DAILY CURRENT AFFAIRS (JULY 09, 2022)

THE GEOGRAPHY: CLIMATOLOGY

WHAT IS A DERECHO, A STORM THAT TURNED THE SKY GREEN IN THE US?

- THE CONTEXT: Recently, the States of Nebraska, Minnesota and Illinois in the US were hit by a storm system called a derecho.

- THE EXPLANATION:

- As the storm rolled in, winds gusting at around 140 km per hour, snapped power lines and knocked down trees. As the storm hit, it turned the skies green, with even many experienced storm chasers claiming to have never witnessed such atmospheric optics.

What is a derecho?

- A derecho, according to the US’s National Weather Service is “a widespread, long-lived, straight-line windstorm” that is associated with a “band of rapidly moving showers or thunderstorms”. The name comes from the Spanish word ‘la derecha’ which means ‘straight’. Straight-line storms are those in which thunderstorm winds have no rotation unlike a tornado. These storms travel hundreds of miles and cover a vast area.

- Being a warm-weather phenomenon, a derecho generally – not always – occurs during summertime beginning May, with most hitting in June and July. However, they are a rare occurrence as compared to other storm systems like tornadoes or hurricanes.

- For a storm to be classified as a derecho it must have wind gusts of at least 93 km per hour; wind damage swath extending more than 400 km. According to University of Oklahama’s School of Meteorology, the time gap between successive wind damage events should not be more than three hours.

- Why did the sky turn green during the derecho that hit US recently?

- Severe thunderstorms result in a ‘green sky’ due to light interacting with the huge amount of water they hold. A report in the Washington Post said that it is believed that the big raindrops and hail scatter away all but the blue wavelengths due to which primarily blue light penetrates below the storm cloud. This blue then combines with the red-yellow of the afternoon or the evening sun to produce green, the report said.

- Are there different types of derechos?

- They fall into three categories – progressive, serial and hybrid. A progressive derecho is associated with a short line of thunderstorms that may travel for hundreds of miles along a relatively narrow path. It is a summer phenomenon.

- A serial derecho, on the other hand, has an extensive squall line – wide and long – sweeping across a large area. It usually occurs during spring or fall.

- Hybrid ones have the features of both progressive and serial derechos.

THE INDIAN POLITY AND GOVERNANCE

SUB-CATEGORISATION OF OBCS: GOVT EXTENDS TERM AGAIN WITHOUT PANEL ASKING FOR IT

- THE CONTEXT:The Union Cabinet gave the 13th extension to the Justice Rohini Commission, giving it time until January 31, 2023, to submit its report.

- THE EXPLANATION:

- The commission was set up on October 2, 2017 under Article 340 of the Constitution. It was tasked with sub-categorisation of the Other Backward Classes (OBCs) and equitable distribution of benefits reserved for them. Its initial deadline to submit its report was 12 weeks — by January 2, 2018.

What is sub-categorisation of OBC?

- Under the central government, OBCs are granted 27% reservation in jobs and education.

- A debate arose due to the perception that only a few affluent communities among the Central List of OBCs have secured a major part of this 27% reservation.

- The argument for sub-categorisation — or creating categories within OBCs for reservation — is that it would ensure “equitable distribution” of representation among all OBC communities.

- To examine this, the Rohini Commission was constituted in 2017. At that time, it was given 12 weeks to submit its report, but has been given several extensions since.

- Before the Rohini Commission was set up, the Centre had granted constitutional status to the National Commission for Backward Classes (NCBC).

About Rohini commission

- The mandate of Rohini commission includes examining the extent of inequitable distribution of benefits of reservation among the castes or communities included in the OBCs.

- The commission was also mandated to work out the mechanism, criteria, norms and parameters in a scientific approach for their sub-categorisation.

- The commission’s mandate is also to take up the exercise of identifying the respective castes or communities or sub-castes or synonyms in the Central List of Other Backward Classes and classifying them into their respective sub-categories.

