must take due note of its adverse impact on the military’s short and mid-term operational effectiveness.

- Water resources are essential for economic development. India has 4 per cent of global water resources for its use. India’s water resources are under immense pressure.

- India needs to embark on export-led growth to create high-income jobs with a big role of MSMEs.

- The Government should identify better alternatives and encourage innovation that can eventually lead to the betterment of public health. It is essential for the government to take on a multidimensional and unprejudiced stance in adopting harm reduction alternatives for the betterment of its citizens.

- Consensus among political parties is needed to avert the financial disaster that freebies will lead to in the long run.

- Fostering peaceful coexistence of the diverse sects and sections of society is crucial for India’s image globally, too, as its voice gains credence in diplomatic and geopolitical affairs.

- The Supreme Court’s intervention in the matter is welcome. Now, political and legal action must follow in case of hate speech.

- Development projects bolster internal security and help policing become more focused and result-oriented, ensuring a government-people bond.

- Administrative bias on the one hand and the spread of social prejudice on the other cannot be allowed to vitiate the national mood. the Court must do everything possible to nudge authorities to enforce the law against the propagation of hate.

ESSAY TOPIC

- Education is the kindling of a flame, not the filling of a vessel.

- Overcoming poverty is not a gesture of charity but an act of justice.

50-WORD TALK

- Comparative dip in pollution level in Delhi this Diwali is a relief but no cause for celebration or self-congratulation for AAP government. Early Diwali, unexpected rains delaying peak in stubble-burning and warmer temperatures contributed to it. AQI is still in very poor category. Complacency can be a potential health hazard.

- Excited polemical exchanges between Indian politicians over Rishi Sunak miss the point. The new UK prime minister was picked for his talent, not ethnicity. Like Sunak, millions of immigrants have infused energy into the economy and public life of democracies. Immigration—of people and ideas—empowers societies. Xenophobia dooms them to mediocrity.

Things to Remember:

- For prelims-related news, try to understand the context of the news and relate it with its concepts so that it will be easier for you to answer (or eliminate) from given options.

- Whenever any international place is in the news, you should do map work (marking those areas in maps and exploring other geographical locations nearby, including mountains, rivers, etc.) applies to the national places.)

- For economy-related news (banking, agriculture, etc.) you should focus on terms and how these are related to various economic aspects; for example, if inflation has been mentioned, try to relate with prevailing price rises, shortage of essential supplies, banking rates, etc.

- For main exam-related topics, you should focus on the various dimensions of the given topic; the most important topics which occur frequently and are important from the main point of view will be covered in ED.

- Try to use the given content in your answer. Regular use of this content will bring more enrichment to your writing.

Day-315 | Daily MCQs | UPSC Prelims | CURRENT DEVELOPMENTS

[WpProQuiz 360]

TOPIC : THE TYRANNY OF CREDIT RATING AND CREDIT SCORE

THE CONTEXT: Recently, there is a debate on illusion of rating agencies. Basically, the issues are -their necessities, flaws & fragilities, and the need for regulation. Similarly, credit score has also become complicated due to the current covid induced financial crisis.

WHAT IS A RATING AGENCY?

Credit rating is an informed opinion of a recognised entity on the relative creditworthiness of an issuer or instrument. In other words, it is an opinion “on the relative degree of risk associated with the timely payment of interest and principal on a debt instrument”. Such recognised entity is known as Credit Rating Agencies (CRAs).

CRAs typically rate on the basis.

- Debt securities

- Short term debt instruments, like commercial papers

- Structured debt obligations

- Loans and fixed deposits

WHY THERE ARE ISSUES OF ILLUSION?

IDEOLOGICAL BIASES

- CRAs might lower ratings for left governments as a strategy to limit negative policy and market surprises as they strive to keep ratings stable over the medium term.

- For e.g. a panel analysis of Standard & Poor’s, Moody’s, and Fitch’s rating actions for 23 Organisation for Economic Co-Operation and Development (OECD) countries from 1995 to 2014 shows that left executives and the electoral victory of nonincumbent left executives are associated with significantly higher probabilities of negative rating changes.

CONFLICT OF INTERESTS

- CRAs are funded by the very companies they rate.

LACK OF ABILITY TO PREDICT

- CRAs follow the market, so the market alerts the agencies of trouble. This reason can be attributed to CRAs ability to predict frequent near default, default, and financial disasters.

NEGLIGENCE & INCOMPETENCE

- The methodology of CRAs has come under question. For example, even after using different methodologies, the result for sovereign debts comes the same. It is also alleged that CRAs can make a sound judgement on rating, but they didn’t make an effort to do it.

- For e.g. Moody accepted that it did not have a good model on which it could have estimated a correlation between mortgage-backed securities, so they made them up.

POLITICALLY MOTIVATED

- It has also been alleged that CRAs, through their rating mechanism, force the govt to follow the path they prescribe.

- For e.g. during the turmoil in Tunisia, S&P issued a report warning of “downward rating pressures” on neighbouring governments if they tried to calm social unrest with “populist” tax cuts or spending increases. Further, after Crimea annexation, rating agencies downgraded the rating of Russia.

POLICY MEDDLING

- In 203, to stop predatory lending state of Georgia brought a law. Other state of the USA, were to follow suit until S&P retaliated. And it is well known that predatory lending is responsible for the financial crisis of 2008-09.

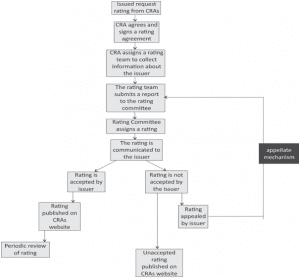

HOW A RATING AGENCY FUNCTION

1. FOR COMPANIES

It is evident from the Above picture that credit rating agencies depend upon the audited statements. The agencies are only as effective the as honesty of their clients.

2. FOR COUNTRY

Following are the parameters on which a country is rated

- Regulatory framework

- Tariffs

- Fiscal Policy

- Monetary Policy

- Foreign Currency Control

- Physical and human Infrastructure

- Financial Markets

- Macro Factors (Consumer spending, Inflation, Interest Rates)

WHY RATING AGENCY IS REQUIRED

From the 80s onwards, as the financial system became more deregulated, companies started borrowing more and more from the globalised debt markets, and so the opinion of the credit ratings agencies became more and more relevant.

ROLE OF THE CRAs

REDUCE INFORMATION ASYMMETRY

- Since CRAs get access to the company’s management and confidential information about its working, they can give an informed opinion about the ability of an instrument to meet its obligations.

UTILITY FOR ISSUERS

- Issuer concisely communicates the quality of their issue through the rating of the CRAs, which help it establish its creditworthiness.

GATEKEEPERS FOR FINANCIAL MARKETS

- CRAs provide tangible benefits to financial market regulators by reducing the costs of regulation. Regulators such as RBI use CRAs to improve the awareness and decision-making of their regulated entities. For instance, credit ratings are used to determine the capital adequacy of banks the resolution of stressed assets.

PURVEYORS OF REGULATORY LICENSES

- Some financial regulators mandate that certain instruments must be rated mandatorily before they are issued. Extensive integration of CRAs into the financial system transforms their role as purveyors.

MORAL SUASION

- It compels developing countries to pursue more prudent and sensible monetary and fiscal policies.

INSTANCES WHEN RATING AGENCIES FAILED

- The financial collapse of New York City in the mid-1970s

- Asian financial crisis

- Enron scandal,

- Global Financial Crisis

- During the global financial crisis, hundreds of billions of dollars worth of triple-A-rated mortgage-backed securities were abruptly downgraded from triple-A to “junk” (the lowest possible rating) within two years of the issue of the original rating.

- The US Financial Crisis Inquiry Commission called them “key enablers” of the financial crisis and “cogs in the wheel of financial destruction.”

THE HISTORY OF RATING AGENCY

- Credit rating agencies were first established after the financial crisis of 1837 in the US. Such agencies were then needed to rate the ability of a merchant to pay his debts, consolidating such data in ledgers.

- Systematic credit rating started with the rating of US railroad bonds by John Moody in 1909.

