TOPIC : AN ANALYSIS OF THE NITI AAYOG’S REPORT ON THE GIG ECONOMY

THE CONTEXT: In June 2022, NITI Aayog released a report on the Gig economy in India. The report “India’s Booming Gig and Platform Economy: Perspectives and Recommendations on the Future of Work”, underlines the opportunities and challenges of this sector. Among other things, the report estimates the gig workforce to be 68 lakhs by 2019-20 and 77 lakhs by 2020-21. As per the estimates in the report, close to 60% of such Workforce are in Retail & the Transportation sector. The article identifies the opportunities and challenges of this sector.

IMPORTANCE OF THE REPORT

- The report is a first-of-its-kind study that presents comprehensive perspectives and recommendations on the gig–platform economy in India.

- The report provides a scientific methodological approach to estimate the current size and job-generation potential of the sector.

- It highlights the opportunities and challenges of this emerging sector and presents global best practices on initiatives for social security, and delineates strategies for skill development and job creation for different categories of workers in the sector.

HIGHLIGHTS NITI AAYOG REPORT

- As of 2021, the gross volume of the gig economy is estimated to be around USD 348 billion USD. India is also an emerging player, the importance of which is identified by the Government of India.

- The report estimates that in 2020–21, 77 lakh (7.7 million) workers were engaged in the gig economy. They constituted 2.6% of the non-agricultural Workforce or 1.5% of the total Workforce in India.

- The gig workforce is expected to expand to 2.35 crore (23.5 million) workers by 2029–30.

- Gig workers are expected to form 6.7% of the non-agricultural Workforce or 4.1% of the total livelihood in India by 2029–30.

- At present, about 47% of the gig work is in medium-skilled jobs, about 22% in high skilled, and about 31% in low-skilled jobs.

- The trend shows the concentration of workers in medium skills is gradually declining and that of the low skilled and high skilled is increasing.

DEVELOPING CONCEPTUAL UNDERSTANDING

WHAT IS THE GIG ECONOMY?

- The gig economy is a job market which consists of short-term or part-time work done by people who are self-employed or on temporary contracts.

- Section 2(35) of the Code on Social Security 2020 defines a gig worker as a person who participates in a work arrangement and earns from such activities outside of a traditional employer-employee relationship.

- As per the World Economic Forum, gig economy is defined by its focus on workforce participation and income generation via “gigs”, single projects or tasks for which a worker is hired.

- The term “gig” is a slang word for a job that lasts a specified period of time; it is typically used by musicians.

- Examples of gig employees in the Workforce could include work arrangements such as freelancers, independent contractors, project-based workers and temporary or part-time hires.

- As there is no employer-employee relationship, the gig workers are not tied to any particular employer and therefore have greater flexibility in terms of the work they can choose and the hours they dedicate.

- Businesses have flexibility when they are not dependent on a set of employees for executing tasks and additionally benefit from avoiding the cost of social security and fixed remuneration provided to employees.

- The service sector fuelled by the digital economy has been the most resilient segment of the gig economy. The size of the gig economy is projected to grow at Compounded Annual Growth Rate of 17% and is likely to hit a gross volume of $455 billion by 2023, as per ASSOCHAM.

WHAT IS PLATFORM WORK?

- Platform work means a work arrangement in which an organization or an individual uses online platform to provide goods and services to consumers. For example, Uber, Ola, Zomato etc.

- The Code on Social Security 2021 defines platform work as a work arrangement outside the traditional employer-employee relationship in which organizations or individuals use an online platform to access other organizations or individuals to solve specific problems or to provide specific services in exchange for payment.

- Section 2(61) of the Code on Social Security defines a platform worker as someone engaged in or undertaking platform work.

- In general, platform workers are the most visible and vulnerable faces of the gig economy. The gig work includes platform work also, and often; these terms are used interchangeably. For the purpose of our discussion, we also take a similar approach.

WHAT IS MEANT BY INFORMALISATION OF LABOUR?

- When the share of the informal workers in the total labour force increases, the situation is called the informalisation of labour.