- Its initial deadline to submit its report was 12 weeks — by January 2, 2018.

Findings of the report so far

- In 2018, the Commission analysed the data of 3 lakh central job given under OBC quota over the preceding five years and OBC admissions to collveges over the preceding three years.

- The findings were: 97% of all jobs and educational seats have gone to just 25% of all sub-castes classified as OBCs;

- 95% of these jobs and seats have gone to 10 OBC communities;

- 37% of the total OBC communities—983 OBC communities—have zero representation in jobs and educational institutions;

- 994 OBC sub-castes have a total representation of only 2.68% in recruitment and admissions.

THE ENVIRONMENT, ECOLOGY AND CLIMATE CHANGE

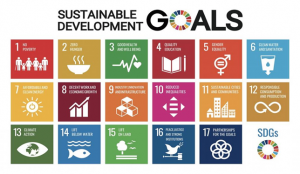

THE SDG REPORT 2022

- THE CONTEXT: Recently, the United Nations released the Sustainable Development Goals Report 2022 provides a global overview of progress on the implementation of the 2030 Agenda for Sustainable Development, using the latest available data and estimates.

- THE EXPLANATION:

- According to the United Nations-mandated Sustainable Development Goals (SDG) are in danger of slipping away from reach and along with them years of progress on eradicating poverty, hunger and ignorance.

- All 17 SDGs, set at the UN General Assembly in 2015, are in jeopardy due to the climate crisis, the COVID-19 pandemic and an increase in the number of conflicts across the world.

- The “cascading and intersecting” issues impact the environment, food and nutrition, health, peace and security as well as education, according to a UN statement on the report.

- Greenhouse gas emissions are set to rise 14 per cent over a decade, the statement noted, antithetical to the Paris Agreement plan — a 2025 peak followed by a 43 per cent decline by 2030 and Net 2050. Energy-related carbon dioxide emissions shot up 6 per cent, taking down gains due to the COVID-19.

- The pandemic itself has emerged as one of the biggest threats to several SDGs, the statement said pointing at 15 million “excess deaths” directly or indirectly due to the novel coronavirus by 2021.

- Economic shocks due to the worldwide health emergency pushed 93 million into poverty in 2020 alone, undoing “more than four years” work at alleviating poverty. It also affected education and healthcare services for millions. Immunisation, for example, has dropped for the first time in a decade even as deaths from malaria and TB have risen.

- The pandemic and the Russia-Ukraine war have already led to lowering of global economic growth projections by 0.9 percentage point, the statement highlighted, flagging the conflict for harming in more ways than one:

- Raising food and fuel prices

- Hampering global supplies and trade

- Roiling financial markets

- The report also flagged threats to food security and aids, rising unemployment (especially among women) and increases in child labour as well as child marriages. The burden was greater on least developed countries and vulnerable population groups.

Sustainable Development Goals – Background

- In September 2000, the United Nations-mandated that all of its members adhere to a Millennium Development Goal, which consisted of a set of eight time-bound goals that were to be met within a fifteen-year period. The eight targets of the Millennium Development Goals were as follows:

- To make extreme poverty and hunger a thing of the past.

- To make primary education universal

- To advance gender equality and women’s empowerment

- To lower the infant mortality rate

- To improve the health of mothers

- HIV/AIDS, malaria, and other diseases are being combated.

- To ensure long-term environmental viability

- Creating a global development partnership

- In 2015, the UN received a final report confirming the beneficial impact of the Millennium Development Goal on the eight parameters as well as the maternal mortality rate. Once the MDG’s 15-year target was met, the responsibility for development was transferred to the Sustainable Development Goal’s 17 targets.

THE GOVERNMENT INTERVENTION AND POLICIES

CHHATTISGARH GETS CENTRE’S NOD FOR WORLD BANK FUNDED SCHOOL PROJECT

- THE CONTEXT:The Chhattisgarh Government has received an in-principle nod from the Centre to go ahead with a $300 million (approximately ₹2,100 crore) school education project the State is negotiating with the World Bank.