COMPARATIVE RATING SYMBOLS FOR LONG TERM RATINGS

DEGREE OF SAFETY – RATING – Meaning

Highest – AAA – Timely payment of financial obligations

High – AA – Timely payment of financial obligations

Adequate – A – Changes in circumstances can adversely affect such issues more than those in the higher rating categories.

Moderate – BBB – Changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal.

Inadequate – BB – Less likely to default in the immediate future

Greater likelihood of default – B – While currently financial obligations are met, adverse business or economic conditions would lead to a lack of ability or willingness.

Vulnerable to default – C – Timely payment of financial obligations is possible only if favourable circumstances continue

In default or are expected to default – D – Such instruments are extremely speculative and returns from these instruments may be realised only on reorganisation or liquidation.

Some factors which render instruments outstanding meaningless – NM – Factors include reorganisation or liquidation of the issuer; the obligation is under dispute in a court of law or before a statutory authority etc.

CREDIT RATING AGENCIES IN INDIA

CRISIL

- This full-service rating agency is India’s major credit rating agency, with a market share of more than 60%.

- It is offering its services in the financial, manufacturing, service, and SME sectors.

- The headquarter of CRISIL is in Mumbai.

- The majority stake of CRISIL was held by the world’s largest rating agency, Standard & Poor’s.

CREDIT ANALYSIS AND RESEARCH LIMITED RATINGS (CARE) RATINGS

- Credit Analysis and Research Limited Ratings was established in 1993.

- It is supported by Canara Bank, Unit Trust of India (UTI), Industrial Development Bank of India (IDBI), and other financial and lending institutions.

- This is considered the second-largest credit rating company in India.

- The headquarter of Credit Analysis, and Research Limited Ratings is in Mumbai.

SMALL AND MEDIUM ENTERPRISES RATING AGENCY (SMERA)

- It is a rating agency entirely created for the rating of Small Medium Enterprises.

- It is a joint enterprise by SIDBI, Dun & Bradstreet Information Services India Private Limited (D&B), and some chief banks in India.

- The headquarter of SMERA is in Mumbai

- It has accomplished 7000 ratings.

ONICRA CREDIT RATING AGENCY

- Mr. Sonu Mirchandani incorporated it in 1993

- It investigates data and arranges for possible rating solutions for Small and Medium Enterprises and Individuals.

- The headquarter of ONICRA Credit Rating Agency is located in Gurgaon

- It has broad experience in performing a wide range of areas such as Accounting, Finance, Back-end Management, Analytics, and Customer Relations. It has rated more than 2500 SMEs.

FITCH (INDIA RATINGS & RESEARCH)

- Fitch Ratings is a global rating agency dedicated to providing the world’s credit markets with independent and prospective credit opinions, research, and data.

- The headquarter of Fitch Ratings is in Mumbai.

ICRA

- It was created in 1991 by prominent financial institutions and commercial banks in India with a devoted crew of experts for the MSME sector

- Moody’s, which is considered as the international credit rating agency holds the major share.

DIFFERENT BUSINESS MODELS OF CREDIT RATING AGENCIES

MODELS

ISSUER PAY MODEL

ADVANTAGE

- Ratings are available to the entire market free of charge and will greatly aid small investors.

- It gives the rating agencies access to high-quality information that enhances the quality of analysis.

DISADVANTAGE

- It can lead to serious conflict of interest since the company pays the CRAs to get the rating. The CRAs may inflate the rating to satisfy the company.

- It may lead to ‘Rating Shopping’ which refers to the situations where an issuer approaches different rating agencies for the ratings and then choose to publish the most favourable ratings to disclose it to the public via media while concealing the lower ratings.

INVESTOR PAYS MODEL

ADVANTAGE

- It would avoid the serious conflict of interest of the CRAs.

- This would enable the investors to get the credit rating based on the company’s true and actual financial condition.

DISADVANTAGE

- Ratings would be available only to those investors who can pay for them and takes ratings out of the public domain and thus affects the small investors.

- The company may not always share all the necessary information with the CRAs which can have an adverse impact on the quality of the ratings.

- It can pose serious conflict of interest involving the investors themselves. If investors are the payees, they can influence CRAs to give lower-than-warranted ratings to help them negotiate higher interest rates.

REGULATOR PAYS MODEL

ADVANTAGE

- It eliminates the conflict of interest as seen in both Issuer Pay Model and Investor Pay Model.

DISADVANTAGE

- The problem with this model lies in choosing the CRA and payment to be fixed.

- The CRA chosen by the regulator may not provide the best credit rating. Further, if the regulator pays less amount of money to the CRA, the CRA may find it difficult to continue with its business and could have an adverse impact on the quality of the ratings issued.

SHOULD RATING AGENCIES BE REGULATED?

- RATING SHOPPING: It has often been seen that both issuer and investor are involved in rating shopping. CRAs inflate the rating particularly for structured product markets for getting more market share and profit margins.

- OLIGOPOLISTIC TENDENCIES: Around 95% of the market is controlled by only 3 CRA VIZ. S&P, MOODY’S and Further, they use expansionist marketing. For e.g. Hannover Re lost a big chunk of the market share when it didn’t pay the service fee. (CRAs promised it free service).

- HEGEMONIC CONTROL: As the big three CRAs are located in north America, America exerts a great control on the functioning of CRAs. When CRAs downgraded USA, CRAs were fined. Further, rating of country is not done objectively. UK was rated lower than USA, even when the fiscal deficit of UK was lower than USA.

- CONTROL: CRAs have great control on the world economy as their rating can result in the flight of the capital.

- ACCOUNTABILITY: CRAs are not accountable to any country and their functioning is not transparent

CHANGES THAT IS IMPERATIVE FOR BETTER FUNCTIONING

DODD FRANK ACT

In response to the Global Financial Crisis of 2008-2009, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act in July 2010. It encourages CRAs to invest in due diligence, strengthen internal controls and corporate governance, and improve their methodology. But some of the following provision of it are still unimplemented:

- legal liability of credit rating agencies should be increased.

- Use of credit ratings in regulations that set capital requirements and restrict asset holdings for financial institutions should be removed or replaced.

- Internal controls, conflicts of interest for credit analysts, standards for credit analysts, transparency, internal conflict of interest, and rating performance statistics should be ruled based and regulated.

THE WAY FORWARD

- A ratings agency run by the UN, funded by pooled contributions from both lenders and borrowers should be established. Ratings business must be made a utility, rather than a semi-cartel that intimidates elected politicians and rakes in excess profits

- With the help of technology, open-source models with fully transparent inputs and outputs should be created and promoted. Credit Risk Initiative of National University of Singapore Risk Management Institute is one such example.

THE CONCLUSION: CRAs play a valuable role in financial markets by analysing credit for many investors, but their inaccurate ratings can create problem of enormous proportion for world economy. A unified, integrated effort by all the country is needed to avoid another economic meltdown which would severe repercussion for both, any country or its citizen

Ethics Through Current Development (25-10-2022)

Today’s Important Articles for Geography (25-10-2022)

Today’s Important Articles for Sociology (25-10-2022)

Today’s Important Articles for Pub Ad (25-10-2022)

WSDP Bulletin (25-10–2022)

(Newspapers, PIB and other important sources)

Prelim and Main

- Bengal sends report on Pradhan Mantri Awas Yojana-Gramin corrections, awaits Centre’s response READ MORE

- ISRO launches 36 broadband satellites in its heaviest rocket from Sriharikota READ MORE

- Five new varieties to expand India’s Basmati platter READ MORE

- Kerala Governor demands resignation of nine Vice-Chancellors, sets stage for a political, legal battle with State government READ MORE

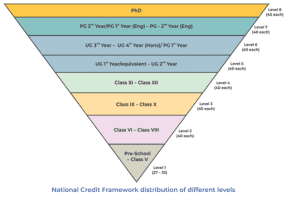

- Explained | What is the National Credits Framework (NCrF) and how does it propose to change the education system? READ MORE

- What is FCRA, and when can an NGO’s registration be cancelled? READ MORE

- As NSCN-IM meets rival Naga groups, hope for reconciliation, shared roadmap to peace READ MORE

- Chinese President Xi Jinping creates history, wins record third term in power READ MORE

- Grazing animals play key role in maintaining soil carbon health: Study READ MORE

