Ethics Through Current Development (07-07-2022)

WSDP Bulletin (06-07-2022)

(Newspapers, PIB and other important sources)

Prelim and Main

- Restoring Banni grasslands, Gujarat battles invasive tree species READ MORE

- Odisha tops first-ever NFSA state ranking index READ MORE

- Increase paddy sowing, Centre asks States READ MORE

- Ukrainian mathematician becomes the second woman to win Fields Medal READ MORE

- PMI: Service activity touches an 11-year high of 58.9 in May on strong demand READ MORE

- India still among countries with poor access to banking: Report READ MORE

- Direct-seeded rice: Why this water-saving method failed in Punjab this year READ MORE

- DoT warns e-commerce companies on the illegal sale of wireless jammers READ MORE

Main Exam

GS Paper- 1

- Unity and diversity: Our obsession with diversity misses the point READ MORE

GS Paper- 2

POLITY AND GOVERNANCE

- As students gear up for university, the devil is in the NEP’s details READ MORE

- Rule of law, anyone? READ MORE

- Social media, content moderation and free speech: A tussle READ MORE

SOCIAL ISSUES

- The way to control tuberculosis READ MORE

INTERNATIONAL ISSUES

- Explained | What is the status of China’s Belt and Road Initiative in South Asia? READ MORE

- CARs of foreign policy: Uzbekistan’s troubles are a reminder of Central Asian Republics’ importance to India READ MORE

GS Paper- 3

ECONOMIC DEVELOPMENT

- A matter of import: Spectre of wider trade and current account deficits is dragging the rupee down READ MORE

- India must be the new champion of globalization READ MORE

- Reverse migration could hurt the urban economy READ MORE

- A regulatory framework for digital assets in India READ MORE

- GST has to resolve anomalies in tax structure READ MORE

ENVIRONMENT AND ECOLOGY

- Greening better: NGT is a vital cog in environment regulation but it needs a performance review & better staffing READ MORE

- A call to protect the Western Ghats READ MORE

- Heavy rainfall due to climate change increasing landslides, say experts READ MORE

DISASTER MANAGEMENT

- Road safety: Himachal must adopt a targeted programme READ MORE

GS Paper- 4

ETHICS EXAMPLES AND CASE STUDY

- 5 ways in which we can experience constant contentment READ MORE

- SEEKING NEUTRALITY, AND DETACHMENT IN THE WORLD READ MORE

Questions for the MAIN exam

- Critically examine the recent steps taken by the government of India to improve higher education in India. Do you think these steps are able to fill the gap in India’s higher education system? Substantiate your view.

- Critically analyse the impacts of reverse migration, as seen during the recent pandemic, on the Rural as well as the Urban economy.

QUOTATIONS AND CAPTIONS

- The way to have power is to take it.

- Policymakers ought to recognise the country’s untapped potential and work towards dismantling the many hurdles.

- The Supreme Court’s directives on handcuffing must be observed, but issues that affect police reform cannot be ignored.

- All nations have diversity. It is only by overcoming narrow identities that they flourish.

- A confluence of factors has made space for us to help reshape global trade and supply-chain arrangements to our advantage.

- The recent PLFS data reveals the extent of Covid-induced urban exodus, as well as rising labour participation in rural India.

- Delays in finalising the notification to earmark eco-sensitive areas can prove to be quite costly.

- Meditation helps look at a problem or dispute from a neutral perspective, facilitating a balanced and unbiased decision and choices. In order for things to flow or move smoothly even speed needs to be controlled and brought to a neutral point.

- The rule of law is a good thing to have, but it must ultimately be backed by groups and communities working out their own arrangements for peace and respect for the law based on reciprocity and give and take.

- With increasing online misinformation, fake news and hate speech, content moderation has flummoxed social media intermediaries and regulators alike.

- Any reforms to bring in platform accountability and prevent harmful speech, would require research identifying what should online spaces look like, who are its beneficiaries, what hinders achieving the ideals and how a policy change could overcome it.

50 WORD TALK

- In the rush to regulate social media while assuming the platforms are working against the Constitution, the Proposed Amendments to the IT (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021 do not assess the already existing mechanisms of these platforms that may be reconciled with the Rules and codified accordingly.

Things to Remember:

- For prelims-related news try to understand the context of the news and relate with its concepts so that it will be easier for you to answer (or eliminate) from given options.

- Whenever any international place will be in news, you should do map work (marking those areas in maps and exploring other geographical locations nearby including mountains, rivers, etc. same applies to the national places.)

- For economy-related news (banking, agriculture, etc.) you should focus on terms and how these are related to various economic aspects, for example, if inflation has been mentioned, try to relate with prevailing price rises, shortage of essential supplies, banking rates, etc.

- For main exam-related topics, you should focus on the various dimensions of the given topic, the most important topics which occur frequently and are important from the mains point of view will be covered in ED.

- Try to use the given content in your answer. Regular use of this content will bring more enrichment to your writing.

Day-238 | Daily MCQs | UPSC Prelims | GEOGRAPHY

| [WpProQuiz 268] |

Day-238 | Daily MCQs | UPSC Prelims | GEOGRAPHY

[WpProQuiz 268]

TOPIC: IS THERE ANY DICHOTOMY BETWEEN INDIA’S NEW FTA STRATEGY AND ITS TRADE POLICY?

THE CONTEXT:In 2022, India has renewed its interest in free trade agreements (FTAs) with several economies, including the UAE, the United Kingdom and Australia. Several negotiations are going on with other countries. This shows a renewed focus on FTAs by India that was stalled for years. However, there is a view that a dichotomy exists between the FTA push and the actual trade policy of India, leading to poor implementations and outcomes of FTAs. This article examines this debate in detail.

SOME IMPORTANT FACTS ABOUT INDIAN FTAs

FTA SCEPTICISM

- During the period from 2004 to 2011, India has signed, ratified, and enforced 11 preferential and free trade agreements, but it has not signed even a single trade agreement after that till 2022.

FTA MOMENTUM

- So far, India has signed 13 Free Trade Agreements (FTAs) with its trading partners, including the 3 agreements signed in 2022, namely:

-

-

- India-Mauritius Comprehensive Economic Cooperation and Partnership Agreement (CECPA),

- India-UAE Comprehensive Partnership Agreement (CEPA),

- India-Australia Economic Cooperation and Trade Agreement (IndAusECTA).

-

ONGOING FTA NEGOTIATIONS

-

- India is also aiming to reach out to the United Kingdom, the European Union, Canada, Israel, and the Eurasian Economic Union to negotiate similar trade agreements.

- India is also scheduled to complete trade agreements with Israel and the United Kingdom by the end of 2022.

- The Indian government is renegotiating existing free trade agreements with the ASEAN, Japan, and South Korea to resolve provisions linked to anomalies and asymmetries that have contributed to the country’s persistent trade deficit.

RATIONALE FOR NEWFOUND FTA MOMENTUM

CHANGING NATURE OF GLOBAL SUPPLY CHAIN VIS A VIS CHINA

- Developed countries, including the United States (US), the United Kingdom (UK), Europe, Australia, and Canada, are addressing supply-chain vulnerabilities and seeking strategies to lessen their reliance on China.

- This opens the door for India to establish itself as a viable alternative supplier of commodities and profit from this trend.

- This necessitates a greater economic and trade interaction with these established economies through bilateral and multilateral trade agreements in order to offer business possibilities for Indian companies.

ECONOMIC AND STRATEGIC STANDPOINT

- India is not a member of either the Regional Comprehensive Economic Partnership Agreement (RCEP) or the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

- There are also concerns about market access being eroded as a result of the cumulative impact of mega-trade agreements.

- The propensity to redirect value chains’ geography can displace Indian enterprises from established production networks.

BUYONT EXPORTS AND GLOBAL VALUE CHAIN DISRUPTIONS

- The country’s strong export performance moulds India’s increased interest in FTAs in 2021.

- A rapid increase in India’s exports has prompted authorities to believe that the country requires free trade agreements to maintain its current export pace.

- Furthermore, the global supply chain disruption caused by the Ukraine–Russia war, as well as the economic crisis in Sri Lanka, have opened up new export prospects for India in specialized industries such as agriculture and textiles.