- THE EXPLANATION:

- The proposal, discussions on which started in April 2022 and then it was sent to the Centre after the State Finance Department cleared it. If it goes through, the initiative will allow the Chhattisgarh Government to borrow $300 million over a period of five years at significantly lower than market rates, and repay it over a period of 20 years.

- An in-principle nod means that the Centre has no objection to the State borrowing money from an external financial institution such as the World Bank. This is not the final approval, but it paves the way for the State to proceed with subsequent discussions. Similarly, the World Bank has also approved in-principle that it’s willing to fund the project.

- “This will be followed by a World Bank team’s visit to Chhattisgarh. The team is scheduled to arrive later this month (July 2022). Then the state Govt will prepare the Detailed Project Report (DPR) with the Centre and the World Bank, which will be put up before the World Bank Board and the Centre for a final approval.

- The World Bank has been associated with India’s school education system since 1994, according to sources. One of its more recent projects, inked in 2021, is the $500 million Strengthening Teaching-Learning and Results for States Program (STARS) to improve the quality and governance of school education in six Indian States. That list, however, does not include Chhattisgarh.

Why states need centre’s permission while borrowing? Is it mandatory for all states?

- Article 293(3) of the Constitution requires states to obtain the Centre’s consent in order to borrow in case the state is indebted to the Centre over a previous loan.

- This consent can also be granted subject to certain conditions by virtue of Article 293(4).

- In practice, the Centre has been exercising this power in accordance with the recommendations of the Finance Commission.

- Every single state is currently indebted to the Centre and thus, all of them require the Centre’s consent in order to borrow.

- Does the Centre have unfettered power to impose conditions under this provision?

- Neither does the provision itself offer any guidance on this, nor is there any judicial precedent that one could rely on.

- Interestingly, even though this question formed part of the terms of reference of the 15th Finance Commission, it was not addressed in its interim report.

- So, when can the centre impose conditions?

- The Centre can impose conditions only when it gives consent for state borrowing, and it can only give such consent when the state is indebted to the Centre.

- Why are such restrictions necessary?

- One possible purpose behind conferring this power upon the Centre was to protect its interests in the capacity of a creditor.

- A broader purpose of ensuring macroeconomic stability is also discernible, since state indebtedness negatively affects the fiscal health of the nation as a whole.

CENTRE TO PROMOTE DRAGON FRUIT CULTIVATION IN 50,000 HECTARES

- THE CONTEXT: The Gujarat Government recently renamed dragon fruit as kamlam (lotus) and announced an incentive for farmers who cultivate it. The Haryana Government also provides a grant for farmers who are ready to plant this exotic fruit variety.

- THE EXPLANATION:

- The Centre feels that considering the cost effectiveness and global demand for the fruit due to its nutritional values, its cultivation can be expanded in India. At present, this exotic fruit is cultivated in 3,000 hectares; the plan is to increase cultivation to 50,000 hectares in five years.

- According to the Central Govt, the demand for the fruit is high in domestic and global markets because of its nutritional values. “Fifty thousand hectares in five years is an achievable target. The demand for the fruit will remain. Prices for farmers will also be good. The benefit is that this fruit can be cultivated in degraded and rainfed land”.

- Also, Indian Council of Agriculture Research, the fruit plant doesn’t need much water and can be cultivated on dry land. When it comes to cost, the dragon fruit is now sold at a price of ₹400 per kg and the effort is to make it available to consumers for ₹100 per kg. “The cost of cultivation is initially high. But the plant doesn’t need productive land; it gives maximum production from non-productive, less fertile area. This is beneficial for a lot of farmers.

- The Centre plans to come up with an annual action plan to motivate more State governments. At the moment, Mizoram tops among the States that cultivate this fruit, which is indigenous to Mexico and is now produced mainly in Vietnam. The export of the fruit has made a huge contribution to Vietnam’s GDP. “All the States in India except cold areas are suitable for dragon fruit plants. Market demand so high as production is less”.