Main Exam

GS Paper- 1

- A Gandhian Future READ MORE

- Upholding unity, opposing uniformity: The Indian Union is an agglomeration of ethno-linguistic nationalities that have their own languages and cultures READ MORE

- Old Age Insecurity READ MORE

- What ‘viral spillover risk’ means, and how it could lead to new pandemics READ MORE

- Water security must be enhanced in India READ MORE

GS Paper- 2

POLITY AND GOVERNANCE

- Vital intervention: On the Supreme Court order against hate speech READ MORE

- Hate speech is a serious concern READ MORE

- Supreme Court paves way to revisit POCSO act READ MORE

SOCIAL ISSUES

- We will bridge the poverty gap by our own means READ MORE

- Govt must start a broadbased anti-smoking policy READ MORE

- Rising Hunger, Growing Poverty READ MORE

GS Paper- 3

ECONOMIC DEVELOPMENT

- The MSP card: Hike announced is just right to induce farmers to sow wheat READ MORE

- Oil and the dollar: India’s twin challenges READ MORE

- Course correction is a must to stop freebies READ MORE

- Paradox of growing economy, shrinking workforce READ MORE

ENVIRONMENT AND ECOLOGY

- Why India has not been successful at eliminating plastic pollution READ MORE

SECURITY

- Why development projects are critical for rooting out extremism READ MORE

DISASTER MANAGEMENT

- How to assess disasters: 8 Indian states adopt global standards READ MORE

- Could Melting Glaciers Cause Future Pandemics? READ MORE

GS Paper- 4

ETHICS EXAMPLES AND CASE STUDY

- Can every single day be a day of rejoicing? READ MORE

- We need true social enterprises READ MORE

- What’s wrong with desire? READ MORE

- GIVE UP ‘MY’ and ‘mine’ TO BE FREE READ MORE

Questions for the MAIN exam

- ‘The battle against internal terror cannot be fought without the help of the people’. Discuss, why development projects are critical for rooting out extremism?

- How far do you agree with this view that recent supreme court concern against hate speech is good move, but this is the administration and executive that can work effective against the propagation of hate? Justify your view.

QUOTATIONS AND CAPTIONS

- Every election is determined by the people who show up.

- The Global Hunger Index exposes the falsity of poverty estimates that do not take into account the true rise in cost of living.

- Grazing by mammalian herbivores can be a climate mitigation strategy.

- The quest for Atmanirbharta has to be an ongoing and long-term endeavour that must take due note of its adverse impact on the military’s short and mid-term operational effectiveness.

- Water resources are essential for economic development. India has 4 per cent of global water resources for its use. India’s water resources are under immense pressure.

- India needs to embark on export-led growth to create high-income jobs with a big role of MSMEs.

- The Government should identify better alternatives and encourage innovation that can eventually lead to the betterment of public health. It is essential for the government to take on a multidimensional and unprejudiced stance in adopting harm reduction alternatives for the betterment of its citizens.

- Consensus among political parties is needed to avert the financial disaster that freebies will lead to in the long run.

- Fostering peaceful coexistence of the diverse sects and sections of society is crucial for India’s image globally, too, as its voice gains credence in diplomatic and geopolitical affairs.

- The Supreme Court’s intervention in the matter is welcome. Now, political and legal action must follow in case of hate speech.

- Development projects bolster internal security and help policing become more focused and result-oriented, ensuring a government-people bond.

- Administrative bias on the one hand and the spread of social prejudice on the other cannot be allowed to vitiate the national mood. the Court must do everything possible to nudge authorities to enforce the law against the propagation of hate.

ESSAY TOPIC

- Education is the kindling of a flame, not the filling of a vessel.

- Overcoming poverty is not a gesture of charity but an act of justice.

50-WORD TALK

- No text books until age six, use of toys, games, stories – the National Curriculum Framework for Foundational Stage ticks the right boxes by focusing on learning. But this change won’t be easy. Teachers will have to learn to teach differently. And parents will have to stop equating learning with marks.

Things to Remember:

- For prelims-related news try to understand the context of the news and relate with its concepts so that it will be easier for you to answer (or eliminate) from given options.

- Whenever any international place will be in news, you should do map work (marking those areas in maps and exploring other geographical locations nearby including mountains, rivers, etc. same applies to the national places.)

- For economy-related news (banking, agriculture, etc.) you should focus on terms and how these are related to various economic aspects, for example, if inflation has been mentioned, try to relate with prevailing price rises, shortage of essential supplies, banking rates, etc.

- For main exam-related topics, you should focus on the various dimensions of the given topic, the most important topics which occur frequently and are important from the mains point of view will be covered in ED.

- Try to use the given content in your answer. Regular use of this content will bring more enrichment to your writing.

Day-314 | Daily MCQs | UPSC Prelims | ECONOMY

| [WpProQuiz 359] |

DAILY CURRENT AFFAIRS (OCTOBER 22, 2022)

POLITY AND CONSTITUTION

1. WHAT IS ‘GENERAL CONSENT’ FOR CBI, RESTORED BY MAHARASHTRA GOVERNMENT?

THE CONTEXT: Recently the government of Chief Minister restored general consent to the Central Bureau of Investigation (CBI) to investigate cases in Maharashtra, reversing the decision of the state’s previous Maha Vikas Aghadi (MVA) government.

THE EXPLANATION:

According to the sources, CBI will no longer require the permission of the state government to open investigations in the state.

Why is the consent of states needed?

- CBI is governed by The Delhi Special Police Establishment (DSPE) Act, 1946, and it must mandatorily obtain the consent of the state government concerned before beginning to investigate a crime in a state.

- Section 6 of The DSPE Act (“Consent of State Government to exercise of powers and jurisdiction”) says: “Nothing contained in section 5 (titled “Extension of powers and jurisdiction of special police establishment to other areas”) shall be deemed to enable any member of the Delhi Special Police Establishment to exercise powers and jurisdiction in any area in a State, not being a Union territory or railway area, without the consent of the Government of that State.”

- The CBI’s position is in this respect different from that of the National Investigation Agency (NIA), which is governed by the NIA Act, 2008, and has jurisdiction all over the country.

What is the general consent for CBI?

- The consent of the state government to CBI can be either case-specific or “general”.

- General consent is normally given by states to help the CBI in the seamless investigation of cases of corruption against central government employees in their states. This is essentially consent by default, which means CBI may begin investigations taking consent as having been already given.

- In the absence of general consent, CBI would have to apply to the state government for its consent in every individual case, and before taking even small actions.

- In the absence of general consent, CBI would have to apply to the state government for its consent in every individual case, and before taking even small actions.

Withdrawal of consent

- Traditionally, almost all states have given CBI general consent. However, since 2015, several states have begun to act differently.

- On March 4 2022, Meghalaya became the ninth state to have withdrawn consent to the CBI — after Maharashtra, Punjab, Rajasthan, West Bengal, Jharkhand, Chhattisgarh, Kerala, and Mizoram. Out of these states, Maharashtra has now reversed its decision and restored general consent.

INTERNATIONAL RELATIONS

2. PAKISTAN IS OFF FATF’s GREY LIST: WHAT DOES THAT MEAN?

THE CONTEXT: Pakistan is off the ‘grey list’ of the Financial Action Task Force (FATF) after four years, a development that has been welcomed across the country.

THE EXPLANATION:

What does that mean? Let’s start with FATF.

- The Financial Action Task Force (FATF) is commonly referred to as the world’s “terrorism financing watchdog”, which means it is the author — and custodian — of an international regime that works to ensure that the flows of money in the global financial system are not misused to fund terrorist activities.

- FATF describes itself as an inter-governmental body that works to “set standards and promote effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system”.

And what is the FATF’s grey list?

- FATF maintains a “grey list” of countries that it watches closely. In essence, these are countries that have, in the assessment of the FATF, failed to prevent international money laundering and terrorist financing, and are, therefore, on a global watchlist for bad behaviour.

- Pakistan was the most important country on the list. After it (along with Nicaragua) was taken off the list, 23 countries remain under watch.

- Among these countries are the Philippines, Syria, Yemen, the United Arab Emirates, Uganda, Morocco, Jamaica, Cambodia, Burkina Faso, and South Sudan, and the tax havens of Barbados, Cayman Islands, and Panama.