FTA PUSH AND EXPORT GROWTH: AN ANALYSISJust before the end of the fiscal year 2021–22, India’s yearly merchandise exports surpassed $400 billion. These exports have risen from $290 billion in 2020–21 to $417 billion in 2021–22, representing an annual growth of more than 40%. India has set an ambitious export target of $1 trillion by 2030 as part of its larger Self-Reliant India project (Atmanirbhar Bharat) . To meet this goal, it is widely believed that India should take a proactive approach to free trade agreements (FTAs) and enter into trade agreements with countries that not only contribute to improved market access for goods but also deepen strategic trade and investment linkages, making India’s supply chain much more resilient. |

DICHOTOMY BETWEEN FTAs AND TRADE POLICY

- An FTA’s foundation is an open and liberal trade policy, with FTA parties being able to reciprocate market access. This boosts bilateral trade and investment flows while also fostering stronger economic and strategic ties. For this reciprocal relationship to work, greater coherence between FTA strategy and trade policy is required. India’s newfound excitement for free trade agreements appears to be at odds with the country’s trade policy under the Self-Reliant India project, which is based on “vocal for local,” favouring domestically made items above imported ones. This is because of the tariff policy regime, the Customs (Administration of Rules of Origin under Trade Agreements) Rules (CAROTAR), 2020 for regulating imports under FTAs, and greater importance to geo-strategic interest vis-à-vis trade. Let us examine these in some detail.

TARIFF POLICY REGIME

- India has the highest average tariff of 15% in the Asia–Pacific region.

- According to the World Trade Organization (WTO) tariff profile, average import tariffs have climbed from 13.5 per cent in 2016 to 15 per cent in 2020.

- The Government of India has imposed import licencing requirements as well as a blanket ban on several products.

- Import restrictions on light-emitting diode (LED)/television and 101 defence products have been imposed.

- Aside from import tariffs, the Government of India has implemented a number of non-tariff barriers (NTBs), such as quality control orders and an import monitoring system (for example, a steel import monitoring system).

RULES OF ORIGIN

- The main objective of these rules is to restrict the potential misuse of preferential tariffs by third countries under India’s trade agreements.

- The introduction of CAROTAR is primarily aimed to regulate the entry of third-country goods through its FTA partners.

- Under these rules, the customs officers can grant or deny the benefits of preferential tariffs to the importers if they have reason to believe that the import violates rules of origin requirements.

- Customs officers’ whims and fancies could impact the outcome, negating the potential benefits of preferential tariffs under an already negotiated and mutually approved FTA.

- Furthermore, over-reliance on customs officers’ judgement capacity may lead to a rise in rent-seeking among bureaucrats, undermining the importance of existing and future free trade agreements.

- Also, the failure to obtain the required information, which is quite cumbersome and exhaustive for compliance with RoR, may deprive the importing firm of availing of the preferential benefits, thus increasing the cost of imported products.

- It effectively undermines the market access of FTA partners negotiated under a trade agreement, thereby making its exports uncompetitive.

GEO-STRATEGIC INTERESTS

- India’s bilateral trade pacts with the UAE and Australia have strong geo-strategic and geopolitical elements, given the fact that both FTA partners are members of the two Quadrilateral Security Dialogues (QUAD).

- But, the depth and breadth of these two agreements, in terms of coverage and substantive provisions, are more or less in line with India’s trade agreements with Japan and South Korea.

- The AI-ECTA is an interim agreement and far away from its original ambition of a CEPA, which will include important areas of negotiations such as digital trade, agriculture, government procurement, etc.

- The AI-ECTA requires the ratification of the Australian Parliament, which was recently dissolved and this means that even the interim arrangement is not enforceable.

- Thus, it is held that these trade agreements, especially the one with Australia, have more strategic undertones than trade per se.(Both the countries have a raging conflictual relationship with China).

DEFENDING THE DICHOTOMY-IMPERATIVE OF DOMESTIC CHALLENGES

It is true that there seems to be a dichotomy in the approach to FTAs and India’s trade policy. But this must be seen in the context of India’s domestic environment and the challenges it poses. For instance, the Bharatiya Kisan Union, India’s largest farmers’ organization, has already threatened to resist the proposed FTA with Australia. Protests like these were one of the primary domestic roadblocks to India’s participation in the RCEP. Automobile makers and wine producers in India want to fight the FTAs with Australia and the United Kingdom aggressively. The Swadeshi Jagran Manch shares similar goals. The RSS has repeatedly warned the government about the negative effects of free trade agreements and advised it to avoid any such agreements. The agricultural sector will resist an FTA with Australia, while the manufacturing sector will spearhead protests against the UK–India FTA. On a strategic front, trade relations are one component of the larger strategic framework and many times such agreements are able to send out geopolitical messages to the relevant countries. And the concept of ” Early Harvest Deals” helps to achieve strategic goals along with trade, although it may be in a relatively sub-optimal way.

THE WAY FORWARD

FAST TRACK THE NEW FOREIGN TRADE POLICY

- The announcement of India’s foreign trade policy (FTP) has been lingering on for almost two years. The existing one has been kept extended by the Ministry, which was meant for 2015-2020.

- It is one of the most important policy documents that sets the long-term direction for exports and provides clarity regarding various policies and incentives to the Indian trade community.

- Thus, India needs to fast-track the announcement of a new FTP.

REVISITING THE CAROTAR RULES

- These rules either need to be amended or withdrawn to make sure that India’s trade policy is in consonance with its external trade engagement.

- Otherwise, the lack of synergy between trade policy and FTA strategy not only weakens India’s negotiating capacity but also undermines the potential economic benefits of free trade

COMPREHENSIVE TRADE PACTS

- India’s trade pacts with the western and eastern QUAD members (the UAE and Australia) are driven by geostrategic interest rather than trade.

- India’s trade pacts with the UAE in general, and Australia in particular, are not comprehensive in terms of their coverage, scope, and depth.

- This is not a promising proposition and hence requires significant changes in approach to FTAs in the context of strategic objectives.

CONSENSUS BUILDING ON FTAs

- Domestic challenges need to be overcome through wide-ranging building consensus by holding stakeholder consultations in a meaningful manner.

THE CONCLUSION: Lockdowns devastated manufacturing factories and global supply systems as the COVID-19 pandemic spread throughout the world. Companies began to consider relocation possibilities for their production sites, and economies began to recognize the value of integration. India was no different. This has set in motion a slew of signing of FTAs with various countries by India. However, it is necessary to address the issues that can undermine the potential of the FTAs, and free trade should not become a casualty under long-term strategic goals.

Questions to Ponder

- How far do you agree with the view that there exists a dichotomy between India’s trade policy and its approach toward Free Trade Agreements? Explain.

- The general structure of India’s tariff policy displays an inward focus and is incompatible with the country’s FTA strategy, which strives to improve reciprocal market access. Discuss

- India’s recalibrated approach towards FTAs is full of ambivalence and reflects inconsistencies with its trade-policy stance under the Self-reliant India initiative that underpins the importance of domestically produced goods over imported ones. Comment.

- ” India’s newly found momentum for concluding a series of FTAs has less to do with trade but has more to do with geo-strategic interests”. Critically Examine.

DAILY CURRENT AFFAIRS (JULY 05, 2022)

THE INDIAN HISTORY

1. ALLURI SITARAMA RAJU

THE CONTEXT: In honor of Alluri Sitarama Raju’s 125th birth anniversary Prime Minister unveiled a 30-foot bronze statue of the freedom fighter. As part of celebrations for the 75th anniversary of Independence, the statue was placed in the Municipal Park at ASR Nagar in Bhimavaram.

THE EXPLANATION:

- The 125th anniversary of Alluri Sitarama Raju’s birth, as well as the 100th anniversary of “Rampa Kranti,” will be commemorated throughout the year marking 75 years of independence.

Who was Alluri Sitarama Raju?

- Alluri Sitarama Raju was popularly known as ‘Manyam Veerdu’ (Hero of the Forest). He also referred to by his surname Alluri. He was born at Pandrangi village of then Visakhapatnam district, on July 4, 1897.

- Regular patriotic discourse during the freedom struggle had highly influenced him. After the death of his father, his schooling got disrupted. He went on a pilgrimage and toured the western, north, north-western, and north-eastern India during his teens.

- The socio-economic conditions of India under the British regime, especially in the tribal areas, moved him deeply.

