DAILY CURRENT AFFAIRS (AUGUST 01, 2022)

THE INDIAN POLITY AND GOVERNANCE

1. HOUSE PANEL REVIEWS GOA CIVIL CODE

THE CONTEXT: According to sources, the parliamentary panel has reviewed Goa’s uniform civil code and some of its members feel that there are some peculiar and outdated provisions related to matrimony in it.

THE EXPLANATION:

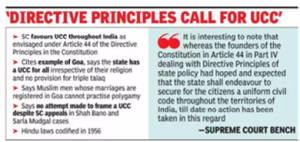

• The Goa Civil Code, a set of civil laws that governs all residents of the coastal State irrespective of their religion and ethnicity, has come under focus amid a call for the implementation of a uniform civil code (UCC) across the country.

• Citing various positives of the Goa Civil Code, Chief Minister said earlier that it could be a model for implementing the UCC across the country.

What is UCC?

• The UCC refers to a common set of laws governing personal matters such as marriage, divorce, adoption, inheritance and succession, that will apply to all citizens irrespective of their religion, caste, and gender.

• The code comes under Article 44 of the Constitution, which lays down that the state shall endeavor to secure a Uniform Civil Code for the citizens throughout the territory of India.

• It is intended to replace the system of fragmented personal laws, which currently govern interpersonal relationships and related matters within different religious communities.

What Do We Have Now?

• Different religious communities in India are currently governed by a system of personal laws, which have been codified over the years through various pieces of legislation.

codified over the years through various pieces of legislation.

• These laws largely focus on the following areas: Marriage and divorce Custody and Guardianship, Adoption and Maintenance Succession and Inheritance.

• For example, Hindu personal law is codified in four bills: the Hindu Marriage Act, Hindu Succession Act, Hindu Minority and Guardianship Act, and Hindu Adoptions and Maintenance Act. The term ‘Hindu’ also includes Sikhs, Jains and Buddhists for the purpose of these laws

• Muslim personal law is not codified per se, and is based on their religious texts, though certain aspects of these are expressly recognized in India in acts such as the Shariat Application Act and Dissolution of Muslim Marriages Act.

• Christian marriages and divorces are governed by the Indian Christian Marriages Act and the Indian Divorce Act, while Zoroastrians are subject to the Parsi Marriage and Divorce Act.

• Then, there are more ‘secular’ laws, which disregard religion altogether, such as the Special Marriage Act, under which Inter-religion marriages take place, and the Guardians and Wards Act, which establishes the rights and duties of guardians.

• Furthermore, to protect distinct regional identities, the Constitution makes certain exceptions for the states of Assam, Nagaland, Mizoram, Andhra Pradesh and Goa with respect to family law.

• Goa is, at present, the only state in India with a uniform civil code.

• The Portuguese Civil Code of 1867, which continues to be implemented after India annexed the territory in 1961, applies to all Goans, irrespective of their religious or ethnic community.

2. ELECTORAL BONDS: PARTIES MOP UP OVER RS 10,000 CRORE SINCE 2018

THE CONTEXT: According to data available from State Bank of India (SBI), the donations to political parties through electoral bonds (EBs) have crossed the Rs 10,000-crore mark, with parties getting another Rs 389.5 crore through such bonds in the 21st sale of EBs conducted between July 1 and 10 2022.

THE EXPLANATION:

• With this, the total amount collected by parties has gone up to Rs 10,246 crore from various anonymous donors in 21 phases since 2018 when the EB scheme was introduced.

• Political parties received EBs worth Rs 648.48 crore from donors in the previous sale in April this year.

• As many as 475 EBs worth Rs 389.5 crore were redeemed by parties in the latest phase, SBI, the only bank authorised to sell these bonds, according to RTI sources. Significantly, this amount has been collected by the political parties even though no election is scheduled in any of the states in the near future.

• As per the provisions of the EB Scheme, only the political parties registered under Section 29A of the Representation of the People Act, 1951 (43 of 1951) and have secured not less than 1 per cent of the votes polled in the last general election to the House of the People or the Legislative Assembly, as the case may be, are eligible to receive electoral bonds.