What are countries on the grey list expected to do?

- FATF calls these countries “jurisdictions under increased monitoring”. Basically, these countries have to comply with certain conditions laid down by the FATF, failing which they run the risk of being “black listed” by the watchdog. Their compliance is periodically reviewed by the FATF.

- According to the FATF, when a jurisdiction is placed under increased monitoring, “it means the country has committed to resolve swiftly the identified strategic deficiencies within agreed timeframes and is subject to extra checks”.

- Specifically, these jurisdictions are now “actively working with the FATF to address strategic deficiencies in their regimes to counter money laundering, terrorist financing, and proliferation financing”.

ENVIRONMENT, ECOLOGY AND CLIMATE CHANGE

3. DURGAVATI TIGER RESERVE

THE CONTEXT: Madhya Pradesh Wildlife Board recently approved the establishment of a new tiger reserve called Durgavati Tiger Reserve.

THE EXPLANATION:

- The Madhya Pradesh Wildlife Board recently approved the creation of the Durgavati Tiger Reserve.

- It will host tigers of Panna Tiger Reserve (PTR), quarter of which is set to be submerged because of the linking of Ken-Betwa rivers.

- It will span cross 2,339 square kilometres new tiger reserve, covering Narsinghpur, Damoh and Sagar districts of Madhya Pradesh.

- It will have 1,414 sq km of land as core area and 925 sq km area of buffer zone.

- The tigers will be shifted to the new reserve by encouraging their natural movement via a green corridor that will link it with Panna Tiger Reserve.

- The proposal is in line with the National Tiger Conservation Authority’s order urging Uttar Pradesh and Madhya Pradesh governments to notify new tiger reserves to manage wildlife in Panna Tiger Reserve, which will be impacted by the Ken-Betwa river linking project.

- Earlier, in September 27, the Uttar Pradesh Cabinet approved the notification of fourth tiger reserve in the state in the Ranipur Wildlife Sanctuary (RWS), which is frequented by tigers from the Panna Tiger Reserve.

Ken-Betwa link project

- The Ken-Betwa link project is set to become one of the first river interlinking projects implemented in India. At the Union Budget 2022-23, Rs 44,605 crore was allocated for this project. It is expected to provide for the irrigation needs to around 9 lakh hectares of farmland and drinking water for over 62 lakh people.

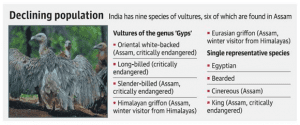

- It will also generate 103 Mega Watt of hydropower and 27 Mega Watt of solar power. The project will be especially beneficial for the drought prone Bundelkhand region. It is expected to be completed in over 8 years. It may adversely affect various species in the Panna Tiger Reserve, which is home to the largest population of vultures in Central India.

SCIENCE AND TECHNOLOGY

4. WHAT IS INTERPOL METAVERSE?

THE CONTEXT: Recently, The Interpol Metaverse was launched at the 90th General Assembly held in New Delhi.

THE EXPLANATION:

- The world’s first metaverse specifically designed for law enforcement was launched recently.

- It enables the registered users to take virtual tour of Interpol’s general secretariat headquarters in Lyon, France to interact with other officers through their avatars.

- It also provides training courses on forensic investigation and other policing skills.

- This newly launched facility is provided via the Interpol’s secure cloud.

- It is currently fully operational for use by law enforcement officials from 195 member countries of the Interpol.

- It provides benefits like remote work capabilities, networking, collection and preservation of evidence from crime scenes and capacity building.

- It enables trainees to receive hands-on experiences in new skills related to law enforcement.

- Metaverse’s role is expected to widen in the near future, with an estimated one in every four people spending at least an hour in Metaverse to work, study, shop and socialize in the year 2026.

- With this comes the growing concerns of the security and safety in the metaverse.

- The World Economic Forum, which collaborated with the Interpol, meta, Microsoft and others to define and govern metaverse, warned that social engineering challenges, violent extremism and misinformation will be the major threats in metaverse.

- In the future, crimes targeting children, data theft, money laundering, financial fraud, counterfeiting, ransomware, phishing, and sexual assault and harassment are expected to occur in the metaverse.

- This is going to be major challenge since current laws do not consider some of these activities as crimes when they occur in virtual world and not in physical world.

- Interpol Metaverse will help address these issues and create a secure future by providing training and capacity building opportunities for law enforcement officials.

- It will also create a forum for discussions of such concerns among the members of the Interpol.

PRELIMS PERSPECTIVE

5. “MOST POPULAR GI” AWARD

THE CONTEXT: Union Ministry of Commerce and Industry recently conferred the ‘Most Popular GI’ award to Hyderabadi Haleem and other GI products

THE EXPLANATION:

- Hyderabadi Haleem received the ‘Most Popular GI’ award under the food category and agriculture category.

- It received the award by beating dishes like Rasgulla, Bikaneri Bhujia, and Ratlami Sev.

- The award was presented to the director of Pista House and president of Hyderabad Haleem Makers Association MA Majeed.

- Under the handicraft category, Thanjavur Art Plate from Tamil Nadu won the award.

- Mysore Sandal Soap from Karnataka received the award under the manufacturing category and Uttar Pradesh’s Chunar Balua Patthar won in the natural category.

- The winners of this award were chosen based on the popular vote.

About Hyderabadi Haleem

- Hyderabadi Haleem is a unique meat-based aromatic stew-like dish made with lentils, wheat, and spices. It is consumed mainly during Ramzan. During the holy month of Ramadan, Haleem outlets are set up in Hyderabad. These outlets mainly serve Muslims breaking their fast in the evening. The dish received the GI tag in 2010. It is the first non-vegetarian dish in India to receive it. Its GI tag was renewed in May 2022. The tag expired in December 2019. It is the only product in Telangana to receive a GI tag under the foodstuff category.

What is a GI tag?

- The Geographical Indication (GI) tag is given to products so that only authorized people can use the popular product’s name. It is given to products having a specific geographical origin and qualities or reputation associated with that origin.

- It was given to products related to agriculture, handicrafts, foodstuffs, spirit drinks, and industrial products. The first product to receive this tag is Darjeeling Tea. The rules and regulations of the GI tag are governed by the WTO’s agreement on trade-related aspects of intellectual property rights. In India, GI products are governed by the Geographical Indications of Goods (Registration and Protection) Act, 1999.

6. WHO IS ACTOR ANNA MAY WONG, THE FIRST ASIAN-AMERICAN TO BE FEATURED ON US CURRENCY?

THE CONTEXT: Anna May Wong, a Chinese-American movie star in Hollywood, is set to become the first Asian-American to feature in US currency.

THE EXPLANATION:

- A quarter-dollar coin depicting a close-up image of Anna May Wong will commence circulation on October 24, 2022.

- This will be the fifth coin in the American Women Quarters (AWQ) Program.

- It will have the Latin phrase “E PLURIBUS UNUM”, which means “out of many, one”.

- It is designed to recognize Wong’s accomplishments while overcoming challenges and hurdles during her lifetime.

- Wong is regarded as Hollywood’s first Chinese-American star, having a decades-long career in motion pictures, television, and theatre amid the widespread racism in the United States.

- As the first Asian female actor, she faced discrimination and was cast aside in favour of non-Asian actresses.

- She was forced to play exoticized stereotypes of East Asians and could not get lead roles in films because of laws prohibiting actors from different races from kissing on screen.

- She is famed for dying a thousand deaths due to the villainous roles she played.

- Wong received a star on the Hollywood Walk of Fame. She was the first Asian American actress to do so. Lucy Liu became the second Asian American woman to achieve this feat in 2019.

- Wong was born in Los Angeles to second-generation Taishanese Chinese-American parents in 1905.

- During the silent film era, she featured in “The Toll of the Sea” (1922) – one of the first colour films.

American Women Quarters (AWQ) Program

The AWQ program is a four-year program that honors the achievements of women in the United States from 2022 to 2025. Under this program, the US mint will issue a series of quarters featuring notable women in United States History. Till date, Maya Angelou, Dr. Sally Ride, Wilma Mankiller, and Nina Otero-Warren have been featured under the program.