Rampa Rebellion

- During his tourney to almost entire India, he met revolutionaries in Chittagong (now in Bangladesh). Following this, he decided to build a movement against the British. He organised local Adivasis in forest areas of Visakhapatnam and East Godavari districts into a potent force, for launching a frontal attack. Thus, ‘Rampa Rebellion’ or ‘Manyam Uprising’ born, in the Rampachodavaram forest area of East Godavari district.

- This force was using the traditional weapons of Adivasis’ like bows and arrows and spears. However, he later realised that traditional weaponry was no match to heavily armed British forces. Thus, he planned to snatch weapons of the British in 1924, he got trapped and captured by the British at Koyyuru village in Chintapalle forests. He was tied to a tree and executed by a firing squad.

2. T. N. SENDS SOIL SAMPLES FOR PROJECT RELATING TO NEW PARLIAMENT BUILDING

THE CONTEXT: The rich cultural history of the Tamils will be featured in a project relating to the new Parliament being constructed by the Union government in New Delhi.

THE EXPLANATION:

- Multiple sources confirmed on a request from Delhi, multiple State government departments coordinated to collect the soil samples and sent them to the capital late last month (June 2022). Brief synopses of the samples, such as the place of origin, its geological features and historical importance, have also been sent.

- Soil samples from five ecological regions mentioned in ancient Tamil Sangam literature — Kurinji, Mullai, Marutham, Neithal and Paalai — have been collected and sent to the capital recently.

VALUE ADDITION:

SANGAM LITERATURE

- Tolkappiyam, Pattuppattu, Ettutogai,Pathinenkilkanakku, and two epics named Silappathikaram (Written by Ilango Adigal) and Manimegalai (Written by Sittalai Sattanar) are among the Sangam literature.

- Tolkappiyam: It was written by Tolkappiyar and is thought to be the earliest Tamil literary work.

- Despite the fact that it is a study on Tamil grammar, it also contains information about the political and socio-economic conditions of the time.

- It is a unique work on grammar and poetics that deals with Ezhuthu (letter), Col (word), and Porul (subject matter) in three parts, each with nine sections.

- Tolkappiyar’s study encompasses almost all levels of human language, from spoken to poetic, as he treats phonology, morphology, syntax, rhetoric, prosody, and poetics in exquisitely poetic and epigrammatic statements.

THE INDIAN POLITY AND GOVERNANCE

3. EXPLAINED: THE FREQUENCY, REASONS, AND CONTROVERSY OVER INTERNET SUSPENSIONS BY THE GOVERNMENT

THE CONTEXT: According to the Software Freedom Law Center, since 2012 there have been 665 Internet shutdowns in India to date.

THE EXPLANATION:

- Following the brutal on-camera killing of tailor Kanhaiyalal Teli in Udaipur by two men, the Rajasthan government imposed a ban on Internet services. Shutting down the Internet as an administrative or law-and-order measure has been a common step taken across India — for a range of reasons and by almost all political parties and governments.

- There is no official data on the number of shutdowns but based on estimates by research organisations, it would seem their frequency has increased over the last few years. An increasing number of people have been impacted as a result, because Internet usage has been going up in India, and the coronavirus pandemic has made it even more of a commonly used essential service.

What do the data on internet suspensions say?

- According to the Software Freedom Law Center (SFLC), a legal services organisation working in this field in India, since 2012 there have been 665 Internet shutdowns in India to date. Here, ‘shutdowns’ mean a total ban on mobile (3G, 4G/LTE), or fixed-line (dial-up, wired/wireless broadband) Internet, both or either of which may be shut down.

- According to Internet freedom and tech policy organisations, India is the leading country (by number) for Internet disruption incidents and frequency of shutdowns. This year, 59 shutdowns have been enforced, according to SFLC, which determines shutdowns based on government orders and media reports.

- This brings up another question: Internet shutdowns are not always officially announced, so it might be difficult to know if your phone is simply not working properly, or if a shutdown is in place.

State with highest Suspension

- Jammu and Kashmir has had more than 411 shutdowns since 2012, and the longest one went on for more than 552 days after the abrogation of the special status of the erstwhile state.

- Among the states, Rajasthan has had the most shutdowns — with 88 such instances in almost 10 years. The reasons have ranged from protests by the Gujjar community for reservation, to preventing cheating in the Rajasthan Eligibility Examination for Teachers (REET) held to select primary school teachers last year, which was taken by an estimated 16 lakh aspirants.

How do governments justify shutting down the Internet?

- Governments say misinformation and rumours can lead to deterioration in law and order in an area, so curbing the flow of information helps maintain peace among communities in times of crisis.

- But many experts have countered that in the absence of information sources like news outlets, rumours can actually end up spreading even more. Also, important services such as those related to payments, banking, and educational access, all get cut in an instant, resulting in disruptions at multiple levels and economic losses.

What is the procedure for shutting down the Internet?

- In February 2022, Lok Sabha MP asked in Parliament whether the government maintains records for shutdowns or has plans to do so, and if not, what protocol is followed.

- Minister of State for Communications replied that The Review Committee in states, chaired by the Chief Secretary (the senior-most civil servant in a state) is mandated through the Temporary Suspension of Telecom Services (Public Emergency or Public Safety) Rules, 2017, to decide that the shutdowns have been made as per rules.

- The rules framed by the central government say temporary suspensions can be “due to public emergency or public safety” and give senior bureaucrats from the Home Ministry at the central and state levels the power to order shutdowns.

- Before these rules came into force in 2017, Internet shutdowns were ordered under Section 144 of the Code of Criminal Procedure, which gives District Magistrates broad powers during dangerous situations.

Apex Court’s view

- In SC order passed in January 2020, the court ruled that “freedom of speech and expression and the freedom to practice any profession or carry on any trade, business or occupation over the medium of Internet enjoys constitutional protection under Article 19 (1) (a) and Article 19 (1) (g)”.

- It said, “restriction upon such fundamental rights should be in consonance with the mandate under Article 19 (2) and (6) of the Constitution, inclusive of the test of proportionality”.

THE ENVIRONMENT AND ECOLOGY

4. EXPLAINED: ENFORCING THE SINGLE-USE PLASTIC BAN

THE CONTEXT: A ban on the use of single-use plastics that was notified by the Union Environment Ministry on August 2021 came into effect on July 1 2022. The notification said national and State-level control rooms would be set up to check illegal manufacture, import, stocking, distribution, sale and use of banned single use plastic items.

THE EXPLANATION:

The Plastic Waste Management Amendment Rules, 2021, will also prohibit manufacture, import, stocking, distribution, sale and use of plastic carry bags having thickness less than 120 microns with effect from December 31, 2022.

What is single-use plastic?

- The Centre defines it as an object made of plastic that is intended to be used “only once” before being disposed off or recycled. For the purposes of the ban, there is a list of 21 items that come under the definition of single-use plastic including ear buds with plastic sticks, plastic sticks for balloons, plastic flags, candy sticks, ice-cream sticks, thermocol for decoration, plates, cups, glasses, cutlery such as forks, spoons, knives, straw, trays, wrapping or packing films around sweet boxes, invitation cards, and cigarette packets, plastic or PVC banners less than 100 microns, stirrers.

- These objects were listed by the Environment Ministry in August when it notified the Plastic Waste Management Amendment Rules, 2021. Single-use plastic items such as these had “low utility and high littering potential,” it noted.

- Plastic packaging waste, a major contributor to the much larger problem of plastic waste pollution, isn’t yet covered under the phase-out of single-use plastic items. Mineral water bottles or plastic bottles of aerated drinks are unaffected by the ban, though, in popular imagination, they are representative of ‘plastic pollution.’

Why are Single Use Plastics disastrous?

- By 2050, it has been predicted that single-use plastic might contribute 5–10% of greenhouse gas emissions, depending on the production trajectory currently in place.

- India ranks 94th out of the top 100 nations for producing the most single-use plastic garbage, behind Singapore, Australia, and Oman according to Australia’s charitable organisation, the Minderoo Foundation.

- India produces 4 kg of single-use plastic garbage per person yearly, with 11.8 million metric tonnes produced domestically and 2.9 million tonnes imported.

- The decision to ban the initial batch of single-use plastic items was made due to their “difficulty of collection, and consequently recycling.”

- Microplastics, which are particularly dangerous, are created when plastic is left in the environment for a very long time and does not decompose.

- These microplastics then find their way into our food supplies and eventually into our bodies.

How do other nations handle single-use plastic?

