DAILY CURRENT AFFAIRS (OCTOBER 13, 2022)

POLITY AND CONSTITUTION

1. LANGUAGES PANEL RECOMMENDATIONS AND A FRESH ‘HINDI IMPOSITION’ ROW

THE CONTEXT: Recently, the 11th volume of the Report of the Official Language Committee headed by Home Minister, which was submitted to President in September 2022 has triggered angry reactions from the Chief Ministers of Tamil Nadu and Kerala, who have described the Report as an attempt by the Union government to impose Hindi on non-Hindi-speaking states.

THE EXPLANATION:

What is this language panel led by Union Home Minister?

- The Committee of Parliament on Official Language was set up in 1976 under Section 4 of The Official Languages Act, 1963. Section 4 of the Act says “there shall be constituted a Committee on Official language, on a resolution to that effect being moved in either House of Parliament with the previous sanction of the President and passed by both Houses”.

- The Committee is chaired by the union Home minister, and has, in accordance with the provisions of the 1963 Act, 30 members — 20 MPs from Lok Sabha and 10 MPs from Rajya Sabha. The job of the Committee is to review the progress made in the use of Hindi for official purposes, and to make recommendations to increase the use of Hindi in official communications.

What has the panel recommended in its latest (2021) report?

- The contents of the report submitted to President on September 9 by Union Home Minister and other members of the Committee are not in the public domain. Sources close to the Committee said it has made around 100 recommendations, including that Hindi should be the medium of instruction in IITs, IIMs, and central universities in the Hindi-speaking states.

- “The language used for communication in the administration should be Hindi, and efforts should be made to teach the curriculum in Hindi, but the latter is not mandatory. Lower courts in Uttar Pradesh, Uttarakhand, Madhya Pradesh, Bihar, Haryana, and Rajasthan already use Hindi.

- High Courts in other states, where proceedings are recorded in English or a regional language can make available translations in Hindi, because verdicts of High Court of other states are often cited in judgments,” according to sources, referring to the recommendations.

Is this the first time that such recommendations have been made?

- The makers of the Constitution had decided that both Hindi and English should be used as official languages for the first 15 years of the Republic, but in the wake of intense anti-Hindi agitations in the south, the Centre announced that English would continue to be used even after 1965.

- On January 18, 1968, Parliament passed the Official Language Resolution to build a comprehensive programme to increase the use of Hindi for official purposes by the Union of India.

- With the active promotion of Hindi being mandated by Article 351 of the Constitution, the Official Language Committee was set up to review and promote the use of Hindi in official communications. The first Report of the Committee was submitted in 1987.

- The ninth Report, submitted in 2011 by the panel headed by then Home Minister, made 117 recommendations, including suggestions to increase the use of Hindi in computers in government offices.

What does the new education policy say about teaching in Hindi and other regional languages?

- The announcement of the new National Education Policy (NEP) in 2020 too had triggered controversy over this issue. Politicians from Southern India had alleged attempts to “impose Hindi and Sanskrit”; however, the Centre had said it was only promoting regional languages.

- The NEP says that mother tongue or the regional language would be the “preferred” mode of instruction until Class 5, and possibly Class 8.

2. THE SUPREME COURT TO EXAMINE VALIDITY OF 2016 NOTE BAN AND HOW IT WAS DONE

THE CONTEXT: Recently, the Constitution Bench questioned whether the government and the Reserve Bank of India (RBI) realised their stated objectives of choking black money, terror financing and fake currency through the policy to demonetise ₹500 and ₹1,000 notes in 2016.

THE EXPLANATION:

- According to Solicitor-General questioned the very maintainability of the case which concerned a purely economic policy of the government.

- Also, it must be noted that Demonetisation in 1946 and 1978 were implemented through separate Acts debated by Parliament. In 2016, it was done through a mere notification issued under provisions of the Reserve Bank of India Act, 1934. The court should declare the law or nothing would stop the government from repeating the exercise which had seen “horrendous consequences”.