THE PRELIMS PRACTICE QUESTION

QUESTION OF THE DAY

Q1. Groningen gas fields, recently seen in news, are located in-

India’s first slender loris sanctuary was recently set up in which of the following state of India?

a) Kerala

b) Karnataka

c) Tamil Nadu

d) Assam

Answer: C

Explanation:

India’s first slender loris sanctuary in Tamil Nadu

- Tamil Nadu government has notified the country’s first Kadavur slender loris sanctuary covering 11,806 hectares in Karur and Dindigul districts of the State.

- Slender lorises are small nocturnal mammals and are arboreal in nature, as they spend most of their life on trees.

- The species, listed as endangered as per the IUCN, acts as a biological predator to pests of agricultural crops and benefits farmers.

TOPIC : RBI REVISED PCA FRAMEWORK FOR BANKS

THE CONTEXT: In November 2021, RBI issued a revised Prompt Corrective Action (PCA) Framework for Scheduled Commercial Banks (SCBs) excluding Small Finance Banks, Payment Banks, and Regional Rural Banks to enable intervention at the appropriate time and require the SCB to initiate and implement remedial measures in a timely manner. The provisions of the revised PCA framework will be effective from January 1, 2022. The detailed analysis of the development is as follows.

THE DEVELOPMENT

- The revised framework excludes return on assets as a parameter that may trigger action under the framework.

- Payments banks and small finance banks (SFBs) have also been removed from the list of lenders where prompt corrective action can be initiated. Capital, asset quality and leverage will be the key areas for monitoring in the revised framework.

- Indicators to be tracked for capital, asset quality and leverage would be CRAR/ common equity tier I ratio, net NPA ratio and tier I leverage ratio, respectively.

- In governance-related actions, the RBI can supersede the board under Section 36ACA of the BR Act, 1949.

- The framework will apply to all banks operating in India, including foreign banks operating through branches or subsidiaries based on breach of risk thresholds of identified indicators.

WHAT HAS CHANGED?

2017 (Revised) Framework

Key Monitoring areas

Capital, asset quality and profitability, while leverage would be monitored additionally.

Indicators to be tracked

Capital, asset quality and profitability would be CRAR/ Common Equity Tier I ratio, Net NPA ratio and Return on Assets, respectively.

Profitability – ROA

Negative ROA for 2/3/4 consecutive years

Leverage

Tier 1 Leverage ratio:

- Threshold 1: <=4.0% but > = 3.5% (leverage is over 25 times Tier 1 capital)

- Threshold 2: < 3.5% (leverage is over 28.6 times Tier 1 capital)

Expense monitoring

The following points were mandatory:

- Threshold 2: Higher provisions as part of the coverage regime

- Threshold 3: Restriction on management compensation and directors’ fees, as applicable

Discretionary Corrective Actions – Special Supervisory Actions

RBI could amalgamate/ reconstruct a bank under extant regulations

Exit from PCA and Withdrawal of Restrictions under PCA

Exit of a bank from the PCA framework was based on RBI’s assessment on multiple parameters based on the financials of the bank.

New Framework

Key Monitoring areas

Capital, Asset Quality and Leverage

Indicators to be tracked

Capital, Asset Quality and Leverage would be CRAR/ Common Equity Tier I Ratio, Net NPA Ratio, and Tier I Leverage Ratio, respectively.

Profitability – ROA

Has been removed from the New Framework

Capital – Risk Threshold 3

RBI has specifically included this level of 400 bps below CRAR as a monitorable

Leverage

Monitoring of leverage has been made explicit and levels have been made explicit across thresholds

- Threshold 1: Up to 50 bps below the regulatory minimum

- Threshold 2: More than 50 bps but not exceeding 100 bps below the regulatory minimum

- Threshold 3: More than 100 bps below the regulatory minimum

Expense monitoring

These actions have been included in discretionary activities and have been made applicable across all thresholds. They have been combined and made more stringent by restriction/ reduction on variable operating costs, outsourcing activities, and restriction/reduction of outsourcing activities. Further restrictions on capital expenditure, other than for technological up-gradation within board-approved limits, have been made mandatory in risk threshold 3.

Discretionary Corrective Actions – Special Supervisory Actions

The RBI has specifically included resolution of the bank by Amalgamation or Reconstruction (Ref. Section 45 of Banking Regulation Act 1949) under the revised framework.

Exit from PCA and Withdrawal of Restrictions under PCA

The new framework has laid down an explicit framework for a bank to exit the PCA framework as follows:

Once a bank is placed under PCA, taking the bank out of PCA Framework and/or withdrawal of restrictions imposed under the PCA Framework will be considered: a) if no breaches in risk thresholds in any of the parameters are observed as per four continuous quarterly financial statements, one of which should be Audited Annual Financial Statement (subject to assessment by RBI); and b) based on Supervisory comfort of the RBI, including an assessment on sustainability of profitability of the bank.

WHAT IS PCA FRAMEWORK?

- Prompt Corrective Action or PCA is a framework under which banks with weak financial metrics are put under watch by the RBI. The PCA framework deems banks as risky if they slip below certain norms on three parameters — capital ratios, asset quality and profitability.

- Based on where a bank stands on these ratios, it has three risk threshold levels (1 being the lowest and 3 the highest). Banks with capital to risk-weighted assets ratio (CRAR) of less than 10.25 per cent but more than 7.75 per cent fall under threshold 1.

- Those with CRAR of more than 6.25 per cent but less than 7.75 per cent fall in the second threshold. In case a bank’s common equity Tier 1 (the bare minimum capital under CRAR) falls below 3.625 per cent, it gets categorised under the third threshold level.

- Banks that have a net NPA of 6 per cent or more but less than 9 per cent fall under threshold 1, and those with 12 per cent or more fall under the third threshold level.

- On profitability, banks with negative return on assets for two, three, and four years fall under threshold 1, threshold 2 and threshold 3, respectively.

WHAT IS THE PURPOSE OF THE PCA FRAMEWORK?

- The objective of the PCA framework is to enable supervisory intervention at the appropriate time and require the supervised entity to initiate and implement remedial measures in a timely manner to restore its financial health.

- Act as a tool for effective market discipline.

- It does not preclude the Reserve Bank of India from taking any other action as it deems fit at any time, in addition to the corrective actions prescribed in the framework”.

- In the last almost two decades — the PCA was first notified in December 2002 — several banks have been placed under the framework, with their operations restricted. In 2021, UCO Bank, IDBI Bank and Indian Overseas Bank exited the framework on improved performance. Only the Central Bank of India remains under it now.

HOW DO BANKS BENEFIT FROM PCA?

- One of the objectives of PCA is to amend a bank’s mistakes before they lead to a crisis.

- RBI controls the loan disbursal of banks belonging to the PCA watchlist. That said, note that the regulator does not entirely prohibit PCA banks from disbursing loans.

- RBI’s PCA framework has been designed to improve a bank’s financial performance by tracking vital metrics. In other words, it involves the RBI taking remedial measures.

- PCA banks cannot enter a new line of business, which improves their core financials.

- In some rare cases RBI might choose to close non-compliant banks or initiate amalgamation for them.

WHEN DOES RBI INVOKE PROMPT CORRECTIVE ACTION?

RBI considers four factors to determine whether it needs to put a bank under the PCA framework. These include profitability, asset quality, capital ratios and debt level. The central bank grades each of these factors based on actions depending upon the grade/threshold level, categorised from one to three, where 1 is the lowest of the lot and 3 being the highest based on how banks stand with respective frameworks.

Following is a look at these factors and their grades:

CAPITAL ADEQUACY RATIO (CRAR)

- The CRAR is the capital needed for a bank measured in assets (mostly loans) disbursed by the banks. The higher the assets, the higher should be the capital retained by the bank. This measures how much debt and equity capital banks possess to cover their asset book risk. If CRAR is less than 10.25%, but above 7.75%, the bank falls in the first grade. Banks having a CRAR of over 6.25%, but below 7.75%, fall under grade 2. However, if a bank’s capital adequacy ratio is less than 3.625%, it is categorised under grade 3.