- A resolution to draft an agreement that will eventually make it legally binding for the signatories to address the full life of plastics from production to disposal in order to end plastic pollution was signed earlier this year by 124 countries, parties to the United Nations Environment Assembly, including India.

- In 2002, Bangladesh became the first nation to outlaw thin plastic bags. In July 2019, New Zealand became the most recent nation to outlaw plastic bags. 2020 saw the issuance of a phased-in ban on plastic bags in China.

- 68 nations had plastic bag bans in place as of July 2019 with various levels of enforcement.

- Plastic straws are totally prohibited in Vanuatu and the Seychelles.

Way forward

- The lack of specific recommendations regarding alternatives to the ban has drawn criticism.

- In its statement, the CPCB mentions biodegradable plastics, cotton bags, sustainable apparel, bamboo tableware and straws, wood from sustainably managed forests for domestic products, pottery without hazardous glazes, and ceramics.

- Additionally, it created a Standard operating procedure (SOP) for awarding biodegradable plastics makers and merchants with certificates.

- The CPCB is required by the Plastic Waste Management Rules 2022 to create a sustainable packaging guideline based on the following criteria: package designing that encourages reuse; package designing that is conducive to recycling; recycled plastic content in plastic packaging material; and package designing for the environment. However, nothing is publicly available yet.

THE SCIENCE AND TECHNOLOGY

5. EXPLAINED: THE NEED FOR SPACE SUSTAINABILITY

THE CONTEXT: Recently, the U.K. hosted the fourth summit for Space Sustainability in London in collaboration with the Secure World Foundation. During the summit, the UK launched a new ‘Plan for Space Sustainability’.

THE EXPLANATION:

About the ‘Plan for Space Sustainability’

Aim:

- To set a global commercial framework for the insurability, licensing and regulation of commercial satellites.

- To reduce the cost for those who comply with the best sustainability standards and thus encourage a thriving ecosystem for the industry.

- The plan also hopes to drive the sustainability factor internationally and provide an opportunity for the private sector to develop models that enhance operations’ safety and reduce debris footprint.

How does the plan propose to achieve space sustainability?

- The U.K. calls for an “Astro Carta” for space sustainability, based on the Artemis Accords model for sustainable space exploration.

- The plan proposes a) Active debris removal and in-orbit servicing, b) Encouraging space research and the development of technology to ensure the reuse and recycling of satellites at every stage.

Where does India stand on space sustainability?

India has always emphasised cost-effective and efficient missions with problem-solving applications. For example, India’s debris footprint is minuscule; India has 114 debris among the 25,182 pieces of sizes larger than 10 cm, in the lower earth orbits. Apart from that, the recent activities of India on space sustainability are,

- Project NETRA: The Indian Space Research Organisation (ISRO) has initiated ‘Project NETRA’ to monitor space debris, 2

- Earlier this year, India and the U.S. signed a new pact for monitoring space objects at the 2+2 dialogue.

- Increased private participation: With Indian National Space Promotion and Authorisation Centre (In-SPACe), India expects an increased role of the private sector in India’s space activities, and

- SPADEX: ISRO is developing a docking experiment to provide in-orbit servicing named SPADEX. It looks at docking a satellite on an existing satellite, offering support in re-fuelling and other in-orbit services while enhancing the capability of a satellite. Hence, the SPADEX can increase the longevity of a mission and also provide a futuristic option to combine missions/experiments.

What are the challenges in achieving space sustainability?

- Orbital crowding poses a big threat to space sustainability. This poses a direct threat to the operations and safety of a mission and is likely to cause legal and insurance-related conflicts.

- Space debris: After the completion of a mission, an ‘end-of-life protocol’ requires space objects to be moved to the graveyard orbit or to a low altitude. Neither of the options is sustainable in the long run.

- Solar and magnetic storms: These storms can potentially damage communication systems. Such space weather threats need to be addressed along with the efforts to identify the terrestrial carbon footprint of outer space missions.

- Note: Outer space is considered a shared natural resource. The United Nations Committee on the Peaceful Uses of Outer Space (COPUOS) in 2019 adopted a set of 21 voluntary, non-binding guidelines to ensure the long-term sustainability of outer space activities.

What’s Next?

- A collective effort by all space players, with the active role of the UN COPUOS or the United Nations Office for Outer Space Affairs (UNOOSA), is needed to set equitable standards for the ease of activities.

- Many of the measures for sustainability are resource-consuming and expensive for medium-and-small space programs. Hence, there is a need for addressing the principles and rules that guide the activities in outer space with better clarity.

- Encourage the private sector with a set of sustainability guidelines to ensure optimum utilisation of resources and increase the safety and productivity of missions.

VALUE ADDITION:

ABOUT UNITED NATIONS OFFICE FOR OUTER SPACE AFFAIRS (UNOOSA):

- The United Nations Office for Outer Space Affairs (UNOOSA) works to promote international cooperation in the peaceful use and exploration of space, and in the utilisation of space science and technology for sustainable economic and social development.

- The Office assists any United Nations Member States to establish legal and regulatory frameworks to govern space activities and strengthens the capacity of developing countries to use space science technology and applications for development by helping to integrate space capabilities into national development programmes.

- UNOOSA is also responsible for implementing the Secretary-General’s responsibilities under international space law and maintaining the United Nations Register of Objects Launched into Outer Space.

- UNOOSA is the current secretariat of the International Committee on Global Navigation Satellite Systems (ICG).

- Headquartered: Vienna, Austria.

THE PRELIMS PRACTICE QUESTIONS

QUESTION OF THE DAY

1. Why was Alluri Sitarama Raju well known?

(a) He led the militant movement of tribal peasants in Andhra Pradesh.

(b) He led a peasant movement in Avadh.

(c) He led a satyagraha movement in Bardoli.

(d) He set up an organisation for the uplifment of the dalits.

ANSWER FOR 4TH JULY 2022

ANSWER: A

EXPLANATION:

- The Athirappilly Falls is located in Kerala.

Ethics Through Current Development (05-07-2022)

Today’s Important Articles for Geography (05-07-2022)

Today’s Important Articles for Sociology (05-07-2022)

Today’s Important Articles for Pub Ad (05-07-2022)

- Stable trading worse than horse-trading READ MORE

- Protecting the SC: Politically sensitive matters require care READ MORE

- India has 71 towns, cities under Police Commissionerate. It just creates hierarchy READ MORE

- Don’t leave regulation in hands of social media platforms. Govt must re-evaluate its role READ MORE

WSDP Bulletin (05-07-2022)

(Newspapers, PIB and other important sources)

Prelim and Main

- What is the Large Hadron Collider, now readying to seek answers to fundamental questions of particle physics? READ MORE

- Explained | The need for space sustainability READ MORE

- Government to review oil export tax based on forex rate, oil prices every fortnight READ MORE

- Explained: The Law of Arrest, Remand and Bail READ MORE

- Amid rising inflation, the global drive to keep food cheap is unsustainable READ MORE

- Urbanisation, low profitability: Why prices of tamarind leaves in Andhra Pradesh have rocketed READ MORE

- Glacier collapses in Italian Alps, at least 6 reported dead READ MORE

- Digital India empowered people by making technology more accessible, says PM Modi; launches ‘Digital India Bhashini’ to provide easy access to the internet & digital services in Indian languages READ MORE

Main Exam

GS Paper- 1

- Contrasting laws on abortion in India, US READ MORE

- The individual has become the new society READ MORE

GS Paper- 2

POLITY AND GOVERNANCE

- Stable trading worse than horse-trading READ MORE

- Protecting the SC: Politically sensitive matters require care READ MORE

- India has 71 towns, cities under Police Commissionerate. It just creates hierarchy READ MORE

- Don’t leave regulation in hands of social media platforms. Govt must re-evaluate its role READ MORE

INTERNATIONAL ISSUES

- A chaotic world, the perils of multilateralism: Instead, bilateral engagements may be much more productive at this point in history READ MORE

- With China’s expanding influence, Asia is also seeking to diversify its security partnerships READ MORE

- What will India’s G20 presidency focus on? READ MORE

GS Paper- 1

ECONOMIC DEVELOPMENT

- Slippery slope: RBI should stick to its approach of maintaining an orderly movement in the rupee READ MORE

- GST @ 5 Years: The Union Govt and States Can’t Ignore the Most Contentious Bits Any Longer READ MORE

- Amid rising inflation, the global drive to keep food cheap is unsustainable READ MORE

ENVIRONMENT AND ECOLOGY

- Clear & present danger: Five types of extreme weather events are linked to human-induced climate change READ MORE

- Single-use plastic ban success is suspect without options READ MORE

- Climate initiatives must keep out large hydropower projects READ MORE

GS Paper- 1

ETHICS EXAMPLES AND CASE STUDY

- Living Rightly READ MORE

- The absence of civil liberties leads to violence READ MORE

- Everyday mystic experiences God through duties READ MORE

Questions for the MAIN exam

- How far do you agree with this view that by disempowering MPs and MLAs, anti-defection law is undermining the very idea of representation in a parliamentary democracy? Analyse your view.