- It is a process of consistent decline in the percentage of formal-sector labour force and consistent increase in the percentage of the informal sector labour force in the economy.

- The Economic Survey of 2018-19, released in July 2019, said “almost 93%” of the total Workforce is “informal”.

- These workers are engaged in economic activities with lower productivity resulting in lower incomes. They are also engaged in activities with less stable employment contracts (including the self-employed) and fewer or nil social security benefits.

WHAT IS THE MEANING OF FORMAL AND INFORMAL SECTORS?

- It must be made very clear that there is no universally accepted definition of formal and informal or organized and unorganized sector in India (http://iamrindia.gov.in/writereaddata/UploadFile/org_unorg.pdf read for further information)

- In general, the informal sector of the economy is characterized by irregular and low income, precarious working conditions, no access to social safety nets, lack of legal safeguards etc.

- While the formal sector has fixed working conditions, social security benefits and labour law being applied to them.

DEFINITION OF LABOUR FORCE

- Persons who are either ‘working’ (employed) or ‘seeking or available for work’ (unemployed) or both during a major part of the reference period constitute the labour force. In simple words, persons who are employed and unemployed are included in the labour force (15-60 in general).

DEFINITION OF WORKFORCE

- The Workforce, on the other hand, includes only the employed and excludes the unemployed. People who are actually working are included in the Workforce. The difference between the labour force and the Workforce is the total number of unemployed persons.

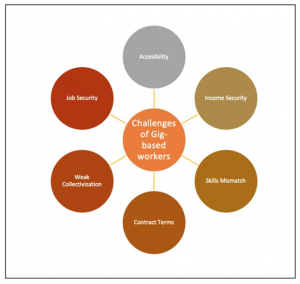

JOB & INCOME SECURITY, OCCUPATIONS SAFETY ARE AMONG THE MAJOR CHALLENGES WITH GIG-BASED WORK

- While patronization i.e., using digital platforms to identify work, has helped to formalize gig works, there are multiple issues identified internationally. The main issue is with the algorithmic control of the platform labour by digital platforms. Rating-based reputation systems, power of consumers/customers over workers, etc., facilitated by these platforms are said to cause significant risks and unfair working conditions to the workers.

- The study report identifies that the gig-work in India also faces these challenges with the platforms. The report further takes cognizance of various other challenges faced by gig workers in India.

- One of the major challenges is with the job & income security. They are typically classified as independent workers or contractors and hence are not extended benefits from labour regulations relating to wages, hours of work, working conditions etc.

- Accessibility is another issue with the availability of jobs depending on location (urban vs rural), gender, access to the internet etc. Varying degrees of skill-mismatch are observed on online web-based platforms, with workers with better qualifications not necessarily finding jobs.

- Unfavourable terms of contract and non-collectivism of the gig workers are among the other challenges faced by gig workers.

- While these challenges exist for gig-based jobs in the country, the study report notes that gig & platform-based jobs have contributed to inclusivity, especially for women and people with disabilities.

HOW DOES THE GIG ECONOMY LEAD TO INFORMALISATION?AN ANALYSIS

OUTSIDE THE PURVIEW OF THE REGULATORY FRAMEWORK

- The gig economy is outside the ambit of almost all the regulations applicable to the other sectors of the economy. The formal sector employment has been tightly regulated one and even the informal sector faces some regulation. There is near absence of regulation in the area of gig economy, especially in the context of labour rights.

UNCLEAR EMPLOYMENT RELATIONSHIP

- In the gig economy, the traditional employer and employee relationship is replaced by vague ideas of “partners, independent contractors and the like “. These companies call themselves “aggregators and not employers” which provides an escape route from the application of labour laws to them

EXPLOITATIVE SERVICE CONDITIONS

- The remuneration and working conditions are arbitrarily set by the companies and workers often complain about unwarranted deductions from their salaries. For instance, a Swiggy delivery boy earlier received 50 rupees for an order which has been progressively reduced to 20(10 in some cases) rupees on weekdays. There exists no grievance mechanism to raise the concerns of the workers.