ASSET QUALITY

- This parameter refers to the non-performing assets of a bank. If the net NPA of a bank is more than 6%, but less than 9%, it falls under the first threshold. If Net NPA crosses the 9% mark, it triggers the second grade. That said, if this metric is 12% or more, the bank will fall in the third grade of PCA.

PROFITABILITY

- The regulator considers the bank’s return on assets (ROA) as the key measure for profitability. Note that if a bank’s ROA is negative for two, three and four years in a row, it will be categorised as grade 1, grade 2 and grade 3, respectively.

DEBT LEVEL/LEVERAGE

- The last factor that RBI considers to measure the financial risk of any bank is its overall debt level/leverage. The regulator triggers grade 1 if the overall leverage is more than 25 times its Tier 1 capital. However, when total leverage is over 28.5 times its core capital (including disclosed reserves), RBI acts according to grade 2 of PCA.

WHAT HAPPENS WHEN RBI PUTS A BANK UNDER PCA?

When RBI puts a bank on its PCA watchlist, it imposes two types of limitations on it – mandatory and discretionary. These include restrictions related to the expansion of a branch, dividend, and director’s remuneration and so on.

Nevertheless, the Central Bank may choose to take these actions at their discretion, where the RBI can:

- Ask the bank’s board to reassess its business model and evaluate the profitability of the business line and operations.

- Advise banks to reassess their business plans and strategy to take remedial measures, including dismissing certain officials from employment.

- Ask a Bank’s board to implement a resolution plan after seeking approval from the supervisor.

- Advise banks to gauge their viability over the medium to long term besides evaluating balance sheet estimates.

- PCA banks might not be able to hire more employees or fill up vacant positions.

- Lastly, RBI may allow PCA banks to incur capital expenditure only to upgrade technology. However, the allocation of funds for the same has to be within pre-approved limits.

ANALYSIS OF NEW FRAMEWORK

- The revised rules propose changes on three fronts —

- the triggers to invoke PCA against a bank,

- the mandatory actions RBI may take after it

- conditions for a bank to exit it.

- Rules currently allow RBI to invoke PCA, if a bank’s capital-to-risk weighted assets ratio and Tier 1 capital ratio, Return on Assets (ROA), net Non-Performing Assets and leverage fall well short of statutory thresholds.

- Under the new regime, a negative ROA will no longer trigger a bank to invite corrective action. This appears sensible because the accounting profit for a bank is the residual sum left over after provisioning for bad and doubtful loans.

- A bank that proactively provisions for possible NPAs and maintains high provision coverage may report losses, but is better protecting the interests of its stakeholders than a bank that skimps provisioning to show a profit.

- Some of the corrective actions to be taken by RBI once a bank falls under PCA, have been left to its discretion instead of being mandated.

- PCA rules require RBI to enforce higher provisioning norms and cap management compensation. The new rules allow it to take a discretionary call, perhaps to avoid denting depositor confidence.

- The existing curbs placed by the RBI on PCA banks lending to lower-rated or unsecured borrowers have been diluted and replaced with more generic powers, which is a good step.

THE CONCLUSION: While the new framework rightly affords RBI greater flexibility in resolving stressed banks on a case-to-case basis, the roadmap it offers for a bank’s exit from PCA appears to run counter to this. While such exit was earlier left to RBI’s discretion, the new regime requires a bank to stay above-mandated capital, NPA and leverage thresholds for four consecutive quarters to apply for the exit. This may be a rather high bar. A troubled bank can mend its capital adequacy or leverage quickly with an infusion from its promoter. But resolving legacy NPAs often requires it to pursue business growth or margin-improving strategies that may not be possible while PCA ties its hands.

DAILY CURRENT AFFAIRS (OCTOBER 21, 2022)

POLITY AND CONSTITUTION

1.COMPETITION COMMISSION OF INDIA IMPOSED A FINE ON MAKEMYTRIP, GOIBIBO AND OYO

THE CONTEXT: Recently,the Competition Commission of India (CCI) fined online hotel booking sites MakeMyTrip and Goibibo, and IPO-bound budget hotel chain OYO for a total of over Rs. 392 crore ($47 million) for anti-competitive conduct in hotel room listings.

THE EXPLANATION:

The competition watchdog had been investigating the companies since 2019, after the Federation of Hotel & Restaurant Associations of India (FHRAI) lodged a complaint that MakeMyTrip gave “special treatment” to SoftBank-backed Oyo on its platform. It had also complained that a listing agreement between the companies was creating a dominance in the online hotel booking market, and that MakeMyTrip used deep discounting methods.

What did the CCI say in its order?

- In a redacted order made public, the CCI said that MakeMyTrip and Goibibo will have to fix their “market behaviour”. According to CCI, apart from the monetary penalty, “MMT-Go [MakeMyTrip] is directed to suitably modify its agreements with hotels/chain hotels, to remove/abandon the price and room availability parity obligations imposed by it on its hotel/chain hotel partners with respect to other OTAs”.

- This essentially means that MakeMyTrip cannot force hotels it has partnered with to offer identical or higher prices on other platforms.

- “The Commission is of the view that the commercial arrangement between OYO and MMT-Go which led to the delisting of FabHotels, Treebo and the independent hotels, which were availing the services of these franchisors, was anticompetitive”.

VALUE ADDITION:

About Competition Commission of India (CCI)

- Competition Commission of India (CCI) is a statutory and quasi-judicial body and works under the Ministry of Corporate Affairs.

- The Competition Commission of India (CCI) was established in March 2009 (established in 2003 but became fully functional in 2009) by the Government of India under the Competition Act, 2002 for the administration, implementation, and enforcement of the Act.

- Competition Act, 2002: It repealed and replaced the Monopolies and Restrictive Trade Practices Act, 1969 (MRTP Act).

- Under the Act, the Competition Commission of India and the Competition Appellate Tribunal (COMAT) have been established.

- The Act prohibits anti-competitive agreements, abuse of dominant position by enterprises, and regulates combinations (acquisition, acquiring of control, and Merger and acquisition), which causes or are likely to cause an appreciable adverse effect on competition within India.

- In 2017, functions of the COMAT were subsumed under National Company Law Appellate Tribunal (NCLAT).

- Composition: It has a chairperson and 6 Members appointed by the Central Government.

- These members are appointed for 5 years or 65 years of age (whichever comes first). However, these members are eligible for reappointment.

Objectives and functions of CCI:

- To Eliminate practices having an adverse effect on competition

- To promote and sustain competition

- To protect the interests of consumers

- To ensure freedom of trade in the markets of India

- To Establish a robust competitive environment through:

- Proactive engagement with all stakeholders, including consumers, industry, government, and international jurisdictions.

- Being a knowledge-intensive organization with high competence level.

- Professionalism, transparency, resolve, and wisdom in enforcement.

ENVIRONMENT, ECOLOGY AND CLIMATE CHANGE

2. ‘MISSION LIFE’ (LIFESTYLE FOR ENVIRONMENT)

THE CONTEXT: Recently, Prime Minister in the presence of U.N. Secretary-General Antonio Guterres, launched ‘Mission LiFE’ (Lifestyle For Environment), a new initiative for sustainable and healthy lifestyle at the Statue of Unity in Gujarat.

THE EXPLANATION:

- Listing climate change and global warming as the main challenges before the world and mankind, the Prime Minister underlined that Mission LiFE makes the fight against climate change democratic with the contribution of everyone in per own capacity.

- According to him, India and the UN have joined hands in this new initiative which will become a global success. “India had proposed the International Day of Yoga, which was supported by the UN. Today it is inspiring millions of people around the world to lead a healthy life.”

OBJECTIVE OF THE INITIATIVE:

- LiFE envisions replacing the prevalent ‘use-and-dispose’ economy—governed by mindless and destructive consumption—with a circular economy, which would be defined by mindful and deliberate utilization.

- The Mission intends to nudge individuals to undertake simple acts in their daily lives that can contribute significantly to climate change when embraced across the world.

- LiFE plans to leverage the strength of social networks to influence social norms surrounding climate. The Mission plans to create and nurture a global network of individuals, namely ‘Pro-Planet People’ (P3), who will have a shared commitment to adopt and promote environmentally friendly lifestyles.