- ‘Social media discourse has demonstrated an exceptional ability to upend trust in established authorities in recent years’. In light of the statement, to what extent do you think that Social Media regulation is needed at the time? Justify your views with relevant examples.

QUOTATIONS AND CAPTIONS

- Divide each difficulty into as many parts as is feasible and necessary to resolve it.

- Multilateral negotiations will be increasingly difficult in the present chaotic global situation. Only by working bilaterally with potential allies can India attain the status of a pole in the new world with steadfast friends and followers.

- The core changes proposed by the Draft E-waste Management Rules require careful deliberation.

- The draft e-waste Rules propose a few positive changes, including expanding the definition of e-waste, more clearly specifying the penalties for violation of rules, introducing an environmental compensation fund based on the ‘polluter pays’ principle, and recognising the informal waste workers.

- The core changes it proposes within the EPR framework, however, require careful deliberation with all the relevant stakeholders before the Rules are finalised.

- With China’s expanding influence, Asia is also seeking to diversify its security partnerships. This has led to greater Asian engagement with Europe as well as the creation of new Indo-Pacific regional institutions – including Quad and AUKUS.

- Any form of media regulation is tricky, and that of social media hard to enforce, given its more amorphous nature.

- Comprehensive restrictions imposed on basic freedoms during the Emergency jolted India. We realised that it is not enough to grant rights.

- Freedom lies at the heart of a coherent theory of rights.

- Even after the Supreme Court judgment uphold the dignity of sex workers, a lot more needs to be done on the ground to ensure they really lead a dignified life.

- The anti-defection law is evil because, by disempowering MPs and MLAs, it has killed the very idea of representation in a parliamentary democracy.

- Social media discourse has demonstrated an exceptional ability to upend trust in established authorities in recent years.

Essay topic

- Freedom lies at the heart of a coherent theory of rights.

50 WORD TALK

- The hike in taxes on gold imports is retrograde. Taxes on gold, a high-priced commodity, reaching almost 19% breaches the arbitrage threshold where smuggling becomes profitable. A big gain of the 1991 reform was putting an end to gold smuggling, which financed malevolent mafias. It’d be imprudent to reverse that.

Things to Remember:

- For prelims-related news try to understand the context of the news and relate with its concepts so that it will be easier for you to answer (or eliminate) from given options.

- Whenever any international place will be in news, you should do map work (marking those areas in maps and exploring other geographical locations nearby including mountains, rivers, etc. same applies to the national places.)

- For economy-related news (banking, agriculture, etc.) you should focus on terms and how these are related to various economic aspects, for example, if inflation has been mentioned, try to relate with prevailing price rises, shortage of essential supplies, banking rates, etc.

- For main exam-related topics, you should focus on the various dimensions of the given topic, the most important topics which occur frequently and are important from the mains point of view will be covered in ED.

- Try to use the given content in your answer. Regular use of this content will bring more enrichment to your writing.

TOPIC: HOW INFLATION IS BEING DEALT BY RBI AND THE GOVERNMENT OF INDIA?

THE CONTEXT: The RBI and government of India took several measures after retail Inflation hit 7.8 per cent in April and the wholesale prices crossed 15 per cent reflecting the input cost pressures. Retail Inflation has been trending above the Reserve Bank’s upper tolerance level of 6 per cent for the past three months. The rising food and fuel prices have made the situation worse in the wake of the Russia-Ukraine war. The Increases in the prices of imported fuels, materials, and components increase domestic costs of production and lead to increases in the prices of domestically produced goods. Thus the Inflation is mostly imported in nature. This article explains in detail about approach and steps taken by RBI and the government of India.

THE BACKGROUND

- The main driver of the surge in the consumer price index (CPI) was the increase in food prices, which rose from 0.7% in September 2021 to 8.4% in April 2022. Among food products, the highest increase was in edible oil and fats (17.3%) in April 2022. This was mainly fuelled by the rise in international edible oil prices after the disruption of trade following the war and the ban on oil exports by Indonesia.

- The prices of services continue to accelerate even after the containment of the pandemic. For instance, the prices of goods and services consumed by households have shot up from 1.9% in April 2021 to 8% now. And the price increases of recreation and health services have moved up above 7%, while that of personal care is above 8%, and that of transport and communication above 10%. All these belie the claim that supply-side bottlenecks are the main reason for the rising prices.

MEASURES TAKEN BY RBI AND THE GOVERNMENT OF INDIA

STEPS TAKEN BY RBI TO CONTROL INFLATION

- The Reserve Bank of India called an off-cycle policy meeting and increased the cash reserve ratio by 50 basis points to 4.5% and the repo rate by 40 basis points to 4.4%, the first-rate hike after August 2018.

STEPS TAKEN BY THE GOVERNMENT OF INDIA TO CONTROL INFLATION

- The government announced an excise tax cut of Rs 8 per litre on petrol and Rs 6 per litre on diesel. The government will bear a shortfall of Rs 1 lakh crore due to the excise duty cut on petrol and diesel.

- Taking a cue from Centre. Three states – Kerala, Rajasthan and Maharashtra – also announced a reduction in state taxes. The reduction in pump prices of petrol and diesel will bring down the logistics cost for the industry.

- The government also reduced the import duty on key raw materials and inputs for the steel and plastic industry.

- The government has levied export duty on some steel products and raised it on iron ore and concentrates. Together with the import duty cut, the price of steel will come down.

- During the current and next financial year, the government has permitted duty-free imports of 20 lakh tonnes of crude soybean and crude sunflower oil.

- Under the Ujjwala Yojana, the government has also granted a Rs 200 per cylinder subsidy. This will benefit around nine crore beneficiaries.

- The government set a limit of 100 lakh tonnes on sugar exports to ensure that there is adequate stock when the sugar season begins in October to cover three months’ worth of consumption.

- The Centre has also regulated sugar exports to maintain adequate stocks in the country. From June 1, only 10 million tonnes of sugar can be exported in the current marketing year, which ends in September.

- India slapped a ban on wheat exports to maintain food security and cool prices.

- Over and above Rs 1 lakh crore budgeted for the current fiscal, the government will provide an additional fertilizer subsidy of Rs 1.1 lakh crore to farmers.

WHAT IS INFLATION TARGETING?

- Inflation can be majorly caused due to two reasons. One is the Demand-Pull Inflation, and the other is the cost-push Inflation on the supply side.

- In the case of demand-pull Inflation, all the control measures revolve around reducing the demand, and this can be done by either reducing the money supply or increasing prices by taxation.

- In the case of cost-push Inflation, the control measures revolve around increasing the supply to meet the demand in the market and reducing the prices by providing subsidies and technological expertise.

- In all cases, the inflation control measures can be divided into Monetary Measures, Fiscal Measures, and Price controls.

MONETARY MEASURES:

- Monetary policy refers to the central bank’s approach to managing the money supply and interest rates through the use of monetary policy instruments under its control.

- The Reserve Bank of India (RBI) Act, 1934, was amended in May 2016 to provide a legal foundation for the implementation of the flexible inflation-targeting framework.

- The primary goal of monetary policy is to keep prices stable (keeping Inflation within the target band of 2 per cent to 6 per cent).

FISCAL MEASURES:

- Fiscal policy is the policy by which a country’s government controls the flow of tax revenues and public expenditures in order to navigate the economy.

- For example, during a slowdown, the government may decide to spend more on infrastructure projects and other initiatives in order to stimulate the economy. To increase revenue, the government may raise taxes on the wealthy.

- To combat/control inflation, the government employs a variety of fiscal policy measures.

PUBLIC EXPENDITURE:

- It is the amount of money spent by the country’s government. For example, the government constructs public infrastructure such as roads, railways, and housing.