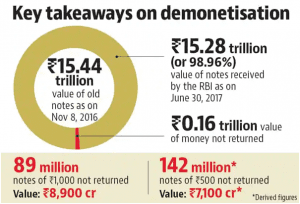

- Citing the RBI’s annual report, submitted that ₹15.44 lakh crore worth of currency was demonetised. The withdrawn money amounted to 86.4% of the currency in circulation at the time. Only ₹16,000 crore out of the ₹15.44 lakh crore was not returned. According to experts only .0027% fake currency was “captured” following demonetisation.

- The court wondered whether the government had thought about the consequences before going ahead with the withdrawal of the banknotes. It scheduled the next hearing on November 9, 2022 and directed the government and the RBI to file comprehensive affidavits in response to then opponent’s submissions.

INTERNATIONAL RELATIONS

3. HOW MUCH CRUDE OIL DOES THE EU STILL IMPORT FROM RUSSIA?

THE CONTEXT: According to the International Energy Agency (IEA), Russian oil imports into the European Union and United Kingdom fell 35% to 1.7 million barrels per day (bpd) in August from 2.6 million bpd in January 2022, but the EU was still the biggest market for Russian crude.

THE EXPLANATION:

- Recently Poland said it had detected a leak in one pipeline in the Druzhba system that carries oil from Russia to Europe, an event that will add to concerns about Europe’s energy security after the Nord Stream gas pipeline leak.

- The UK has already stopped importing Russian crude following Moscow’s invasion of Ukraine, and the EU will ban imports from December in an attempt to strip the Kremlin of revenue to fund the war.

- The ban will most likely create a shortage of oil due to a general lack of spare crude volumes in the world.

What are the alternatives to Russian crude?

- Under the looming ban, the EU will need to replace an additional 1.4 million barrels of Russian crude, with some 300,000 bpd potentially coming from the United States and 400,000 bpd from Kazakhstan, the IEA has said.

- Norway’s largest oilfield Johan Sverdrup, which produces medium-heavy crude similar to Russia’s Urals, also plans to ramp-up production in the fourth-quarter, potentially by 220,000 bpd.

- The IEA says imports from other areas such as the Middle East and Latin America would be needed to fully meet EU demand.

- Some Russian oil will continue to flow into the EU via pipelines as the ban excludes some landlocked refineries unless Russia decides to stop the flows.

How much does the EU depend on Russian crude imports?

- Germany, the Netherlands and Poland were the top importers of Russian oil in Europe last year, but all three have capacity to bring in seaborne crude.

- Landlocked countries in Eastern Europe, such as Slovakia or Hungary, however, have few alternatives to pipeline supplies from Russia.

- The EU’s dependence on Russia has also been underpinned by companies such as Rosneft and Lukoil, controlling some of the bloc’s largest refineries.

- According to the IEA, Russian crude oil flows, based on loading data in August, rose month-on-month to Italy and the Netherlands, where Russian oil major Lukoil owns refineries.

VALUE ADDITION:

ABOUT NORD STREAM 2 GAS PIPELINE:

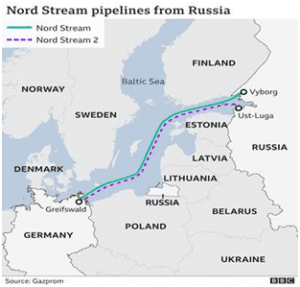

- In 2015, the Russian energy major Gazprom and five other European firms decided to build Nord Stream 2 which is valued at around $11 billion.

- The Approx 1,200-km pipeline will run from Ust-Luga in Russia to Greifswald in Germany through the Baltic Sea and will carry 55 billion cubic metres of gas per year.

- The under-construction pipeline will run along with the already completed Nord Stream 1 system, and the two together will supply an aggregate of 110 billion cubic metres of gas to Germany per year.

- The pipeline falls in the territory of EU members Germany and Denmark and is about 98% complete.

ENVIRONMENT, ECOLOGY AND CLIMATE CHANGE

4. THE FIRST WORLD SLOTH BEAR DAY-12TH OCTOBER

THE CONTEXT: The first ever World Sloth Bear Day celebrations by Wildlife SOS in Agra in collaboration with International Union for Conservation of Nature (IUCN) and the UP-Forest Department.