SUBJUGATION TO ALGORITHMS

- The software application controls the platform workers’ work-life. It decides everything from when and where to onboard (log in), how much time is allowed for delivery, calculation of incentives and even imposition of penalty! The gig worker has no voice in deciding any of these aspects and the application exerts total control over the workers.

NON EXISTENT SOCIAL SAFETY NET

- None of the social security benefits available to traditional workers are available to gig workers. Even the ad-hoc group insurance is available only on “on duty days’. The companies don’t even have any data on how many of its partners have succumbed to Covid 19 or were infected by the virus. The workers are vulnerable to risks of accidents and many have lost lives during the course of their duties.

DEMAND AND SUPPLY MISMATCH

- when the labour supply is high and more disposable, the gig workers have no power to influence payment offerings, and the freedom to choose becomes an illusion. In the interplay of demand and supply mechanisms, the gig workers always lose out. Thus, as platforms become more popular among gig workers, more of them join the pool, which leads to companies dictating the terms and conditions of work. The All India, Gig Workers union, has been protesting against the wage reduction by Swiggy but to no avail.

NO SCOPE FOR COLLECTIVE BARGAINING

- The problem of lack of a formal relationship within the gig economy landscape is accentuated by the lack of effective unionization of the workers. The temporary nature of work, disaggregated location of workers etc do not make it feasible for a collective airing of grievances. Even the recently formed Indian federation of App-based Transport workers’ protests did not change the status quo.

EXERCISING CONTROL WITHOUT ACCOUNTABILITY

- The companies claim that their workers are self-employed, and they can choose when and how long they wish to work. This is not true as, for instance, Swiggy does not allow “home log in” and the worker has to reach a “hot zone” for login. When a worker logs out or is irregular, then the frequency of the orders he receives is reduced. In other words, the companies exercise almost all the control of a traditional employer without commensurate responsibility to workers.

POSITIVE SIDE OF GIG ECONOMY

FREEDOM OF CHOICE

- The employees have the freedom to choose from a host of firms operating in the sector. For instance, a delivery executive can choose Swiggy, Zomato or any other food delivery app. This choice is also available in the case of e-commerce companies or cab aggregators and others. This freedom to choose can help the workers to look for greener pastures.

FLEXIBLE WORKING HOURS

- There are no mandatory working hours in these sectors and the worker is free to join in or out at any time. This flexibility provides scope for control over one’s work which can be harnessed by those looking for a part-time job like students, employed etc,

NO FORMAL TRAINING REQUIRED

- The gig economy generally does not demand any formal education, skills or formal training for carrying out these jobs. For instance, a smartphone and a bike are enough to get work in food delivery apps (of course, subject to company policies). Thus it provides great livelihood opportunities for the unskilled and semi-skilled.

INCENTIVISATION OF HARD WORK

- The gig economy works on the principle of ‘the more you work, the more you earn’. This approach encourages those having a zeal for hard work by providing incentives on a par with the output of work. The scope for extra earning works as a great motivator.

GENDER EMPOWERMENT

- The rise of the gig economy in the wake of COVID-19 has the potential to boost women’s employment in the formal sector. The adoption of new technologies could create better opportunities for women.

- In a UNDP survey, around 57% of the respondent firms agree that the gig economy will itself expand and boost women’s employment because it is based on flexible, temporary, or freelance jobs, often involving connecting with clients or customers through an online platform.

- The technology-based platforms enable women to be a part of Workforce by virtue of their openness.

- Like Uber, there are various other on-demand platforms that have come into existence to facilitate consumer access to a range of care and domestic work services, such as cooking, cleaning, and child and elderly care. These include MyDidi.

HOW TO BRING ELEMENTS OF FORMALIZATION IN GIG ECONOMY?

DATA ON THE SIZE OF THE GIG WORKFORCE

- Any step towards addressing the issue of informalisation in the gig economy require proper data on the size of the Workforce. The Parliamentary Standing Committee on Labour has criticized the labour ministry for its lackadaisical attitude relating to data collection. Data-driven policy-making and governance need to be the core of reforming the sector.