- It is an important tool in the fight against Inflation.

- When Inflation is high, the government reduces government spending. A decrease in public spending has an impact on private investment, resulting in a decrease in aggregate demand.

- For example, during periods of high Inflation, the government reduces its spending on rural infrastructure expansion. It will result in a decrease in demand in rural areas.

- Similarly, in the event of deflation, the government increases public spending in order to boost private investment and aggregate demand.

TAXATION:

- Taxation policy can be used to encourage or discourage household consumption and private investment by raising or lowering the personal income tax, corporate tax, or indirect tax (Such as GST)

- In the event of high Inflation, the government may raise personal or corporate taxes in order to reduce household expenditure/private investment. Increased taxation means that people have less money to spend (and private players for investment). This would result in a decrease in aggregate demand and aid in the containment of rising Inflation.

- Similarly, in the event of deflation, the government lowers tax rates in order to stimulate household and private consumption, resulting in an increase in aggregate demand.

- Conclusion:Inflation in a regulated manner is good for the growth of the country. However, if it’s not under control, then it will spiral, cause hyperinflation, and lead the economy into a vicious cycle. Therefore necessary measures are designed both by the central bank and the government to keep it in check.

ADMINISTRATIVE MEASURES

- In addition to monetary and fiscal instruments, the government can use other measures to maintain price stability and control inflationary price rises in the economy. Other measures include direct price controls, restrictions on speculation and hoarding, the use of buffer stocks, a ban on exports, and imports to supplement domestic supply, and a prohibition on commodity futures trading.

PRICE CONTROL THROUGH DIRECT ACTION

- Under the Essential Commodity Act of 1955, the government can declare a commodity to be an essential commodity in order to ensure that it is available to the public at reasonable prices. The Drug Price Control Order (DPCO) aims to keep pharmaceutical prices under control.

EXAMINE SPECULATION AND HOARDING

- The Act to Prevent Black Marketing and Maintain Supplies of Essential Commodities, 1980 – This act authorizes the central government or a state government to detain individuals who engage in activities such as hoarding, creating artificial scarcity of essential commodities in the market, and price rigging.

POLICY ON BUFFER STOCKS

- The Government of India has maintained buffer stocks of food grains to cover any unanticipated situation. Food Corporation of India is in charge of purchasing, storing, moving, transporting, distributing, and selling food grains and other food items.

BAN ON EXPORTS

- The Government of India imposes a Minimum Export Price (MIP) to discourage commodity exports and ensure their availability in domestic markets.

BAN ON COMMODITY FUTURES TRADING

- Commodities (e.g., the government prohibited future trading in chana, etc.).

To reduce speculation-driven price increases, governments frequently prohibit future trading in

THE WAY FORWARD

- Focus on supply of agricultural goods: The implication for the policymaker that Inflation is driven by agricultural goods prices, as is the case in India presently, is that the focus should be on increasing the supply of these goods.

- Growing per capita income in India has shifted the average consumption basket towards foods rich in minerals, such as fruits and vegetables, and protein, such as milk and meat.

- The government should reduce unnecessary expenditure on non-development activities in order to curb Inflation. This will also put a check on private expenditure, which is dependent upon government demand for goods and services. But it is not easy to cut government expenditure. Though this measure is always welcome, it becomes difficult to distinguish between essential and non-essential expenditure. Therefore, this measure should be supplemented by taxation.

- An important measure is to adopt the anti-inflationary budgetary policy. For this purpose, the government should give up deficit financing and instead have surplus budgets. It means collecting more in revenues and spending less.

- Another important measure is to adopt a rational wage and income policy. Under hyperinflation, there is a wage-price spiral. To control this, the government should freeze wages, incomes, profits, dividends, bonus, etc.

THE CONCLUSION: Inflation in a regulated manner is good for the growth of the country. However, if it’s not under control, then it will spiral, cause hyperinflation, and lead the economy into a vicious cycle. Therefore, necessary measures are designed both by the central bank and the government to keep it in check.

VALUE ADDITION

Monetary policy:

- Monetary policy refers to the central bank’s approach to managing the money supply and interest rates through the use of monetary policy instruments under its control.

- In India, the monetary policy of the Reserve Bank of India is aimed at managing the quantity of money in order to meet the requirements of different sectors of the economy and to increase the pace of economic growth.

- The RBI implements the monetary policy through open market operations, bank rate policy, reserve system, credit control policy, moral persuasion and many other instruments.

- The Reserve Bank of India (RBI) Act, 1934, was amended in May 2016 to provide a legal foundation for the implementation of the flexible inflation-targeting framework.

- The primary goal of monetary policy is to keep prices stable (keeping Inflation within the target band of 2 per cent to 6 per cent).

Monetary policy committee:

- The Monetary Policy Committee (MPC) is the committee set up by the Union government to set the policy interest rates as a part of its monetary policy. It is headed by the Governor of the Reserve Bank of India (RBI). The Monetary Policy Committee decisions will impact the money supply and liquidity in the economy.

- The monetary policy Committee is concerned with setting policy rates and other monetary policy decisions in order to achieve:

- Price stability

- Accelerating the growth of the economy

- Exchange rate stabilization

- Balancing savings and investment

- Generating employment

- Financial stability

- In order to maintain price stability, Inflation must be kept under control.

- Every five years, the Indian government sets an inflation target. The Reserve Bank of India (RBI) plays an important role in the consultation process for inflation targeting. The current inflation-targeting framework in India is flexible, with a target of 4% with a band of +/-2%.

QUESTIONS FOR MAIN EXAMINATION

- Explain the role played by the Central bank and Government of India in curbing the Inflation? Also, suggest some measures to deal with Inflation in the present scenario.

- ”Inflation in a regulated manner is good for the growth of the country. If it’s not under control, then it will spiral, cause hyperinflation, and lead the economy to a vicious cycle.’’ Elucidate.

Day-237 | Daily MCQs | UPSC Prelims | CURRENT DEVELOPMENTS

[WpProQuiz 267]

DAILY CURRENT AFFAIRS (JULY 04, 2022)

THE HEALTH AND SOCIAL ISSUES

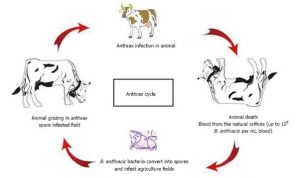

EXPLAINED: WHAT IS ANTHRAX, THE INFECTIOUS DISEASE FOUND IN KERALA?

THE CONTEXT: After finding several carcasses of wild boar, Kerala health officials confirmed the presence of anthrax, a serious infectious disease caused by spore-forming bacteria, in Athirappilly of Thrissur district.

THE EXPLANATION:

Anthrax has usually been found in India’s southern states and is less frequently found in the northern states. Over the past years, it has been reported in Andhra Pradesh, Jammu and Kashmir, Tamil Nadu, Assam, Odisha and Karnataka.

What is Anthrax?

- Anthrax, also known as malignant pustule or woolsorter’s disease, is a rare but serious disease caused by rod-shaped bacteria known as Bacillus anthracis. It occurs naturally in soil and, according to the WHO it is primarily a disease of herbivores, with both domestic and wild animals being affected by it.

- Anthrax is a zoonotic disease, meaning that it is naturally transmissible from animals (usually vertebrae) to humans. People can get the disease through contact with infected animals or animal products that are contaminated with bacteria.

- According to the WHO, Anthrax is generally regarded as non-contagious. There have been instances of person-to-person transmission, however, such instances are extremely rare.

How do animals get Anthrax?

- Domestic and wild animals can get infected when they breathe in or ingest spores in contaminated soil, plants or water.

- According to the Ministry of Health and Family Welfare’s National Health Portal, Herbivorous animals can get the disease through contaminated soil and feed, while omnivorous and carnivorous animals get infected through contaminated meat, bones and other feeds. Wild animals get sick through feeding on anthrax-infected carcasses.

How do humans get infected?

- Humans almost always contract the disease directly or indirectly from animals or animal products.

- People get infected with anthrax when spores enter the body, through breathing, eating contaminated food or drinking contaminated water, or through cuts or scrapes in the skin. The spores then get “activated” and multiply, spreading across the body, producing toxins and causing severe illness.

Use in Bioterrorism:

- Anthrax has been used in biological warfare by agents and by terrorists to intentionally infect.