THE EXPLANATION:

- It was observed to generate awareness and strengthen conservation efforts around the unique bear species endemic to the Indian subcontinent.

- A proposal for observing the World Sloth Bear Day was mooted by Wildlife SOS India, an organisation involved in sloth bear conservation and protection for over two decades and the IUCN-Species Survival Commission sloth bear expert team accepted the proposal and declared the day to be celebrated worldwide.

- Sloth bears are identified by their very distinct long, shaggy dark brown or black fur, distinct white V-shaped chest patch and four-inch long ivory-coloured curved claws used for digging out termites and ants from rock-hard mounds.

Barbaric tradition being resolved

A statement issued by Wildlife SOS stated that the organisation rescued and rehabilitated over hundreds of “performing dancing bears, thereby resolving a 400-year-old barbaric tradition (of dancing bears) while also providing alternative livelihoods to the nomadic Kalandar community members “.

Conservation Status:

Listed under Schedule I of The (Wildlife Protection) Act of India, 1972 the species has the same level of protection as tigers, rhinos and elephants. They can occupy a wide variety of habitats, such as grasslands, thorn scrub and forests, but their range has shrunk considerably in recent years due to habitat loss.

IUCN Status: Vulnerable.

CITES listing: Appendix I

Habitat:

Sloth bears are one of the eight bear species found across the world, and they mainly inhabit the region of India, Nepal, Sri Lanka and presumably Bhutan.

5. TAMIL NADU NOTIFIES INDIA’S FIRST SLENDER LORIS SANCTUARY

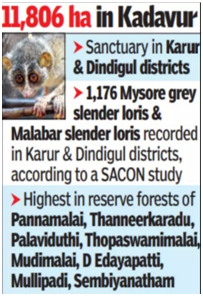

THE CONTEXT: In a first in the country, the Tamil Nadu government notified the Kadavur slender loris sanctuary covering 11,806 hectares in Karur and Dindigul districts.

THE EXPLANATION:

- Slender lorises, which are small nocturnal mammals, are arboreal as they spend most of their life on trees.

- The species acts as a biological predator of pests in agricultural crops and benefits farmers. Listed as an endangered species by the International Union for Conservation of Nature, slender loris has a wide range of ecological roles in the terrestrial ecosystem.

- Also, it has been brought under Schedule I of the Wild Life (Protection) Act, 1972 in order to provide the highest level of legal protection

Habitat improvement

- The survival of the species depends on habitat improvement, conservation and mitigation of threats,

- The sanctuary will cover Vedasandur, Dindigul East and Natham taluks in Dindigul district and Kadavur taluk in Karur district.

- In significant steps towards conservation of wildlife, the State government notified India’s first Dugong Conservation Reserve in the Palk Bay,Kazhuveli bird sanctuary in Villupuram, Nanjarayan Tank birds sanctuary in Tiruppur and the State’s fifth elephant reserve at Agasthyamalai in Tirunelveli. Further, 13 wetlands were declared as Ramsar sites. These path-breaking initiatives in 15 months have put Tamil Nadu at a pivotal position in the field of conservation.

THREATS:

- As it is believed that these animals have some medicinal properties, they are captured and sold.

- Since there is great demand for keeping these animals as pets, they are illegally smuggled.

- Habitat loss, electrocution of live wires, and road accidents are other threats that have caused its populations to dwindle.

GOVERNMENT SCHEMES AND INITIATIVES IN NEWS

6. THE PM-DEVINE SCHEME

THE CONTEXT: The Union Cabinet has approved the Prime Minister’s Development Initiative for North East Region (PM-DevINE) – a new scheme for the Northeastern states which was announced in the Union Budget earlier this year. The scheme will be operational for the remaining four years of the 15th Finance Commission, from 2022-23 to 2025-26, and will have an outlay of Rs 6,600 crore.

THE EXPLANATION:

What is PM-DevINE?

- The new scheme, PM-DevINE, is a Central Sector Scheme with 100% Central funding and will be implemented by Ministry of Development of North Eastern Region (DoNER) through North Eastern Council or Central Ministries/ agencies.