- Through the P3 community, the Mission seeks to create an ecosystem that will reinforce and enable environmentally friendly behaviours to be self-sustainable.

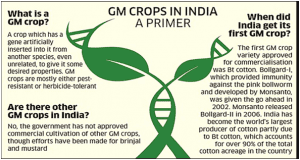

3. ‘APPROVAL OF GM MUSTARD MAY THREATEN FOOD SECURITY, INCREASE PESTICIDE TOLERANCE’

THE CONTEXT: According to experts, genetically modified crops may soon get the central government nod, a move that could pose a threat to crop diversity, food security and increase tolerance for use of pesticides.

THE EXPLANATION:

- Genetic Engineering Appraisal Committee (GEAC), which functions in the Union Ministry of Environment, Forest and Climate Change, might approve the commercial cultivation of modified mustard. A group of activists have also written to the ministry, objecting to the potential approval of “unsafe, unneeded and unwanted genetically modified organisms.”

- Also, they move might also severely affect the agrarian sector, as the seed market will be in the hands of private companies instead of farmers.

- This would be the first time since 2002 for such approval to grow GM mustard, a genetically modified hybrid variety of the mustard species, for consumption by the masses.

- However, experts fear that such a move would have multiple repercussions for crop diversity and threaten food security as a whole.

- The green signal for GM mustard was given by the central government in May 2017 after trials in Punjab Agricultural University (PAU) and Indian Agricultural Research Institute (IARI), New Delhi.

- However, it remained pending for approval from the environment ministry. The decision to approve it took a pause after activists and farmer bodies approached the Supreme Court to oppose the move.

ABOUT GM MUSTARD:

- Mustard is one of India’s most important winter crops sown between mid-October and late November.

- It a self-pollinating crop difficult to hybridise naturally as it cross-pollinate.

- It is largest edible oil yielding crop of India.

- DMH (Dhara Mustard Hybrid)-11 is genetically modified variety of mustard developed by Centre for Genetic Manipulation of Crop Plants at Delhi University.

VALUE ADDITION:

Genetic Engineering Appraisal Committee (GEAC) :

- The Genetic Engineering Appraisal Committee (GEAC) functions in the Ministry of Environment, Forest and Climate Change (MoEF&CC).

- It is responsible for appraisal of activities involving large scale use of hazardous microorganisms and recombinants in research and industrial production from the environmental angle.

- The committee is also responsible for appraisal of proposals relating to release of genetically engineered (GE) organisms and products into the environment including experimental field trials.

- GEAC is chaired by the Special Secretary/Additional Secretary of MoEF& CC and co-chaired by a representative from the Department of Biotechnology (DBT). Presently, it has 24 members and meets every month to review the applications in the areas indicated above.

SECURITY AFFAIRS

4. ‘SCORCHED-EARTH TACTICS’

THE CONTEXT: Recently, German Chancellor Olaf Scholz said Russian President Vladimir Putin was using “energy and hunger” as weapons but his “scorched earth tactics” would not help Russia win the war over Ukraine.

THE EXPLANATION:

What are scorched earth tactics?

- Scorched earth tactics form part of a military strategy which seeks to destroy anything that could be of use to the enemy, including energy supplies, bridges, provision stores, agricultural fields, road and railway links, etc. The destruction could be carried out by the enemy, or by the retreating army of a country which does not want invaders to use its resources. Harming civilians as part of this strategy has been banned under the 1977 Geneva Convention.

- According to the Oxford Reference, the “term was first used in English in 1937 in a report of the Sino-Japanese conflict, and is apparently a translation of Chinese jiāotŭ.”

- The strategy seeks to deplete the enemy’s resources to sustain warfare, and also break their morale by inflicting heavy hardships on combatants and non-combatants alike.

Over the past week, Russia has rained missiles on Ukraine’s cities, destroying civilian infrastructure, including power and water supply lines. As winter approaches, lack of electricity is likely to cause serious suffering. Experts have commented that the tactic is being used by Russia as on the actual battlefield, its military is experiencing setbacks.

Some past instances

- Scorched earth policy has been part of warfare since ancient times, with the nomad Scythians using the tactics in their war against the Persian Achaemenid Empire led by King Darius the Great (who ruled 522 BCE to 486 BCE). The nomadic herders Scythians would hide in the steppes after destroying food supplies and poisoning wells.

- In India, the armies of Maratha leader Chhatrapati Shivaji were known for their scorched earth tactics. Some historians have said that while the Maratha leaders looted and burnt enemy towns, they were under orders to not harm civilians or desecrate religious sites

GOVERNMENT SCHEMES AND INITIATIVES IN NEWS

5. CENTRE LAUNCHES PROGRAMME TO STRENGTHEN KASHI-T.N. BOND- KASHI-TAMIL SANGAMAM’

THE CONTEXT: Amid the continued debates over the imposition of Hindi across the country, the Union Government announced a month-long programme to “strengthen” and “rekindle” the cultural and civilisational bond between Tamil Nadu and Varanasi.

THE EXPLANATION:

- Named the ‘Kashi-Tamil Sangamam’, the programme would be held from November 16 to December 16 this year.

- “The period will cover the Tamil month of Karthikeya during which all Tamil households go pray to Lord Shiva. This programme, which would be a part of the Ek Bharat Shreshtha Bharat initiative, is aimed at rekindling the civilisational link between the new Kashi and Tamil Nadu — both deep centres of knowledge.

- As part of the programme, a total of 2,500 people divided into 12 groups would be travelling to Varanasi by train during the month-long period. The journey points in Tamil Nadu would be Chennai, Rameswaram and Coimbatore. The groups would include students, teachers, artisans and people from various walks of life.

- The knowledge partners for the Kashi-Tamil Nadu Sangamam programme would be IIT-Madras and the Banaras Hindu University, while the Uttar Pradesh government would be the host State.

- The other stakeholders would be departments of culture, textiles, food-processing, commerce and films.

SIGNIFICANCE:

- The Kashi Tamil Sangamam is a first of its kind initiative to showcase the entire Tamil cultural heritage.

- Activities will be centred around a series of themes – ancient texts, literature, spirituality, philosophy, music, dance, drama, yoga, Ayurveda, handlooms, handicrafts etc.

- Bharatanatyam dance, Carnatic music, Tamil folk music, Nadaswaram music concert, Thevaram thiruvasagam in Tamil music form, debate on Kamba Ramayana, Villu-paattu, Bommalattam, Silambattam, Kavadi Attam, Karagam, Pattimandram, Tamil folk dances Karakattam, Poikkal Kuthirai, Thappaattam, etc., have been planned across different locations in Varanasi.

VALUE ADDITION:

EK BHARAT SHRESHTHA BHARAT PROGRAMME

Ek Bharat Shreshtha Bharat programme aims to enhance interaction & promote mutual understanding between people of different states/UTs through the concept of state/UT pairing. The states carry out activities to promote a sustained and structured cultural connect in the areas of language learning, culture, traditions & music, tourism & cuisine, sports and sharing of best practices, etc.

The mission of Ek Bharat Shreshtha Bharat is as follows:

- To CELEBRATE the Unity in Diversity of our Nation and to maintain and strengthen the fabric of traditionally existing emotional bonds between the people of our Country;

- To PROMOTE the spirit of national integration through a deep and structured engagement between all Indian States and Union Territories through a year-long planned engagement between States;

- To SHOWCASE the rich heritage and culture, customs and traditions of either State for enabling people to understand and appreciate the diversity that is India, thus fostering a sense of common identity

- To ESTABLISH long-term engagements and,

- To CREATE an environment which promotes learning between States by sharing best practices and experiences.

6. U.P. BAGS TOP HONOURS AT PMAY-U AWARDS 2021

THE CONTEXT: Recently, Union Ministry of Housing & Urban Affairs recognized the states for PMAY-U Awards 2021.

THE EXPLANATION:

- Uttar Pradesh bagged the first position followed by Madhya Pradesh and Tamil Nadu at second and third place, respectively.

- Poll-bound Gujarat saw five special category awards — for performance related to Affordable Rental Housing Complexes and ‘Convergence with other Missions’ — coming its way.

- Madhya Pradesh got three special category awards followed by Jammu and Kashmir, which was adjudged the ‘Best Performing UT’ alongside Dadra and Nagar Haveli and Daman & Diu.