• Non-governmental organisations (NGOs) — Common Cause and Association for Democratic Reforms (ADR) — have legally challenged the scheme that was started in 2018. They, along with several other critics, have been alleging that the introduction of electoral bonds is “distorting democracy” in India. The Supreme Court has agreed to take up for hearing a pending plea challenging the scheme. Only 23 political parties are eligible for redemption of electoral bonds.

• According to the ADR, in the case of continuance of the Scheme, the principle of anonymity of the bond donor enshrined in the Electoral Bond Scheme, 2018 must be done away with. “All political parties which receive donations through Electoral Bonds should declare in their Contributions Reports the total amount of such donations received in the given financial year, along with the detailed particulars of the donors as against each Bond; the amount of each such bond and the full particulars of the credit received against each bond”.

VALUE ADDITION:

What are electoral bonds?

• Electoral Bond is a financial instrument for making donations to political parties.

• The bonds are available for purchase by any person (who is a citizen of India or incorporated or established in India) for a period of ten days each in the months of January, April, July and October as may be specified by the Central Government.

• These can be redeemed only by an eligible party by depositing the same in its designated account maintained with a bank. The bonds are issued by SBI in denominations of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh and Rs 1 crore

3. IPC SECTION 295A

THE CONTEXT: Amid controversy surrounding the comments by Political Spokespersons Nupur Sharma and Naveen Jindal has put the spotlight on the law that deals with criticism of or insult to religion. Provisions in the Indian Penal Code (IPC), primarily Section 295A, define the contours of free speech and its limitations with respect to offences relating to religion.

What is IPC Section 295A?

• Section 295A defines and prescribes punishment for deliberate and malicious acts, intended to outrage religious feelings of any class by insulting its religion or religious beliefs.

• “Whoever, with the deliberate and malicious intention of outraging the religious feelings of any class of citizens of India by words, either spoken or written, or by signs or by visible representations or otherwise, insults or attempts to insult the religion or the religious beliefs of that class, shall be punished with imprisonment of either description for a term which may extend to [three years], or with fine, or with both.”

• Simply put, Section 295A is one of the key provisions in the IPC chapter to penalize religious offences.

• The chapter also includes offences to penalize damage or defilement of a place of worship with intent to insult the religion (Section 295); trespassing in a place of sepulture (Section 297); uttering, words, etc, with deliberate intent to wound the religious feelings of any person (Section 298); and disturbing a religious assembly (Section 296).

• Section 295A has been invoked on a wide range of issues from penalizing political satire and seeking bans on or withdrawal of books to even political critique on social media.

• Note: India does not have a formal legal framework for dealing with hate speech. However, a cluster of provisions, loosely termed hate speech laws, are invoked. These are primary laws to deal with offences against religions.

What are the other similar Sections or Provisions?

• Section 153A IPC penalizes ‘the promotion of enmity between different groups on grounds of religion, race, place of birth, residence, language, etc., and doing acts prejudicial to maintenance of harmony.

• Section 153B IPC penalises ‘imputations, assertions prejudicial to national-integration’.

• Section 505 of the IPC punishes statements conducing to public mischief.

• Part VII of the Representation of People Act, 1951 classifies hate speech as an offence committed during elections into two categories: corrupt practices and electoral offences. The relevant provisions regarding hate speech in the RPA are Sections 8, 8A, 123(3), 123(3A) and 125.

• Model Code of Conduct (MCC) Item 1 (General Conduct)- prohibits parties and candidates from making any appeals to caste or communal feelings for securing votes.

• Section 66A of the Information Technology Act – In cases of hate speeches online, the section punishes sending offensive messages through communication services is added. In a landmark verdict in 2015, the Supreme Court struck down Section 66A as unconstitutional on the ground that the provision was “vague” and a “violation of free speech”. However, the provision continues to be invoked.

Why is Rangila Rasool case important ?

• Section 295A was brought in 1927. The case which becomes important as it is linked to the origin of Section 295A is the Rangila Rasool case.