- It was spread in the US through mail. It killed 5 people and made 22 sick.

THE ENVIRONMENT AND ECOLOGY

EXPLAINED: HOW KERALA HAS STRUGGLED TO IDENTIFY BUFFER ZONES AROUND ITS PROTECTED FORESTS

THE CONTEXT: Recently, the three-judge bench of the Supreme Court, in its order on (June 3, 2022) said national parks, wildlife sanctuaries and such protected forests must have an ESZ of a minimum 1 km from their boundaries.

THE EXPLANATION:

- The court said the guidelines issued by the Ministry of Environment, Forest and Climate Change (MEF & CC) on 9 February 2011, which have either banned or regulated a bunch of activities within the ESZ, should be strictly adhered to.

- In 2011, the environment ministry had issued a set of guidelines, which either completely banned or regulated certain activities in ESZ. The banned activities are mining, running of sawmills, polluting industries, commercial use of fire woods, mega hydel-power projects and manufacturing of hazardous objects. Mining would be allowed only for loc

al use, the guidelines said.

al use, the guidelines said. - The permissible activities are ongoing agricultural and horticulture practices, rainwater harvesting, organic farming and the adoption of green technology for all activities.

About ESZs:

- Eco-Sensitive Zones (ESZs) or Ecologically Fragile Areas (EFAs) are areas notified by the MoEFCC around Protected Areas, National Parks and Wildlife Sanctuaries.

- The purpose of declaring ESZs is to create some kind of “shock absorbers” to the protected areas by regulating and managing the activities around such areas.

- They also act as a transition zone from areas of high protection to areas involving lesser protection.

- The Environment (Protection) Act, 1986 does not mention the word “Eco-Sensitive Zones”.

- An ESZ could go up to 10 kilometres around a protected area as provided in the Wildlife Conservation Strategy, 2002.

- Moreover, in the case where sensitive corridors, connectivity and ecologically important patches, crucial for landscape linkage, are beyond 10 km width, these should be included in the ESZs.

Significance of ESZ:

- The purpose of declaring ESZs around national parks, forests and sanctuaries is to create some kind of a “shock absorber” for the protected areas.

- These zones would act as transition zone from areas of high protection to those involving lesser protection.

VALUE ADDITION:

SIGNIFICANCE OF WESTERN GHATS:

- Older than the Himalayan mountains, the mountain chain of the Western Ghats represents geomorphic features of immense importance with unique biophysical and ecological processes.

- The site’s high montane forest ecosystems influence the Indian monsoon weather pattern. Moderating the tropical climate of the region, the site presents one of the best examples of the monsoon system on the planet.

- It also has an exceptionally high level of biological diversity and endemism and is recognized as one of the world’s eight ‘hottest hotspots’ of biological diversity.

- The forests of the site include some of the best representatives of non-equatorial tropical evergreen forests anywhere and are home to at least 325 globally threatened flora, fauna, bird, amphibian, reptile and fish species

Connect the Dots:

- Madhav Gadgil and Kasthurirangan Committees are related to the Western Ghats.

EXPLAINED: IS GROWING SPACE TOURISM POSING A RISK TO THE CLIMATE?

THE CONTEXT: Recently, an article published in the journal, Earth’s Future wherein researchers from University College London (UCL), the University of Cambridge and Massachusetts Institute of Technology (MIT) found that the soot emissions from rocket launches are far more effective at warming the atmosphere compared to other sources.

THE EXPLANATION:

- The researchers state that routine launches by the rapidly growing space tourism industry “may undermine progress made by the Montreal Protocol in reversing ozone depletion.”

- They argue that there is an urgent need for environmental regulation to reduce the climatic damage from this fast-growing industry.

Space tourism industry

- According to the authors of the recent study published in Earth’s Future, “The space industry is one of the world’s fastest-growing sectors”.

- From $350 million in 2019, the industry is forecasted to grow to more than $1 trillion by 2040. With companies like Virgin Galactic, SpaceX and Blue Origin launching commercial space flights, space tourism has become, at least theoretically, a possibility for enthusiasts.

What are the study’s findings?

- Unlike other sources of pollution, the study finds that environmental damage caused by rockets is far greater, as they emit gaseous and solid chemicals directly into the upper atmosphere.

- The space tourism’s current growth trends also indicate a potential for the depletion of the ozone layer above the Arctic. This is because the pollutants from rocket fuel and heating caused by spacecraft returning to Earth, along with the debris caused by the flights are especially harmful to the ozone layer.

- What is of great concern is the black carbon (BC) soot that is emitted by rockets directly into the atmosphere. These soot particles have a far larger impact on the climate than all other sources of soot combined, as BC particles are almost 500 times more efficient at retaining heat.

- “Soot particles from rocket launches have a much larger climate effect than aircraft and other Earth-bound sources, so there doesn’t need to be as many rocket launches as international flights to have a similar impact. According to researchers, what we really need now is a discussion amongst experts on the best strategy for regulating this rapidly growing industry”.

- The team of researchers showed that within only 3 years of additional space tourism launches, the rate of warming due to the released soot would more than double.

- This is because of the use of kerosene by SpaceX launches and hybrid synthetic rubber fuels by Virgin Galactic.

Undermining Montreal Protocol

- While the loss of ozone from current rocket launches is “small”, the researchers argue that in the likelihood of weekly or daily space tourism rocket launches, the recovery of the ozone layer caused by the Montreal Protocol could be undermined.

- Researchers also noted, “The only part of the atmosphere showing strong ozone recovery post-Montreal Protocol is the upper stratosphere, and that is exactly where the impact of rocket emissions will hit hardest.

VALUE ADDITION:

MONTREAL PROTOCOL

- The Montreal Protocol is a landmark international treaty that was adopted in Montreal in 1987 and was aimed at protecting the Earth’s ozone layer by regulating the production and consumption of nearly 100 chemicals called ozone-depleting substances (ODS).

- The treaty phases down the consumption and production of various ODS in a stepwise manner.

- As per the Montreal Protocol, developing and developed countries have equal and differentiated responsibilities, however all countries have to follow binding, time-targeted and measurable commitments.

- Considered to be one of the most successful environmental interventions on the global scale, it is the first treaty to achieve universal ratification by all countries in the world.

- The United Nations Environment Programme (UNEP) states that without this treaty, ozone depletion would have increased by more than ten times by 2050, as compared to current levels.

THE PRELIMS PERSPECTIVE

MAYURBHANJ’S SUPERFOOD ‘ANT CHUTNEY’ READY FOR GI-TAG

THE CONTEXT: In Odisha, scientists are now fine-tuning their research to make a presentation for the Geographical Indications (GI) registry of Kai chutney.

THE EXPLANATION:

- Applied under food category, the GI tag will help develop a structured hygiene protocol in the preparation of Kai chutney for standard wider use. Geographical Indications labels enhance the reputation and value of local products and support local businesses.

- People often keep a safe distance from red weaver ants as their sting inflicts a sharp pain and reddish bumps on the skin. Despite this, weaver ants are popular among the tribes of the Mayurbhanj district in Odisha for the mouth-watering dish made of them — the Kai chutney.

- This savoury food item, rich in proteins, calcium, zinc, vitamin B-12, iron, magnesium, potassium, sodium, copper, fibre and 18 amino acids, is known to boost the immune system.

- Weaver ants, Oecophylla smaragdina, are abundantly found in Mayurbhanj throughout the year. They make nests with leaves of host trees.

VALUE ADDITION:

About GI tag:

- A GI is primarily an agricultural, natural or manufactured product (handicrafts and industrial goods) originating from a definite geographical territory.

- Typically, such a name conveys an assurance of quality and distinctiveness, which is essentially attributable to the place of its origin.

Security:

- Once the GI protection is granted, no other producer can misuse the name to market similar products. It also provides comfort to customers about the authenticity of that product.

Who is a registered proprietor of a geographical indication?

- Any association of persons, producers, organisation or authority established by or under the law can be a registered proprietor.

- Their name should be entered in the Register of Geographical Indication as registered proprietor for the Geographical Indication applied for.

How long the registration of Geographical Indication is valid?

- The registration of a geographical indication is valid for a period of 10 years. Also, It can be renewed from time to time for further period of 10 years each.

- In India, Geographical Indications registration is administered by the Geographical Indications of Goods (Registration and Protection) Act, 1999 which came into force with effect from September 2003. The first product in India to be accorded with GI tag was Darjeeling tea in the year 2004-05.