- Also, Kudumbashree has received two national awards of the Pradhan Mantri Awas Yojana (PMAY) Urban Award 2021.

- According to the Ministry of Housing and Urban Affair, 1.23 crore houses were sanctioned under the scheme of which 64 lakh — over 52% — have already been completed and delivered while the rest were at various stages of completion.

- Also, the Ministry highlighted that PMAY-U, had emerged as the largest housing scheme in the world since its launch seven years ago in June, 2015 with the number of houses sanctioned under it so far — 1.23 crore — “9 times the number that was achieved in the 10 years of the previous regime” between 2004 and 2014.

VALUE ADDITION:

Pradhan Mantri Awas Yojana (Housing for All – Urban):

PMAY-U scheme is aimed at confronting and tiding over the shortage of housing facilities in urban India for beneficiaries under the Economically Weaker Section (EWS), Low-Income Groups (LIGs) and Middle Income Groups (MIGs) categories.

Scope

- The Mission covers the entire urban area consisting of Statutory Towns, Notified Planning Areas, Development Authorities, Special Area Development Authorities, Industrial Development Authorities or any such authority under State legislation which is entrusted with the functions of urban planning & regulations.

- “Housing for All” Mission for urban area is being implemented during 2015-2022 and this Mission will provide central assistance to implementing agencies through States and UTs for providing houses to all eligible families/beneficiaries by 2022.

- Mission will be implemented as Centrally Sponsored Scheme (CSS) except for the component of credit linked subsidy which will be implemented as a Central Sector Scheme.

THE PRELIMS PRACTICE QUESTION

QUESTION OF THE DAY

Q1. Groningen gas fields, recently seen in news, are located in-

a) Russia

b) Netherlands

c) S.A.

d) Mexico

Answer: B

Explanation:

Please refer to the given map-

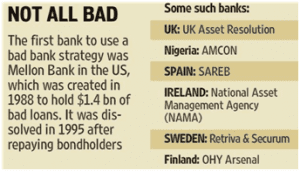

TOPIC : THE BAD BANK- ISSUES, CHALLENGES AND WAY FORWARD

THE CONTEXT: In September 2021, Union Finance Minister announced that the Cabinet had approved Rs 30,600 crore in security receipts to be issued by the National Asset Reconstruction Company (NARC) or Bad Bank towards the resolution of bad loans.

WHAT IS THE PROPOSAL?

- The move is another step in the direction of making the NARC operational.

- Banks have identified bad loans worth Rs 2 lakh crore, which will be shifted to the NARC for resolution, and nearly Rs 90,000 crore of bad debt would be resolved in the first phase.

- The NARC is now awaiting a licence of operation from the Reserve Bank of India after applying with the central bank.

- The government indicated that the licence is under process and could be issued soon.

THE DEVELOPMENT SO FAR

- The National Asset Reconstruction Company Limited (NARCL) has already been incorporated under the Companies Act. It will acquire stressed assets worth about Rs 2 lakh crore from various commercial banks in different phases.

- Another entity — India Debt Resolution Company Ltd (IDRCL), which has also been set up — will then try to sell the stressed assets in the market. The NARCL-IDRCL structure is the new bad bank.

- To make it work, the government has okayed Rs 30,600 crore to be used as a guarantee.

How will the NARCL-IDRCL work?

- The NARCL will first purchase bad loans from banks, and it will pay 15% of the agreed price in cash, and the remaining 85% will be in the form of “Security Receipts”. When the assets are sold, with the help of IDRCL, the commercial banks will be paid back the rest.

- Suppose the bad bank is unable to sell the bad loan or has to sell it at a loss. In that case, the government guarantee will be invoked and the difference between what the commercial bank was supposed to get and what the bad bank was able to raise will be paid from the Rs 30,600 crore that the government has provided.

ALL YOU NEED TO KNOW ABOUT BAD BANK

What is the bad bank?

- A bad bank is a financial entity set up to buy banks’ non-performing assets (NPAs) or bad loans.

- Setting up a bad bank aims to help ease the burden on banks by taking bad loans off their balance sheets and getting them to lend again to customers without constraints.

- After purchasing a bad loan from a bank, the bad bank may later try to restructure and sell the NPA to investors who might be interested in buying it.

- Generating profits is usually not the primary purpose of a bad bank – the objective is to ease the burden on banks, hold a large pile of stressed assets, and get them to lend more actively.

Why Bad Bank?

- Indian banks’ pile of bad loans is a significant drag on the economy, and it’s a drain on banks’ profits.

- Due to the lockdown imposed last year, the proportion of banks’ gross non-performing assets is expected to rise sharply from 7.5% of gross advances in September 2020 to at least 13.5% of gross advances in September 2021.

- Because profits are eroded, public sector banks (PSBs), where the bulk of the bad loans reside, cannot raise enough capital to fund credit growth.

- Lack of credit growth, in turn, comes in the way of the economy’s return to an 8% growth trajectory. Therefore, the bad loan problem requires effective resolution.

Evolution of Concept of Bad Bank:

- The concept was pioneered at the Pittsburgh-headquartered Mellon Bank in 1988 in response to problems in the bank’s commercial real estate portfolio.

- According to McKinsey & Co, the concept of a “bad bank” was applied in previous banking crises in Sweden, France, and Germany.

PROS AND CONS OF SETTING UP A BAD BANK

PROS

- In one quick move, a bank will get rid of all its toxic assets, which were eating up its profits.

- When the recovery money is paid back, it will further improve the bank’s position. Meanwhile, it can start lending again.

- It can help consolidate all bad loans of banks under a single exclusive entity. A single government entity will be more competent to take decisions rather than 28 individual PSBs.

- International experience: The troubled asset relief program, also known as TARP, implemented by the U.S. Treasury in the aftermath of the 2008 financial crisis, was modelled around the idea of a bad bank. Under the program, the U.S. Treasury bought troubled assets, such as mortgage-backed securities, from U.S. banks at the peak of the crisis and later resold them when market conditions improved. According to reports, it is estimated that the Treasury, through its operations, earned nominal profits.

CONS

- Former RBI governor Raghuram Rajan has been one of the critics, arguing that a bad bank backed by the government will merely shift bad assets from the hands of public sector banks, which the government owns, to the hands of a bad bank, which the government again owns.

- Analysts believe that unlike a bad bank set up by the private sector, a bad bank backed by the government is likely to pay too much for stressed assets.

- While this may be good news for public sector banks, which have been reluctant to incur losses by selling off their bad loans at low prices, it is bad news for taxpayers, who will once again have to foot the bill for bailing out troubled banks.

AN ANALYSIS OF THE MOVE?

IS IT A RIGHT MOVE?

- Professional Management: The new bad bank can be equipped with professional management which will be capable enough to run the assets and sell them while making a profit.

- Competition: The new bad bank can provide the required competition to the private bad banks and thus provide better pricing to the banks for their NPAs.

- Failure of the current system of Private Bad Banks: Banks are scared of selling the bad loans to private sector bad banks at a heavy discount due to the fear of being accused of causing loss to the bank and exchequer. Thus, the current system has failed.

- Ownership of new Bad Bank: The new bad bank should be owned by the Public sector banks and by private banks that want to join in and their respective shares of ownership can be their share in the total bad loan portfolio. Thus, the profit by resolution will accrue to the banks themselves and thus, the scare of causing loss to the bank and exchequer is eliminated.

CASE OF JHABUA POWER: IBC vs. Bad Bank

1. Jhabua power for resolution under Insolvency and Bankruptcy code on account of shortage of working capital.

2. Bids: Two bids were received for Jhabua power.

a. NTPC Bid – 1900 Crore at the rate of Rs. 3.2 per MW.

b. Adani Power – 750 crores at Rs 1.25 per MW.

Lesson: If NTPC had not entered the bid, the plant, in all probability, could have been purchased by Adani power at the cost to the exchequer. This would have given less money to the government and also brought the wrath of CVC/CBI and further litigation. A Bad bank can do this with expertise and manage the asset until it finds a suitable buyer.

WILL A ‘BAD BANK’ REALLY HELP EASE THE BAD LOAN CRISIS?