- According to sources, India is now importing about 15,491 tonnes of dragon fruits and has potential to match the production of China, where cultivation of the fruit takes place in 40,000 hectares, and Vietnam, which grows the fruit in 60,000 hectares. “The initial investment high. But it gives fast returns within a year. The red and pink varieties of the fruit give better yield”.

PRELIMS PERSPECTIVE

DRAGON FRUIT (A) KAMLAM (LOTUS)

- It is scientifically referred to as Hylocereusundatus,

- Production of ‘dragon fruit’ commenced in India in early 1990s and it was grown as home gardens.

- Due to high export value, the exotic ‘dragon fruit’ has become increasingly popular in recent years in the country and it has been taken up for cultivation by farmers in different states.

- Three main varieties of dragon fruit: white flesh with pink skin, red flesh with pink skin, and white flesh with yellow skin.

- However, the red and white flesh is in demand among the consumers.

- Indian States that grow Dragon fruit: Karnataka, Kerala, Tamil Nadu, Maharashtra, Gujarat, Odisha, Andhra Pradesh, West Bengal and Andaman and Nicobar Islands.

- Major Dragon fruit growing countries: Malaysia, Thailand, the Philippines, the USA and Vietnam

- These countries are the major competitors for Indian Dragon Fruit.

- Growth requirements and benefits:

- It requires less water

- It can be grown in various kinds of soils.

- The fruit contains fiber, vitamins, minerals, and antioxidants.

- It can help in repairing the cell damage caused by oxidative stress and reduce inflammation,

- It can also improve the digestive system.

THE PRELIMS PERSPECTIVE

ONE WORD A DAY – CO-LOCATION

- THE CONTEXT:Market regulator SEBI has penalised 18 entities, including the National Stock Exchange (NSE), its former managing director Chitra Ramkrishna and group president Ravi Varanasi, in the ‘dark fibre’ case.

- THE EXPLANATION:

What is co-location?

- Co-location is typically associated with a facility where a third party can lease a rack/server space along with other computer hardware.

- A co-location facility provides infrastructure such as power supply, bandwidth, and cooling for setting up servers and storage of data.

What is dark fibre?

- The dark fibre or unlit fibre, with respect to network connectivity, refers to an already laid but unused or passive optical fibre, which is not connected to active electronics/equipment and does not have other data flowing through it and is available for use in fibre-optic communication.

What is the dark fibre case?

- The case relates to the alleged differential access given to certain broking firms in the form of ‘dark fibre’ at NSE, to connect across the colocation facilities before other members.

THE PRELIMS PRACTICE QUESTIONS

QUESTION OF THE DAY

Q.The term “Derecho” recently seen in the news related to

- a)It is latest nuclear weapon made in Russia.

- b)It is a Straight-line storms.

- c)It is a new mineral found in Luhansk, Ukraine.

- d)It isa method for suppressing the people during protest.

ANSWER FOR 7TH JULY 2022

ANSWER: B

EXPLANATION:

Funded by the Union Ministry of Science & Technology.

What is TiHAN?

- Funded by the Union Ministry of Science & Technology at a budget of Rs 130 crore, the “Technology Innovation Hub on Autonomous Navigation” is a multidisciplinary initiative, which aims at making India a global player in the futuristic and next-generation “Smart Mobility” technology.

- The multi-departmental initiative includes researchers from electrical, computer science, mechanical and aerospace, civil, mathematics, and design at IIT-H. There is also collaboration and support from reputed institutions and industry.

- The focus will be on solving various challenges hindering the real-time adoption of unmanned autonomous vehicles for both terrestrial and aerial applications.

- It will facilitate research grounds to investigate the functioning of unmanned and connected vehicles in a controlled environment by replicating different situations.

- It should be noted that there is no such testbed facility in India to evaluate the autonomous navigation of vehicles.

- TiHAN aims to fill this gap by developing a fully functional and exemplary testbed facility dedicated to connected autonomous vehicles (CAVs).