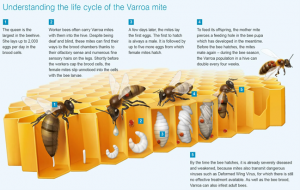

EXPLAINED: WHY AUSTRALIA HAS HAD TO KILL MILLIONS OF BEES TO SAVE ITS HONEY INDUSTRY

THE CONTEXT: The recent outbreak of the deadly varroa mite, a sesame seed-sized parasite that was first spotted at a port near Sydney, Australia poses a massive threat to the country’s multimillion-dollar honey industry.

THE EXPLANATION:

- Recently, Australia was one of the few countries that was able to successfully clamp down on the spread of Varroa mite-induced plagues, known to be the biggest threat to bees worldwide.

- According to the Australian Honeybee Industry Council, Colonies of honeybees have been put under “lockdown” as part of a wide range of biosecurity measures to limit the outbreak. “It is critically important that beekeepers in the Newcastle area do not move any hives or equipment in or out of the area”.

What is the Varroa mite?

- The Varroa mite, or Varroa destructor, is a parasitic insect that attacks and feeds on honeybees. Reddish-brown in colour, the tiny pests are known to kill entire colonies of honeybees. They often travel from bee to bee and also via beekeeping equipment, such as combs that have been extracted.

- The spread of the mite is largely blamed for a sharp decline in the number of honeybee colonies worldwide. It has plundered bee colonies across the globe.

- According to Australian beekeeping website Bee Aware “Although Varroa mites can feed and live on adult honeybees, they mainly feed and reproduce on larvae and pupae in the developing brood, causing malformation and weakening of honey bees as well as transmitting numerous viruses.”

Why do bees’ matter?

- According to a report, the latest lockdown could adversely impact the growth of several crops — including almonds, macadamia nuts and blueberries — that are dependent on hives for pollination.

THE MISCELLANEOUS

EXPLAINED: ARE HUMANS OLDER THAN WE THOUGHT? EXPLAINING THE STUDY OF THE SKELETAL REMAINS FROM SOUTH AFRICA

THE CONTEXT: According to a new study published in the journal Proceedings of the National Academy of Science, the fossils of our earlier human ancestors, located in a cave in South Africa, is a million years older than previously understood.

THE EXPLANATION:

The researchers analysed the fossilised remains of Australopithecus from Sterkfontein caves and argued they lived at the same time as their East African counterparts like the famous Lucy, complicating the way scholars have understood human evolution.

What is Australopithecus?

- Australopithecus, meaning “southern ape”, was a group of hominins or now-extinct early humans, that was closely related to and almost certainly the ancestors of modern humans.

- They inhabited the planet 4.4 million to 1.4 million years ago, likely encompassing a time period longer than our own genus, Homo. Their fossils have been found across sites in eastern, northern, central and southern Africa.

- Australopithecus was originally defined by the anthropologist Raymond Dart in 1925, after the discovery of the first australopith fossil (a small child’s skull) in Tuang, South Africa. Through his research, Dart argued that early humans first evolved in Africa, challenging the conventional wisdom that they had done so in Europe and Asia.

- Our early ancestors were bipedal in nature and travelled on the ground (but used trees for food and protection), had large teeth with thick enamel caps for chewing, and their brains were only slightly larger than apes. The facial and dental features suggest that they were able to consume tough foods, such as nuts, seeds, tubers and roots.

- They stood at a height of around 3 ft 9 inches to 4 ft 11 inches, and likely weighed around 30 to 50 kg, with males almost double the size of females.

What are the Sterkfontein caves?

The “Cradle of Humankind” is a 47,000-hectare paleoanthropological site, declared a World Heritage Site by UNESCO. Located 40 km northwest of Johannesburg, it contains a complex system of limestone caves, where a significant number of hominin fossils have been found.

THE PRELIMS PRACTICE QUESTIONS

QUESTION OF THE DAY

Q.The Athirappilly Falls is located in which state?

a) Kerala

b) Tamil Nadu

c) Karnataka

d) Maharashtra

ANSWER FOR 2ND JULY 2022

Answer: D

Ethics Through Current Development (04-07-2022)

Today’s Important Articles for Geography (04-07-2022)

- Monsoon: Continued vigilance is needed READ MORE

- Plastic ban: There may be issues but the well-intentioned move to ban SUP mustn’t end up badly READ MORE

- Whither Justice: While COP26 had managed to achieve significant procedural and institutional outcomes, it had fallen short of achieving substantive outcomes which could reflect the imperative of climate justice. READ MORE

Today’s Important Articles for Sociology (04-07-2022)

Today’s Important Articles for Pub Ad (04-07-2022)

WSDP Bulletin (04-07-2022)

(Newspapers, PIB and other important sources)

Prelim and Main

- Restoring the Sun temple’s exquisite carvings READ MORE

- Explained | The functioning of the National Investigation Agency READ MORE

- Celebrating the unknown, the unsung, and the underappreciated READ MORE

- With GI tag, Mayurbhanj’s superfood ‘ant chutney’ set to find more tables READ MORE

- NATO Invites Finland, Sweden to Join, Says Russia Is a ‘Direct Threat’ READ MORE

- La Niña Likely To Enter ‘Extremely Unlikely’ Third Year. What Must India Do? READ MORE

- UN Ocean Conference: 198 countries adopt Lisbon Declaration READ MORE

- Under the revised rule, individuals now have 90 days to inform the govt. if the amount exceeds READ MORE

- India’s Gig Economy to Expand to 2.35 Crore Workers by 2029-30: Niti Aayog READ MORE

Main Exam

GS Paper- 1

- The Simla Agreement: An imperfect peace READ MORE

- Monsoon: Continued vigilance is needed READ MORE

- The post-pandemic global inequality boomerang READ MORE

GS Paper- 1

POLITY AND GOVERNANCE

- Why is defection a non-issue for voters? Indian voters are divided on what kind of representatives they prefer voting for READ MORE

- Technology is no panacea for custodial deaths READ MORE

- Reimagining the post-pandemic world READ MORE

SOCIAL ISSUES AND SOCIAL JUSTICE

- Inclusive social protection READ MORE

INTERNATIONAL ISSUES

- The West Asia pivot: India must persist in its attempt to experiment with policy changes READ MORE

- G7 infra plan a lifeline developing nations can’t ignore but first crack this code, like BRI READ MORE

- India, BRICS in Cold War Conditions READ MORE

GS Paper- 1

ECONOMIC DEVELOPMENT

- Dogged by inflation: Policymakers must focus on easing price pressures so as not to derail recovery READ MORE

- Why rice and wheat bans aren’t the answer to inflation READ MORE

- Farm reforms need a GST-like council READ MORE

- India faces sharp fiscal deficit slippage READ MORE

- Why the rupee’s ‘record low’ is not necessarily a cause for concern READ MORE

ENVIRONMENT AND ECOLOGY

- Plastic ban: There may be issues but the well-intentioned move to ban SUP mustn’t end up badly READ MORE

- Whither Justice: While COP26 had managed to achieve significant procedural and institutional outcomes, it had fallen short of achieving substantive outcomes which could reflect the imperative of climate justice. READ MORE

SCIENCE AND TECHNOLOGY

GS Paper- 1

ETHICS EXAMPLES AND CASE STUDY

- Technology is no panacea for custodial deaths READ MORE

- How we sow and reap our samskaras READ MORE

- Gratitude is Beatitude READ MORE

Questions for the MAIN exam

- ‘Technology may make policing more convenient, but it can never be an alternative for compassionate policing established on trust between the police and the citizens. Discuss the statement in light of the use of AI and Machine Learning in policing in recent times.

- ‘While COP26 had managed to achieve significant procedural and institutional outcomes, it had fallen short of achieving substantive outcomes which could reflect the imperative of climate justice’. Comment on the statement in light of COP 26 outcomes.

- ‘Fairness in governance is guaranteed only when there is a suitable constitutional climate’. Comment on the statement.

- ‘The Constitution works not merely through its institutions. It works through the people’. Discuss the statement.

QUOTATIONS AND CAPTIONS

- It is not enough to stare up the steps, we must step up the stairs.

- Evidence from the National Election study indicates that the views of Indian voters are divided on what kind of representatives they would prefer to vote for.