LEGAL INTERVENTIONS

- Regulation by the State of this sector without undermining its animal spirit is the need of hour. The Code on Social Security, although it defines the gig and platform workers, is silent on the aspect of regulation. A separate regulatory regime for gig sector can be brought which must balance the interest of both the companies and workers.

PROVIDING CONCRETE SOCIAL SAFETY MEASURES.

- The companies need to be persuaded to set up a social security system for the workers. Alternatively, they can be legally mandated to contribute to the fund established by the Centre or state governments.

- For instance, the Code on Social Security, 2020, mandate companies employing gig or on-demand workers to allocate 1-2% of their annual turnover or 5% of the wages paid to gig workers.

CLARIFYING THE RELATIONSHIP BETWEEN THE COMPANY AND THE WORKERS

- It is necessary to define clearly the nature of the relation between these platform companies and the workers. Taking shelter under terms (partner etc) which have no legal basis will only lead to conflicts between workers and the companies and eventually impact the business prospects of the companies.

LEARNING FROM INTERNATIONAL JUDICIAL INTERVENTIONS

- In 2021, the UK Supreme Court ruled that Uber’s drivers were entitled to employee benefits; in 2018, the California Supreme Court specified a test for determining an employer-employee relationship, which effectively designated gig workers are employees. Indian courts must take a leaf out of these progressive judicial interventions.

UNIONIZATION OF THE WORKERS

- There is strength in numbers and the workers need to organize themselves to press for legitimate demands from the government and the companies. A federation of all gig workers must be established to work as a pressure group and a forum for constructive suggestions for improving the work culture and business practices.

BEST PRACTICES OF THE STATE GOVERNMENTS.

- Karnataka govt is in the process of drafting a law to provide minimum wages and social security benefits to gig workers. It also formed a company, inter alia, to promote gig economy companies. The Karnataka Digital Economy Mission, a company with 51% stake in the industries aim to promote the gig economy through various facilitative measures. These types of positive interventions can be replicated in other states also.

HOW CAN THE ABOVE ISSUES BE ADDRESSED?

NITI Aayog’s study report takes cognizance of the different challenges faced by gig workers in the country. The report has also identified the need to upskill the gig workers to take advantage of the existing and future opportunities. A few of the recommendations of the study report are the following.

- Undertake a separate enumeration exercise to estimate the size of the gig economy and identify the characteristic features of gig workers.

- Platform India initiative to catalyze Platformization.

- Accelerating financial inclusion.

- Skilling of the Workforce through Outcome-based skilling, platform-led transformational skilling, platform skilling with government schemes etc.

- Integration and linking of employment and skill development portals.

- Enhancing social inclusion through gender sensitization & awareness programmes, inclusive systems & communication, self-development support etc.

- Paid sick leave, health access & insurance, occupational disease & work-accidental insurance, retirement & pension plans etc.

- Support to workers in situations of irregularity of work, contingency cover etc.

- RAISE framework for operationalizing the Code on Social Security to be adopted for gig & platform workers.

THE CONCLUSION:The Economic Survey 2021 has appreciated the role of the gig economy in service delivery and employment provision to the labour force during the pandemic period. This sector holds out huge promise, especially in the context of governments’ push toward a digital economy through Digital India. It is true that the freelance nature of the work and other attributes may not strictly fit into the traditional employer-employee matrix. But that does not mean the labour should be left for exploitation and suffer from poor working conditions. It is in the interest of all stakeholders, the promoters, management, workers, the shareholders, the consumers and others that adequate concrete measures be adopted for a win situation for all.

Questions

- Critically analyze the NITI Aayog’s recent report on the platform-based economy.

- Defining the concept of the gig economy, explain how it contributes to the informalisation of the Workforce in India.

- While the gig economy provides huge scope for choice and freedom of work, it also leads to the informalisation of labour. Comment.