- The PM-DevINE Scheme will have an outlay of Rs.6,600 crore for the four-year period from 2022-23 to 2025-26 (remaining years of 15th Finance Commission period).

- PM-DevINE will lead to creation of infrastructure, support industries, social development projects and create livelihood activities for youth and women, thus leading to employment generation.

- Measures would be taken to ensure adequate operation and maintenance of the projects sanctioned under PM-DevINE so that they are sustainable.

- To limit construction risks of time and cost overrun, falling on the Government projects would be implemented on Engineering-procurement-Construction (EPC) basis, to the extent possible.

- Efforts will be made to complete the PM-DevINE projects by 2025-26 so that there are no committed liabilities beyond this year.

What are the objectives of PM-DevINE?

The objectives of PM-DevINE are to:

(a) Fund infrastructure convergently, in the spirit of PM Gati Shakti;

(b) Support social development projects based on felt needs of the NER;

(c) Enable livelihood activities for youth and women;

(d) Fill the development gaps in various sectors.

Initiatives/activities of MDoNER:

NESIDS

- North East Special Infrastructure Development Scheme” (NESIDS) was approved by the Government of India as a Central Sector Scheme. Under the Scheme guidelines of NESIDS, 100% centrally funding is provided to the State Governments of North Eastern Region for the projects of physical infrastructure relating to water supply, power and connectivity enhancing tourism and Social infrastructure relating to primary and secondary sectors of education and health.

The North East Venture Fund (NEVF)

- Ministry of DoNER had joined with North Eastern Development Finance Corporation Ltd (NEDFi) to set up the North East Venture Fund, the first and the only Venture Fund for Northeast with an initial corpus of Rs. 100 crores.

- The fund targets to invest in Start-Ups and unique business opportunities to provide resources for new entrepreneurships. The main focus of North East Venture Fund (NEVF) is for mostly the enterprises involved in Food Processing, Healthcare, Tourism, segregation of services, IT, etc.

THE DATA POINT

THE PRELIMS PRACTICE QUESTION

QUESTION OF THE DAY

Q1. ‘Vyommitra’, recently seen in news, is

a) A Supercomputer developed by C-DAC.

b) A Humanoid designed and developed by ISRO to fly aboard unmanned test mission.

c) An asteroid which will be explored for minerals.

d) A space mission of ISRO to study atmosphere of Venus.

Answer: B

Explanation:

- Vyommitra, the humanoid designed and developed by the Indian Space Research Organisation (ISRO) to fly aboard unmanned test missions ahead of the Gaganyaan human spaceflight mission.

- The ISRO and the IISU were in the news when they unveiled Vyommitra, a “female” robot astronaut, in 2020. Vyommitra is a half-humanoid lacking lower limbs.

- The IISU was responsible for the design, development, and integration of the robot, while the Vikram Sarabhai Space Centre (VSSC) at Thumba here developed its fingers. The AI-enabled robot is designed to fly aboard a rocket, withstanding vibrations and shock during the flight.

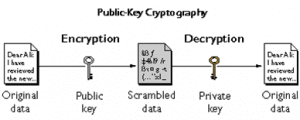

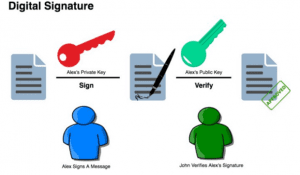

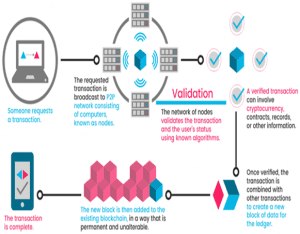

This is what Estonia has done and can be used in the Indian context to improve the efficiency of medical insurance schemes faster. Additionally, since the data is stored in the cloud, some person can sell it for clinical trials or experiments or research to a pharma company within a few seconds, since the digital data can be transferred in a few mouse clicks.

This is what Estonia has done and can be used in the Indian context to improve the efficiency of medical insurance schemes faster. Additionally, since the data is stored in the cloud, some person can sell it for clinical trials or experiments or research to a pharma company within a few seconds, since the digital data can be transferred in a few mouse clicks.