THE INTERNATIONAL RELATIONS

4. INDIA, OMAN TO HOLD MILITARY EXERCISE

THE CONTEXT: India and Oman will carry out a nearly two-week military exercise beginning August 1, 2022 with a focus on counter-terror cooperation.

THE EXPLANATION:

• The exercise, ‘AL NAJAH-IV’, will take place in the Mahajan field firing ranges in Rajasthan from August 1 to 13.

• A 60-member team from the Royal Army of Oman has arrived at the site of the exercise.

• The Defence Ministry said the joint military exercise aims to enhance the level of bilateral defence cooperation.

AIM:

• “The joint exercise would focus on counter-terrorism operations, regional security operations and peacekeeping operations under United Nations charter apart from organising joint physical training schedules, tactical drills, techniques and procedures.

• It said the scope of the exercise includes “professional interaction, mutual understanding of drills and procedures, the establishment of joint command and control structures and elimination of terrorist threats”.

THE ECONOMIC DEVELOPMENTS

5. INDIA’S JUTE ECONOMY IS FALTERING WHILE BANGLADESH’S IS FLOURISHING

THE CONTEXT: According the third advanced estimates released by the Union Ministry of Agriculture and Farmers Welfare in May 2022. Production of the cash crop has fallen by over 13 per cent in the past decade — 1.77 million tonnes in 2021-22, from 2.03 million tonnes in 2011-12.

THE EXPLANATION:

• The same is the case with land under jute. The average area under jute in the country was 0.82 million ha between 2000-01 and 2009-10, according to a 2021 report by the Commission for Agricultural Costs and Prices (CACP). This declined to 0.73 million ha between 2010-11 and 2019-20.

• In West Bengal — the country’s largest jute-producing state, which also has 70 of India’s 93 jute mills — the area under jute has reduced by 0.1 million ha between 2009-10 and 2020-21.

• According to farmers “the jute price kept falling. From Rs 30,000-40,000 per tonne in late 2000s, it reduced to Rs 25,000 in 2010-11. This was barely enough to recover the input cost,” he said. Other farmers in the village agreed that jute stopped fetching fair price and was even causing losses.

An Analysis:

• When the prices fell, the Jute Corporation of India (JCI) Ltd, a Government of India enterprise for procurement of raw jute from the growers at the minimum support price, barely intervened.

• This reflected in official procurement figures as well. Between 2007-08 and 2021-22, the quantity procured by JCI decreased to 0.014 million tonnes, from 0.14 million tonnes.

• The poor procurement figures came despite the government being the largest buyer of jute bags, which form the highest share of the total jute products manufactured in the country.

• There is a special law — the Jute Packaging Materials (Compulsory Use in Packing Commodities) Act 1987 (JPMA) — that provides for use of jute packaging material for foodgrains. Under this Act, the government issues orders from time to time for mandatory use of jute packaging.

• Since 2017, the norms provide that 100 per cent of foodgrains and 20 per cent of sugar should only be packed in jute bags. Due to this, jute sacks account for 75 per cent of the total production of the jute industry.

• Ninety per cent of the jute sacks are supplied to the Food Corporation of India and state procurement agencies, according to a Union government press release dated November 10, 2021, while the remaining are exported or sold directly. It also says the government purchases jute sacks worth Rs 8,000 crore every year from mills.

VALUE ADDITION:

• India is the world’s biggest producer of jute , followed by Bangladesh. Jute is primarily grown in West Bengal, Odisha, Assam, Meghalaya, Tripura and Andhra Pradesh.

• The jute industry in India is 150 years old. There are about 70 jute mills in the country, of which about 60 are in West Bengal along both the banks of river Hooghly.

• Jute production is a labour intensive industry. It employs about two lakh workers in the West Bengal alone and 4 lakh workers across the country.

• Jute is the second most abundant natural fibre in the world. It has high tensile strength, acoustic and thermal insulation, breathability, low extensibility, ease of blending with both synthetic and natural fibres, and antistatic properties.

• Jute can be used: for insulation (replacing glass wool), geotextiles, activated carbon powder, wall coverings, flooring, garments, rugs, ropes, gunny bags, handicrafts, curtains, carpet backings, paper, sandals, carry bags, and furniture.

• A ‘Golden Fibre Revolution’ has long been called for by various committees, but the jute industry is in dire need of basic reforms.

THE SCIENCE AND TECHNOLOGY

6. DEBRIS FROM CHINESE ROCKET FALLS TO EARTH

THE CONTEXT: Recently, the Chinese rocket fell back to Earth on over the Indian Ocean, but NASA said Beijing had not shared the “specific trajectory information” needed to know where possible debris might fall.

THE EXPLANATION:

• The Long March 5B blasted off July 24, 2022 to deliver a laboratory module to the new Chinese space station under construction in orbit, marking the third flight of China’s most powerful rocket since its maiden launch in 2020.

• U.S. Space Command said the Long March 5B said the rocket re-entered over the Indian Ocean but referred questions about “reentry’s technical aspects such as potential debris dispersal impact location” to China.

• Earlier analysts said the rocket body would disintegrate as it plunged through the atmosphere but is large enough that numerous chunks will likely survive a fiery re-entry to rain debris over an area some 2,000 km (1,240 miles) long by about 70 km (44 miles) wide.

VALUE ADDITION:

What is space junk?

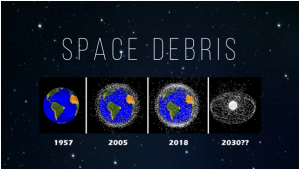

• Space junk, or space debris, is any piece of machinery or debris left by humans in space.

• It can refer to big objects such as dead satellites that have failed or been left in orbit at the end of their mission. It can also refer to smaller things, like bits of debris or paint flecks that have fallen off a rocket.

• Some human-made junk has been left on the Moon, too.

How much space junk is there?

While there are about 2,000 active satellites orbiting Earth at the moment, there are also 3,000 dead ones littering space. What’s more, there are around 34,000 pieces of space junk bigger than 10 centimetres in size and millions of smaller pieces that could nonetheless prove disastrous if they hit something else.

Concerns

• Can be a hazard to active satellites and spacecraft.

• At orbital velocities, even the tiniest pieces of debris can disable an operational satellite.

• Potential collision threat to the space station.

• Earth orbit could even become impassable if the risk of collision grows too high.

• It could hinder our ability to use weather satellites, and hence to monitor weather changes.

• Currently, an estimated 20,000 objects—including satellites and space debris—are crowding low-Earth orbit.

PRELIMS PERSPECTIVE

Kessler syndrome

• This is an idea proposed by NASA scientist Donald Kessler in 1978.

• It says if there is too much space junk in orbit, it could result in a chain reaction where more and more objects will collide and create new space junk in the process, to the point where Earth’s orbit became unusable – a Domino Effect.

• 12 fragmentation events have already taken place every year for the past two decades.

THE PRELIMS PRACTICE QUESTIONS

QUESTIONS OF THE DAY

Q. Consider the following statements with respect to the electoral Bonds:

1. The bonds are issued by SBI in denominations of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh and Rs 1 crore.

2. These bonds are available for purchase all over the year.

Which among the above statements is/are incorrect?

a) 1 only

b) 2 only

c) Both 1 and 2

d) Neither 1 nor 2

ANSWER FOR THE PRACTICE QUESTION

ANSWER: B

EXPLANATION:

ELECTORAL BONDS

• Electoral Bond is a financial instrument for making donations to political parties.

• The bonds are available for purchase by any person (who is a citizen of India or incorporated or established in India) for a period of ten days each in the months of January, April, July and October as may be specified by the Central Government.

• These can be redeemed only by an eligible party by depositing the same in its designated account maintained with a bank. The bonds are issued by SBI in denominations of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh and Rs 1 crore.

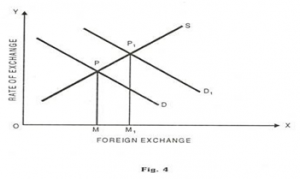

foreign money and not exclusively the function of prices obtained between two countries.

foreign money and not exclusively the function of prices obtained between two countries.